tools spotlight

-

Fed’s Tightening Cycle: Bullish or Bearish for Gold?

March 4, 2022, 9:36 AMThis month, the Fed is expected to hike interest rates. Contrary to popular belief, the tightening doesn't have to be adverse for gold. What does history show?

March 2022 – the Fed is supposed to end its quantitative easing and hike the federal funds rate for the first time during recovery from a pandemic crisis . After the liftoff, the Fed will probably also start reducing the size of its mammoth balance sheet and raise interest rates a few more times. Thus, the tightening of monetary policy is slowly becoming a reality. The golden question is: how will the yellow metal behave under these conditions?

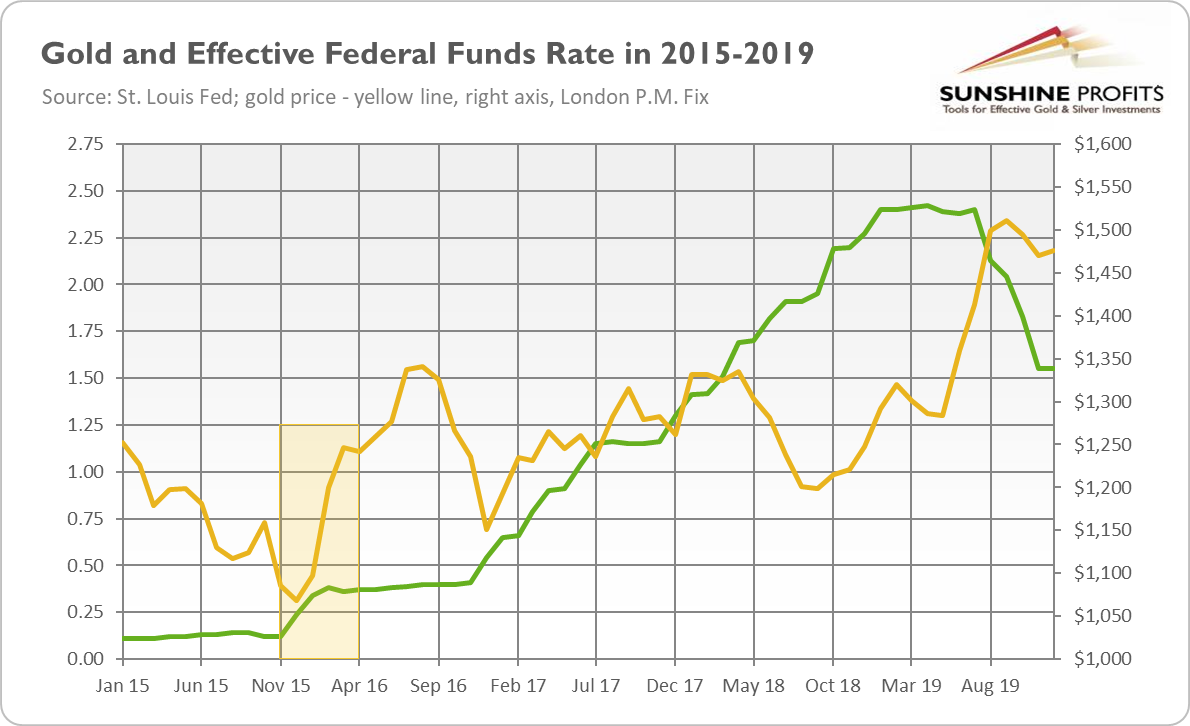

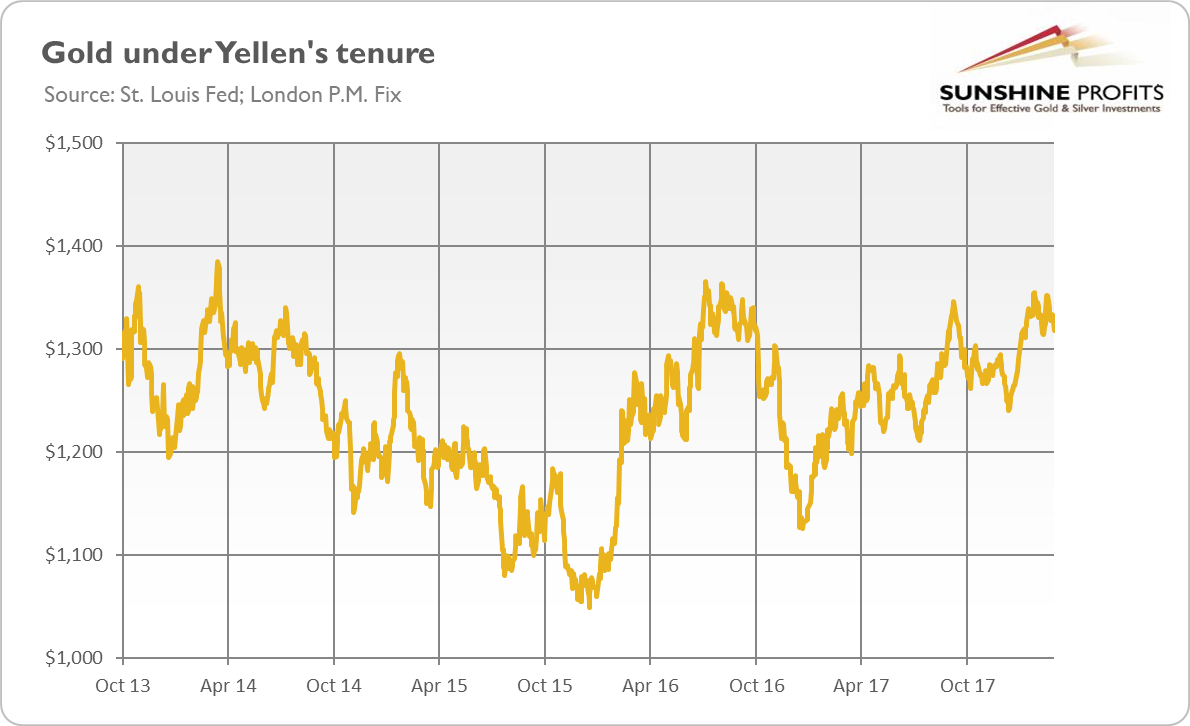

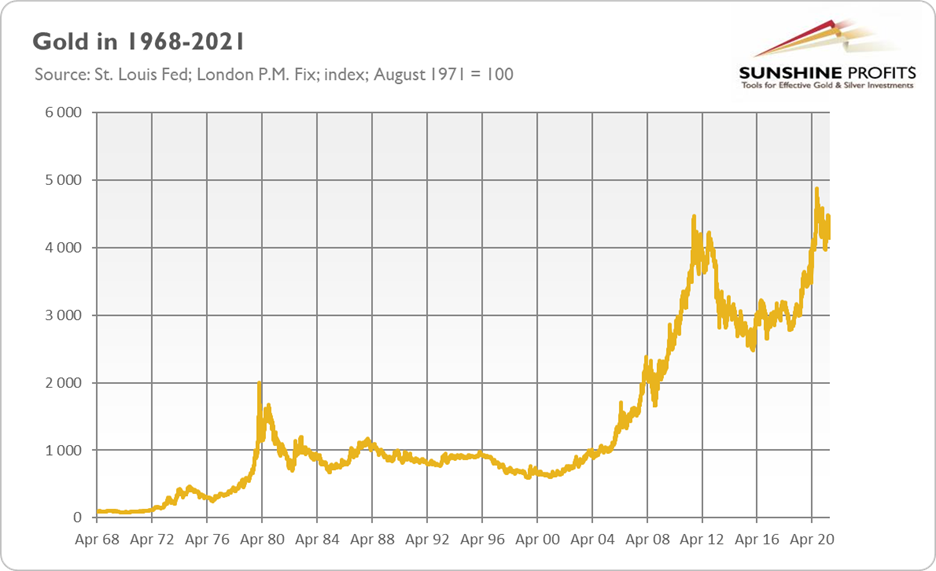

Let’s look into the past. The last tightening cycle of 2015-2019 was rather positive for gold prices. The yellow metal rallied in this period from $1,068 to $1,320 (I refer here to monthly averages), gaining about 24%, as the chart below shows.

What’s really important is that gold bottomed out in December 2015, the month of the liftoff. Hence, if we see a replay of this episode, gold should detach from $1,800 and go north, into the heavenly land of bulls. However, in December 2015, real interest rates peaked, while in January 2016, the US dollar found its local top. These factors helped to catapult gold prices a few years ago, but they don’t have to reappear this time.

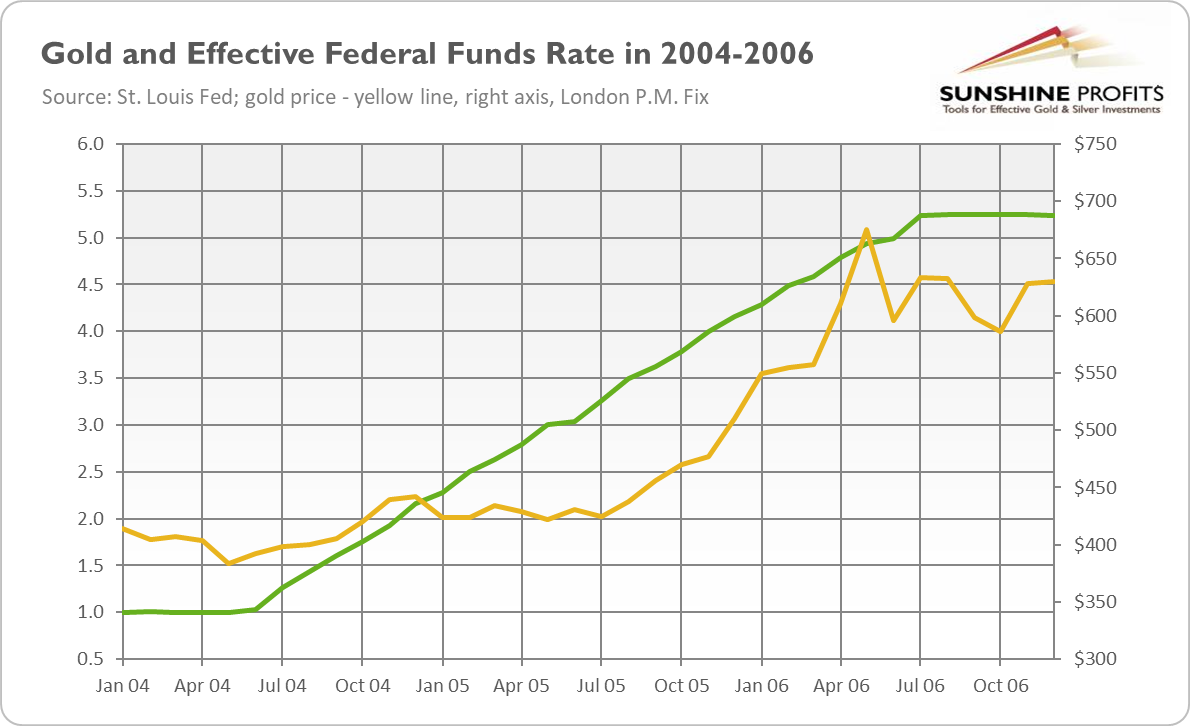

Let’s dig a bit deeper. The earlier tightening cycle occurred between 2004 and 2006, and it was also a great time for gold, despite the fact that the Fed raised interest rates by more than 400 basis points, something unthinkable today. As the chart below shows, the price of the yellow metal (monthly average) soared from $392 to $634, or more than 60%. Just as today, inflation was rising back then, but it was also a time of great weakness in the greenback, a factor that is currently absent.

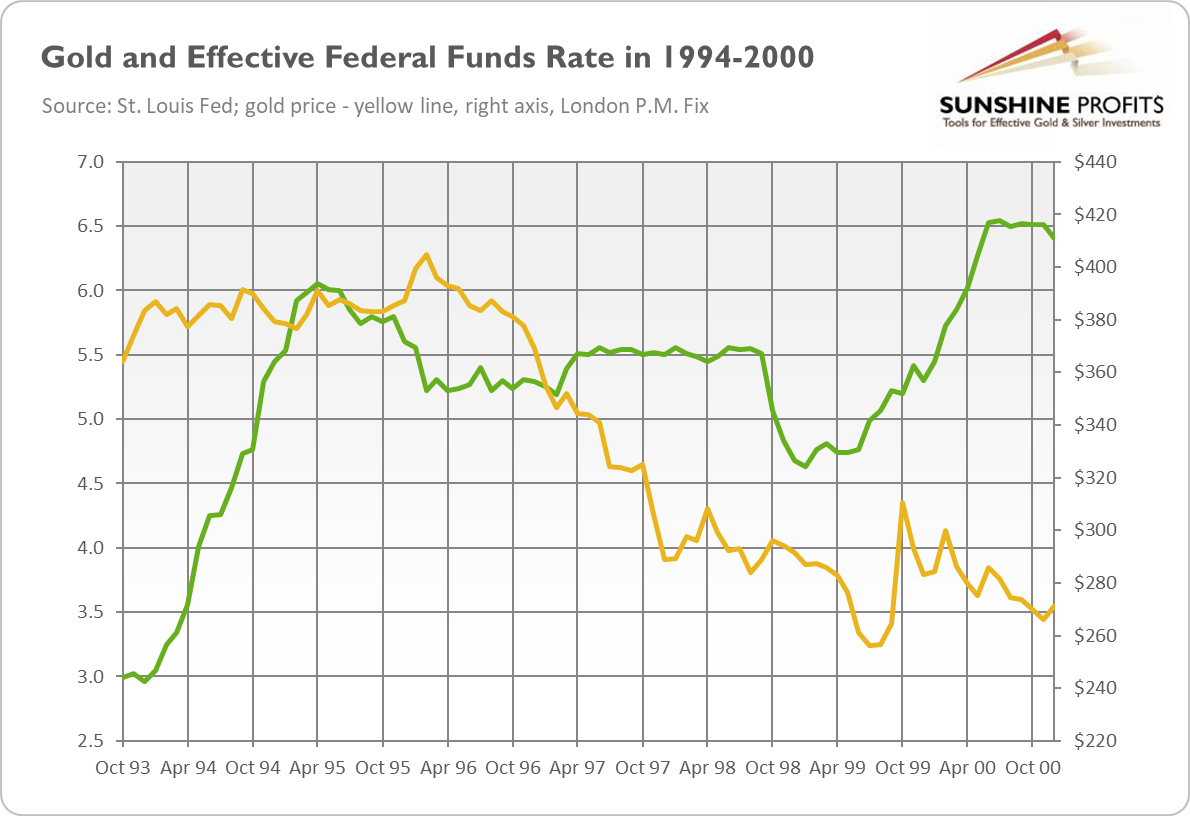

Let’s move even further back into the past. The Fed also raised the federal funds rate in the 1994-1995 and 1999-2000 periods. The chart below shows that these cases were rather neutral for gold prices. In the former, gold was traded sideways, while in the latter, it plunged, rallied, and returned to a decline. Importantly, just as in 2015, the yellow metal bottomed out soon after the liftoff in early 1999.

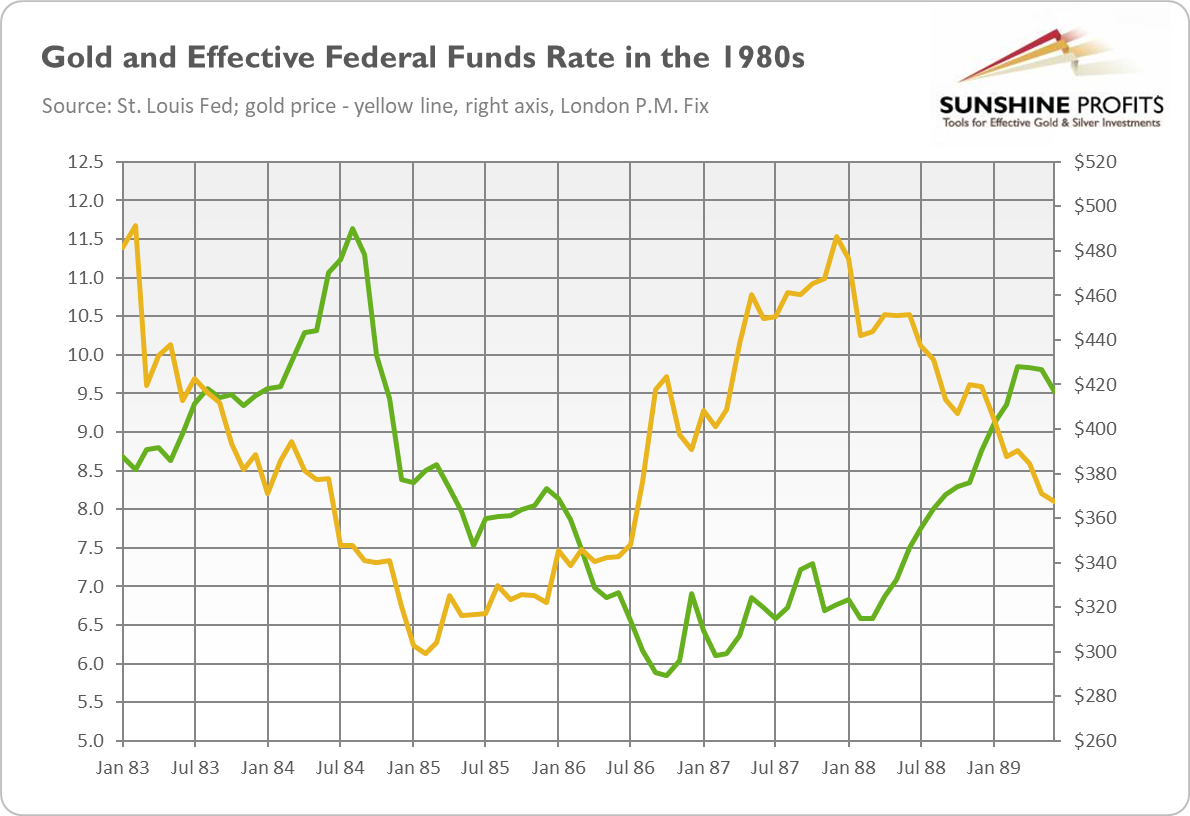

In the 1980s, there were two major tightening cycles – both clearly negative for the yellow metal. In 1983-1984, the price of gold plunged 29% from $491 to $348, despite rising inflation, while in 1988-1989, it dropped another 12%, as you can see in the chart below.

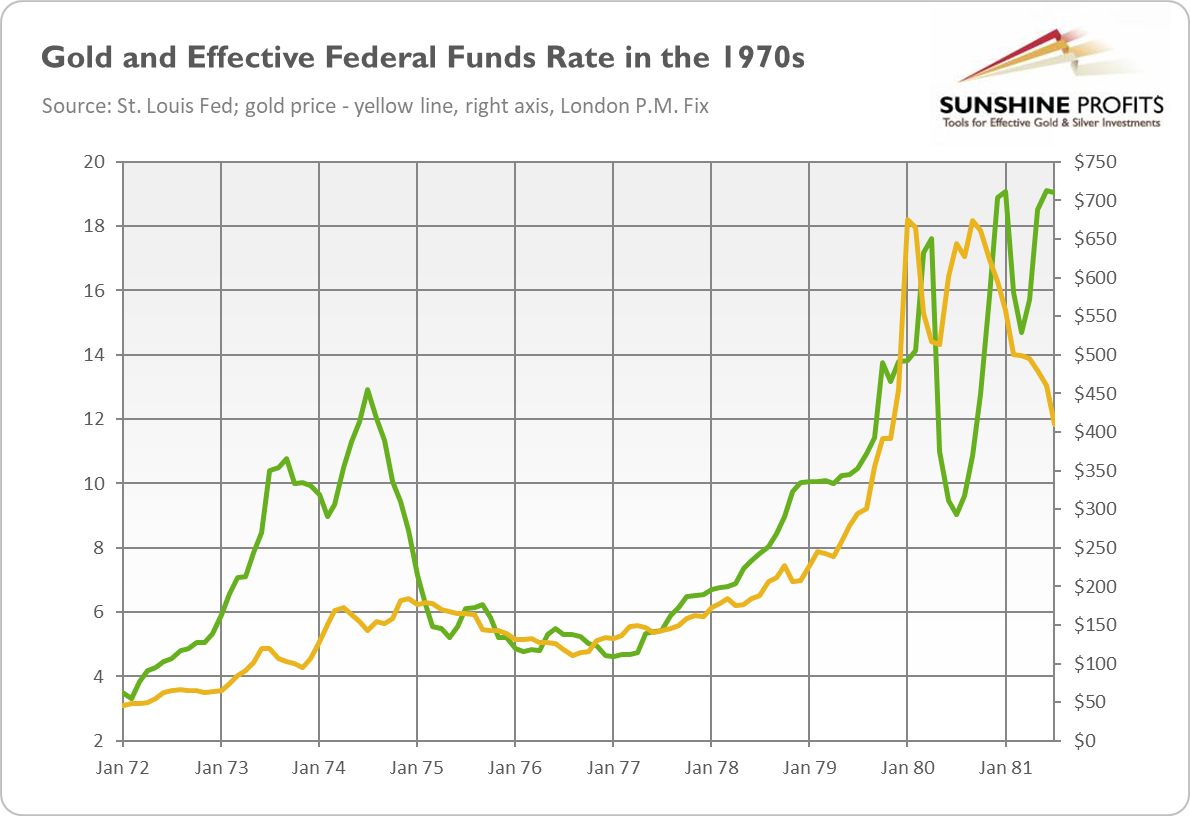

Finally, we have traveled back in time to the Great Stagflation period! In the 1970s, the Fed’s tightening cycles were generally positive for gold, as the chart below shows. In the period from 1972 to 1974, the average monthly price of the yellow metal soared from $48 to $172, or 257%. The tightening of 1977-1980 was an even better episode for gold. Its price skyrocketed from $132 to $675, or 411%. However, monetary tightening in 1980-1981 proved not very favorable , with the yellow metal plunging then to $409.

What are the implications of our historical analysis for the gold market in 2022? First, the Fed’s tightening cycle doesn’t have to be bad for gold. In this report, I’ve examined nine tightening cycles – of which four were bullish, two were neutral, and three were bearish for the gold market. Second, all the negative cases occurred in the 1980s, while the two most recent cycles from the 21st century were positive for gold prices. It bodes well for the 2022 tightening cycle.

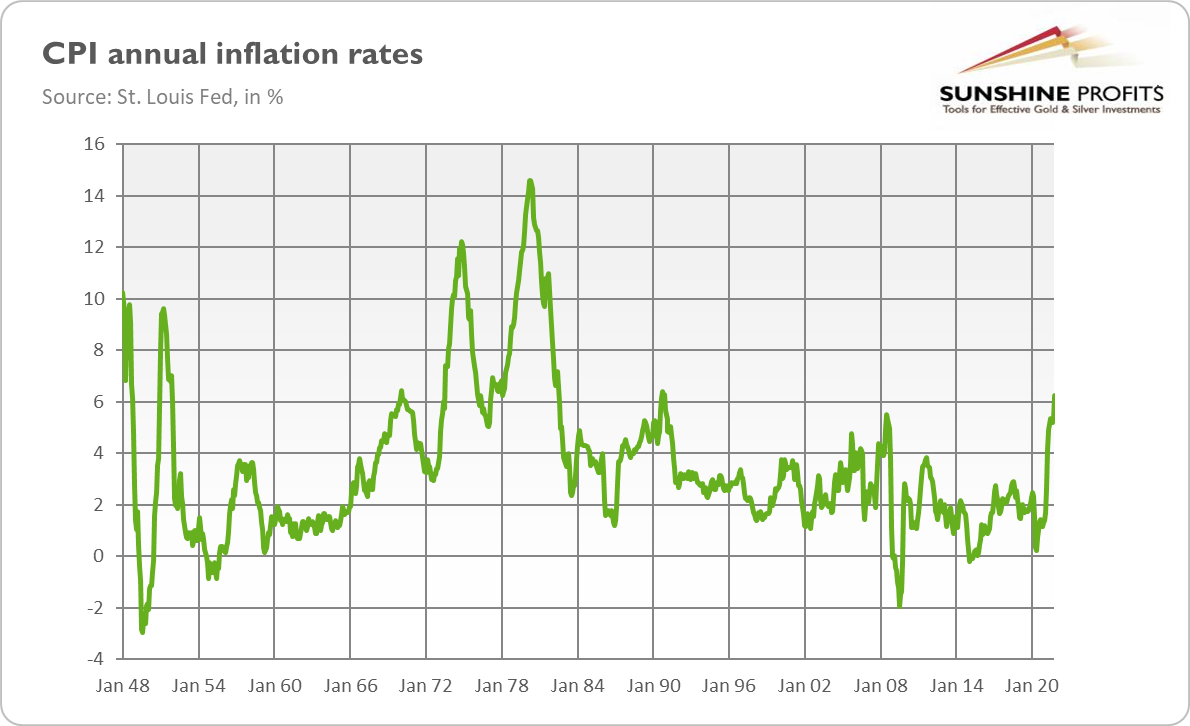

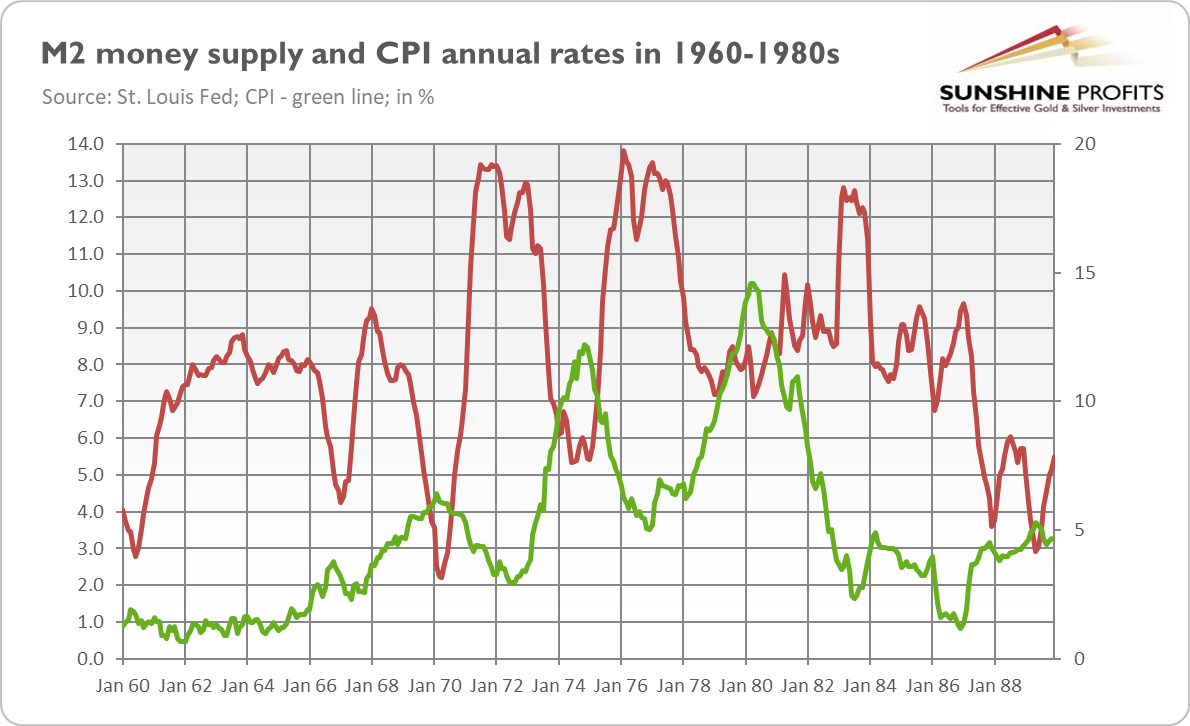

Third, the key is, as always, the broader macroeconomic context – namely, what is happening with the US dollar, inflation, and real interest rates. For example, in the 1970s, the Fed was hiking rates amid soaring inflation. However, in March 1980, the CPI annul rate peaked, and a long era of disinflation started. This is why tightening cycles were generally positive in the 1970s, and negative in the 1980s.

Hence, it seems on the surface that the current tightening should be bullish for gold, as it is accompanied by high inflation. However, inflation is expected to peak this year. If this happens, real interest rates could increase even further, creating downward pressure on gold prices. Please remember that the real federal funds rate is at a record low level. If inflation peaks, gold bulls’ only hope will be either a bearish trend in the US dollar (amid global recovery and ECB’s monetary policy tightening) or a dovish shift in market expectations about the path of the interest rates, given that the Fed’s tightening cycle has historically been followed by an economic slowdown or recession.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the March Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Should We Prepare For the Worst and Buy Some Gold?

February 25, 2022, 8:22 AMAs the COVID-19 pandemic has shown, it is worth being better prepared for a possible crisis. Does that mean it pays to have some gold up your sleeve?

I have to confess something. I always laughed at preppers (aka survivalists) – people who spend their entire lives stockpiling beans and ammo in preparation for the highly unlikely doomsday scenarios. C’mon, who would take these freaks seriously? Well, as the pandemic and supply crisis showed us, we all should.

When most people scrambled for masks and hand sanitizers, preppers laughed. When most people fought epic battles for toilet paper and something to eat to survive the Great Lockdown, preppers laughed. When most people were confronted with surging inflation and supply shortages of different products, preppers laughed. When most people panicked upon hearing about energy blackouts, preppers laughed. It seems that mocked preppers got the last laugh, after all.

Hence, the COVID-19 epidemic made it clear that the world is not a paradise flowing with milk and honey and that bad things do really happen, so we should be more prepared for possible calamities, even if they look like remote possibilities. For example, experts now point out the threat of cyberattacks, and just last month, Kazakhstan’s government turned off the internet nationwide, depriving its citizens of access to their bank accounts.

The problem is, of course, that crises always seem highly unlikely until they occur. Meanwhile, historical cases are too distant and abstract for us, and we tend to think that “this time is different”, or that “we’ll make it through somehow.” Perhaps you will, but it’s much easier when you are prepared. When other people panic, you don’t, because you have made your preparation and have a clear plan of action.

You see, the issue is not if the crisis hits, but when. It’s just a matter of time, even the government suggests storing at least a several-day supply of non-perishable food. However, the problem is that when things are going well, people don’t think about preparing. Why should we worry and spoil the fun? Let’s drink like tomorrow never comes! Maybe the problem will somehow disappear by itself, and if it doesn’t, we’ll deal with it later.

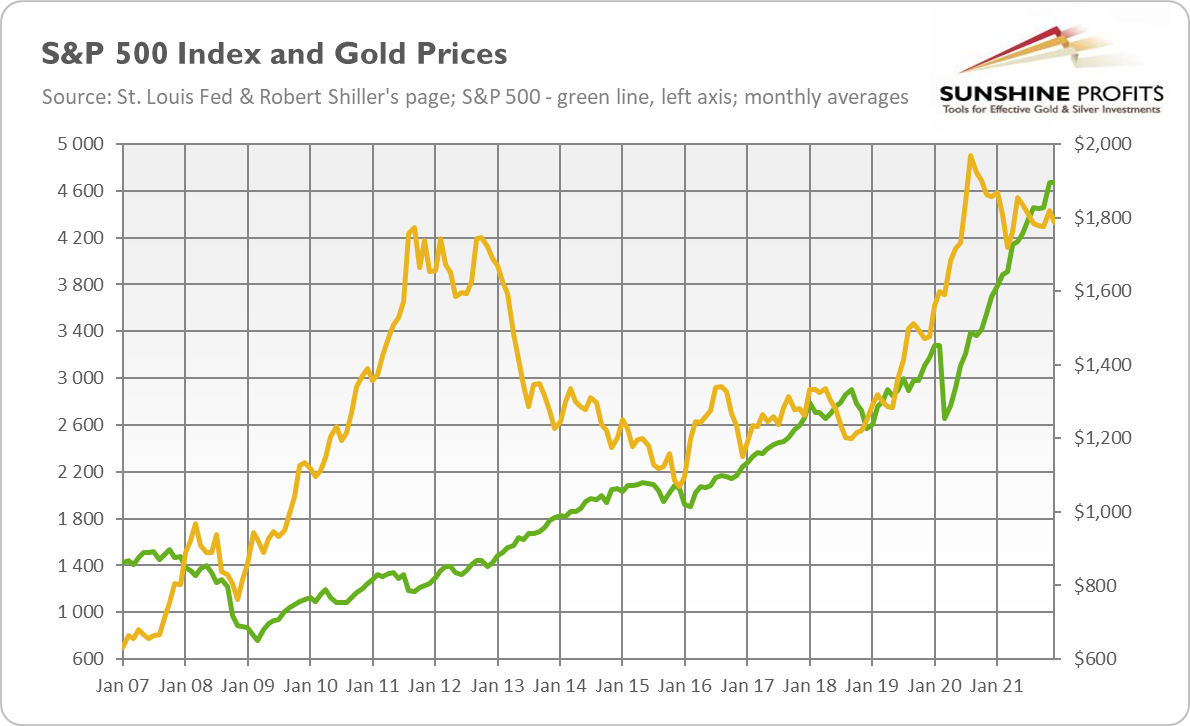

I got it, but how does it all relate to gold? Well, quite simply. Owning gold is a part of preparing for the worst. This is because gold is the store of value that appreciates when confidence in fiat money declines. It’s also a safe-haven asset, which shines during financial crises when asset prices generally decline. The best example may be the Great Recession or 2020 economic crisis when gold performed much better than the S&P 500 Index, as the chart below shows.

You can also think of gold as a portfolio insurance policy or a hedge against tail risks. A house fire is not very likely, but it’s generally smart to have insurance, you know, just in case. Similarly, the collapse of the financial markets and the great plunge of asset prices are not of great probability (although the Great Depression, late 2008, and early 2020 show that they are clearly possible), but it’s nice to have a portfolio diversifier that is not afraid of black swans.

In a sense, the whole issue boils down to individual responsibility. Do you take responsibility for your life and for being prepared for different scenarios, or do you count on other people, the government, or simply luck, magically thinking that everything always goes well? To be clear, being prepared doesn’t equal being pessimistic – it’s rather about being realistic and hoping for the best, but planning for the worst.

However, there are two important caveats to consider before exchanging all of your paper currency for gold coins. First, you shouldn’t conflate holding gold as insurance with gold as an investment asset. When you want protection, you’re not interested in price trends. There might be a bear market, but gold would still fulfill its hedging role. This is also why you shouldn’t own more than about 5-10% of your whole portfolio in precious metals (as insurance, you can invest more in gold as an investment or as a part of your trading strategy).

Second, don’t treat gold as a panacea for all possible disasters. It all depends on what you are preparing for. If you expect power outages, buy batteries, power banks, and think about alternate sources of energy. Precious metals won’t power your home. If you fear a zombie apocalypse (who doesn’t?), flamethrowers and rifles seem to be better weapons than gold bars (although large ones can serve quite well). If you can’t wait for a nuclear explosion (who can?), you will need a proper shelter with uncontaminated food rather than shiny metal (pun intended). It’s possible that in such a post-apocalyptic world, people would initially return to a commodity-based standard rather than the gold standard. It all depends on the particular conditions and how deeply the civilization would devolve.

Hence, don’t be scared by dodgy people and false advertising into buying gold because of imminent hyperinflation, the total collapse of the financial system, nuclear greetings from Kim Jong-Un, or another calamity. The role of gold is not to rescue you from all kinds of troubles, but to be insurance that pays off during economic crises.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the February Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Inflation Peak – High Risk or Opportunity for Gold?

February 18, 2022, 9:38 AMNot only won’t inflation end soon, it’s likely to remain high. Whether gold will be able to take advantage of it will depend, among others, on the Fed.

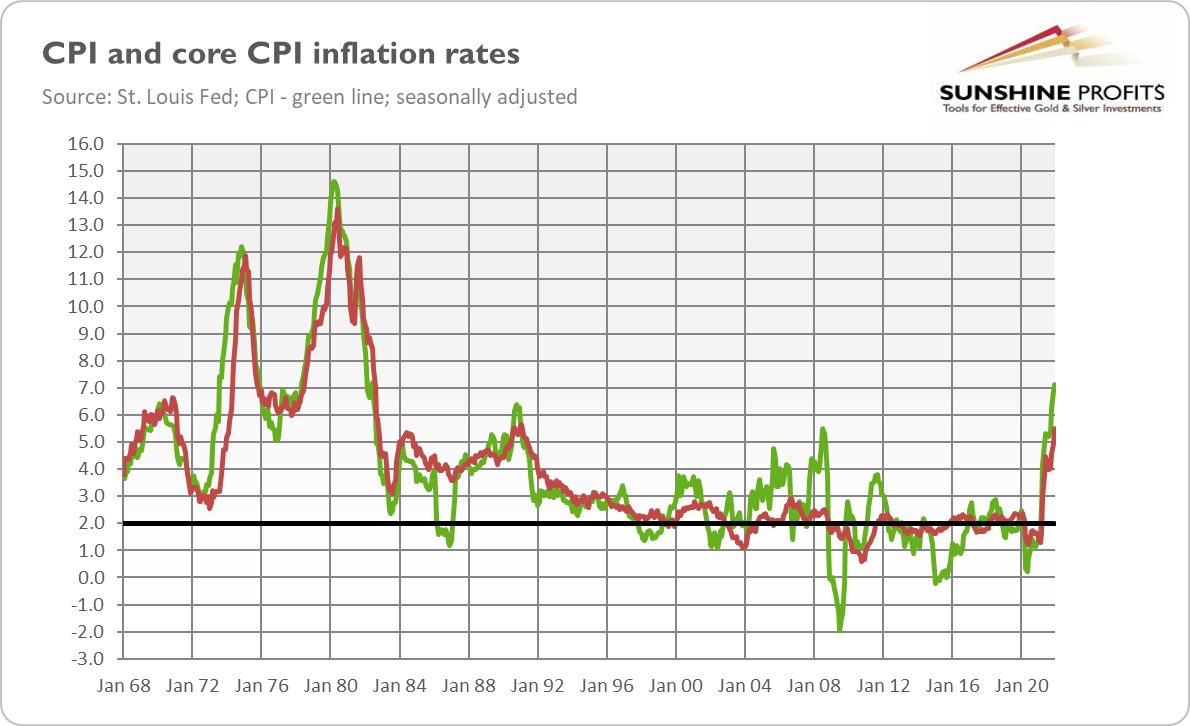

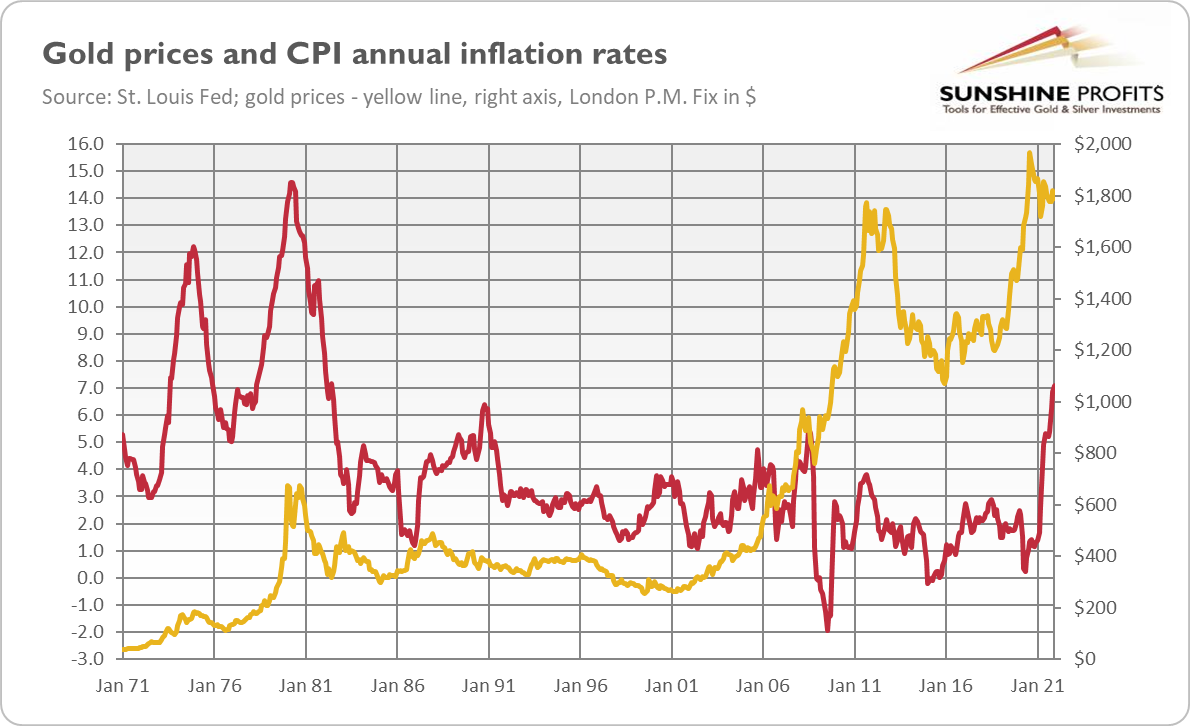

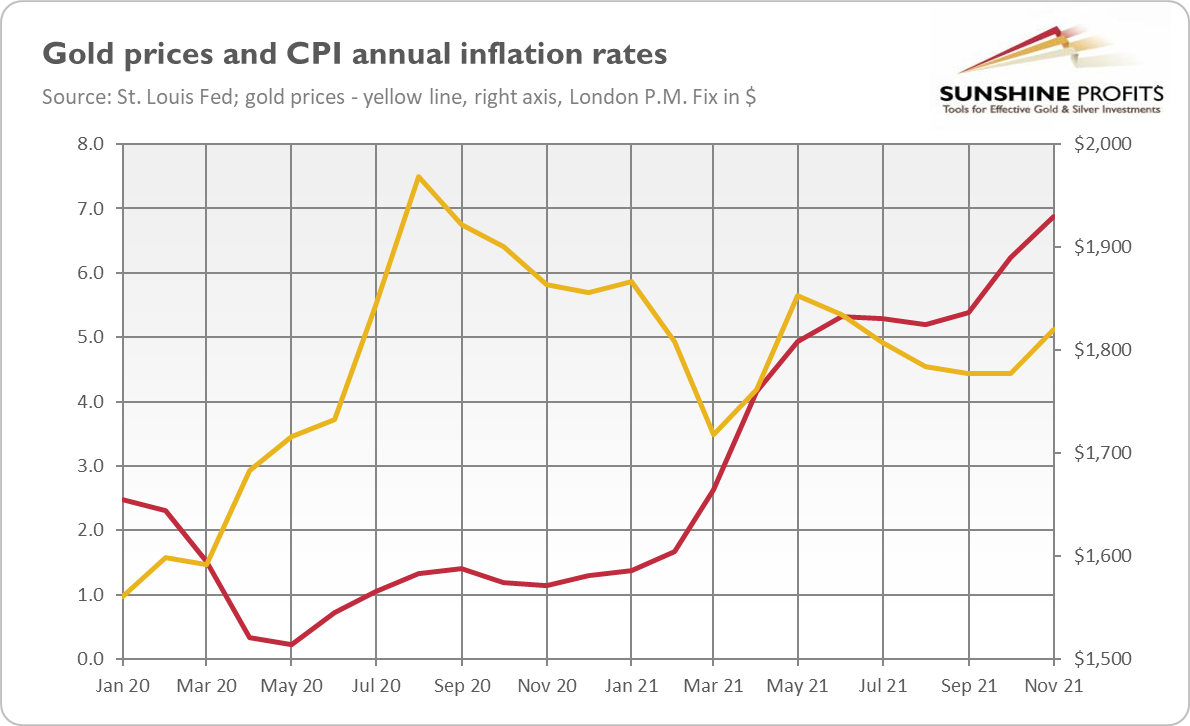

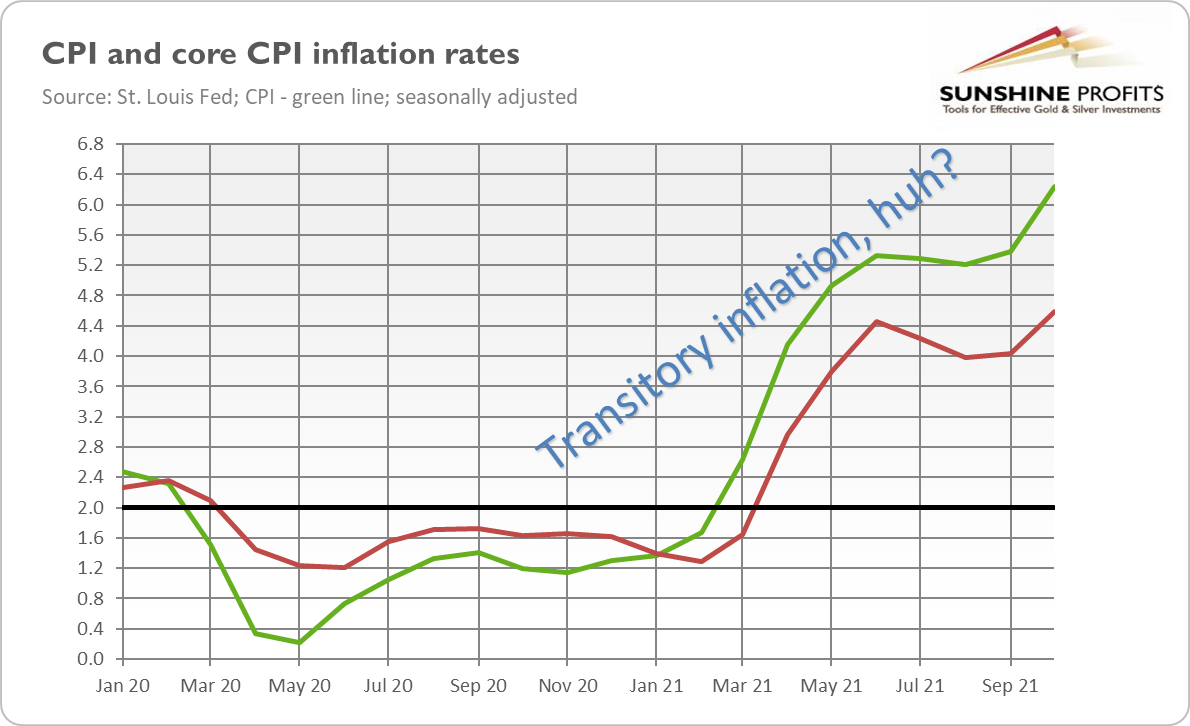

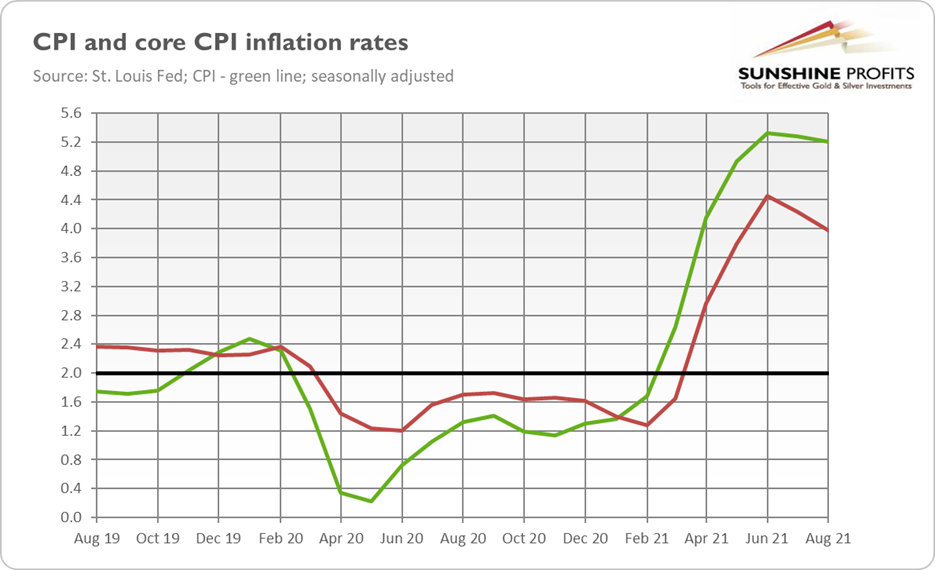

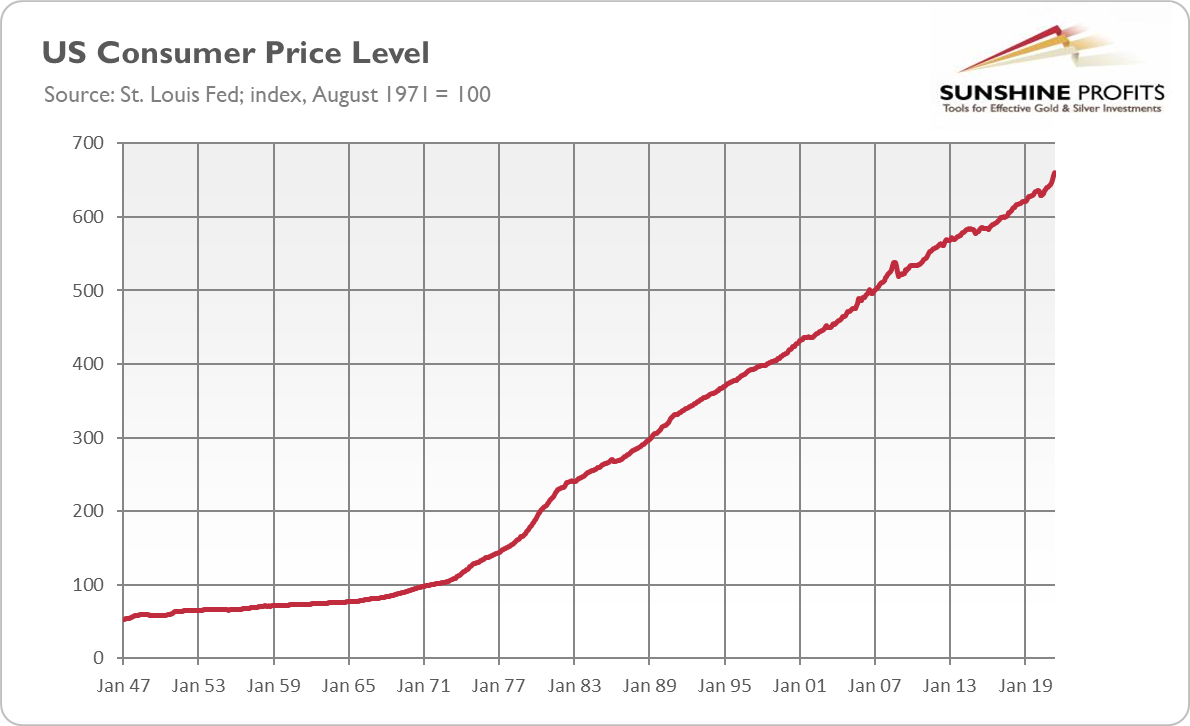

Do you sometimes ask yourself when this will all end? I don’t mean the universe, nor our lives, nor even this year (c’mon, guys, it has just started!). I mean, of course, inflation. If only you weren’t in a coma last year, you would have probably noticed that prices had been surging recently. For instance, America finished the year with a shocking CPI annual rate of 7.1%, the highest since June 1982, as the chart below shows.

Now, the key question is how much higher inflation could rise, or how persistent it could be. The consensus is that we will see a peak this year and subsequent cooling down, but to still elevated levels. This is the view I also hold. However, would I bet my collection of precious metals on it? I don’t know, as inflation could surprise us again, just as it did to most of the economists (but not me) last year. The risk is clearly to the upside.

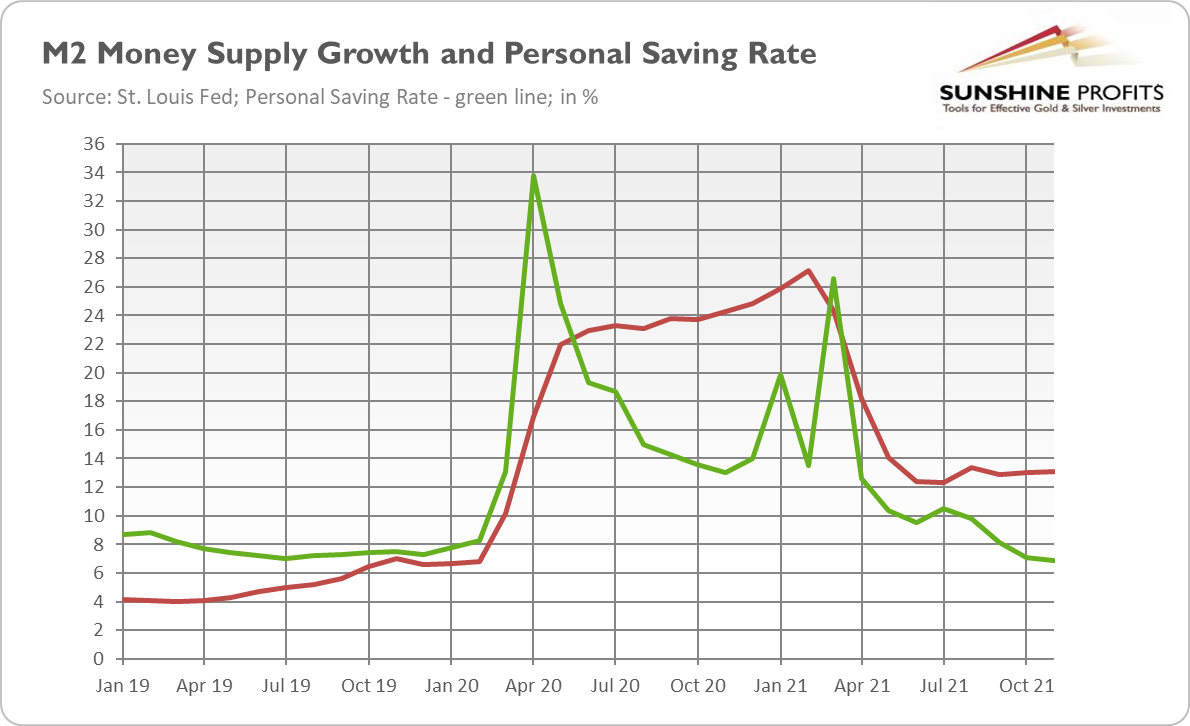

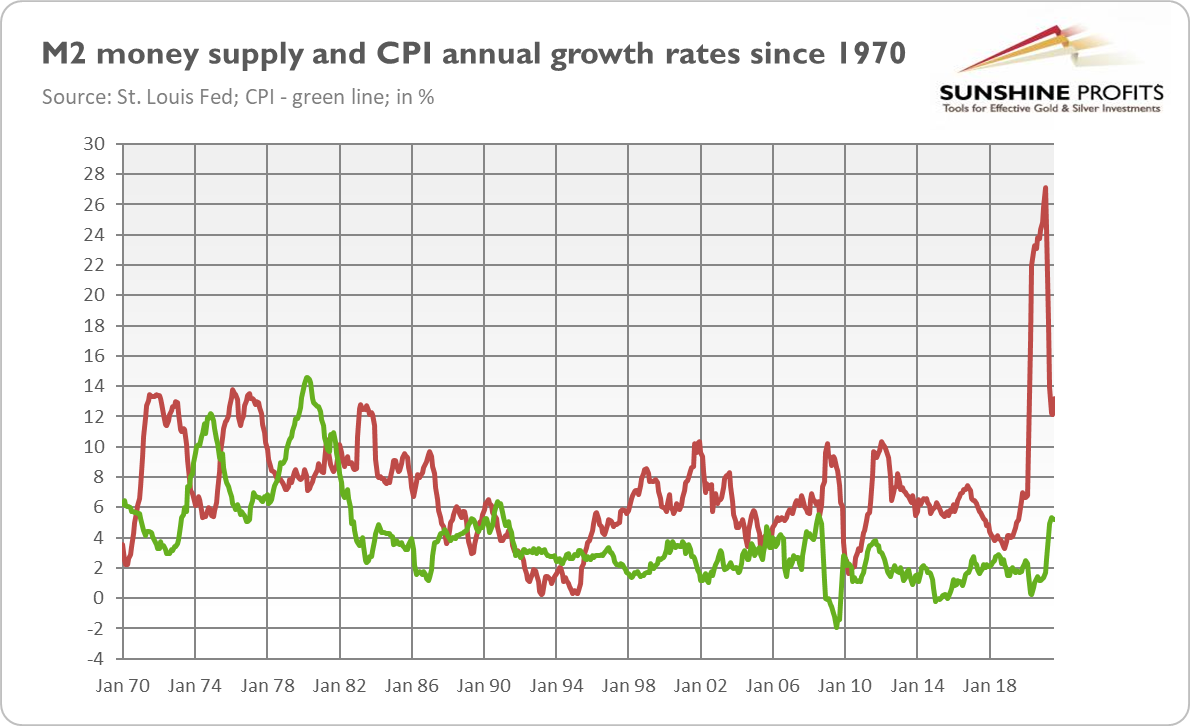

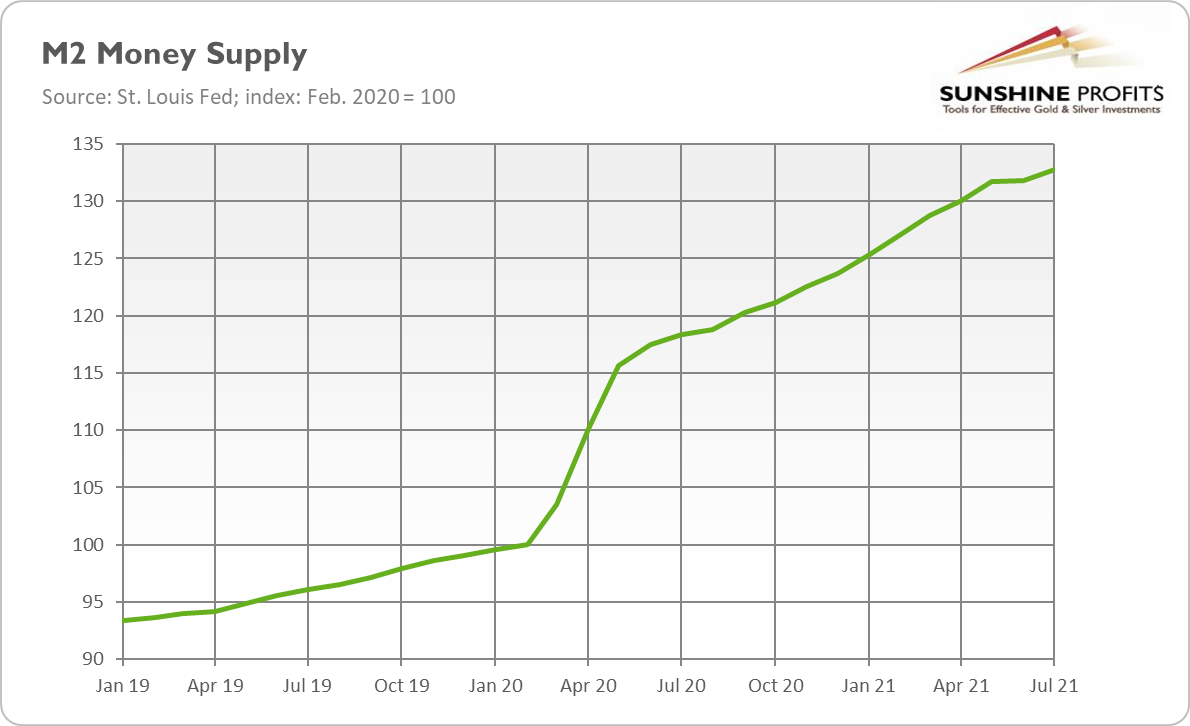

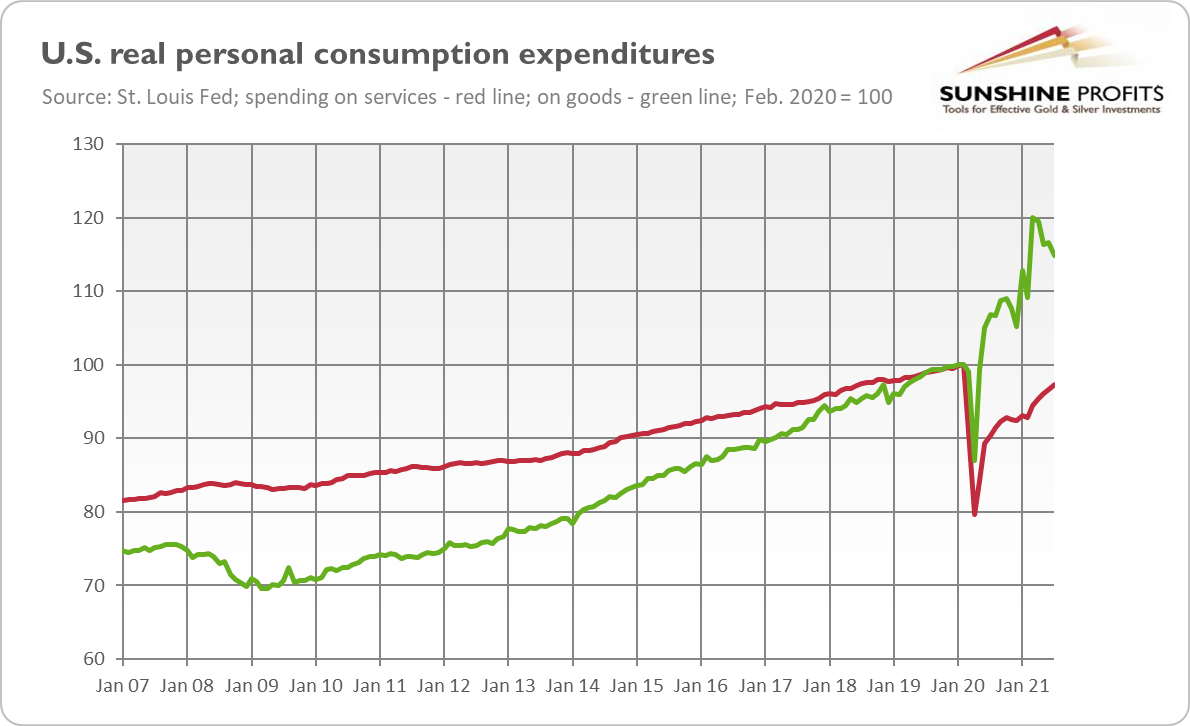

As always in economics, it’s a matter of supply and demand. There is even a joke that all you need to turn a parrot into an economist is to teach it to say ‘supply’ and ‘demand’. Funny, huh? When it comes to the demand side, both the money supply growth and the evolution of personal saving rate implies some cooling down of inflation rate.

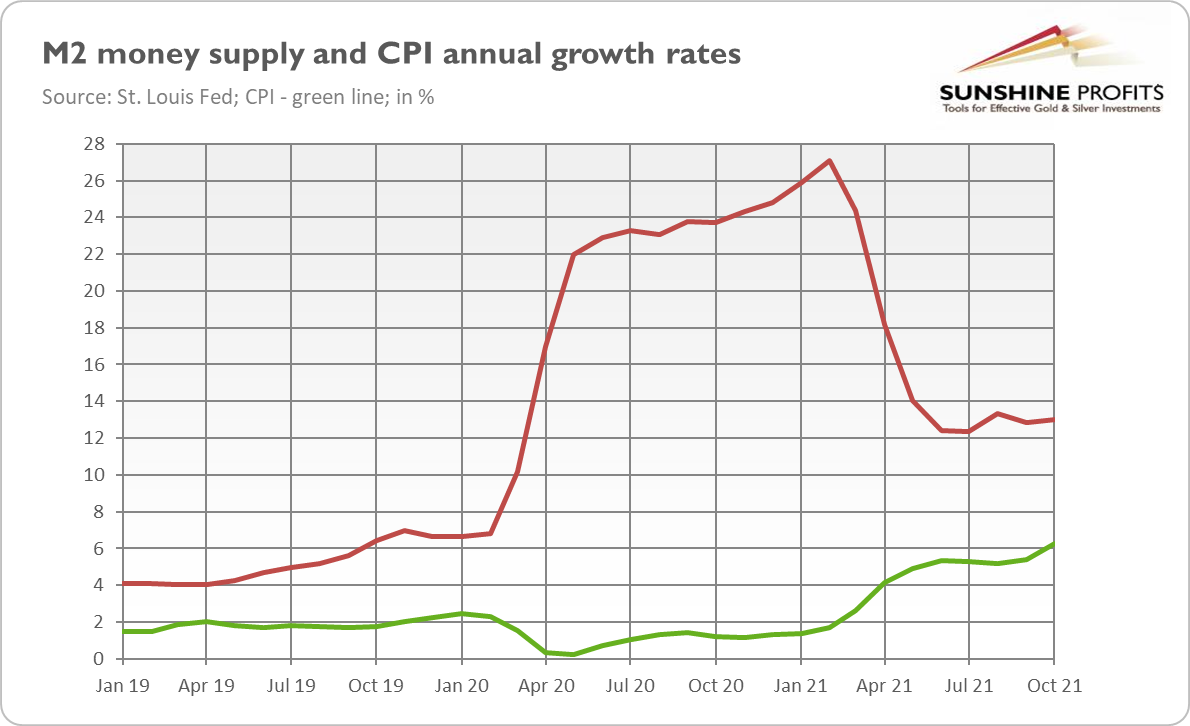

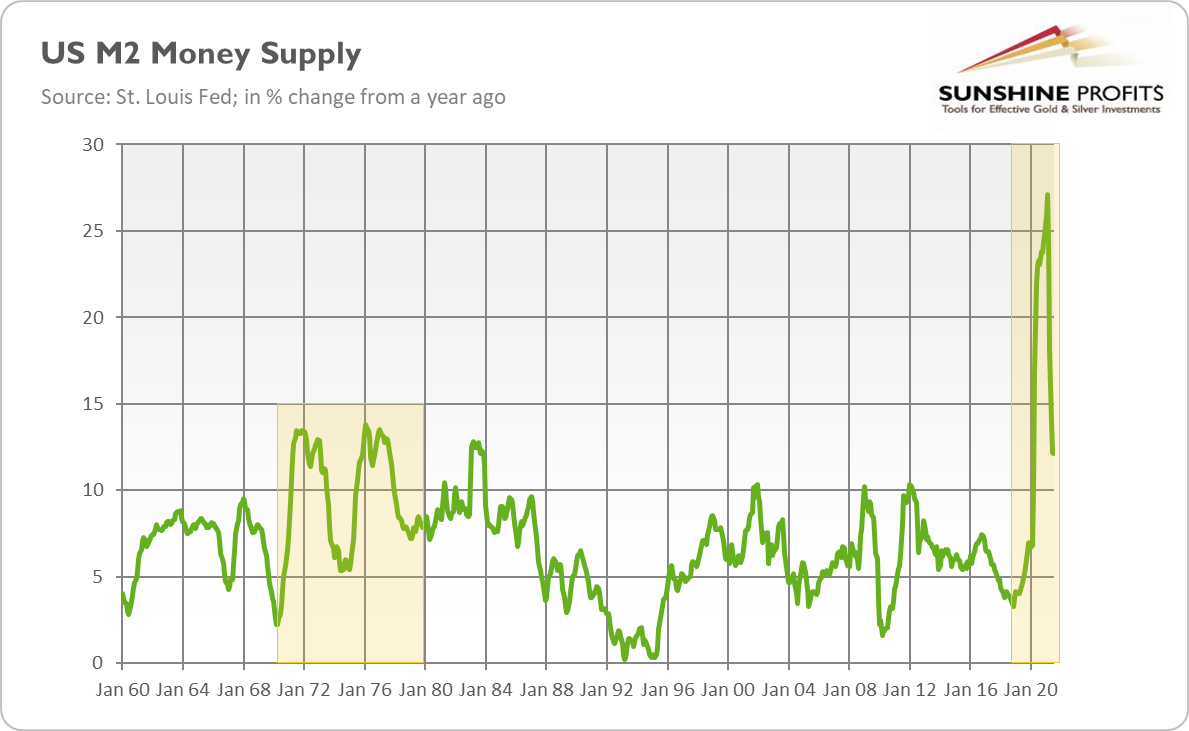

Please take a look at the chart below. As you can see, the broad money supply peaked in February 2021. Assuming a one-year lag between the money supply and price level, inflation rate should reach its peak somewhere in the first quarter of this year.

There is one important caveat here: the pace of money supply growth has not returned to the pre-pandemic level, but it stabilized at about 13%, double the rate seen at the end of 2019. Inflation was then more or less at the Fed’s target of 2%, so without constraining money supply growth, the US central bank couldn’t beat inflation.

As the chart above also shows, the personal saving rate has returned to the pre-pandemic level of 7-8%. It means that the bulk of pent-up demand has already materialized, which should also help to ease inflation in the future. However, not all of the ‘forced savings’ have already entered the market. Thus, personal consumption expenditures are likely to be elevated for some time, contributing to boosted inflation.

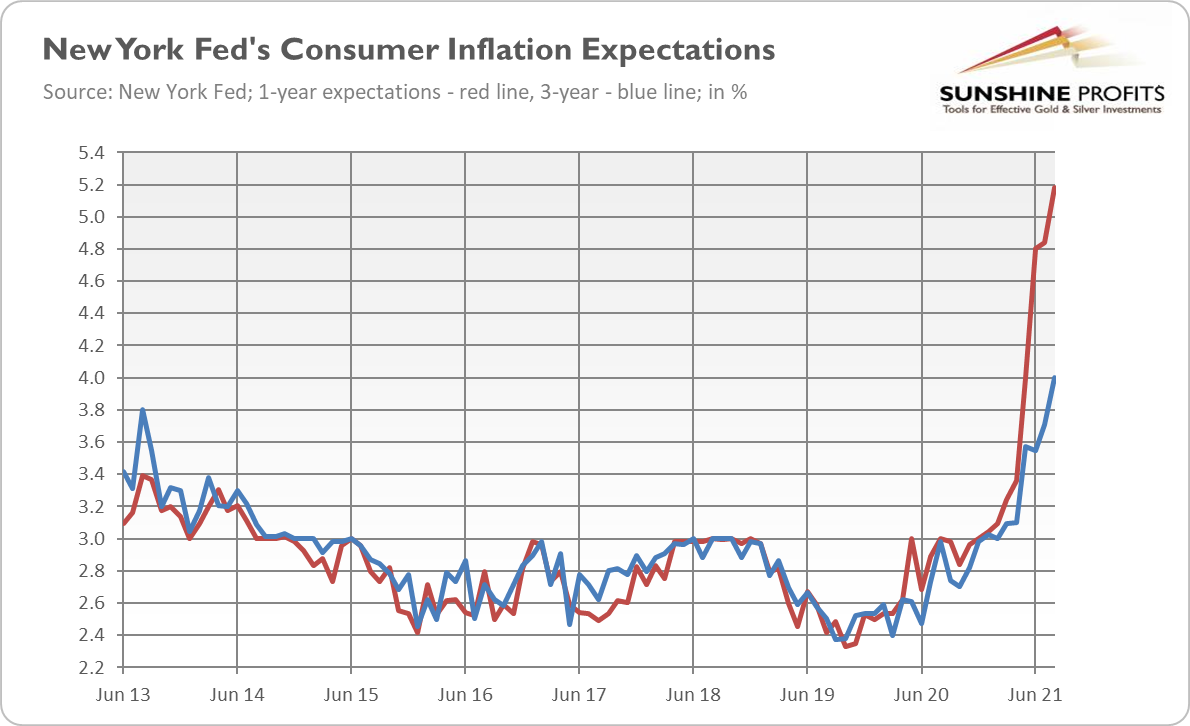

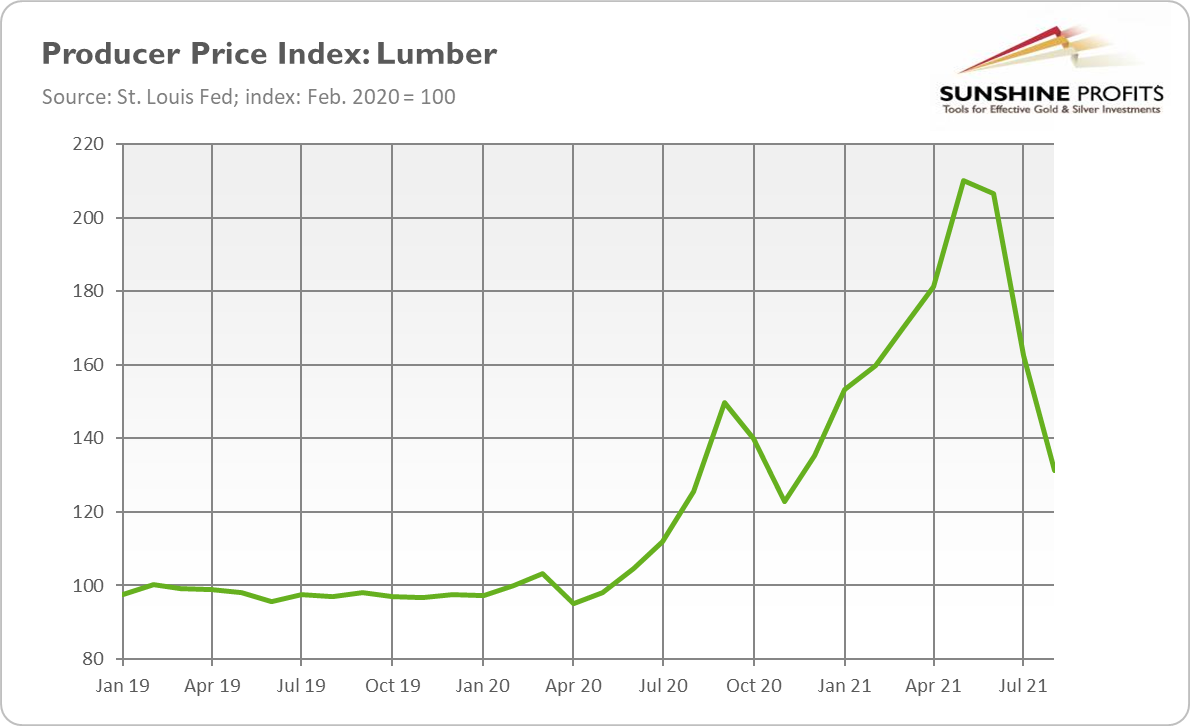

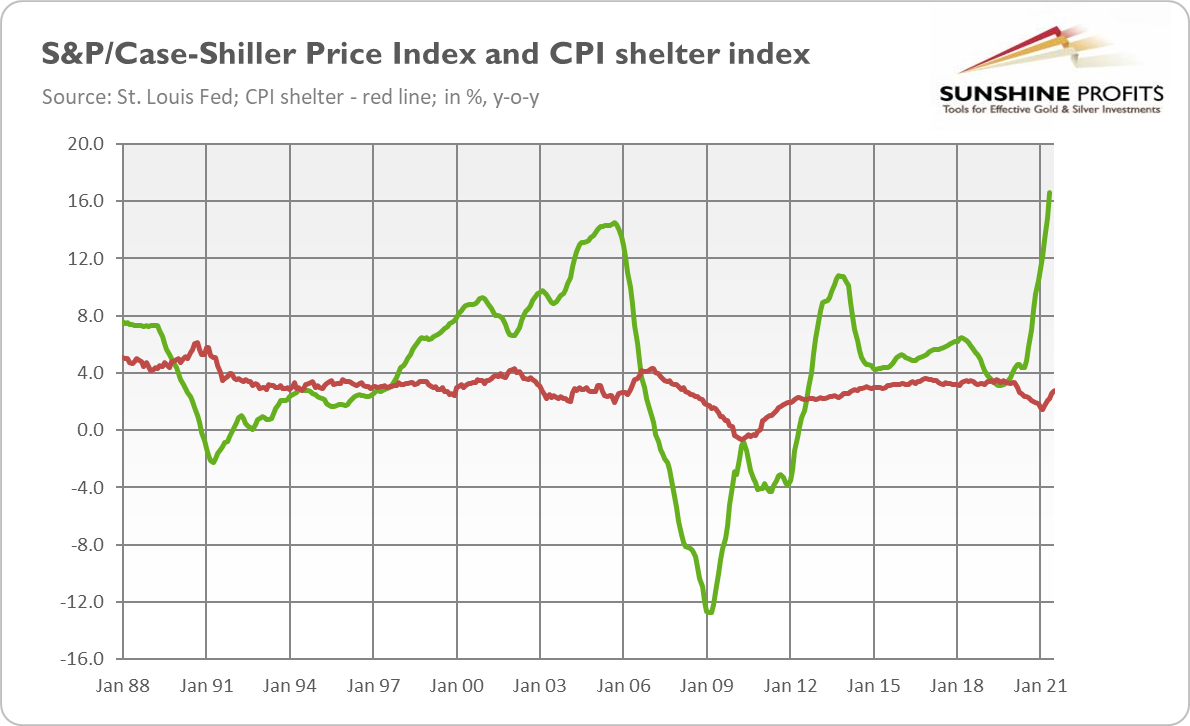

Regarding supply factors, although some bottlenecks have eased, the disruptions have not been fully resolved. The spread of the Omicron variant of the coronavirus and regional lockdowns in China could prolong the imbalances between booming demand and constrained supply. Other contributors to high inflation are rising producer prices, increasing house prices and rents, strong inflation expectations (see the chart below), and labor shortages combined with fast wage growth.

The bottom line is that, all things considered – in particular high level of demand, continued supply issues, and de-anchored inflation expectations – I forecast another year of elevated inflation, but probably not as high as in 2021. After reaching a peak in a few months, the inflation rate could ease to, let’s say, around 4% in December, if we are lucky. Importantly, the moderate bond yields also suggest that inflation will ease somewhat later in 2022.

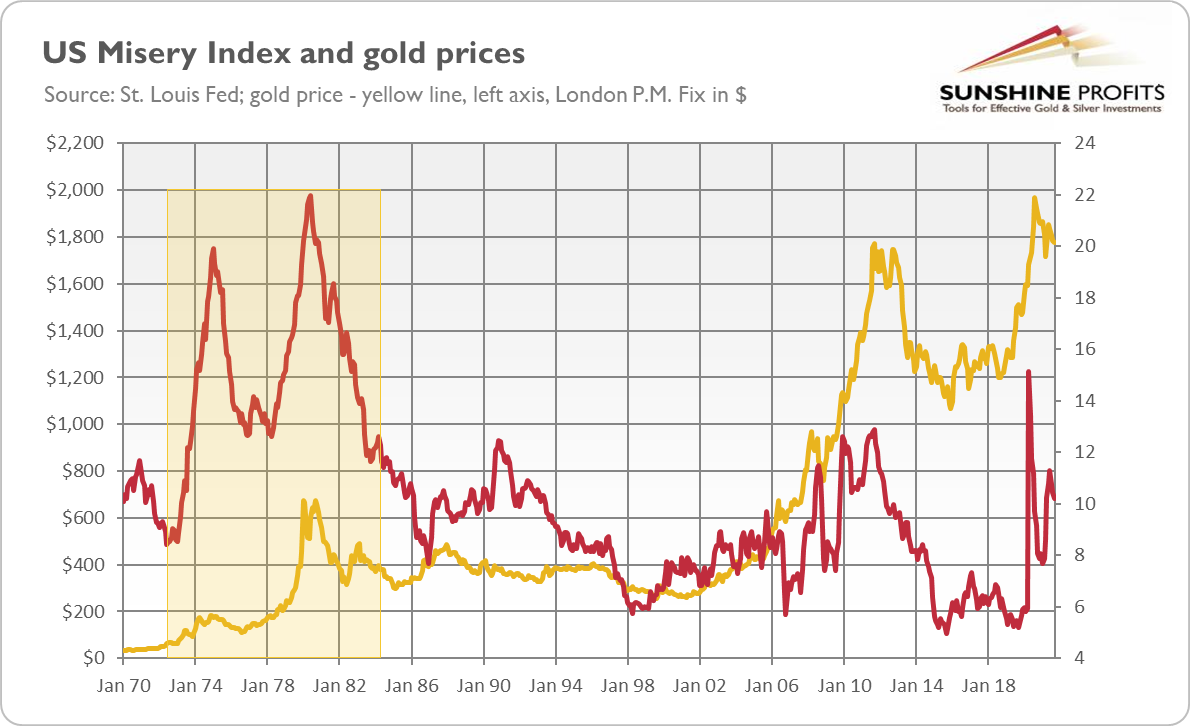

What does it mean for the gold market? Well, I don’t have good news for the gold bulls. Gold loves high and accelerating inflation the most. Indeed, as the chart below shows, gold peaks coincided historically with inflation heights. The most famous example is the inflation peak in early 1980, when gold ended its impressive rally and entered into a long bearish trend. The 2011 top also happened around the local inflationary peak.

The only exception was the 2005 peak in inflation, when gold didn’t care and continued its bullish trend. However, this was partially possible thanks to the decline in the US dollar, which seems unlikely to repeat in the current macroeconomic environment, in which the Fed is clearly more hawkish than the ECB or other major central banks. The relatively strong greenback won’t help gold shine.

Surely, disinflation may turn out to be transitory and inflation may increase again several months later. Lower inflation implies a less aggressive Fed, which should be supportive of gold prices. However, investors should remember that the US central bank will normalize its monetary policy no matter the inflation rate. Since the Great Recession, inflation has been moderate, but the Fed has tightened its stance eventually, nevertheless. Hence, gold may experience a harsh moment when inflation peaks.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the February Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

New Geopolitical Threats for 2022: Is Gold in Danger Too?

February 11, 2022, 11:56 AMAs in previous years, geopolitical tensions are likely to have an impact on the markets in 2022. As a “safe haven”, gold probably won’t be omitted.

Do you have déjà vu? I’m only experiencing one. As you probably remember, January 2020 was a period of vivid geopolitical risks, such as the U.S.-Iran conflict and the North Korea problem. Antonio Guterres, Secretary-General of the United Nations, described these tensions as the highest since 2017. Now, in 2022, here we are again - we have great geopolitical threats ahead of us.

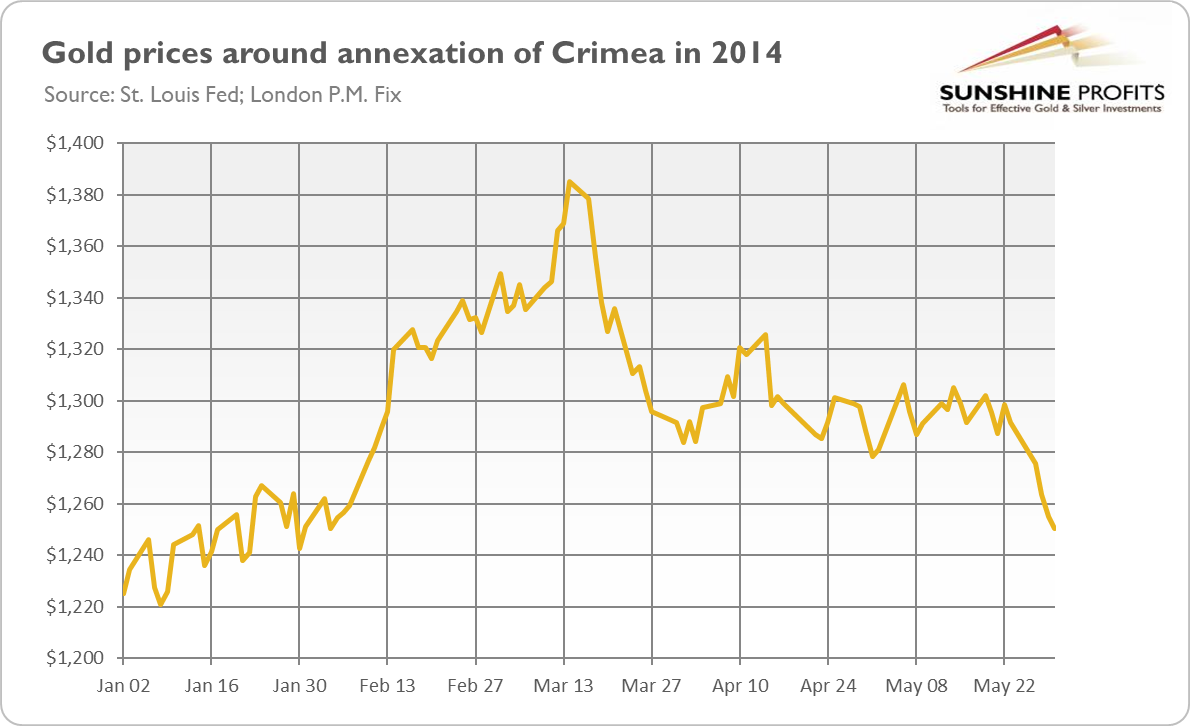

Everyone knows about the renewed tensions between Russia and Ukraine. The former country amassed more than 100,000 troops and military equipment near the border by December 2021, which represents the highest force mobilization since the annexation of Crimea in 2014. In response, NATO sent ships and fighter jets to Eastern Europe and put forces on standby. The risk of Russian invasion and military conflict (which could trigger a response by the US and NATO) worried investors, which possibly spurred some safe-haven demand for gold.

However, the support for the yellow metal may at be short-lived. As the chart below shows, gold soared in February-March 2014, when the annexation of Crimea took place. Its rally started in early February (other factors were also in play then), much before the Crimean crisis, and it quickly ended in mid-March. Gold returned to its long-term bearish trend.

Of course, this time may be different, especially since the West seems to be more ready to help Ukraine than in 2014. However, close economic ties between Germany and Russia make it difficult to achieve unity, and I suspect that the West won’t fight for Ukraine to the last drop of blood (especially given that the country is not even in NATO). Some countries have already started the evacuation of their embassies in Kiev, the Ukrainian capital, which tells us something. However, the marginally higher risk of US military involvement should be more supportive of gold prices, although I wouldn’t buy gold driven solely by the risk of conflict.

The second major conflict that glows in the background is the risk of a potential Chinese invasion of Taiwan. Last year, tensions between China and the island escalated and some experts say that military execution of the “One China” policy is only a matter of time. Taiwan was always a thorn in China’s side, but the country was too weak to do anything about it. However, China’s military power has radically expanded over recent years.

Such a conflict could also temporarily support gold prices, especially since Taiwan has a military alliance with the US and the Pacific crisis could aggravate supply chain disruptions. Another potentially bullish factor could be the lack of any recent track record of China’s military actions and, thus, greater uncertainty compared to the long history of Russia’s military operations and of good old America’s conflicts with the Soviet Union.

Third, there might be an important cyberattack. I know, it sounds almost cliché, as everyone points to this risk. However, after the pandemic, this is one of the greatest threats, according to many experts. This year, we have already seen a cyberattack on Ukrainian government websites as well as a cyber incident that affected Canada’s foreign ministry. Let’s also not forget about Kazakhstan, where the government shut off the internet nationwide in response to civil unrest seen last month.

The last event is more an example of digital authoritarianism rather than a cyberattack, but the result is the same: digital paralysis with huge implications for people’s daily lives. Indeed, guess what happens when people don’t have access to the internet. Yes, they can’t’ check social media for the newest memes with funny puppies, but that’s not the greatest problem (really!). One of the most ominous results is that people don’t have access to their digital bank accounts, i.e., most of their money, which is nowadays generally in electronic form.

This is why it’s smart to do some preparations for worst-case scenarios and always have some cash on hand – and perhaps also some gold bullion, although I suspect that it would be easier to buy groceries with fiat currencies. This is also why cryptocurrencies will probably never replace gold. In our highly digital world, it’s good to hold onto something tangible.

Of course, geopolitical threats are more numerous. I’ve not mentioned Iran’s nuclear advances, the flexing of North Korea’s military muscle, the more virulent, deadly, and vaccine-resistant mutation of the coronavirus (oh boy, that sounds really great, doesn’t it?), the U.S. mid-term elections, environmental risks, mass migration, etc. One thing is certain: geopolitical tensions have intensified recently.

As a safe-haven asset, the yellow metal tends to thrive in periods of high uncertainty. However, geopolitical events usually trigger only short-lived reactions in the precious metals markets, especially if they don’t threaten the United States and its economy directly. This is because all tensions eventually ease, and all conflicts are followed by some kind of settlements. When this happens, there is a sigh of relief, and the upbeat prices of safe havens, including gold, undergo a correction.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the February Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will the Fed Tighten Gold? The Consequences Might Be Ignoble

February 4, 2022, 8:11 AMBeware, the Fed’s tightening of monetary policy could lift real interest rates! For gold, this poses a risk of prices wildly rolling down.

The first FOMC meeting in 2022 is behind us. What can we expect from the US central bank this year and how will it affect the price of gold? Well, this year’s episode of Fed Street will be sponsored by the letter “T”, which stands for “tightening”. It will consist of three elements.

First, quantitative easing tapering. The asset purchases are going to end by early March. To be clear, during tapering, the Fed is still buying securities, so it remains accommodative, but less and less. Tapering has been very gradual and well-telegraphed to the markets, so it’s probably already priced in gold. Thus, the infamous taper tantrum shouldn’t replay.

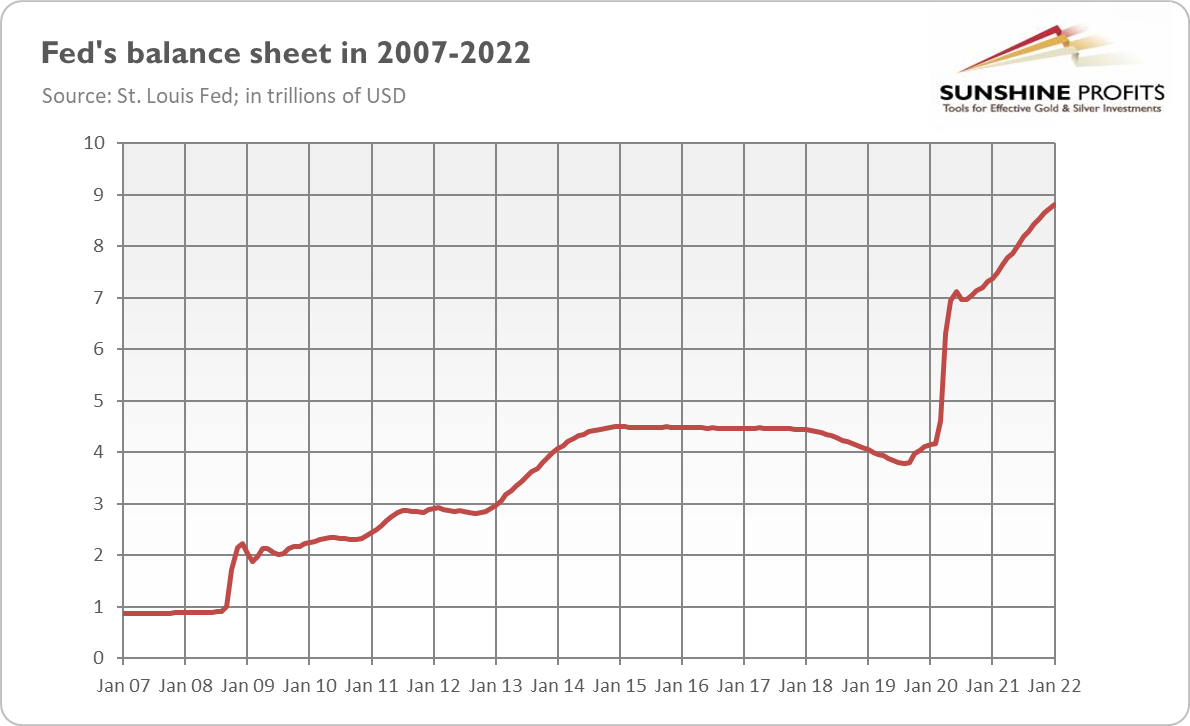

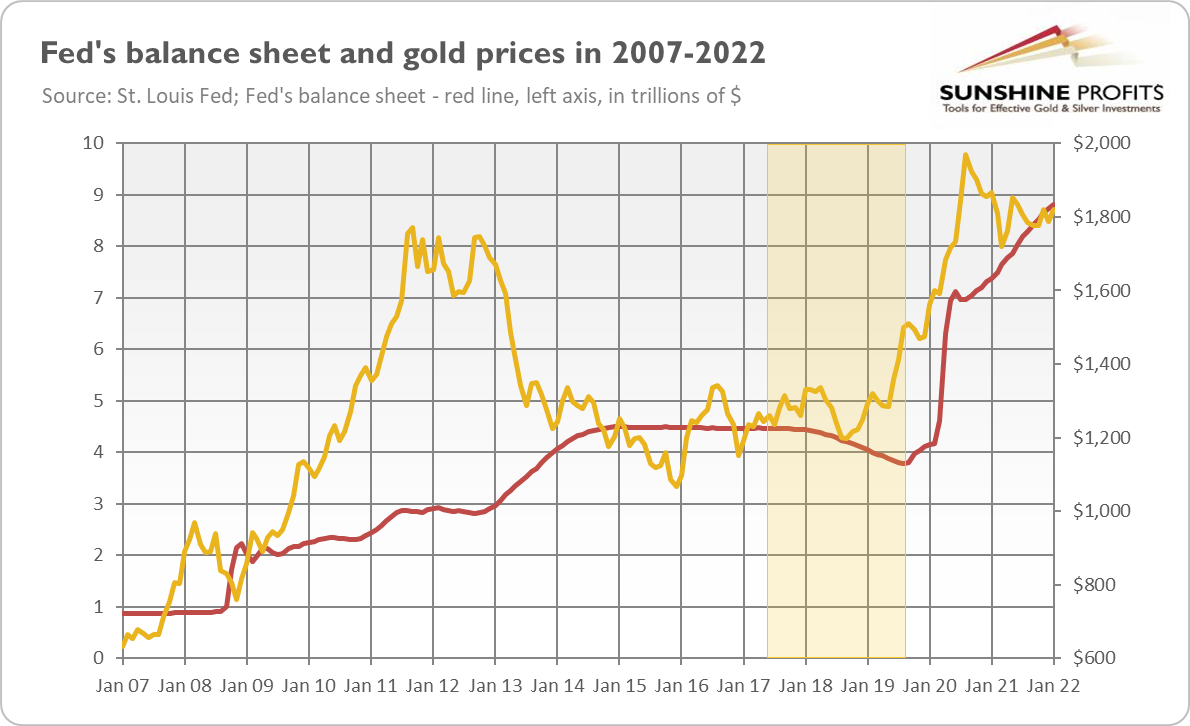

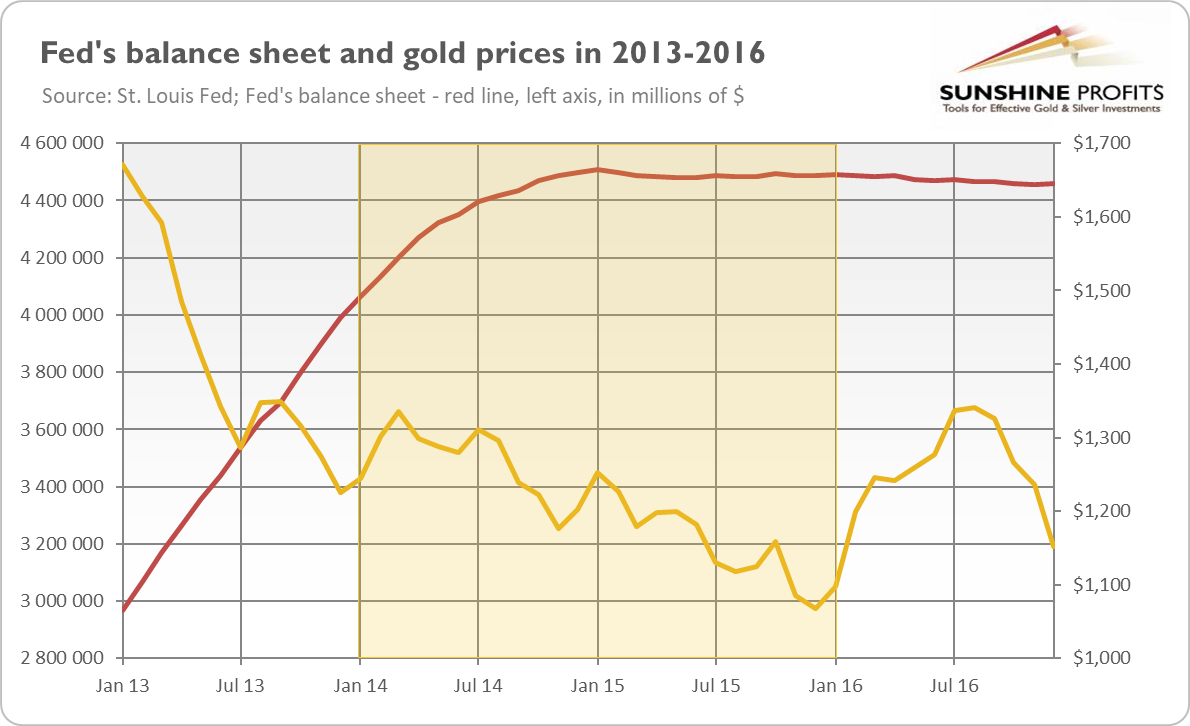

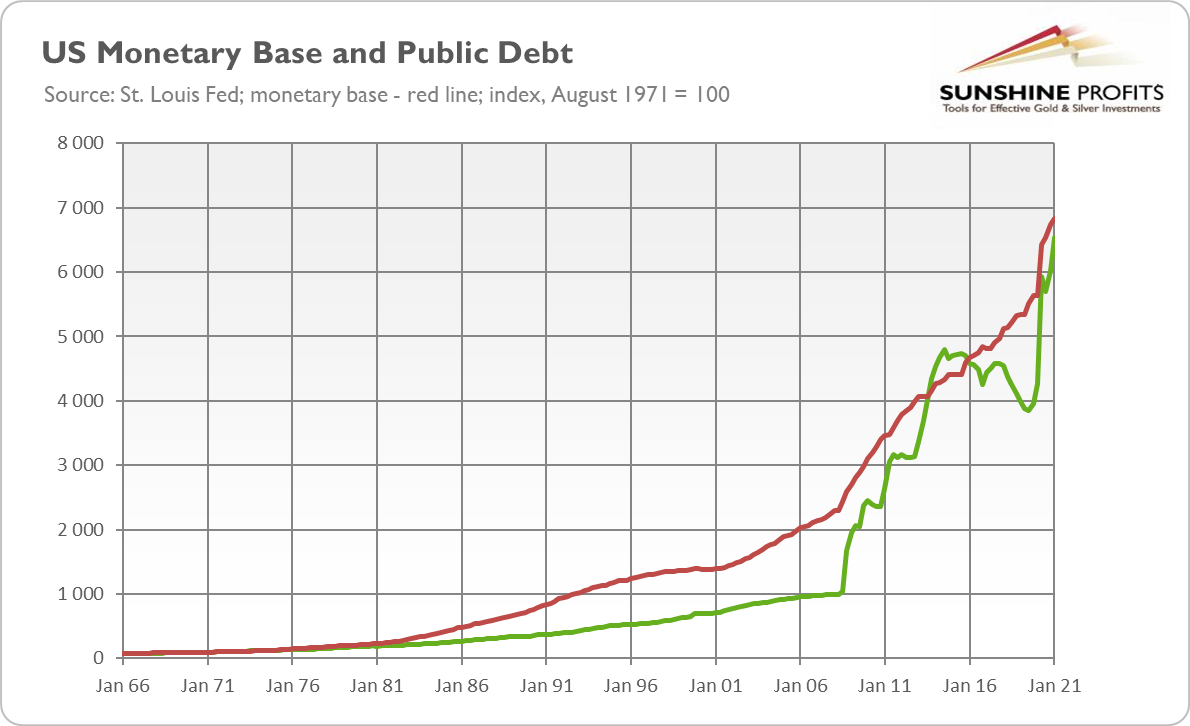

Second, quantitative tightening. Soon after the end of asset purchases, the Fed will begin shrinking its mammoth balance sheet. As the chart below shows, it has more than doubled since the start of the pandemic, reaching about $9 trillion, or about 36% of the country’s GDP. It’s so gigantic that even Powell admitted during his January press conference that “the balance sheet is substantially larger than it needs to be.” Captain Obvious attacked again!

In contrast to tapering, which just reduces additions to the Fed’s holdings, quantitative tightening will shrink the balance sheet. How much? It’s hard to say. Last time, during QT from 2017 to 2019, the Fed started unloading $10 billion in assets per month, gradually lifting the cap to $50 billion.

Given that inflation is now much higher, and the Fed has greater confidence in the economic recovery, the scale of reduction would probably be higher. The QT will create upward pressure on interest rates, which could be negative for the gold market.

However, QT will be a very gradual and orderly process. Instead of selling assets directly, the US central bank will stop reinvestment of proceeds as securities run off. As we can read in “Principles for Reducing the Size of the Federal Reserve's Balance Sheet”,

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account.

What’s more, the previous case of QT wasn’t detrimental to gold, as the chart below shows. The price of gold started to rally in late 2018 and especially later in mid-2019.

Third, the hiking cycle. In March, the Fed is going to start increasing the federal funds rate. According to the financial markets, the US central bank will enact five interest rate hikes this year, raising the federal funds rate to the range of 1.25-1.50%.

Now, there are two narratives about American monetary policy in 2022. According to the first, we are witnessing a hawkish revolution within the Fed, as it would shift its monetary stance in a relatively short time. The central bank will “double tighten” (i.e., it will shrink its balance sheet at the same time as hiking rates), and it will do it in a much more aggressive way than after the Great Recession. Such decisive moves will significantly raise the bond yields, which will hit gold prices. However, in this scenario, the Fed’s aggressive actions will eventually lead to the inversion of the yield curve and later to recession, which should support the precious metals market.

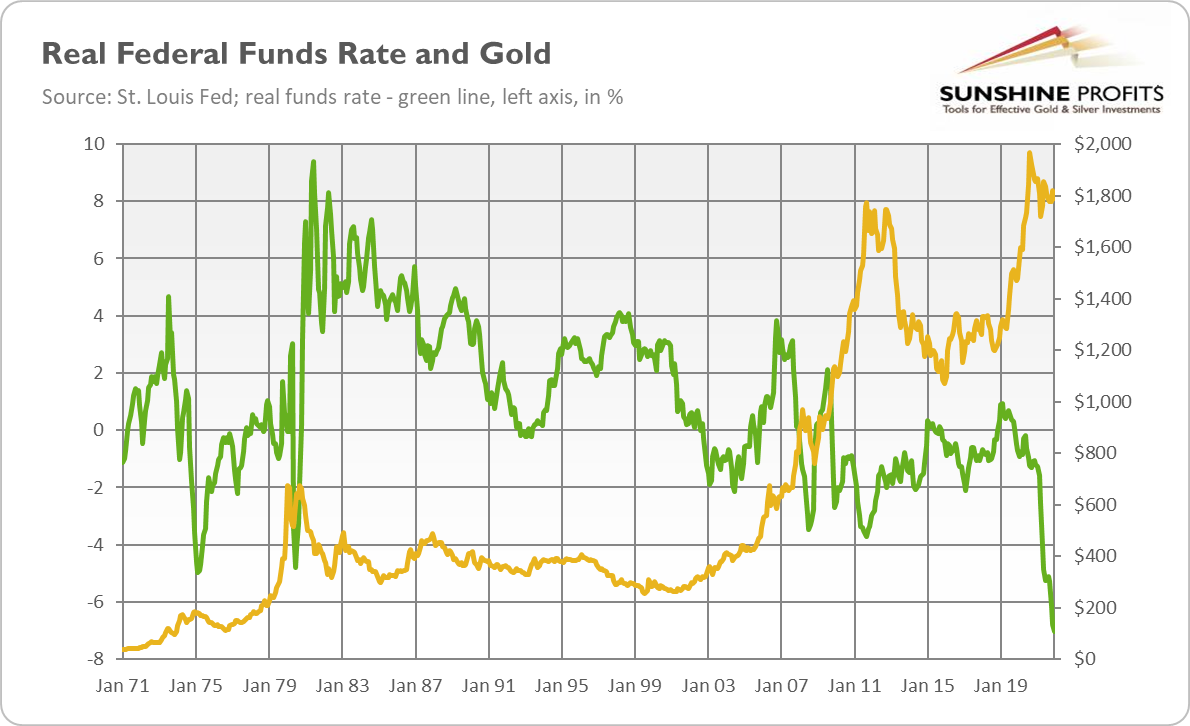

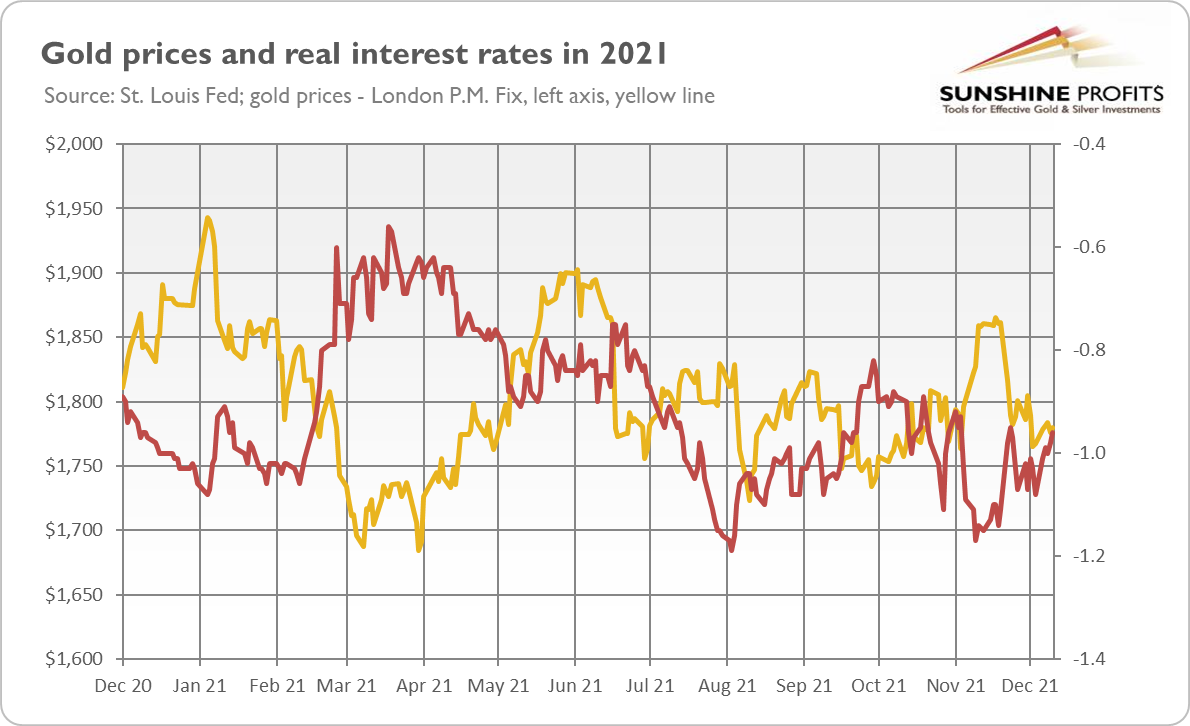

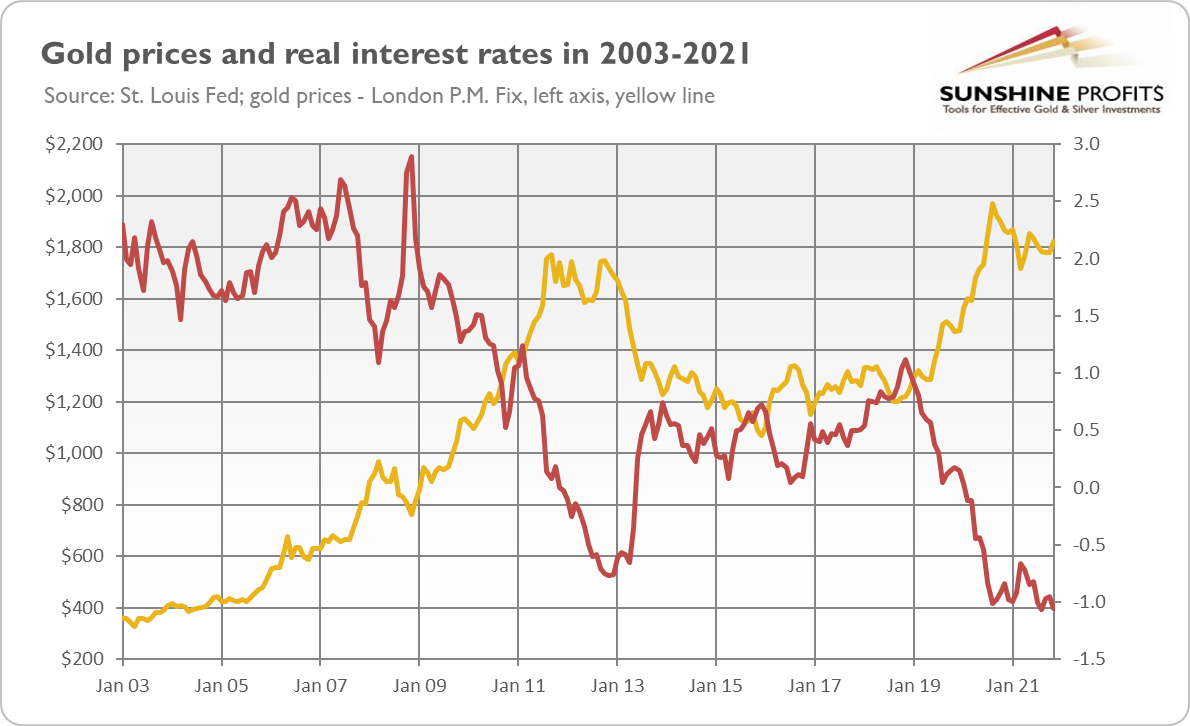

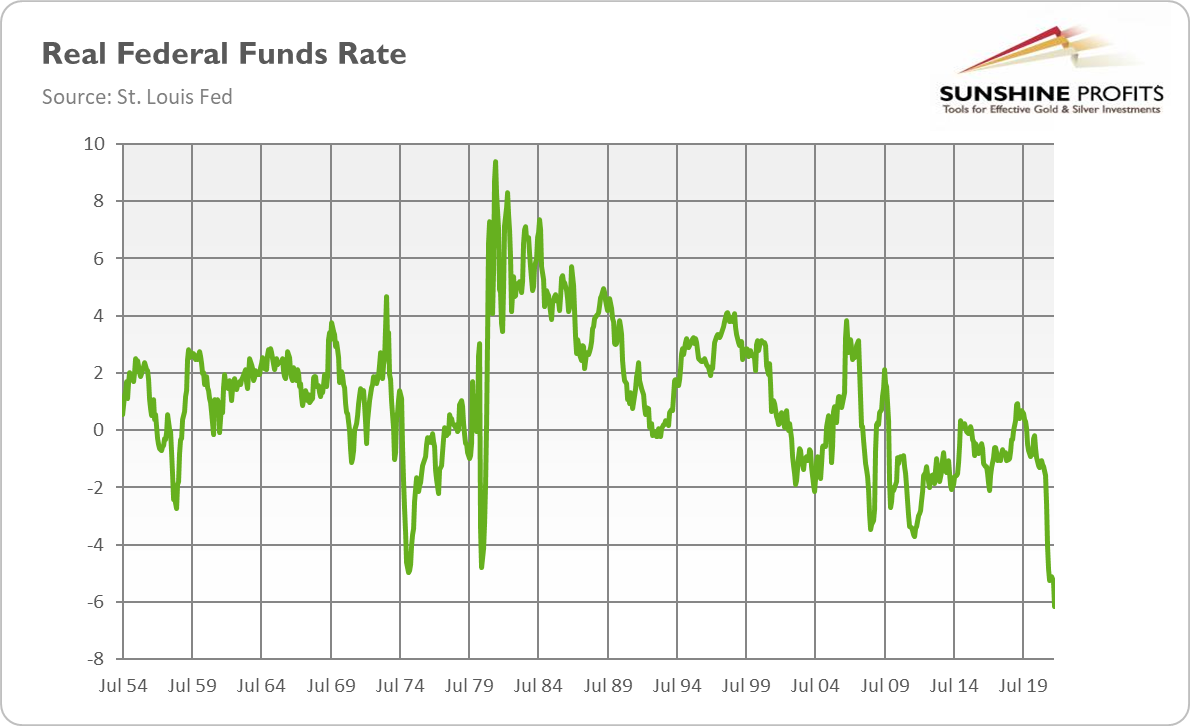

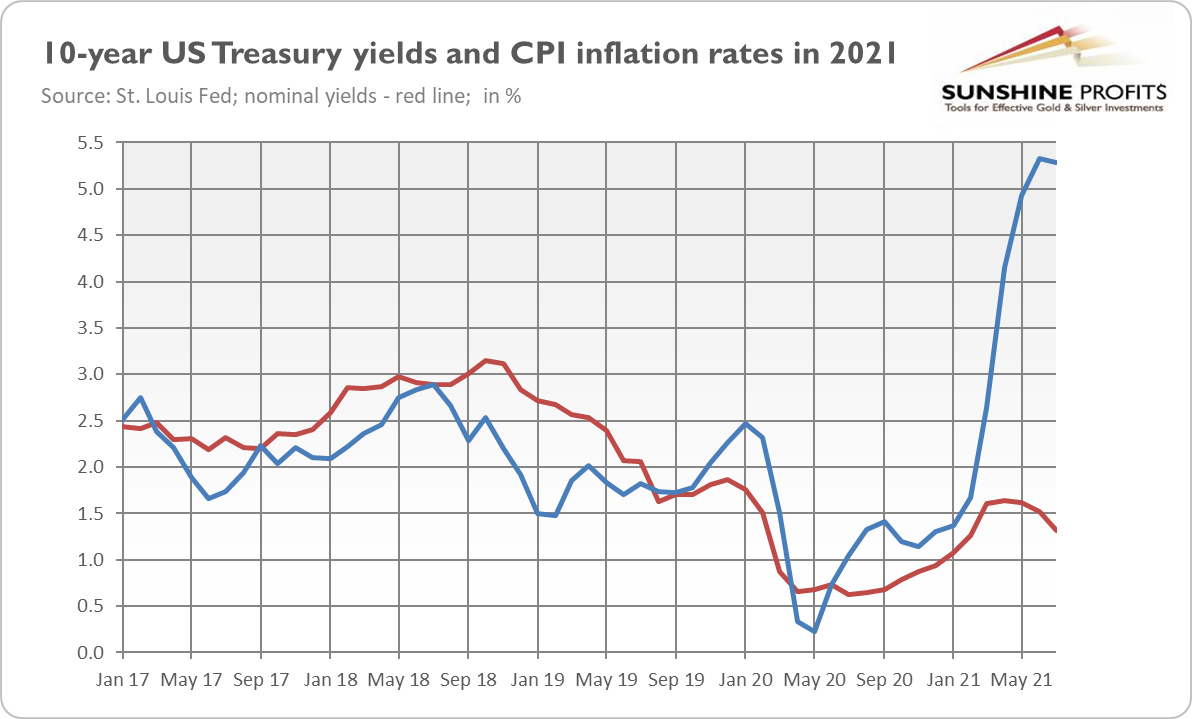

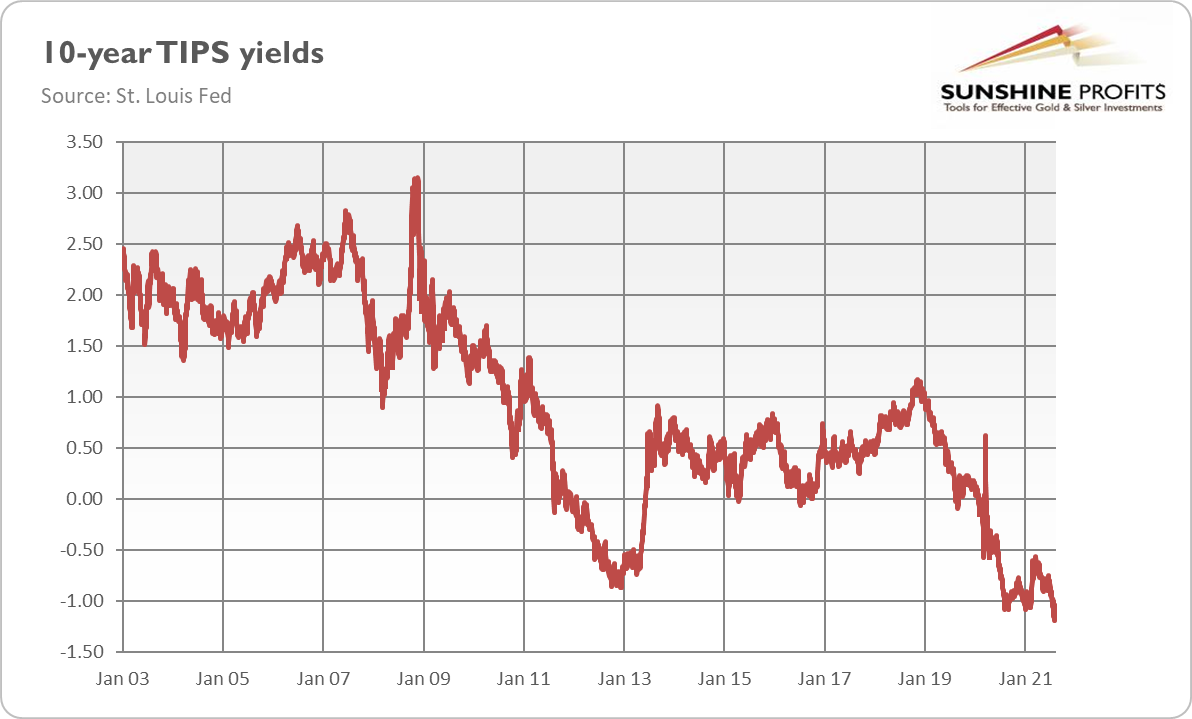

On the other hand, some analysts point out that central bankers are all talk and – given their dovish bias – act less aggressively than they promise, chickening out in the face of the first stock market turbulence. They also claim that all the Fed’s actions won’t be enough to combat inflation and that monetary conditions will remain relatively loose. For example, Stephen Roach argues that “the Fed is so far behind [the curve] that it can’t even see the curve.” Indeed, the real federal funds rate is deeply negative (around -7%), as the chart below shows; and even if inflation moderates to 3.5% while the Fed conducts four hikes, it will remain well below zero (about -2%), providing some support for gold prices.

Which narrative is correct? Well, there are grains of truth in both of them. However, I would like to remind you that what really matters for the markets is the change or direction, not the level of a variable. Hence, the fact that real interest rates are to stay extremely low doesn’t guarantee that gold prices won’t decline in a response to the hiking cycle.

Actually, as the chart above shows, the upward reversal in the real interest rates usually plunges gold prices. Given that real rates are at a record low, a normalization is still ahead of us. Hence, unless inflation continues to rise, bond yields are likely to move up, while gold – to move down.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the February Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold in 2022: Between Inflationary Rock and Hard Fed

January 28, 2022, 4:09 AMGold’s fate in 2021 will be determined mainly by inflation and the Fed’s reaction to it.

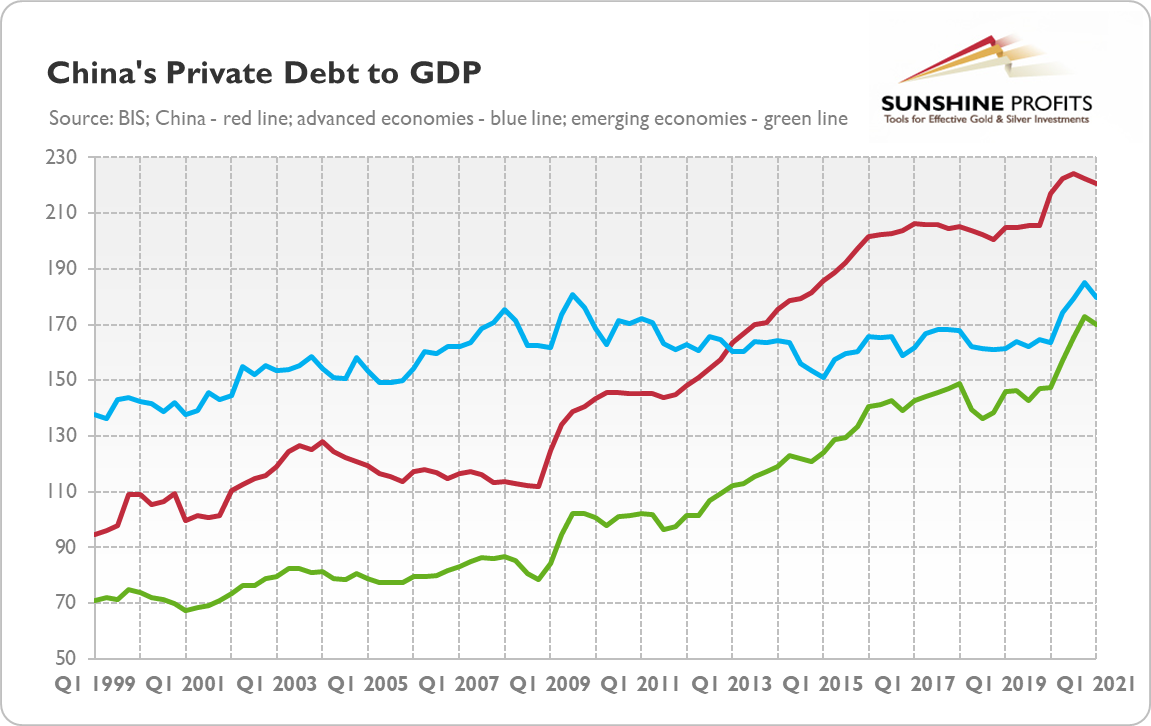

In the epic struggle between chaos and order, chaos has an easier task, as there is usually only one proper method to do a job – the job that you can screw up in many ways. Thus, although economists see a strong economic expansion with cooling prices and normalization in monetary policies in 2022, many things could go wrong. The Omicron strain of coronavirus or its new variants could become more contagious and deadly, pushing the world into the Great Lockdown again. The real estate crisis in China could lead the country into recession, with serious economic consequences for the global economy. Oh, by the way, we could see an escalation between China and Taiwan, or between China and the US, especially after the recent test of hypersonic missiles by the former country.

Having said that, I believe that the major forces affecting the gold market in 2022 will be – similarly to last year’s – inflation and the Fed’s response to it. Considering things in isolation, high inflation should be supportive of gold prices. The problem here is that gold prefers high and rising inflation. Although the inflation rate should continue its upward move for a while, it’s likely to peak this year.

Indeed, based on very simple monetarist reasoning, I expect the peak to be somewhere in the first quarter of 2022. This is because the lag between the acceleration in money supply growth (March 2020) and CPI growth (March 2021) was a year. The peak in the former occurred in February 2021, as the chart below shows. You can do the math (by the way, this is the exercise that turned out to be too difficult for Jerome Powell and his “smart” colleagues from the Fed).

This is – as I’ve said – very uncomplicated thinking that assumes the stability of the lag between monetary impulses and price reactions. However, given the Fed’s passive reaction to inflation and the fact that the pace of money supply growth didn’t return to the pre-pandemic level, but stayed at twice as high, the peak in inflation may occur later.

In other words, more persistent inflation is the major risk for the economy that many economists still downplay. The consensus expectation is that inflation returns to a level close to the Fed’s target by the end of the year. For 2021, the forecasts were similar. Instead, inflation has risen to about 7%. Thus, never underestimate the power of the inflation dragon, especially if the beast is left unchecked! As everyone knows, dragons love gold – and this feeling is mutual.

The Saxo Bank, in its annual “Outrageous Predictions”, sees the potential for US consumer prices to rise 15% in 2022, as “companies bid up wages in an effort to find willing and qualified workers, triggering a wage-price spiral unlike anything seen since the 1970’s”. Actually, given the fact that millions of Americans left the labor market – which the Fed doesn’t understand and still expects that they will come back – this prediction is not as extreme as one could expect. I still hope that inflationary pressure will moderate this year, but I’m afraid that the fall may not be substantial.

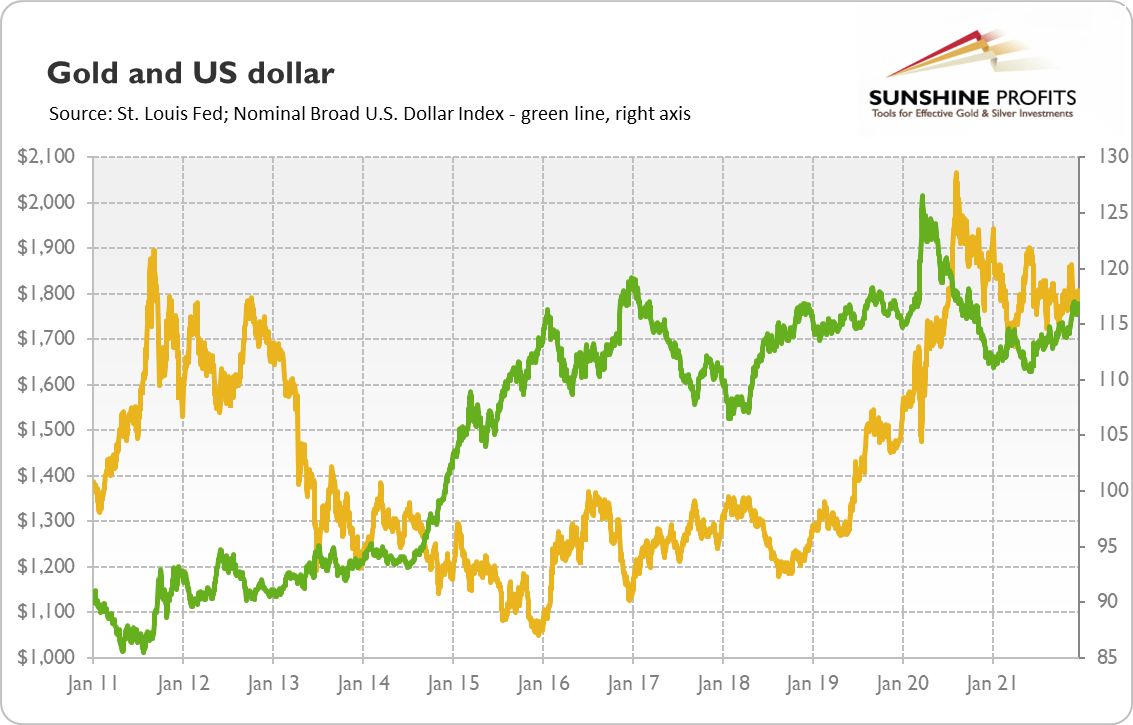

On the other hand, we have the Fed with its hawkish rhetoric and tapering of quantitative easing. The US central bank is expected to start a tightening cycle, hiking the federal funds rate at least twice this year. It doesn’t sound good for gold, does it? A hawkish Fed implies a stronger greenback and rising real interest rates, which is negative for the yellow metal. As the chart below shows, the normalization of monetary policy after the Great Recession, with the infamous “taper tantrum”, was very supportive of the US dollar but lethal for gold.

However, the price of gold bottomed in December 2015, exactly when the Fed hiked the interest rates for the first time after the global financial crisis. Markets are always future-oriented, so they often react more to expected rather than actual events. Another thing is that the Fed’s tightening cycle of 2015-2018 was dovish and the federal funds rate (and the Fed’s balance sheet) never returned to pre-crisis levels. The same applies to the current situation: despite all the hawkish reactions, the Fed is terribly behind the curve.

Last but not least, history teaches us that a tightening Fed spells trouble for markets. As a reminder, the last tightening cycle led to the reversal of the yield curve in 2019 and the repo crisis, which forced the US central bank to cut interest rates, even before anyone has heard of covid-19. Hence, the Fed is in a very difficult situation. It either stays behind the curve, which risks letting inflation get out of control, or tightens its monetary policy in a decisive manner, just like Paul Volcker did in the 1980s, which risks a correction of already-elevated asset prices and the next economic crisis. Such expectations have boosted gold prices since December 2015, and they could support the yellow metal today as well.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the January Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Slides and Rebounds in 2022

January 21, 2022, 6:14 PMMy outlook for the gold market in 2022 suffers from manic depression: I see first a period of despair and an elevated mood later.

So, 2021 is over! 2022 will be better, right? Yeah, for sure! Just relax, what bad could happen?

Seriously, what can we expect from this year? I see a few key trends that are going to shape 2022, and their names are: Death, Famine, Pestilence, and War. Oh, sorry, the wrong list! At least I hope so… I meant, of course: economic recovery, inflation, and the Fed’s tightening cycle. Let’s examine them in detail.

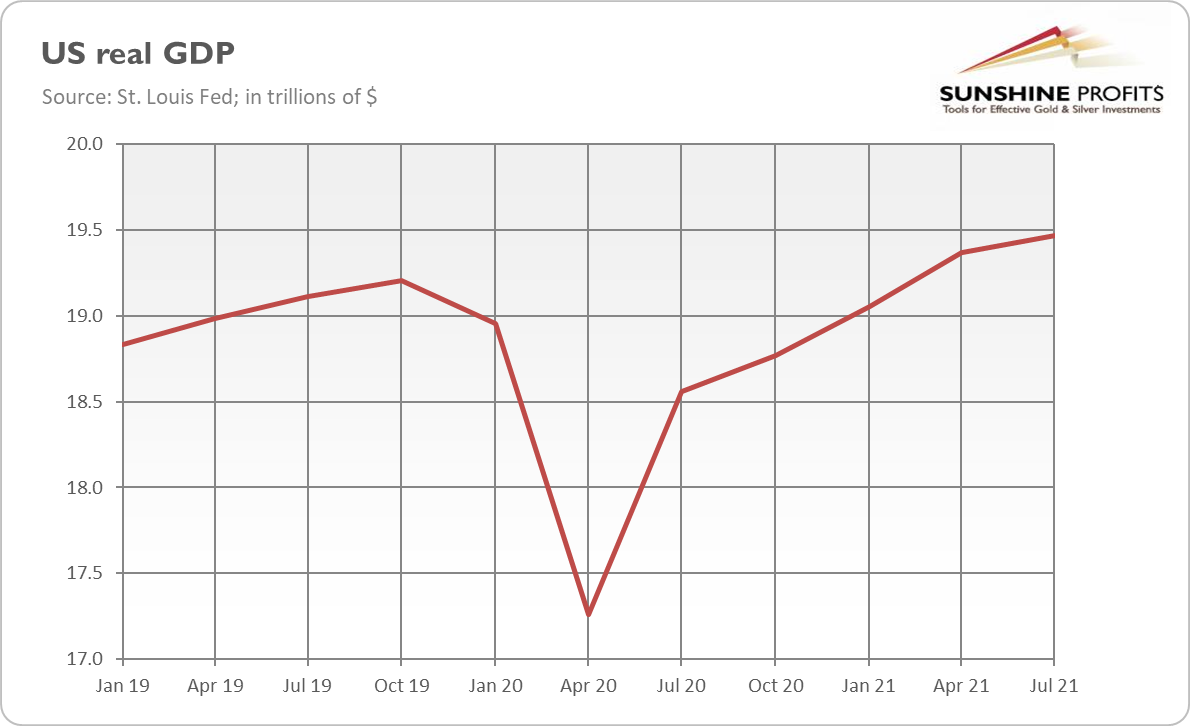

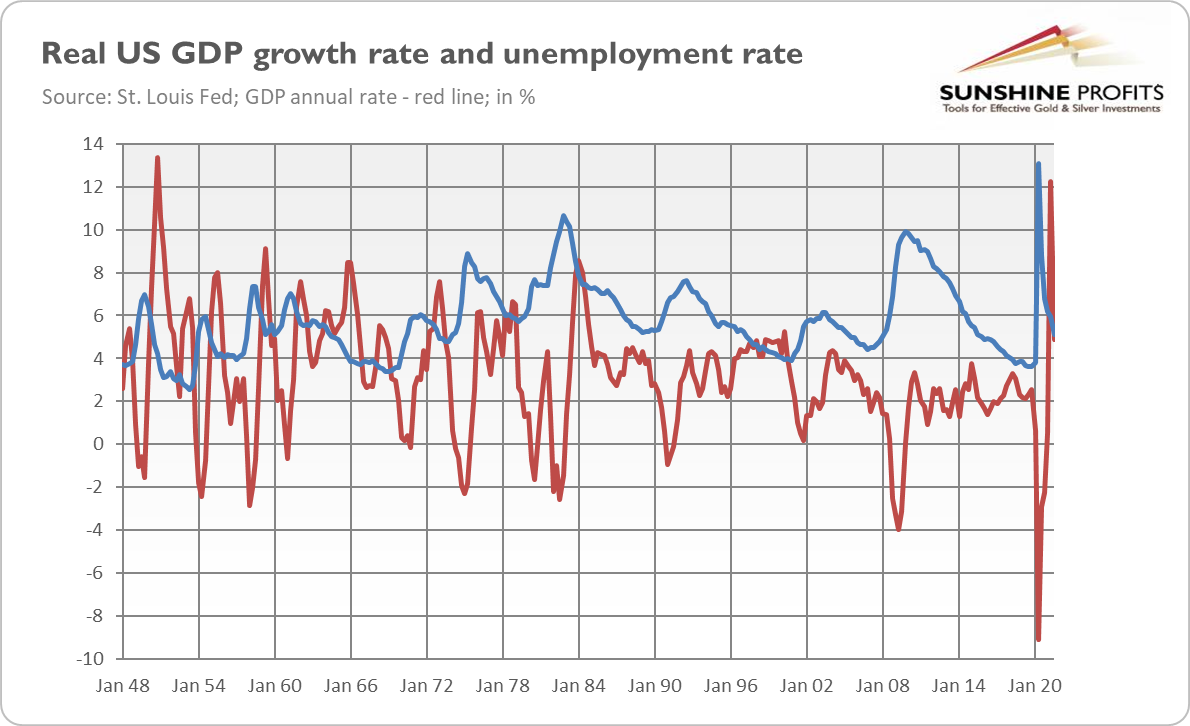

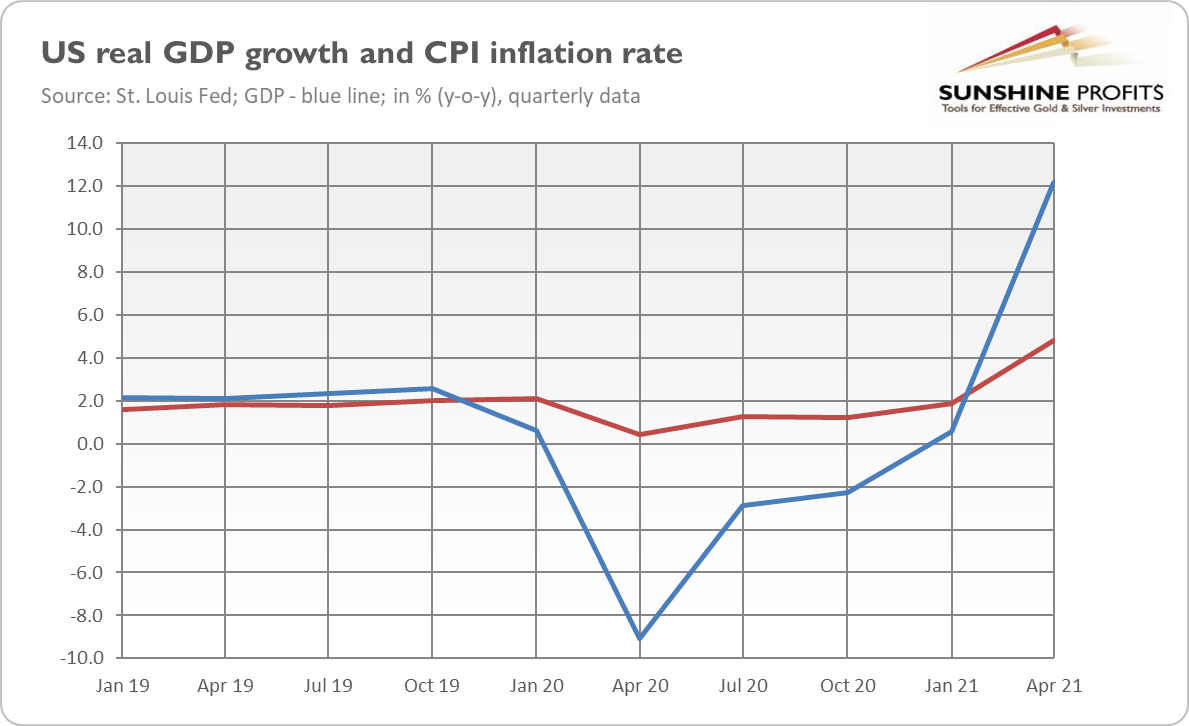

First, there will be the end of the pandemic (or, actually, its most acute phase) and a return to normal economic conditions. In some aspects, such as the GDP, the economy has already recovered from the 2020 economic crisis (as the chart below shows). However, broad population immunity and new drugs will limit the economic impact of coronavirus (the virus won’t disappear and will become endemic) in the future. What’s more, the global economy is likely to solve most of the supply problems that emerged last year (although not immediately). The return to normalcy should support risk appetite while hitting the safe-haven assets such as gold.

To be clear, I do expect a further deceleration in the pace of economic growth, but it should remain positive or even above the trend. In other words, although inflation will stay elevated, I don’t see stagflation coming in 2022. It means that the most favorable scenario for the gold bulls won’t materialize.

Second, inflation is likely to peak somewhere in the first half of this year to get down later. To be clear, inflation won’t disappear on its own; its taming will depend on resolving supply problems and, even more, on appropriately hawkish actions from the Fed. You see, inflation results mainly from the surge in the broad money supply that boosted demand much above the supply. Although fixed bottlenecks will help to ease pressure on the supply, they won’t erase all the newly created money that entered the economy last year. Inflation is, thus, likely to stay elevated in 2022 as well. Inflationary pressure should support gold prices. However, when inflation peaks and disinflation sets in, demand for gold as an inflation hedge will drop.

Third, the Fed will turn more hawkish. Powell has already admitted that the narrative about transitory inflation should be abandoned. Thus, it seems that the US central bank finally understood that it had to react to rising inflation, so it already accelerated the pace of tapering of quantitative easing. Hence, in 2022, the Fed will end its asset purchases and start raising the federal funds rate. The prospects of the Fed’s tightening cycle will put downward pressure on gold, just as they did last year.

Let’s sum up. The economy should normalize and grow further next year, while inflation should reach its peak. Both monetary and fiscal policies will become tighter. In particular, the Fed will hike interest rates, probably twice, or even three times. In consequence, the US dollar should strengthen, especially given the ECB’s dovish stance, while bond yields should increase. Indeed, a more hawkish monetary policy combined with inflation reaching a plateau implies rising real interest rates. Holy Krugerrand, it does not sound like a dreamland for gold! Actually, gold is likely to struggle, and we could see an important slide in prices.

However, the bullish case is not doomed. First, inflation could be more persistent than we all think, so it could peak rather later than sooner this year. Stubbornly high inflation would keep real interest rates deeply in negative territory, which should support gold prices.

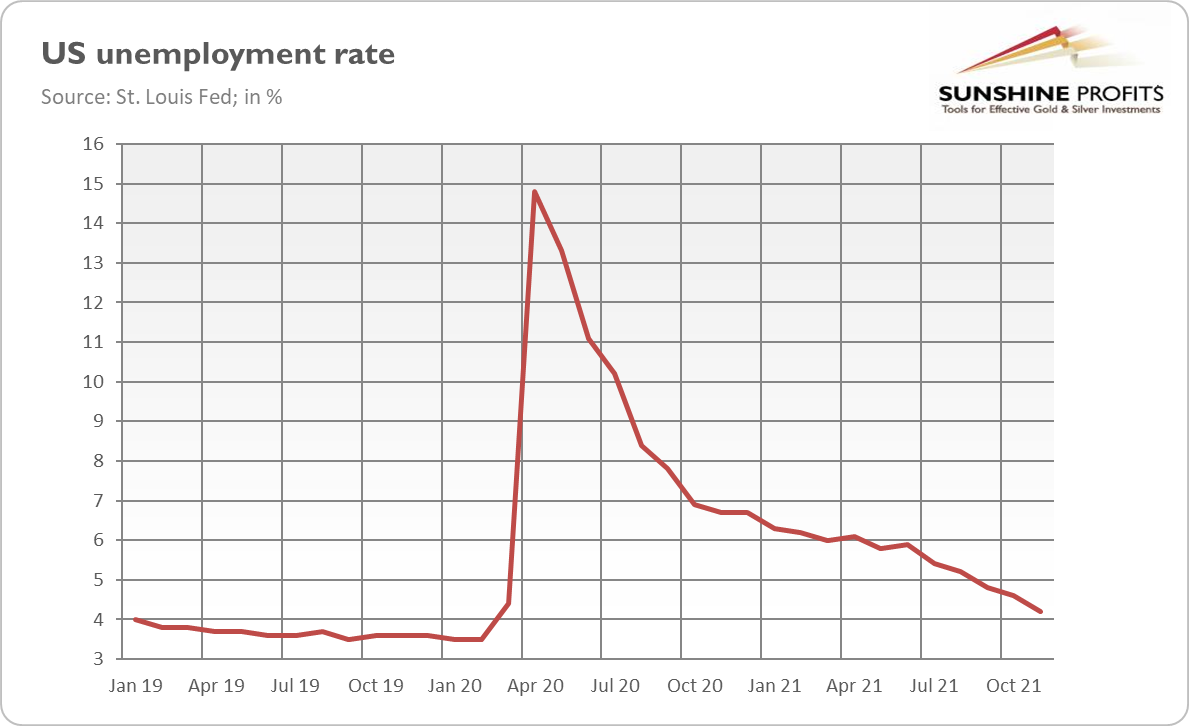

Second, economic growth could also surprise us negatively. I mean here, for example, the fact that the unemployment rate seems to be close to its bottom (as the chart below shows), so the room for further improvements seems to be limited. Elevated inflation, supply problems, and the Fed’s tightening cycle increase the odds of the next financial crisis or even a recession. However, it’s rather a matter of a future beyond 2022.

Third, gold reached its bottom in December 2015 when the Fed hiked interest rates for the first time since the Great Recession. Thus, if this history replays, the actual beginning of the Fed’s tightening cycle could, in fact, be positive for gold prices, contrary to prospects of hikes.

Hence, my baseline scenario for this year is that gold will struggle in the first months of the year and slide to the bottom around the Fed’s first hike, which will occur sometime in the spring. The main downside risk is that this year’s tightening cycle will be worse for gold than in 2015-2019, while the major upside risk is that inflation worries will strengthen or even dominate the marketplace.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the January Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Wars: Revenge of Supply and Inflation

January 14, 2022, 10:24 AMInflation! The Republic is crumbling under attacks by the ruthless Supply Lord, Count Shortage. Dearness is everywhere. Will gold save the galaxy?

If George Lucas were to make a movie about 2021 instead of Jedi knights, he would probably call it Revenge of the Supply. After all, last year will be remembered as the period of semiconductor shortages, production bottlenecks, disrupted value chains, delayed deliveries, surging job vacancies, rising inflation, and skyrocketing energy prices. It could be a shocking discovery for Keynesian economists, who focus on aggregate demand and believe that there is always slack in the economy, but it turned out that supply matters too!

As a reminder, state governments couldn’t deal with the pandemic more smartly and introduced lockdowns. Then, it turned out – what a surprise! – that the shutdown of the economy, well, shut down the economy, so the Fed and the banking system boosted the money supply, while Congress passed a mammoth fiscal stimulus, including sending checks to just about every American.

In other words, 2021 showed us that one cannot close and reopen the economy without any negative consequences, as the economy doesn’t simply return to the status quo. After the reopening of the economy, people started to spend all the money that was “printed” and given to them. Hence, demand increased sharply, and supply couldn’t keep up with the boosted spending.

It turned out that economic problems are not always related to the demand side that has to be “stimulated”. We’ve also learned that there are supply constraints and that production and delivery don’t always go smoothly. The contemporary economy is truly global, complex, and interconnected – and the proper working of this mechanism depends on the adequate functioning of its zillion elements. Thus, shit happens from time to time. This is why it’s smart to have some gold as a portfolio insurance against tail risks.

Evergiven, the ship that blocked the Suez Canal, disrupting international trade, was the perfect illustration. However, the importance of supply factors goes beyond logistics and is related to regulations, taxes, incentives, etc. Instead of calls for injecting liquidity during each crisis, efficiency, reducing the disincentives to work and invest, and unlocking the supply shackles imposed by the government should become the top economic priority.

Another negative surprise for mainstream economists in 2021 was the revenge of inflation. For years, central bankers and analysts have dismissed the threat of inflation, considering it a phenomenon of the past. In the 1970s, the Fed was still learning how to conduct monetary policy. It made a few mistakes, but is much smarter today, so stagflation won’t repeat. Additionally, we live in a globalized economy with strong product competition and weak labor unions, so inflation won’t get out of control.

Indeed, inflation was stubbornly low for years, despite all the easy monetary policy, and didn’t want to reach the Fed’s target of 2%, so the US central bank changed its regime to be more flexible and tolerant of inflation. It was in 2020, just one year before the outbreak of inflation. The Fed completely didn’t expect that – which shows the intellectual poverty of this institution – and called it “transitory”.

Initially, inflation was supposed to be short-lived because of the “base effects”, then because of the “supply bottlenecks”. Only in November, the Fed admitted that inflation was more broad-based and would be more persistent than it previously thought. Well, better late than never!

What does the revenge of supply and inflation imply for the gold market? One could expect that gold would perform better last year amid all the supply problems and a surge in inflation. We’ve learned that gold doesn’t always shine during inflationary times. The reason was that supply shortages didn’t translate into a full-blown economic crisis. On the contrary, they were caused by a strong rebound in demand; and they contributed mainly to higher inflation, which strengthened the Fed’s hawkish rhetoric and expectations of higher interest rates, creating downward pressure on gold prices.

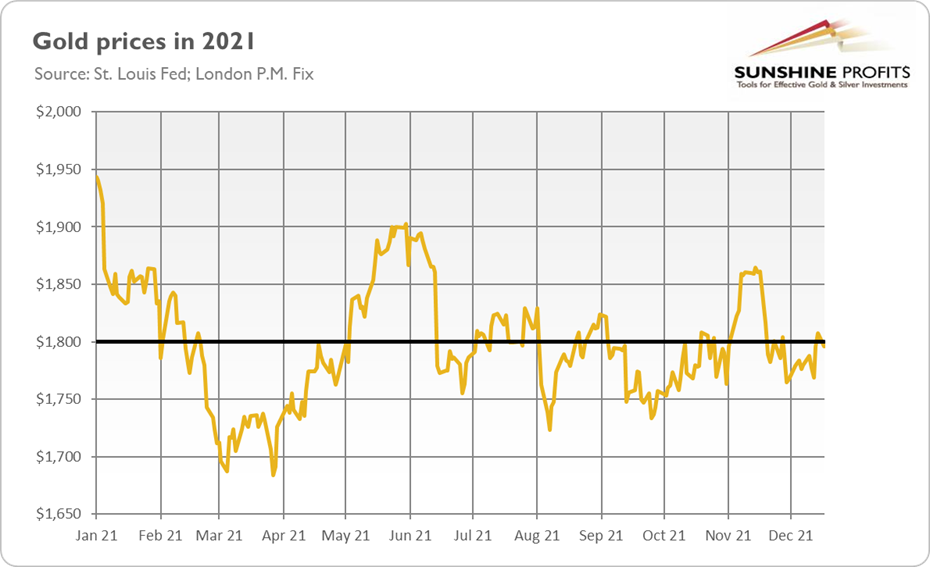

On the other hand, we could say as well that gold prices were supported by elevated inflation and didn’t drop more thanks to all the supply disruptions and inflationary threats. After all, during the economic expansion of 2011-2015 that followed the Great Recession, gold plunged about 45%, while between the 2020 peak and the end of 2021, the yellow metal lost only about 13%, as the chart below shows.

Hence, the worst might be yet to come. I don’t expect a similarly deep decline as in the past, especially given that the Fed’s tightening cycle seems to be mostly priced in, but the real interest rates could normalize somewhat. Thus, I have bad news for the gold bulls. The supply crunch is expected to moderate in the second half of 2022, which would also ease inflationary pressure. To be clear, inflation won’t disappear, but it may reach a peak this year. The combination of improvement on the supply side of the economy, with inflation reaching its peak, and with a more hawkish Fed doesn’t bode well for gold.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the January Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Market in 2022: Fall and Revival?

January 7, 2022, 10:19 AM2021 will be remembered as the year of inflation’s comeback and gold’s dissatisfying reaction to it. Will gold improve its behavior in 2022?

You thought that 2020 was a terrible year, but we would be back to normal in 2021? Well, we haven’t quite returned to normal. After all, the epidemic is not over, as new strains of coronavirus emerged and spread last year. Actually, in some aspects, 2021 was even worse than 2020. Two years ago, the pandemic was wreaking havoc. Last year, both the pandemic and inflation were raging.

To the great surprise of mainstream economists fixated on aggregate demand, 2021 would be recorded in chronicles as the year of the supply factors revenge and the great return of inflation. For years, the pundits have talked about the death of inflation and mocked anyone who pointed to its risk. Well, he who laughs last, laughs best. However, it’s laughter through inflationary tears.

Given the highest inflation rate since the Great Stagflation, gold prices must have grown a lot, right? Well, not exactly. As the chart below shows, 2021 wasn’t the best year for the yellow metal. Gold lost almost 5% over the last twelve months. Although I correctly predicted that “gold’s performance in 2021 could be worse than last year”, I expected less bearish behavior.

What exactly happened? From a macroeconomic perspective, the economy recovered last year. As vaccination progressed, sanitary restrictions were lifted, and risk appetite returned to the market, which hit safe-haven assets such as gold. What’s more, a rebound in economic activity and rising inflation prompted the Fed to taper its quantitative easing and introduce more hawkish rhetoric, which pushed gold prices down.

As always, there were both ups and downs in the gold market last year. Gold started 2021 with a bang, but began plunging quickly amid Democrats’ success in elections, the Fed more optimistic about the economy, and rising interest rates. The slide lasted until late March, when gold found its bottom of $1,684. This is because inflation started to accelerate at that point, while the Fed was downplaying rising price pressures, gibbering about “transitory inflation”.

The rising worries about high inflation and the perspective of the US central bank staying behind the curve helped gold reach $1,900 once again in early June. However, the hawkish FOMC meeting and dot-plot that came later that month created another powerful bearish wave in the gold market that lasted until the end of September.

Renewed inflationary worries and rising inflation expectations pushed gold to $1,865 in mid-November. However, the Fed announced a tapering of its asset purchases, calming markets once again and regaining investors’ trust in its ability to control inflation. As consequence, gold declined below $1,800 once again and stayed there by the end of the year.

What can we learn from gold’s performance in 2021? First of all, gold is not a perfect inflation hedge, as the chart below shows. I mean here that, yes, gold is sensitive to rising inflation, but a hawkish Fed beats inflation in the gold market. Thus, inflation is positive for gold only if the US central bank stays behind the curve. However, when investors believe that either inflation is temporary or that the Fed will turn more hawkish in response to upward price pressure, gold runs away into the corner. Royal metal, huh?

Second, never underestimate the power of the dark… I mean, the hawkish side of the Fed – or simply, don’t fight the Fed. It turned out that the prospects of a very gradual asset tapering and tightening cycle were enough to intimidate gold.

Third, real interest rates remain the key driver for gold prices. As one can see in the chart below, gold plunged each time bond yields rallied, in particular in February 2021, but also in June or November. Hence, gold positively reacts to inflation as long as inflation translates into lower real interest rates. However, if other factors – such as expectations of a more hawkish Fed – come into play and outweigh inflation, gold suffers.

Great, we already know that 2021 sucked and why. However, will 2022 be better for the gold market? Although I have great sympathy for the gold bulls, I don’t have good news for them.

It seems that gold’s struggle will continue this year, at least in the first months of 2022, as the Fed’s hiking cycle and rising bond yields would create downward pressure on gold. However, when the US central bank starts raising the federal funds rate, gold may find its bottom, as it did in December 2015, and begin to rally again.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the January Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Excuse Me, Mr. Gold. What Year Is It?

December 31, 2021, 7:34 AMAlthough your calendar may say otherwise, gold is in the 1960s. The question is whether we will move into the 1970s or speed-run to the mid-2010s.

Did you go overboard with your time travel and lose track of time? Probably not, but just in case, I assure you that the current year is 2021. To be 100% sure, I fact-checked it on a dedicated webpage for time-travelers. However, the authority of science is being questioned, and there are people who say that, from a macroeconomic point of view, we are approaching the 1970s, or at least the 1960s. There are also voices saying that the gold market is replaying 2012-2013. Although appearances point to 2021, let’s investigate what year we really live in.

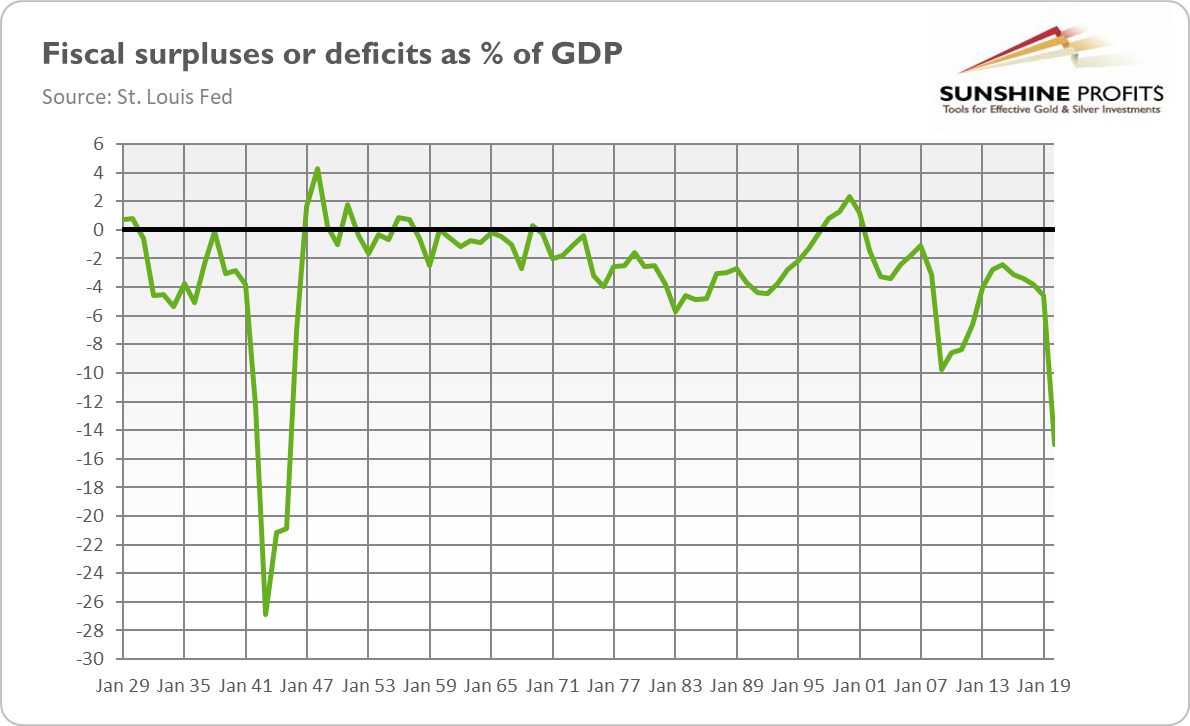

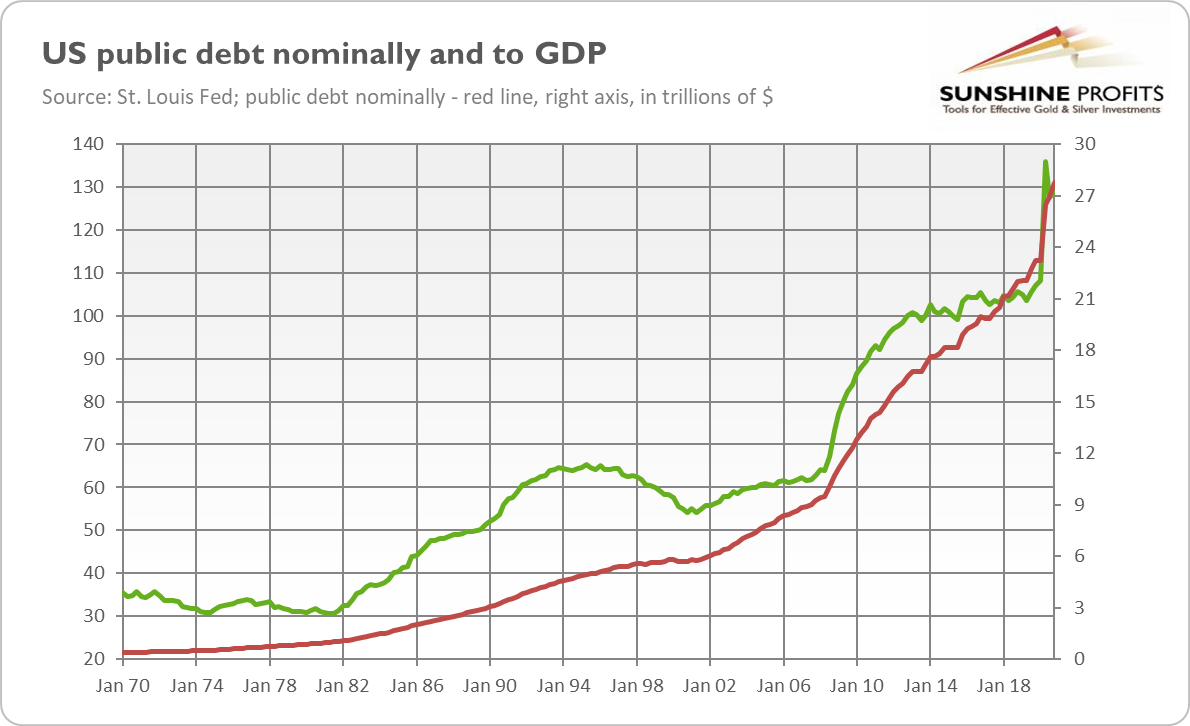

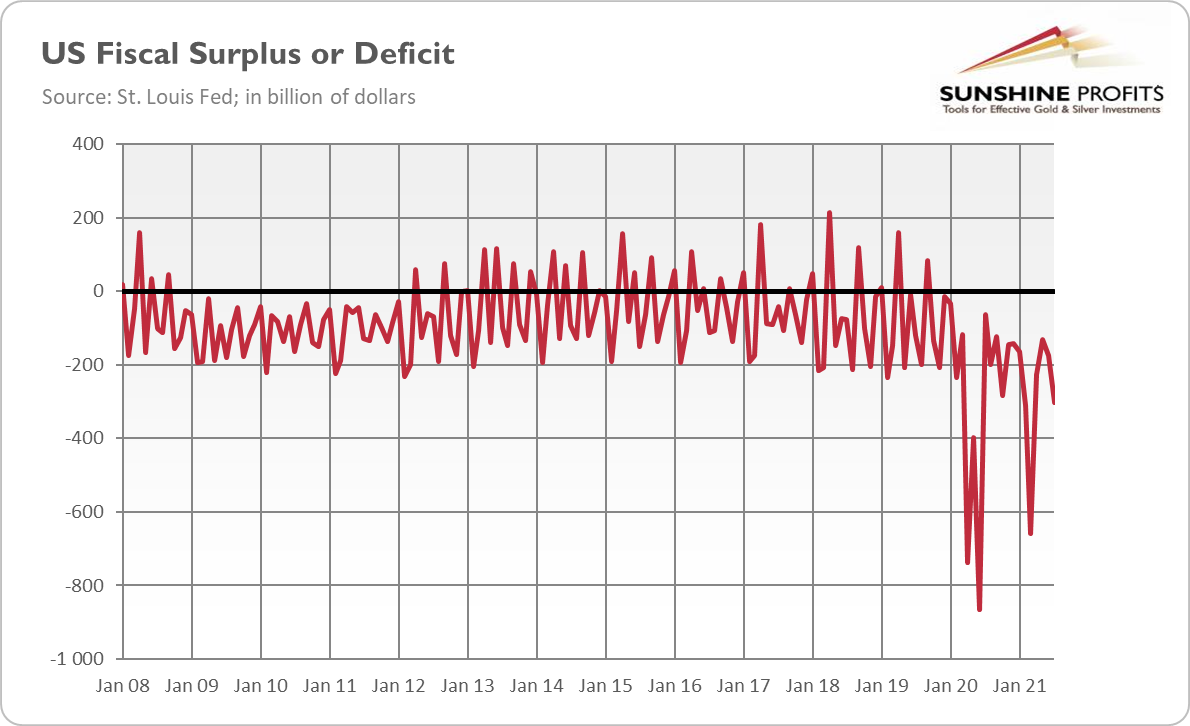

The similarities with the 1970s are obvious. Just like then, we have high inflation, large fiscal deficits (see the chart below), and easy, erroneous monetary policy. Fifty years ago, the Fed blamed inflation on exogenous shocks and considered inflation to be transitory too. The new monetary regime adopted by the US central bank in 2020 also takes us back to the 70s and the mistaken belief that the economy cannot overheat, so the Fed can let inflation run above the target for a while in order to boost employment.

The parallels extend beyond price pressure. The withdrawal of US troops from Afghanistan reminded many of the fall of Saigon. The world is facing an energy crisis right now, another feature of the 1970s. If we really repeat those years, gold bulls should be happy, as the yellow metal rallied from $35 to $850, surging more than 2300% back in that decade (see the chart below).

However, there is one problem with this narrative. In the 1970s, we experienced stagflation, i.e., a simultaneous occurrence of high inflation and economic stagnation with a rising unemployment rate. Currently, although we face strong upward price pressure, we enjoy economic expansion and declining unemployment, as the chart below shows. Indeed, the monthly unemployment rate decreased from 14.8% in April 2020 to 4.2% in November 2021.

The current macroeconomic situation, characterized by inflation without stagnation part, is reminiscent of the 1960s, a decade marked by rising inflation and rapid GDP growth. As the chart below shows, the CPI annual rate reached a local maximum of 6.4% in February 1970, similar to the current inflation level.

Apparently, we are replaying the 1960s right now rather than the 1970s. So far, growth is slowing down, but we are far from stagnation territory. There is no discussion on this. My point was always that the Fed’s actions could bring us to the 1970s, or that complacency about inflation is increasing the risk of de-anchoring inflation expectations and the materialization of a stagflationary scenario. In the 1960s, the price of gold was still fixed, so historical analysis is impossible.

However, it seems that gold won’t start to rally until we see some signs of stagnation or an economic crisis, and markets begin to worry about recession. Given that the current economic expansion looks intact, the yellow metal is likely to struggle at least by mid-2022 (unless supply disruptions and energy crisis intensify significantly, wreaking havoc).

Do we have to go back that far in time, though? Maybe the 2020 peak in gold prices was like the 2011 peak and we are now somewhere in 2012-2013, on the eve of a great downward move in the gold market? Some similarities cannot be denied: the economy is recovering from a recession, while the Fed is tightening its monetary policy, and gold shows weakness with its inability to surpass $1,800. So, some concerns are warranted. I pointed out a long time ago the threat of an upward move in the real interest rates (as they are at record low levels), which could sink the precious metals market.

However, there are two key differences compared to the 2012-2013 period. First, inflation is much higher and it’s still accelerating, while ten years ago there was disinflation. This distinction should support gold prices. The peak in the inflation rate could be a dangerous time for gold, as the disinflationary era would raise interest rates, putting downward pressure on the yellow metal.

Second, the prospects of the Fed’s tightening cycle are probably already priced in. In other words, the next “taper tantrum” is not likely to happen. It implies that a sudden spike in the interest rates similar to that of 2013 (see the chart below) shouldn’t repeat now.

Hence, the answer to the question “what year is it?” should be that we are somewhere in the 1960s and we can move later into the 1970s if high inflation stays with us and stagnation sets in or if the next crisis hits. However, we can leap right into the 2010s if inflation peaks soon and the hawkish Fed triggers a jump in bond yields. It’s also possible that we will see a temporary disinflation before the second wave of elevated inflation. So, gold could continue its struggle for a while before we see another rally.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the December Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Is the End of Transitory Inflation the End of Gold Bulls?

December 24, 2021, 4:53 AMThe debate about the nature of inflation is over. Now the question is what the end of transitory inflation implies for gold. I offer two perspectives.

Welcome, my son. Welcome to the inflationary machine. Welcome to the new economic regime of elevated inflation. That’s official because even central bankers have finally admitted what I’ve been saying for a long time: the current high inflation is not merely a transitory one-off price shock. In a testimony before Congress, Jerome Powell agreed that “it’s probably a good time to retire” the word “transitory” in relation to inflation. Bravo, Jay! It took you only several months longer than my freshmen students to figure it out, but better late than never. Actually, even a moderately intelligent chimpanzee would notice that inflation is not merely temporary just by looking at the graph below.

To be clear, I’m not predicting hyperinflation or even galloping inflation. Nor do I claim that at least some of the current inflationary pressures won’t subside next year. No, some supply-side factors behind recent price surges are likely to abate in 2022. However, other drivers will persist, or even intensify (think about housing inflation or energy crisis).

Let’s be honest: we are facing a global inflation shock right now. In many countries, inflation has reached its highest rate in decades. In the United States, the annual CPI rate is 6.2%, while it reached 5.2% in Germany, 4.9% in the Eurozone, and 3.8% in the United Kingdom. The shameful secret is that central banks and governments played a key role in fueling this inflation. As the famous Austrian economist Ludwig von Mises noticed once,

The most important thing to remember is that inflation is not an act of God; inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy — a deliberate policy of people who resort to inflation because they consider it to be a lesser evil than unemployment. But the fact is that, in the not very long run, inflation does not cure unemployment.

Indeed, the Fed and the banking system injected a lot of money into the economy and also created room for the government to boost its spending and send checks to Americans. The resulting consumer spending boom clogged the supply chains and caused a jump in inflation.

Obviously, the policymakers don’t want to admit their guilt and that they have anything to do with inflation. At the beginning, they claim that there is no inflation at all. Next, they say that inflation may exist after all, but is only caused by the “base effect”, so it will be a short-lived phenomenon that results solely from the nature of the yearly comparison. Lastly, they admit that there is something beyond the “base effect” but inflation will be transitory because it’s caused only by a few exceptional components of the overall index, the outliers like used cars this year. Nothing to worry about, then. Higher prices are a result of bottlenecks that will abate very soon on their own. Later, inflation is admitted to be more broad-based and persistent, but it is said to be caused by greedy businesses and speculators who raise prices maliciously. Finally, the policymakers present themselves as the salvation from the inflation problem(that was caused by them in the first place). Such brilliant “solutions” as subsidies to consumers and price controls are introduced and further disrupt the economy.

The Fed has recently admitted that inflation is not merely transitory, so if the abovementioned scheme is adequate, we should expect to look for scapegoats and possibly also interventions in the economy to heroically fight inflation. Gold could benefit from such rhetoric, as it could increase demand for safe-haven assets and inflation hedges.

However, the Fed’s capitulation also implies a hawkish shift. If inflation is more persistent, the US central bank will have to act in a more decisive way, as inflation won’t subside on its own. The faster pace of quantitative easing tapering and the sooner interest rate hikes imply higher bond yields and a stronger greenback, so they are clearly negative for gold prices.

Having said that, the Fed stays and is likely to stay woefully behind the curve. The real federal funds rate (i.e., adjusted by the CPI annual rate) is currently at -6.1%, which is the deepest level in history, as the chart below shows. It is much deeper than it was at the lows of stagflation in the 1970s, which may create certain problems in the future.

What is important here is that even when the Fed raises the federal funds rate by one percentage point next year, and even when inflation declines by another two percentage points, the real federal funds rate will increase to only -3%, so it will stay deeply in negative territory. Surely, the upward direction should be negative for gold prices, and the bottom in real interest rates would be a strong bearish signal for gold. However, rates remaining well below zero should provide some support or at least a decent floor for gold prices (i.e., higher than the levels touched by gold in the mid-2010s).

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the December Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Not Only Gold Lacks Energy – We All Do Now

December 17, 2021, 8:53 AMFirst a pandemic, then inflation, and now an energy crisis. Should you buy gold when preparing for the winter?

Brace yourselves, winter is coming! And this time I’m deadly serious, as there is a global energy crisis. Not only does gold lack energy to fuel its rally right now, but people from all over the world lack it to fuel their operations and to heat their houses. Apparently, the coronavirus pandemic wasn’t enough, so we also have to deal with inflation, supply bottlenecks, and the energy crisis. I guess there is nothing else to do now but wait for the frogs to start falling from the sky.

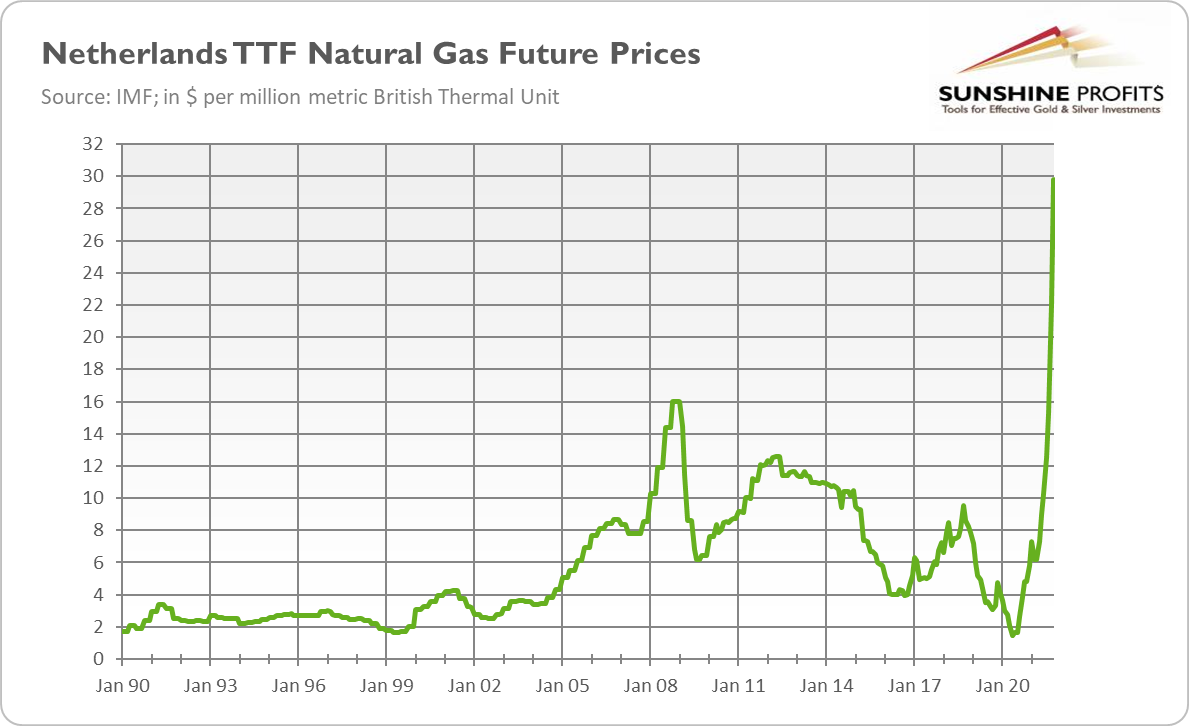

But let’s not give the gods ideas and focus on the energy crisis today. What is it about? A picture is worth a thousand words, so please take a look at the chart below, which presents the Dutch Title Transfer Facility, Europe’s leading benchmark for natural gas prices. As you can see, future prices for European natural gas have skyrocketed to a record level in October 2021, surging several times from their low in May 2020. The persistence and global dimension of these price spikes are unprecedented, as natural gas prices have also surged in Asia and America (although to a lesser degree).

What caused such a spike? Well, as a trained economist, I cannot resist answering that it’s a matter of demand and supply! Yeah, thank you, Captain Obvious, but could you be a little more specific? Sure, so on the demand side, we have to mention a fast recovery from the epidemic and cold fall that increased the use of energy. Oh, and don’t forget about the ultra-low interest rates and the increase in the money supply that boosted spending on practically everything. The increased demand for energy is hardly surprising in such conditions.

On the supply side, there were unpredictable breakdowns of gas infrastructure in Russia and Norway that decreased deliveries. The former country reduced its exports due to political reasons. What’s more, the reduction in the supply of CO2 emission rights and unfavorable weather didn’t help. The windless conditions in Europe generated little wind energy, while drought in Brazil reduced hydropower energy.

More fundamentally, the decline in energy prices in response to the economic crisis of 2020 prompted many producers to stop drilling and later supply simply didn’t catch up with surging demand. You can also add here the political decisions to move away from nuclear and carbon energy in some countries.

Last but not least, the butterfly’s wings flapped in China. Coal production in that country plunged this year amid a campaign against corruption and floods that deluged some mines. Middle Kingdom therefore began to buy significant amounts of natural gas, sharply increasing its prices. China’s ban on importing coal from Australia, of course, didn’t help here.

Great, but what does the energy crisis imply for the global economy and the gold market? First, shortages of energy could be a drag on global GDP. The slowdown in economic growth should be positive for gold, as it would bring us closer to stagflation. Second, the energy crisis could cause discontent among citizens and strengthen the populists. People are already fed up with pandemics and high inflation, and now they have to pay much higher energy bills. Just imagine how they will cheer when blackouts occur.

Third, the surge in natural gas prices could support high producer and consumer inflation. We are already observing some ripple effects in the coal and oil markets that could also translate into elevated CPI numbers. Another inflationary factor is power shortages in China, as they will add to the supply disruptions we are currently facing. All this implies more persistent high inflation, which should provide support for the yellow metal as an inflation hedge, although it also increases the odds of a more hawkish Fed, which is rather negative for gold.

It’s true that a replay of the 1970s-like energy crisis is remote, as today’s economies are much less energy-consuming and dependent on fossil fuels. However, the worst is possibly yet to come. After all, winter hasn’t arrived yet – and it could be another harsh one, especially given that La Niña is expected to be present for the second year in a row. Meanwhile, gas stocks are unusually low. You can connect the dots.

So far, gold has rather ignored the unfolding energy crisis, but we’ve already seen that market narratives can change quickly. It’s therefore possible that prolonged supply disruption and high inflation could change investors’ attitude toward the yellow metal at some point. The weak gold’s reaction stems from the limited energy crisis in the US and from the focus on the Fed’s tightening cycle. But investors’ attention can shift, especially when the Fed starts hiking federal funds rate. Brace yourselves!

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the December Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Another 4 Years of Gold’s Tricky Romance With Jay

December 10, 2021, 10:16 AM“Do you love me?”, asked gold. “Of course, my dear”, replied Jay, but his thoughts were with others: asset purchases tapering and interest rate hikes.

“It’s complicated” – this is how many people answer questions about their romantic lives. The relationship between gold and Jerome Powell is also not a clear one. As you know, in November, President Biden announced that he would reappoint Powell for the second term as the Fed Chair. It means that gold will have to live with Jerome under the same roof for another four years.

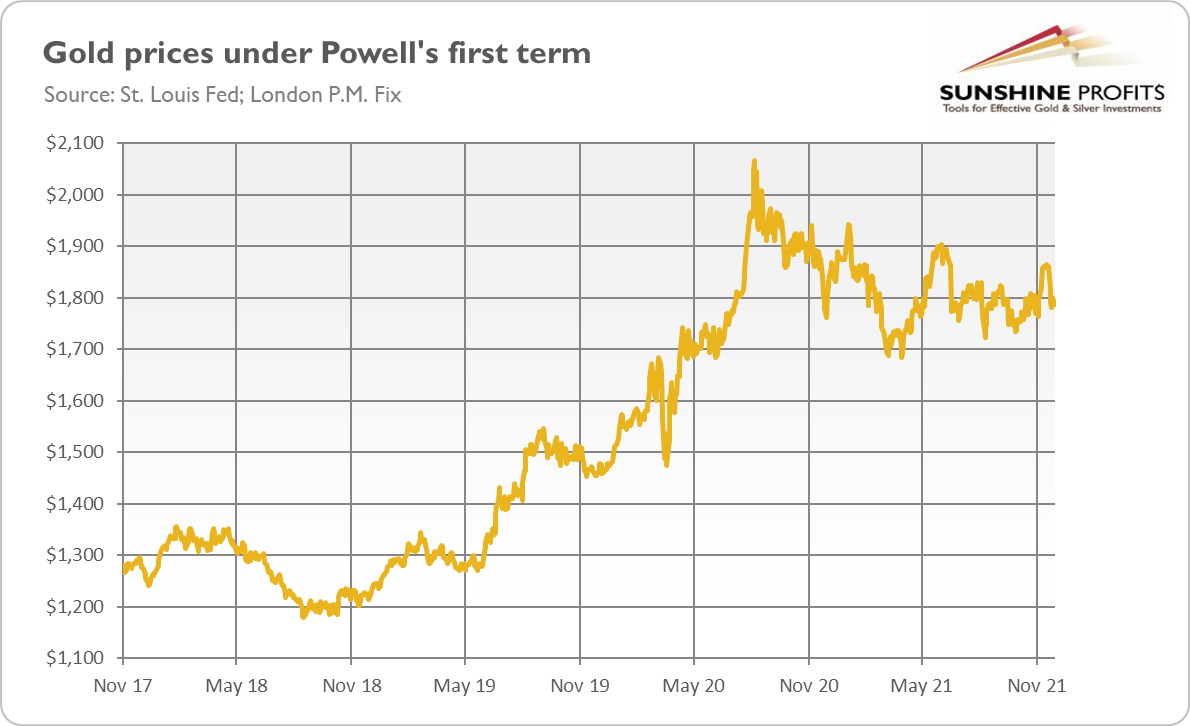

To say that gold didn’t like it is to say nothing. The yellow metal snapped and left the cozy living room of $1,850, slamming the door loudly. In less literary expressions, its price plunged from above $1,860 on November 19 to $1,782 on November 24, 2021, as the chart below shows.

The impulsive gold’s reaction to Powell’s renomination resulted from its failed dream about a love affair with Lael Brainard. She was considered a leading contender to replace Powell. The contender that would be more dovish and, thus, more supportive of gold prices.