Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

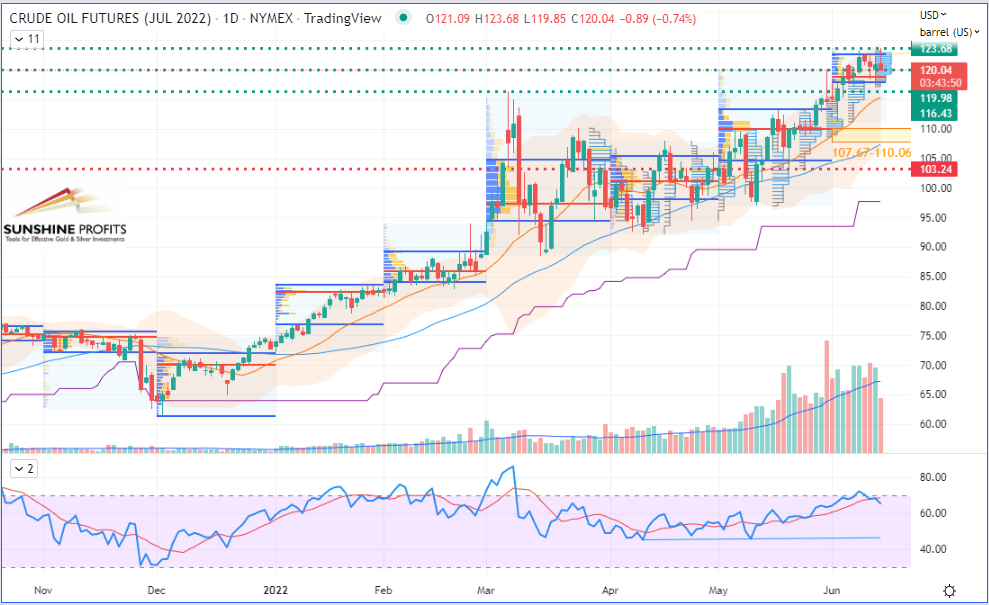

- WTI Crude Oil Long $107.67-110.06 (yellow band) with stop just below $103.24 (red dotted line) and targets at $116.43, 119.98 & 123.68 (green dotted lines).

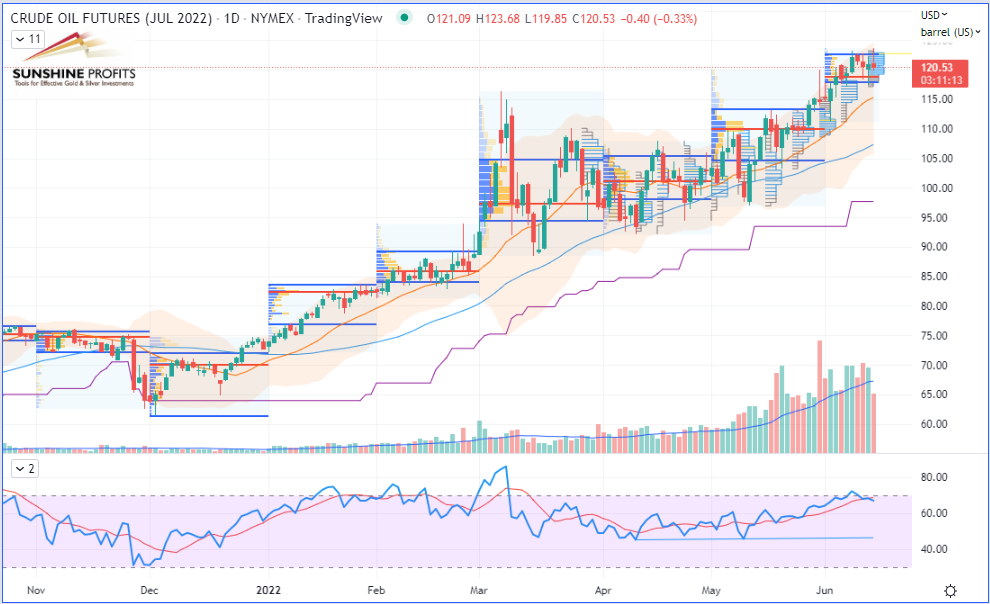

- Brent Crude Oil $110.47-112.27 (yellow band) with stop just below $106.20 (red dotted line) and targets at $118.43, 120.80 & 124.42 (green dotted lines).

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

What scenario for crude oil can we expect based on the geopolitical scene, OPEC forecasts, and oil stocks released by the US Petroleum Institute?

Geopolitical Scene

Crude oil prices were resilient on Tuesday, as fears about supply outweighed those about demand. That was due to the near total shutdown of production in Libya, in the grip of a major political crisis, where two politicians are vying for the post of Prime Minister: interim PM Abdul Hamid Dbeibeh and eastern-affiliated Fathi Bashagha.

Libya is currently missing its oil production at a rate of 1.1 million barrels a day, Libyan Oil Minister Mohammed Aoun said, adding that almost all oil fields in the country have been closed.

Fundamental Analysis

The world economy this year, still largely dependent on fossil fuels, remains full of uncertainties, OPEC estimates in an article devoted to the outlook for the second half of the year. The first quarter of the year showed a weakening trend in growth in the context of sharply rising commodity prices and a booming Omicron wave, which dampened economic momentum, particularly in developed countries and China.

Growth in global oil demand should slow in 2023, according to OPEC delegates and industry sources, as soaring crude and fuel prices help drive up inflation and dampen the global economy. OPEC is expected to release its first demand forecast for 2023 in its monthly report later, on July 12.

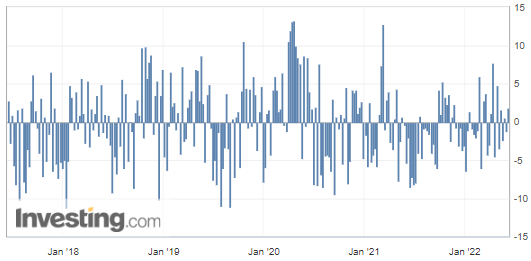

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States increased by over 1.845M barrels while the forecasted figure was expected to be in negative territory (-1.8M barrels), according to figures released on Tuesday by the American Petroleum Institute (API).

US crude inventories have increased by over 1.845 million barrels, which implies slowing demand and is considered a bearish factor for crude oil prices.

Here, the difference with the forecasted figure is quite the opposite, so let us see whether the figure will be confirmed by the Energy Information Administration's (EIA) on Wednesday.

If that scenario is confirmed by the EIA’s figures later today, then the black gold may be set for a corrective wave, possibly back to previous support levels, which I projected for a couple new trades on both Brent and WTI (see our member section).

(Source: Investing.com)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

In conclusion, after floating above $120, the U.S. WTI benchmark might eventually retrace back to its long-term mean to get some fresh air and breathe for a bit. We already defined the next support, so get ready to get in if all the signals are turning green again!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist