Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

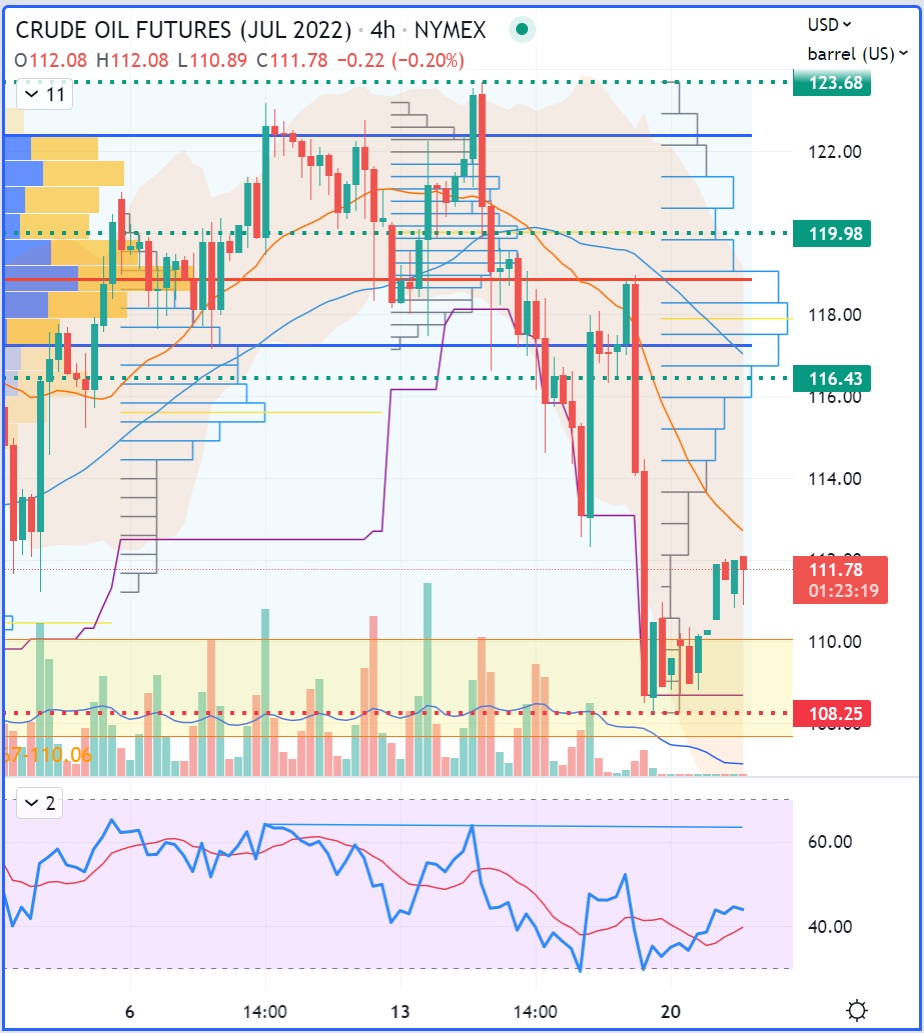

- WTI Crude Oil Long $107.67-110.06 (yellow band) with stop just below $103.24 (red dotted line) and targets at $116.43, 119.98 & 123.68 (green dotted lines).

Update: Entry triggered / Stop to be lifted just below Friday’s low @ $108.25 to reduce risk.

- Brent Crude Oil $110.47-112.27 (yellow band) with stop just below $106.20 (red dotted line) and targets at $118.43, 120.80 & 124.42 (green dotted lines).

Update: Entry triggered / Stop to be lifted just below yesterday/Monday’s low at $111.52.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

Now let’s zoom into the 4H chart to see the price action:

WTI Crude Oil (CLN22) Futures (July contract, 4H chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

For both benchmarks (Brent & WTI), our entry was triggered during the expected corrective wave (mentioned in last Friday’s article). As you can see, the area highlighted by the yellow rectangle represented an ideal support where the crude oil market (in its corrective phase) had found a lower floor to rebound from.

Now, I personally prefer keeping a tight stop (close to break haven) as the yellow rectangle – if broken out – would become resistance in a pivoting market. So far, both benchmarks remain in an overall bullish trend, which is why we can only get long to avoid taking considerable risks. A strong breakout below the current support zone should be monitored carefully because it could eventually signal the switch into a new bearish trend.

That’s all folks, for today. Happy Trading!

As always, we’ll keep you, our subscribers, well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist