-

The Oil Rally Under the Microscope

May 20, 2020, 12:24 PMThe rally in crude oil market continues, as almost half of this year's decline in crude oil's continuous futures contract was erased. This also means that crude oil is getting close to the 50% retracement based on the entire decline. And that's not all that might prevent crude oil from shooting up in the next few weeks.

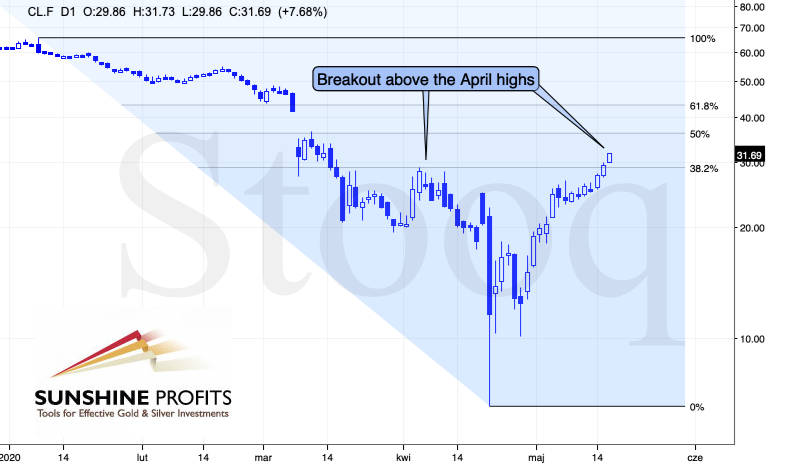

The breakout above the April highs and the 38.2% Fibonacci retracement was a sign of strength, and it seems that this move will be confirmed based on today's closing price. This means that the very short-term (the next few days) outlook for crude oil is now bullish. We are not opening long positions here, though.

The reason is that the next strong resistance is simply too close. The upside potential is there, but it's not significant enough for us to really justify opening a position here.

The resistance provided by the 50% Fibonacci retracement is further strengthened by the early-March high. This means that the current monthly rally in crude oil could end there, or we could see a sizable pullback from the above-mentioned resistance.

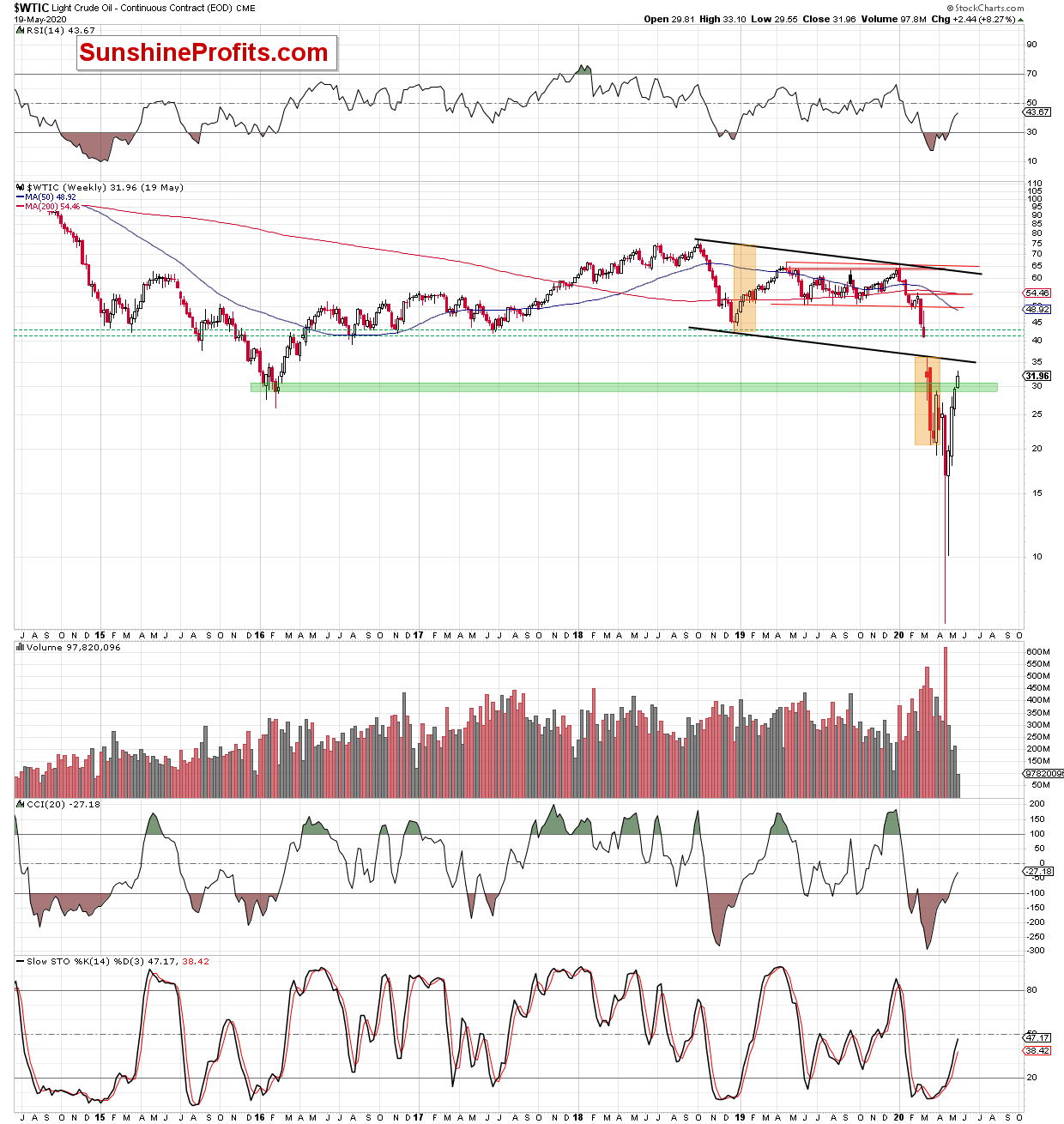

Crude oil's long-term chart seems to confirm the above.

The above-mentioned resistance level is further strengthened by the lower border of the previous trade channel. This line is important as it served as resistance after crude oil's breakdown.

Therefore, at this time it seems that crude oil is going to approach the $36 level, and based on how it approaches it, we might get a great opportunity to enter short positions. We would prefer to see a sizable daily reversal as a bearish confirmation when that happens. For now, we prefer to stay on the sidelines.

Summing up, we might get an opportunity to enter long, or short positions very soon, and increase our 2020 profits, but such opportunity remains absent at this time.

Today's free crude oil analysis is available exclusively on our website. If you enjoyed reading it, and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

It's Make Or Break For the Oil Bulls #2

May 19, 2020, 9:04 AMAvailable to premium subscribers only.

-

It's Make Or Break For the Oil Bulls

May 18, 2020, 11:09 AMJust like the precious metals market, black gold ended the previous week with a sizable upswing. The rally continued in the early Monday trading, as crude oil moved decisively above its previous April highs.

The breakout above the April highs is a sign of strength, but it's not been confirmed so far. Crude oil did close the previous week above the highest daily close of April, but it was just a little higher. The move is definitely bigger based on today's pre-market upswing, but the breakout is still far from being confirmed in terms of time.

The next upside target is the 50% Fibonacci retracement level, which coincides with the mid-March top. However, if the breakout above April highs is invalidated, crude oil could decline all the way down to the $20 level or so, before pausing or bottoming.

Without enough bullish or bearish signs, we don't think that entering an oil trading position is justified at this time due to the lack of either bullish or bearish confirmations. We expect to see more clues shortly.

Summing up, we might get an opportunity to enter long, or short positions very soon, and increase our 2020 profits, but such opportunity remains absent at this time.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Is Oil On the Way Up Now?

May 15, 2020, 10:09 AMCrude oil soared higher yesterday and also in today's pre-market trading, which shows you why it was a good idea to remain cautious yesterday, even despite crude oil's breakdown below the rising support line.

We previously wrote the following:

We saw a tiny breakdown on Wednesday, but it was not based on the decisive move lower, but rather based on the fact that time passed and the next daily candlestick started below the line. While this makes the outlook more bearish than on Tuesday, the breakdown is not confirmed and we think that the outlook is not bearish enough yet to justify opening a trading position at this time.

Unless crude oil moves sharply higher today, the breakdown will be confirmed, which will be bearish. However, since crude oil just managed to break to a new monthly high, the bearish implications of the above-mentioned breakdown will be nullified by the bullish implications of the breakout above previous May highs.

The above means that "when in doubt, stay out" phrase should now be applied, but at the same time, we think that a more decisive signal might present itself shortly. This is due to the proximity to the 38.2% Fibonacci retracement level based on the previous decline in crude oil. As this retracement is very close to the April highs at about $29 level, it means that this strong resistance area, which is confirmed by two resistance levels, might be able to either trigger a reversal or prove that crude oil is particularly strong right now - if it manages to break above it.

Summing up, depending on the way crude oil behaves relative to its nearby resistance level provided by the early-April highs and the 38.2% Fibonacci retracement based on the entire 2020 decline, we might get an opportunity to enter long, or short positions very soon, and increase our 2020 profits.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM