The Fed gives no illusions: it will maintain its hawkish stance. Meanwhile, gold plunged decisively below $1,800, which has bearish implications.

Yesterday (July 6, 2022), the FOMC published the minutes from its last meeting, held in mid-June. Although the publication reveals no major surprises about US monetary policy, it shows rising worries within the Fed and also strengthens its hawkish rhetoric.

Why? First, the Committee’s members acknowledged that “the near-term inflation outlook had deteriorated since the time of the May meeting.” They also agreed that risks to inflation were skewed to the upside and that persistently high inflation could de-anchor inflation expectations:

Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted. On this matter, participants stressed that appropriate firming of monetary policy, together with clear and effective communication, would be essential in restoring price stability.

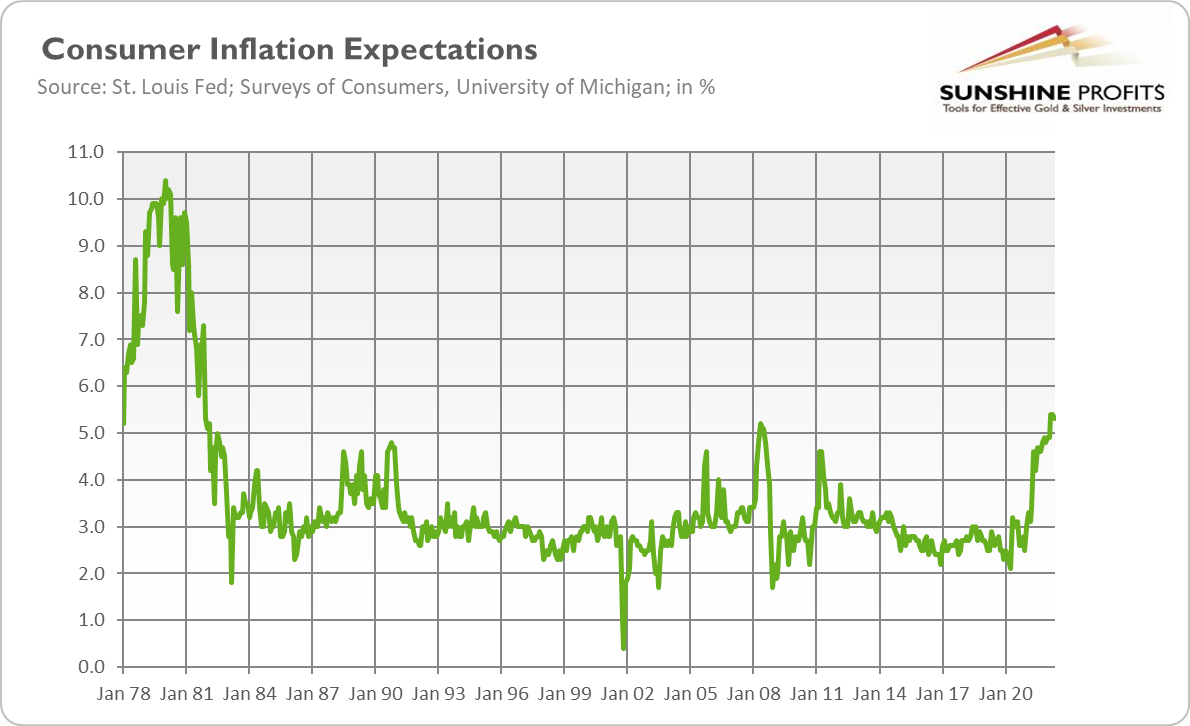

Indeed, consumer inflation expectations have recently surged to the highest level since the early 1980s, as the chart below shows.

All it means is that the Fed now has to be very hawkish, even if it doesn’t want to be, simply to restore the public’s confidence in its ability to combat inflation.

Second, FOMC members openly admitted the necessity of moving to a more restrictive stance of monetary policy in order to restore price stability:

Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.

So, the Fed seems determined to combat inflation and doesn’t intend right now to slow down its tightening cycle. Hence, there is a potential for another 75 (or 50, at least) basis point rate hike at the end of this month. However, the current stance will likely change after a while. So far, the US central bank hasn’t shown any concerns about the possibility of a recession, but it noted in the minutes the downside risks to the economic outlook:

Participants judged that uncertainty about economic growth over the next couple of years was elevated. In that context, a couple of them noted that GDP and gross domestic income had been giving conflicting signals recently regarding the pace of economic growth, making it challenging to determine the economy's underlying momentum. Most participants assessed that the risks to the outlook for economic growth were skewed to the downside. Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated as well as the possibilities that the Russian invasion of Ukraine and the COVID-related lockdowns in China would have larger-than-expected effects on economic growth.

I would say that these downside risks have already materialized. According to the Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate), GDP growth in the second quarter of 2022 was -2.1 percent. If this estimate turns out to be correct, the US economy is already in a technical recession!

Gold Plunged, but Before Minutes

How did gold react to the minutes? Not very much. I mean, it’s true that gold sank on Wednesday, but the plunge happened before the publication was released, and the move was huge. As the chart below shows, the London price of the yellow metal slid from $1,808 on Monday to $1,772 on Tuesday and about $1,754 the next day (gold futures declined even further to about $1,740).

What happened? Well, the first thing that contributed to the decline in gold prices was the dollar’s strength. As the chart below shows, the euro dropped to its lowest value against the greenback since 2002, and the price of gold plunged along with the euro.

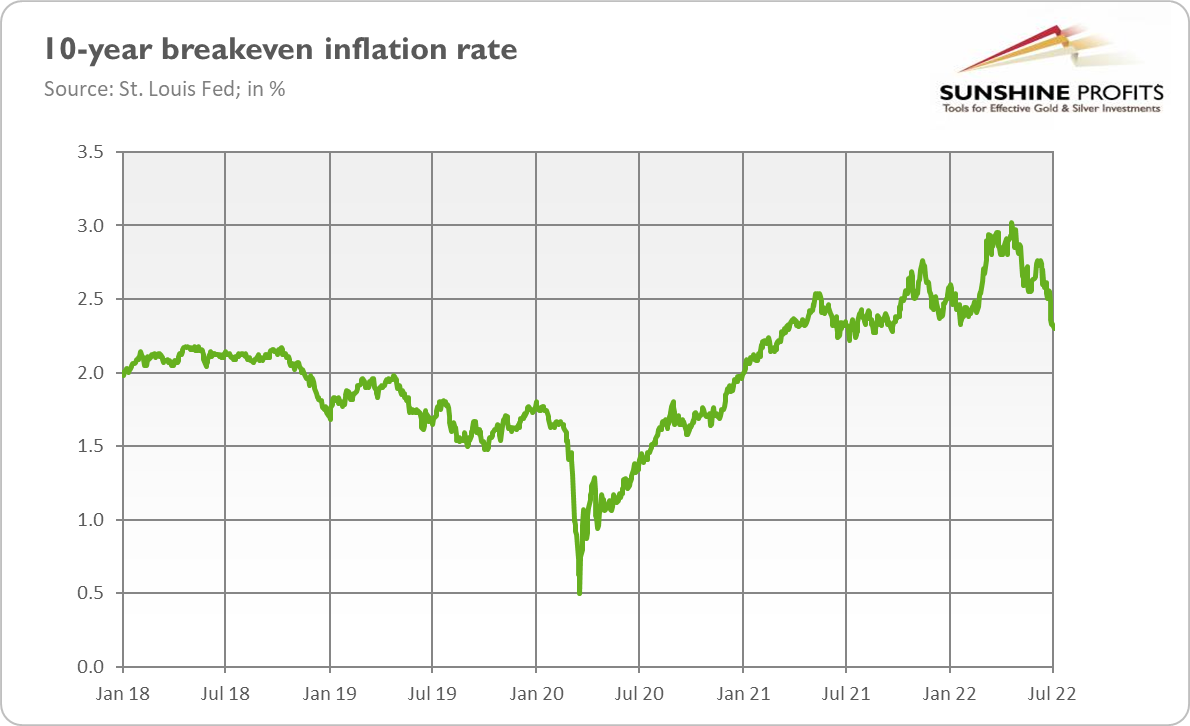

Second, contrary to consumers, financial markets have recently become less worried about inflation. As the chart below shows, market-based inflation expectations have receded in the last few weeks.

Implications for Gold

What does it all mean for the gold market? Well, the trend is clear. Gold is going down. It’s been very resilient this year, outperforming equities and cryptocurrencies, but it seems that it’s finally given up in the face of the hawkish Fed, rising real interest rates, and strengthening of the US dollar.

There are two possible scenarios for gold. The first one is that gold will go through a correction similar to that seen in 2012. This is a more bearish case. The second is that gold is going down because of the widespread sell-off in assets. People are worried about the recession and are selling everything. In both cases, the price of gold is likely to go down before it goes up again. However, the second, recessionary scenario, is more bullish for gold, as downward price movement would be shorter. For me, given that a recession is probably coming, the second narrative is more convincing, but we’ll see. One thing is certain: gold will likely continue to fall in the near future, at least until the next economic crisis occurs and the Fed reverses its stance.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.