-

Gold Returns Above $1,700. For How Long?

October 6, 2022, 10:15 AMGold is back above $1,700. Is this a false rebound or a sign that the worst is behind us?

Gold has returned above $1,700! The chart below shows the recent rebound in gold prices. Does it mean that the worst is behind us and now the yellow metal can only go up?

Well, such conclusions would definitely be premature. Let’s remember that September was really awful for the gold bulls, as the average monthly price plunged 4.7% compared to August. The price of gold slid below $1,700 amid strengthened expectations of a more hawkish Fed, and then the actual FOMC meeting pushed gold prices down even further. This is because the Fed delivered another 75-basis point hike and also boosted its projections of the federal funds rate from 3.4% and 3.8% to 4.4% and 4.6% in 2022 and 2023, respectively.

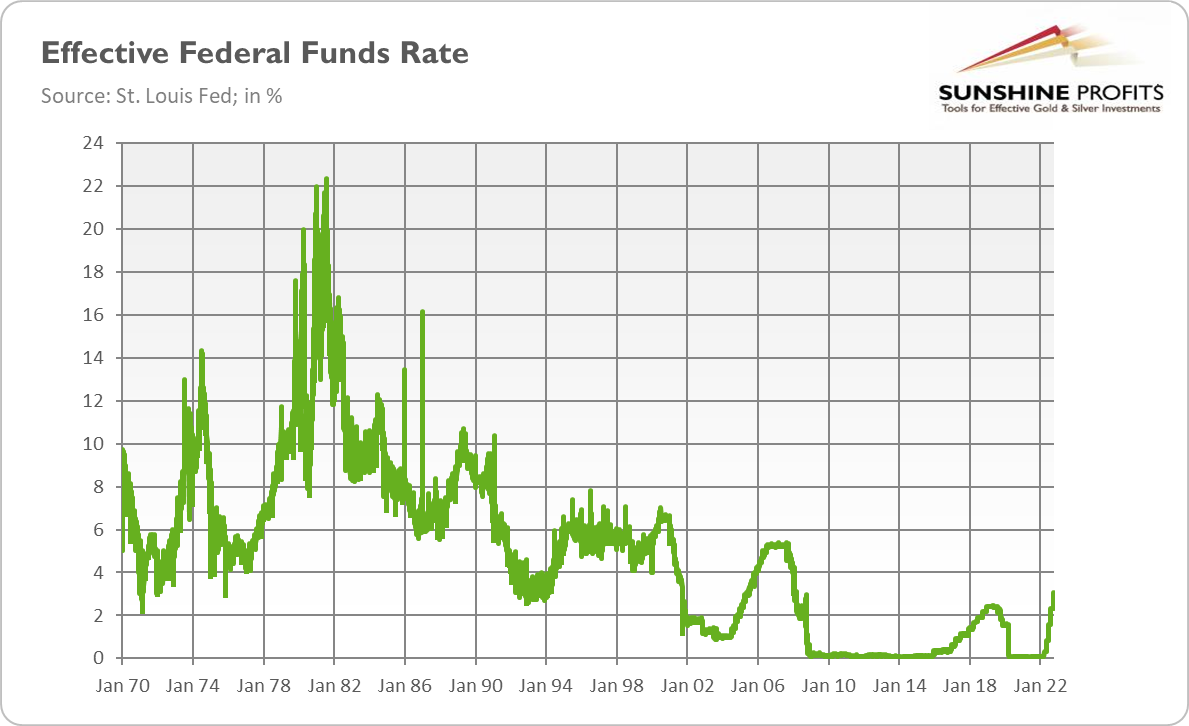

As a result, for the first time since 2008, the federal funds rate exceeded 3%. As the chart below shows, the current tightening cycle is the fastest in more than 40 years, which couldn’t be without negative consequences for the gold market.

A Decline in Yields Helps Gold

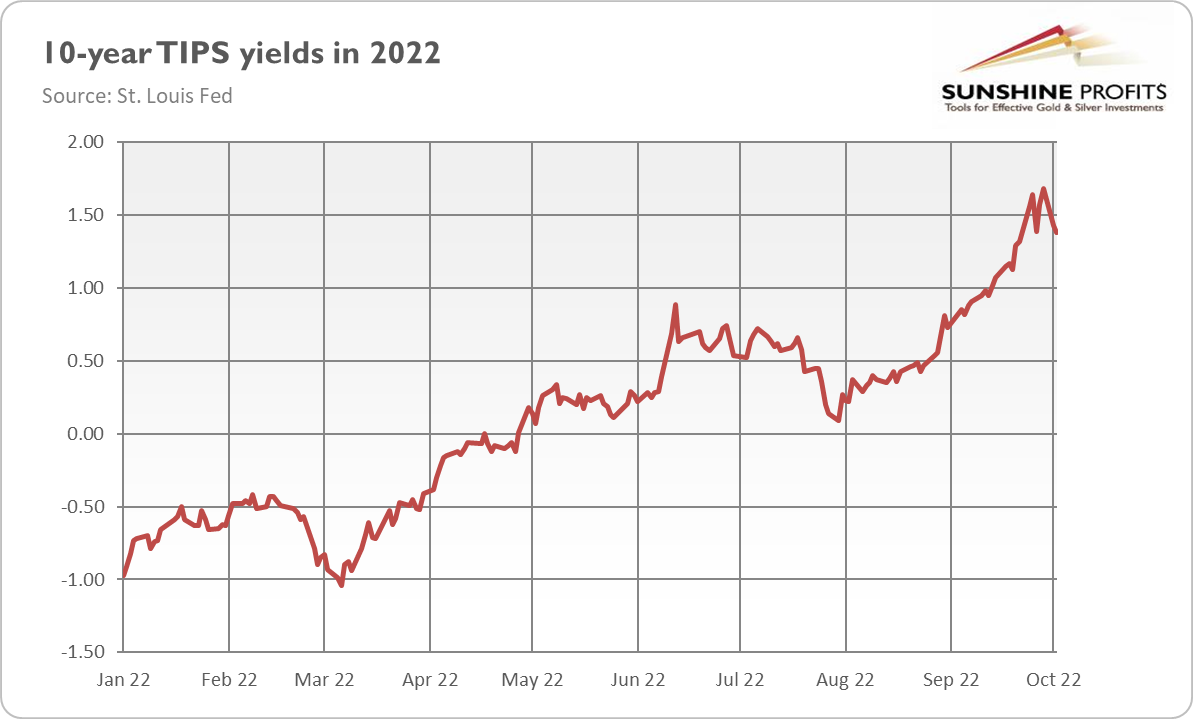

Despite all these headwinds, gold managed to return above $1,700. This is thanks to the decline in real interest rates. As the chart below shows, the yields on 10-year TIPS have moderated somewhat recently, which helped gold catch its breath.

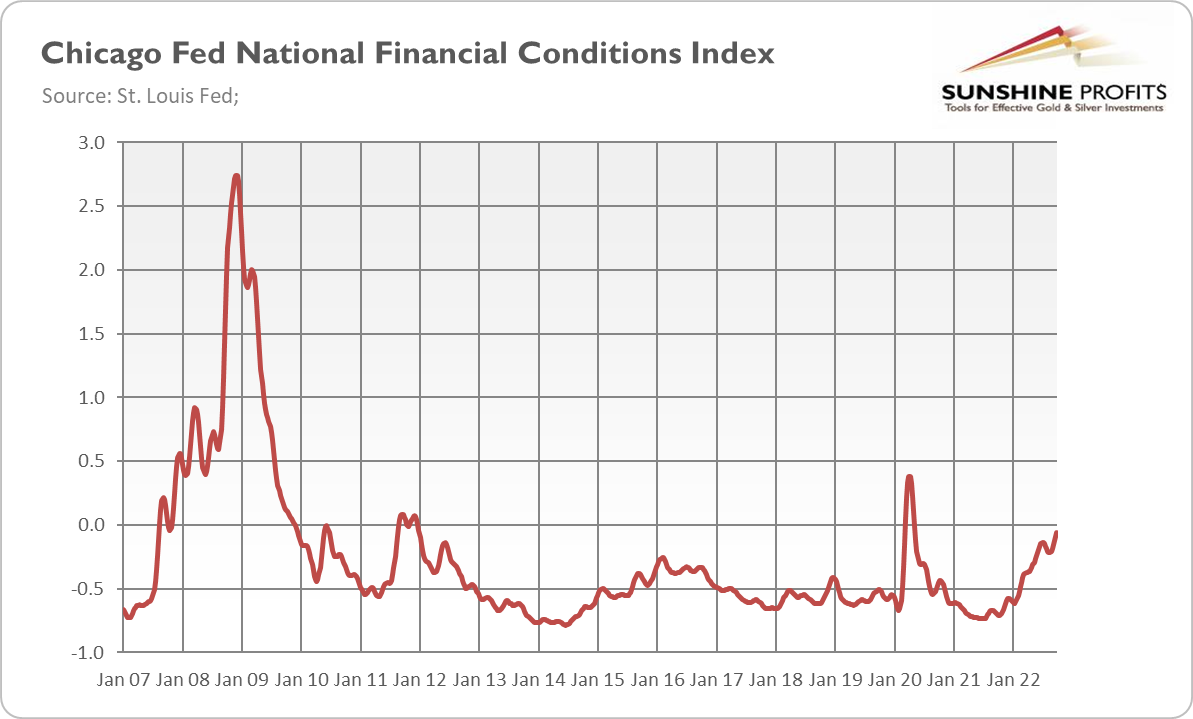

It seems that markets are more and more worried about the risk of excessive tightening of monetary policy and its consequences for the economy. According to Morgan Stanley, dollar liquidity in the United States, Europe, Japan, and China has declined by $4 trillion since March and is falling fast. As the chart below shows, financial conditions – although far from being in a panic mode – have tightened significantly this year. The Chicago Fed’s National Financial Conditions Index moved from -0.74 in mid-2021 to almost 0 (positive values of the index indicate financial conditions that are tighter than average).

Implications for Gold

What does it all mean for the gold market? Well, it goes without saying that gold could decline again amid the aggressive Fed’s stance. The Fed’s pivot may occur, but not necessarily anytime soon, but only in a more distant future. According to Atlanta Fed President Raphael Bostic, “we must remain vigilant because this inflation battle is likely still in early days”.

However, it’s also possible that gold is slowly building the basis for its next rally. Please keep in mind that monetary policy will be less restrictive next year, as – according to the recent dot-plot – the Fed will deliver only one 25-basis-point hike in 2023. Thus, we are quickly moving to the end of the current tightening cycle, and the peak could be already behind us.

Another optimistic issue for gold is that the forecast for GDP growth went down from 1.7% to 0.2% this year, and from 1.7% to 1.2% in 2023. Meanwhile, the projection for the unemployment rate next year increased from 3.9% to 4.4%. The implication is clear: the Fed’s tightening cycle will have negative consequences for the U.S. economy, most likely pushing it into recession. Given the very high inflation, it basically means that the Fed expects stagflation in the coming months. In such an environment, gold should shine.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Enters the Last Quarter of 2022 Depressed

September 29, 2022, 11:19 AMGold started 2022 well, but the recent months were pretty awful. What will it be in the final quarter of the year?

Ladies and gentlemen, please welcome the final quarter of the year! What were the first nine months of 2022 for the gold market? Well, in Q1 there was an impressive rally in gold, with the yellow metal staying above $2,000 for a while. However, the next few months brought a gradual decline in gold prices. After several weeks of being traded between $1,700 and $1,800 during the summer, in September, gold gave up and slid below $1,700, as the chart below shows.

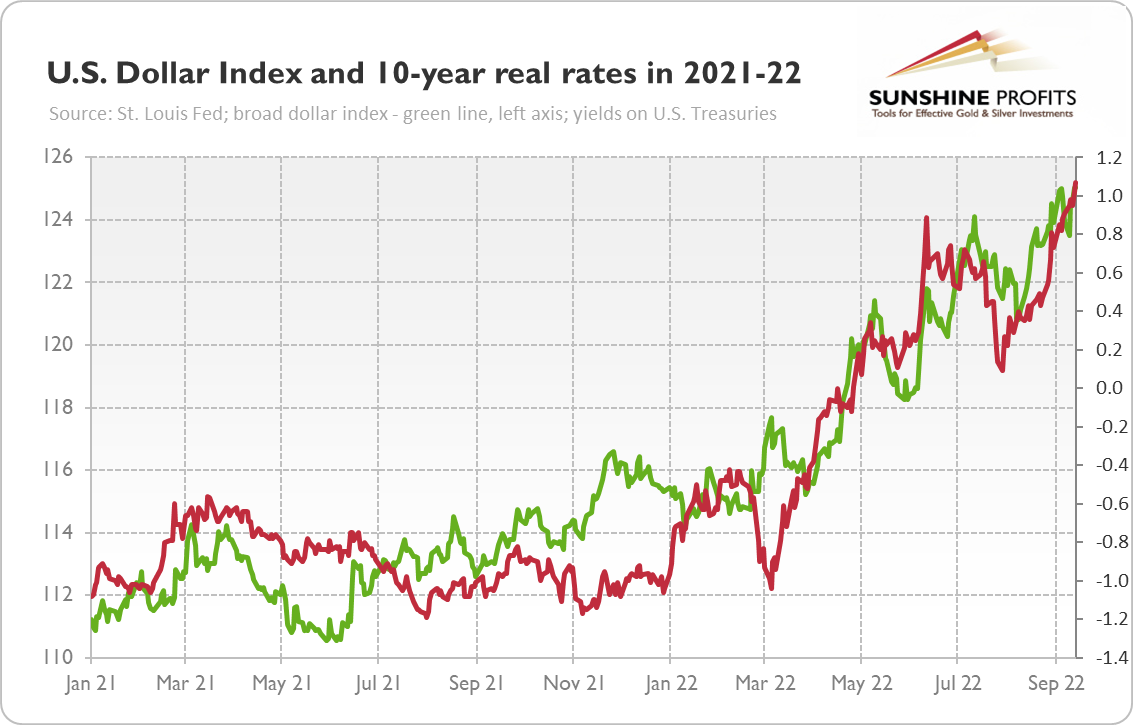

The reason behind this bearish trend in gold is clear, and its name is the Fed, the hawkish Fed. The tightening of monetary policy by the U.S. central bank boosted the greenback, gold’s nemesis, and bond yields (see the chart below). The higher the interest rates, the less attractive gold is compared to interest-bearing assets. Unfortunately for gold, inflation stabilized somewhat, which – with the hikes in the federal funds rate – lead to the rise in the real interest rates that are key for the gold market.

What’s Next for Gold?

We know what happened, but the key question is what awaits us in the last months of the year. Well, I don’t have a crystal ball, but obviously gold could struggle more during this tightening cycle of U.S. monetary policy. Interest rates are set to continue higher until inflation retreats closer to the 2-percent target. The Fed could go all the way to 4.5%. The more hawkish the Fed and the steeper the expected path of the federal funds rate, the worse for gold.

However, everything passes away, and this applies also to gold’s disappointing performance (although please note that gold is still one of the best assets this year – just think about declines in equities – and gold fares much better in other currencies than the U.S. dollar). At some point, either inflation softens or a recession arrives. In August, Bloomberg’s US recession probability forecast increased from 40% to 50%, and according to the World Bank, “as central banks across the world simultaneously hike interest rates in response to inflation, the world may be edging toward a global recession in 2023.”

Then, the Fed will likely reverse its course, and gold could rally again, especially if the economic downturn is accompanied by still high inflation. Gold has historically performed relatively well during stagflations and recessions (according to the World Gold Council, “gold’s median return during such periods has been 0.92%, higher than comparable major asset classes with the exception of US Treasuries and corporate bonds”).

What could also help gold a bit is the Ukrainian counteroffensive (it increases the odds of a resolution and a lack of the energy crisis in Europe during winter) and the continuation of the tightening cycle started recently by the ECB (it could reduce the divergence between interest rates across the pond).

Implications for Gold

Of course, waiting for the Fed’s pivot could be similar to waiting for Godot. In Beckett’s play, Godot never arrives, but we know that at some point, the Fed will at least stop raising interest rates. We just don’t know exactly when this will happen. However, it’s possible that we are already behind the peak of the Fed’s hawkishness and that the upcoming hikes will be smaller compared to those from September and previous months. I also believe that the biggest increases in real interest rates and the U.S. dollar index have already been made. The full reversal in the Fed’s stance would be much better for gold, but such a moderation should be welcomed as well.

Hence, gold could find a bottom in the final quarter of 2022, although it could struggle until Q1 2023. Why? Well, inflation probably won’t moderate this year, and I expect more economic weakness that would finally force the Fed to make a policy shift.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Gold Survive Another Jumbo Rate Hike?

September 21, 2022, 7:58 AMThe key FOMC meeting ends soon. One thing is certain: after this event, the gold market won’t be the same.

The Fed’s Projection Will Be Key for Gold

Ladies and gentlemen, please take your seat and fasten your seat belt, as we’re approaching the FOMC meeting and there could be some turbulence! Actually, gold has already entered an area of turbulence and has declined below the psychologically important level of $1,700. As the chart below shows, the price of the yellow metal has declined from $1,726 last week to the current level of $1,664, in a response to the strengthened expectations of a more hawkish Fed.

The sad truth is that if today’s FOMC meeting turns out to be more hawkish than expected, gold may go down even further. On the other hand, if the Fed surprises markets with a dovish side and provides some clues about the end of its tightening cycle, gold may catch its breath and even rebound somewhat.

What can we expect? Well, some analysts say that the Fed could deliver a full percentage point hike in the federal funds rate to show markets that it’s taking inflation seriously. Such a decision could ruin gold. However, I doubt it. Such a big raise could be interpreted as a panic move and be counter-effective. This is why I expect another 75-basis point hike. This is also supported by futures: the odds of such a move are 84%, while the chances of a full 1% move are only 16%, according to the CME FedWatch Tool. The size of the hike is one thing. However, the markets also await for fresh economic projections, as investors want to know how high the Fed will raise interest rates and what the economic effects of these hikes will be. What can we expect here? Well, long story short, prepare for projections of slower GDP growth, higher inflation, a higher unemployment rate, and higher interest rates. The interest rate forecast for the next year could move from the current 3.8% to 4-4.5%. If the new dot-plot turns out to be more aggressive, gold could get another hit.

On the other hand, Powell and his colleagues are likely to put numbers to the “pain” they’ve been thinking of in recent days. Hence, the expected unemployment rate will rise to reflect the effects of rising interest rates on aggregate demand. The economic slowdown and deteriorating labor market, in the Fed’s eyes, could provide some support for gold prices, especially if their scale is larger than expected.

Implications for Gold

How does the FOMC meeting affect the gold market? Well, it depends, but given the persistent inflation, the monetary policy statement and Powell’s press conference would be decisively hawkish. The federal funds rate is likely to rise by another 75 basis points, the next jumbo-hike in a row, and its forecast for the next year will also increase, creating downward pressure on gold prices. True, much of this is already priced in, so the mere absence of a full 1% increase could provide relief for gold. However, I’m afraid that the event could catalyze the next leg lower in precious metals, especially if we get any hawkish surprises.

Gold bulls will seek clues about the much-anticipated Fed’s pivot. I don’t expect any such hints at this meeting, but there might be signals about the slowdown in the pace of interest rate hikes. There is a clear limit to how high the Fed is willing to hike rates, especially given that the higher the rates, the more costly the federal debt is and the greater the odds of a recession. And the higher we climb, the closer we are to the peak. Gold could find some comfort there. If not comfort, then the bottom at least, setting a stage for the rally in the future.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Inflation Is Hotter Than Expected, Gold Colder Than Hoped

September 15, 2022, 12:43 PMThe annual CPI decelerated in August but came in higher than expected. Bets on a more hawkish Fed increased, while in the case of gold, they decreased.

Inflation stayed hot in August. Unbelievable! At least for the majority of pundits who expected softer inflation. However, I’m not surprised, as I’ve repeated many times that “inflation is likely to stay elevated for some time.” But let’s stop bragging – and start digging into the recent CPI report.

The CPI increased 0.1% in August after being flat in July, according to the Bureau of Labor Statistics. It doesn’t seem to be a huge increase, but let’s note that it occurred despite a 10.6-percent decline in the gasoline index. Without plunging gas prices, inflation would be much higher because of the broad-based monthly item increase.

The core CPI, which excludes food and energy prices, rose 0.6% last month, following a 0.3% rise in July. Increases in the shelter and medical care indexes were the largest of many contributors to the acceleration in the core CPI monthly rate. Thus, I bet that although inflation can’t be seen, Americans feel its impact in their daily lives.

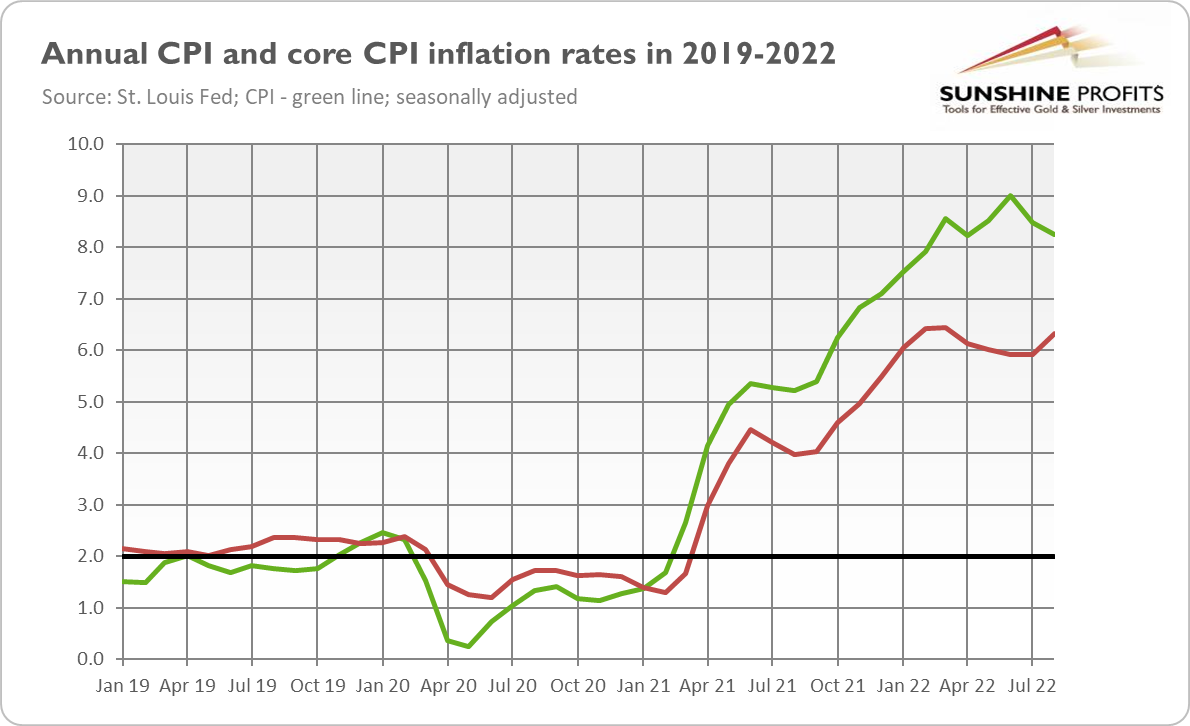

It’s not any better on an annual basis. The overall CPI increased 8.3% for the 12 months ending August, as the chart below shows. It’s a smaller figure than the 8.5-percent rise from July, but higher than expected (the market consensus was 8.0%). The core CPI rose 6.3%, which means an acceleration from July, when it increased 5.9%. Thus, although the overall index has peaked, the core CPI is once again on the rise.

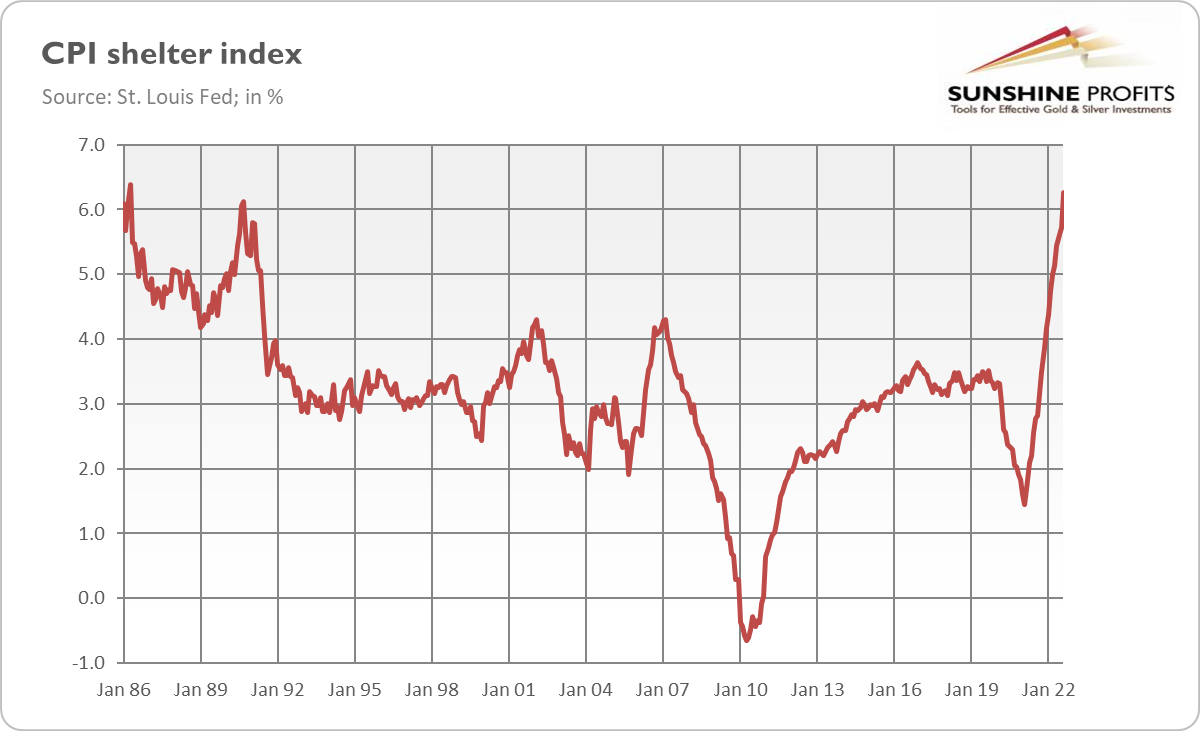

Unfortunately for Americans who struggle with the rising cost of living, inflation will remain elevated for some time. Why? Well, one of the reasons is rising housing inflation. As the chart below shows, the CPI shelter index has accelerated from 5.7% in July to 6.3% in August, the fastest pace since April 1986. The problem here is that this sub-index, which is the major component of the CPI, is rather sticky and the Fed’s actions won’t affect it quickly. In other words, inflationary forces are not weakening at the desirable pace despite the Fed’s hiking rates, while the economy is slowing down and recessionary risks are increasing.

Hot Inflation Implies Hot Fed and Cold Wall Street

Inflation above expectations boosted market bets for steeper interest rate hikes from the Fed. Indeed, according to the CME FedWatch Tool, the market-based probability that the FOMC will raise rates by 100 basis points at its September meeting has risen from literally zero last week to 31% after the release of the CPI inflation report. Meanwhile, the odds of a 50-basis point hike plunged from 23% to zero. Hence, the Fed is likely to deliver another ‘jumbo’ 75-basis point hike, and gold bulls will still have to wait for the dovish pivot.

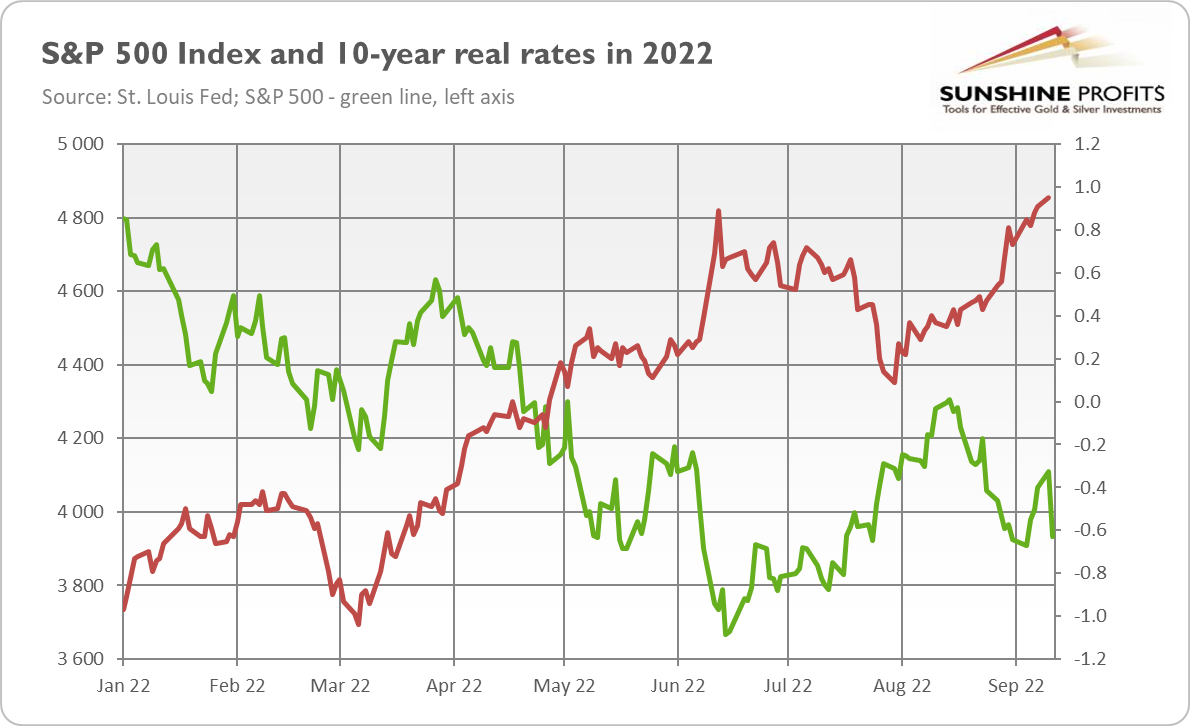

The yields on Treasuries increased, with 10-year real interest rates climbing to almost 1% for the first time since the end of 2018, as the chart below shows. Meanwhile, stock markets plunged, with the S&P 500 and Dow Jones falling 3% and 2.6%, respectively.

Implications for Gold

What does the hot CPI report mean for the gold market? Well, it strengthened expectations of a hawkish Fed and boosted bond yields. Hence, despite all the belief in gold as an inflation hedge, the stronger-than-expected number should be negative for gold prices. Indeed, the London price of the yellow metal declined on Tuesday from $1,726 to $1,705 (or 1.2%), as the chart below shows.

The intra-day drop was a bit larger, but gold still showed relative resilience in the face of a sudden repricing o the future path of the federal funds rate. However, the price of the yellow metal dropped further on Wednesday (September 14, 2022), sinking below $1,700. It goes without saying that gold could suffer more in the upcoming days. Next week, the FOMC members are gathering, and their meeting, not to mention the fresh dot plot, is likely to be hawkish. Of course, much of that hawkishness has already been priced in, but these two weeks could be crucial for the gold market, with more downside potential (especially if gold declines below key price levels).

They say that there is always a silver lining. Indeed, forget about the peak in inflation and the soft landing. Given that the Fed was delayed in its fight against inflation and that interest rates are a rather blunt tool of monetary policy, the U.S. central bank is probably going to overdo it, which will lead to a recession. Then – or sooner if the Fed pivots before the downturn – gold will rally again.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

When Rising Unemployment Is Not Good News for Gold

September 8, 2022, 10:42 AMThe US economy generated 315,000 jobs in August, but the unemployment rate increased. What does it imply for the gold market?

Powell, we could have a problem! According to the BLS, the U.S. unemployment rate rose to 3.7% in August from 3.5% in the previous month, as the chart below shows. It seems to be a fatal blow to the narrative of a strong labor market.

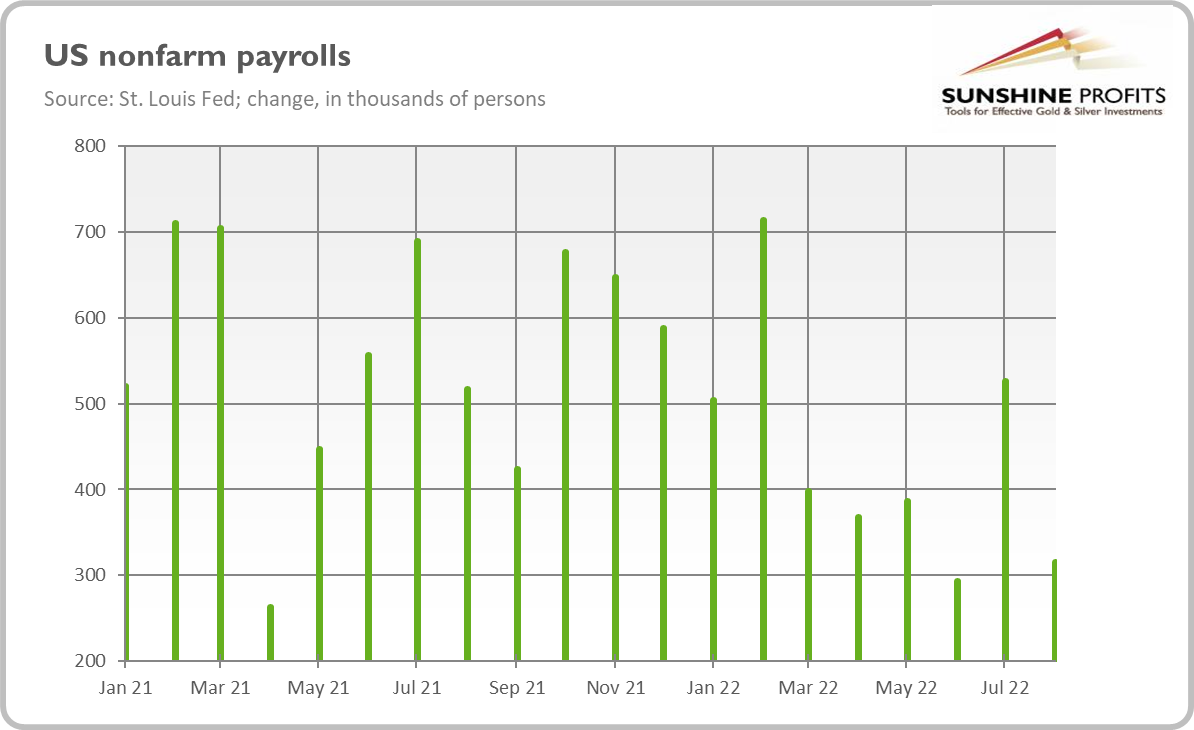

It seems to be, but it’s not! After all, as one can see in the chart below, the U.S. economy created 315,000 jobs last month, roughly in line with expectations, although less than 526,000 jobs added in July. Notable job gains occurred in professional and business services, health care, and retail trade.

What’s more, the rise in the unemployment rate was accompanied by an increase in the labor force participation rate from 62.1% in July to 62.4% in August, which means that more people entered the labor market looking for a job. On the other hand, after revisions, employment in June and July combined is 107,000 lower than previously reported.

However, the headline increase in the unemployment rate is mostly due to the rise in the labor participation rate, so it’s not terrible news. Actually, August’s employment report was strong enough to enable the Fed to continue its tightening cycle at the current hawkish pace. Indeed, the market odds of a 75-basis point hike at the September FOMC meeting rose from 75% to 82% over the last week, according to the CME FedWatch Tool.

The Fed’s commitment to a decisive fight against inflation through hikes in the federal funds rate was also confirmed by recent remarks from the central bankers. Fed Vice Chair Lael Brainard said that the Fed will maintain tight monetary policy “for as long as it takes to get inflation down” and that the U.S. central bank’s stance “will need to be restrictive for some time to provide confidence that inflation is moving down.” Similarly, the new Boston Fed President, Susan Collins, in her first media interview at this job, said that although the Fed has raised interest rates significantly, “there’s more to do.” All this is bad news for the gold bulls, who are waiting for the Fed’s pivot.

The Dollar Strengthens Further

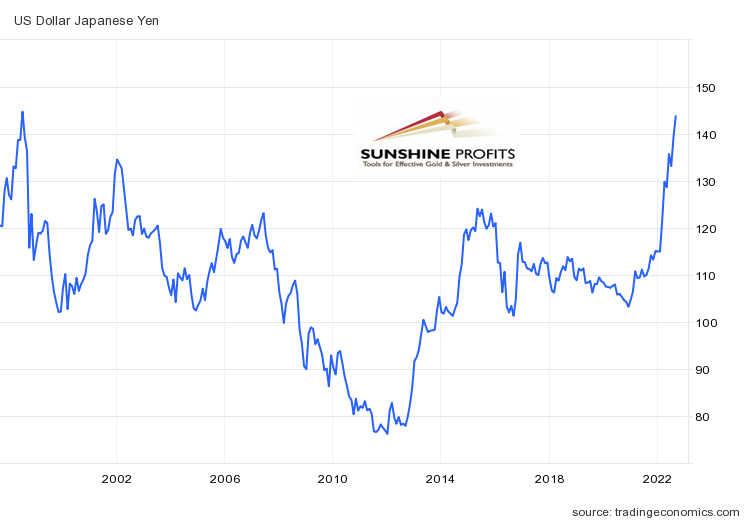

The Fed’s tightening cycle is not the only reason behind the current strength of the U.S. dollar. Another is the relative dovish stance of other major central banks as the ECB and Bank of Japan. As a consequence, the Japanese yen plunged to the level of 143 per dollar, the lowest level since July 1998, as the chart below shows.

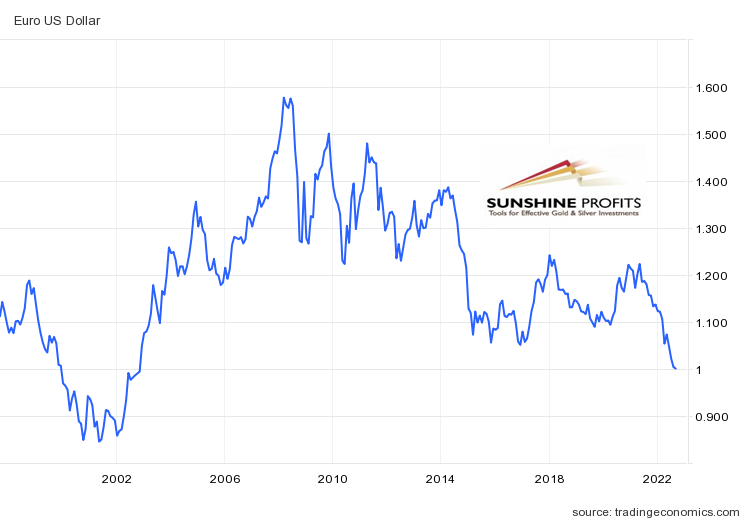

Similarly, the EUR/USD exchange rate has recently tumbled below parity, and also the lowest level since October 2002, as one can see in the chart below. The ECB is not as dovish as the BoJ, but the euro is suffering due to the European energy crisis. The common currency slumped this week after Russia shut the key Nord Stream 1 pipeline into Europe, sending gas prices higher and boosting concerns about a recession.

Implications for Gold

What does it all mean for the gold market? Well, the recent employment report was strong enough to make the Fed feel comfortable with the continuation of its hawkish monetary policy and with further interest rate hikes. The Fed’s tightening cycle is supporting the U.S. dollar, which is weighing on gold. As the chart below shows, the price of the yellow metal remains below $1,700 and continues its struggle to find bullish momentum.

Unfortunately for the gold bulls, prices can decline further, given the Fed’s stance and the dollar’s strength. Gold will start a new rally only if either the recession fears intensify, boosting the safe-haven demand for the precious metal, or if the Fed pivots (which won’t happen until the economy seriously slows down).

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM