Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $69.09-70.11 as a new (long-term) support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $66.92 and with targets around $74.24 (TP1) and $78.33 (TP2);

- Natural Gas [NGX21] Long around $5.480-5.568 with stop below $4.766 (previous swing low) and targets at $6.63 (TP1) and $7.79 (TP2) – Entry triggered!

Oil prices had a choppy day on Wednesday, rebounding after the U.S. crude stocks report before retreating late in the session. Will we see a new dip?

Fundamental Analysis

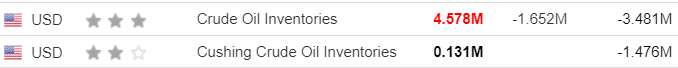

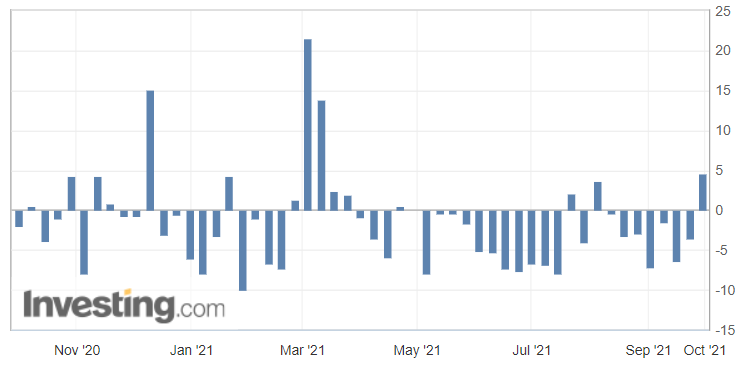

With US stocks increasing – whereas a decrease was expected – exchanges were marked by a continuation of profit-taking, which started the day before, prior to the publication of the weekly report of the US Energy Information Administration’s (EIA) Crude Oil Inventories:

(Source: Investing.com)

During the week ending on Sep. 24, crude inventories rose 4.6 million barrels (Mb), even though analysts had forecast another decline. However, while this surprising rise could have been likely to put pressure on prices, the price of black gold rose after this publication.

It was the first increase after a streak of seven straight declines. Nevertheless, it was not until the end of the session for the oil market to integrate this increase in stocks.

Is the Petroleum Crisis Over in the UK?

The British government has just said that the crisis caused by fears of fuel shortages is now over, even though many fuel stations remain closed in major cities across the United Kingdom.

https://twitter.com/NoContextHumour/status/1443468835554725889?s=19

New Deal of Washington and Tehran

On the UN Security Council agenda, we might see some progress happening towards the end of the year, as Joe Biden’s administration – weakened by the Afghanistan debacle and the Maricopa County (Arizona) Election Audit presented before the Senate last Friday, which lets new suspicions of irregularities in the US election to re-emerge – will now probably focus on making successful negotiations for the return to the Joint Comprehensive Plan of Action (JCPOA) nuclear deal.

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

In brief, after a surge in crude oil prices at the beginning of the week, we could see some pullback happening. In the future, such retracements could be driven by new supplies if, for example, the operations in the Gulf of Mexico were returning to their full capacity, crude oil inventories kept building up, or even the negotiations with Iran were improving. Imagine the a point when new talks are leading to presenting a realistic plan aiming at lifting sanctions on Tehran, which would have an effect on reopening the Iranian oil tap... So many elements to keep an eye on in the forthcoming months!

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $69.09-70.11 as a new (long-term) support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $66.92 and with targets around $74.24 (TP1) and $78.33 (TP2);

- Natural Gas [NGX21] Long around $5.480-5.568 with stop below $4.766 (previous swing low) and targets at $6.63 (TP1) and $7.79 (TP2) – Entry triggered!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist