-

Target Hit! Another Successful Call on Natural Gas

November 5, 2021, 9:43 AMHave you ever tracked your progress during your oil and gas trading journey and seen such trades? Read on… and come aboard!

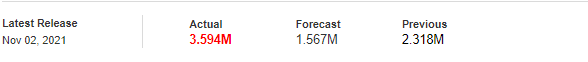

In the previous edition published last week and updated on Monday, I projected the likelihood of a sturdy support level on the gas market – Henry Hub Natural Gas (NGZ21) Futures – for going long around the $5.268-5.361 zone (yellow band), with a relatively tight stop just below $5.070 and targets at $5.750 and $5.890.

So, the market indeed sank just below that band to trigger an entry on Monday, and then it was suddenly pushed back up by the bulls waiting to take over the price to the upward direction.

This long trade was also supported by the fundamentals, as the heating needs for the month of November were gradually increasing. The weather forecasts appeared to orientate the demand upwards backed by an uninterrupted demand for Liquefied Natural gas (LNG) US exports.

Then, Nat-Gas hit the first target at $5.750 on Wednesday, and stopped at the $5.876 mark – located just $0.014 below the second projected target at $5.890 – on Thursday!

Regarding Crude Oil, a new entry, provided to our premium subscribers on Wednesday has just being triggered. The black gold is now attempting to rebound onto that support, which acts as a new floor.

Trading Charts

Chart – Henry Hub Natural Gas (NGZ21) Futures (December contract, daily chart)Now, let’s zoom into the 4H chart to observe the recent price action all around the abovementioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGZ21) Futures (December contract, 4H chart)In conclusion, my trading approach has led me to suggest some long trades around potential key supports - natural gas recently offered multiple opportunities to take advantage of dips onto those projected levels. If you don’t want to miss any future trading alerts, make sure to look at our Premium Section.

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Crude Eyeing OPEC+ Meeting – Where is Oil Headed?

November 3, 2021, 9:54 AMWith the OPEC+ meeting on Thursday, oil looks to be in a corrective phase, as pressure is on for more crude. Are we looking at bearish winds ahead?

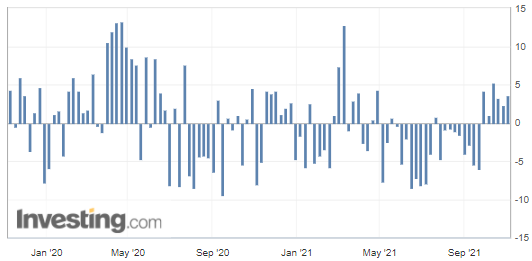

Crude oil prices have started their corrective wave, as we are approaching the monthly OPEC+ group meeting on Thursday, with some market participants now considering the eventuality of a larger-than-expected rise in production.

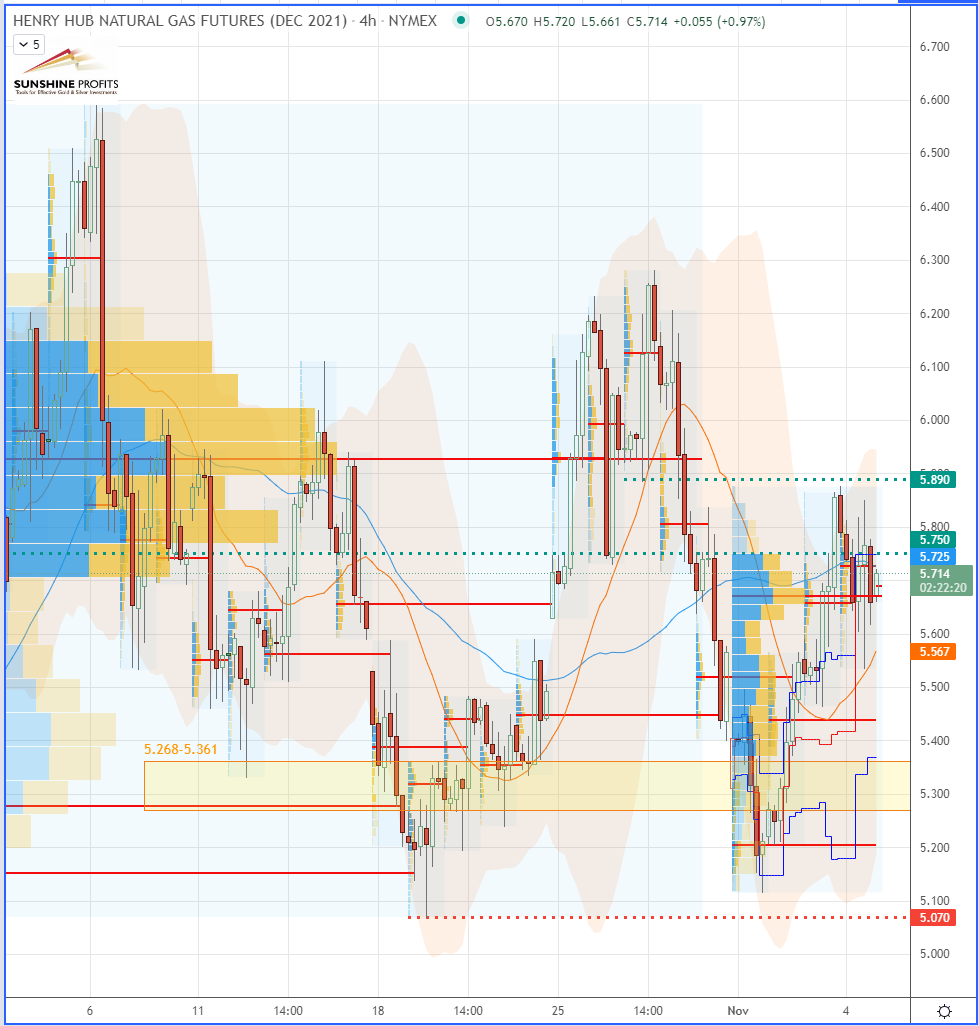

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing.comRegarding the API figures published Tuesday, the increase in crude inventories (with 3.594 million barrels versus 1.567 million barrels expected) implies weaker demand and is normally bearish for crude prices.

Meanwhile, in the United States, the average price of fuel stabilized on Tuesday after several weeks of increase, according to data from the American Automobile Association (AAA), however, that’s 60% higher than a year ago.

Chart – WTI Crude Oil (CLZ21) Futures (December contract, 4H chart)In summary, we are now getting some context on how the oil market might develop in the forthcoming days, with some crucial events to monitor as they could have a strong impact on the energy markets, and particularly on the supply side.

My entry levels for Natural Gas were triggered on Monday (Nov.1), and I’m updating my WTI Crude Oil projections.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil Trading Alerts: Change in Schedule

November 3, 2021, 8:17 AMAvailable to premium subscribers only.

-

Gas Trading Positions: Entry Triggered!

November 1, 2021, 1:11 PMAvailable to premium subscribers only.

After a successful entry triggered today on Natural Gas, let’s do a quick trade review!

-

Current Oil and Gas Trading Positions: A Bit of Context

October 29, 2021, 12:23 PMAvailable to premium subscribers only.

In today’s edition, we provide a bit of context to our most recent projections on WTI Crude Oil and Henry Hub Natural Gas futures…

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM