-

Gold Sees Dovish Light in the Fed's Hawkish Darkness

July 28, 2022, 10:09 AMDespite another hawkish FOMC meeting, gold rose again. Why? Because, as suggested by Powell, the pace of tightening is going to slow down.

Powell Announces Further Hikes

The July FOMC meeting produced another exceptionally hawkish result. The US central bank raised the federal funds rate from 1.5-1.75% to 2.25-2.5%. It was the second 75-basis point hike in a row!

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate.

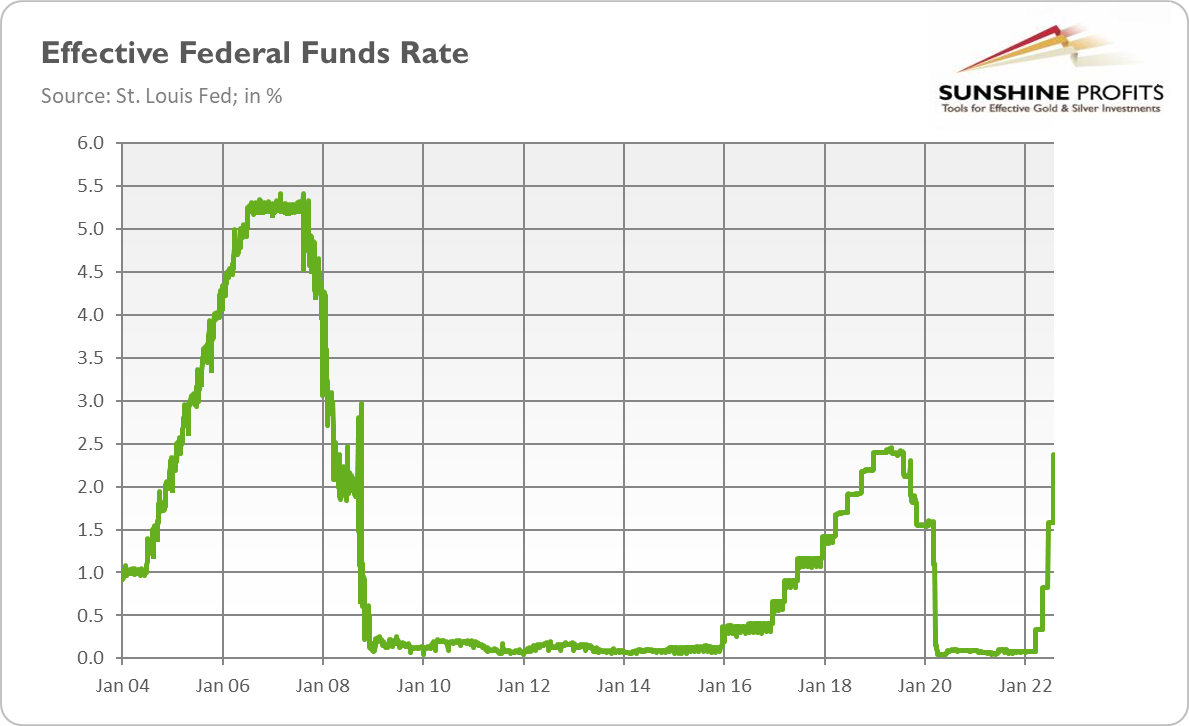

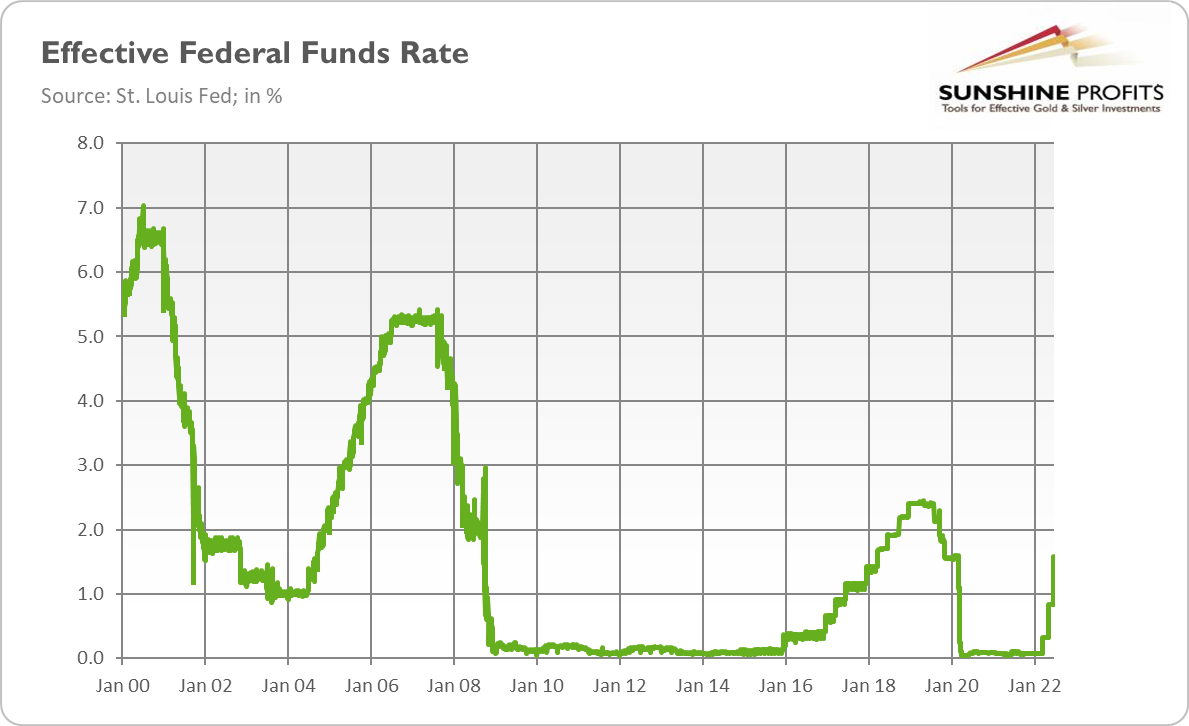

This time, the hike was unanimous, which indicates that support for aggressive tightening has strengthened within the FOMC. Indeed, the current tightening cycle is much steeper than the two previous ones, in which the Fed usually raised interest rates in 25-basis point moves, as the chart below shows.

However, the hawkish stance is not particularly surprising, given that the inflation rate is above 9% while the unemployment rate remains low. Thus, the hike was widely expected by the traders, although some of them bet on a 100-basis point move.

Besides another 75-basis point move, the July monetary policy statement wasn’t too interesting. The only important change compared to June was that the Fed admitted that “recent indicators of spending and production have softened.” Indeed, today’s first release of the GDP data for the second quarter of 2022 is likely to be very weak. The US central bank also removed the following sentence about Chinese lockdowns: “In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions.”

The FOMC meeting was followed by Powell’s press conference. He reiterated a few times how the Fed is committed to restoring price stability and announced that another big interest rate hike could be appropriate. Although Powell didn’t specify the next move, he didn’t exclude another 75-basis point move:

We anticipate that ongoing increases in the target range for the federal funds rate will be appropriate; the pace of those increases will continue to depend on the incoming data and the evolving outlook for the economy. Today’s increase in the target range is the second 75 basis point increase in as many meetings. While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then. We will continue to make our decisions meeting by meeting and communicate our thinking as clearly as possible.

However, my reading is that Powell sent a dovish signal, suggesting that the pace of hikes could slow down in the near future:

As the stance of monetary policy tightens further, it will likely become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.

Hence, Powell would feel more comfortable with a 50-basis point move rather than with the 75-basis point one for the third time in a row, especially if inflation moderates somewhat. As he said:

Now that we’re at neutral, as the process goes on, at some point, it will be appropriate to slow down. And we haven’t made a decision when that point is, but intuitively that makes sense. We’ve been front-end loading these very large rate increases. Now we’re getting closer to where we need to.

Implications for Gold

What does it all mean for the gold market? Well, the price of gold increased yesterday from about $1,715-1,720 to about $1,735, as the chart below shows, and it continued the upward trend today in the morning.

Why did gold prices rise despite the hawkish FOMC meeting? The likely reason is that the Fed stuck to a 75-basis point hike and didn’t go more aggressively with the 100-basis point increase like the Bank of Canada did.

Another factor is that the federal funds rate is getting closer to the neutral rate, so the pace of further hikes is going to slow down. It means that we are also approaching the peak in the interest rates or even a reverse in the Fed’s stance. Indeed, investors believe that the Fed will raise the federal funds rate by 50 basis points in September, followed by two 25-basis point moves in November and December. They also expect the FOMC to cut interest rates in early 2023, according to the market probability tracker compiled by the Atlanta Fed.

Hence, we are finally noticing dovish light in the dark and hawkish night of the Fed. In this light, gold could shine.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Inflation Exceeds 9%, but It’s Still Not Enough for Gold

July 14, 2022, 10:53 AMThe inflation rate accelerated again. It implies a more hawkish Fed and is bad for gold in the short-run, but good in the long-term.

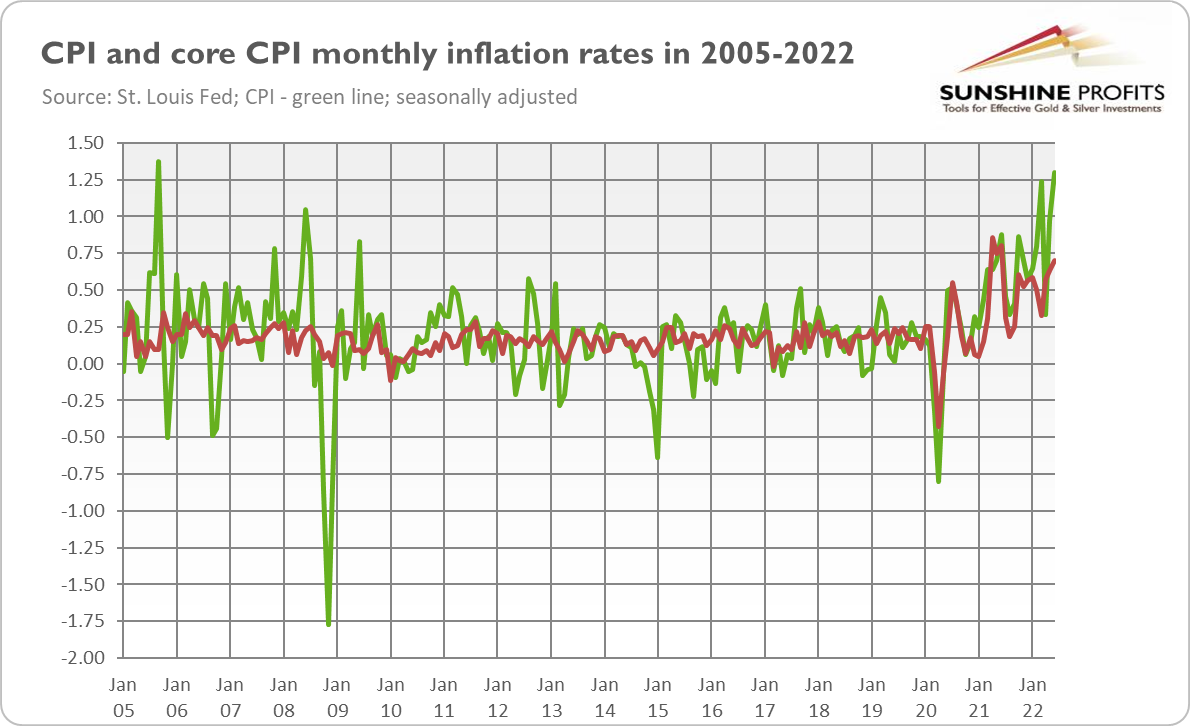

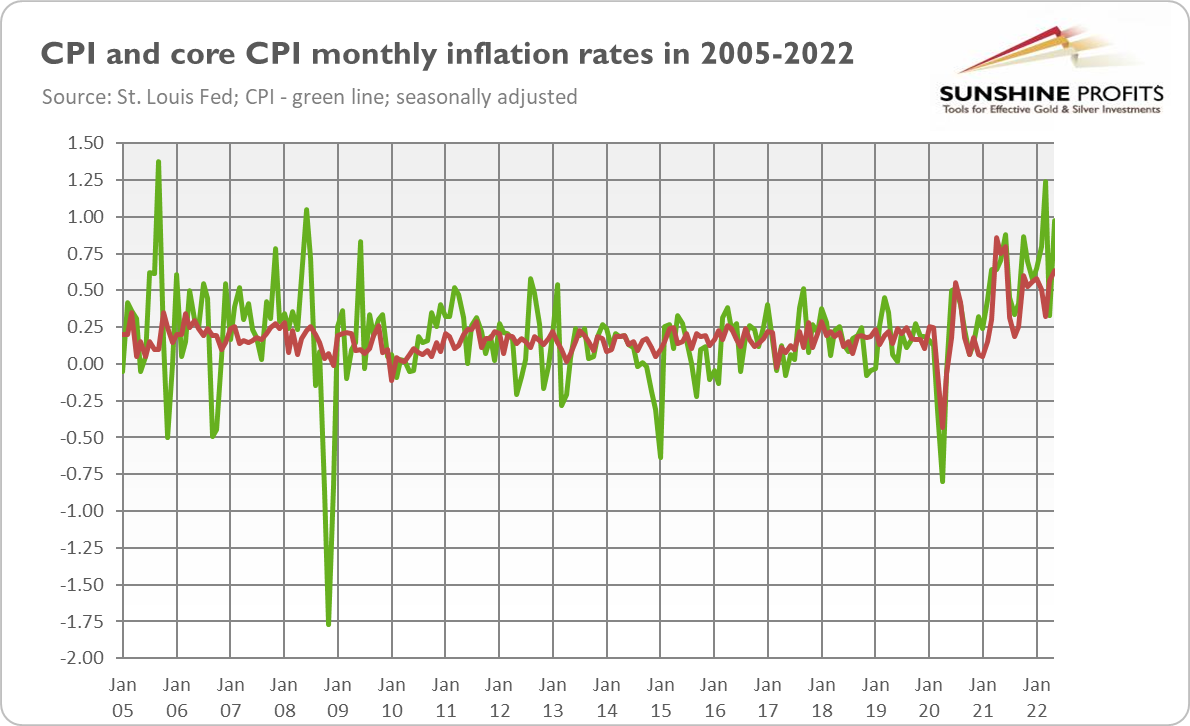

Another inflation report – and another upside surprise! The CPI increased 1.3% in June, after rising 1% in May, according to the Bureau of Labor Statistics. As a reminder, we are talking here about monthly changes – not so long ago, such levels were reserved only for annual inflation rates! However, this was in the past, and the present reality is inflationary. The June rise was the steepest monthly increase since September 2005, but then it was a temporary spike, while now there is a clear upward trend, as the chart below shows.

The core CPI, which excludes food and energy, rose by 0.7% in June, after increasing by 0.6% in the preceding two months. Almost all major sub-indexes increased over the month, which indicates that inflation is broad-based.

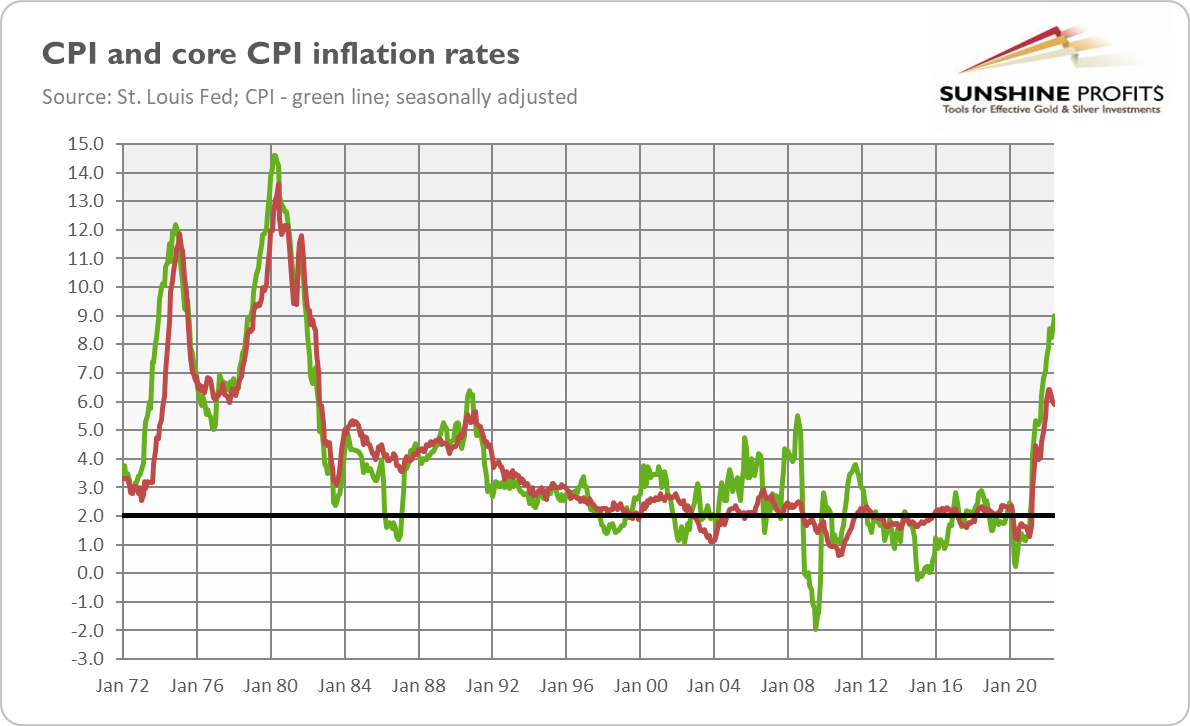

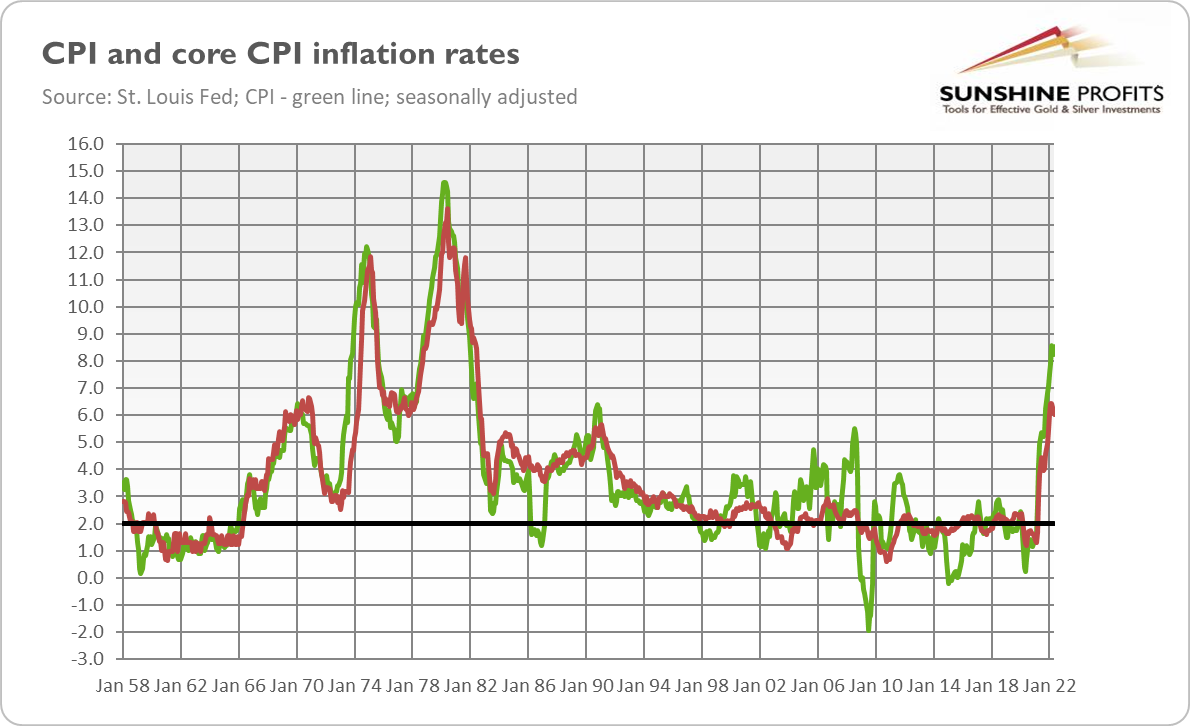

If anyone hoped that the annual rates were better, I don’t have good news. Over the last 12 months, the CPI increased 9.1% in June, following an 8.5% increase in the previous month. It was the largest annual rise since November 1981, as the chart below shows. However, today’s situation is much worse, as inflation is still on the rise, while 1981 was a period of disinflation already. We still have to wait for the inflationary peak and the reverse in the trend.

Will Inflation Peak Soon?

We all wish for it, and there is a faint glimmer of hope: commodity prices have cooled recently, while the core CPI annual inflation rate was “only” 5.9% last month, following 6.0% in May and 6.1% in April. So, June was the second month in a row of a slower pace of core CPI inflation. However, the deceleration has been very modest so far, and below expectations, and the core CPI remains very high, which implies that inflation is well entrenched in the US economy.

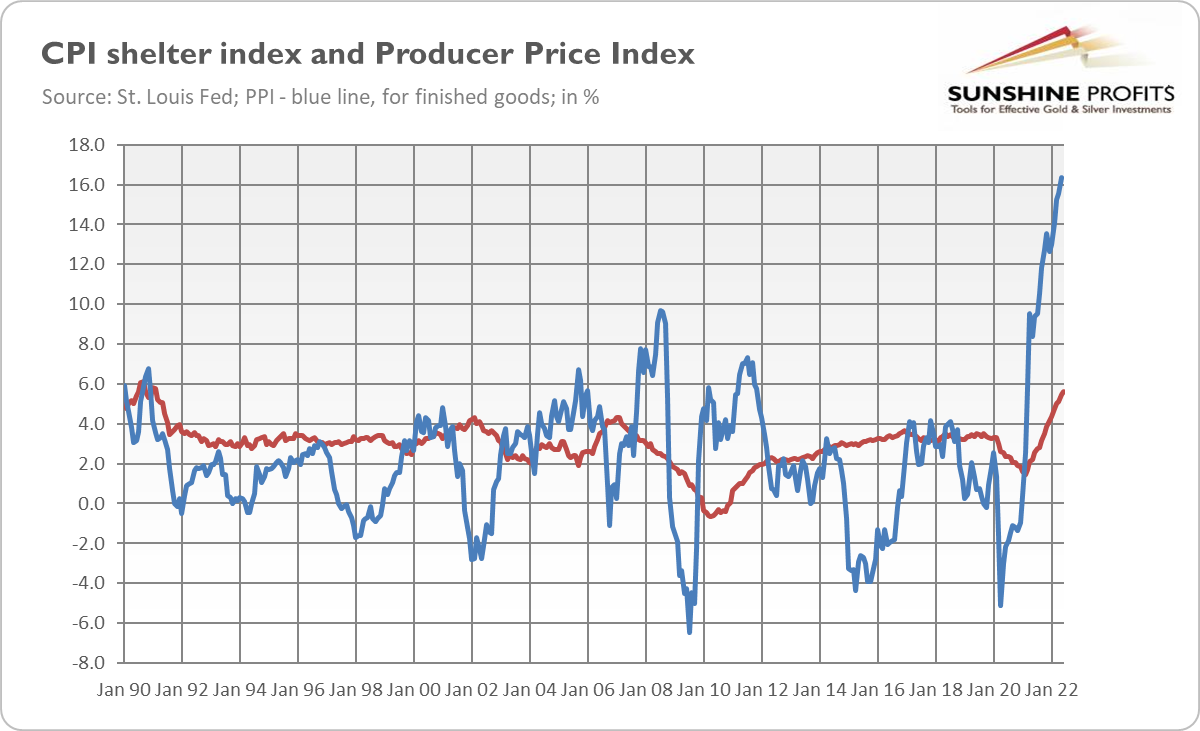

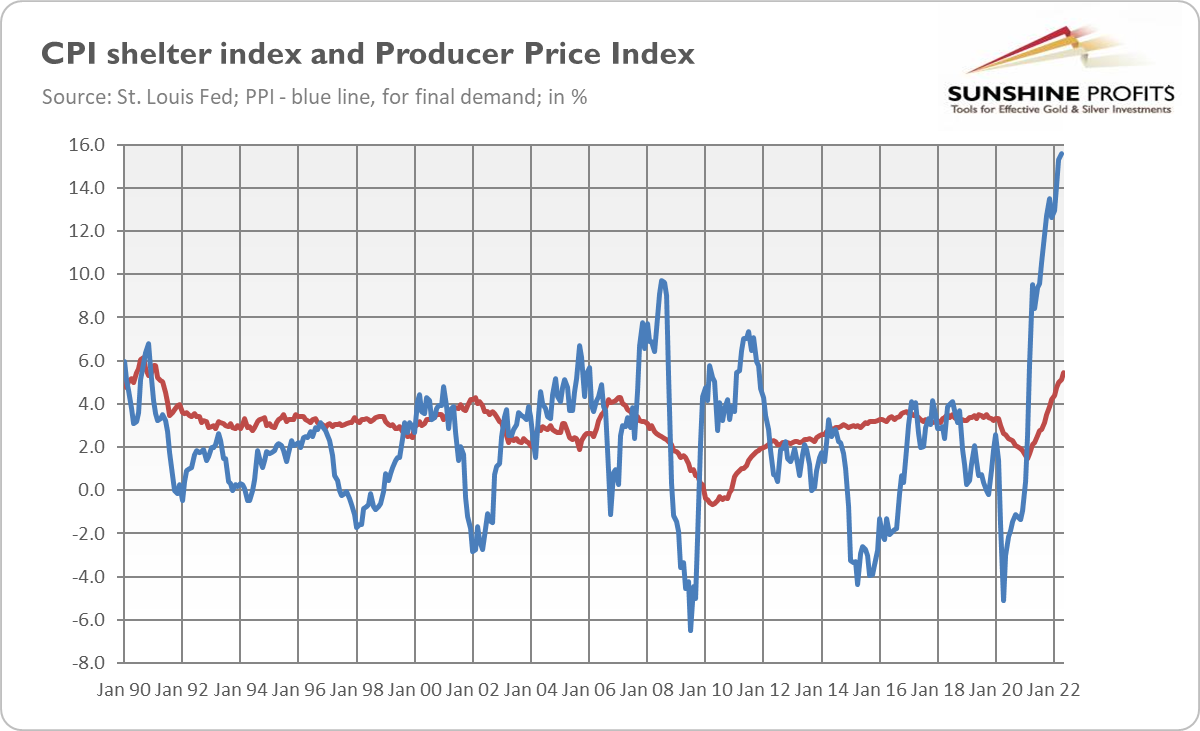

What’s more, the Producer Price Index for finished goods is still accelerating, which suggests that consumer inflation won’t peak anytime soon. As the chart below shows, the PPI annual inflation rate jumped from 15.5% in April to 16.4% in May. Moreover, shelter inflation rose in June to 5.6%, the largest rate since February 1991, as one can see in the chart below.

Implications for Gold

What does it all mean for the gold market? Well, I’m tempted to write that the higher inflation, the better for gold. However, at this point, it should be clear that gold is not a simple inflation hedge. If this were true, the yellow metal would rally and already surpass $2,000, but it’s traded above $1,700 right now, as the chart below shows.

To be clear, trising inflation could be positive for gold as – given the economic slowdown – it implies that stagflation is coming. It could also upset the markets and boost the safe-haven demand for gold.

However, in the current environment, stubbornly high inflation implies a more hawkish Fed. As long as the US central bank delivers hikes in the federal funds rate, the markets don’t see inflation as a long-term problem. So, the more persistent inflation is, the more aggressive the tightening cycle could be. Indeed, according to the CME FedWatch Tool, the market-based probability that the FOMC will raise rates by 100 basis points at its July meeting has risen from literally zero last week to more than 80% after the CPI inflation report.

Is it unbelievable? Well, such a mammoth hike was just delivered by the Bank of Canada. So, the Fed can follow suit, and the more decisive actions of the US central bank, the higher interest rates. The higher interest rates, the stronger the dollar. Rising real interest rates and the appreciation of the US dollar are powerful headwinds for gold.

Not surprisingly, the yellow metal plunged yesterday to an intraday low of $1,704.50 within the first 15 minutes of trading in New York. However, it rebounded later to $1,744.30, but after all, the London price went down. It could further decline if hawkish expectations on interest rates strengthen. But the aggressive tightening will end in a hard landing, which should ultimately make gold shine.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Fed Is Afraid of Inflation and Tightens Its Hawkish Stance

July 7, 2022, 11:20 AMThe Fed gives no illusions: it will maintain its hawkish stance. Meanwhile, gold plunged decisively below $1,800, which has bearish implications.

Yesterday (July 6, 2022), the FOMC published the minutes from its last meeting, held in mid-June. Although the publication reveals no major surprises about US monetary policy, it shows rising worries within the Fed and also strengthens its hawkish rhetoric.

Why? First, the Committee’s members acknowledged that “the near-term inflation outlook had deteriorated since the time of the May meeting.” They also agreed that risks to inflation were skewed to the upside and that persistently high inflation could de-anchor inflation expectations:

Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted. On this matter, participants stressed that appropriate firming of monetary policy, together with clear and effective communication, would be essential in restoring price stability.

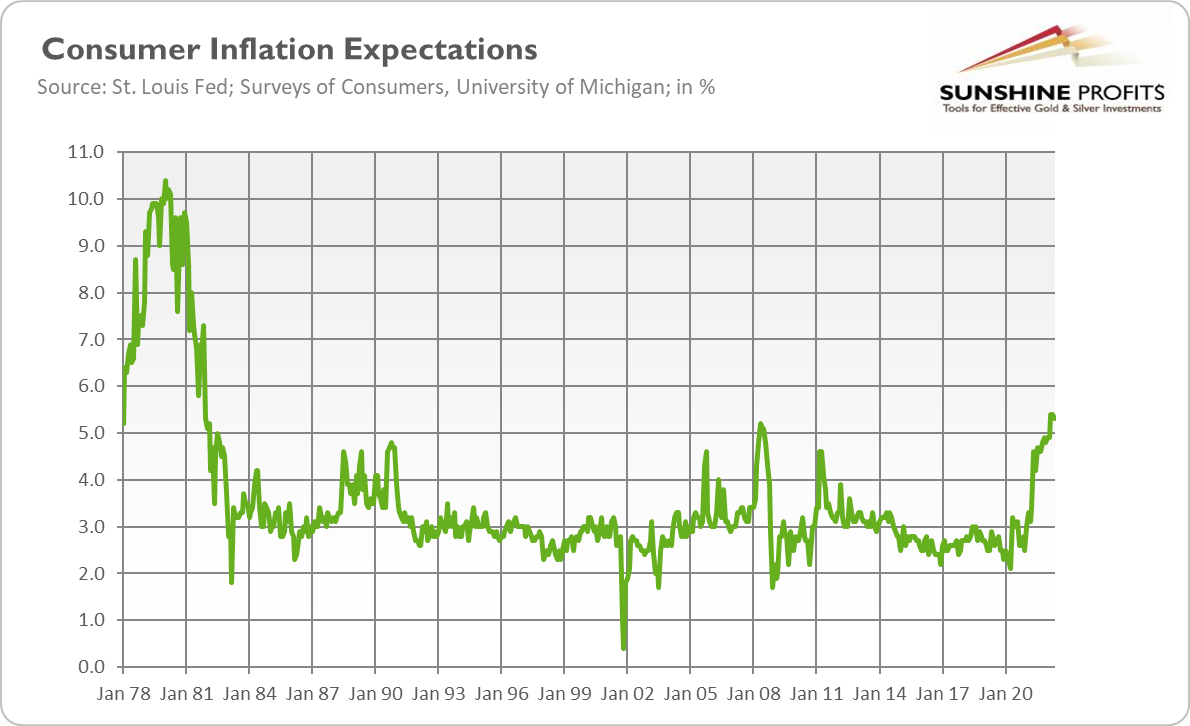

Indeed, consumer inflation expectations have recently surged to the highest level since the early 1980s, as the chart below shows.

All it means is that the Fed now has to be very hawkish, even if it doesn’t want to be, simply to restore the public’s confidence in its ability to combat inflation.

Second, FOMC members openly admitted the necessity of moving to a more restrictive stance of monetary policy in order to restore price stability:

Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.

So, the Fed seems determined to combat inflation and doesn’t intend right now to slow down its tightening cycle. Hence, there is a potential for another 75 (or 50, at least) basis point rate hike at the end of this month. However, the current stance will likely change after a while. So far, the US central bank hasn’t shown any concerns about the possibility of a recession, but it noted in the minutes the downside risks to the economic outlook:

Participants judged that uncertainty about economic growth over the next couple of years was elevated. In that context, a couple of them noted that GDP and gross domestic income had been giving conflicting signals recently regarding the pace of economic growth, making it challenging to determine the economy's underlying momentum. Most participants assessed that the risks to the outlook for economic growth were skewed to the downside. Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated as well as the possibilities that the Russian invasion of Ukraine and the COVID-related lockdowns in China would have larger-than-expected effects on economic growth.

I would say that these downside risks have already materialized. According to the Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate), GDP growth in the second quarter of 2022 was -2.1 percent. If this estimate turns out to be correct, the US economy is already in a technical recession!

Gold Plunged, but Before Minutes

How did gold react to the minutes? Not very much. I mean, it’s true that gold sank on Wednesday, but the plunge happened before the publication was released, and the move was huge. As the chart below shows, the London price of the yellow metal slid from $1,808 on Monday to $1,772 on Tuesday and about $1,754 the next day (gold futures declined even further to about $1,740).

What happened? Well, the first thing that contributed to the decline in gold prices was the dollar’s strength. As the chart below shows, the euro dropped to its lowest value against the greenback since 2002, and the price of gold plunged along with the euro.

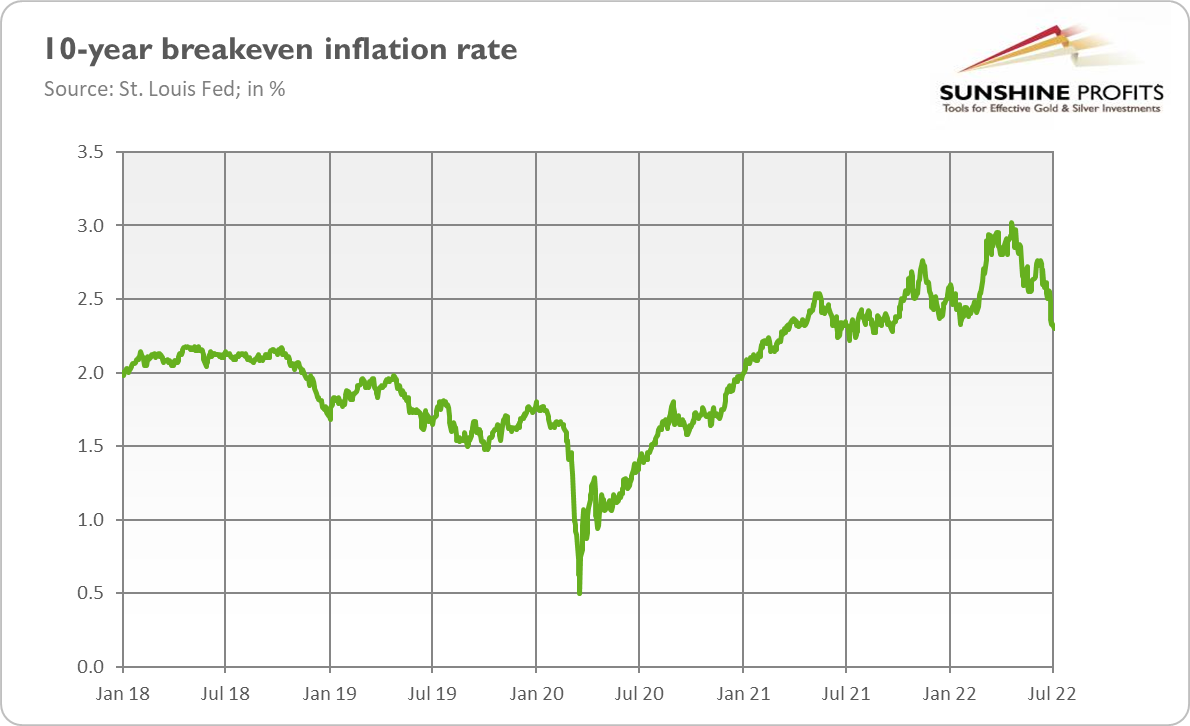

Second, contrary to consumers, financial markets have recently become less worried about inflation. As the chart below shows, market-based inflation expectations have receded in the last few weeks.

Implications for Gold

What does it all mean for the gold market? Well, the trend is clear. Gold is going down. It’s been very resilient this year, outperforming equities and cryptocurrencies, but it seems that it’s finally given up in the face of the hawkish Fed, rising real interest rates, and strengthening of the US dollar.

There are two possible scenarios for gold. The first one is that gold will go through a correction similar to that seen in 2012. This is a more bearish case. The second is that gold is going down because of the widespread sell-off in assets. People are worried about the recession and are selling everything. In both cases, the price of gold is likely to go down before it goes up again. However, the second, recessionary scenario, is more bullish for gold, as downward price movement would be shorter. For me, given that a recession is probably coming, the second narrative is more convincing, but we’ll see. One thing is certain: gold will likely continue to fall in the near future, at least until the next economic crisis occurs and the Fed reverses its stance.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Unlike Gold, the Fed Doesn’t Want a Recession. Who Will Win?

June 30, 2022, 9:09 AMPowell said before the Senate that he didn’t want a recession. Who would? However it can occur anyway, boosting gold prices.

“The Economy Is Strong”

Last week, Powell testified before Congress. He reiterated many things he said during his recent press conference, but I believe that a few issues deserve our attention.

First, Powell repeated that the Fed is strongly committed to combating high inflation and that additional rate hikes are coming. I wouldn’t be surprised to see the federal funds rate at or above 3% at the end of this year, which would make this tightening cycle the fastest in decades.

However, the US central bank is so aggressive only because the labor market remains strong, but if the economy slows down further and the unemployment rate starts to increase, the Fed will face a much more difficult dilemma – and I doubt whether it will stay as hawkish as today. Actually, the reason behind such steep hikes in interest rates could be the fact that the Fed is aware of this and wants to tighten its monetary policy as much as possible before the economy falters. However, such big moves could only accelerate the advent of trouble.

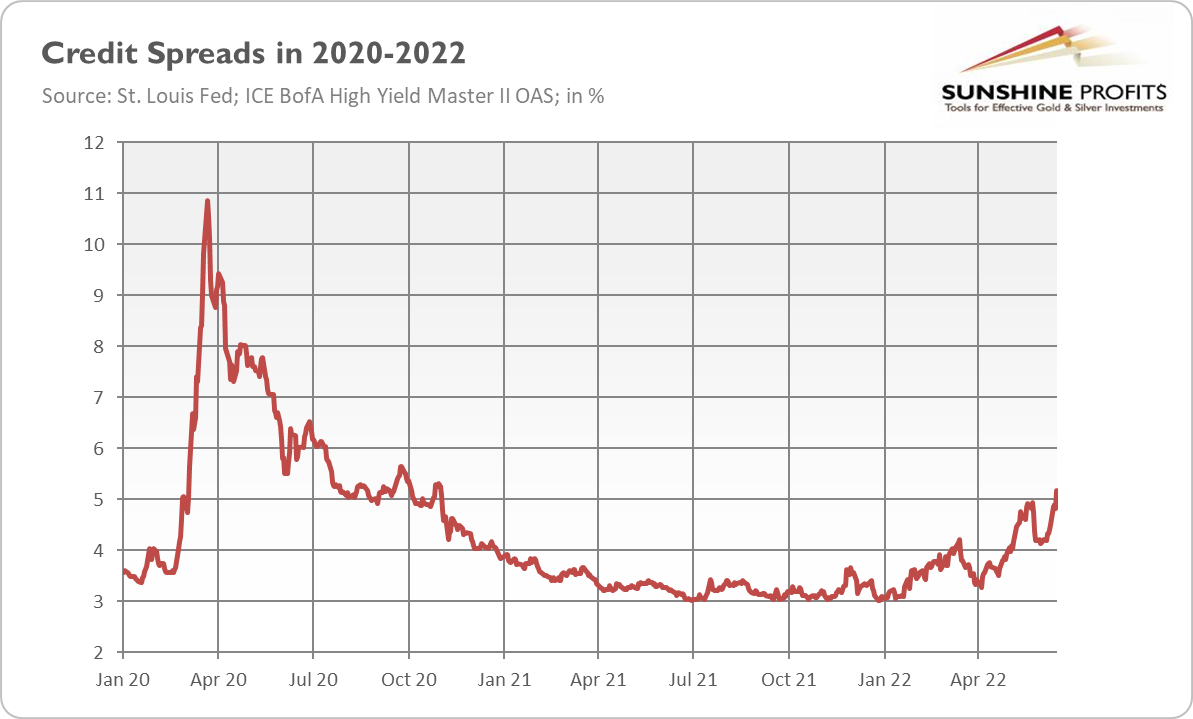

Second, Powell painted a surprisingly optimistic picture of the American economy, saying that it “is very strong and well positioned to handle tighter monetary policy.” Well, I doubt it. The US economy is highly indebted and steep hikes could be difficult to swallow for excessively leveraged entities. Other writings on the wall include the yield curve inverting, the S&P 500 Index entering the bear market, and credit spreads widening significantly, as the chart below shows.

GDP growth is slowing down. Indeed, the GDPNow model estimates that GDP growth (seasonally adjusted annual rate) will increase by 0.0 percent in the second quarter of 2022. On my planet, zero growth doesn’t indicate a “very strong” economy, but stagnation. Now it’s time for a rebus for the Fed officials: stagnation plus inflation = ? Yes, very good, stagflation. Stagflation, which indicates huge macroeconomic imbalances, means all but a very strong economy.

It Can Happen Anyway

Third, Powell downplayed the risk of recession. He admitted that it was “certainly a possibility,” but not the intended outcome of the central bank: “We’re not trying to provoke and don’t think that we will need to provoke a recession.” Well, could he say anything else? Can you imagine the Fed Chair saying before Congress: “We totally failed to timely react to rising inflation and now we have to engineer a recession, or at least an economic slowdown, to curb it”? I can’t.

However, this is exactly what the Philips curve is about, still widely used by the central banks. According to the Phillips curve, there is a tradeoff between inflation and the unemployment rate, and you can only reduce inflation by increasing unemployment. Of course, the Phillips curve is terribly flawed, but this is what the central banks believe in. So, the Fed may not try to invoke a recession, but it certainly attempts to reduce aggregate demand and cool the overheated economy.

The central bankers’ goal is to become modestly restrictive on growth, or, in other words, to engineer a soft landing. The problem is that this is very difficult to achieve and recessions, although not the necessarily intended outcome, are very often the unintended consequence of monetary policy tightening. Charles L. Evans, Chicago Fed President, was surprisingly honest about this issue:

We’re obviously taking on risk when we want to slow demand to keep it in line with supply. To think that we can fine tune something like this with tremendous precision – I mean, we just don’t have that ability.

Indeed, all the last three Fed’s hiking cycles were followed by financial crises and economic downturns (dot-com crisis, the Great Recession, repo crisis in 2019 and coronavirus crisis in 2020), as the chart below shows.

Implications for Gold

What does it all mean for the gold market? Well, the Fed is now really determined to curb inflation. Hence, precious metals investors have to be prepared for more rate hikes in the coming months. This hawkish stance will continue to put downward pressure on gold prices in the near future.

However, in the long or even medium term, I’m more bullish on gold. This is because GDP growth is slowing down, which increases the risk of stagflation and the next economic crisis. Economic confidence is clearly tumbling, which should increase the demand for gold as a safe haven. At some point, the tightening cycle will be over and the Fed will be forced to return to its dovish stance, which should be welcomed by the yellow metal.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Why Did Gold Fall Despite Accelerating Inflation?

June 15, 2022, 7:48 AMGold didn’t react to rising inflation in May as expected and sank. The reason is strengthened expectations of steeper interest rate hikes by the Fed.

Will Inflation Peak Soon?

According to the Bureau of Labor Statistics, the CPI increased 1.0 percent in May, after rising 0.3 percent in April. This is a huge increase, especially since we are talking here about changes from month to month. The core CPI, which excludes energy and food prices, rose 0.6%, the same increase as in April. What is particularly disturbing is that almost all major components increased over the month, which clearly shows that inflation is broad-based. The monthly inflation rate in May was the highest since June 2008, the middle of the Great Recession. However, the previous cases were rather temporary spikes, while now – as the chart below shows – we observe a clear upward trend.

On an annual basis, the situation doesn’t look any better. The overall CPI inflation increased 8.6% for the 12 months ending May, the largest 12-month increase since the period ending December 1981, as the chart below shows. However, it was then a period of disinflation, while inflation is still on the rise today.

Sure, there was a surge in oil and gas prices – the index for fuel oil soared 106.7%, which was the largest increase in the history of the series that began in 1935. But the core CPI rose 6%, which indicates that inflation is broad-based and cannot be simply explained by rising energy prices.

Indeed, inflation is accelerating, not just because gasoline is rising. Inflation is also spiking in services, where consumers spend most of their money. For example, the index for shelter rose in May to 5.45%, the largest rate since October 1990, as the chart below shows. The Producer Price Index is also accelerating, which suggests that inflation may not be in the mood to peak yet.

Implications for Gold

What does it all mean for the gold market? Well, higher and more entrenched inflation should be supportive of the yellow metal. However, hot inflation numbers boosted market bets on steeper interest rate hikes from the Fed. According to the FedWatch Tool, the odds of a 75-basis point hike at the FOMC meeting in June surged from merely 3.9% one week ago to 90.5%! Consequently, both bond yields and the US dollar have risen, pushing gold down. As the chart below shows, the price of the yellow metal decreased from $1,853 last week to about $1,830.

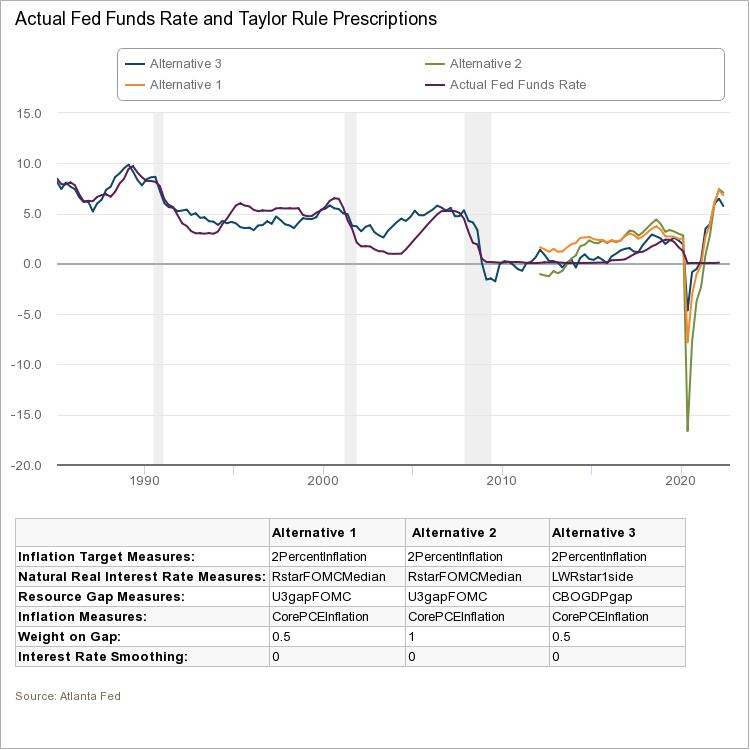

However, the long-term outlook for gold is much better. All periods with such high inflation ended up in recession. You see, there are only two options. The first is that the Fed will stay behind the curve and won’t curb inflation, but then inflation will destabilize the economy on its own. The second is that the Fed will significantly tighten its monetary policy, but then it will probably overdo it and push the economy into recession. So far, monetary policy remains accommodative – at least in terms of what the Taylor rule suggests (see the chart below). Thus, if the Fed really wants to become restrictive, it would have to aggressively hike the federal funds rate, which could lead to stagflation.

Gold should shine during stagflation. However, as long as real interest rates are rising, gold may struggle. However, the yellow metal is still outperforming stocks (not to mention cryptocurrencies), and when the end of the easy money era deflates other asset classes even more, investors will likely to seek a safe haven in gold. The orgy of excess liquidity and ultra low interest rates that began after the financial crisis of 2007-2008 is ending, which could wipe out a lot of value from the markets. Surely, gold will also be liquidated, especially at the beginning of the next economic crisis, but it should ultimately emerge as the winner from the upcoming turmoil.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM