-

The Energy-Focused Stocks Watchlist: Next Steps

September 15, 2021, 10:22 AMAvailable to premium subscribers only.

In yesterday’s article, we started a watchlist in order to help you invest in some energy-focused stocks. Today, we show what we consider good entries for investing in addition to the last three ones…

-

Let’s Start an Energy-Focused Stocks Watchlist!

September 14, 2021, 8:46 AMAvailable to premium subscribers only.

In today’s article, we start a watchlist in order to help build an energy-weighted portfolio…

-

Oil Is Back to Its Monthly Highs! What Now?

September 13, 2021, 10:12 AMOil prices rose to their highest level in a month as US production in the Gulf of Mexico is still limited by damage from Hurricane Ida.

Market Analysis

On Monday, crude pierced through its monthly high ($70.61) by trading up to $70.78 so far, while we learnt from the Bureau of Safety and Environmental Enforcement (BSEE) that the recovery of the US production in the Gulf of Mexico has only reached half of its capacity. According to the BSEE, several offshore oil rigs were forced to be evacuated because of Ida.

Regarding oil demand, the market sentiment seems to appear a little more optimistic about its gradual recovery and with cooler temperatures as we approach the fall season.

The crude oil prices could now develop towards our previously defined medium-term resistance, located at $72.30, on the October contract.

Figure 1 – WTI Crude Oil (CLV21) Futures (October contract, daily)

In summary, we can see some enthusiasm rising on crude, accompanied by a slow recovery of US production in the Gulf of Mexico. In addition to its gradual adjustment by OPEC and its allies, we should see the supply getting retightened with the global oil demand by the end of the year.

As always, we’ll keep you, our subscribers well informed.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Will China Tolerate Higher Inflation on Energy Prices?

September 10, 2021, 10:53 AMHow does inflation impact energy markets? Is it of any importance to them? If you’ve ever asked yourself these questions, I’m here to answer them all.

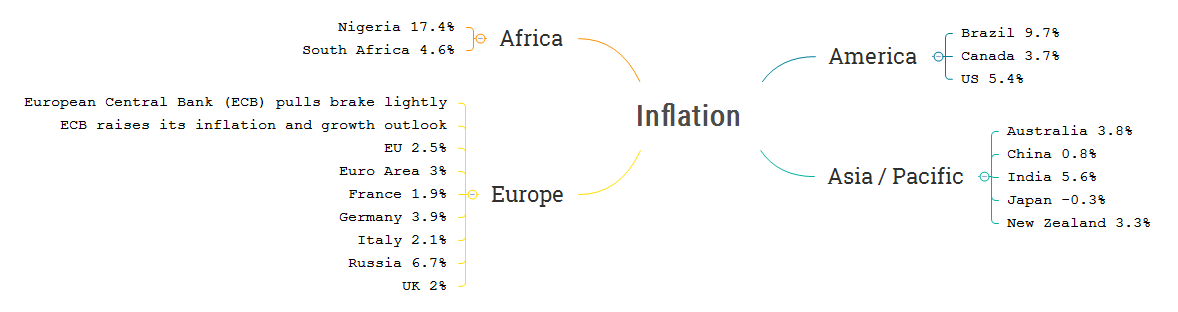

Inflation in Brief

Consumer Price Index (CPI), Producer Price Index (PPI), etc.

To measure US inflation rates, we currently use the Consumer Price Index (CPI), which tracks a basket of consumer goods and services that involves food prices & energy prices.

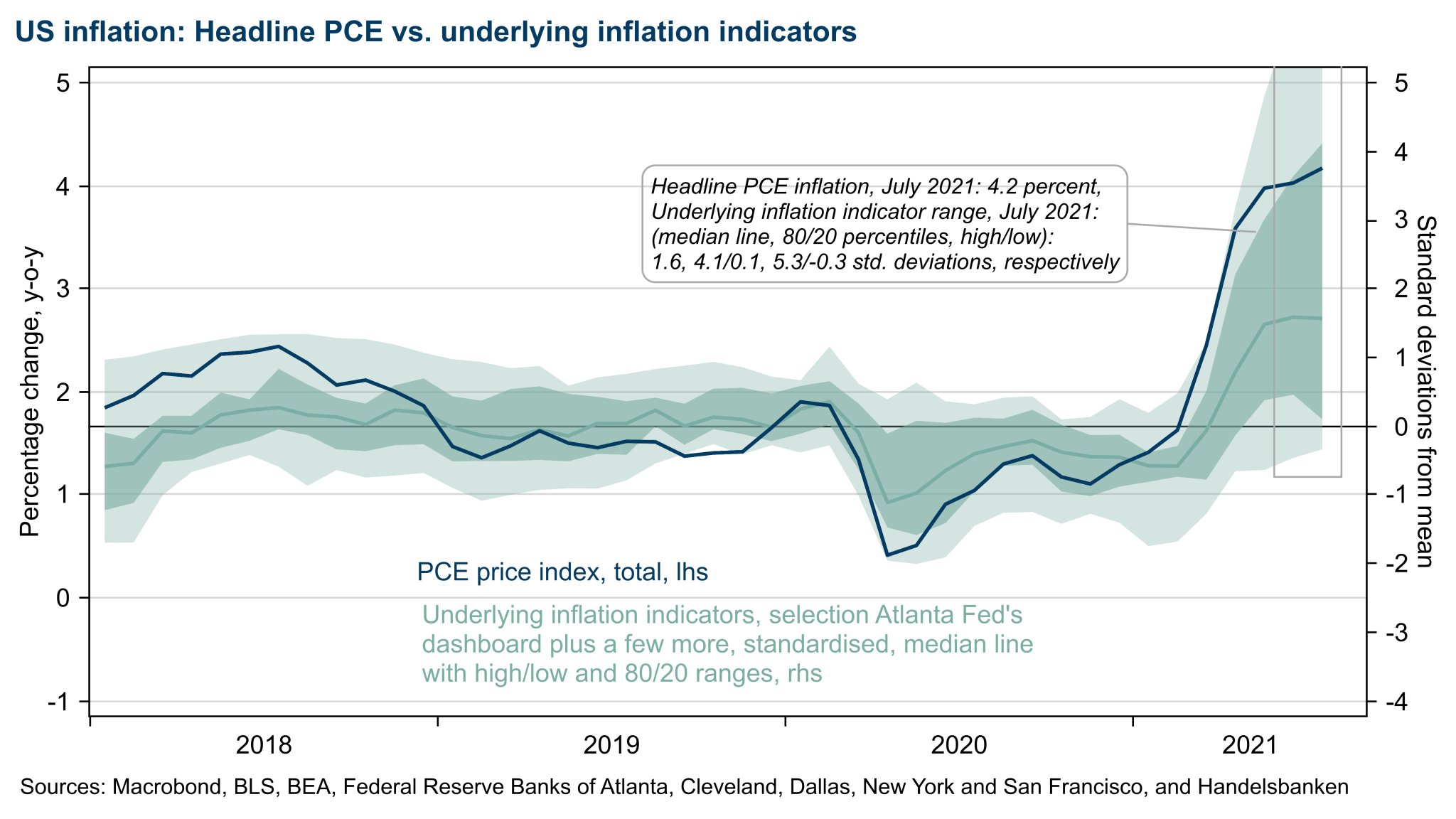

Is underlying inflation really high or has it peaked? Well, it’s difficult to say, as some indicators may contradict each other on that matter…

Tuesday’s CPI report showed the traditional core Consumer Price Index staying at an elevated level of +4.3% year-on-year, according to the Bloomberg survey.

In the case of China’s consumer inflation, it remained generally stable in August, while factory-gate prices registered expansion largely due to the increasing commodity prices: the Chinese CPI rose 0.8% year-on-year in August, a bit lower than 1% in July. The Producer Price Index (PPI) went up 9.5% over the same period in August, so a little faster than 9% in July.

On the U.S. side, the PPI rose +8.3% year-on-year in August (versus estimates at +8.2%) while the Core PPI progressed +6.7% over the same period. It’s higher than the expected +6.6%, but it rose at a slower pace compared to the last month’s increase. Actually, this slowdown in progression might be seen as inflationary pressures being moderated at the moment.

What Impact Does It Have From the Energy Perspective?

Yesterday, we saw that oil prices had fallen due to the announcement that China was using its strategic oil reserves. The Chinese announcement mentioned that millions of barrels were put up for sale in July, according to Bloomberg, which quoted an anonymous government source. In fact, China, as the leading importer of crude, seeks to fight against rising energy prices, signaling that the economic giant will not tolerate too high inflation. However, oil prices rebounded quickly into the same support zone ($67.53-67.94) that we had projected (Fig.1) with the prospect of dwindling reserves in the US, which is the world's largest consumer.

Moreover, even if we know that China has decided to sell a part of its strategic reserves to limit the pressure of rising raw material prices on industrial production, there is still no information on the amount of oil that is going to be put on the market.

Figure 1 – WTI Crude Oil (CLV21) Futures (October contract, daily)

Today, oil prices rose again – back to yesterday morning’s levels – and the market is turning more optimistic on China-US relations after a phone call between US President Joe Biden and his Chinese counterpart Xi Jinping. Indeed, that phone call had the same effect on the oil market as it had on other assets because any signal that Sino-US relations are improving is seen as positive for global trade and therefore for global financial markets.

On the geopolitical scene, we also noticed that Libya aspires to produce two million barrels of oil per day from 2022, which may indeed sustain the supply.

In summary, we can highlight that China has limited tolerance for the impact of higher inflation on the energy prices - and this is perfectly understandable from the perspective of the leading importer of crude oil. Inflation is certainly an important indicator to keep an eye on in the forthcoming weeks, particularly for anyone interested in energy prices.

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil & Gas Position Update: Natural Gas Extends Its Rally

September 9, 2021, 9:12 AMAvailable to premium subscribers only.

In today’s trade review, we look at our recent trade positions for both the WTI Crude Oil & Henry Hub Natural Gas (NG) futures contracts…

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM