-

Is WTI Crude Oil Set Within a New Ranging Market?

August 19, 2022, 11:59 AMRussian production, the Fed's decision to raise interest rates, and the weakened dollar. What other factors are driving crude oil prices these days?

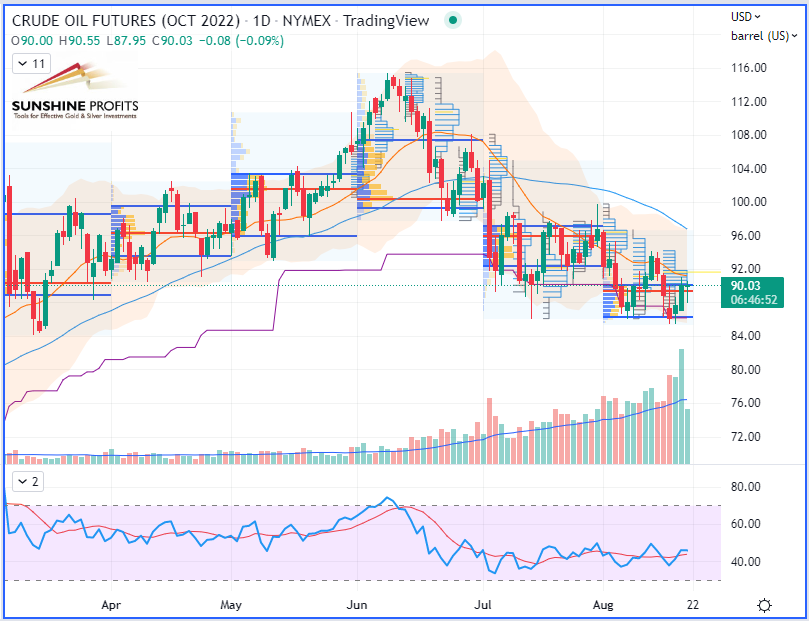

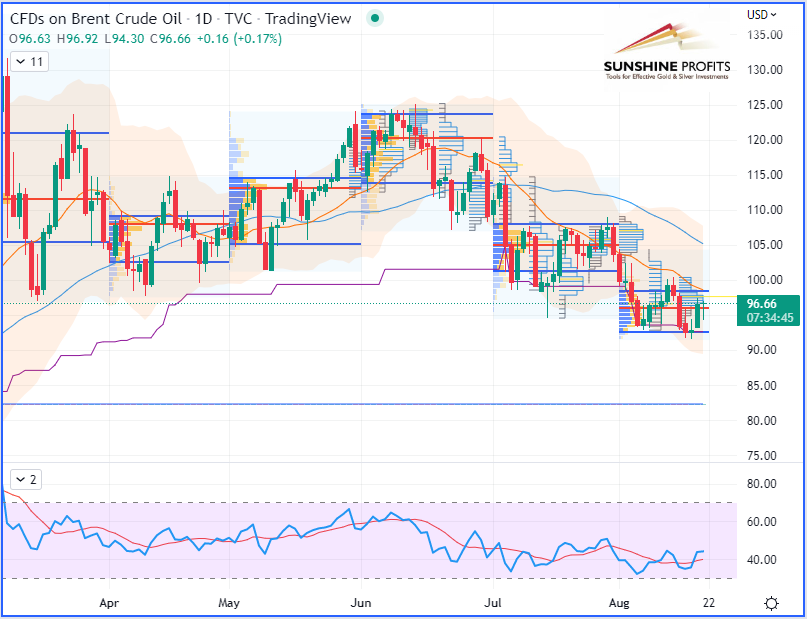

Midweek, black gold gained 5% after rebounding from a 6-month low, as a sharper-than-expected drop in U.S. crude inventories outweighed fears over rising Russian output, export sales, and recession concerns.

Macroeconomics

On the macroeconomic side, the greenback diminished its gains on Wednesday following the U.S. Central Bank’s July minutes. Indeed, during its monthly meeting, the Fed appeared to be more hawkish than expected. This raised concerns from some officials in the U.S. Central Bank, who were debating whether the Fed could raise rates too far to regain control of inflation on the one hand, and the need for further hikes on the other.

As I mentioned in my last article published last Thursday, when all data turns into bearish territory for both legs – the greenback and black gold – it is usually the optimism (or pessimism, depending on which point of view we take) triggered by the macroeconomic perspective that leads the markets. In that case, as the news has rather been bullish for the US dollar, it is the one which will set the tempo for the positively or negatively correlated assets.

Fundamental Analysis

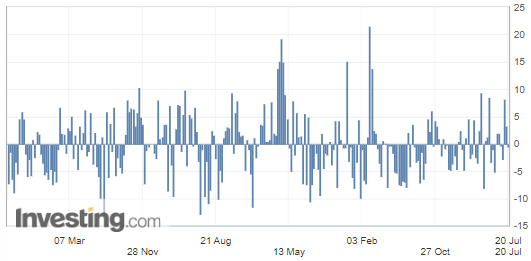

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

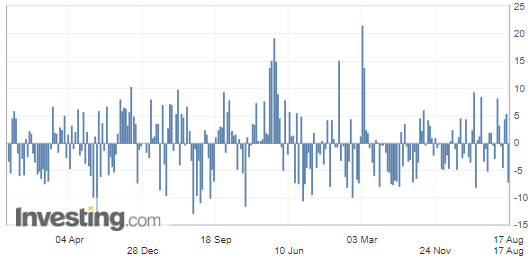

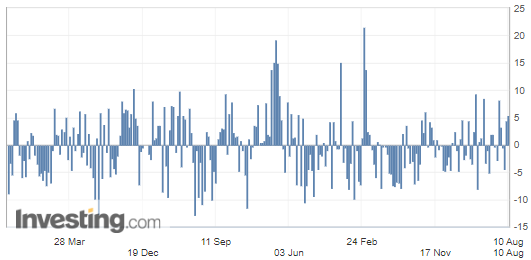

U.S. Crude Oil Inventories

The commercial crude oil reserves in the United States surprised the market by sharply dropping to -7.056M barrels while expectations were just showing a tiny drop (-0.275M barrels).

US crude inventories have thus decreased by over seven million barrels in volume, which is a very significant deviation displaying greater demand and is a strong bullish factor for crude oil prices, since the drop can be explained, in part, by the increase in U.S. crude exports, which more than doubled last week to 5 million barrels per day (Mbpd) against 2.1 Mbpd.

(Source: Investing.com)

The decline in commercial reserves is due to strong domestic demand and rising exports as US trading partners seek to compensate for the loss of Russian hydrocarbons.

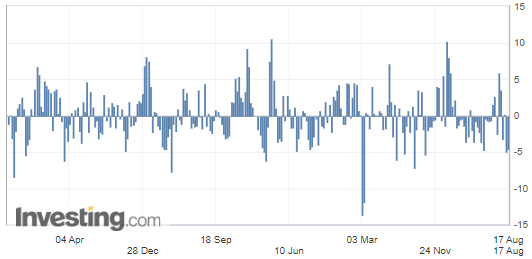

U.S. Gasoline Inventories

Like the previous week, U.S. gasoline demand figures have significantly dropped as well:

This is once again where we could see a sustainable rise in demand marked by an unexpectedly sudden drop in gasoline reserves, since the latter were reduced by four and a half million barrels. Another factor to note is that a few refineries also operated at a lower rate of capacity, at 93.5% versus 94.3%.

Geopolitics

On the geopolitical scene, the ongoing negotiations around the Iranian nuclear agreement, which could allow this major producer to resume its exports, still hover over prices as a bearish factor. However, even a return to the market of Iranian crude oil production would not compensate for the loss of Russian supply. In short, there is little new information about this agreement.

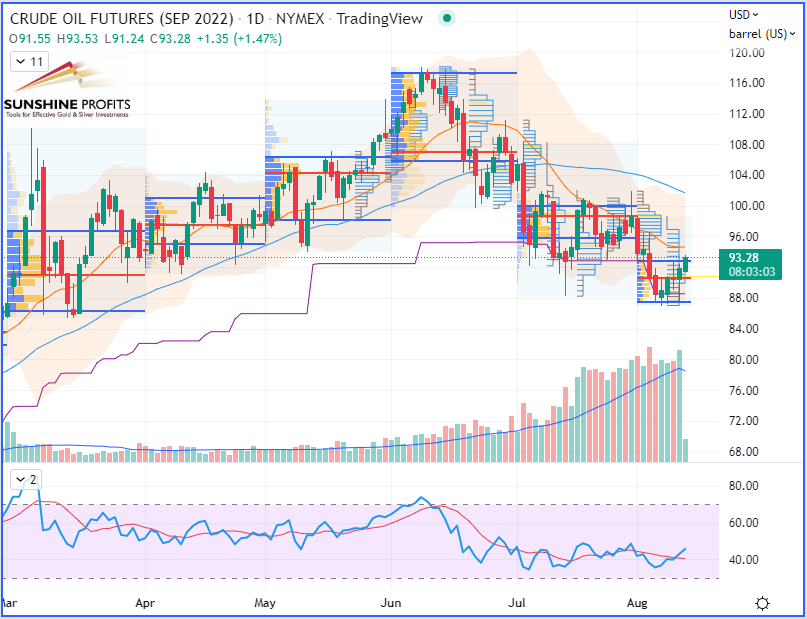

WTI Crude Oil (CLV22) Futures October contract, daily chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

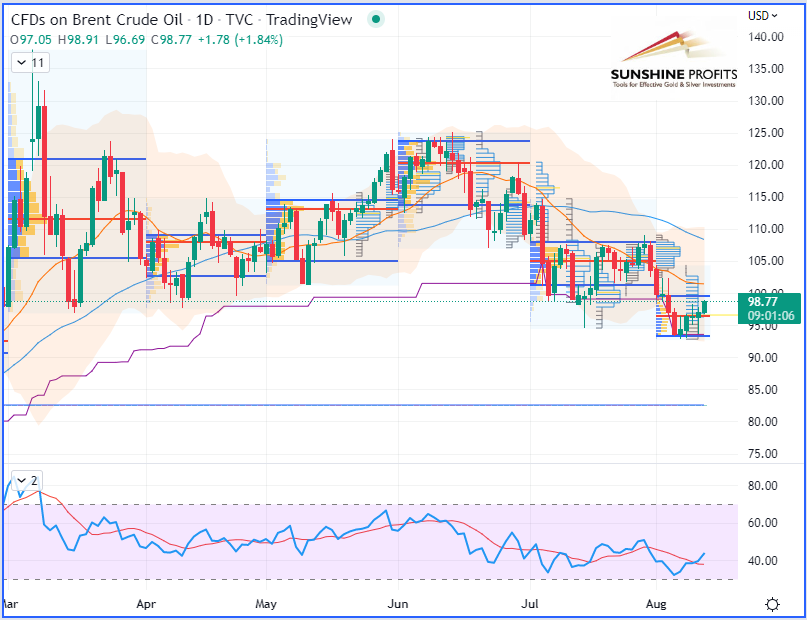

Brent Crude Oil (BRNV22) Futures (October contract, daily chart) –Contract for Difference (CFD) UKOIL

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

The USD and Oil Were on a Tear, but the Dollar Fell Overboard

August 11, 2022, 10:24 AMThe dollar fell following lower-than-expected US inflation data, to the advantage of black gold. What else is driving crude oil prices these days?

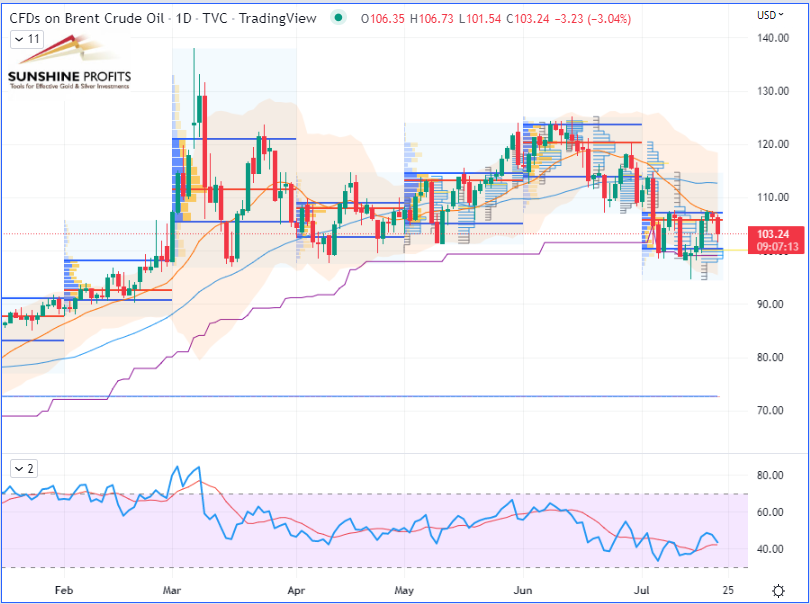

Slowing U.S. Inflation vs. the Greenback

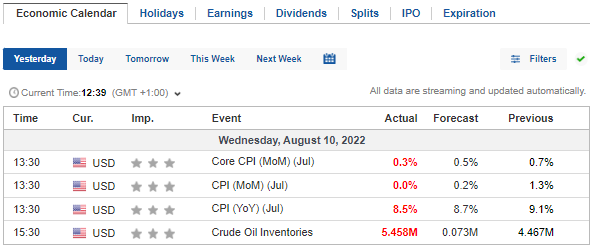

WTI crude oil futures rallied back above the $90 mark this week on the NYMEX as the US dollar weakened. On Wednesday, the safe-heaven currency indeed lost some strength after a lower-than-expected US July inflation figure convinced investors to move towards riskier assets, hence the bound of U.S. equity indexes. The outcome of the Consumer Price Index (CPI) report could potentially lead the Federal Reserve to get a little less aggressive with its interest hike cycle since the CPI in July in the United States slowed its course to 8.5% year on year from 9.1% in June.

(Source: Economic Calendar, Wednesday Aug-10, Investing.com)

(Source: Economic Calendar, Wednesday Aug-10, Investing.com)When all the data turns into bearish territory for both legs – the greenback and black gold – it is usually the optimism (or pessimism, depending on which point of view we take aside) triggered by the macroeconomic perspective that leads the markets. In that case, as the news was bearish for the US dollar as well, it is probably the one which will set the tempo for the rest of the day. Therefore, despite bearish inventory data for crude oil, the drop in the US dollar gets stronger to push other assets towards the upside.

Fundamental Analysis

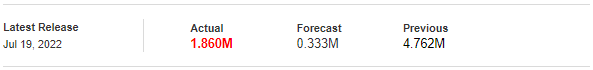

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

U.S. Crude Oil Inventories

Even if we saw the commercial crude oil reserves in the United States sharply rising to 5.458M barrels while the expectations were barely showing a rise (0.073M barrels), the impact was rather mitigated and left in the background as the more optimistic equity indexes were soaring.

(Source: Investing.com)

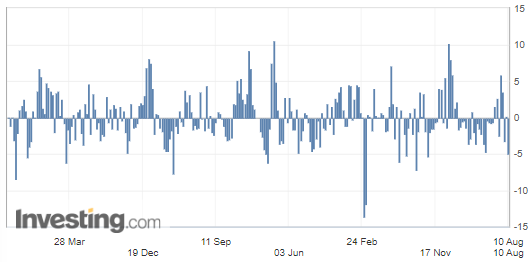

U.S. Gasoline Inventories

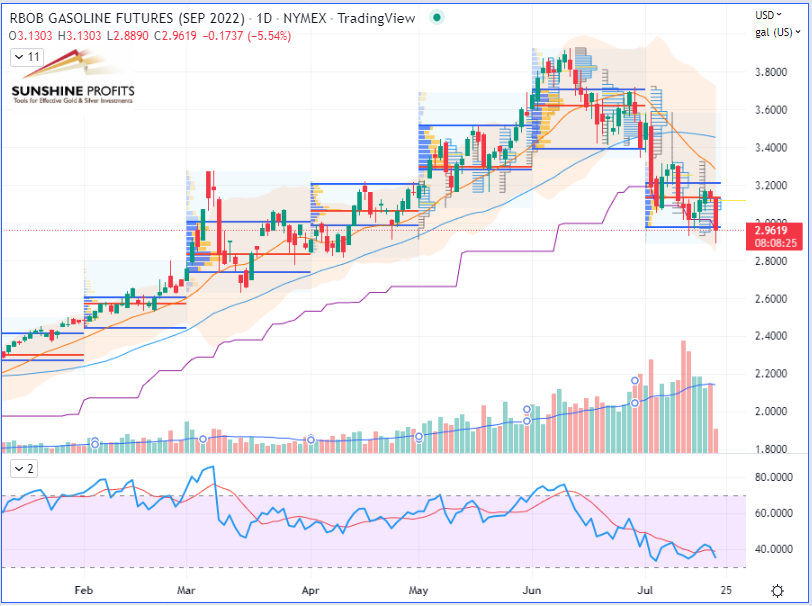

In addition, the U.S. gasoline demand figures probably helped to support rising oil prices:

This is precisely where we could eventually see a rise in demand marked by an unexpectedly sudden drop in gasoline reserves, since the latter were reduced by almost 5 million barrels.

Geopolitics

On the geopolitical scene, investors are monitoring the ongoing US-China tensions over Taiwan. On a more positive note, we are facing a potential return of Iranian crude to the market with the ongoing negotiations of the nuclear agreement with the different trade partners.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

RBOB Gasoline (RBU22) Futures (September contract, daily chart)

Brent Crude Oil (BRNU22) Futures (September contract, daily chart) –Contract for Difference (CFD) UKOIL

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Despite the Right Projections, the Entry Was $1 Too High

August 4, 2022, 9:54 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Here Are My New Trading Projections on Crude Oil Futures

July 27, 2022, 8:26 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Oil Hesitates After Briefly Dropping Below $90

July 21, 2022, 9:41 AMCrude oil futures fell after the bulls took over. What are the determinants of supply and demand that are driving crude oil prices this week?

WTI crude oil futures bounced just below the $90 mark yesterday on the NYMEX. It was before being taken over by bulls in a climate of economic uncertainty over the possibility of a global recession, which would stifle demand.

Macroeconomics, Inflation and Recession Fears

After the CPI figures that I commented on last week, inflation accelerated further in Canada and the United Kingdom, reaching a new peak in 40 years as well. Indeed, the UK consumer price index hit a 40-year high in June (9.4% year on year), with the Bank of England's (BoE) Bailey predicting a 50-bp hike. On the other hand, I noticed that the UK unemployment rate remained at 3.8% in the three months ending in May.

On the Geopolitical Scene

In Libya, the Libyan National Oil Company (NOC) announced on Wednesday the resumption of production in several oil fields, helping to calm the market. Since mid-April, six major oil fields and terminals have been closed by groups close to the eastern camp, which wanted a "fairer distribution" of crude oil revenues.

Fundamental Analysis

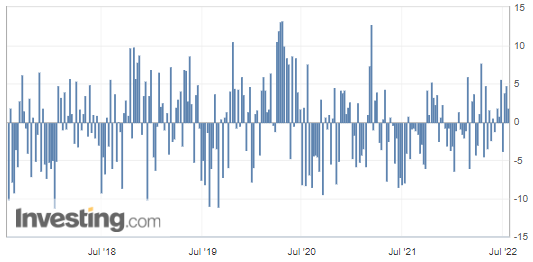

On Wednesday, the Energy Information Administration (EIA) released the weekly change in Crude Oil Inventories.

U.S. Crude Oil Inventories

This time, we could see the commercial crude oil reserves in the United States slightly dropping to -0.446M barrels while expectations were showing an earlier rise of 1.357M barrels.

US crude inventories have thus decreased by not even half a million barrel in volume, which is not a very significant deviation to mention a greater demand and is not really a strong bullish factor for crude oil prices, since the drop can be explained, in part, by the increase in oil exports.

(Source: Investing.com)

Those figures were in contradiction with those reported a day earlier by the American Petroleum Institute (API):

U.S. API Weekly Crude Oil Stock

(Source: Investing.com)

As you can see, no clear directional signal could be extracted from any of those figures for now.

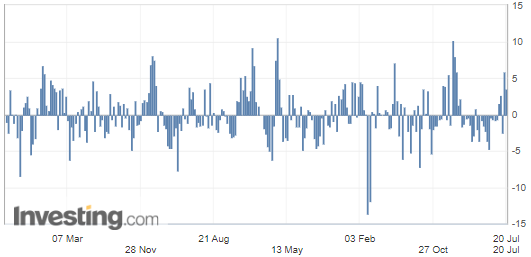

However, the number that showed the largest deviation from the forecast was the gasoline inventories:

U.S. Gasoline Inventories

Here we have a clearer picture regarding the slowdown in demand for gasoline in the United States, with almost three and a half million barrels of commercial gasoline held as per below:

This is precisely where we could eventually see a drop in demand marked by an unexpected increase in gasoline reserves, because the report can be seen more as a bearish signal, as it signals further evidence of waning gasoline demand at the peak of the summer driving season – the latter being usually considered a higher demand period for fuel with rising holiday trips.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

RBOB Gasoline (RBU22) Futures (September contract, daily chart)

Brent Crude Oil (BRNU22) Futures (September contract, daily chart) – Represented by its Contract for Difference (CFD) UKOIL

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM