-

What to Do Next After Our Unthinkable Oil Profits?

April 22, 2020, 10:36 AMFrom the unimaginable lows, crude oil is shaking off the dust. Moving higher, can it rise like a phoenix?

Before moving to the technical part of today's analysis, it seems that a quote from yesterday's Oil Trading Alert would be appropriate:

Crude oil was just trading below 0. Well, not completely, but the nearest futures contract was trading below 0 for the first time ever.

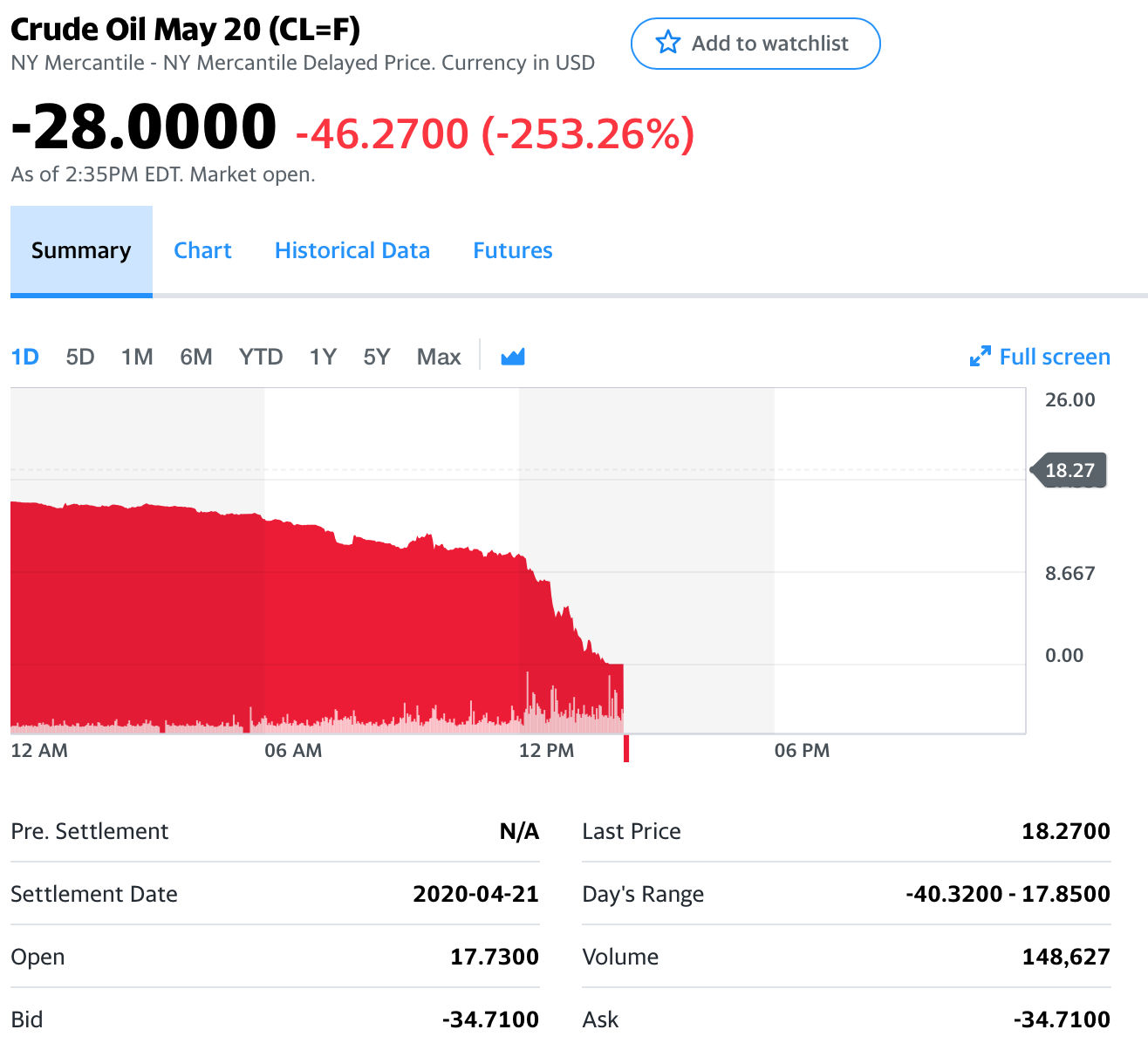

In case you missed it, here's the screenshot from finance.yahoo.com and yesterday's price quote as it was falling.

Crude oil was just trading below 0. Well, not completely, but the nearest futures contract was trading below 0 for the first time ever. Ridiculous, right? Well, yes, and no. It's not that ridiculous if you take into account bigger supply due to earlier OPEC+ disagreement and lower demand due to Covid-19. Producers have to produce crude oil on a daily basis, because shutting down production is costly. One cannot store oil just anywhere and the facilities designed for it were already getting full. This means that people were unwilling to buy it, because it was not really possible to store it. To encourage people to buy it (and take delivery) anyway, producers paid extra instead of charging per barrel - more than $30 per barrel.

Sure, it was just the May contract, which expires today and the delivery is next month. The following futures contracts (the ones that expire in the following months) are priced at about $20 or higher. But will they be able to remain as high? The market thinks that the situation will somehow be resolved within a month. But will this really be the case? If not, we could see something similar once again.

Crazy times, and economic history in the making.

Since the situation in the futures market is too unclear right now, our chart analysis will focus on the most popular crude oil ETF, the USO ETF.

This is what we wrote in our yesterday's Oil Trading Alert:

(...) What's next?

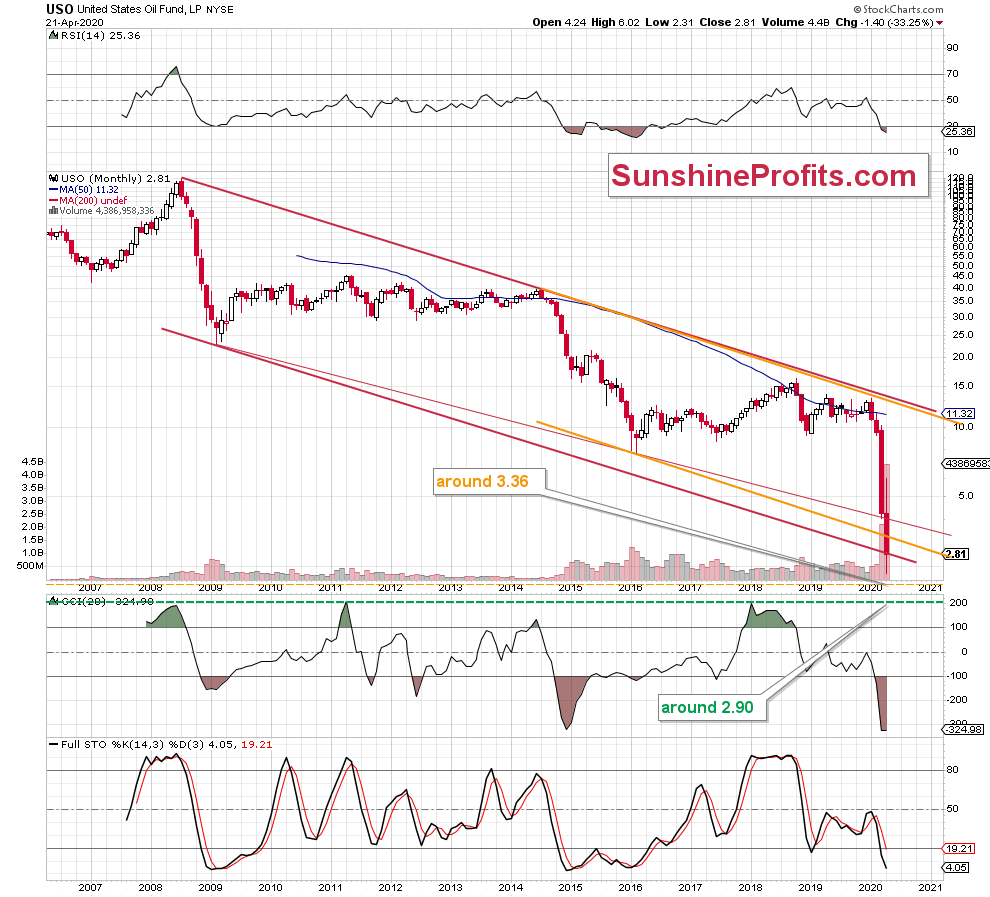

Taking into account this month's breakdown not only below the thin red line, but also below the last month's low, we think that further deterioration may be just around the corner.

How low could the USO go if the sellers move on?

In our opinion, the first downside target will be around 3.36, where the lower border of the orange declining trend channel currently is. Nevertheless, if it won't stop the bears, the next support could be around 2.90, which is where the lower border of the red declining trend channel currently is.

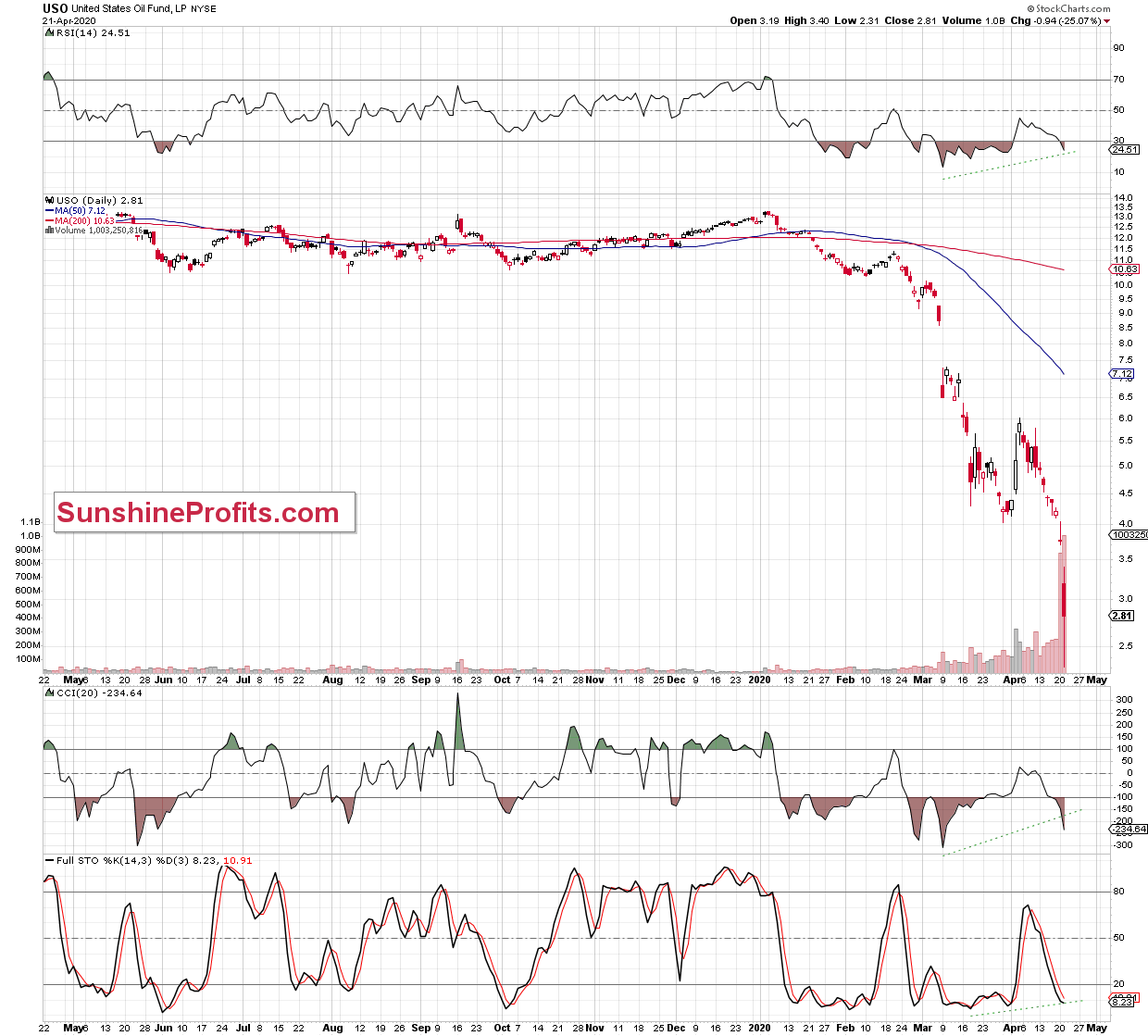

From today's point of view, we see that the overall panic in the oil marked took the USO ETF not only to our downside targets, but also below both support lines.

After a fresh 2020 (and also an all-time) low of 2.31, the ETF pulled back quite sharply, which shows that the bulls were active around the mentioned price level. Thanks to this price action, the USO moved to the previously broken lower border of the red declining trend channel. Unfortunately for the bulls though, this could be just a verification of the earlier breakdown.

Should it be the case, another move to the downside and likely a fresh low (maybe even around 0.50-0.70), is a strong possibility.

Nevertheless, if the bulls show strength once again (similarly to their rebound from yesterday's lows) and manage to invalidate the above mentioned breakdown (closing the day above 2.90), an attempt to close the gap created at the beginning of yesterday's session wouldn't surprise us.

Before summarizing, let's keep in mind that the ETF rose in pre-market trading. Coupled with all the yesterday-discussed technical signs (the bullish divergences, indicators' posture and the similarity to what we saw in the past) could trigger further improvement and a test of the lower (or even the upper) border of yesterday's gap.

However, in our opinion, it is too early to say that the worst is already behind the bulls, the USO ETF and the oil market. The rush to open any positions can easily prove premature.

Summing up, while it seems that crude oil might drop some more before rebounding, it might also be the case that the short-term outlook turns bullish if crude oil successfully tests the previous lows. After Monday's enormous and unbelievable profits in crude oil, it doesn't appear that opening new positions right now is justified from the risk to reward point of view. Soon, it might be though.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Crude Oil Carnage and Enormous Profits

April 20, 2020, 9:34 AMAvailable to subscribers only. Today's Oil Trading Alert includes very profitable details.

-

Oil Is On the Move, On a Sharp One Actually

April 17, 2020, 12:29 PMCrude oil has been consolidating with a downward bias recently, and took a dive earlier today. Is this move to be trusted - is it for real?

These were our yesterday's observations:

(...) Earlier today, black gold futures tested the previously broken lower border of the blue consolidation. This could be considered as a verification of the earlier breakdown below this formation - and should it actually be the case, we'll likely see a reversal and then decline in the following hours.

Analyzing the 4-hour chart, we also added:

(...) thanks today's "increase" crude oil futures also climbed to the upper border of the green consolidation (...) This level stopped the bulls, and triggered a pullback in the following hours.

Therefore it's our opinion that as long as both the above-mentioned resistances remain unbeaten, the way to the north is blocked and reversal may be just around the corner.

Should it be the case and oil moves lower from here, the first downside target for the bears will be yesterday's low of $19.20.

Looking at the above charts, we clearly see that the bulls were quite weak during yesterday's session. They didn't even manage to retest the above-mentioned premarket peak and the previously broken lower border of the blue consolidation marked on the daily chart.

This underscores their weakness, which doesn't bode well for higher values of crude oil and its futures ahead. Actually, it increases the probability of at least a re-test of yesterday's low.

Should this level be broken, the way to the south would open. How low could the futures go should we see further deterioration?

In our opinion, the first downside target will be around $17.50, where the size of the downward move will correspond to the height of the green consolidation seen on the 4-hour chart.

But if this level is broken, we'll likely see our Wednesday's scenario realized:

(...) The next strong support is provided by the 2001 low of about $17, but if it fails, crude oil could slide all the way down to the $11 level. Ridiculous? Yes, but impossible? Absolutely not. Likely? Yes, but not very likely. We might see the final bottom at $17, but it's too early to say that it will indeed be the case. Unless we see some meaningful bullish indication while crude oil is trading close to $17, we'll likely keep our original target for this decline intact.

Summing up, while the situation in crude oil is very tense, the bears are increasingly enjoying the upper hand. It seems that our profitable short positions will become even more so shortly. The sharp move lower is clearly underway as we speak.

Thank you.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Pressures in the Oil Market Are Building

April 16, 2020, 11:04 AMCrude oil bulls don't seem to be making much progress these days. The situation is tense, and black gold keeps hovering ever so close to its recent lows. Can the bulls get their act together and avert the fall of a cliff ahead?

Looking at daily chart, we see that although crude oil futures extended losses and hit a fresh 2020 low, it was formed only 7 cents below the previous low. After that, the futures rebounded a bit, invalidating the earlier breakdown.

Earlier today, black gold futures tested the previously broken lower border of the blue consolidation. This could be considered as a verification of the earlier breakdown below this formation - and should it actually be the case, we'll likely see a reversal and then decline in the following hours.

And speaking about today's peak... thanks to today's "increase" crude oil futures also climbed to the upper border of the green consolidation marked on the 4-hour chart above. This level stopped the bulls, and triggered a pullback in the following hours.

Therefore it's our opinion that as long as both the above-mentioned resistances remain unbeaten, the way to the north is blocked and reversal may be just around the corner.

Should it be the case and oil moves lower from here, the first downside target for the bears will be yesterday's low of $19.20.

Nevertheless, when we focus on the current position of the 4-hour indicators, we see that all of them generated their buy signals. This suggests that another attempt to move higher is likely in the very short term - and it could happen even later today). However, such development would be more likely and reliable only if the bulls take futures above $20.52, which is where both the above-mentioned resistances are.

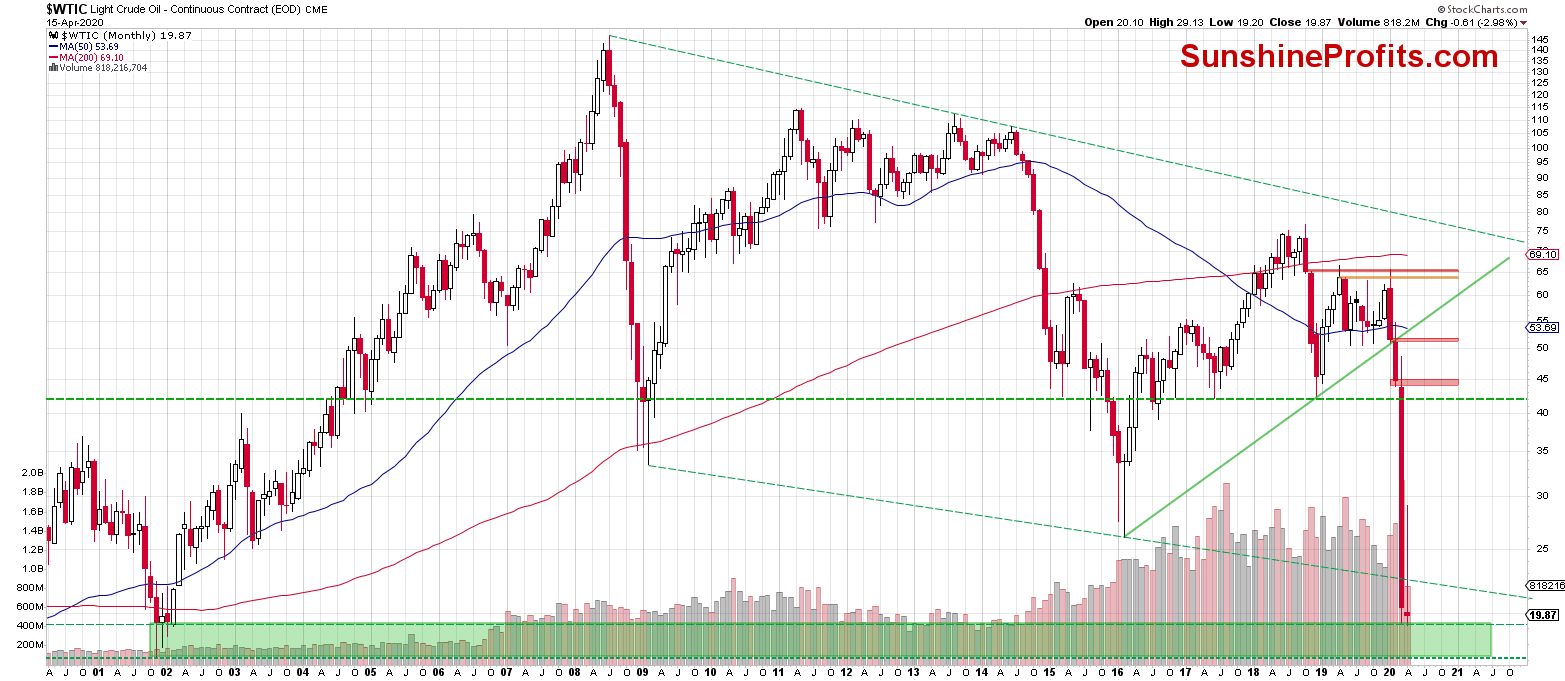

This scenario is also supported by the long-term green area seen on the long-term chart below.

From this perspective, we see that crude oil reached in March the upper border of the green support zone based on November 2001, December 2001, January 2002 and February 2002 lows (in terms of intra- monthly lows, monthly closing and opening prices). These serve as the nearest and major support for the price of black gold.

Connecting the dots, we think that the fate of crude oil and the futures will depend on the outcome of the fight around today's pre-market peak. In other words, if the bulls use buy signals as a signal to fight and manage to push the futures above $20.52, the way to around $21.76 may be open. In this area, the size of the upswing would correspond to the height of the green consolidation seen on the 4-hour chart.

On the other hand, if the buyers fail once again and the futures won't finish the day above $20.52, a reversal and the probability of at least a re-test of yesterday's low, will increase. In this case, our yesterday's observations will be up to date:

(...) The next strong support is provided by the 2001 low of about $17, but if it fails, crude oil could slide all the way down to the $11 level. Ridiculous? Yes, but impossible? Absolutely not. Likely? Yes, but not very likely. We might see the final bottom at $17, but it's too early to say that it will indeed be the case. Unless we see some meaningful bullish indication while crude oil is trading close to $17, we'll likely keep our original target for this decline intact.

Summing up, the situation is very tense in crude oil, but overall it seems that our profitable short positions will become even more so shortly.

Thank you.

Nadia Simmons

Day Trading and Oil Trading StrategistPrzemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM