Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one third (1/3rd) and two fifth (2/5th) in case of further dips and depending on the volatility of each chosen security…

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Either below the previous swing low (depending on your timeframe/time horizon);

- Or just use some Average True Range (ATR) multiplicator.

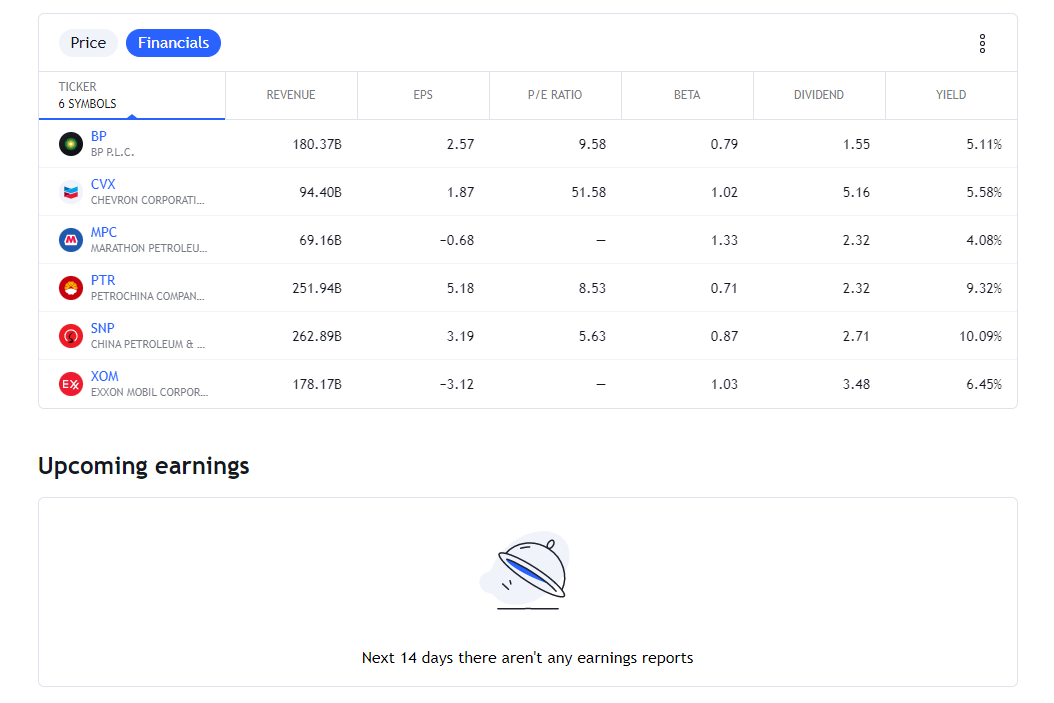

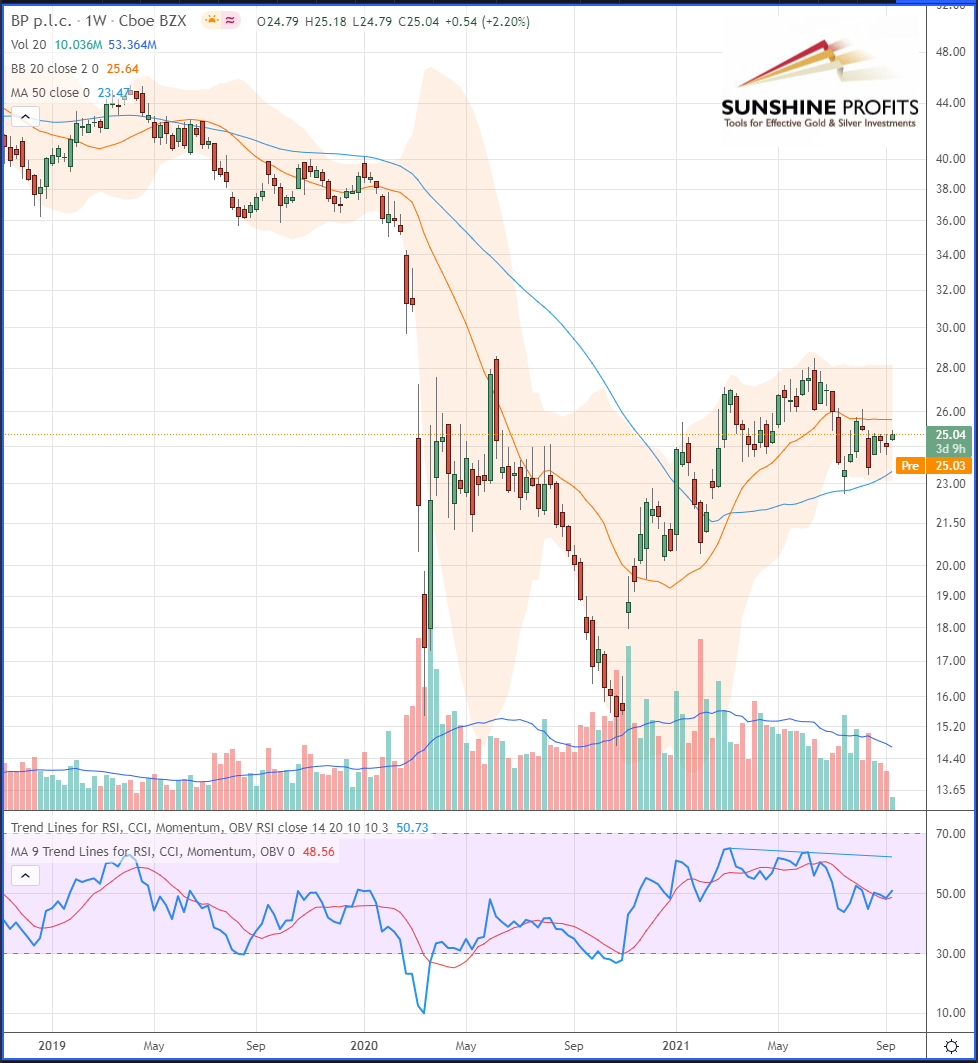

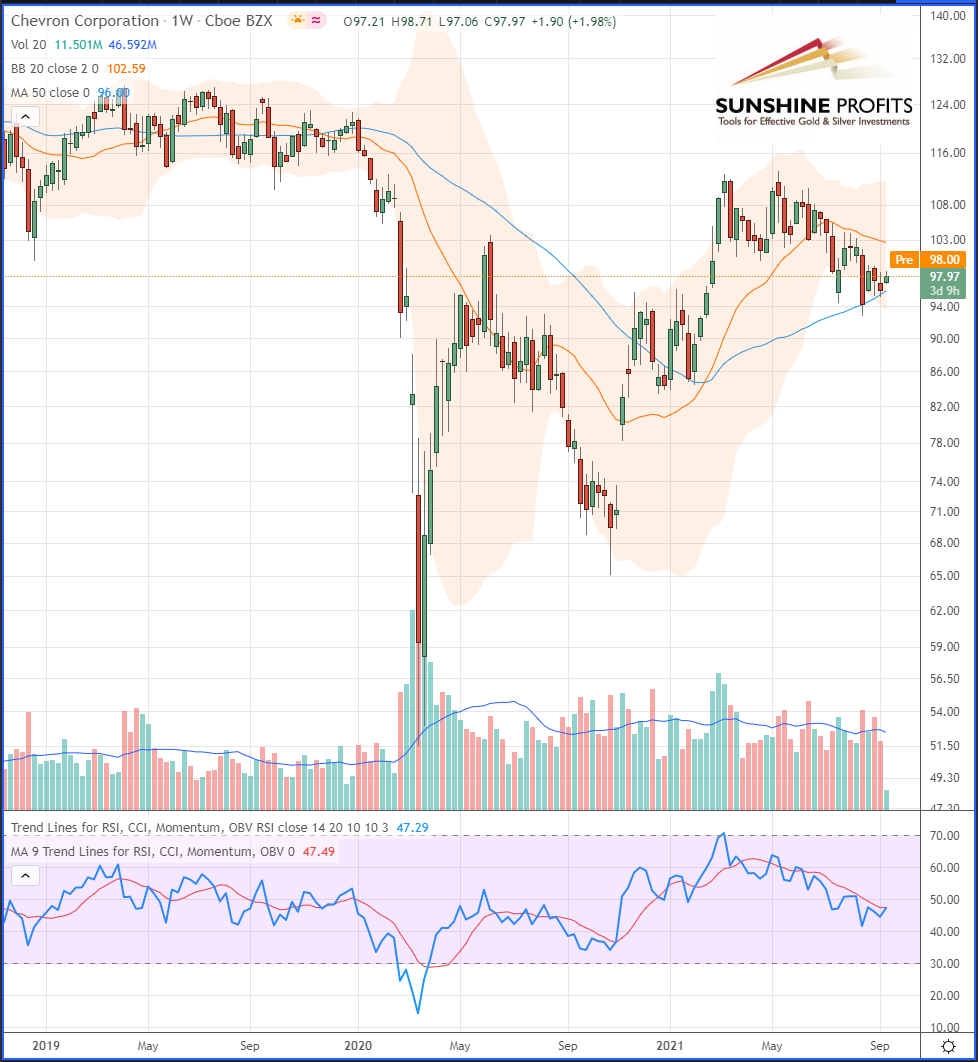

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

Stocks |

|

BP, 21.66-24.46 |

|

CVX, 92.74-94.29 |

|

MPC, 51.86-53.58 |

A good way to start with the construction of a sturdy portfolio is to lay the main pillars for getting exposure to the energy sector, as well as its industrial components.

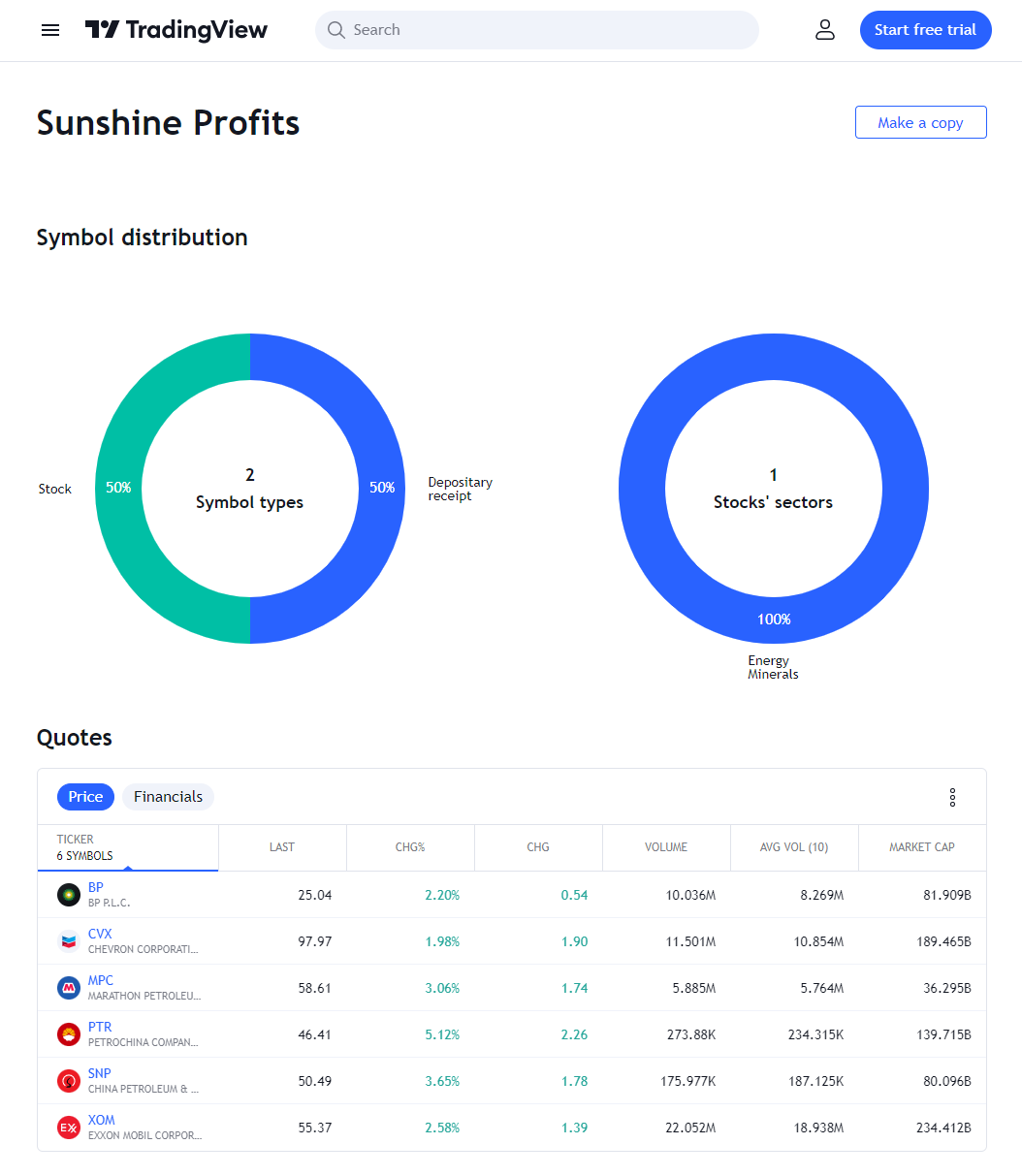

Stock Watchlist

Our stock-picks will be shared through that link to our dynamic watchlist, which will be updated from time to time as we progress through this portfolio construction process.

See an example of some indicative metrics below:

As we mentioned - to lay the pillars of our portfolio, we picked six of the world’s biggest oil and gas companies (with the highest revenues) that are quoted in the US exchange.

Revenue (in billion US dollars):

- British Petroleum (BP) $180.37B

- Chevron (CVX) $94.4B

- Marathon Petroleum (MPC) $69.16B

- PetroChina (PTR) $251.94B

- Sinopec (SNP) $262.89B

- Exxon Mobil (XOM) $178.17B

Figure 1 – British Petroleum (BP) Stock (weekly chart, logarithmic scale)

Figure 2 – Chevron (CVX) Stock (weekly chart, logarithmic scale)

Figure 3 – Marathon Petroleum (MPC) Stock (weekly chart, logarithmic scale)

In summary, the large oil and gas corporations mentioned above may provide some benefits at the start of your portfolio construction while giving you balanced exposure to energy prices.

We will expand on this in the following Oil Trading Alerts, and…

…as always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one third (1/3rd) and two fifth (2/5th) in case of further dips and depending on the volatility of each chosen security…

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Either below the previous swing low (depending on your timeframe/time horizon);

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

Stocks |

|

BP, 21.66-24.46 |

|

CVX, 92.74-94.29 |

|

MPC, 51.86-53.58 |

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist