-

Henry Hub Natural Gas Futures: Entry Triggered!

February 7, 2022, 9:32 AMCrude oil prices were giving themselves a break in Monday’s European session, ahead of negotiations on the Iranian nuclear deal, which could lead to the lifting of sanctions after a new multi-year high for Brent.

In today’s trade review, I will provide a quick update on my last projections for natural gas.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Ukrainian Tensions and Oil - Is Russia Really the Bad Guy?

February 4, 2022, 10:11 AMWhile everyone is criticizing Russia, it’s easy to follow the US ‘savior’ narrative. However, what if we looked at what’s happening with oil in mind?

Several port facilities in Germany, the Netherlands and Belgium have been the target of cyberattacks, prompting the judicial authorities to investigate the suspicions of extortion of funds at the expense of German operators in the oil sector. Indeed, it would appear that this series of computer hackings that began several days ago primarily concerns oil terminals. This is disrupting deliveries in several major European ports against a backdrop of soaring energy prices.

After jumping the day before, thanks to the strengthening of the euro against the US dollar induced by ECB President Lagarde, oil prices continued to rise during the European session on Friday. Consequently, the fall in the greenback came on top of the recovery in demand, the fall in US crude inventories and the disruptions in supply to boost the price of black gold on the climb, the two crude benchmarks evolving above the psychological mark of 90 dollars a barrel, galvanized by solid demand and tensions on the offer coming from (geo-)political risks.

Who is Provoking Who?

The situation is rather complex on the geopolitical scene, with the US claiming that Russia is planning an invasion in Ukraine, whereas the US under NATO cover sent additional troops to Eastern Europe. The question that may arise here is: who is provoking who? So far, we haven’t seen Russia placing troops in Mexico, on the border with the United States. On the other hand, the Biden administration may encounter difficulties in accepting that the Kremlin can agree to various partnerships with its European neighbors, especially regarding more favorable energy supplies. Instead, it’s in the US interest to weaken those diplomatic relations, potentially leading to additional partnerships that may arise between the EU and Putin.

And as we see the US-led narrative getting through the Western mainstream media with more aggressive, suspicious, and tense tones towards Russia, this obviously has the effect of pouring some oil on the Russian-Ukrainian fire. Furthermore, the US needs reasons to demonstrate that NATO is still alive and relevant while a number of countries are now questioning their own participation in the US-led military organisation created in 1949, even going so far as to show some doubts regarding its current motivations.

Isolating the Russian Bear

By maintaining a hostile tone towards Russia’s intentions, the US is consequently trying to isolate the Russian bear and push their European partners to blindly follow the “official narrative” (as the EU being part of NATO), which could possibly lead to new sanctions on Russia, the latter being able to retaliate by using its energy assets and capacities to deprive the EU of the Russian supplies, which currently on the gas side represent between 30% and 40% of total gas imports for Europe. Then, as a result, the Americans could start exporting more gas into Europe via Liquefied Natural Gas (LNG) shipping – which again could benefit their energy-led commercial balance – the Europeans thus becoming the losing players in this game.

As an example, we saw this week that a tanker loaded with LNG from the US will arrive at the LNG terminal in Świnoujście (Poland) at the end of this month, since Poland has LNG import capabilities which could be used to deliver US gas to Ukraine. Apparently, this is the second time (after the first one took place two years ago) that such gas deliveries are made by PGNiG, the Polish state-controlled oil and gas company, in cooperation with ERU (their strategic trading partner on the Ukrainian market).

Actually, Ukraine suspended imports of Russian gas at the end of 2015. After relying on Russian gas imports for decades, they currently increasingly depend on imports from Europe. Since Ukraine has no LNG import capabilities, such US gas deliveries have been organized via a pipeline from the Polish terminal (through re-gasified LNG).

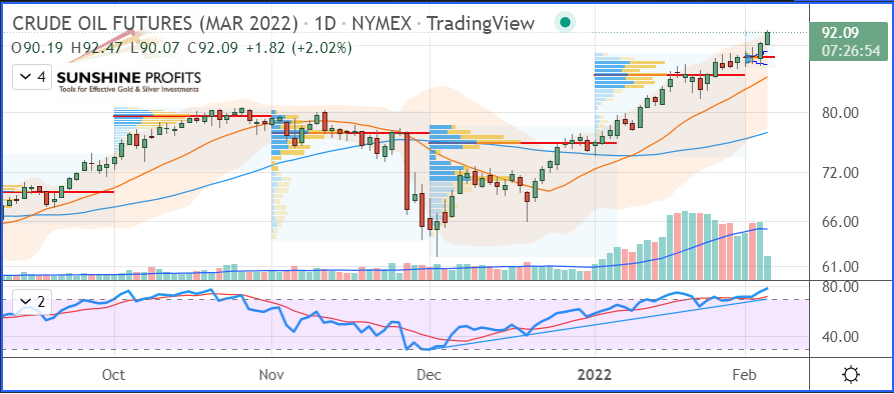

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

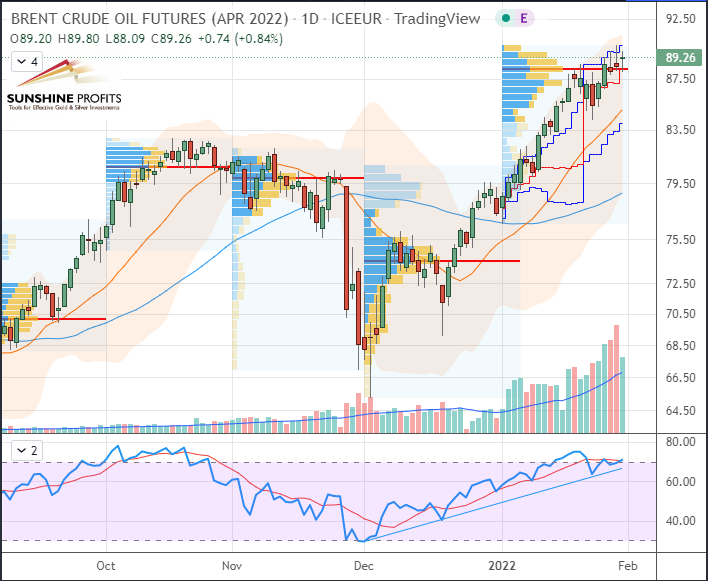

Brent Crude Oil (BRJH22) Futures (April contract, daily chart)

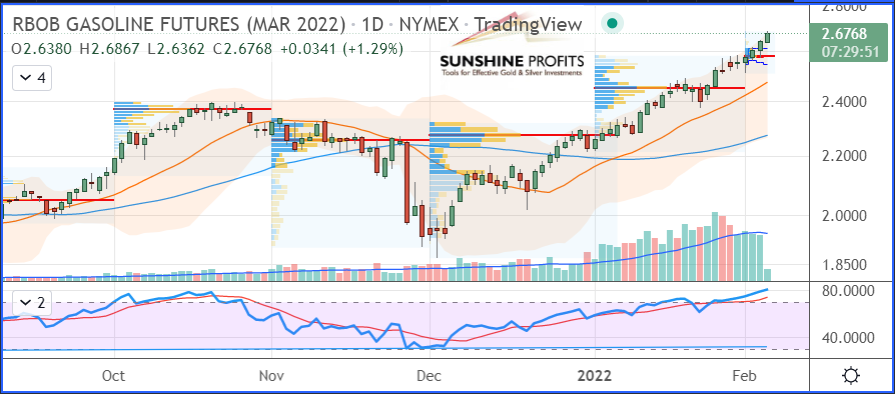

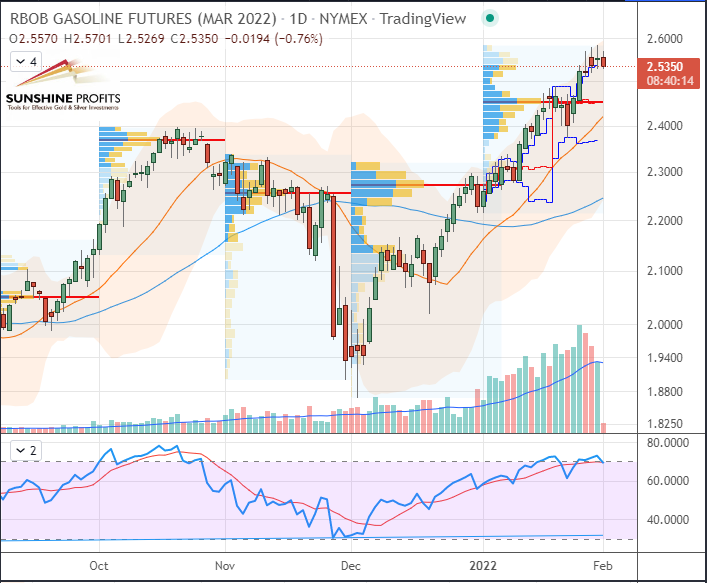

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

In summary, geopolitics is always complex because it relies on individual economic and strategic interests of countries. The readings also depend on different views, and since there is always a lot of noise, it often helps to take some steps back in order to analyze the global situation from a different angle.

Therefore, what I delivered here was my own analysis from a pure energy-focused perspective. I do not claim it represents THE right view, but rather one of those that won’t be as visible in the mainstream. It is interesting to add different views as pieces of the same puzzle. I am looking forward to reading yours in the comments!

Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil Trading Alert Update: No Further Increases for OPEC+

February 2, 2022, 11:51 AMAvailable to premium subscribers only.

Today’s premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Is Black Gold Set for a Retracement Towards Lower Levels?

February 1, 2022, 9:52 AMWhile last week's geopolitical tensions have eased a bit, the OPEC+ members’ meeting knocks at the door. How will it affect crude inventories?

Crude oil prices paused this morning in the European trading session, the day after a new technical increase linked to the expiration of futures contracts. OPEC+ members, including Russia, are due to hold a meeting tomorrow in which speculative talks suggest that OPEC+ could announce a quicker increase in supply. On the other hand, US crude inventories should be scrutinized this week, with the first figure to be released later today by the American Petroleum Institute (API) at 2130 GMT / 1530 Chicago Time.

Therefore, we could see a new rise in crude stockpiles of 2 million barrels. As a result, the oil market could be set to start a pullback down to previous support – $ 85.80 could represent a level that would attract more bulls, eventually.

Regarding OPEC+ output, Saudi Arabia could decide to add barrels on top of its quota, as the kingdom is one of the only members of the cartel able to ramp up production, if necessary.

On the US dollar side, the recent rally of the greenback has propelled the dollar index (DXY) towards higher levels, even though it has not had a huge impact on crude oil. The overall inverted/negative correlation between the USD and black gold could catch up now as we have a greenback sliding after less hawkish comments from the Fed than expected and a barrel located in overbought territory.

On the geopolitical scene, the slight ease of tensions from the past week – or, at least, the diminution of anxiety inducing news in the mainstream media headlines – is characterized by decreasing volatility. The latter is thus marked by a volatility index (VIX) – aka “Fear Index” sliding just below 25 today.

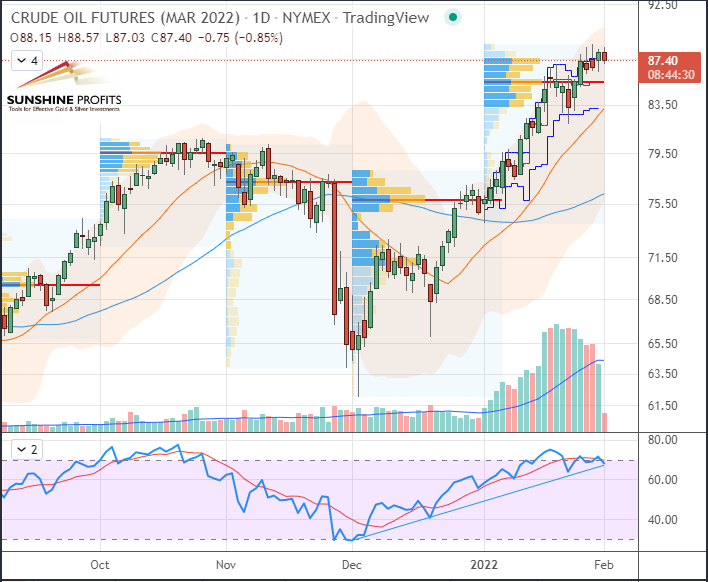

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Brent Crude Oil (BRNJ22) Futures (April contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

In summary, after such a rally in January 2022 on crude oil prices, we may start to see a weakening of the momentum, which could result in correcting oil prices, if such a scenario of supply and demand dynamics is followed on both sides (input rise / stockpiles accumulation) of the market.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

New Trade Projections on Henry Hub Natural Gas Futures

January 28, 2022, 9:45 AMOil prices continue to surge after a short pause due to the rising USD, with escalating geopolitical tensions still leaving crude supplies at risk.

On Thursday, by evoking a rate hike in March and refusing to rule out the possibility of successive rises thereafter, Federal Reserve (Fed) Chairman Jerome Powell boosted the dollar, thus temporarily affecting crude prices.

In today’s Oil Trading Alert, I will provide you with my new projections on Natgas’ new front month (Mar ’22) contract.

Available to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM