-

Is Natural Gas Losing Momentum?

September 8, 2021, 9:04 AMAvailable to premium subscribers only.

In today’s market review, we look at the recent market developments for the Henry Hub Natural Gas (NG) futures.

-

The Economic Slowdown Weights on Crude Oil

September 7, 2021, 8:17 AMAvailable to premium subscribers only.

Today, we look at the recent market developments for WTI Crude Oil (CL) futures…

-

Crude Oil on the Right Track to Hit Our Target!

September 3, 2021, 9:07 AMAs we discussed and expected in Monday’s OTA, the oil market found a rebounding floor to rally this week. Let’s find out why it happened!

Note that today’s full analysis features the position created on Monday. If you want to see the details and see how to manage your holdings in crude oil, sign up for the premium newsletter now!

Market Analysis

- Both Brent and WTI already gained 2% on Thursday. The benchmark contract across the Atlantic took the opportunity to go above $70 per barrel for the first time in nearly a month;

- The OPEC+ meeting was marked by the continued gradual increase (+400k) in production;

- When the greenback gets weaker – it has lost around 0.50% against the basket of other currencies since the start of the week – the oil market (quoted in the USD) becomes cheaper for investors using alternative currencies;

- Finally, the passage of Hurricane Ida in the Gulf of Mexico has caused so much damage to refineries (with over 93% of the production at a standstill) that it will likely take weeks for a number of them to be restarted.

Therefore, it is the combination of all those elements that created such a propitious environment for crude to recover from its three-month lows!

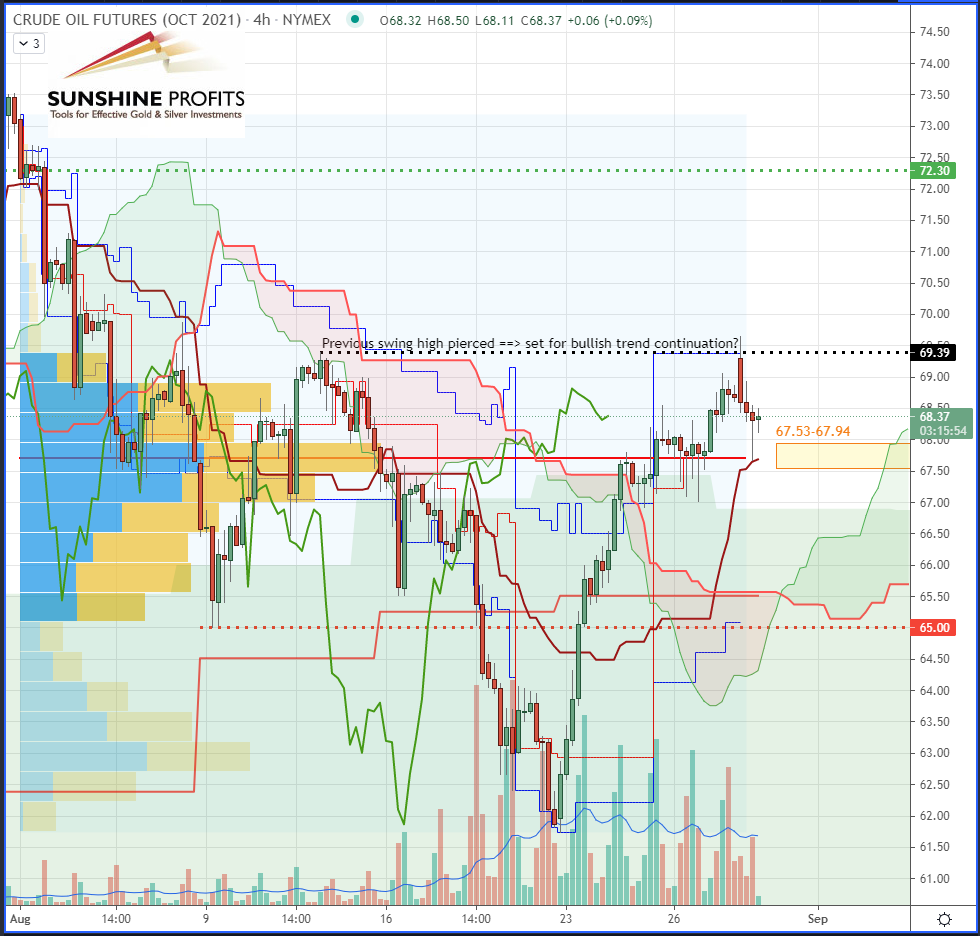

Figure 1 – Monday’s suggested trade plan on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, 4H)

Figure 2 – Today’s trade plan status on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, daily)

In summary, the scenario drawn last Monday for WTI crude oil (CL) futures has been validated so far by the recent market developments, with a successful entry on the retracement. Today, we showed how we will protect our trade to reduce risk and optimize our exit(s). Happy trading and have a nice weekend!

Today's premium Oil Trading Alert includes details of our trading position, which we successfully entered on the retracement. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Natural Gas: How Are Futures And ETFs Correlated?

September 2, 2021, 10:11 AMBuckle up, time for a ride to the energy ETFs’ world. If you've ever wondered how to trade the energy markets – read on, you are in the right place!

Correlation Analysis

For the sake of this study, we will take the Henry Hub Natural Gas (NG) futures contract as a parameter and draw the correlations on each ETF chart to better visualize their relationship.

- United States Natural Gas Fund LP (UNG):

“This fund offers exposure to one of the America’s most important commodities, natural gas, and potentially has appeal as an inflation hedge. While natural gas may be appealing, UNG often suffers from severe contango making the product more appropriate for short-term traders.” (ETFdb.com)

As you can see on the chart below, the correlation coefficient remains 1 all the time, which is an indication of a perfectly correlated asset to the Henry Hub Natural Gas futures.

To read more about Contango versus Backwardation, I suggest checking these out: o “Trading the Curve in Energies” (CME Group);

o “What is Contango and Backwardation” (CME Group).

- ProShares UltraShort Bloomberg Natural Gas (KOLD):

“This ETF offers 2x daily inverse leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that KOLD is really only appropriate for sophisticated, active investors.” (ETFdb.com)

This instrument is particularly useful when you want to short-sell natural gas with leverage of 2:1. So, buying it (w/ a long position) is equivalent to short/selling the underlying asset. As you can see on the chart below, the correlation this time is perfectly inverted (or negative).

- ProShares Ultra Bloomberg Natural Gas (BOIL):

“This ETF offers 2x daily leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that BOIL is really only appropriate for sophisticated, active investors.” (ETFdb.com)

This instrument is very similar to the first one — the only difference is, you can buy natural gas with leverage of 2:1.

- United States 12 Month Natural Gas Fund LP (UNL):

“This fund offers exposure to one of the America’s most important commodities, natural gas, and potentially has appeal as an inflation hedge. Unlike many commodity products UNL diversifies across multiple maturities, potentially mitigating the adverse impact of contango.” (ETFdb.com)

This fund is similar to the first one (UNG), but more adapted to longer-term traders.

- iPath Series B Bloomberg Natural Gas Subindex Total Return ETN (GAZ):

“This ETN is one of the options available to investors looking to establish exposure to natural gas prices through futures contracts. As such, this product isn’t very useful for those building a long-term, buy-and-hold portfolio; its appeal will be to those looking to express an outlook on movements in natural gas prices over the short term. There are several noteworthy elements of this product. First, GAZ is an ETN, meaning that investors are exposed to the credit risk of the issuer. Second, this ETN won’t generally correspond to changes in spot natural gas prices, as the underlying index is comprised of futures contracts (in many cases, the difference over extended periods of time can be significant). GAZ is really only appropriate for those with a short holding period; investors seeking longer-term exposure to natural gas may want to consider NAGS or UNL. Finally, this ETN has often traded at a significant premium to NAV historically as a result of limitations on the number of shares outstanding; before establishing a position, take careful note of the relationship of price to NAV.” (ETFdb.com)

This instrument is actually an exchange-traded note (ETN) for short-term traders.

To better understand the difference between ETFs & ETNs, I suggest that you read: o “Exchange-Traded Notes (ETN) Definition” (Investopedia);

o “ETF vs. ETN: What's the Difference?” (Investopedia).

In summary, you can trade natural gas with high leverage (NG futures), little leverage (BOIL/KOLD), no leverage at all (UNG/UNL) or via an ETN (GAZ). You have various options to adopt depending on your personality, risk appetite, and trading strategy. So, let’s get rolling!

The ETFs I listed are definitely worth looking at, but it’d be too easy if I just listed them – anyone can do that. I do the hard work and give you signals and ideas on entry and exit points, as well as assets to use. That’s my job, that’s what I do best, and it’s that knowledge that makes the difference. It’s all found in the premium version. Benefit today and sign up to get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist - United States Natural Gas Fund LP (UNG):

-

Time For a Correction on Natural Gas?

September 1, 2021, 8:47 AMThe long rally on natural gas prices may lose some fuel as it started ranging on the top!

A quick scoop on natural gas:

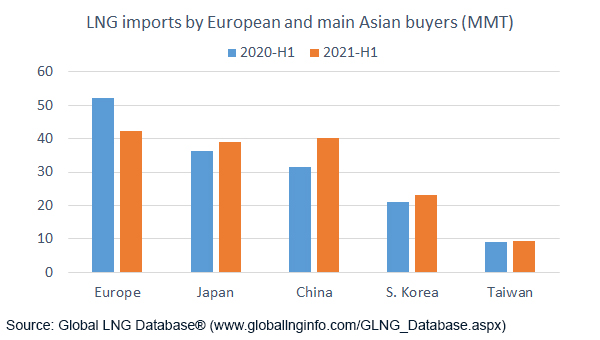

- LNG imports by the European buyers in the first half of 2021 decreased by 19% compared to 2020, while they increased by 16.8% for Chinese buyers over the same period:

- The UP-World LNG Shipping Index gained 9% last week, reducing its spread with the S&P500:

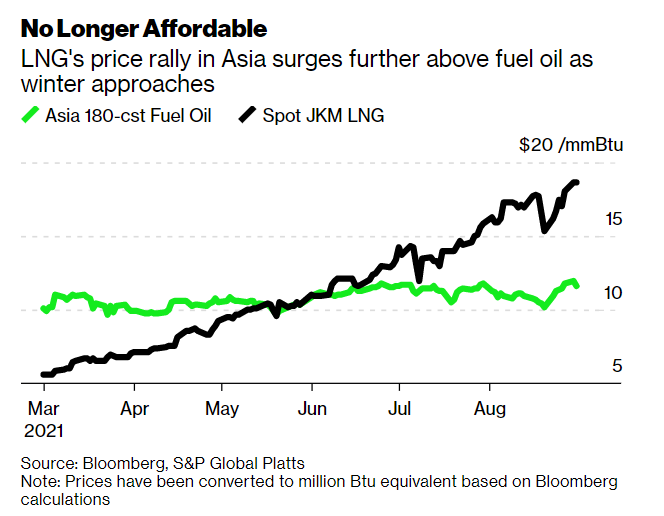

- A Bloomberg article explains that LNG prices in Asia are so high that some countries like Pakistan and Bangladesh can no longer afford to buy spot cargoes, raising the risk of blackouts or shifting to (more) polluting fuel-oil:

Here’s what might happen:

The Henry Hub Natural Gas futures (Oct’21) contract, currently ranging around its top levels between $4.200 and $4.550, could be set for a correction back onto its $3.848-3.897 support.

If natural gas futures were set to take a correction back onto support anytime soon, we would like to anticipate and be ready to enter at the best risk-optimised levels.

For more context and a detailed analysis with trading positions, head over to the premium version. Benefit today and sign up to get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM