Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions are justified from the risk-reward perspective.

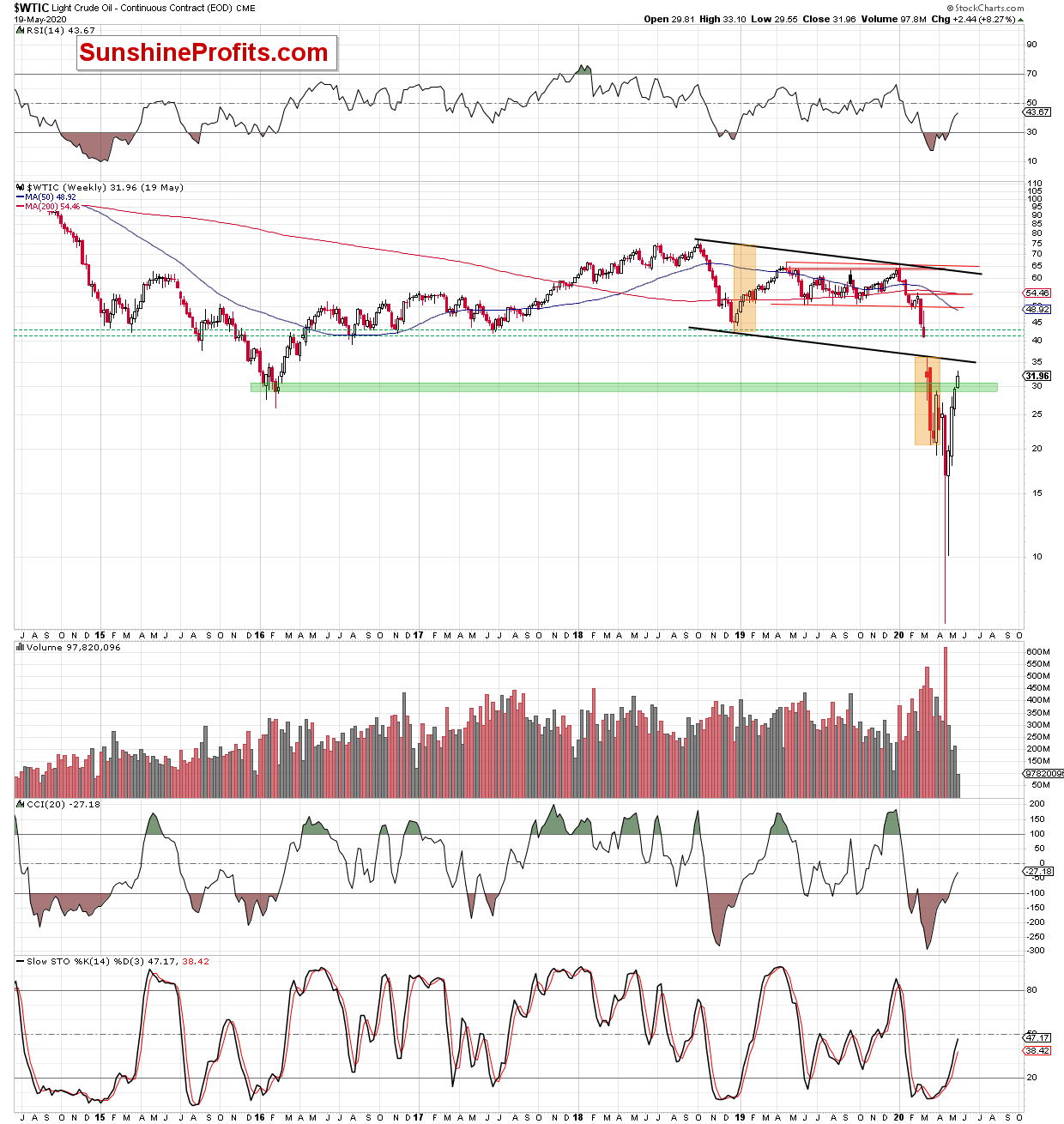

The rally in crude oil market continues, as almost half of this year's decline in crude oil's continuous futures contract was erased. This also means that crude oil is getting close to the 50% retracement based on the entire decline. And that's not all that might prevent crude oil from shooting up in the next few weeks.

The breakout above the April highs and the 38.2% Fibonacci retracement was a sign of strength, and it seems that this move will be confirmed based on today's closing price. This means that the very short-term (the next few days) outlook for crude oil is now bullish. We are not opening long positions here, though.

The reason is that the next strong resistance is simply too close. The upside potential is there, but it's not significant enough for us to really justify opening a position here.

The resistance provided by the 50% Fibonacci retracement is further strengthened by the early-March high. This means that the current monthly rally in crude oil could end there, or we could see a sizable pullback from the above-mentioned resistance.

Crude oil's long-term chart seems to confirm the above.

The above-mentioned resistance level is further strengthened by the lower border of the previous trade channel. This line is important as it served as resistance after crude oil's breakdown.

Therefore, at this time it seems that crude oil is going to approach the $36 level, and based on how it approaches it, we might get a great opportunity to enter short positions. We would prefer to see a sizable daily reversal as a bearish confirmation when that happens. For now, we prefer to stay on the sidelines.

Summing up, we might get an opportunity to enter long, or short positions very soon, and increase our 2020 profits, but such opportunity remains absent at this time.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions are justified from the risk-reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager