Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s October futures contract):

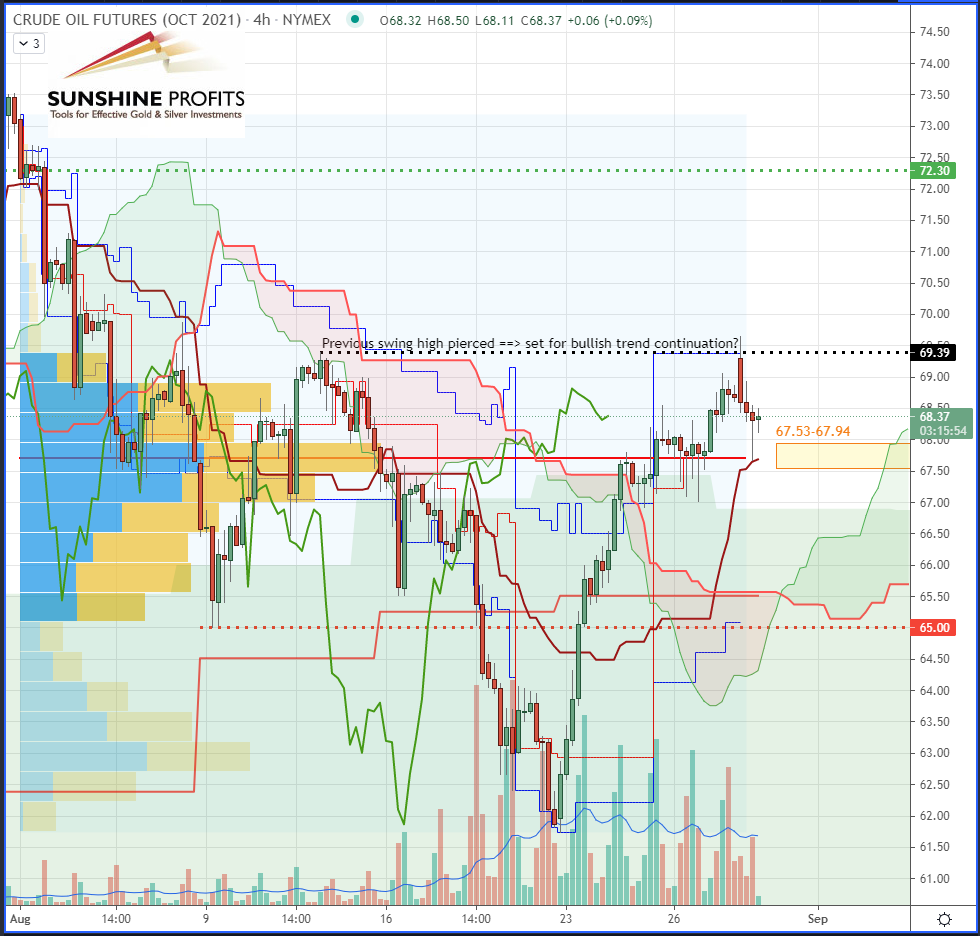

On Monday we suggested getting ready to go long around the $67.53-67.94 support zone, with a stop-loss below the previous swing low ($65) and a target at $72.30 (Fig.1).

Since our order was executed on Wednesday’s retracement, prior to the impulse from the support zone (Fig.2), the risk was reduced on Friday by tightening the stop-loss market order below the new swing low ($67.12) or the breakeven ($67.84). The next candle that triggers a breakout above $70.51 will justify lifting the stop-loss again to the point just below that candle.

A possible re-entry could be considered in between $68.16-68.54 while keeping a tight stop-loss at the new levels mentioned above to minimize the risk of crude dropping lower at the US opening.

Some concerns about global demand pushed oil prices lower, but the bullish scenario is still in play. Where are we headed?

Oil prices are hesitating today, divided between good Chinese data — a positive demand signal supported by the surprising rebound in Chinese exports (+ 25.6% over one year) — and the announcement of a drop in Saudi Aramco's prices.

For China (the world's largest crude importer), this rate of growth in foreign sales has been the fastest since February.

Market Analysis

Oil prices have retreated slightly since Friday, as more fears of an economic slowdown captured the market's attention last week (OPEC meeting and Hurricane Ida).

The outlook for demand has been sluggish, especially in Asia, pushing Saudi Arabia, the world's largest exporter, to lower prices. According to the report shared by Saudi Aramco that surprised the market, the Kingdom said that it would cut October selling prices for its entire range of oil by at least a dollar a barrel.

And yet, the OPEC+ – an alliance in which Saudi Arabia is very influential – decided last week to increase its next month’s production by 400k barrels , just as it was previously planned.

Figure 1 – Last Monday’s suggested trade plan on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, 4H)

Figure 2 – Today’s trade plan status on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, daily)

Conclusion

In summary, our bullish scenario, which was outlined last Monday for WTI crude oil (CL) futures, still remains valid today despite the recent drop in black gold. The risk on that trade was reduced on Friday to avoid any losses in case of the development of a less favorable scenario.

As always, we’ll keep you, our subscribers well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s October futures contract):

On Monday we suggested getting ready to go long around the $67.53-67.94 support zone, with a stop-loss below the previous swing low ($65) and a target at $72.30 (Fig.1).

Since our order was executed on Wednesday’s retracement, prior to the impulse from the support zone (Fig.2), the risk was reduced on Friday by tightening the stop-loss market order below the new swing low ($67.12) or the breakeven ($67.84). The next candle that triggers a breakout above $70.51 will justify lifting the stop-loss again to the point just below that candle.

A possible re-entry could be considered in between $68.16-68.54 while keeping a tight stop-loss at the new levels mentioned above to minimize the risk of crude dropping lower at the US opening.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist