-

Our Trade Plan on Natural Gas Is Developing Well!

October 6, 2021, 10:14 AMAvailable to premium subscribers only.

In today’s trade review, we do some risk adjustments on our trade position in natural gas…

-

OPEC+ Sticks to Its Tight Supply Plan, So What Now?

October 5, 2021, 10:17 AMOPEC+ is not adjusting its (perhaps too gradual) uplift in supply, sending the WTI to its highest since 2014 (and for Brent since 2018).

Market Analysis

The surge in oil and gas prices threatens to extend the rise in energy prices in general, and consequently to worsen the levels of inflation observed in the United States and Europe. Thus, central banks are under further pressure to tighten their monetary policies quickly. This galloping inflation also frightens the tech sector, whose cash needs are very important. Regarding natural gas, the onset of winter with colder temperatures could further accelerate the shift in demand from gas to oil.

In short, since energy is the heart of the global economy, if inflationary prices are accelerating further, they could lead to a global state of tachycardia, which would rapidly spread to other sectors and, consequently, threaten the entire economy… it’s not impossible, though, to navigate through such dangerous waters with profits. Detailed positions for oil/natural gas trading can be found in my premium Oil Trading Alerts.

Keeping an eye on everything energy-related emerging on the horizon and holding the helm firmly during the storm is what I do when cruising through charts — especially at sea full of black waters.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

How the Recent Natural Gas Surge Boosts Crude Prices

October 4, 2021, 11:29 AMThis could be an interesting week for both energy commodity markets!

Market Analysis

While most of the UK fuel crisis is resolved, the British government suggested that the military truck drivers will be helping out to facilitate the arrival of fuel to the South-East region, including London, where shortages still remain to be fixed around the capital.

(Source: Matt Cartoons)

As I already mentioned in a number of previous editions of our Oil Trading Alerts, we are still witnessing a very particular phenomenon of gas demand shifting to oil demand, as crude is nowadays relatively more competitive. Thus, this switch in energy demand could come in the following forms:

- From a slowdown in electricity production in Asia.

- From a hedging effect in the anticipation of a colder than normal winter in the northern hemisphere.

OPEC+ members are meeting today and, therefore, might increase their production a little more than expected to rebalance supply. So, would it help the black gold to make a new dip?

Check out my premium analysis for full trading positions.

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart, logarithmic scale)

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas News: Europe Lacks Supply, So It Turns to Asia

October 1, 2021, 10:31 AMWhat’s happening in the natural gas markets? Prices are surging like crazy. The answer may be complex, but I’m here to provide it.

Market Analysis

Today, we expect the market to be accumulating since the U.S. Energy Information Administration (EIA) on Thursday reported an injection of 88 billion cubic feet (Bcf) of natural gas into storage for the week ending on Sept. 24. This could indeed be explained by warmer temperatures and entering the month of October.

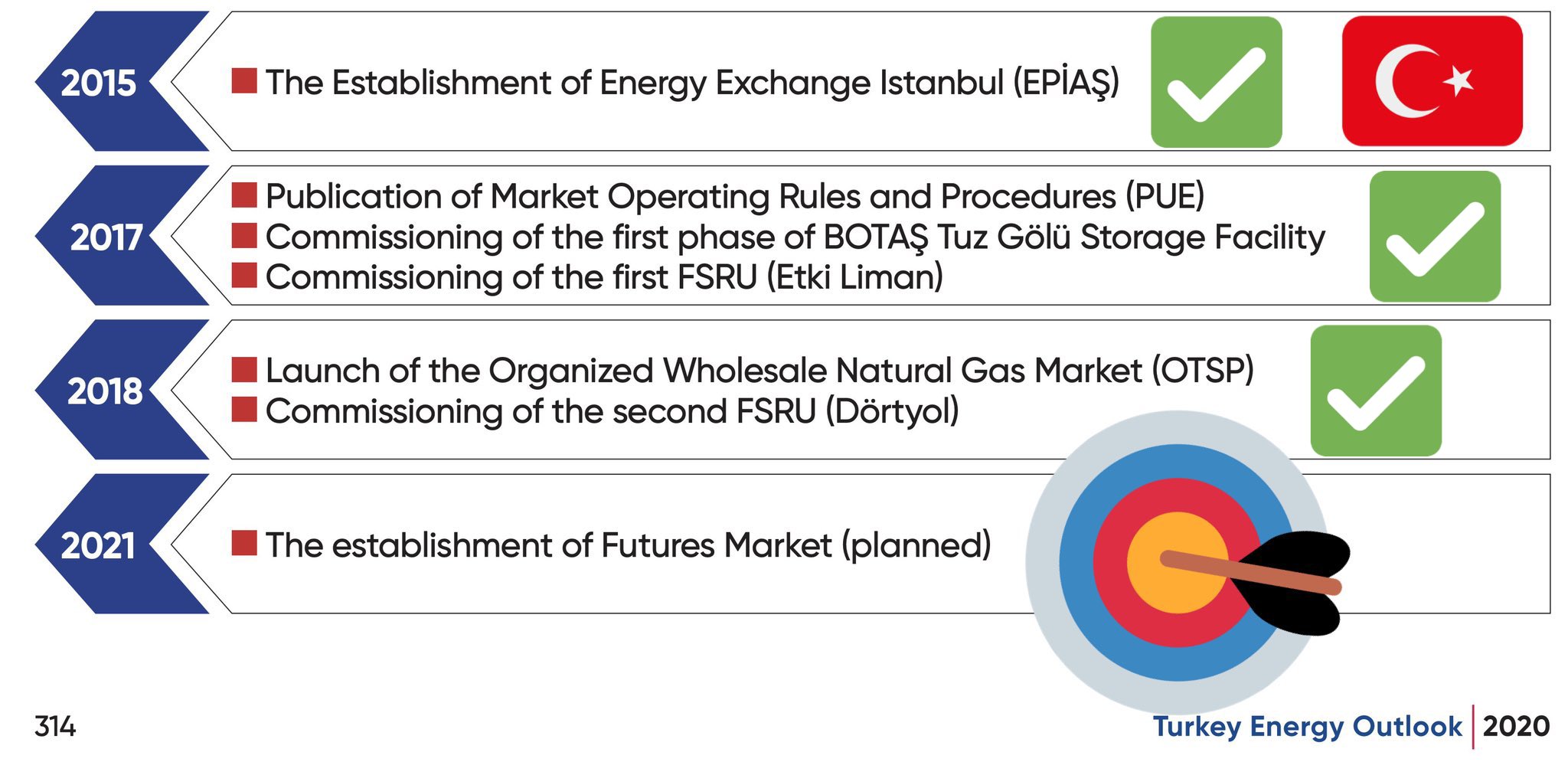

New Futures Market in Turkey

For those interested in watching foreign energy markets, please note that today marks the start of the Turkish Natural Gas Futures Market (NFM), a new milestone in the Nat-Gas trade.

(Source: Turkey Energy Outlook)

European Gas

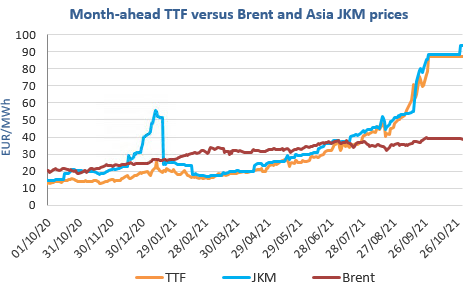

Gas prices are still fuelled by supply concerns in Europe, where inventories are recording multi-year lows. FYI, we also talked about this in a previous edition of Oil Trading Alerts.

(Source: EnergyScan)

The sudden spike in Asia JKM November 2021 prices could be explained by the fact that European buyers are forced to keep competing aggressively with their Asian counterparts to attract LNG cargoes (Liquefied Natural Gas Transportation).

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGV21) Futures (October contract, weekly chart, logarithmic scale)

In brief, today we provided you with some recent updates regarding the market developments for various natural gas markets in order to get a wider view of what’s happening in them. Nobody said it’s impossible to navigate through them. That’s what I do best – I keep an eye on everything energy-related happening in the world. Detailed positions for oil/natural gas trading can be found in my premium Oil Trading Alerts.

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Now That US Stocks Pushed Oil Higher, Is It Correction Time?

September 30, 2021, 10:30 AMOil prices had a choppy day on Wednesday, rebounding after the U.S. crude stocks report before retreating late in the session. Will we see a new dip?

Fundamental Analysis

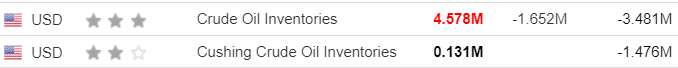

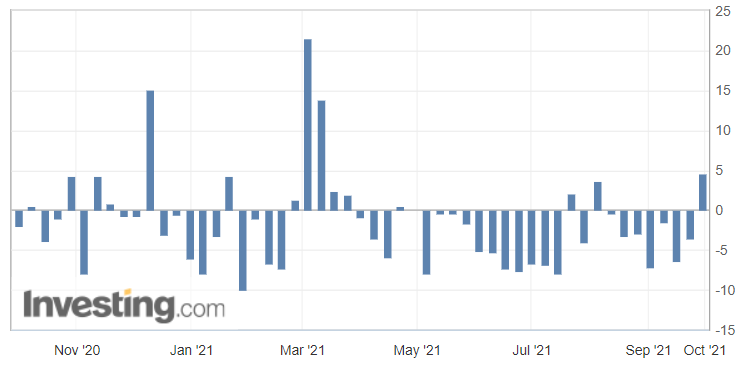

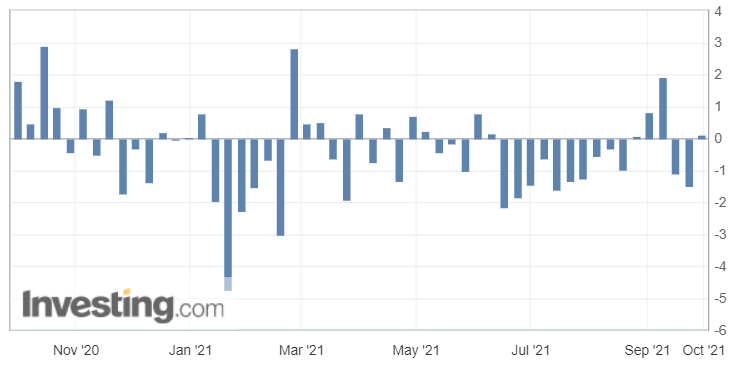

With US stocks increasing – whereas a decrease was expected – exchanges were marked by a continuation of profit-taking, which started the day before, prior to the publication of the weekly report of the US Energy Information Administration’s (EIA) Crude Oil Inventories:

(Source: Investing.com)

During the week ending on Sep. 24, crude inventories rose 4.6 million barrels (Mb), even though analysts had forecast another decline. However, while this surprising rise could have been likely to put pressure on prices, the price of black gold rose after this publication.

It was the first increase after a streak of seven straight declines. Nevertheless, it was not until the end of the session for the oil market to integrate this increase in stocks.

Is the Petroleum Crisis Over in the UK?

The British government has just said that the crisis caused by fears of fuel shortages is now over, even though many fuel stations remain closed in major cities across the United Kingdom.

https://twitter.com/NoContextHumour/status/1443468835554725889?s=19New Deal of Washington and Tehran

On the UN Security Council agenda, we might see some progress happening towards the end of the year, as Joe Biden’s administration – weakened by the Afghanistan debacle and the Maricopa County (Arizona) Election Audit presented before the Senate last Friday, which lets new suspicions of irregularities in the US election to re-emerge – will now probably focus on making successful negotiations for the return to the Joint Comprehensive Plan of Action (JCPOA) nuclear deal.

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)In brief, after a surge in crude oil prices at the beginning of the week, we could see some pullback happening. In the future, such retracements could be driven by new supplies if, for example, the operations in the Gulf of Mexico were returning to their full capacity, crude oil inventories kept building up, or even the negotiations with Iran were improving.

Imagine a point where new talks lead to presenting a realistic plan aiming at lifting sanctions on Tehran, which would have an effect on reopening the Iranian oil tap... So many elements to keep an eye on in the forthcoming months! However, nobody said it’s impossible to navigate through such a complex market. That’s what I do, and that’s what I do best – I keep an eye on everything energy-related happening in the world. Detailed positions for oil/natural gas trading can be found in my premium Oil Trading Alerts.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM