-

Gold Falls as Powell Appears Hawkish in Jackson Hole

September 1, 2022, 9:29 PMPowell’s speech at the Jackson Hole symposium confirmed his hawkish stance, sending gold prices towards $1,700.

Markets Were Quick to React to Powell’s Speech

Jackson Hole is behind us! What have we learned from Powell’s remarks at this year’s symposium? Well, the Fed Chair delivered a decisive and firm speech that reinforced the Fed’s hawkish stance and put to rest beliefs about a quick dovish pivot:

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.

Although Powell didn’t specify how large the next interest rate hike will be, he said that “another unusually large increase could be appropriate at our next meeting”. Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month's improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Powell also emphasized the Fed’s commitment for delivering low and stable inflation. He said that:

Our responsibility to deliver price stability is unconditional (…). There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job (…). We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

What’s important, is that Powell acknowledged the costs of restoring price stability in the form of drag on aggregate demand and the labor market (and that it would bring “some pain,” or the so-called hard landing), but he seemed to be ready to bear these costs in order to defeat inflation. The logic is simple: as “the employment costs of bringing down inflation are likely to increase with delay,” the Fed should act with resolve now until the job is done:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Last but not least, Powell clearly stated that estimates of the longer-run neutral level of federal funds rate – estimated in June FOMC’s economic projections to be 2.50% – are not a place to stop or pause the Fed’s tightening cycle. It means that interest rates may go significantly higher. This week, Cleveland Fed President Loretta Mester said that the Fed will need to raise the federal funds rate somewhat above 4% by early next year.

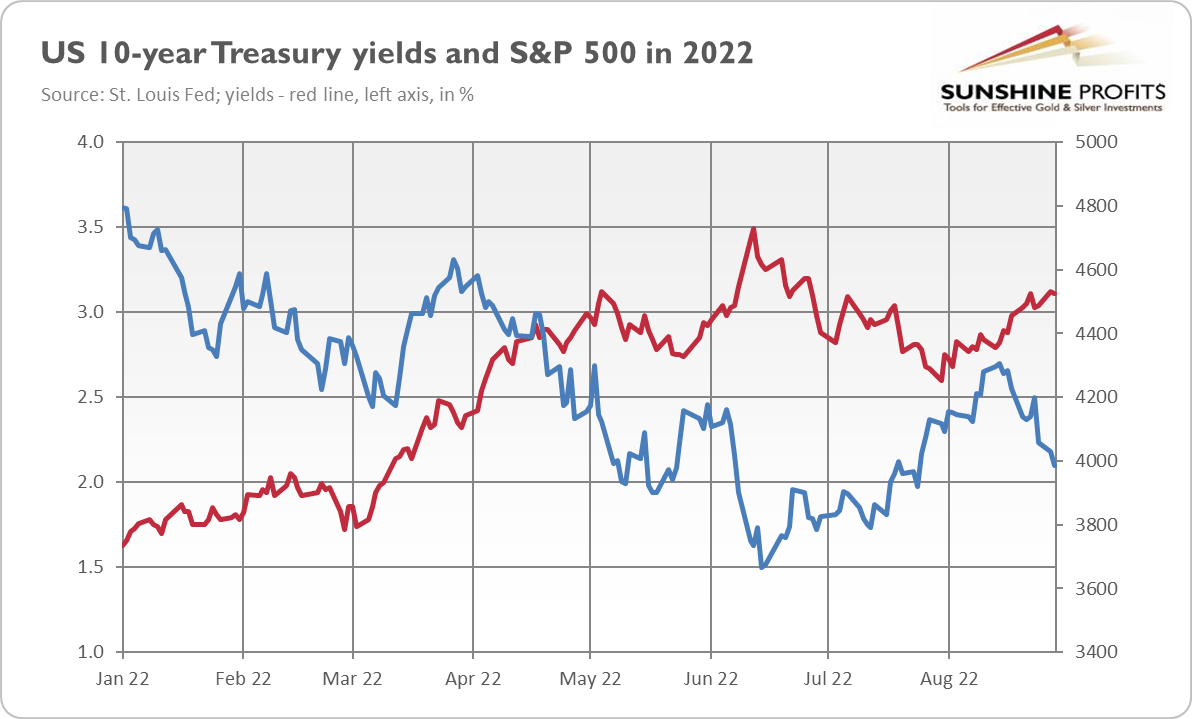

Powell’s speech at Jackson Hole pushed the dollar and bond yields higher, while equities plunged. As the chart below shows, the 10-year yield on U.S. Treasuries rose from 3.03% to 3.12%, while the S&P 500 Index plummeted from 4,199 to 3,955. Moreover, according to the CME FedWatch Tool, the odds of 75-basis points hike in the federal funds rate increased from 64% to 72%, which also put downward pressure on the gold prices.

Implications for Gold

What do the recent Fed’s hawkish comments imply for the gold market? Well, they add downward pressure on the yellow metal. As the chart below shows, the gold prices have been gradually sliding in August from $1,800 towards $1,700. Powell’s speech at Jackson Hole has accelerated this downward trend, pushing the price of gold from $1,754 to $1,716 one week later.

Unfortunately for the gold bulls, this downward trend could continue for a while, although most of the downside risks seem to have been already priced in. The hawkish Fed, strong greenback, and rising real interest rates are clear headwinds for gold that keep its price below $1,800 or even lower.

However, remember that talk is cheap. Powell’s speech was resolute, but the question is how is he going to sound when the data seriously deteriorates. After all, a recession is practically unavoidable, and the only question is how deep and painful it will be. Hence, gold is likely to struggle further, but at some point, it should get a boost from recessionary and stagflationary tailwinds.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Even a Steep Decline in PMI Didn’t Move Gold Higher

August 25, 2022, 11:23 AMAccording to recent PMI reports, the third quarter of 2022 could also see negative GDP growth. Will gold finally rally then?

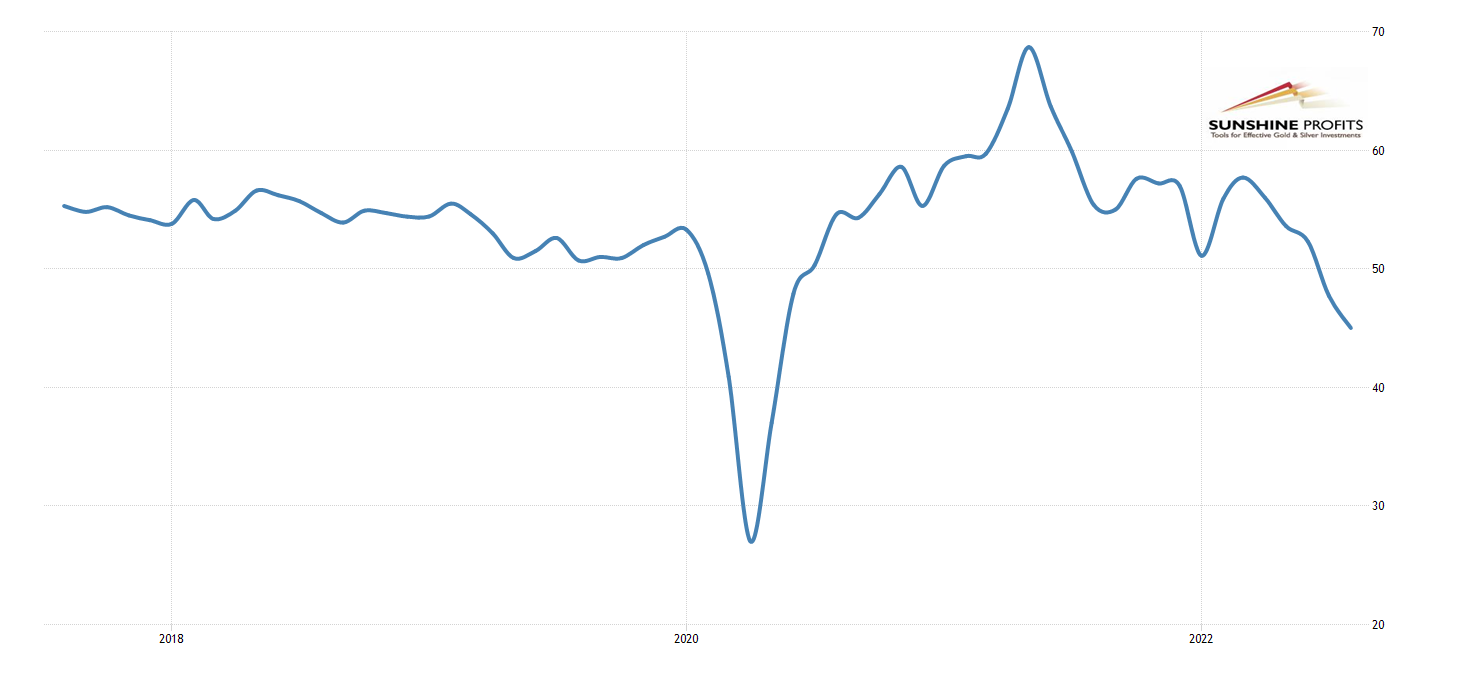

The latest S&P Global Flash US Composite PMI doesn’t bode well for the U.S. economy. The headline Flash US PMI Composite Output Index declined from 47.7 in July to 45 in August, as the chart below shows. It was the second successive monthly decrease in total business activity. The drop in output was the steepest seen since May 2020. Actually, excluding the pandemic period, “the fall in total output was the steepest seen since the series began nearly 13 years ago,” as Siân Jones, Senior Economist at S&P Global Market Intelligence noted.

It was also broad-based, with both manufacturers and service companies registering lower activity, although – interestingly – service sector firms recorded the steeper rate of decline. The S&P Global Flash US Services Business Activity Index declined from 47.3 in July to 44.1 in August, while the Flash US Manufacturing Output Index dropped from 49.5 to 49.3. However, the overall manufacturing activity remained within expansion territory, as Flash US Manufacturing PMI posted at 51.3 in August, down from 52.2 in July. But this index fell to its lowest level in just over two years. Coupled with two quarters of negative GDP growth, it doesn’t look the best economy in modern history.

OK, so what’s happening in the U.S. economy? Why is the output declining? Well, the culprits are – who would have guessed it? – inflation and the Fed’s tightening cycle. Surging prices and hikes in interest rates simply squeezed the real disposable incomes of Americans and reduced their spending. The supply issues, such as material shortages and delivery delays, also didn’t help producers. Oh, and one more thing, rising costs: although the rate of producer price inflation slowed down, rising wages, transportation surcharges, and supplier costs pushed up business expenses. Additionally, although it’s another report, new home sales plunged 12.6% to 511,000 units in July, which also shows the negative impact of higher mortgage rates.

Economic Slowdown Is Likely to Intensify

This is in line with what I wrote some time ago: a recession (or a serious economic downturn) is practically inevitable, as either the Fed’s tightening of monetary policy or inflation on its own will lead to a decline in economic activity. You see, the dichotomy between inflation and recession is a false one. The actual choice is between a recession with high inflation or a recession with moderate inflation under control. Inflation distorts the economic structure, and it was obvious from the very beginning that high inflation would severely hit the economy. This is exactly what we are observing right now.

I don’t have good news about the future. Why? Inflation, even if it has peaked, will remain elevated for several, if not a few months. Similarly, although the Fed is going to slow down the pace of hikes in the federal funds rate, it will remain hawkish for some time (at least until there is a big increase in the unemployment rate or a really serious economic crisis or strong recession). Hence, the downward pressure on people’s disposable incomes will continue, dampening further the pace of economic growth. The decline in new orders was the sharpest in over two years, as the composite survey’s new orders index dropped from 50.8 in July to 48.8 in August.

Implications for Gold

What do the recent PMI reports imply for the gold market? Well, the immediate reaction was rather limited, as one can see in the chart below. The fact that the steep decline in PMI wasn’t able to move gold prices decisively higher is disturbing.

However, from the fundamental point of view, the slowdown in economic activity should be positive for gold prices. It brings us closer to stagflation and increases the odds of a more dovish Fed in the future.

Anyway, tomorrow Jerome Powell will speak at the Jackson Hole Economic Symposium. Who knows, maybe this will even provide a catalyst for the gold price. If the Fed Chair is more dovish than expected, the yellow metal could gain. However, if Powell delivers a more hawkish speech than anticipated, gold prices could go down. You have been warned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Barely Reacts to July FOMC Minutes

August 18, 2022, 10:29 AMAlthough gold barely reacted to the July FOMC minutes, the Fed worries about an economic slowdown. That bodes well for the long-term outlook for gold.

Yesterday (August 17, 2022), the FOMC published the minutes from its last meeting from the end of July. They don’t reveal many surprises for the markets. However, the publication shows a few interesting things. First, Fed officials continue to worry about inflation, believing it will remain elevated for some time:

Participants agreed that there was little evidence to date that inflation pressures were subsiding. They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time (…).

Uncertainty about the medium-term course of inflation remained high, and the balance of inflation risks remained skewed to the upside, with several participants highlighting the possibility of further supply shocks arising from commodity markets.

Second, because of this grim inflation outlook, the US central bank is going to continue its tightening cycle and further hike the federal funds rate.

In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee's objectives. With inflation remaining well above the Committee's objective, participants judged that moving to a restrictive stance of policy was required to meet the Committee's legislative mandate to promote maximum employment and price stability.

What’s more, the FOMC members agreed that moving to a restrictive stance would also be wise from a risk-management point of view:

In light of elevated inflation and the upside risks to the outlook for inflation, participants remarked that moving to a restrictive stance of the policy rate in the near term would also be appropriate from a risk-management perspective because it would better position the Committee to raise the policy rate further, to appropriately restrictive levels, if inflation were to run higher than expected.

The fact that the Committee’s participants remain hawkish and firm in the fight against inflation is negative for gold prices.

The Fed Expects an Economic Slowdown and a Rise in Unemployment

However, and this will be the third interesting issue revealed by the minutes, the FOMC participants are fully aware that the US economy is decelerating and that monetary policy tightening is one of the reasons behind the slowdown.

With regard to current economic activity, participants noted that consumer expenditures, housing activity, business investment, and manufacturing production had all decelerated from the robust rates of growth seen in 2021 (…). Participants observed that indicators of spending and production suggested that the second quarter of this year had seen a broad-based softening in economic activity. Many participants remarked that some of the slowing, particularly in the housing sector, reflected the emerging response of aggregate demand to the tightening of financial conditions associated with the ongoing firming of monetary policy. Participants anticipated that U.S. real GDP would expand in the second half of the year, but many expected that growth in economic activity would be at a below-trend pace, as the period ahead would likely see the response of aggregate demand to tighter financial conditions become stronger and more broad-based.

Fourth, although the labor market remains strong, the Committee’s members worry that it might not be as tight as it’s widely believed:

Several participants also observed, however, that the labor market might not be as tight as some indicators suggested, and they noted that data provided by the payroll processor ADP and employment as reported in the household survey both seemed to imply a softer labor market than that suggested by the still-robust growth in payroll employment as reported in the establishment survey.

Additionally, the FOMC participants admitted that some labor markets were deteriorating:

Many participants also noted, however, that there were some tentative signs of a softening outlook for the labor market: These signs included increases in weekly initial unemployment insurance claims, reductions in quit rates and vacancies, slower growth in payrolls than earlier in the year, and reports of cutbacks in hiring in some sectors. In addition, although nominal wage growth remained strong according to a wide range of measures, there were some signs of a leveling off or edging down. In some districts, contacts suggested that labor demand–supply imbalances might be diminishing, with firms being more successful in hiring and retaining workers and under less pressure to raise wages.

Moreover, the Fed’s staff projects that the unemployment rate will start rising in the second half of 2022 and will reach an estimate of its natural rate at the end of next year. Oops… Please remember that the official view was that there was no recession because the unemployment rate remained low. However, now the Fed’s staff itself forecasts rising unemployment. Does it mean that a recession is coming or that it has already begun?

Fifth, the US central bank is fully aware that the worst is yet to come. I have here in mind that the tightening of monetary policy hasn’t yet been transmitted fully into the real economy. So, you can expect a further slowdown:

Participants pointed to some evidence suggesting that policy actions and communications about the future path of the federal funds rate were starting to affect the economy, most visibly in interest-sensitive sectors. Participants generally judged that the bulk of the effects on real activity had yet to be felt because of lags associated with the transmission of monetary policy (…).

Hence (and sixth), the pace of monetary tightening will slow down after some time and the Fed will pause with interest rate hikes at some point:

Participants judged that, as the stance of monetary policy tightened further, it would likely become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation. Some participants indicated that, once the policy rate had reached a sufficiently restrictive level, it would likely be appropriate to maintain that level for some time to ensure that inflation was firmly on a path back to 2 percent.

The Fed’s pause, not to mention the reversal of its hawkish policy, would be positive for gold prices.

Implications for Gold

What do the recent FOMC minutes imply for the gold market? Well, the price of the yellow metal barely moved yesterday and stayed in a slightly downward trend. However, from the medium-term perspective, gold remains in a sideways drift. As the chart below shows, gold has been trading in a corridor of $1,700-$1,800 since early July.

However, the minutes show that more rate hikes are coming, but their pace should slow as the Fed expects a softening labor market and a slowdown in economic activity. After the publication of the minutes, the odds of a 50-basis point hike increased relative to the odds of a 75-basis point hike, according to the CME FedWatch Tool.

In other words, given the deteriorating economic outlook, the FOMC members started to worry about possible overtightening – many of the committee’s participants noted a risk that the Fed “could tighten the stance of policy by more than necessary to restore price stability”. This is why, at some point, the US central bank will pause on interest rate hikes, but it won’t stop the stagflationary train.

It seems that the nasty combination of elevated inflation, stagnant growth, and rising unemployment is coming fast. It will crush everything in its path – except gold, which should shine in these unusual economic conditions.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Strong Job Creation Shifts the Upper Hand from Gold to the Fed

August 11, 2022, 11:30 AMThe US economy generated almost 530,000 jobs in July. That’s good for monetary hawks but bad for gold bulls.

Strong Employment Report Strengthens Fed’s Hawks

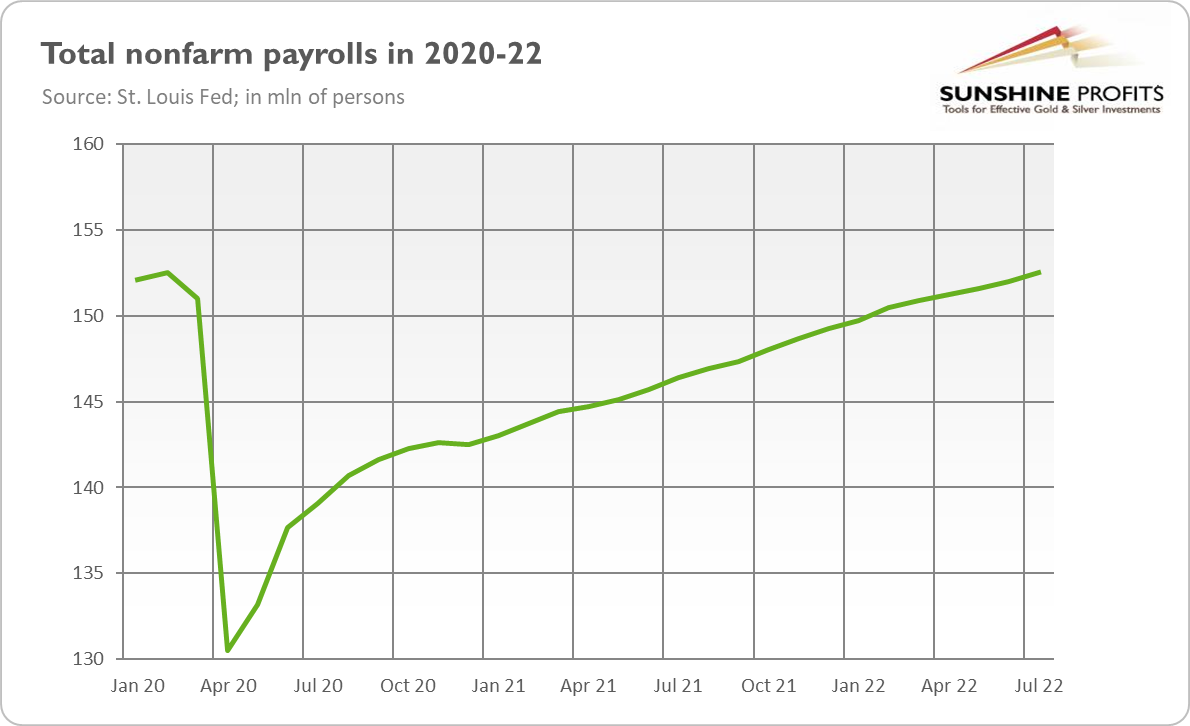

A positive economic surprise! The US labor market added 528,000 jobs last month. As the chart below shows, the number is above June’s figure (+398,000) and much above the market expectations (MarketWatch’s analysts forecasted only 258,000 added jobs). The July number was the highest since February and well above the average monthly gain over the prior 4 months. Importantly, job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Additionally, revised employment in May and June combined was 28,000 higher than previously reported.

Hence, the latest nonfarm payrolls strengthen the optimistic view of the US economy and soften recessionary worries. After all, the narrative is that the economy can’t be in a recession as long as the labor market remains strong. Importantly, total nonfarm payrolls have returned to the pre-pandemic levels of 152,5 million people, as the chart below shows.

What’s more, strong job creation boosted employment and the unemployment rate decreased slightly from 3.6% in June to 3.5% in July, as the chart above shows. It strengthens the narrative about the healthy state of the US economy. However, the drop in the unemployment rate was accompanied by a decrease in the labor force participation rate from 62.2% to 62.1%.

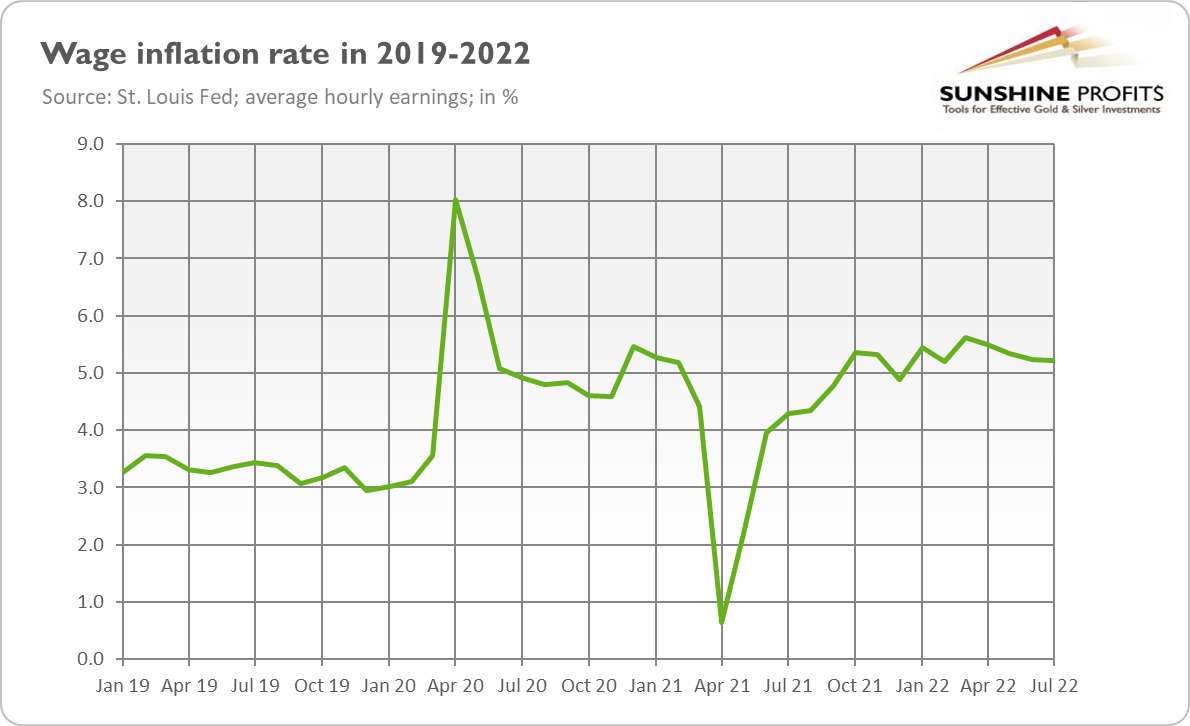

Regarding other labor market indicators, average hourly earnings have increased by 5.2% over the past 12 months. It means that wage inflation remains elevated, which could add to the pressure for the Fed to continue its hawkish stance.

Strong Employment Report Strengthens Fed’s Hawks

The July employment report will further strengthen the already hawkish stance of the US central bank. The surprisingly strong payrolls will strengthen the Fed’s confidence in the American economy and reduce worries about a hard landing. Hence, with strong job creation (and wage growth), the Fed could deliver a larger interest rate hike in September. This is at least what traders have started to expect. The market odds for a 75-basis point move surged from 34% to more than 68%, according to the CME FedWatch Tool. As a result of these expectations, bond yields and the U.S. dollar rose, while the stock market declined following the release of the Employment Report. In other words, the Fed is still on target to raise rates, and the hopes for the pivot early next year could be premature.

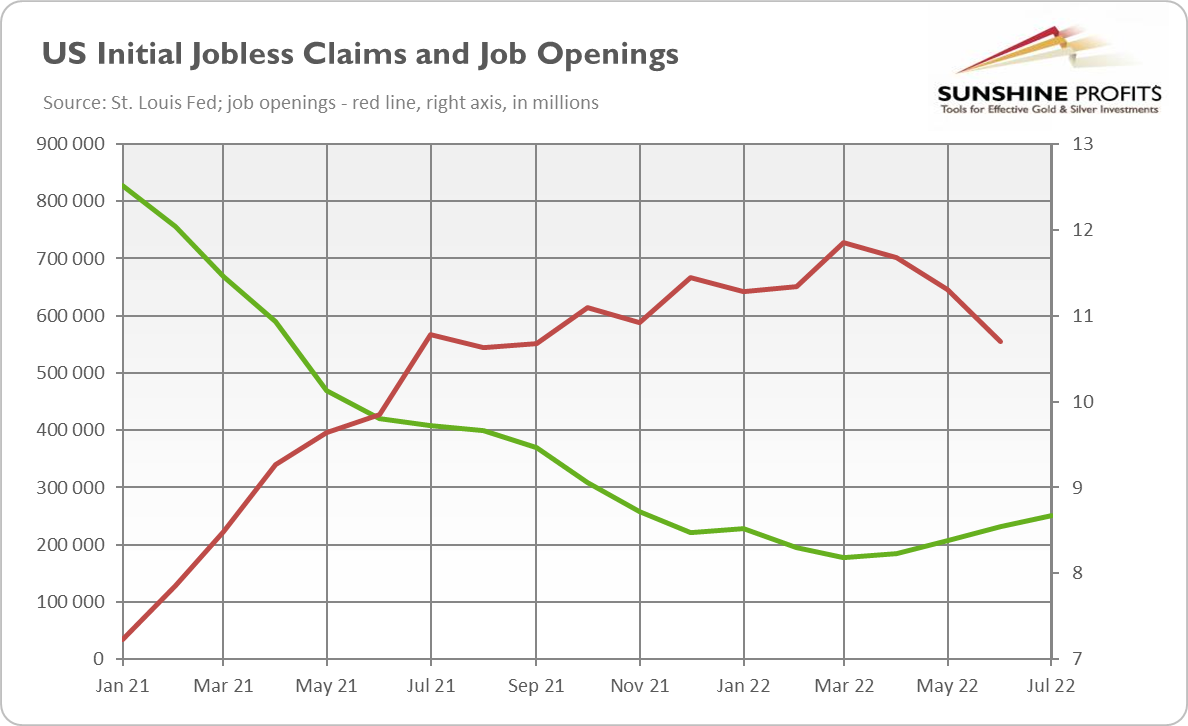

However, I would like to point out two things. One is that the unemployment rate, and the labor market in general, are lagging indicators. So, it’s logically unjustified to conclude that a recession is not likely because the labor market remains strong. The second point is that not all labor market indicators indicate strength. For example, initial claims for unemployment insurance totaled 260,000 last week, near the highest level since November, as you can see in the chart below (it shows monthly averages, but the trend is the same).

Meanwhile, job openings plunged from 11.3 to 10.7 million in June, the lowest level since September 2021, as the chart above shows. Thus, I would say that the labor market has started to slow down, but it’s not yet seen in the nonfarm payrolls or the unemployment rate.

Implications for Gold

What does it all mean for the gold market? Well, gold did the same as equities after the release of the July payrolls – it fell that day. The price of the yellow metal declined from about $1,790 to about $1,770. It’s because strong job creation reduces recessionary fears and the likelihood of the Fed’s monetary policy pivot. No doubt, the latest employment reports give the upper hand to the Fed, so if nothing spectacularly bad occurs in the upcoming weeks, the US central bank could hike interest rates by 75 basis points in September rather than 50 basis points. Such a recalibration of market expectations is clearly negative for gold prices. However, there is still plenty of time before the next FOMC meeting and a lot could happen in the meantime. Stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Recession Is Good for Gold, but a Crisis Would Be Even Better

August 4, 2022, 10:59 AMThe US economy fell into a technical recession. As a safe-haven asset, will gold soar now?

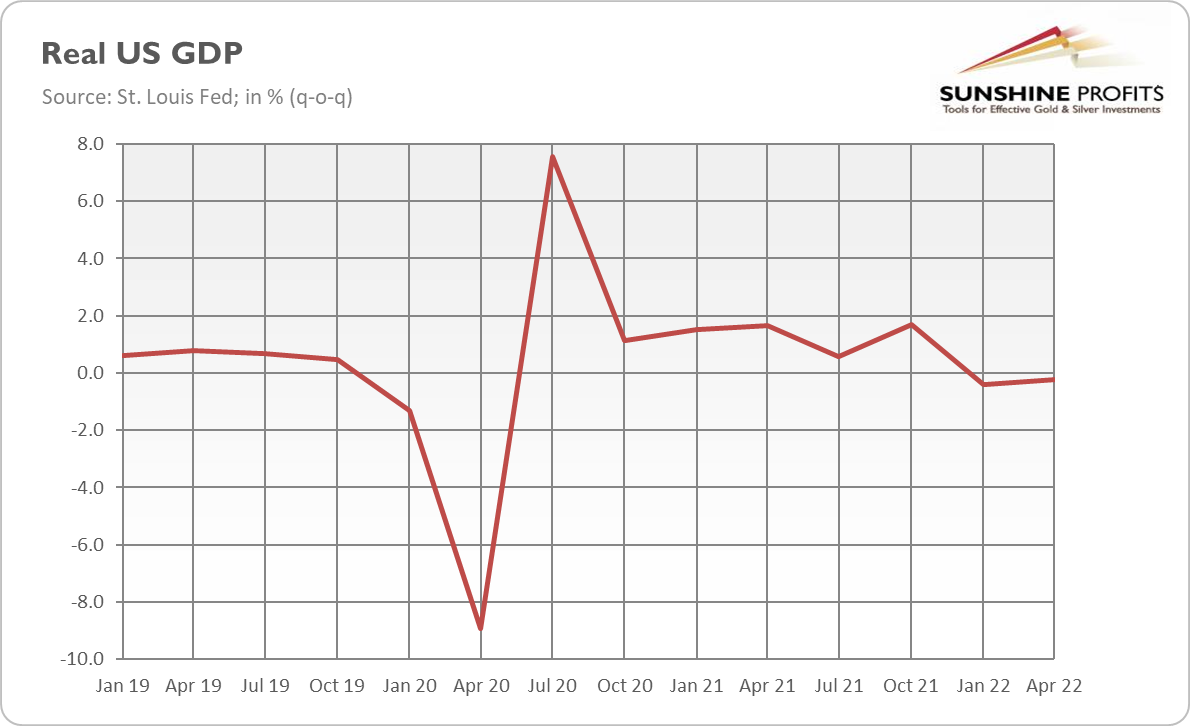

Ladies and gentlemen, please welcome the technical recession! According to the initial measure of the Bureau of Economic Analysis, real GDP dropped 0.9% in the second quarter, following a 1.6% decline in the first quarter (annualized quarterly rates). As the chart below shows, on a quarter-on-quarter basis, real GDP decreased by 0.4 and 0.2 percent, respectively. Thus, the US economy recorded two quarters of negative growth, which implies a technical recession.

However, are we really in a recession? The Fed and the White House deny that. For example, President Biden said last week: “We’re not going to be in a recession, in my view.” Similarly, Treasury Secretary Janet Yellen said that the US economy is not in a recession, instead it’s “in a period of transition in which growth is slowing”. Yeah, sure! But what else could the officials say?

There is a grain of truth in their statements. After all, with a very low unemployment rate and several economic indicators still relatively strong, the picture isn’t very gloomy. However, unemployment is a lagging indicator, so I wouldn’t seek comfort in the labor market. As well, I wouldn’t trust the officials this time, as they are the same guys who were claiming that high inflation would be only transitory.

What Is Recession, Anyway?

Sure, a true recession is defined by the NBER, which determines when the US economy is in such a state as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” In this light, we are not yet in a total recession, as the scale of the decrease has been too small – so far. However, this can change when the impact of high inflation and the Fed’s interest rate hikes is fully transmitted into the economy. The monetary policy operates with a lag, so the worst is yet to come.

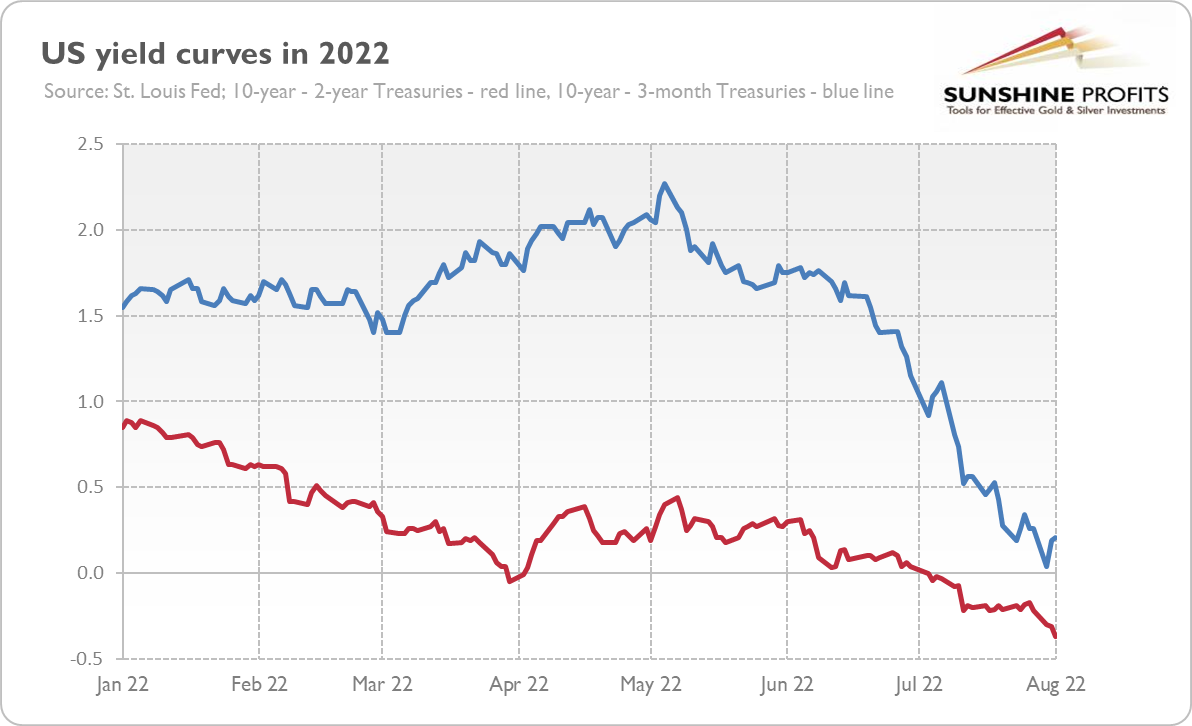

This is also what is suggested by the yield curve. The spread between 10-year and 2-year Treasury bonds (red line) has already fallen deeply into negative territory, while the spread between 10-year and 3-month Treasuries (blue line) will probably do it soon, as the chart below shows.

However, who actually cares – except the politicians – about the labels? The economy may be in a recession or not, but one thing is clear: the state of the economy is not good and it’s getting weaker. Just look at the Atlanta Fed’s projection of GDP in the third quarter. According to the GDPNow model estimate from August 1, the real GDP growth (seasonally adjusted annual rate) in the Q3 of 2022 will be 1.3%, down from the 2.1% projected on July 29. It doesn’t bode well, does it?

The same scenario was in late 2007, when economic data was already looking bad, but the pundits disagreed with statements that the US was headed into a recession. People always try to deny their problems – until they become undeniable some time later.

Implications for Gold

What does it all mean for the gold market? Well, gold – as a safe-haven asset – usually thrives during recessions. In recent weeks, the yellow metal rebounded from about $1,700 to about $1,760, as the chart below shows.

One reason for this upward move was a more dovish FOMC meeting than expected. Another driver could be renewed tensions between China and Taiwan, but gold could also start to smell recession.

To be clear, it’s too early to declare a new bull market in gold. Gold needs a full-blooded recession or an economic crisis that would trigger a lot of fear and force the Fed to ease its monetary stance. Please be prepared that gold could decline substantially before it starts its new rally. In my view, the last FOMC meeting reduced the odds of a large decline, but the sell-off at the beginning of a crisis phase is still very likely, as it was in 2008 and in 2020.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM