-

Went Long the Barrel? Beware of the Headwinds Ahead…

October 14, 2021, 9:42 AMFalling oil demand and bearish US inventories are not of any good to WTI investors. However, a deeper slide might be a great place to enter the trade…

Fundamental Analysis

The Organization of Petroleum Exporting Countries (OPEC) has downgraded its estimate of world oil demand for 2021. The demand has been lower than expected so far despite strong prospects for the end of the year.

In fact, in its monthly report, the cartel estimates that oil demand will rebound by 5.82 million barrels per day (mb/d) this year, while it forecast 5.96 mb/d last month.

Global crude demand is therefore expected to reach 96.6 mb/d this year.

As a reminder, the member countries of the cartel and their allies (OPEC+) chose at the beginning of October to renew their strategy of a modest increase in production, ignoring the calls to open the floodgates further and thus propelling prices upwards.

By the way, the two oil-producing countries that contributed the most to this increase are Nigeria and Saudi Arabia.

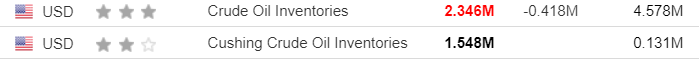

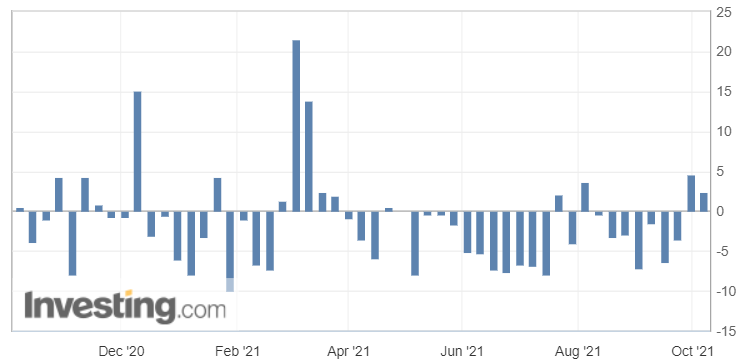

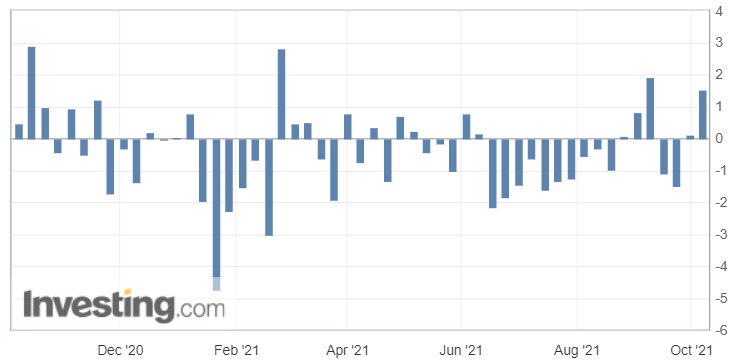

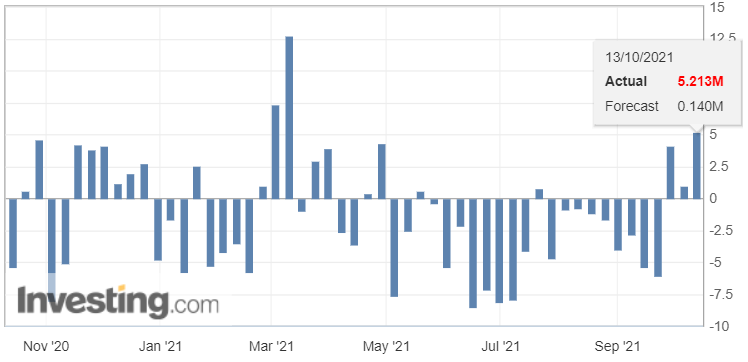

U.S. API Weekly Crude Oil Stock

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via InvestingRegarding the API figures published on Wednesday, the increase in crude inventories (with 5.213 million barrels versus 140k) was more than expected — this implies weaker demand and is bearish for crude prices. However, we have yet to see whether or not these figures are confirmed by the weekly Energy Information Administration's (EIA) report published later today.

If this scenario is confirmed by the EIA’s figures later today, then the black gold will be well set for a deeper correction, possibly back to its lower support levels – levels which, by the way, were provided yesterday to our premium subscribers, along with our most recent projections.

WTI Crude Oil (CLX21) Futures (November contract, daily chart)Finally, to wrap up today’s article, we have seen a few choppy days on the energy markets with some contradictory data to interpret. This uncertainty usually leads to a ranging market, which can be an interesting place for some shorter-term trades. For a longer-term trade horizon, it is necessary to combine some fundamental analysis with your charting and be patient.

This is exactly what we do here, and we are happy to help you surf on the waves of uncertainty! You can find more information about exact positions and outlooks in our premium Oil Trading Alerts.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil & Gas Position Updates

October 13, 2021, 8:25 AMAvailable to premium subscribers only.

In today’s edition, we update our trade plans on both WTI crude oil & natural gas…

-

Trading Oil & Gas: Some Spicy MLPs to Choose From!

October 12, 2021, 9:26 AMLet’s focus on less-popular securities to trade energies today: Master Limited Partnership (MLP). How do they work and how can they be profitable?

By the way, a big “thank you!” goes to Simon, one of our readers, who asked us about this last Friday. Feel free to send us your questions or any topics that you would like us to write about in the forthcoming editions, and we’ll try our best to answer them!

Note: Trading positions are available to our premium subscribers.

A good way to diversify the construction of your oil and gas investment portfolio is to use a variety of assets for balanced exposure to the energy sector and its industrial components.

What Is a Master Limited Partnership (MLP)?

To learn in detail what a MLP is, we invite you to read the following articles that already contain the necessary basic information you need to know before starting investing in them.

- Master Limited Partnership (MLP), Investopedia.com

- The Benefits of Master Limited Partnerships, Investopedia.com

Key Reason for Going Into Those Alternative Investments

The most important advantage is the high-income potential. Indeed, Master Limited Partnerships (MLPs) typically pay high yields to investors, mainly due to the fact that they do not pay corporate income taxes.

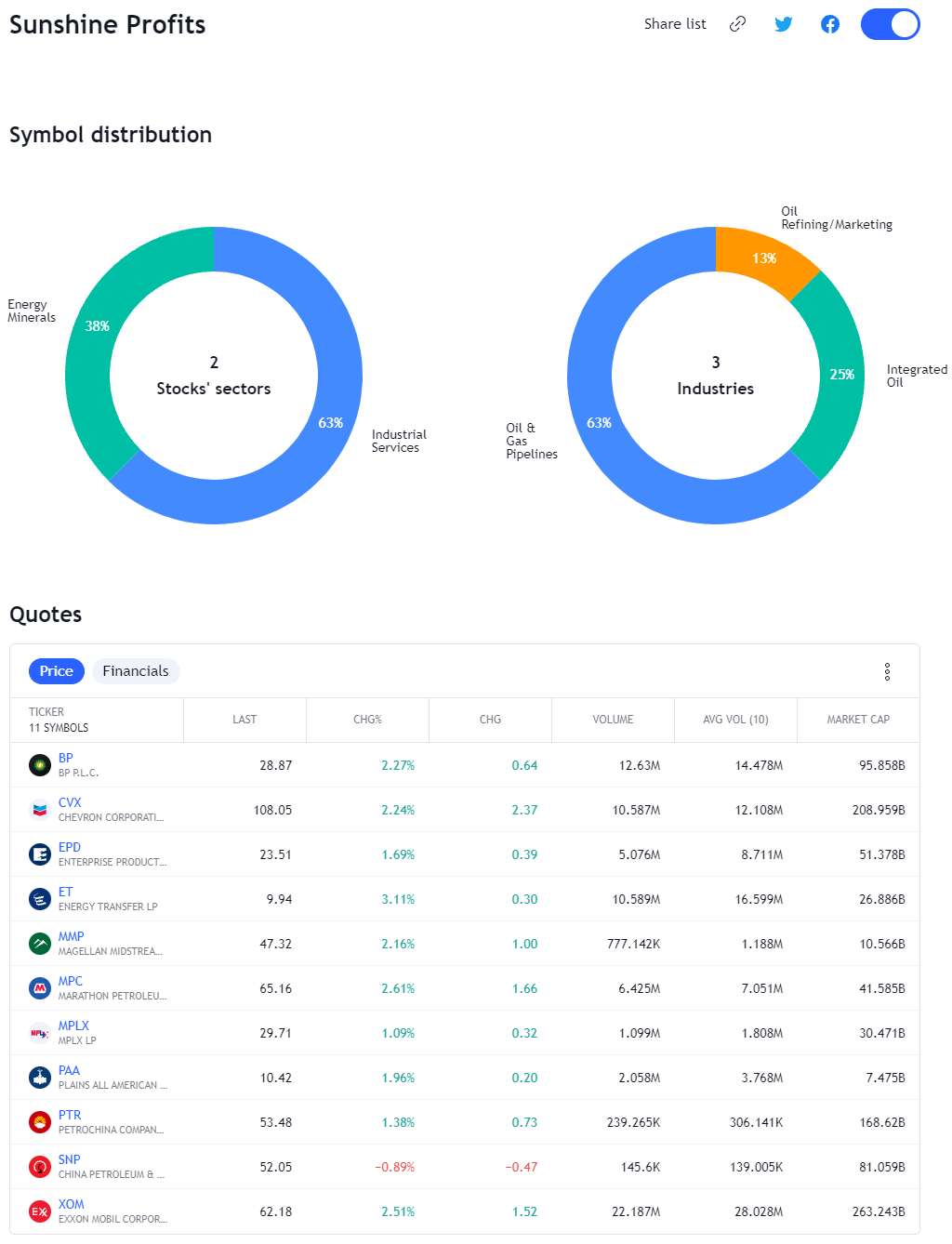

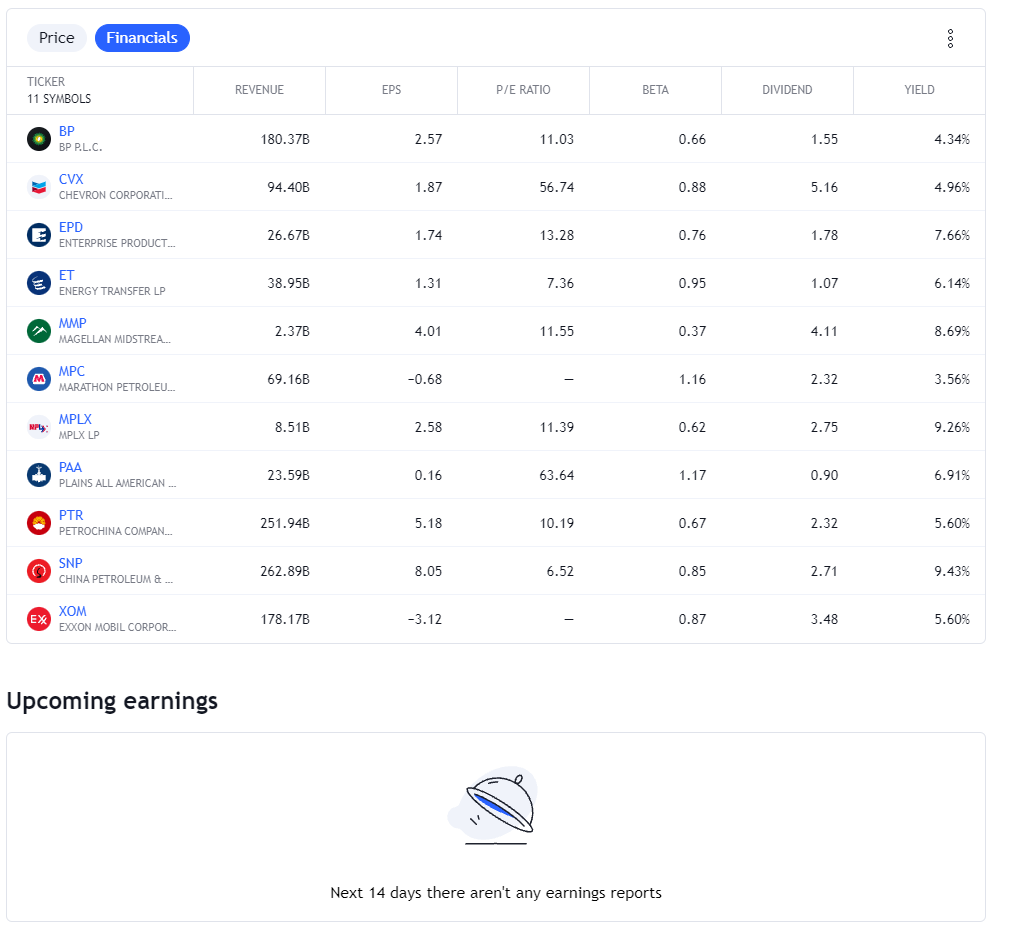

Stock Watchlist (Continued)

In the first article about alternative investments, we started a watchlist with some major energy stocks. Today, let’s update it!

As usual, our stock-picks will be shared through this link to our dynamic watchlist (which will be included in the position from now on). It will be updated from time to time as we progress through our portfolio construction process.

Take a look below at a few examples of some indicative metrics:

Today we picked five oil and gas Master Limited Partnership (MLP) companies that are quoted on the US exchange. Their revenues are as stated below:

Revenue (in billion US dollars):

- Enterprise Products Partners LP (EPD) $26.67B

- Energy Transfer LP (ET) $38.95B

- Magellan Midstream Partners LP (MMP) $2.37B

- MPLX LP (MPLX) $8.51B

- Plains All American Pipeline LP (PAA) $23.59B

In summary, those alternative investments may present stable benefits and diversify your energy portfolio… So, what MLPs do you guys trade? I’ve already selected mine, as well as the exact positions associated with them. All of this (and much more!) can be found in my premium Oil Trading Alerts.

As always, we’ll keep you, our subscribers, well-informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil & Natural Gas Position Updates

October 8, 2021, 9:40 AMAvailable to premium subscribers only.

In today’s edition, we update our trade plans for both the WTI crude oil & natural gas… which recently proved to be very profitable. Don’t believe us? That’s a testimonial we received just yesterday:

“Dear Sebastien,

This should be banned. I cant believe it. Just going in for my 3rd scoop on the same gas trade. Happy effin’ days. Do you buy MLP’s? […]

All the best…and thank you!

-Simon”

If you don’t want to miss out anymore when an opportunity presents itself, make sure to subscribe to the premium version of our Oil Trading Alerts! -

What Can We Learn from US Crude Inventories?

October 7, 2021, 9:12 AMCrude oil inventories turned positive for the second week in a row. Was that the only reason for the recent plunge of black gold?

Fundamental Analysis

The larger-than-expected rise in crude reserves in the US weighed down oil prices on Wednesday. During the week ending on Oct. 1, crude inventories totalled about 2.35 million barrels according to the Energy Information Administration (EIA), while a number of analysts polled by Bloomberg expected no more than one million barrels. The additional increase signals that the production capacities which were impacted by Hurricane Ida in the Gulf of Mexico are gradually getting back to normal on an operational level.

Consequently, WTI crude oil futures tumbled more than 2% at the end, even though they are still sustained by the maintenance of the OPEC+ gradual production increase of 400k barrels a day in November!

In the meantime, Vladimir Putin's accommodating remarks on Russian gas production pushed natural gas prices down after an initial surge at the start of the market session, making for another choppy day in the market.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM