Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

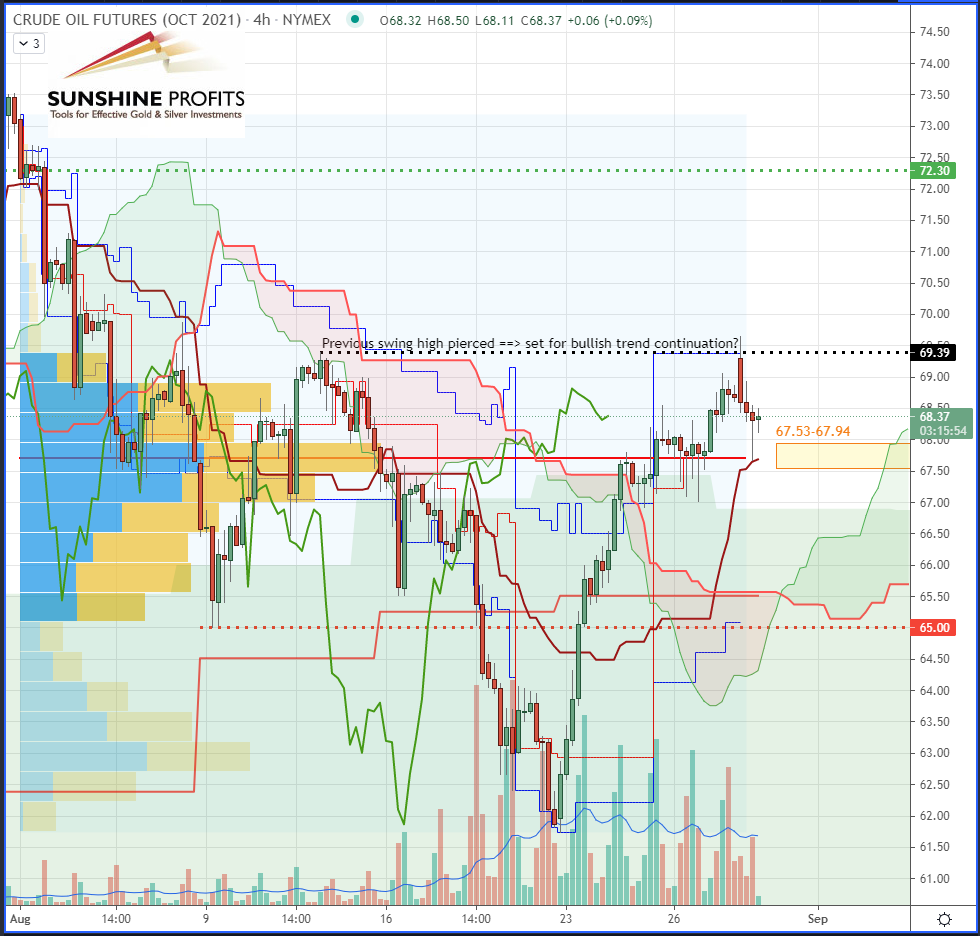

Trading position (short-term, our opinion; levels for crude oil’s October futures contract): Long @ $67.53-67.94 / SL @ $65 / Target @ $72.30

As per our Friday’s watchlist, the market is waiting for Hurricane Ida and has OPEC+ in its sights.

Trading Analysis

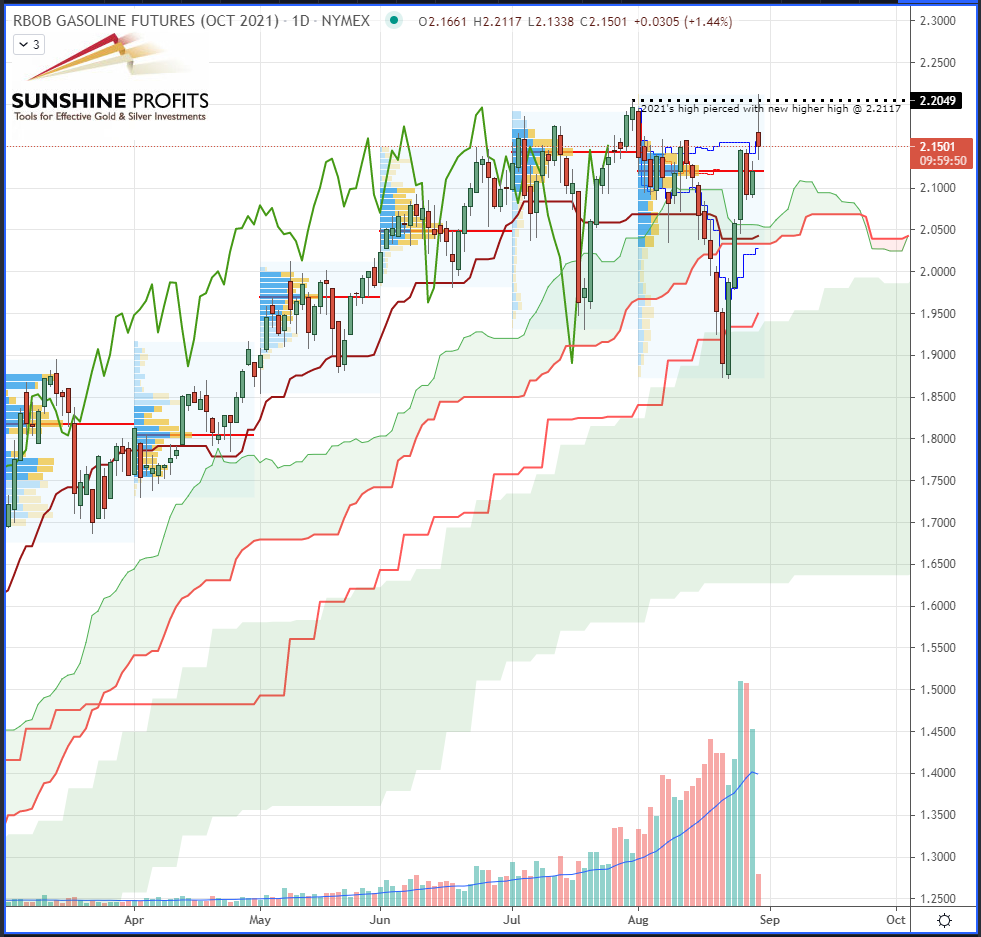

RBOB Gasoline (RB) futures surged – piercing their year high with a new high at $2.2117 for the October contract (Fig.1) – after hurricane Ida hit Louisiana. Another element to consider is the weather cooling down, thus increasing demand.

This week, we expect traders to assess the fallout from Ida (leaving the US Gulf with more than 90% of its crude oil offline), as well as the likelihood that OPEC+ rolls over its 400k easing plan when it meets on September 1.

On the geopolitical scene, Tehran may discuss their return to the market, still depending on how far the negotiations go on the nuclear deal.

The Volume Point of Control (VPOC) on crude oil (CL) has been lifted up between $67.53-67.94, which may give a new entry to the bulls who expect some further rally towards the $72.30 target (Fig. 2). The 4H chart shows that the previous swing high on Aug. 12 located at $69.39 was pierced at the Sunday open before the prices retraced back to the new VPOC.

In an optimistic scenario, we would suggest a STOP to be placed either below the current volume area at $65 or, depending on your risk profile, to use an Average True Range (ATR) measure.

Figure 1 – RBOB Gasoline (RBV2021) Futures (Oct’21 contract, daily)

Figure 2 – WTI Crude Oil (CLV2021) Futures (Oct’21 contract, 4H)

In summary, we expect the prices to evolve through a volatile week for energy futures.

As always, we’ll keep you, our subscribers well informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s October futures contract): Long @ $67.53-67.94 / SL @ $65 / Target @ $72.30

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist