tools spotlight

-

Inflation Accelerates in June. Will Gold Finally React?

August 20, 2021, 9:24 AMInflation surged in June to 5.4%. It may retrace soon, but there’s a good chance that it will increase again later, boosting gold at last.

The inflation monster has reared its ugly head. The CPI annual rate surged to 5.4% in June, accelerating from already mind-blowing 5% in May. It was the hottest pace since the Great Recession. However, Powell and his colleagues from the FOMC still claim that inflation will only be temporary, as it was boosted by the reopening from the Great Lockdown, while others predict a replay of the stagflation from the 1970s. Who is right?

Well, it’s true that some inflation measures will decline in the near future. After all, the economy faces supply chain bottlenecks, which are causing price spikes. The global shortage in the supply of semiconductors chips is one of the temporary problems that led to the annual 45.2% spike in the price of used cars in June, accounting for more than one-third of the surge in the overall index.

However, used vehicle prices are skyrocketing not just because of the problems on the supply side, but also because of a higher-than-expected demand. And where did this strong demand come from? You got it – from the extra cash that has been created and distributed to people. There is so much liquidity in the markets thanks to very easy fiscal and monetary policies that people just want to buy stuff, no matter the price.

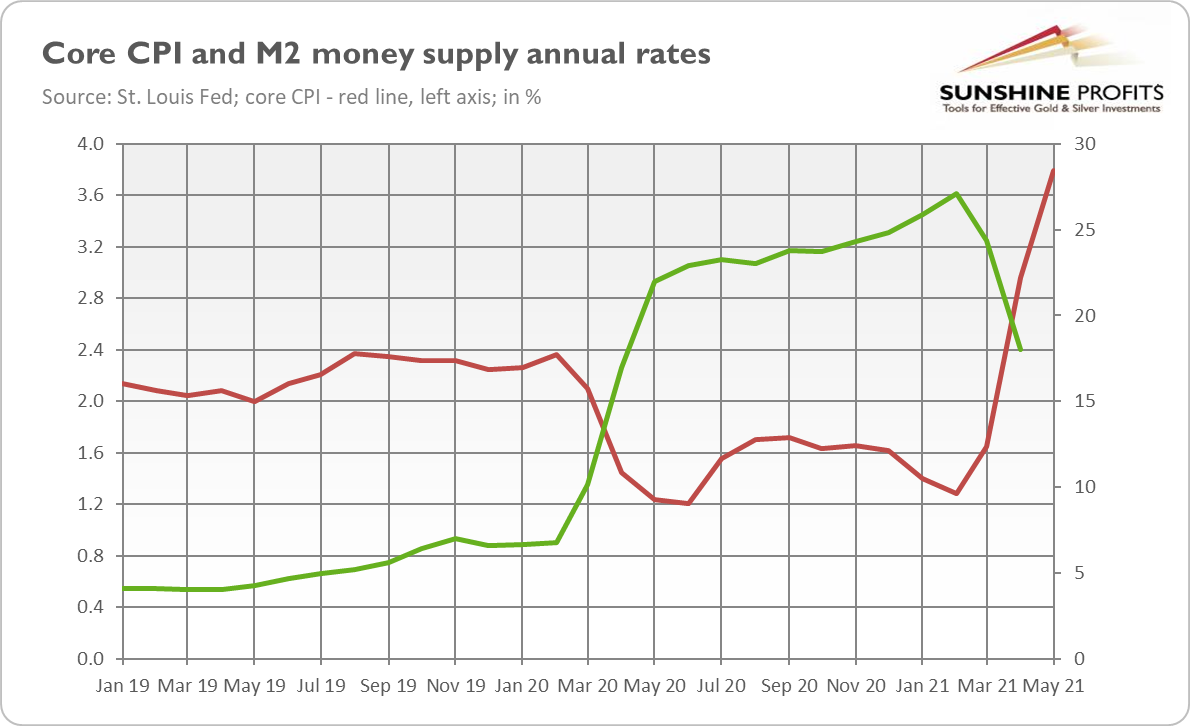

As Milton Friedman notes, “inflation is always and everywhere a monetary phenomenon” – prices cannot keep on rising without the expansion of money supply. So, supply bottlenecks are only one driver of rising inflation – the surge in the broad money supply, the reduced pace of globalization and the complacent stance of central banks are other factors.

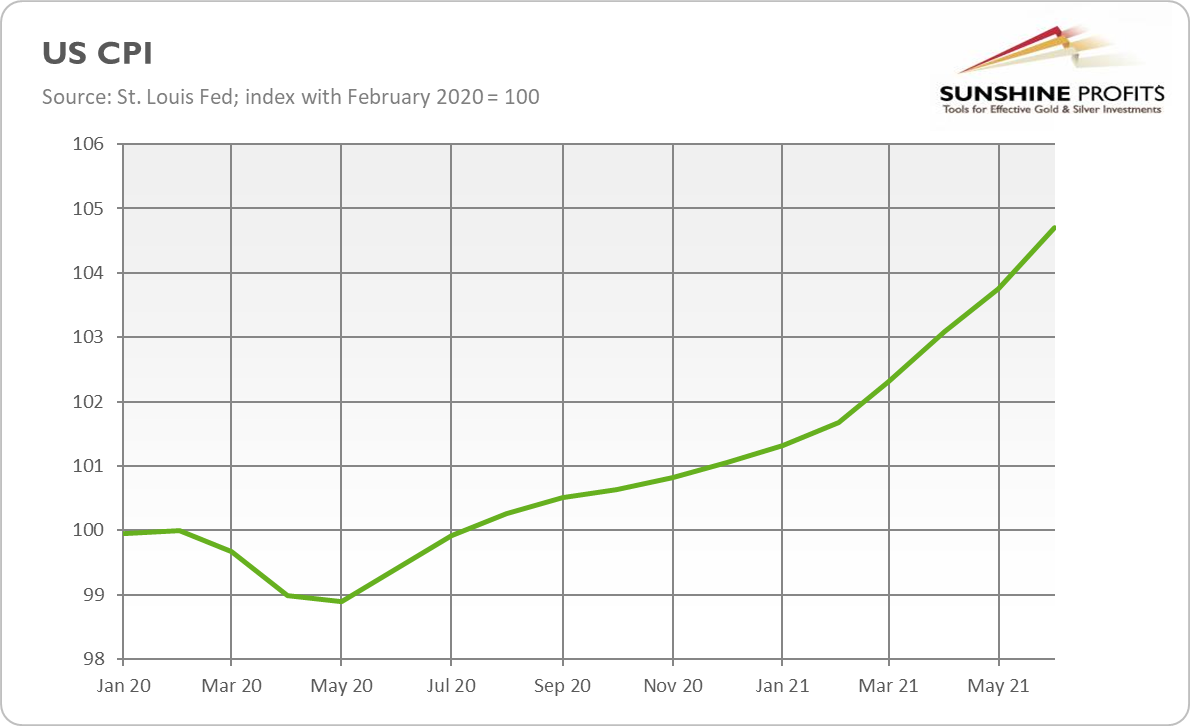

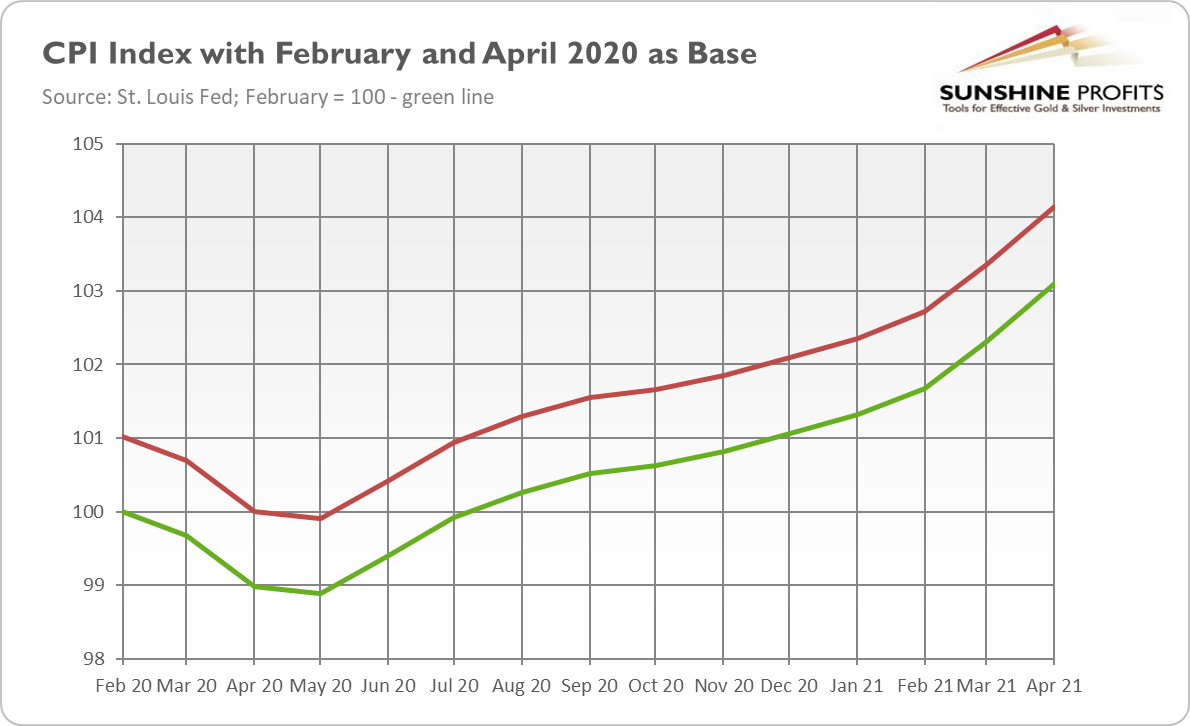

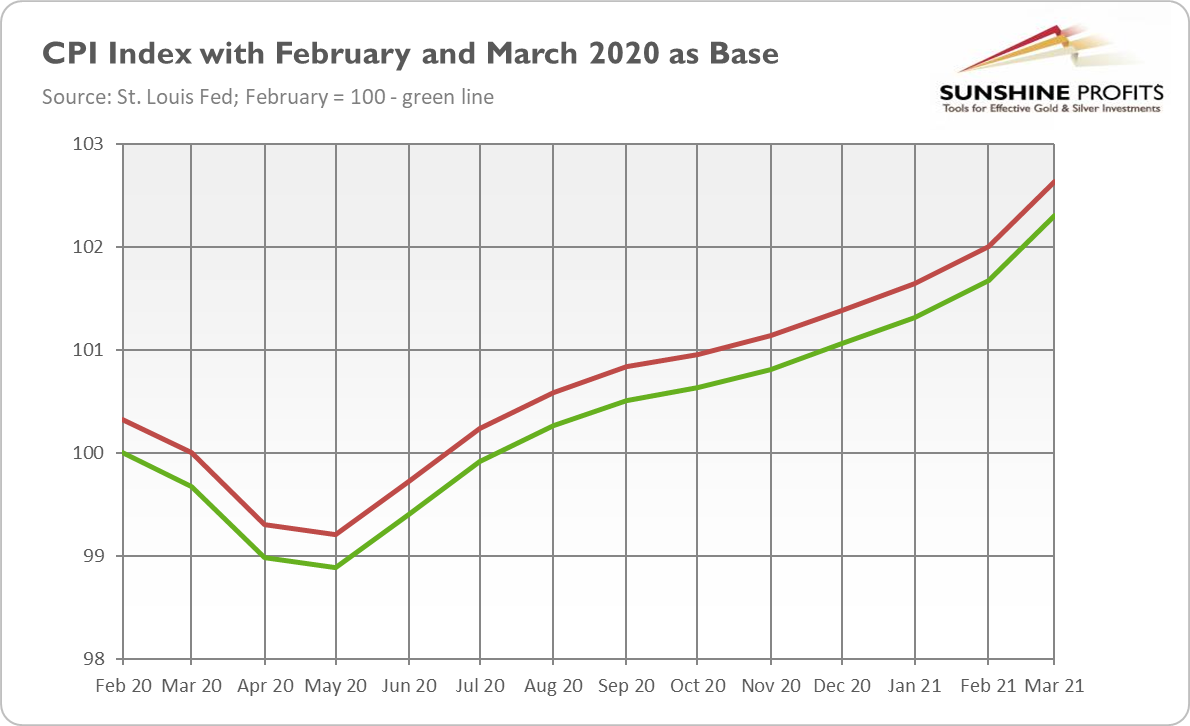

What’s more, even if we drop the subindex for used cars from the calculation, the annual inflation rate would be 3.6%, almost twice the Fed’s target. Indeed, there is still some base effect, but even if we compare the recent inflation readings to February 2020, we see in the chart below that the CPI is 4.7% higher than before the pandemic.

So, some improvement in the supply of semiconductors (if we drop out low CPI readings from the calculation) could soften inflation somewhat in July or later this year. However, even if inflation backs out of its current pace, it will likely remain elevated; even experts admit it. The economists polled by the Wall Street Journal forecast that inflation will drop to 3.2% by the end of this year and stay above 2% through 2023.

There is still high inflationary pressure that should keep consumer prices boosted. For instance, the ISM® Prices Index registered 92.1%in June, indicating that raw materials’ prices increased for the 13th consecutive month. The index has risen to its highest level since July 1979. Producer prices are also rising, while transportation costs, in particular freight prices, are skyrocketing. All this should add to the inflationary pressure, possibly translating into higher consumer prices in the future.

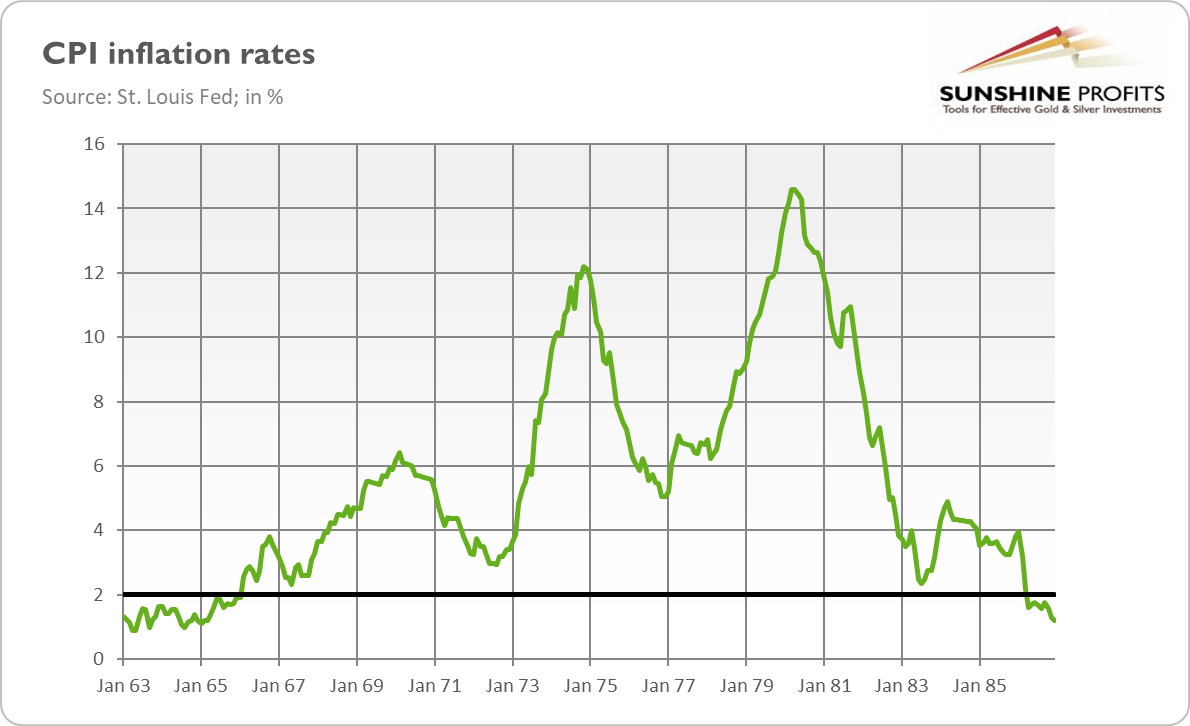

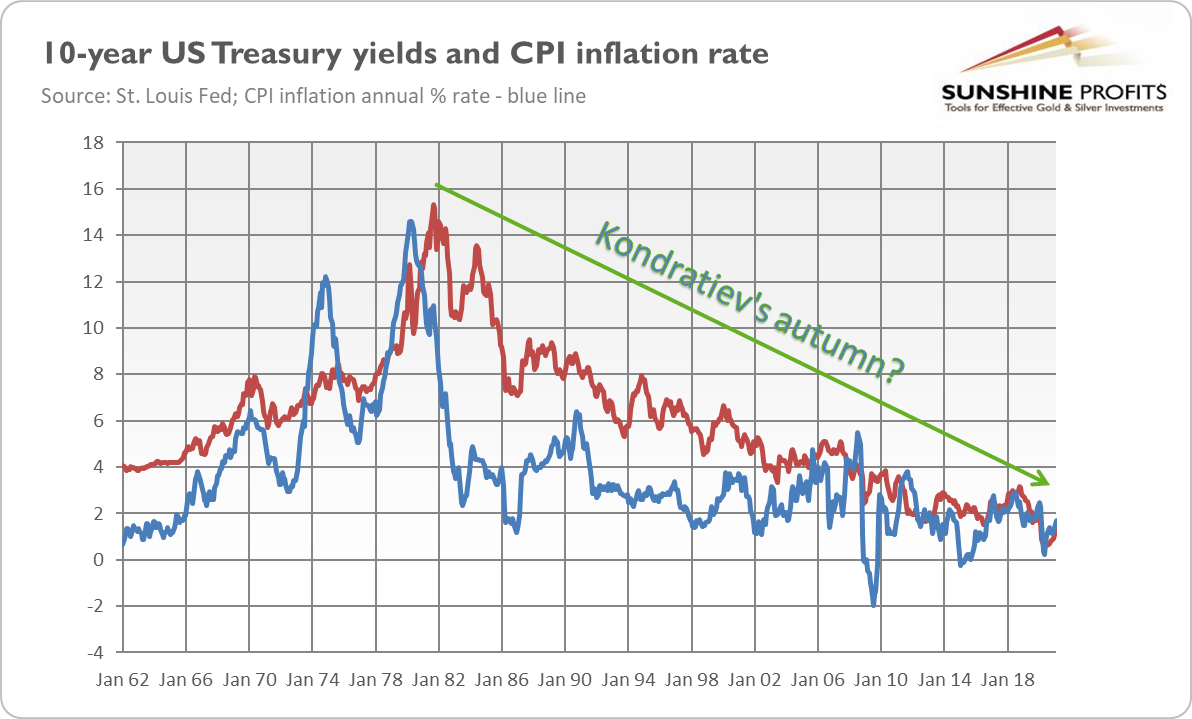

Another important issue is that inflation often comes in waves. So, even if the first bout ends soon, it won’t mean that the threat of high inflation is going to disappear. It might be the case that we are just in a transitional phase, slowly moving into a period of higher inflation. Please take a look at the chart below. As you can see, the stagflation from the 1970s didn’t show up overnight.

Instead, the first wave started in 1965 and peaked a year later. However, in 1967, the second wave began, which peaked in 1970. Then, inflation eased, giving false hopes, but it accelerated again in 1973-1975, and – after another temporary retreat –in 1978-1980.

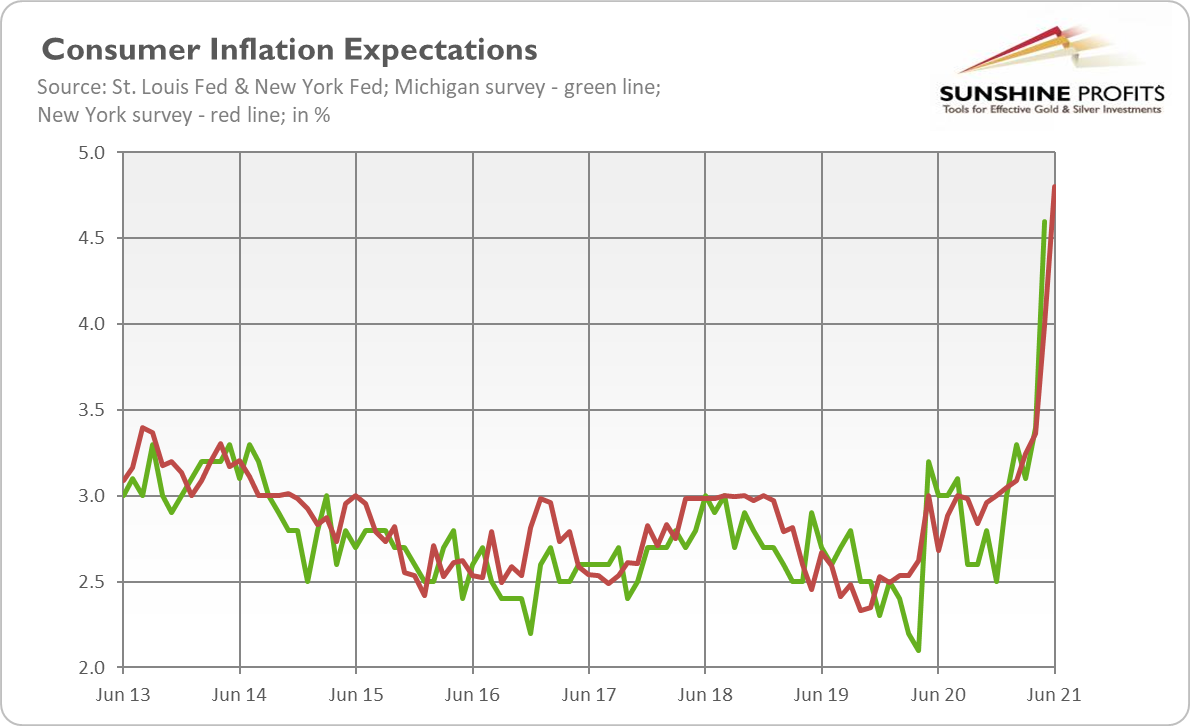

So, the first bout of inflation always looks temporary, but it may lay the groundwork for even higher inflation, especially if inflation expectations de-anchor. And, indeed, although medium-term consumer expectations remain stable, one-year expectations have recently risen, as the chart below shows. In the case of New York Fed’s Survey of Consumer Expectations (red line), they have soared 0.8 percentage points, reaching 4.8% – a new series high.

What does it all imply for the gold market? Well, initially, the impact of inflation might be negative. This is because the markets will eventually react to higher inflation and the more hawkish Fed. So, the bond yields will rise, increasing the opportunity costs of holding gold.

However, after some time, higher inflation will become disruptive for the economy. Either real household incomes or corporate profits will decline (depending on the companies’ ability to pass surging costs), while higher interest rates will trigger some defaults. When inflationary psychology sets in and people start to worry about all the bad consequences of inflation, gold should shine. So far, the party goes on; but a hangover lurks just around the corner.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook and the gold market, we invite you to read the August Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will the Fed Bring Gold to the Bottom?

August 6, 2021, 6:40 AMThe Fed’s reverse repos reached almost $1 trillion in June. Brace yourselves gold bulls – tightening is coming!

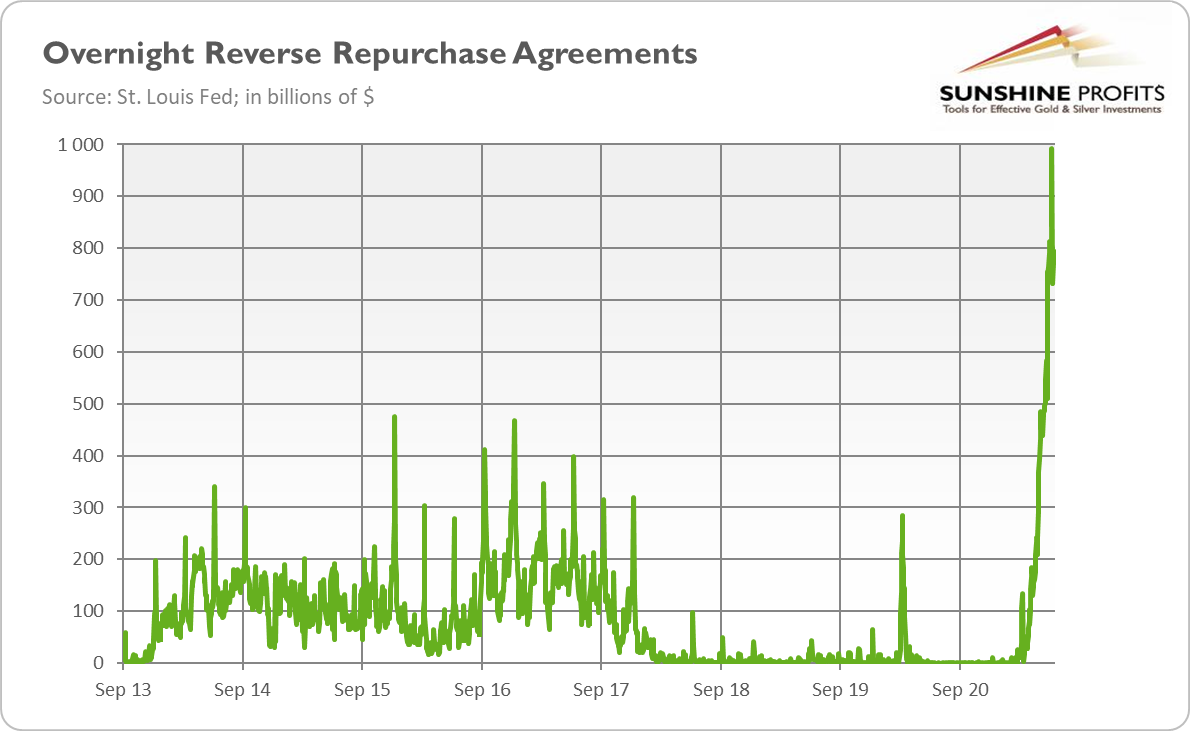

Something interesting is happening in the financial markets. As you probably know, the Fed’s reverse repurchase operations have been increasing recently. At the very end of June, their volume almost reached one trillion dollars ($991.9 billion)! It’s a record high, as the chart below shows.

Oh boy, what a spike! What does it mean? Well, when the Fed purchases assets, it injects liquidity into the markets. On the contrary, when the US central bank engages in reverse repurchase operations, it drains liquidity from the markets. This is because reverse repurchase agreements are purchases of securities with the agreement to sell them at a higher price at a specific future date – of course, we refer here to buying and selling from the point of view of financial institutions. They are purchasing assets from the Fed to resell them later, so they basically lend some money to the US central bank.

In other words, the record high volume of repos means that financial institutions pour cash into the Fed like mad. We could say that there is an excessive liquidity problem in the financial markets, so commercial banks and other institutions deposit abundant cash at the Fed (you can think of reverse repos as short-term loans).

So, we have a somewhat paradoxical situation. The Fed is still purchasing assets under its quantitative easing program, injecting liquidity into the financial sphere. However, market participants don’t need this liquidity, so they buy back some assets from the Fed in the form of reverse repo operations. Given that the Fed buys about $120 billion per month in Treasuries and MBS, the reverse repos have already undone more than eight months of QE!

Part of the problem here is the crazy world of negative real interest rates. In such an environment, commercial banks prefer safe, close-to-zero interest rates from the Fed to risking anything in the market. In other words, the bond yields are so low that banks don’t want to deploy funds productively but prefer to hold them safely at the Fed. Such behavior is completely understandable in the world of negative yields, but it will lead to sluggish investment and economic growth. Well, abundant liquidity that becomes a hot potato, as well as slow real growth, sound like positive factors for gold, which likes stagflation-like conditions.

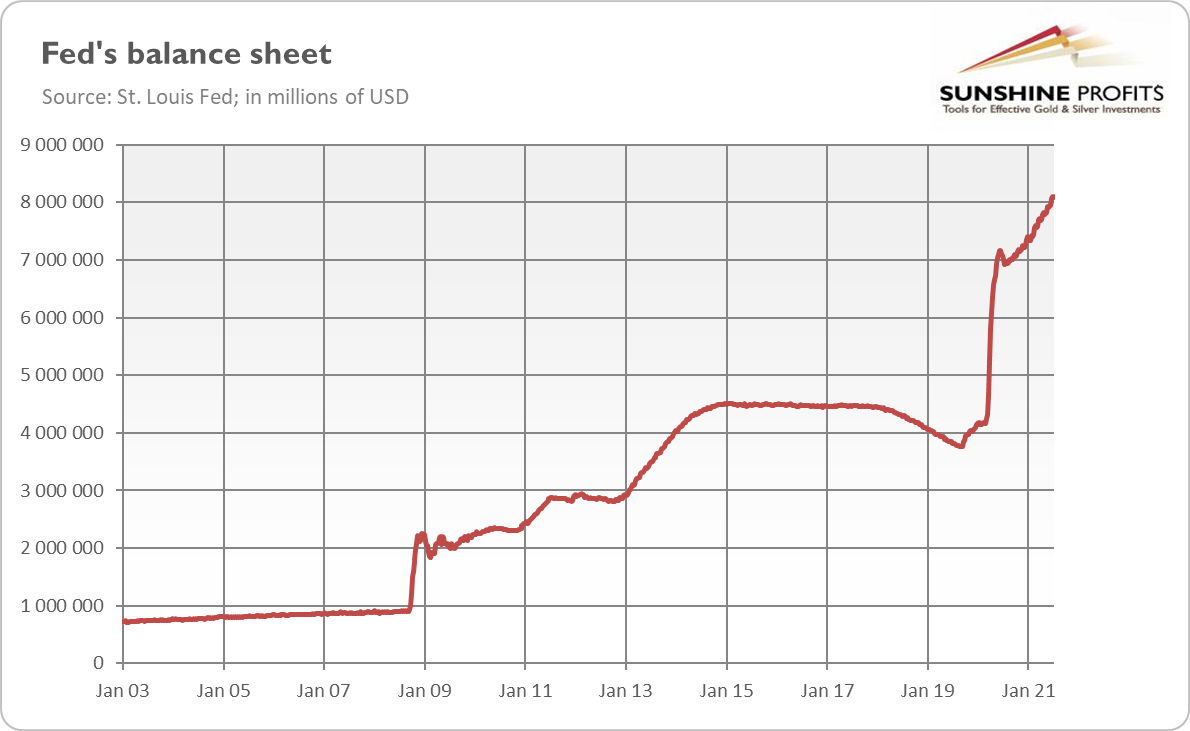

However, the reverse repos are strictly linked to the Fed’s plan to normalize its monetary policy at some point in the future. But hiking the federal funds rate is not simple with such a mammoth balance sheet. You see, the Fed’s balance sheet is simply too big. As the chart below shows, the US central bank’s assets amount to above $8 trillion.

Such a giant balance sheet creates downward pressure on the interest rates. If left alone, they could even drop below zero. This is why the Fed started the overnight repurchase operations – to drain some excessive liquidity from the markets in order to regain control over the interest rates. So, the current developments in the repo market are a strong signal that the Fed is preparing for raising the interest rates. Actually, the Fed has already lifted its repo rate from 0% to 0.05%, allegedly as a technical adjustment. This is a fundamentally negative factor for the gold market.

Nonetheless, gold bulls may find comfort in the fact that it’s not easy to return to normalcy. Remember the Fed’s previous attempt to normalize its monetary policy? The US central bank had to reverse its course in 2019, just two years after starting the balance sheet’s reduction. It turned out that quantitative tightening was too harsh for fragile financial markets, and the Fed had to pump liquidity again (in the form of repo operations), as well as cut the interest rates – even before the pandemic and the following economic crisis started. Similarly, by paying trillions in reverse repos at 0.05% now, the Fed makes them more attractive, planting the seeds of the next liquidity crisis.

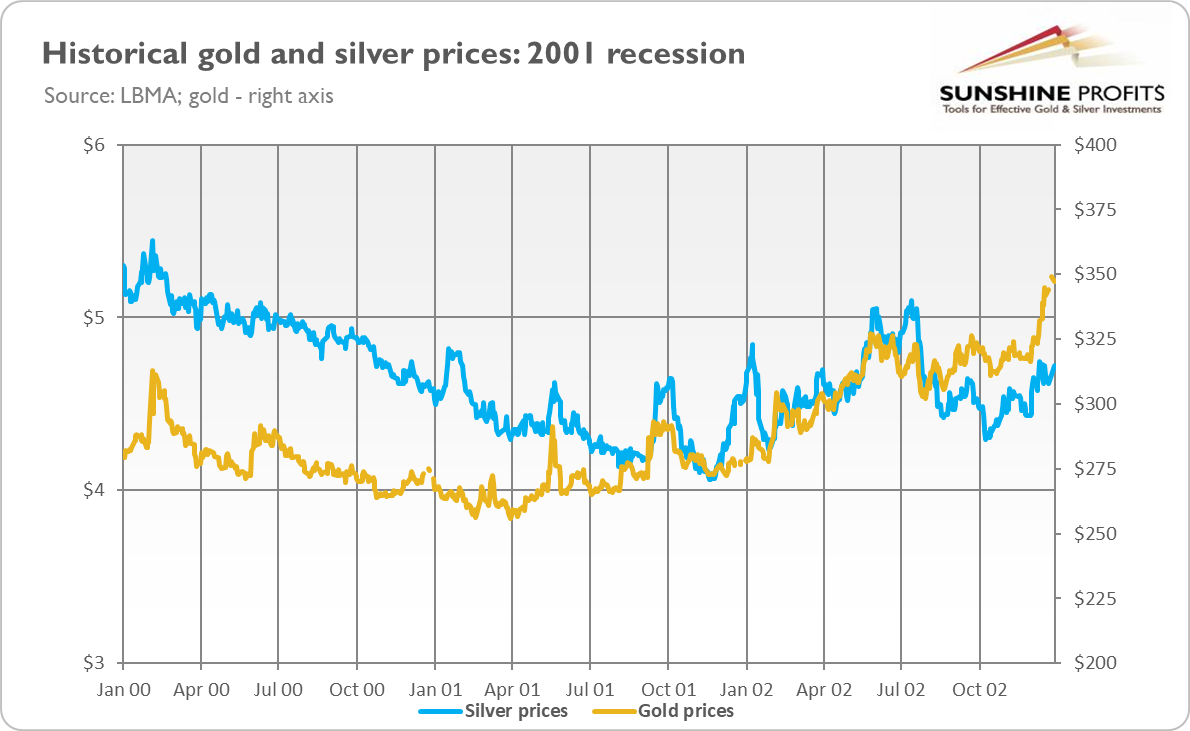

In other words, the Fed’s tightening cycle practically always ended up in a recession. Moreover, there were many indicators that the recession would take place in 2020 or 2021 anyway, even without the coronavirus and the Great Lockdown. So, this time won’t be different. Well, actually, it could be different –in such a way that the next recession will be accompanied by higher inflation. If stagflation really occurs, gold will shine as it did in the 1970s.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook and the gold market, we invite you to read the August Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold at a Crossroads of Hawkish Fed and High Inflation

July 30, 2021, 11:58 AMGold has been trading sideways recently, but this won’t last forever – the yellow metal is likely to move downward before continuing its rise.

So, so you think you can tell heaven from hell, a bull market from a bear market? It’s not so easy, as gold seems to be at a crossroads. On the one hand, accelerating inflation should take gold higher, especially that the real interest rates stay well below zero. On the other hand, a hawkish Fed should send the yellow metal lower, as it would boost the expectations of higher bond yields. The Fed’s tightening cycle increases the interest rates and strengthens the US dollar, creating downward pressure on gold.

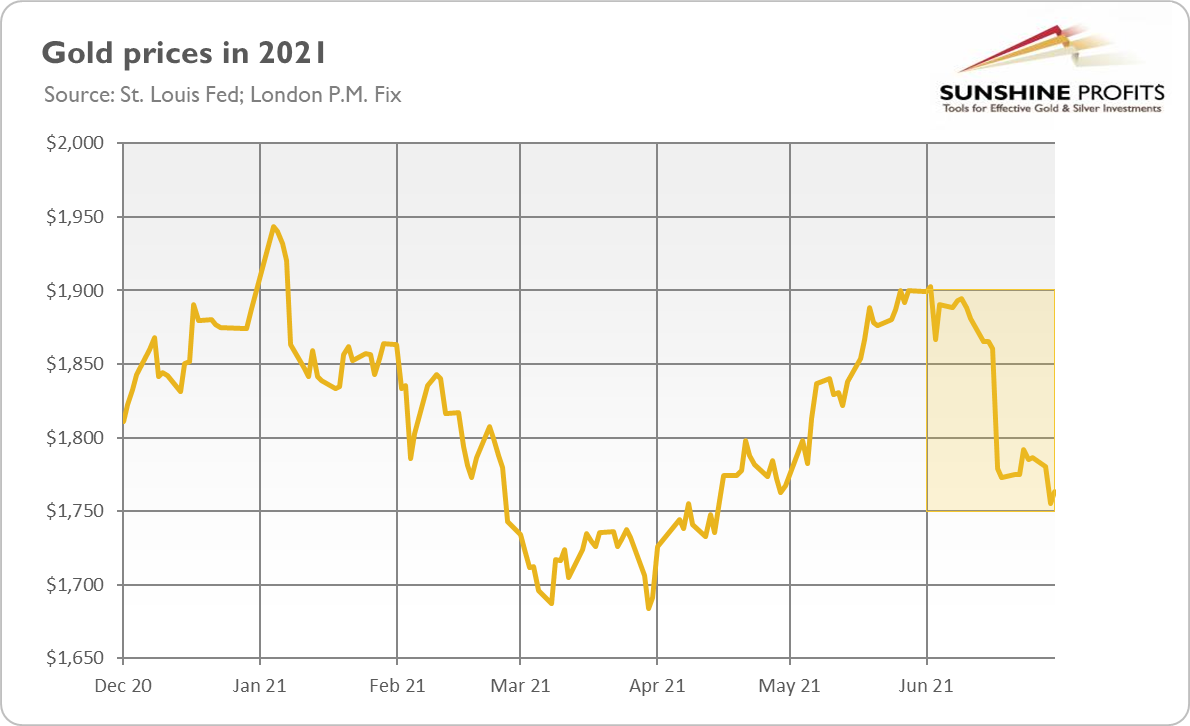

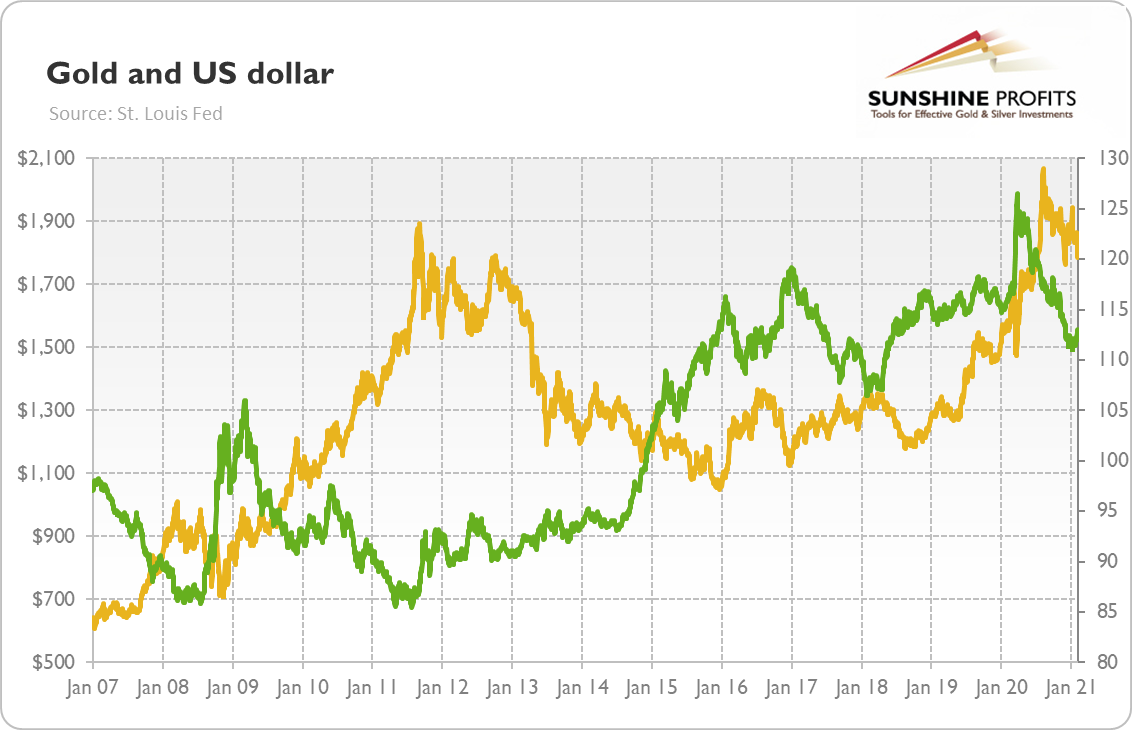

However, gold is neither soaring nor plunging. Instead, it seems to be in a sideways trend. Indeed, as the chart below shows, gold has been moving in a trading zone of $1,700-$1,900 since September 2020.

Now, the obvious question is: what’s next? Are we observing a bearish correction within the bull market that started in late 2018? Or did the pandemic and the following economic crisis interrupt the bear market that begun in 2011? Could a new one have started in August 2020? Or maybe gold has returned to its sideways trend from 2017-2018, with the trading corridor simply situated higher?

Oh boy, if I had the answers to all the wise questions that I’m asking! You see, the problem is that the coronavirus crisis was a very special recession – it was very deep but also very short. So, all the golden trends and cycles have intensified and shortened. What used to be years before the epidemic, took months this time. Welcome to a condensed gold market!

Hence, I would say that the peak of July 2021 marked the end of the bull market which started at the end of 2018, and triggered a new bear market, as traders decided that the vaccines would save the economy and the worst was behind the globe. This is, of course, bad news for all investors with long positions.

I didn’t call the bear market earlier, as the combination of higher inflation and a dovish Fed was a strong bullish argument. However, the June FOMC meeting and its dot-plot marked a turning point for the US monetary policy. The Fed officials started talking about tapering, divorcing from its extraordinary pandemic stance.

So, I’ve become more bearish in the short-to-medium term than I was previously. After all, gold doesn’t like the expectations of tapering quantitative easing and rising federal funds rate. The taper tantrum of 2013 made gold plunge.

Nonetheless, the exact replay of the taper tantrum is not likely. The Fed is much more cautious, with a stronger dovish bias and better communication with the markets. The quantitative tightening will be more gradual and better announced. So, gold may not slide as abruptly as in 2013.

Another reason for not being a radical pessimist is the prospects of higher inflation. After all, inflation is a monetary phenomenon that occurs when too much money is chasing too few goods – and the recent rate of growth of the broad money supply was much higher than the pace needed to reach the Fed’s 2% target. The inflationary worries should provide some support for gold prices. What gold desperately needs here is inflation psychology. So far, we have high inflation, but markets remain calm. However, when higher inflation expectations set in, gold may shine thanks to the abovementioned worries about inflation’s impact on the economy – and, thanks to stronger demand for inflation hedges.

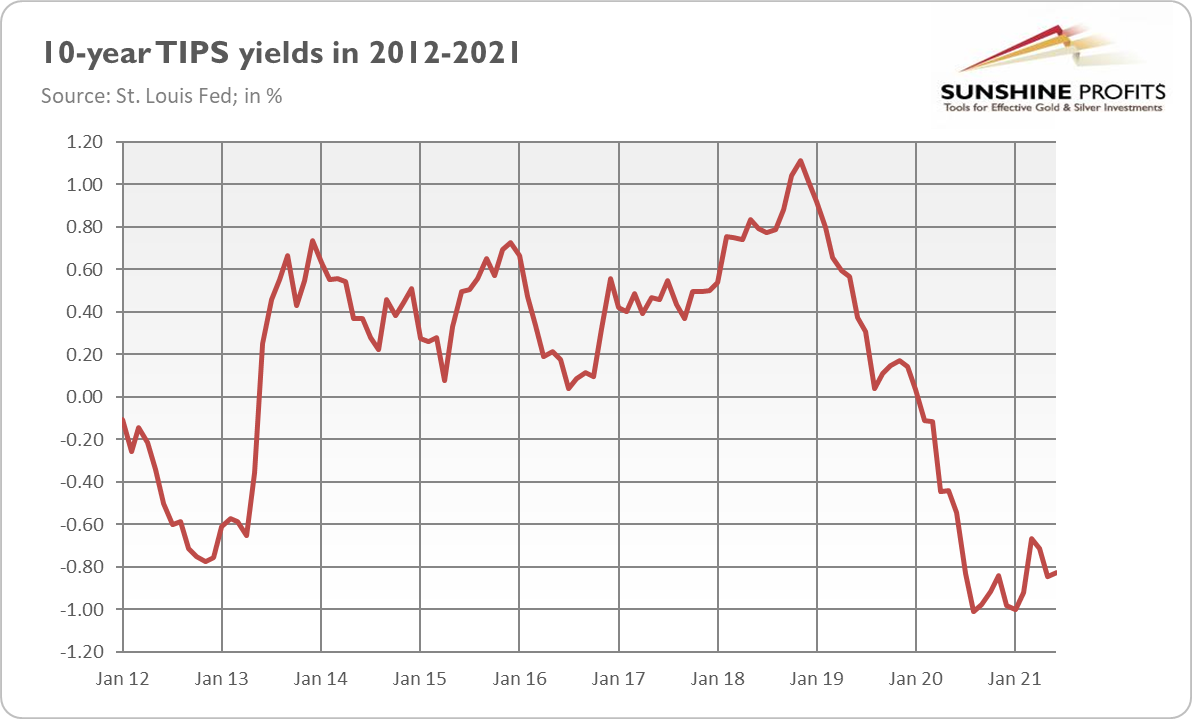

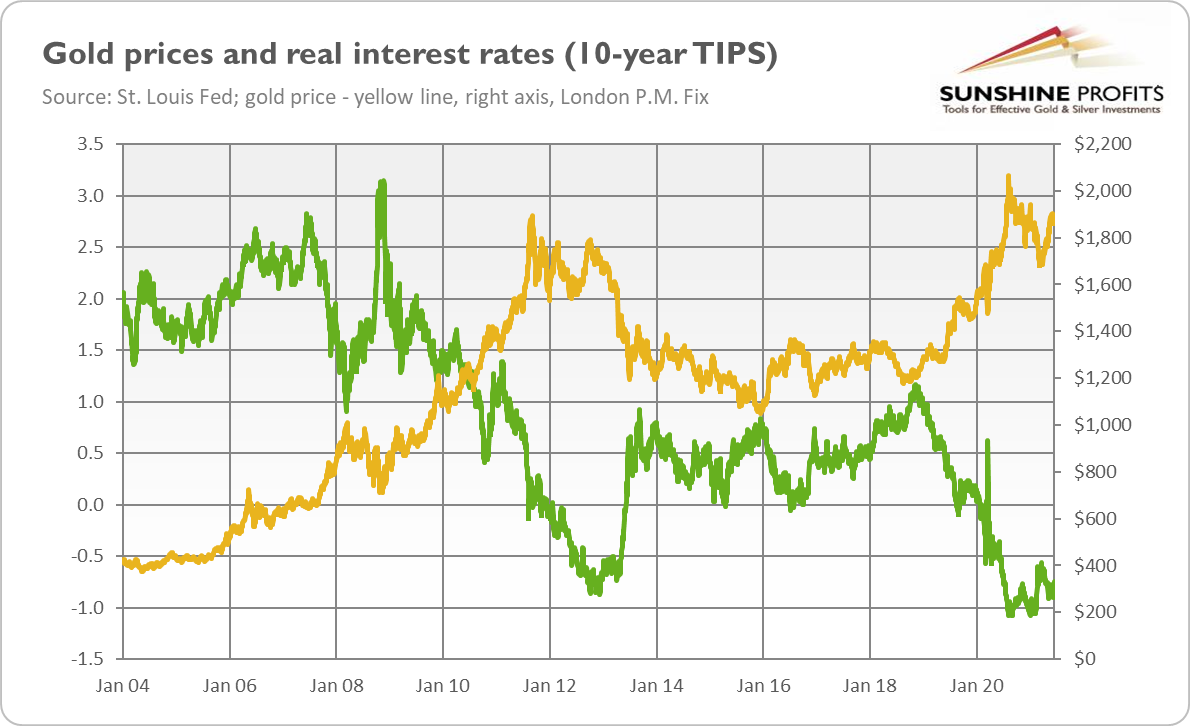

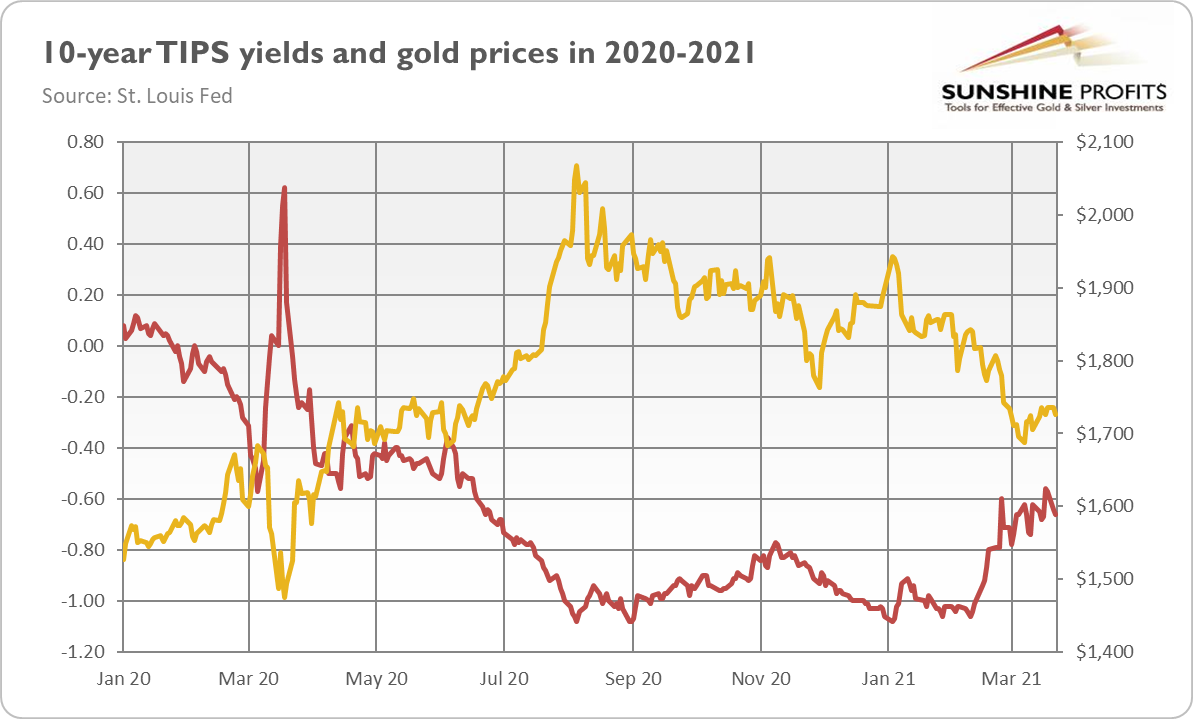

In other words, gold is not plunging because the Fed is not hawkish enough, and it’s not rallying because inflation is not disruptive enough. Now, the key point is that it’s more likely that we will see a more hawkish Fed (and rising interest rates) sooner than stagflation. As the chart below shows, the real interest rates haven’t yet started to normalize. When they do, gold will suffer (although it might not be hit as severely as in April 2013).

Therefore, gold may decline shortly when the US central bank tapers its asset purchases (and the bond yields increase) while the first bout of inflation softens. But later, gold may rise due to the negative effects of rising interest rates and the second wave of higher inflation.

In other words, right now, the real economy is thriving, so inflation is not seen as a major problem, as it is accompanied by fast GDP growth. However, the economy will slow down at some point in the future (partially because of higher inflation) – and then we will be moving towards stagflation, gold’s favorite macroeconomic environment.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook and the gold market, we invite you to read the August Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold’s Behavior in Various Parallel Inflation Universes

July 23, 2021, 6:18 AMThe current high inflation could theoretically transform into hyperinflation, disinflation, stagflation, or deflation. What does each mean for gold?

Inflation, inflation, inflation. We all know that prices have surged recently. And we all know that high inflation is likely to stay with us for a while, even if we assume that the CPI annual rate has already peaked, which is not so obvious. But let’s look beyond the nearest horizon and think about what lies ahead after months of high inflation, and what consequences it could have for the gold market.

From the logical point of view, there are three options. Inflation rates could accelerate further, leading to hyperinflation in an extreme case. They could remain more or less the same, resulting possibly in stagflation when the pace of GDP growth decelerates. And, finally, the rates of annual changes in the CPI could slow down, implying disinflation, or they could even become negative – in this scenario, we would enter the world of deflation. So, which of these “flations” awaits us?

Although some commentators scare us with the specter of hyperinflation, I would reject this variant. Surely, the inflation rate at 5% is relatively high, but it’s not even close to 50%, which is an accepted hyperinflation threshold. We also don’t see people getting rid of depreciating money as quickly as possible – instead, the demand for money has been rising recently (or, in other words, the velocity of money has been decreasing).

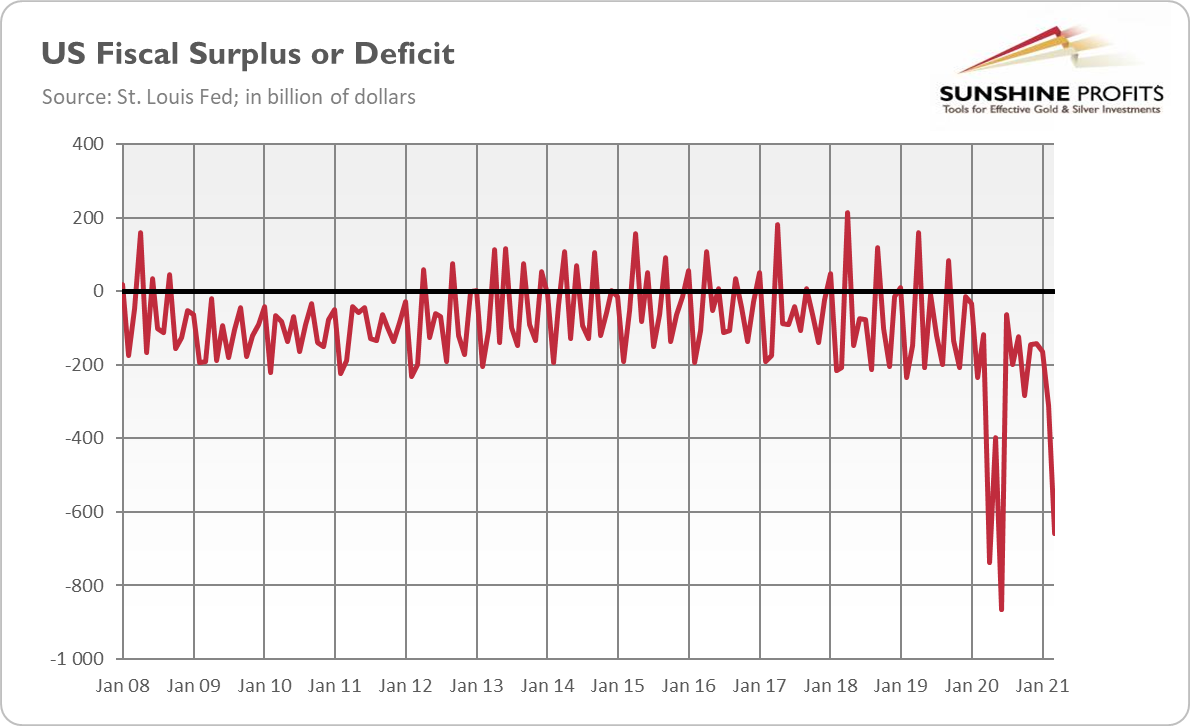

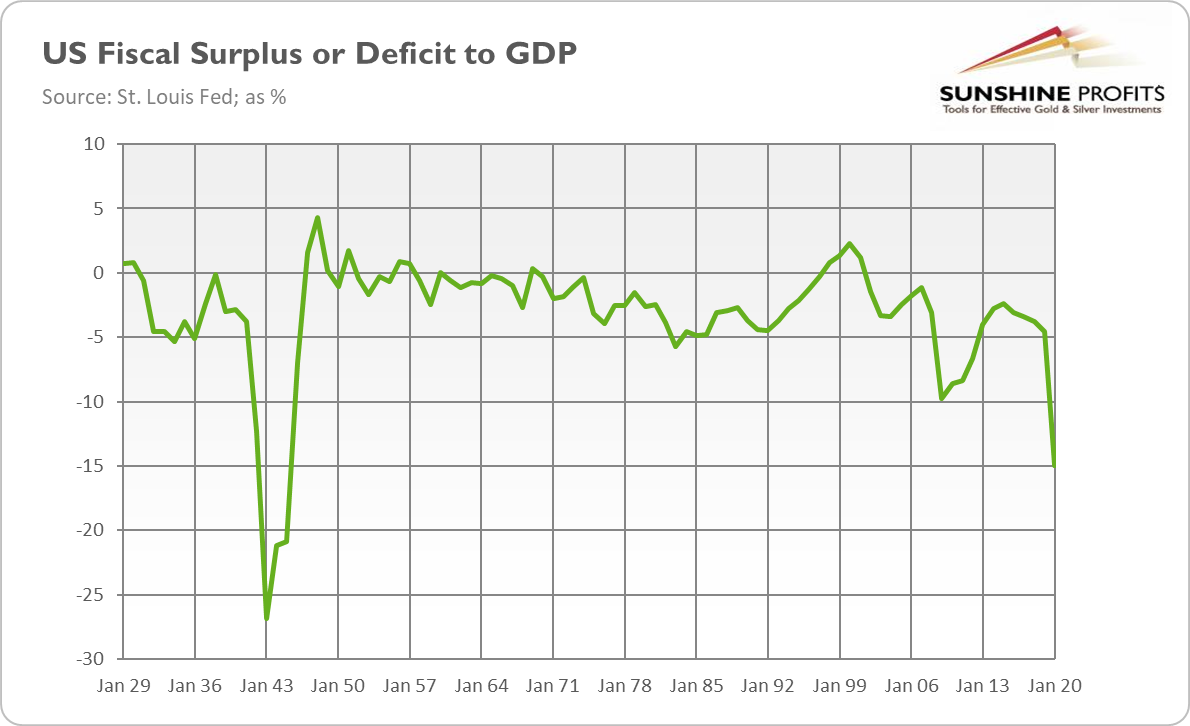

It’s also worth remembering that hyperinflation usually occurs when fiscal deficits are financed by money creation, especially when the government cannot raise funds through borrowing or taxes, for example because of a war or other sociopolitical convulsions. Sure, the budget deficits are partially monetized, but we are far from the situation in which the US government would be unable to collect taxes or find lenders ready to buy its bonds. Hence, gold bugs counting on hyperinflation may be disappointed – but I doubt that they would really want to live during the collapse of the monetary system.

The opposite scenario, i.e., deflation, is also unlikely. To be clear, asset price deflation is possible if some of the asset bubbles burst, but the absolute declines in the consumer prices, similar to those observed during the Great Depression, or even the Great Recession, are not very probable. The broad money supply is still increasing rapidly, the fiscal policy remains easy as never, and the Fed remains ultra-dovish and ready to intervene to prevent deflation. For deflation to happen, we would need to have the next global financial crisis which would severely hit the aggregate demand and oil prices.

Although there are significant vulnerabilities in the financial sector, it’s definitely too early to talk about significant deflation risks on the horizon. As with hyperinflation, this is bad news for gold, as the yellow metal performs well during the deflationary crises (although at the beginning, people usually collect cash, disposing of almost all assets).

So, we are left with two options. Inflation will either diminish to its previous levels (maybe to slightly higher readings than before the pandemic), and we will return more or less to the Goldilocks economy, or inflation will stay relatively high (although it may subside a bit), while the economic growth will slow down significantly (and more than inflation). It goes without saying that the latter option would be much better for gold than the former one, as gold doesn’t like periods of decelerating inflation rates and of a decent pace of economic growth (remember 1980 and the 1990s?). So, could gold investors reasonably ask whether we will experience disinflation or stagflation?

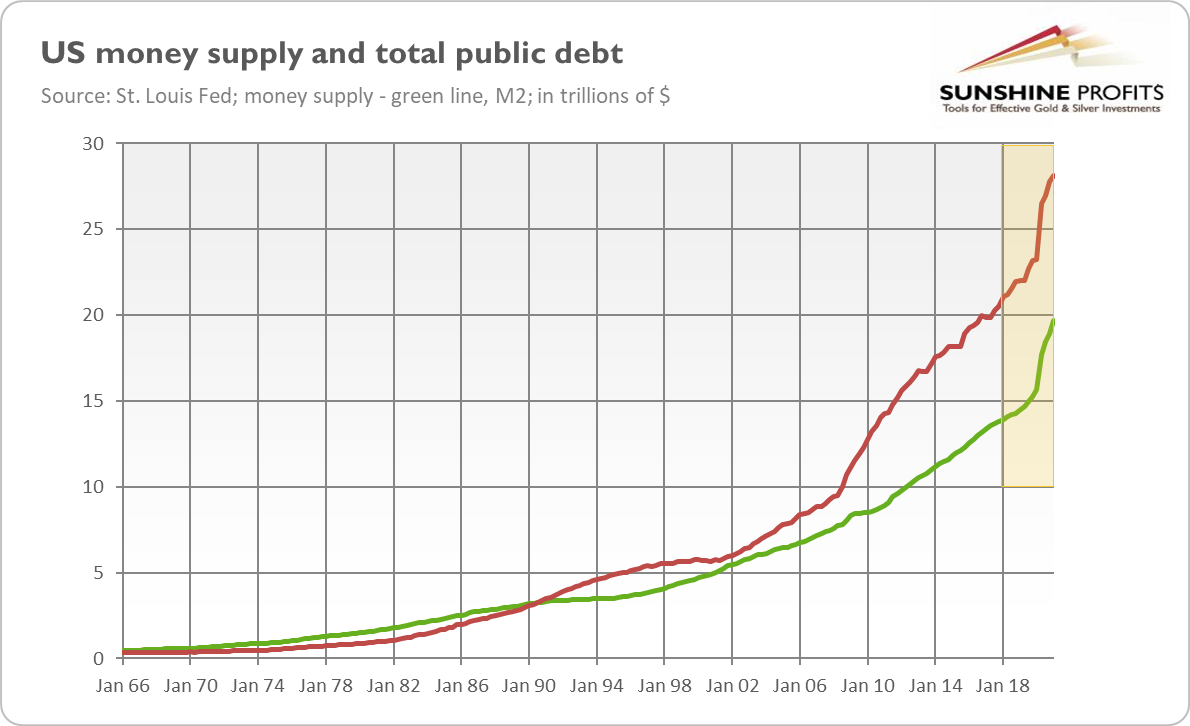

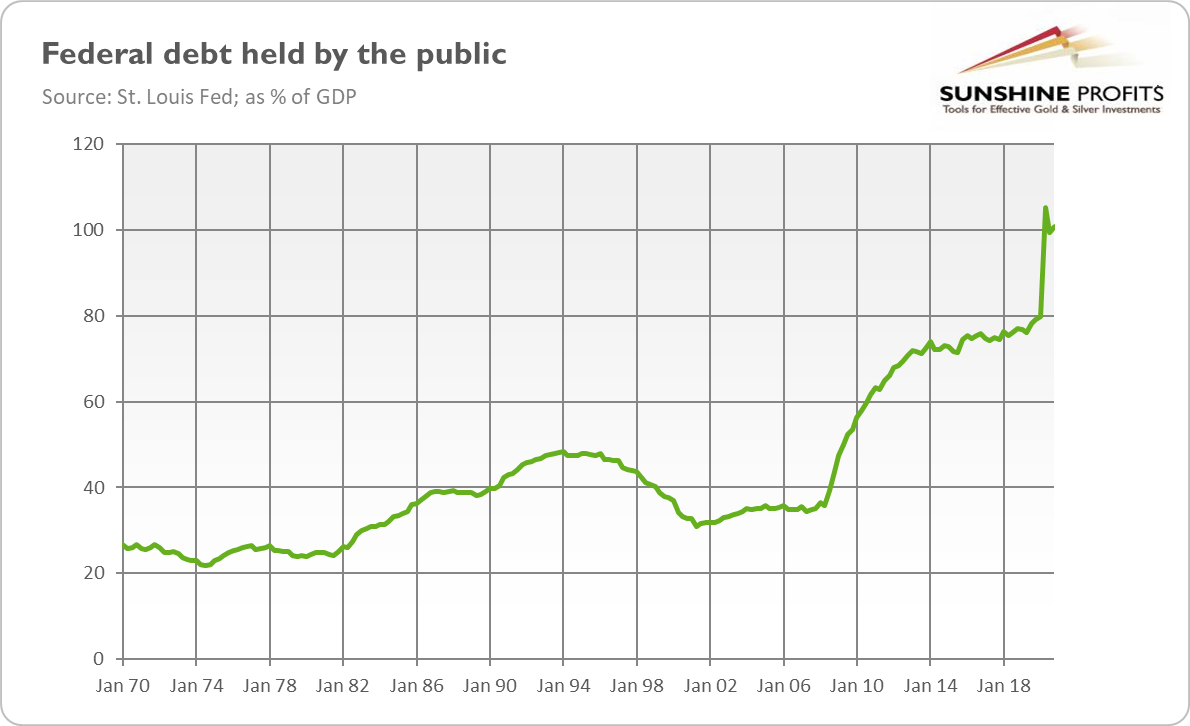

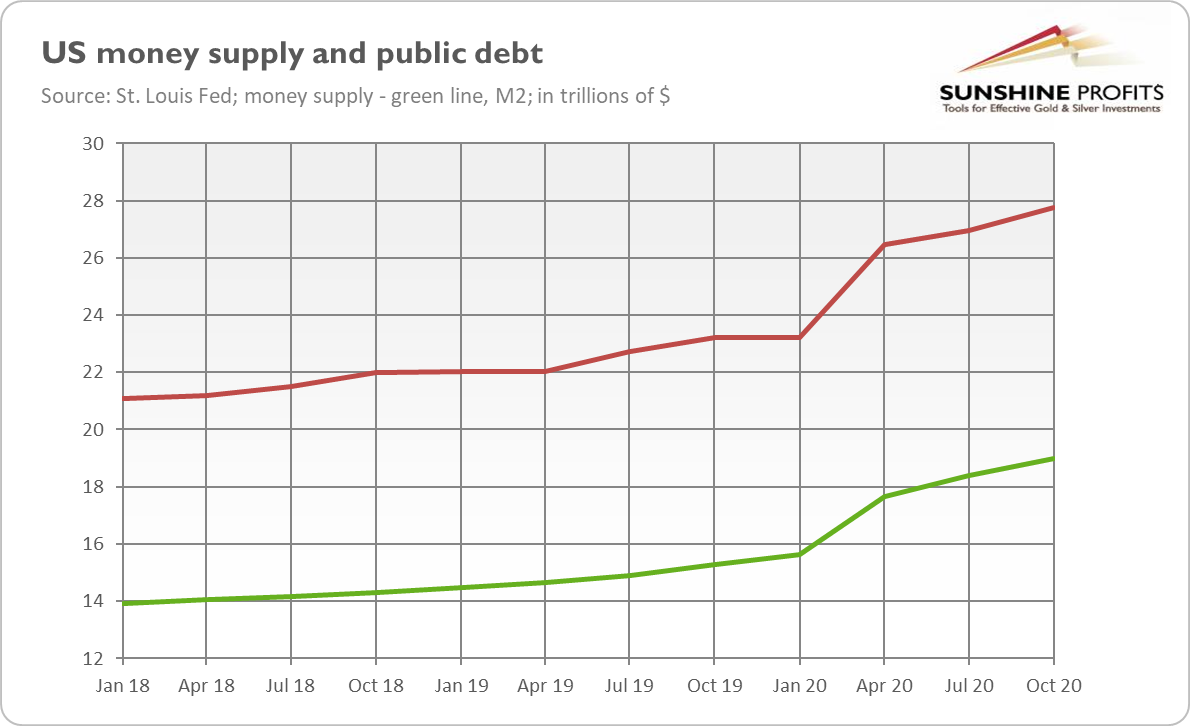

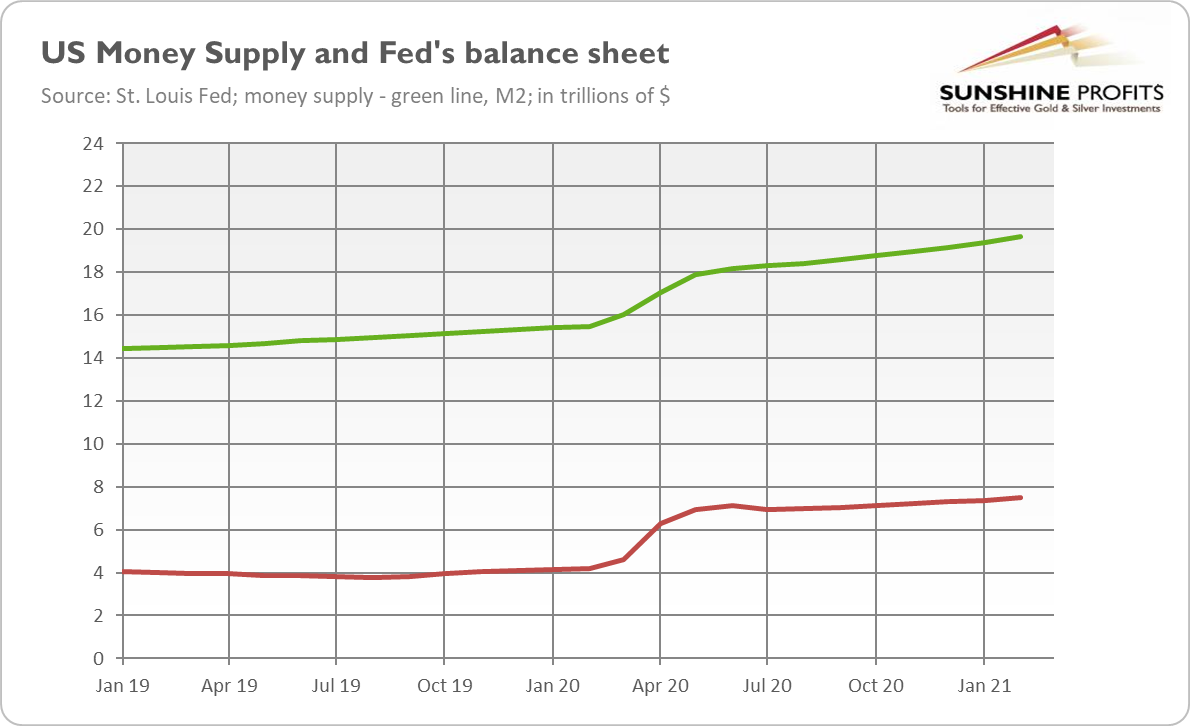

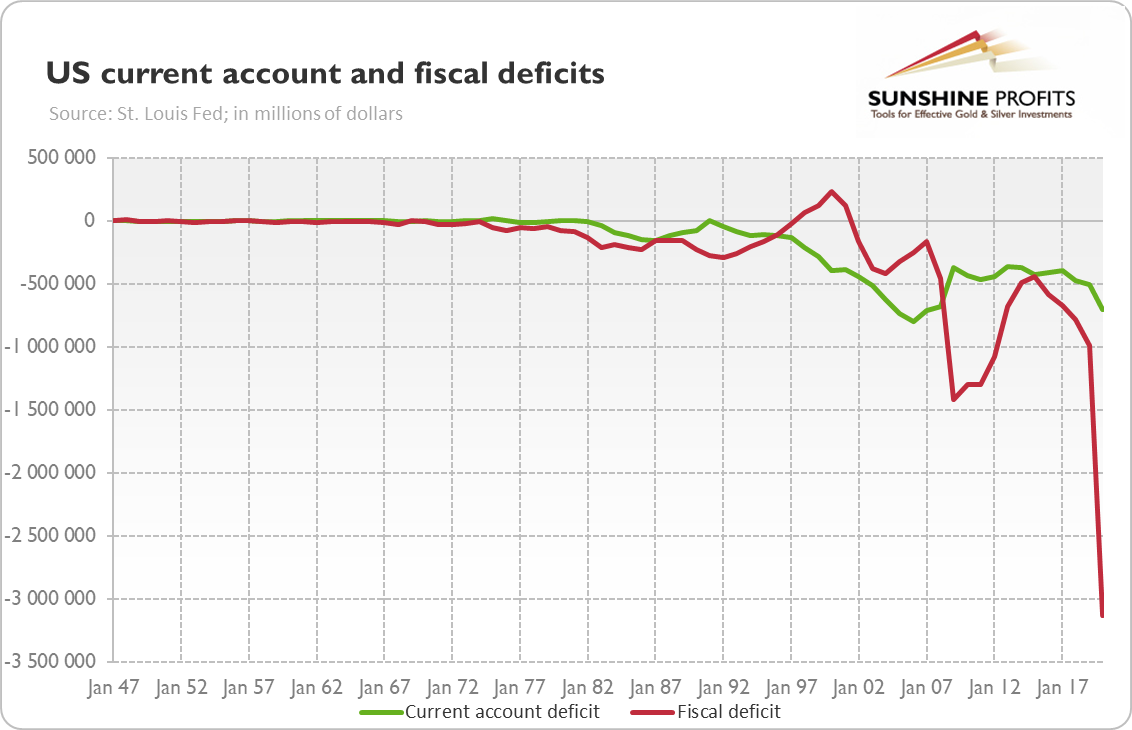

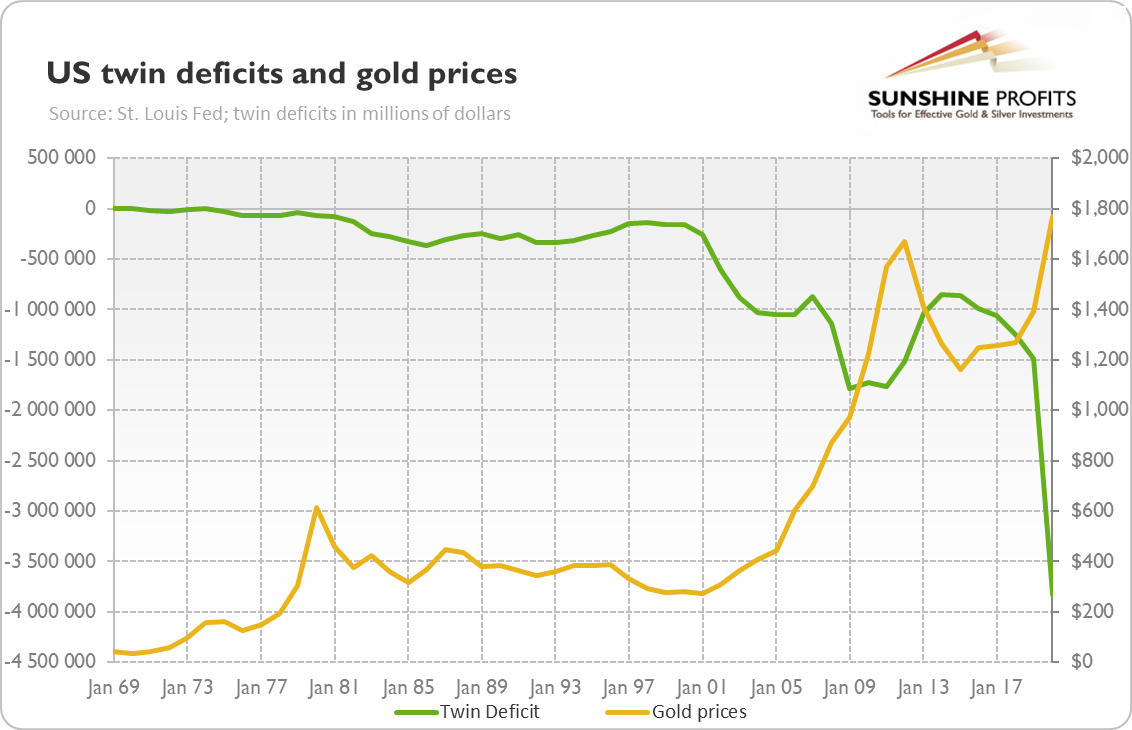

Well, the Fed believes that the current high inflation readings will prove to be temporary and we will return to the pre-epidemic era of low inflation. But you can’t step in the same river twice, and you can’t step in the same economy twice. You can’t undo all the monetary and fiscal stimulus nor the surge in the broad money supply and the public debt (see the chart below).

So, the pre-pandemic low inflation readings are not set in stone. And the impact of some deflationary forces could be exaggerated by the central bankers and the pundits – for example, the recent ECB research shows that “the disinflationary role of globalization has been economically small”.

Hence, I worry about stagflation. And I’m not alone. The results of the latest biannual survey of the chief U.S. economists from 27 financial institutions for the U.S. Securities Industry and Financial Markets Association also highlight the risks of high inflation and stagnation. They reveal that 87% of respondents consider “stagflation, as opposed to hyperinflation or deflation, as the bigger risk to the economy.”

Actually, the GDP growth is commonly projected to slow down significantly next year. For example, according to the recent Fed’s dot-plot, the pace of the economic growth will decline from 7% in 2021 to 3.3% in 2022. It’s still fast, but less than half of this year’s growth. And it’s likely to be slower, as the FOMC members tend to be overly optimistic.

The stagflation scenario could be positive for gold, as the yellow metal likes the combination of sluggish (or even negative) growth and high inflation. Indeed, gold shined in the 1970s, the era of The Great Stagflation. Of course, there are important differences between then and now, but the economic laws are immutable: the mix of easy fiscal policy and monetary policy superimposed on economic reopening is a recipe for overheating and, ultimately, stagflation.

However, so far, the markets have bet on transitory inflation. Moreover, they are focused on fast economic expansion and the Fed’s hawkish signals. But we could see more uncertainty later this year when higher interest rates and inflation hamper the economic activity. In that case, gold could get back on track.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the July Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Asks: Has Inflation Already Peaked?

July 16, 2021, 4:16 PMInflation surged in May, and some worry that it has already reached its peak. Has it indeed? This issue is key for the Fed and the gold market.

Inflation has soared recently. The CPI annual rate surged 5% in May, which was the fastest jump since the Great Recession. However, the Fed officials still maintain that inflation will only be temporary. Some of the analysts even claim that inflation has already peaked, and it will decelerate from now on. Are they right?

Well, they present a few strong arguments. First, there is no doubt that the recent rise in prices has been partially caused by the problems with the supply chains. But, luckily, the bottlenecks are short-lived phenomena, and they always resolve themselves, i.e., by the magic of market mechanism. The best example may be lumber prices which were skyrocketing earlier this year but which have recently declined, as production surged in response to rallying prices.

Second, the detailed data on inflation shows that the surge in the overall inflation index was partially driven by categories that were heavily distorted by the pandemic, such as used cars or airline fares. The increases in these categories are not surprising or worrying, given the current recovery from the epidemic.

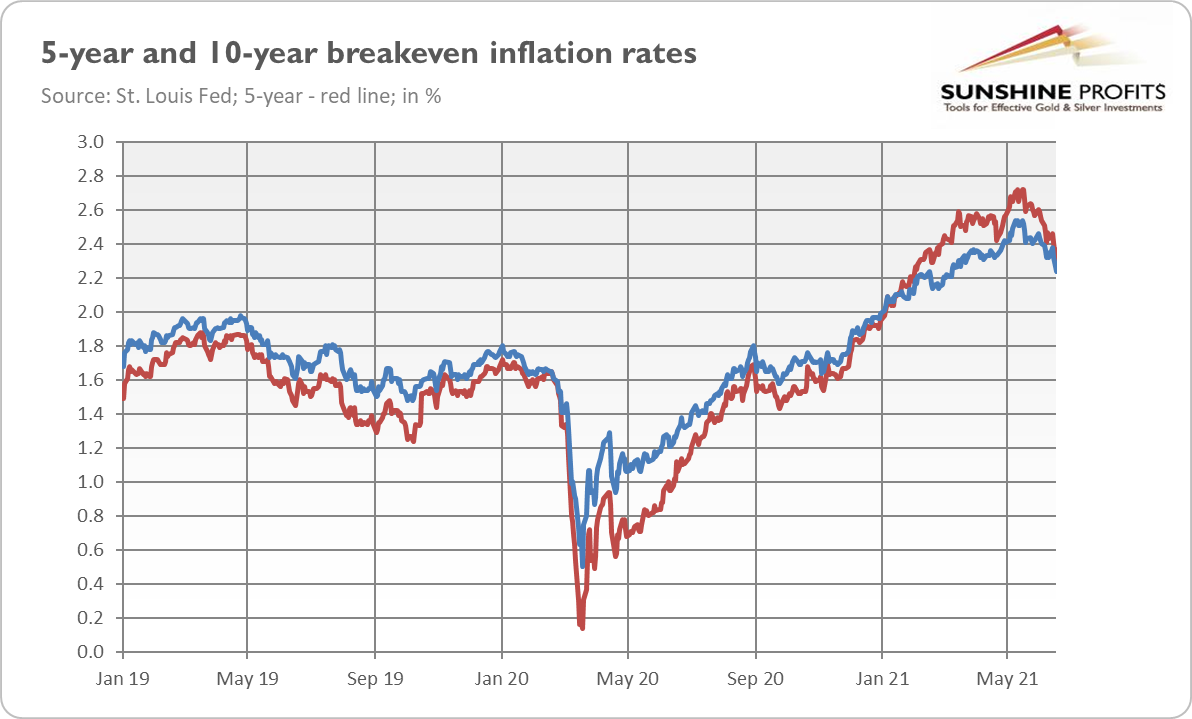

Third, the market-based inflation expectations have already peaked. As the chart below shows, both 5-year and 10-year breakeven inflation rates have reached their heights in May. Since then, the former ones have declined from above 2.7% to about 2.3%, while the latter from above 2.5% to about 2.2%

It means that the markets bought the Fed’s narrative about temporary inflation and started to worry less about it.

Should gold investors do the same? I’m not so sure. To be clear, I acknowledge and always acknowledged that the supply problems contributed to the acceleration in inflation. However, the risk of inflation doesn’t solely depend on continuously rising commodity prices. And the Fed officials always say that increases in inflation rates are temporary, as they don’t want to admit they failed in maintaining price stability.

Some fundamental factors supporting high inflation are still in force. First, as the chart below shows, the broad money supply is still increasing fast (although there was a deceleration since February), as the monetary impulses probably haven’t been fully transmitted into the real economy yet.

Second, both the monetary and fiscal policies remain very easy. Given President Biden’s fiscal agenda and the continuous increase in the public debt, the Fed is unlikely to materially normalize its monetary policy.

Third, we know that in response to input cost inflation, producers raised their charges at an unprecedented pace. It means that their power to pass on greater costs has increased, which could increase both inflation and consumers’ expectations of inflation in the future.

Fourth, we have just finished recovering from the economic crisis. Usually, inflationary pressures only intensify with the progress of the business cycle. With a developing and then maturing economic expansion, employment will rise, manufacturing capacity will be more fully utilized, and inflation could prove to be more persistent than anticipated by the pundits. Please remember that the fiscal stimulus the economy got was greater than the estimated size of the output gap, so the risk of overheating is still present, even if some bottlenecks have resolved.

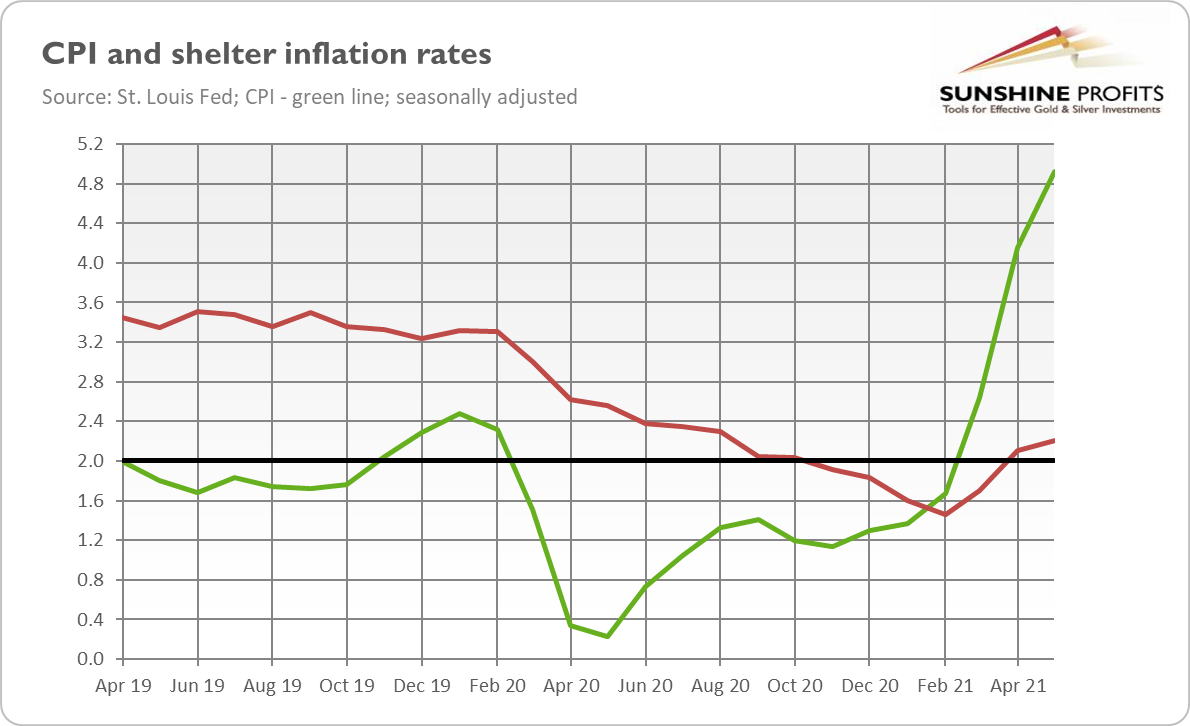

Last but not least, the rise in inflation wasn’t driven solely by the recovery from the pandemic. Some categories which were severely hit by the epidemic are not surging. For example, the index for food away from home rose annually by 4% in May 2021. Meanwhile, some core components surged. For instance, the index for shelter, which makes almost one-third of the overall index, increased from 1.5% in February to 2.2% in May 2021, as the chart below shows. It suggests that inflation may be more broad-based than many analysts think.

What does all this mean for the gold market? Well, if inflation remains high or even continues to rise, the real interest rates will remain in negative territory, supporting gold prices. However, there is an important caveat: upward inflationary surprises could force the Fed to send fresh hawkish messages or even taper its quantitative easing earlier than planned, pushing the nominal bond yields higher and creating selling pressure on gold prices.

It seems that so far investors were more worried by the sooner-than-expected hikes in the federal funds rate than by the rising inflation and the fact that the FOMC members have raised their inflation forecasts by an entire percentage point. Gold bulls need a shift in investors’ focus. Otherwise, the markets could remain optimistic about the future, purchasing risky assets rather than safe havens such as gold.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the July Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Is There Any Gold in Basel?

July 9, 2021, 9:05 AMAt the end of June, the Basel III accord became binding for European banks. This new set of rules could have an effect on the entire gold market.

On June 28, the Basel III agreement came into force for EU, Swiss, and US banks. On January 1, 2022, it will also be binding for British banks, so I guess it’s high time to cover this issue in the Gold Market Overview.

So, let’s begin by explaining what the Basel III accord is. It is a set of financial reforms that were agreed in 2010 after the Great Recession revealed some “deficiencies” in the global financial system. The name comes from the Basel Committee on Banking Supervision at the Bank for International Settlements, which is based in Basel, Switzerland. The main idea behind the third Basel Standards is to strengthen bank capital requirements in order to limit the risk taken by commercial banks and prevent the replay of the global financial crisis of 2007-2009.

OK, great, the idea of more prudent commercial banks is glorious, but what does Basel III have to do with gold? Well, it turns out quite a lot! First, physical or allocated gold could be treated as a risk-free asset. As we can read in the Basel framework (p. 192), “at national discretion, gold bullion held in own vaults or on an allocated basis to the extent backed by bullion liabilities can be treated as cash and therefore risk-weighted at 0%”.

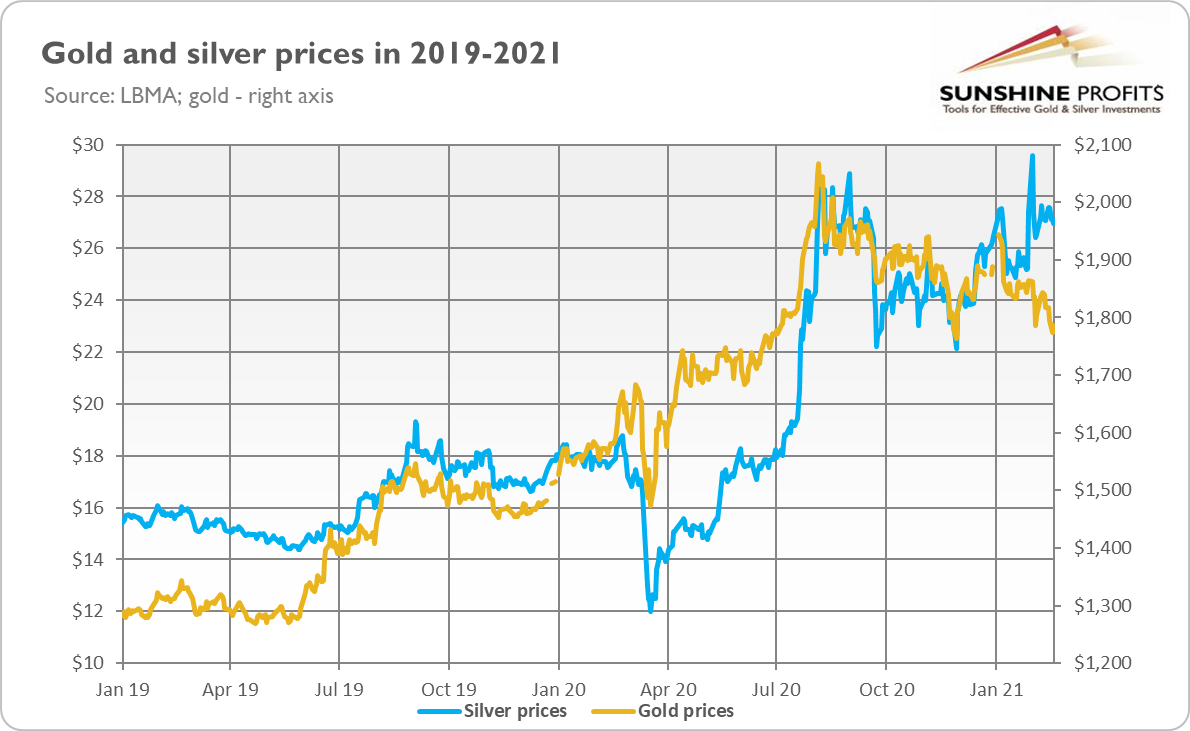

This reform, if introduced now and analyzed separately, would be bullish for gold, as considering gold a risk-free asset makes it less costly and more attractive for banks to hold. However, the announcement of this particular decision goes back to 2017 and its implementation to April 2019. The chart below shows that this announcement didn’t cause any rally in gold.

However, now this change will be accompanied by another rule. It’s the Net Stable Funding Ratio requirement, which obliges banks to hold enough stable funding to cover their long-term assets. The key ramification is that this new rule requires banks to have stable funding at 85% of unallocated gold. In other words, the precious metals transactions undertaken by clearing banks have to be backed now in 85% by gold. Or, the reserve ratio has, in a sense, increased from the pre-Basel III level of 0% to 85%. As mentioned in the framework (p. 977), “Assets assigned an 85% RSF [requires stable funding] factor comprise: (…) physical traded commodities, including gold”.

So, for example, let’s assume that a bank has $10 billion in gold positions, with $2 billion in allocated gold and $8 billion in unallocated gold. Under Basel III, the allocated gold is fine, but unallocated gold is considered as risky as equities, and banks have to provide collaterals for 85% of its value, in cash or physical gold.

The direct consequences for the banking sector are clear. The handling of unallocated gold will become more expensive, undermining the pre-Basel bullion business model. So, some banks will exit the precious metals market (Nova Scotiabank has already exited it), while remaining clearing banks will be forced to increase the costs they charge or to raise the shareholders’ equity to provide the required reserves.

The indirect effects on the yellow metal are more difficult to predict. Some analysts believe that Basel III will hit the precious metals market, sending gold prices down. The reason is that the new framework makes unallocated gold less attractive, and unallocated gold performs some valuable functions like providing liquidity for gold producers, refiners, jewelry, etc. So, the gold market will become less liquid, which will reduce gold’s attractiveness as a portfolio element for all would-be investors.

In other words, under Basel III, the cost of holding gold on banks’ balance sheets increases, undermining the clearing and settlement system of the precious metals and hurting the part of gold demand that relies on the unallocated gold market.

However, some claim that Basel III will be fundamentally bullish for gold, especially for physical gold. The reasoning goes as follows: the new regulations will diminish the profitability of trading gold derivatives, reducing the supply of unallocated paper gold. Meanwhile, as physical, allocated gold is a risk-free asset, market participants will move from paper gold to physical bullion, pushing its price higher. As there is – the argumentation continues – price suppression in the paper gold derivatives like Comex gold futures and London LBMA forwards, the significance of physical gold will increase and the true price of gold will rise. In other words, Basel III is believed to cause a liquidity squeeze in the physical metal, which could send gold prices higher.

As one can see, this view assumes the existence of systematic price suppression, which is far from being proven. But we can hold the bullish view without assuming price manipulation. This is because unallocated gold accounts function similarly to fractional reserve banking: banks have only part of gold deposited at them. But now, the reserve ratio is 85%, up from 0%, which means that the supply of unbacked gold positions will have to diminish (or banks will have to buy more physical gold or other risk-free assets to back them). In other words, banks will try to cover their short positions of gold in order to fulfill the NSFR requirement; and the decrease in the supply of gold should increase its price.

However, I suspect that gold bulls’ hopes about Basel III could be exaggerated. It doesn’t have to be a game-changer for gold prices – instead, we could just see fewer clearing banks, higher costs charged by the remaining ones, and lower liquidity in the gold market. Stronger demand for physical gold doesn’t have to transform into a rally in gold prices, as these are shaped in the international ‘paper’ markets.

Additionally, the announcement of reclassification of the risk weighting of gold didn’t make gold skyrocket. The price of gold did start to rally in 2019, but it was quite likely caused by the dovish U-turn of the US central bank. So, the recent regulatory changes don’t have to push gold prices higher, especially if expectations of the Fed’s tightening cycle increase and the real interest rates rise. But maybe later, closer to 2022 (when Basel III finally takes effect in the UK), we will see some upward movement, as most of the unallocated gold is traded on the London gold market.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the July Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Fed Hawks Peck Gold?

July 2, 2021, 10:33 AMAlthough gold doesn’t have to suffer during the actual tightening cycle, the Fed’s hawkish turn is fundamentally negative for gold prices.

Oh no, my worst nightmare related to the precious metals has materialized. In the June edition of the Gold Market Overview, I wrote:

Of course, gold is not a perfect inflation hedge in the short term. If the interest rates increase or the Fed tightens the monetary conditions in response to inflation, gold may struggle. Actually, the start of normalization of the monetary policy could push gold downward, just as it happened in 2011.

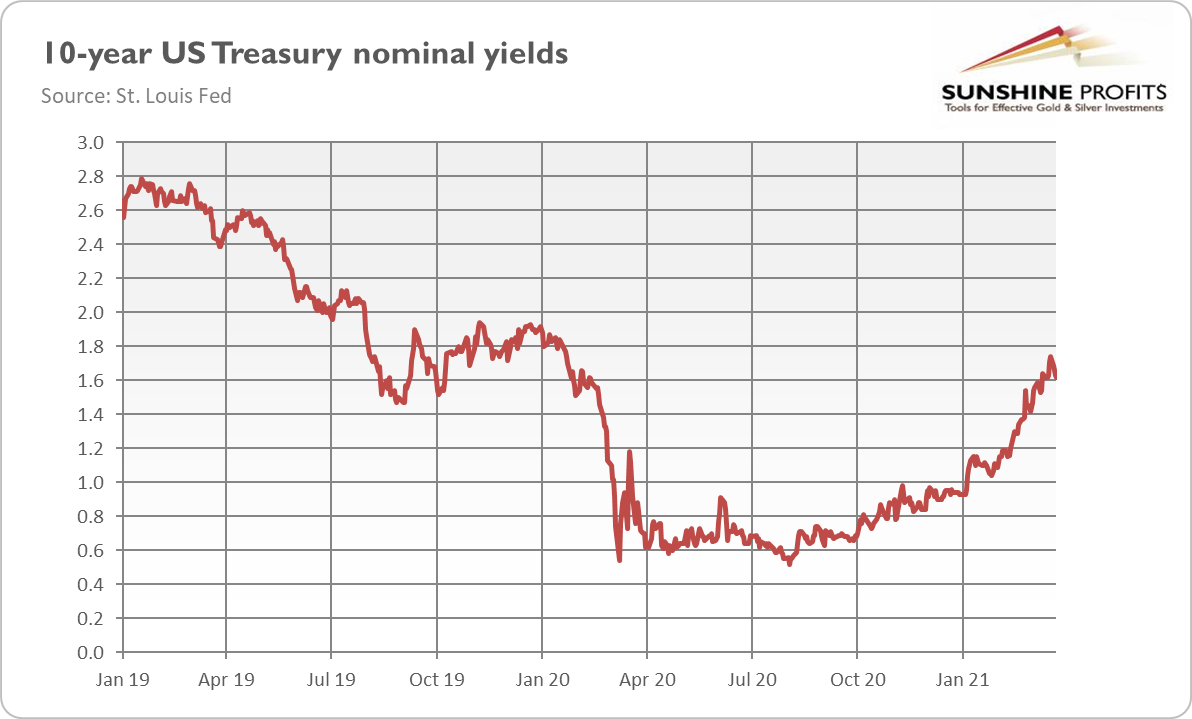

And indeed, the Fed turned hawkish in June. The FOMC members started talking about tapering quantitative easing, and at the same time the recent dot-plot revealed great willingness among them to hike interest rates. And, in line with the prediction, gold prices plunged in response to the Fed’s hawkish signals about possible normalization of the monetary policy. As the chart below shows, the London (P.M. Fix) price of gold declined from $1,895 to $1,763 in June.

Now, the key question is: what’s next for gold? Was the June slide just a correction? An exaggerated reaction to the not-so-meaningful economic projections of the FOMC members? After all, “they do not represent a Committee decision” and they “are not a great forecaster of future rate moves”, as Powell reminded in the prepared remarks for his press conference in June.

But maybe it's the other way around? Did the Fed’s about-face mark the end of the bull market in gold? Are we witnessing a replay of 2013, where expectations of the Fed’s tightening cycle and higher interest rates (and later the taper tantrum) sent gold lower, pushing it into bears’ embrace?

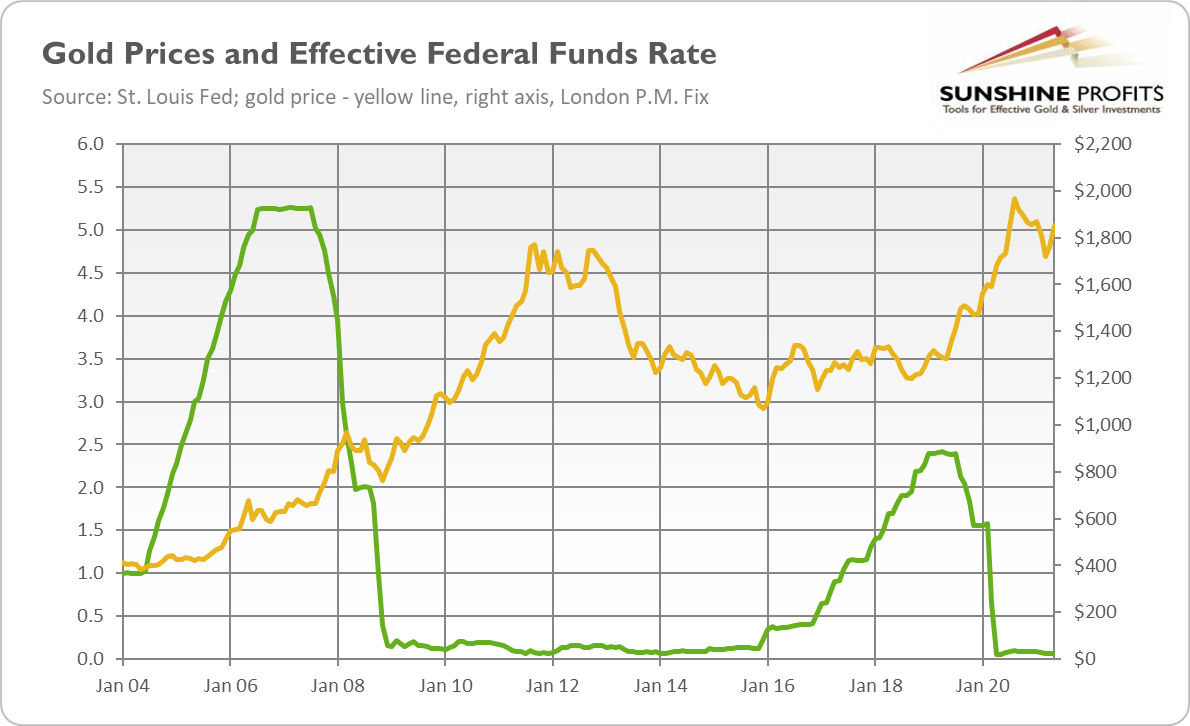

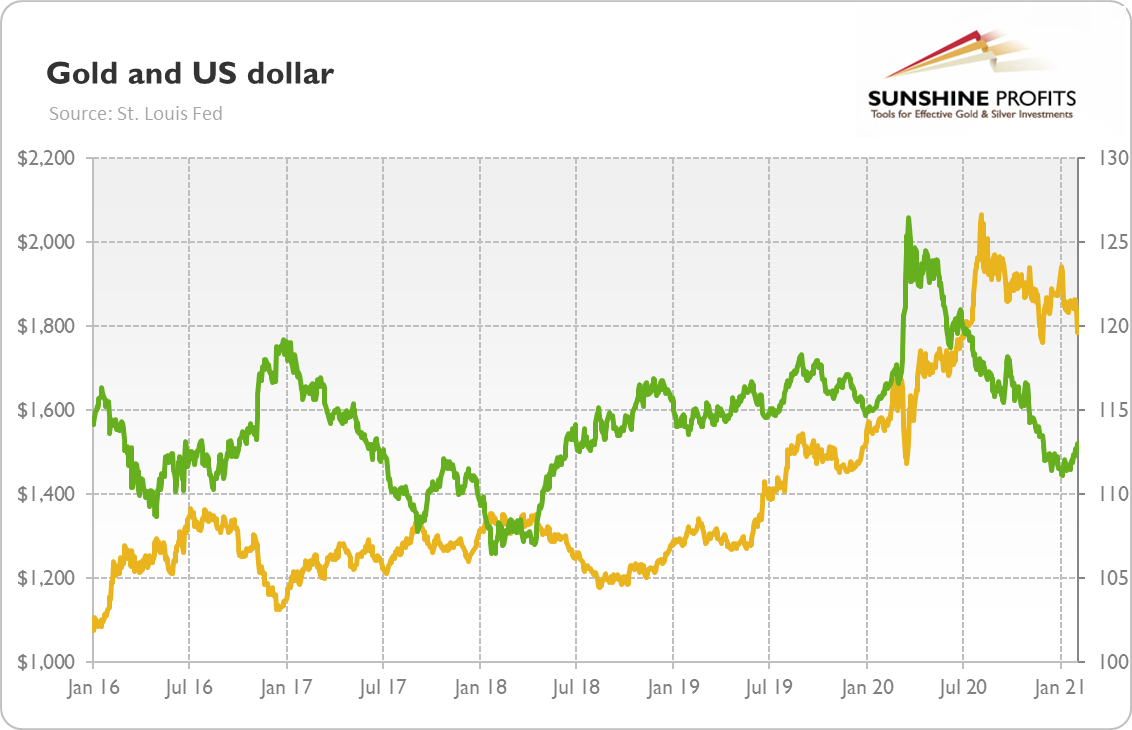

To find out, let’s check how gold behaved in the previous tightening cycles. As one can see in the chart below, the last tightening cycle of 2015-2019 wasn’t very detrimental for the yellow metal; gold prices weren’t declining, they remained in the sideways trend.

Of course, the tightening created downward pressure on gold. We can see that its price started to rally when the normalization ended, and it accelerated when the Fed turned dovish and started the cycle of interest rate cuts. However, gold didn’t enter a bear market; it’s consoling news for all gold bulls.

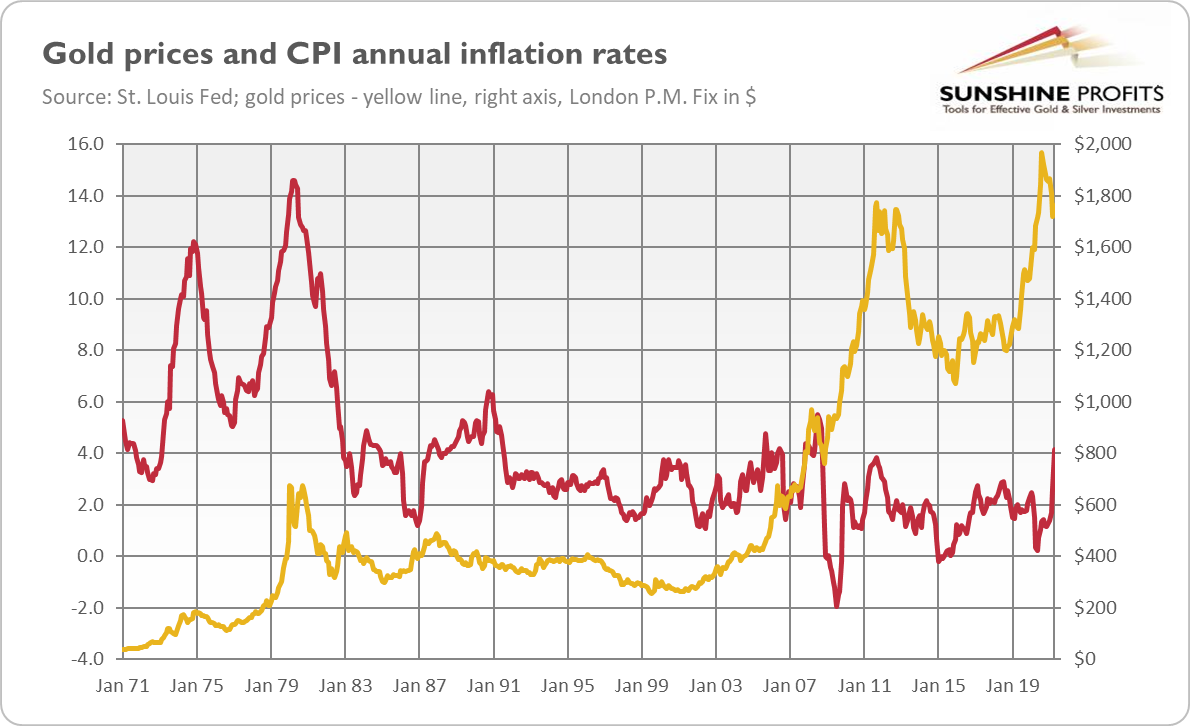

Neither the tightening cycle of 2004-2006 was negative for gold prices. On the contrary, the price of gold appreciated in that period. Interestingly, it was a period of rising inflation, as the chart below shows. Similarly, the tightening cycle of the mid-1970s was accompanied by accelerating CPI annual rates, and it was also a positive period for gold.

Hence, the upcoming tightening cycle doesn’t have to be bad for the yellow metal. If it is accompanied by rising inflation, gold may rise in tandem with the federal funds rate. So, it turns out that the key is not the actual changes in the Fed’s policy and interest rates, but the expectations of these changes, which translate into the real interest rates.

Indeed, the chart below reveals a strong positive correlation between gold prices and real interest rates. It shows that gold suffered not from the actual previous tightening cycle, but from the expectations of the tightening cycle. As one can see in the chart, the yellow metal definitely entered a bear market in late 2012, just when the real interest rates bottomed out. And then, gold prices plunged in 2013 amid the taper tantrum, when the surprising announcement of tapering of asset purchases by Ben Bernanke pushed the bond yields much higher. Importantly, the actual tapering began a few months later, while the first interest rate hike came only in December 2015.

So, what does this short review of the previous tightening cycles imply for the gold market? Well, the good news is that gold doesn’t have to suffer from the tightening cycle, especially if higher inflation turns out to be more lasting than commonly believed. This is because the real interest rates will remain low. And, given the increase in the public debt, Wall Street’s addiction to easy money, and the Fed’s dovish bias, the upcoming tightening will probably be less tight than the previous ones.

However, I also have some bad news. First, it might be the case that inflation and inflation expectations have already peaked in May, while the real interest rates have reached the bottom. In this scenario, the outlook for gold is rather grim.

Second, although gold may be fine with the actual tightening cycle, we are in the expectations phase. And what do I mean by that? Investors are betting that the Fed will start tightening its monetary policy soon; for example, they expect the official announcement on tapering as early as September 2021. And the expectations are what matters. The Fed’s meeting in June could have been a mini taper-tantrum, as it surprised investors, the bond yields rose, and the price of gold plunged. So, if history is any guide, it seems that gold still has more room to slide.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the July Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Is There a Next Housing Bubble That Will Make Gold Shine?

June 25, 2021, 10:06 AMHome prices are surging, making some investors worry about the housing market. These fears seem to be exaggerated, but bubble-like conditions are widespread.

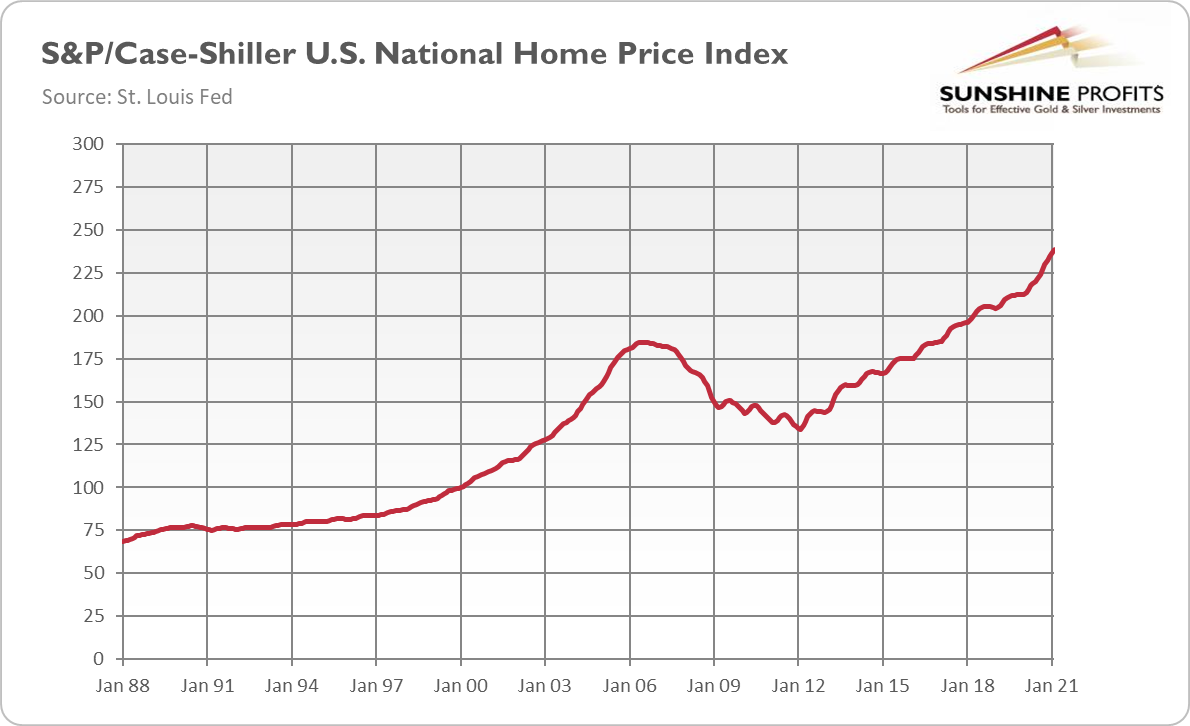

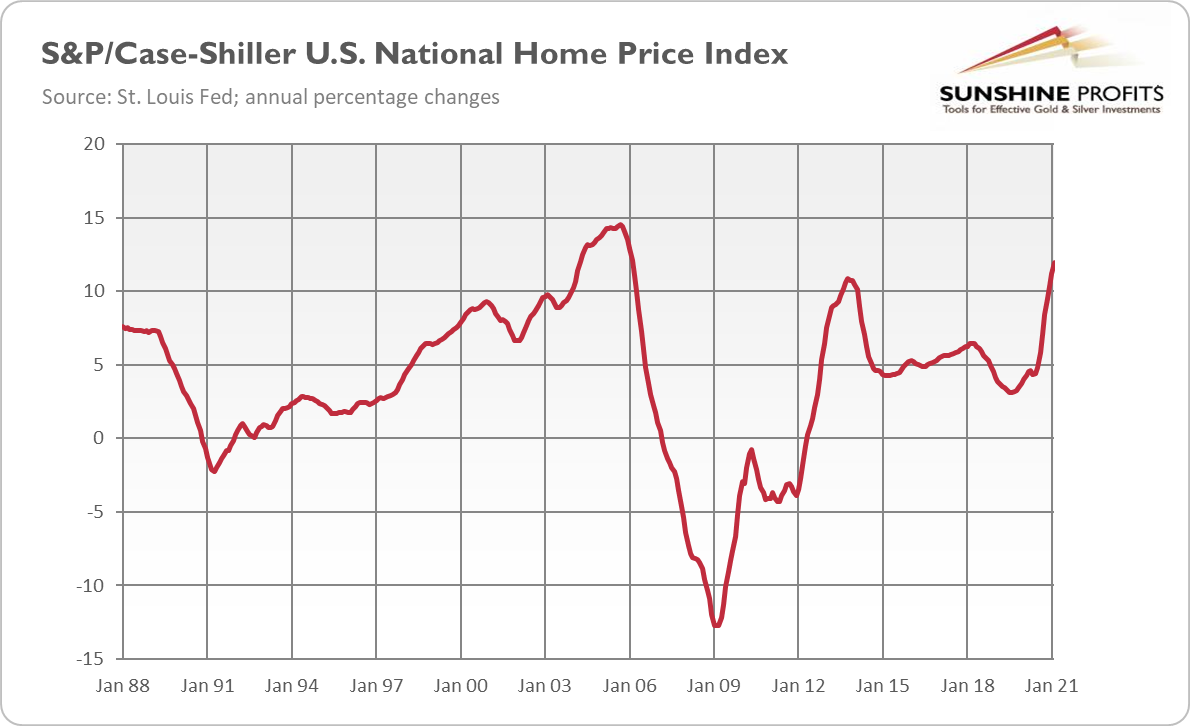

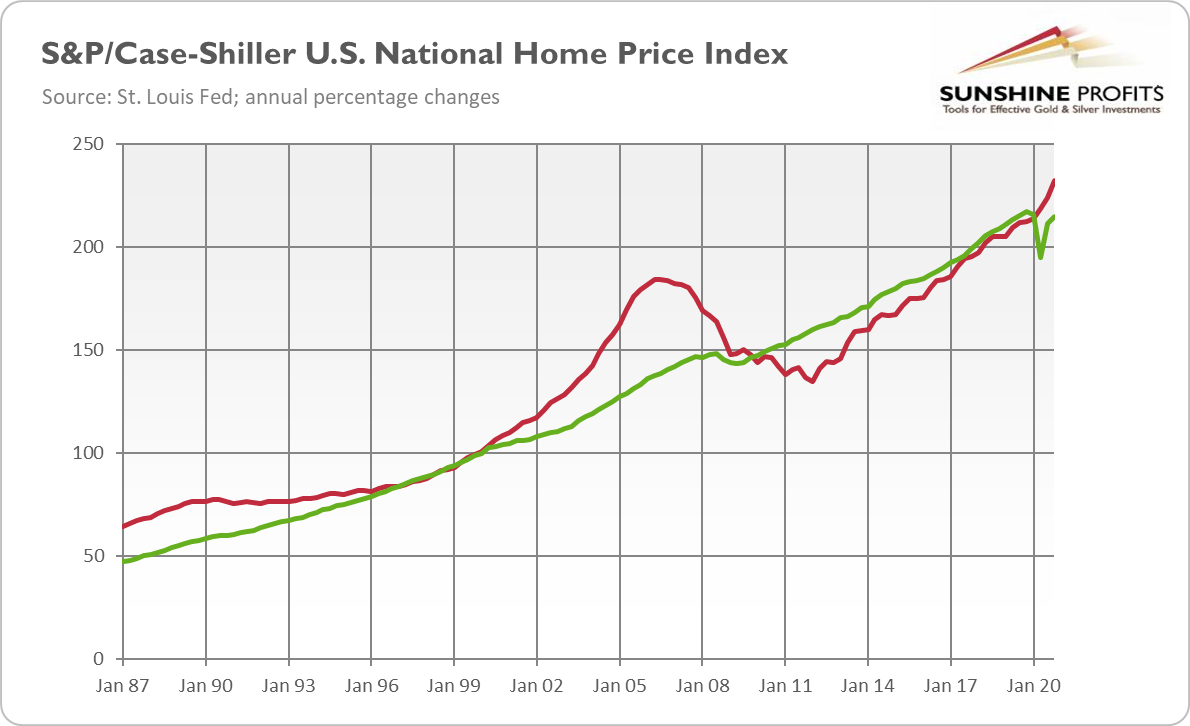

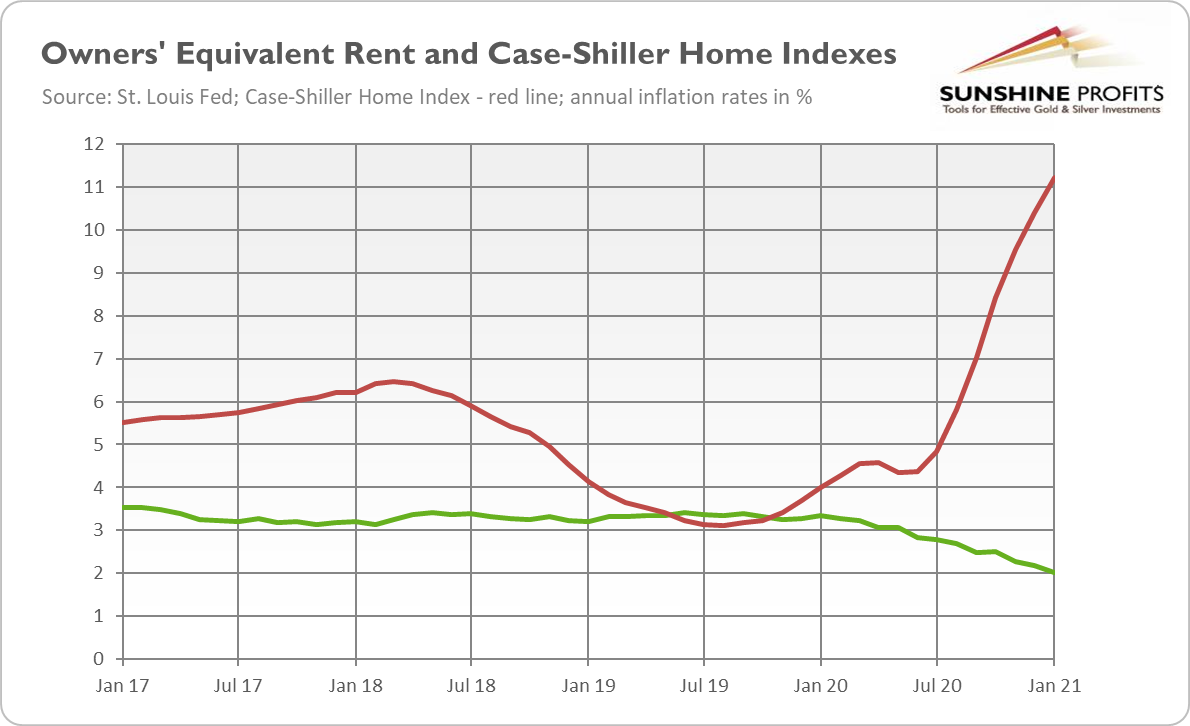

House prices are surging. As the chart below shows, the S&P/Case-Shiller U.S. National Home Price Index has reached 239 in February 2021, the highest number in history and about 30% higher than during the 2006 peak.

What’s more, the National Home Price Index has jumped 12% year-over-year in February, which is the highest annualized gain since January 2006 when the housing bubble started deflating as can be seen in the chart below. At the same time, inventory in many regions has hit record lows.

Not surprisingly, some analysts started to worry about the formation of the next housing bubble. The previous one led to the global financial crisis. However, at least some part of the recent increases can be explained by other factors than mere expectations of price increases, which characterizes a bubble.

The mortgage rates plunged thanks to the Fed’s zero-interest-rate policy and accommodative monetary policy. The easy fiscal policy with stimulus checks also added fuel to the fire, especially given that people couldn’t spend money on services, so they spent more on housing.

The demographic factors also helped to move prices up. Many Millennials have just entered the prime home-buying age, and the pandemic made a lot of people demand more space as they work remotely.

In other words, the recent surge in prices is likely a result of an imbalance between tight supply (that rises too slowly to meet booming demand fueled by low interest rates) and income growth rather than an irrational exuberance. Furthermore, lending standards are also tighter now. Please take a look at the chart below, which shows the home price index vis-à-vis the GDP (presented also as an index).

As one can see, in the 2000s there was a clear, huge divergence between the pace of GDP growth and the pace of home prices’ appreciation that lasted a few years before the bubble burst. But since the end of the Great Recession, the growth in house prices was below the GDP growth. Therefore, I would say that there is no bubble in the housing market. Not yet, at least – house prices started to diverge from GDP growth during the pandemic recession…

Hence, it would be smart to monitor the housing market carefully. However, so far, gold bulls shouldn’t count on the housing bubble and its burst as important factor that could support the price of the yellow metal. Nevertheless, the recent ultra-low real interest rates and high inflation should support both: gold and houses. After all, they are both hard assets sensitive to interest rates and are being eagerly bought during inflationary periods.

More importantly, despite the fact that it’s maybe too early to call the national bubble in the housing market (although some locations are really hot), in many markets there are bubble-like conditions. Just think about soaring stock market indices reaching one record after another. Or negative-yielding bonds worth about $18 trillion. Or surging used car prices that have just hit an all-time high. Or lumber that has become America’s hottest commodity.

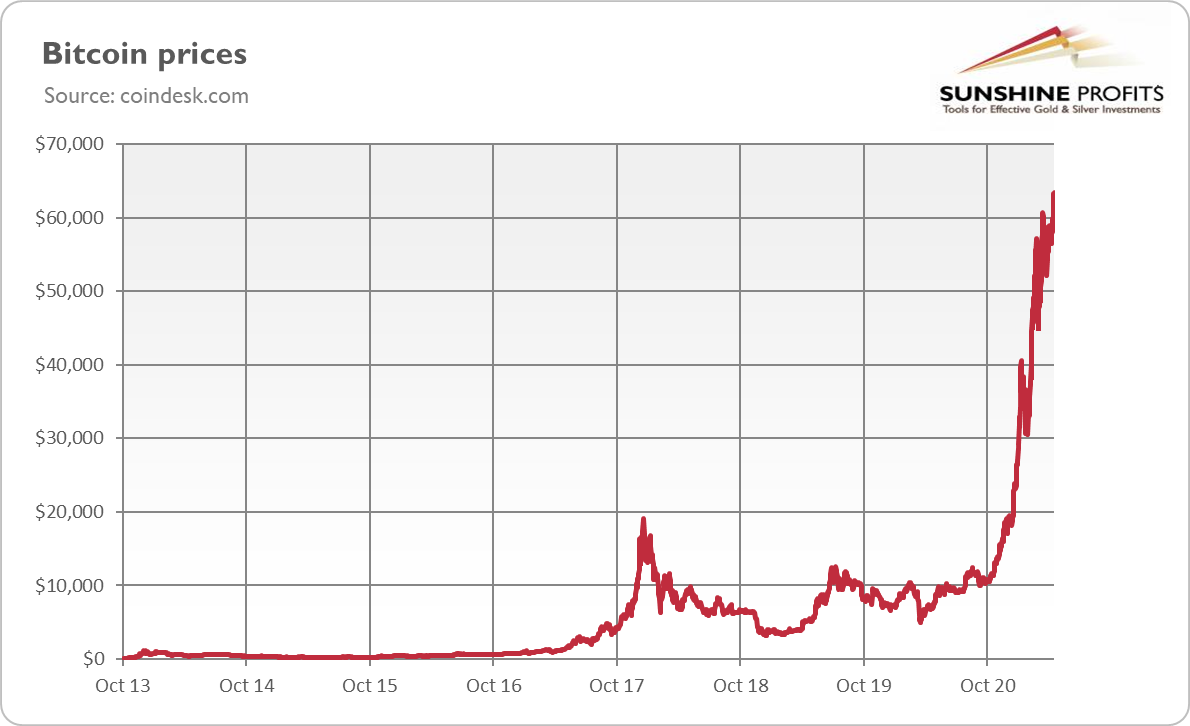

Or Dogecoin, a cryptocurrency that was created as a joke. It has gained about 8,500% this year, despite the recent sell-off in the cryptocurrency market. As a popular tweet commented on this, “Moderna created a lifesaving vaccine in record time and is worth $70 billion. Dogecoin became a meme and is worth $87 Billion.”

The widespread character of these price increases is the reason why some analysts refer to the “everything bubble”. It might be an exaggeration, but the scope of bubble-like conditions clearly shows that markets are awash in liquidity. All this new money supply and excess liquidity simply entered the economy, exerting inflationary pressure across the board and boosting mainly risk assets.

Indeed, there is inflation, but still mainly in the asset markets, not in the consumer sphere. However, this is changing, as the April CPI reading has clearly indicated. Producer/commodity inflation could advance into the next stage in which consumer prices are also generally increasing. Inflated asset valuations and rising prices of goods suggest that caution is warranted, and it would be smart to allocate some portion of the investment portfolio toward gold.

The bottom line is that the global expansion will continue, which is bad for gold. However, the growth is fueled by excessive liquidity and ultra-low interest rates, which also creates inflationary pressure and bubble-like conditions. Gold could be supported by all this – it may even thrive if inflation turns out to be higher and more lasting than it’s widely believed.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Asks: Will the Economic Boom Continue?

June 17, 2021, 9:33 AMThe US GDP has already recovered from the pandemic recession. What’s next for the economy and the gold market?

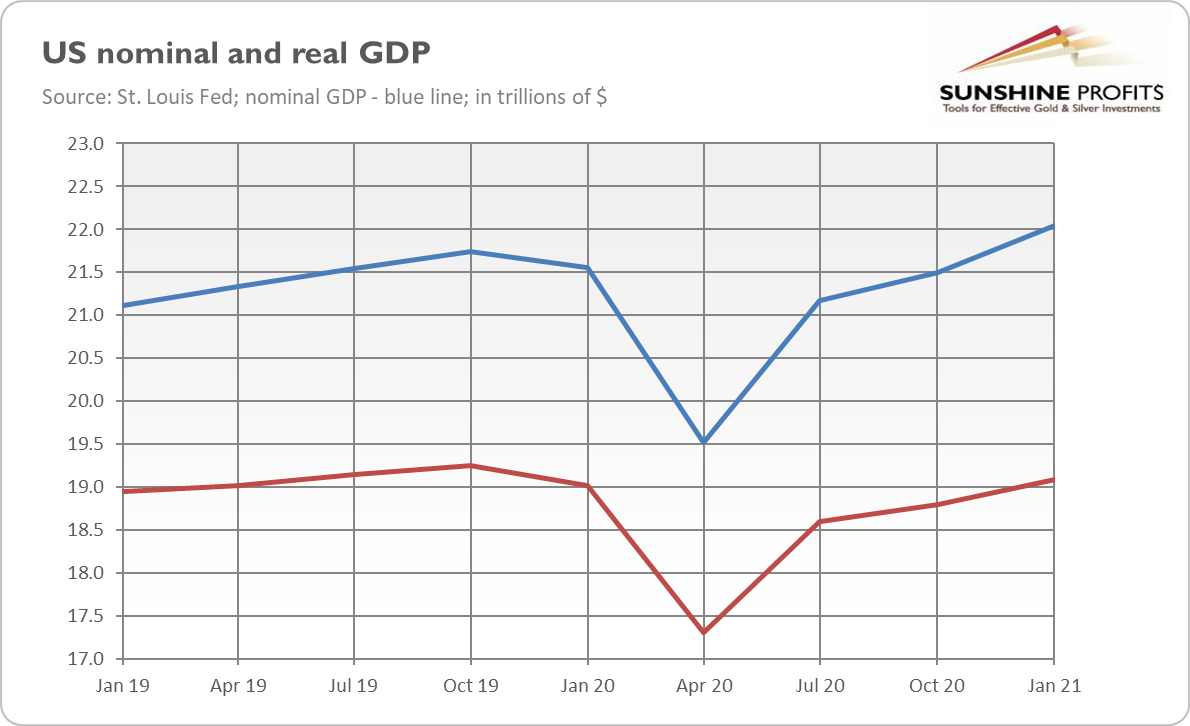

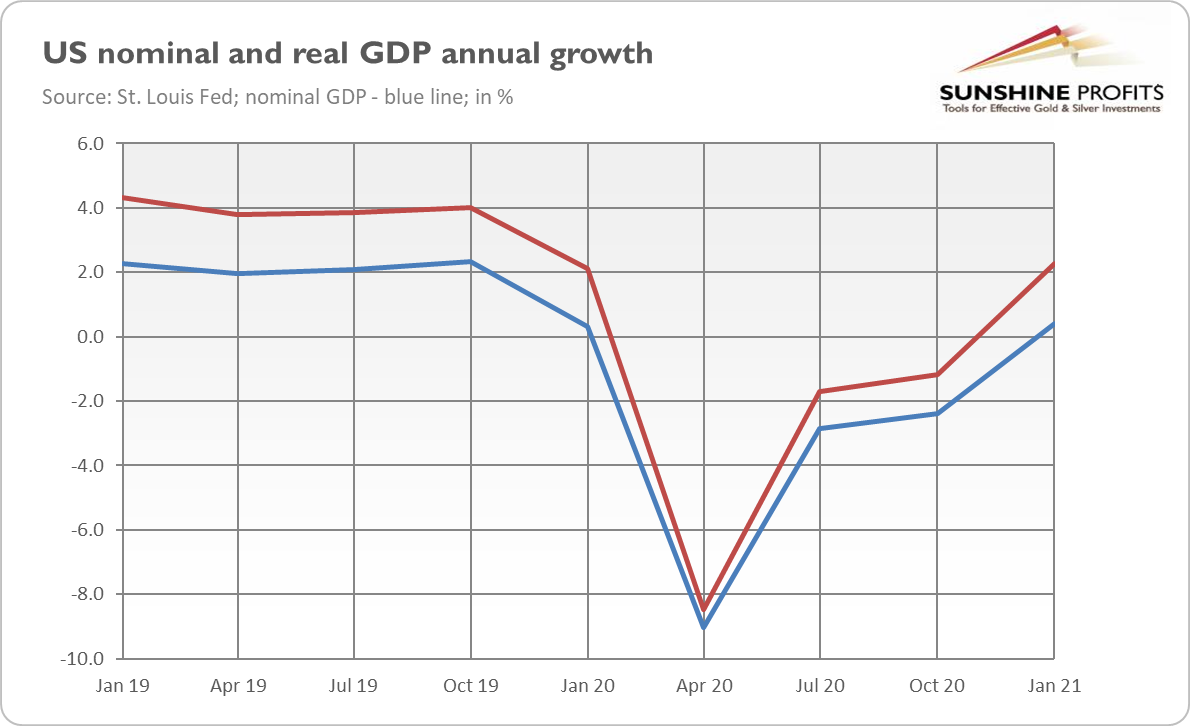

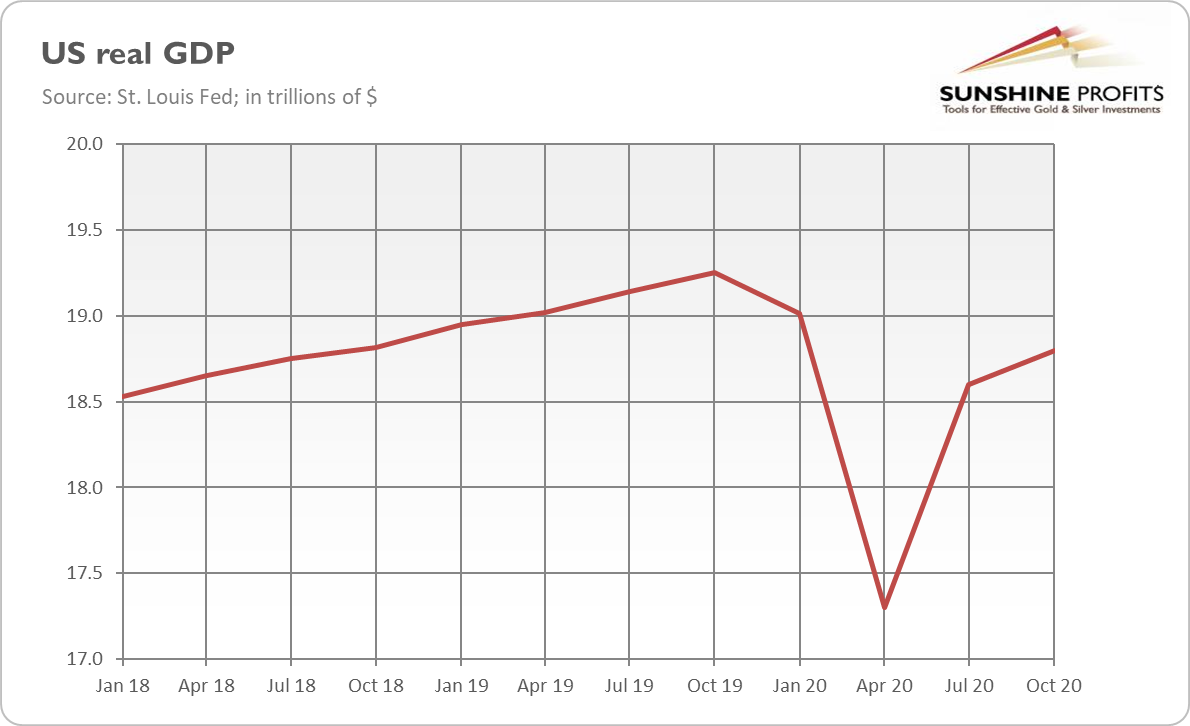

Ladies and Gentlemen, the economic crisis has ended. Actually, not only is the recession over but so is the recovery! This is at least what the recent GDP readings are indicating. As the chart below shows, the US nominal GDP has already jumped above the pre-pandemic level. The real GDP, which takes inflation into account, remained in the first quarter of 2021 below the size of the economy seen at the end of 2019, but it will likely surpass this level in the second quarter of the year.

As one can see in the chart below, in terms of GDP growth, the situation is a bit worse, as the annual percentage changes are still below the pre-epidemic level. However, this should change in the second quarter of 2021 when the growth pace is likely to peak amid base effect and reopening of the economy.

So, the question is: what’s next? Will the economic boom become well-established or will we see a lot of volatility or even new slumps? Given the recent flux of disappointing high-frequency indicators that fell considerably short of expectations (just think about April’s nonfarm payrolls), the question is very relevant.

Well, there are many threats to growth, that’s for sure. The first is, of course, the ever-evolving coronavirus and its new variants. However, judging by preliminary evidence, the vaccines should remain effective, allowing economies to function freely.

The second obvious danger is clearly the economy overheating and higher inflation. The Fed and the Congress injected a lot of liquidity into the economy although it would recover if it was left to its own devices thanks to the rollout of vaccinations and easing lockdowns. So, much of government funds arrived just when the economy practically recovered, which is a recipe for higher prices and inflation-related turbulences in the financial markets.

Third, the increase in debt – both private and public – makes the global economy more fragile. Given the level of indebtedness, even small increases in real interest rates would be dangerous. They would increase the costs of servicing debts for the governments and could hit the asset prices. The fact that the Fed will be under great pressure to remain very dovish is, of course, positive for gold prices. Even if we see some effort to normalize the monetary policy, interest rates and the Fed’s balance sheet will never return to the pre-recession levels.

Last but not least, there is a threat of financial crisis. Many people are worried that there is a bubble in the stock market (and in other markets as well, such as the cryptocurrency market). Indeed, the equities have been reaching new peaks and the valuations are elevated. The margin debt has also jumped. Not surprisingly, the relative frequency of Google searches for the “stock market bubble” has recently risen (just as for the word “inflation”).

Even the Fed in its latest Financial Stability Report expressed some concerns. This is what the Fed Governor Lael Brainard said in a statement linked to the report:

Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year. Equity indices are setting new highs, equity prices relative to forecasts of earnings are near the top of their historical distribution, and the appetite for risk has increased broadly, as the "meme stock" episode demonstrated. Corporate bond markets are also seeing elevated risk appetite, and the spreads of lower quality speculative-grade bonds relative to Treasury yields are among the tightest we have seen historically. The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.

To sum up, the US economy has already recovered from the coronavirus recession, which is bad for safe-haven assets such as gold, as the yellow metal doesn’t like economic expansions. However, there are important threats to sustainable economic growth, which should support the price of gold.

Actually, there is still room for gold to rally further. This is because we are in an inflationary phase of the economic expansion (this boom will be more inflationary than the post-Great Recession period), and all the money created during the pandemic has flowed into the asset markets, pushing their prices into elevated levels not necessarily justified by fundamentals (just think about Dogecoin). Gold could benefit from such a bubble, as well as from an inflationary and hot environment.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Is Gold Really an Inflation Hedge?

June 11, 2021, 10:48 AMInflation is back, and that’s usually depicted as good for gold. But is the yellow metal still a hedge against inflation, or has something changed?

Inflation has returned. This is partly understandable. After all, during the Covid recession, consumers and businesses accumulated a lot of cash as their spending was reduced, while revenues were sustained by money transfers from the government. These funds are now entering the economy, which makes demand grow much faster than supply, thus boosting prices. After some time, supply may catch up, curbing inflation. However, there is an important risk that inflation will turn out to be higher and/or more permanent than many analysts believe.

From the fundamental point of view, gold should benefit from higher inflation. But why? In theory, there are several channels by which inflation supports the yellow metal. First, the inflationary increase in the money supply makes all goods and services more expensive, including gold. Indeed, the scientific paper by Lucey and others finds a reliable long-run relationship between gold and the US money supply.

Second, gold is a real, tangible and rare good with limited supply that cannot be increased quickly or at will. These features make gold a key element during the so-called flight into real values or into hard assets, which happens when inflation gets out of control. In other words, gold is the ultimate store of value which proved to hold its worth over time, unlike paper currencies that are subject to inflation and lose their value systematically.

Third, inflation means the loss of purchasing power of the currency, so when the greenback depreciates quicker than its major peers, the dollar-denominated price of gold increases. Fourth, when inflation is unexpected or when the Fed remains behind the curve and doesn’t hike nominal interest rates, real interest rates decline, supporting gold prices.

Fifth, high inflation increases economic uncertainty, which increases safe-haven demand for gold. In other words, an outbreak of inflation introduces some turbulences and leads to portfolio rebalancing, thus increasing gold’s appeal as a portfolio diversifier. During inflation, bonds underperform, so gold’s attractiveness increases.

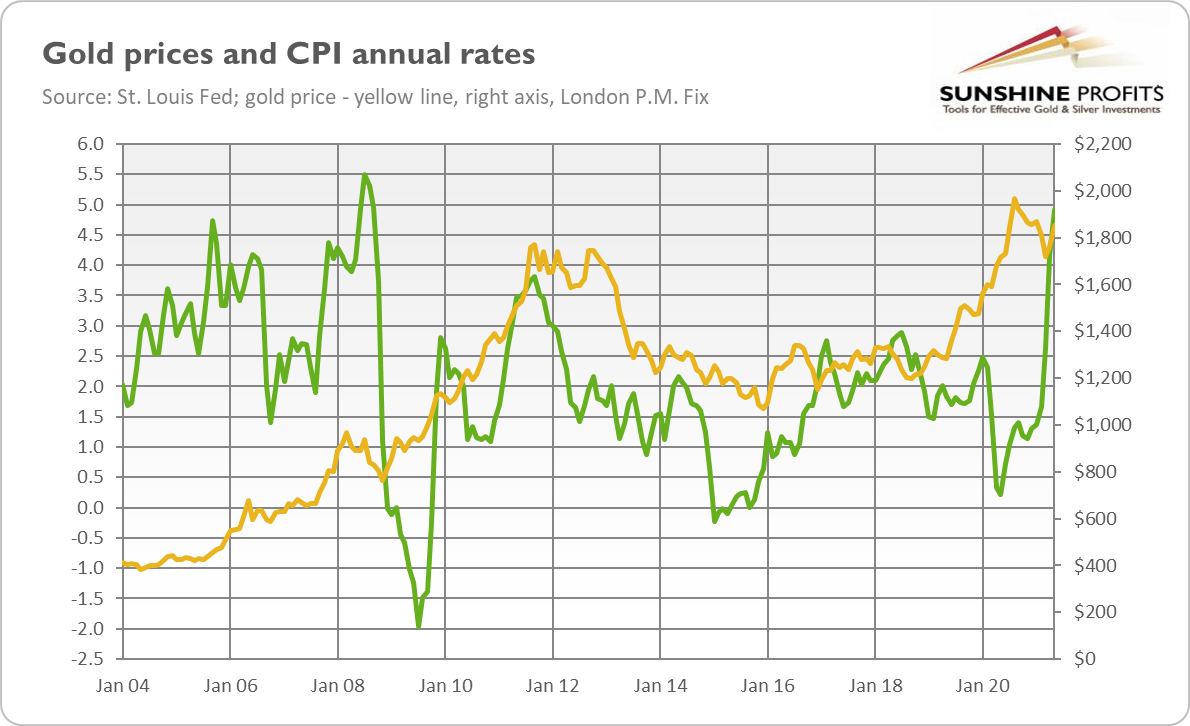

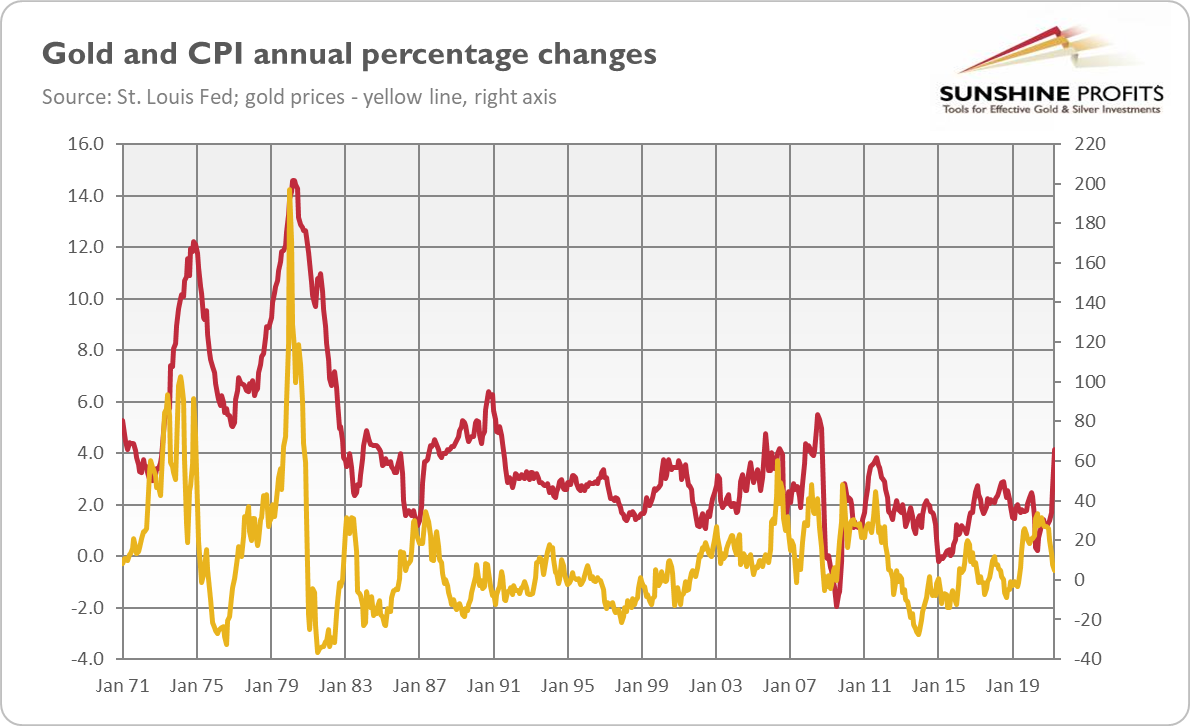

And last but definitely not least, gold is perceived as an inflation hedge. But is it really a good hedge against inflation? I analyzed this issue a few years ago – it would be nice to provide an update in light of more recent developments. So, let’s take a look at the chart below, which shows gold prices and CPI annual inflation rates.

As one can see, the relationship between these two series is far from being perfect. Actually, the correlation coefficient is significantly below zero (-0.41), which means that the correlation is negative! It means that although there are certain long-term trends – for example, gold rallied during stagflation in the 1970s and entered a bear market during the disinflation period in the 1980s and 1990s – there is no positive relationship between the CPI annual percentage change and the price of gold on a monthly basis.

In other words, the data shows that gold may serve as an inflation hedge only in the long run, as gold indeed preserves its value over a long time (for example, in the period from 1895 to 1999, the real price of gold increased on average by 0.3% per year). It is a good choice for investors also when there is relatively high and accelerating inflation, usually accompanied by fears about the current state of the U.S. dollar and a lack of confidence in the Fed and the global monetary system based on fiat monies.

However, let’s not draw conclusions too hastily. The chart below also presents the CPI and gold – but this time both series are year-on-year percentage changes (previously we had gold prices, now we have annual percentage changes in these prices).

Have you noticed something? Yup, this time both series behave much more similarly. Indeed, the correlation coefficient is now positive (0.44). Hence, there is a positive relationship between gold and inflation although not always seen in absolute prices (but in changes in these prices), and not always seen in the CPI (as inflation has broader effects not limited only to consumer prices).

Summing up the above analysis, it seems justified to claim that gold could benefit from the current elevated levels of inflation, especially if it turns out to be more lasting than commonly believed. It will also be good for gold if the Fed remains dovish and tolerant of inflation surpassing its target significantly.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Return of Inflation. Can Gold Withstand the Dark Side?

June 4, 2021, 6:17 AMInflation broke into the economy violently. It’s a destructive, dark force. But gold can resist it, being after all a much stronger asset than Anakin Skywalker.

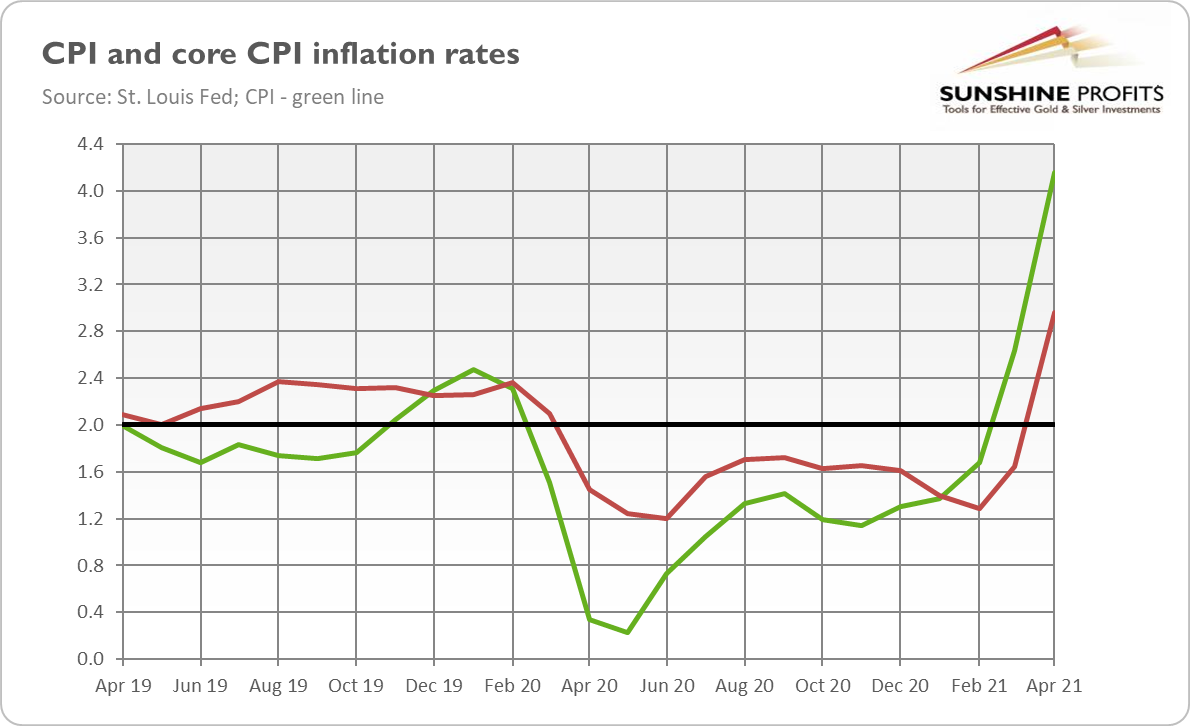

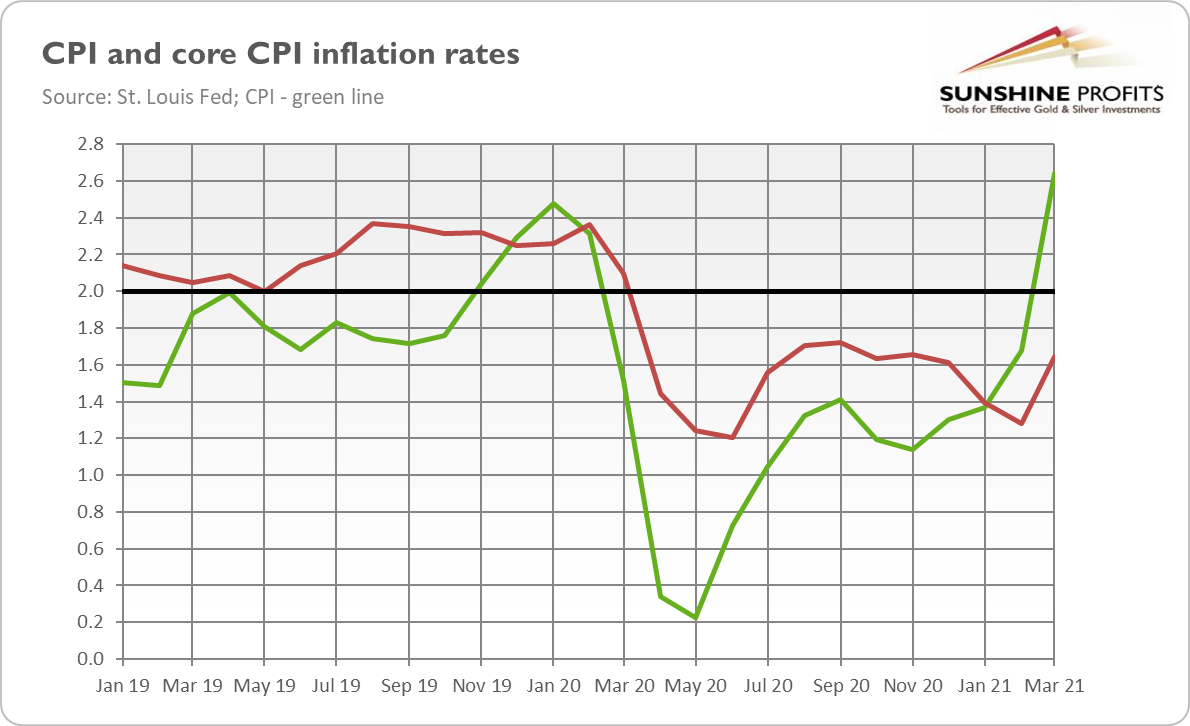

Last month, I wrote that “inflation is knock, knock, knockin’ on golden door”. I was wrong. Inflation didn’t knock, it broke down the door! Indeed, as the chart below shows, the core CPI surged 3%, while the overall CPI annual rate soared 4.2% in April – this is twice the Fed’s target!

Now, the question is whether this elevated inflation will turn out to be just “transitory”, as the Fed and the pundits claim, or become more permanent. On the one hand, given that April-May 2020 was the worst phase of the pandemic with the deepest price declines, the current high inflation readings are perfectly understandable, and we could see lower numbers later this year.

On the other hand, inflation may be higher and/or more persistent than many analysts believe. After all, the April reading came as a shock for them and even for the top US central bankers. For example, Richard Clarida, the Fed Vice-Chair, said: “I was surprised”. It shows that there is more in high inflation than just the base effect. Indeed, the CPI index with February 2020, i.e., the last pre-pandemic month as a base, has jumped 3.1% so far – lower but still significantly above the Fed’s target.

It shouldn’t be surprising given the surge in the broad money supply and increase in fiscal transfers to citizens. Incomes are higher and people are ready to spend their money. Stronger demand met with supply shortages, so the prices rose. And what is important, the increases are widespread: from commodities to used cars and houses.

However, there are a few important upside risks to inflation. First, a rise in wages. Although employment is far from the pre-epidemic level, entrepreneurs struggle to find workers. Therefore, they could be forced to increase wages to pull employees away from generous government benefits. If passed on, higher input costs would translate into higher consumer prices.

Second, a housing boom. Rising housing prices show that inflationary pressure is something more than just CPI inflation, and all this could drive shelter inflation higher. More importantly, though, as shelter dominates in the CPI basket, the official inflation would rise as a result.

Third, an increase in inflationary expectations. In May, the University of Michigan index that gauges near-term inflation expectations surged to 4.6%from 3.4%in April. What’s important, the index that measures inflation expectations for the next five years also rose – from 2.7% in April to 3.1% in May, which is the highest level in a decade. As the chart below shows, the market-based inflation expectations have also been surging recently.

This is a very important development, potentially even a game-changer. You see, inflation remained low for years partially because Americans didn’t expect high inflation. They used to see persistent inflation as a thing of the past. They had strong confidence in the Fed, believing that the US central bank would quickly intervene to prevent inflation.

However, that belief could go away now. The Fed’s new monetary framework and officials’ speeches clearly indicate that the US central bank has become more tolerant of higher inflation. The Fed has returned – just like in the 1970s – to focus on full employment and its “shortfalls” instead of deviations, forgetting that economies can become too hot as well as too cold. Given the dominance of doves in the Fed – but also in the Treasury with Yellen as a Secretary – one can reasonably doubt whether or not the US central bank is ready to hike the federal funds rate in response to higher inflation. Just like in the years before the Great Stagflation, the Fed could decide that it’s better to live with inflation than bear the pain of combating it.

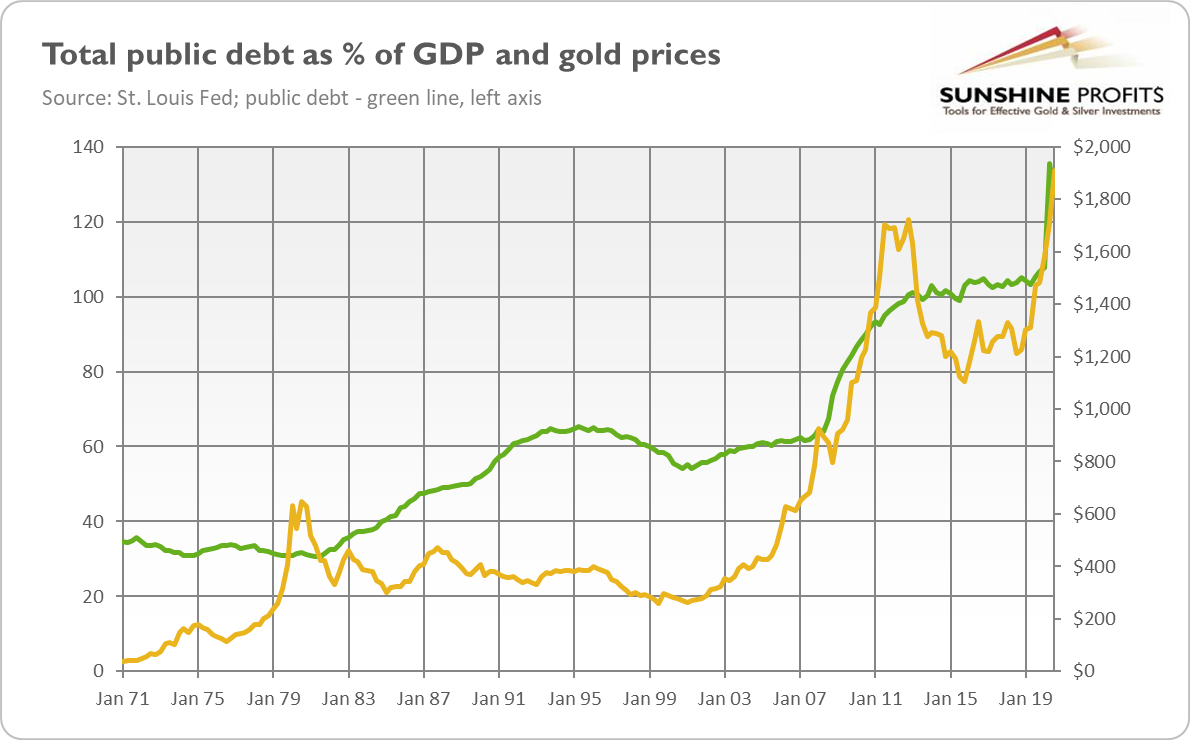

More importantly, such a fight would be challenging now, as the public debt is a few times higher.

As the chart below shows, the federal debt held by the public is now 100% of the GDP, four times larger than throughout the 1970s. Hence, the increase in interest rates would amplify fiscal deficits even more. To paint the perspective, April’s core CPI was the highest since 1982, when the Fed was trying to control inflation, and interest rates were double-digit. So, the government would be obliged to cut its expenditures, while the climate is rather to spend as much money as possible. Therefore, the Fed is under strong pressure not to tighten its monetary policy.

What does all this mean for the gold market? Well, when people question the willingness or ability of the government and central bank to tame inflation, they expect it to go higher, which increases the actual inflation and make it more persistent. Such a negative surprise, with inflation expectations unanchored, would make prices rise abruptly – but also the demand for gold as an inflation hedge would increase. Given the widespread economic repercussions and elevated uncertainty triggered by higher inflation – which is one of the biggest threats to this economic cycle – gold could gain as a safe-haven asset.

Of course, gold is not a perfect inflation hedge in the short term. If interest rates increase or the Fed tightens monetary conditions in response to inflation, gold may struggle. Actually, a start of normalization of the monetary policy could push gold downward, just as it happened in 2011.

However, given the current pretending that “there is no inflation” by the Fed, it’s likely that the US central bank won’t react promptly, remaining behind the curve. The delay in tightening could de-anchor inflationary expectations and trigger an inflationary spiral, pushing real interest rates down but also gold prices up.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Gold Shine Under Bidenomics?

May 28, 2021, 11:21 AMBidenomics is a big departure from sound economics. But when reason sleeps, gold fortunes are born.

Biden’s triumph in the presidential election does not just mean that a new man lives in the White House. It actually implies a fundamental shift in economic policy. Some analysts even see Biden’s agenda as a decisive break with neoliberalism or “Washington consensus”.

You see, in the old orthodoxy, most economists trusted in markets, argued for privatization, deregulation, and liberalization. Taxes and social benefits should be low and don’t discourage work and investments. The governments should run balanced budgets, avoiding large and permanent fiscal deficits, while central banks should hike interest rates to prevent inflation from running out of control.

The focus was on scarcity and limited supply. The economy was believed to operate generally at potential, so the key factors to fast economic growth were structural reforms and adequate supply-side policy to strengthen incentives to work and invest. Governments shouldn’t run fiscal deficits as they could crowd out private investments, and they shouldn’t stimulate the demand as it would misallocate resources and could overheat the economy, leading to inflation. The monetary policy was better suited to occasionally fight economic crises.

How much has changed! Now, the focus is on slack and the demand side of the economy. The growth is held by chronic lack of demand – this is the key tenet of Keynesian economics, the hypothesis of secular stagnation, and the Modern Monetary Theory – so, governments and central banks should continuously stimulate the economy through easy monetary and fiscal policies. As real interest rates are low and demand is weak, rising public debt is not a problem. Inflation is not a problem either; after all, if there is always slack in the economy which operates below its full potential, there is practically no risk of inflation.

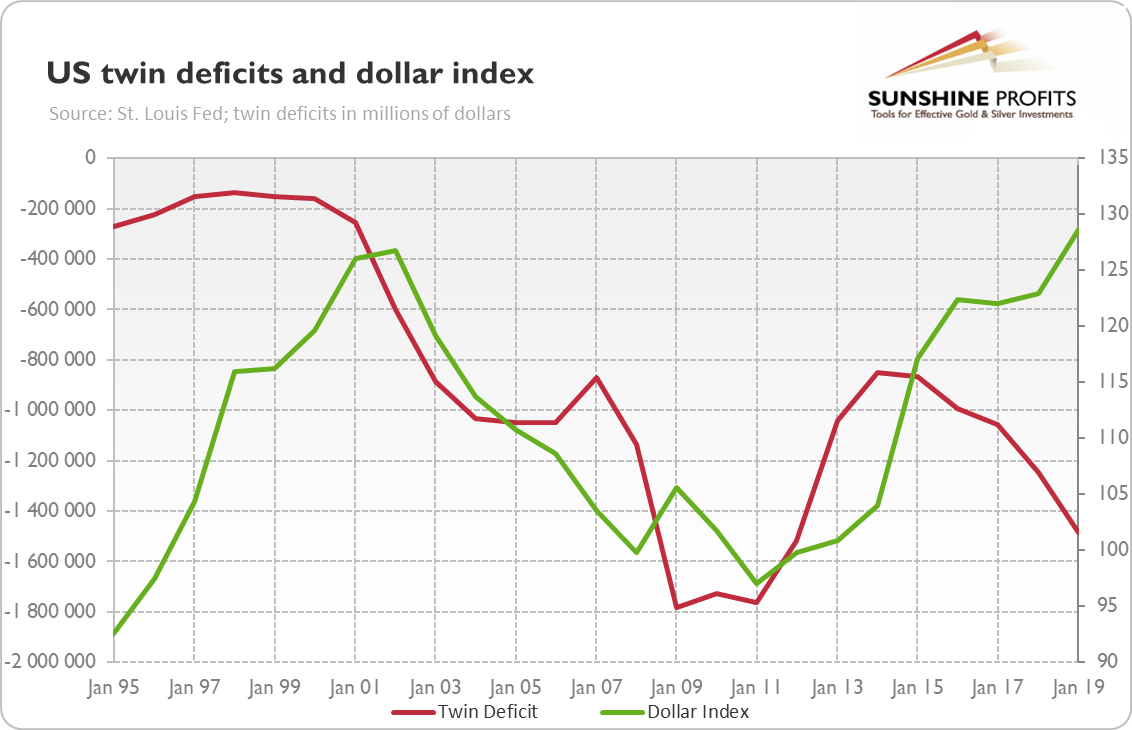

Indeed, Biden has pushed the American Rescue Plan Act of $1.9 trillion (or about 9%of the GDP) without presenting any plan of longer-term deficit reduction. And additional huge government expenditures are coming with Biden’s infrastructure plan. It seems that no one is interested any longer in how the government is going to pay for its spending and obligations, or in long-term consequences of practically unprecedentedly large fiscal deficits (see the chart below). Interest rates are low, so let’s live like there’s no tomorrow!

Another notable example is, of course, the Fed’s new monetary framework. The US central bank has ultimately disregarded the idea of the Philips curve and the natural rate of unemployment. There is no level of employment that could boost the inflation rate, so there is no need for any preventive actions. What really counts is the actual inflation rate, not the expected one. The central bank shouldn’t fight with symmetrical deviations from the economy’s long-term path determined by technological progress and other supply-side factors any longer, but only with shortfalls from the full employment.

So, what does Bidenomics (and Powellomics) imply for the gold market? Well, Biden is not the first politician who thinks that there are no economic limits to his ideas. But the pandemic and the economic crisis, the environment of ultra-low interest rates, and the fact that the Democratic base has shifted further to the left implies that Bidenomics may become a radical departure from sound economics. However, a crazy idea that “borrow & spend without a limit” is the key to prosperity is positive for the gold market, as the yellow metal is a safe-haven asset and a hedge against insane economic policies.

What is important here is the fact that we have actually tested this approach. In 1960, just like today, the Keynesian economists who dominated in the mainstream (and politicians who trusted them) thought that the main task of economic policy is to actively and permanently stimulate aggregate demand. The result was stagflation in the 1970s, as it turned out that economies may overheat as well. Gold shined then, so it should also benefit today from similarly unsound economic ideas and policies.

So far, the pace of economic recovery has been fast, while the inflation rate has remained limited. But this may change quickly when people stop trusting that the Fed and the government will swiftly take action to contain inflation if it breaks out. However, given the current mindset and macroeconomic ideas, how probable is it that the policymakers will accept substantial interest rate hikes, cuts in spending, and probably also a recession when faced with 1970s-style inflation? Not very likely, indeed. Hence, if inflation continues to rise, while the Fed remains ultra-dovish, inflationary expectations may become unanchored, and inflation may get out of control taking gold with it on a wild journey north.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the May Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----