-

Getting Ready for the Decisive Action in Crude Oil

May 28, 2020, 7:52 AMAvailable to premium subscribers only.

-

Has Oil Topped Yesterday?

May 22, 2020, 6:03 AMJust like all good and bad things alike come to an end, so do "never-ending" rallies. Crude oil declined well over 5% today, which might mean that we already saw the end of the rally.

But did we certainly see it? Will crude oil be trading lower shortly?

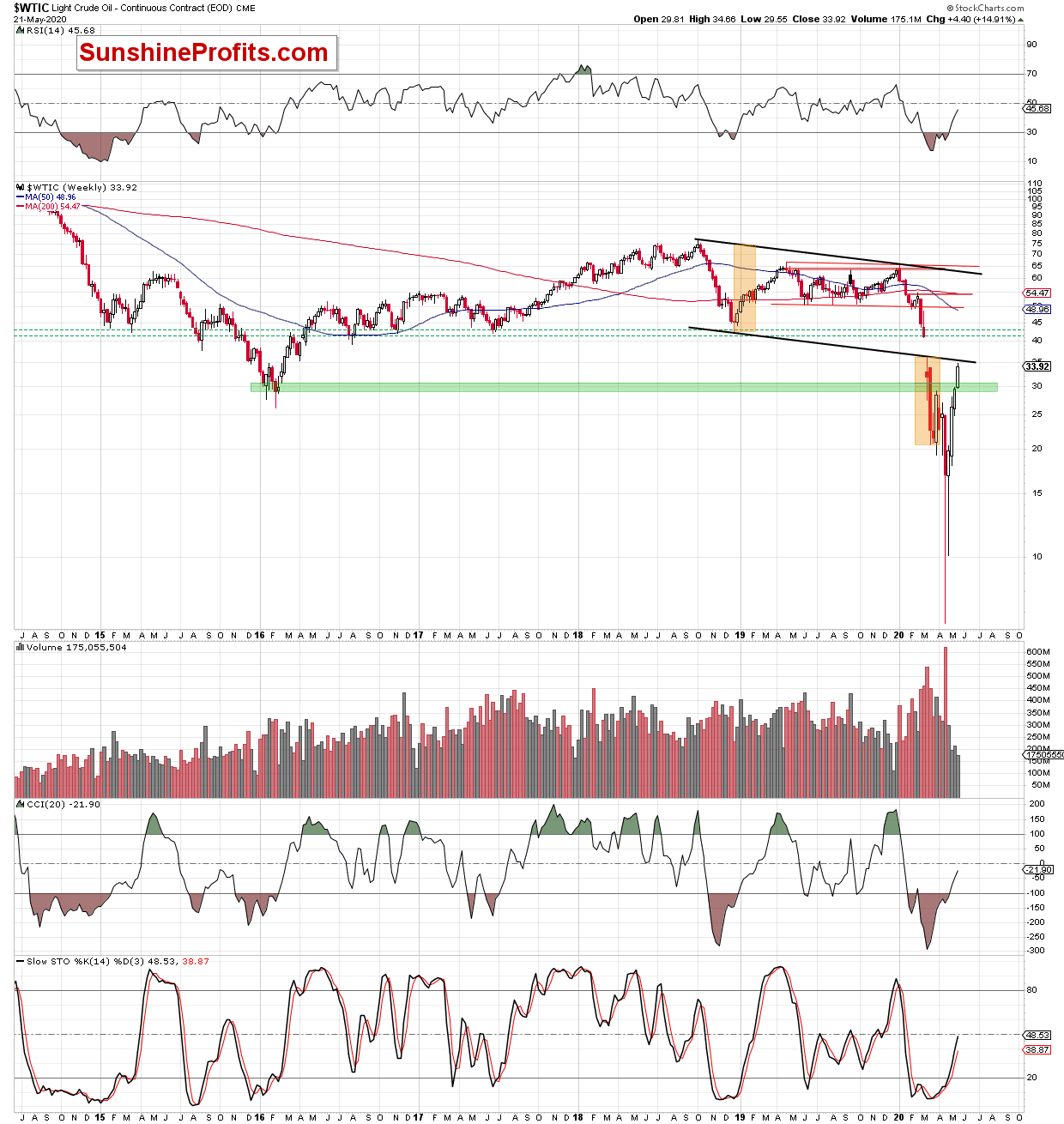

Crude oil reversed without moving to the 50% Fibonacci retracement. It did encounter a resistance, though. The resistance was the highest daily close that we saw in the first half of March, right after the huge price gap.

That (March 10th) closing price was $34.36 and crude oil closed at $33.92 yesterday, after temporarily rallying to $34.66. This means that crude oil attempted to move above the above-mentioned resistance, and that it had failed.

This is a bearish sign, especially since it was followed by a sizable overnight decline.

Still, it's not a proof that the next sizable decline is already underway - not yet. The close below the 38.2% Fibonacci retracement would make subsequent declines very likely, but given that the 50% retracement and the intraday, mid-March highs were not reached, it seems that crude oil could still launch another intraday rally before truly topping.

The monthly crude oil chart also suggests that crude oil hasn't reached its key resistance level just yet, and therefore it's not particularly likely to have topped right now.

Has crude oil topped yesterday? That's quite possible. The answer as to whether it does or doesn't justify opening a trading position, is reserved for our subscribers.

Today's free crude oil analysis is available exclusively on our website. If you enjoyed reading it, and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM