Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position

- Short-term, our opinion; levels for natural gas October futures contract: short positions with entry via stop order placed just below $4.557 price level, with a stop-loss above previous swing high (4.774) or just above higher range level ($4.727) and $4.378 (TP1) / $4.251 (TP3) / $4.156 (TP2) as price targets;

- Medium-term, our opinion; levels for natural gas’s October futures contract: long positions with entry at $3.848-3.897, with a stop-loss below August’s swing low (3.751) and $4.016 (TP1) / $4.156 (TP2) / $4.251 (TP3) as price targets.

Some clear price divergences are visible in Natural Gas. Is this an opportunity to go short?

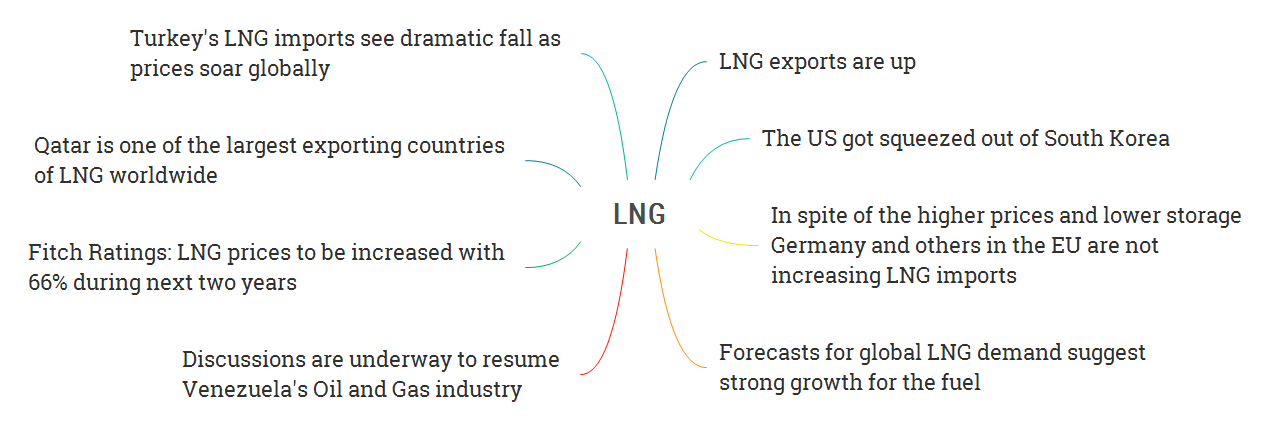

LNG in brief

Technical Analysis

The Henry Hub Natural Gas futures (Oct’21) contract, currently ranging around its top levels between $4.557 and $4.727, could be set for a correction back onto its $3.848-3.897 medium-term support levels.

- On the daily chart (Fig.1), we already showed in Sept.1’s Oil Trading Alert what we believed to be the optimal levels to enter long and exit for a good risk to reward ratio if a corrective wave were going to happen down there (arrow up);

- Now, for the more aggressive traders who would like to take advantage of a short-term price drop, we could eventually suggest going short by placing a stop limit (or market) order just below the lower range level (that is to say, just below $4.557). By doing so, you would expect entering the market once a breakout of that lower range level happens. Currently, both the RSI (14) and Momentum indicators are supporting this scenario by showing bearish divergences in “overbought” areas.

- The weekly chart (Fig.2) displays a loosening in strength this week with a doji which could be interpreted as a lack of fuel on the buy side, and again a visible bearish divergence on an RSI trapped into a flag pattern, forming lower tops.

Figure 1 – Henry Hub Natural Gas (NGV21) Futures (October contract, daily)

Figure 2 – Henry Hub Natural Gas (NGV21) Futures (October contract, weekly)

In summary, if natural gas futures were set to take a correction back onto support anytime soon, we would like to anticipate and be ready to enter at the best risk-optimised levels, whether we decide to go short (more aggressive traders) or wait for going long later on.

As always, we’ll keep you, our subscribers well informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position

- Short-term, our opinion; levels for natural gas’s October futures contract: short positions with entry via stop order placed just below $4.557 price level, with a stop-loss above previous swing high (4.774) or just above higher range level ($4.727) and $4.378 (TP1’) / $4.251 (TP3) / $4.156 (TP2) as price targets;

- Medium-term, our opinion; levels for natural gas’s October futures contract: long positions with entry at $3.848-3.897, with a stop-loss below August’s swing low (3.751) and $4.016 (TP1) / $4.156 (TP2) / $4.251 (TP3) as price targets.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist