Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $72.65-73.03 as new support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $69.39 and with a target around $80 (see on Figure 3) – Updated trade position;

- Natural Gas [NGX21] Long around $5.480-5.568 with the initial stop below $4.766 (previous swing low) and targets at $6.62-6.63 (TP1) & $7.79 (TP2) – More details…

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, 4H chart, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart, logarithmic scale)

Figure 3 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Fundamental Analysis

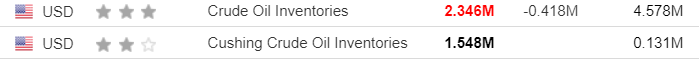

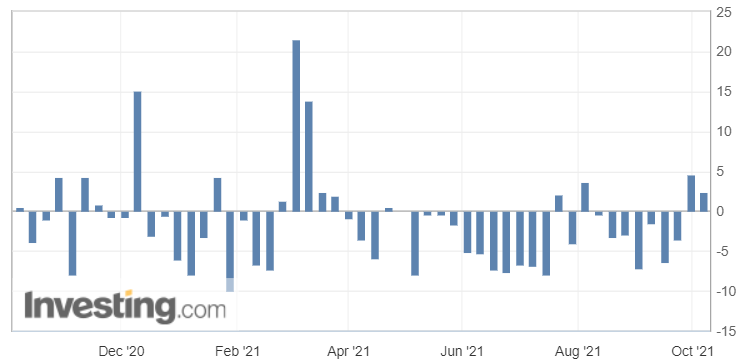

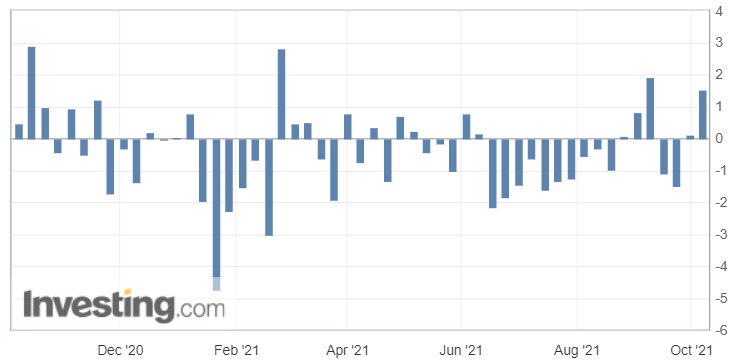

Crude oil inventories turned positive for the second week in a row. Was that the only reason for the recent plunge of black gold?

The larger-than-expected rise in crude reserves in the US weighed down oil prices on Wednesday. During the week ending on Oct. 1, crude inventories totalled about 2.35 million barrels according to the Energy Information Administration (EIA), while a number of analysts polled by Bloomberg expected no more than one million barrels. The additional increase signals that the production capacities which were impacted by Hurricane Ida in the Gulf of Mexico are gradually getting back to normal on an operational level.

Consequently, WTI crude oil futures tumbled more than 2% at the end, even though they are still sustained by the maintenance of the OPEC+ gradual production increase of 400k barrels a day in November!

In the meantime, Vladimir Putin's accommodating remarks on Russian gas production pushed natural gas prices down after an initial surge at the start of the market session, making for another choppy day in the market.

In summary, we have seen a few choppy days in the energy markets, with some contradictory data to interpret in a balanced manner. This kind of uncertainty usually leads to ranging markets, which can be used to place some shorter-term trades.

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $72.65-73.03 as new support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $69.39 and with a target around $80 (see on Figure 3) – Updated trade position;

- Natural Gas [NGX21] Long around $5.480-5.568 with the initial stop below $4.766 (previous swing low) and targets at $6.62-6.63 (TP1) & $7.79 (TP2) – More details…

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist