-

Today's Key Move in Oil

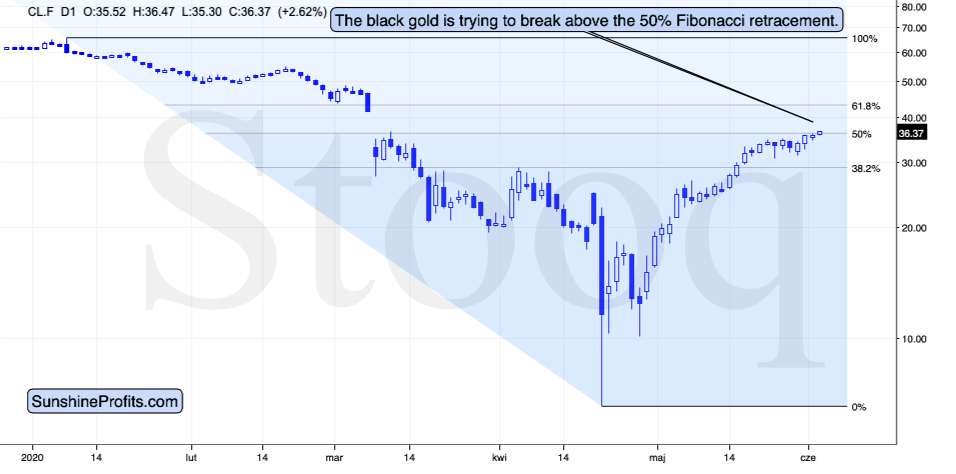

June 2, 2020, 9:31 AMAt the moment of writing these words, crude oil is attempting to break above its 50% Fibonacci retracement level. So far, it has been trading above it for just a few hours, so one better remain skeptical about this move just yet.

At the same time, crude oil moved above the mid-March high that the commodity made right after forming the big price gap.

This means that crude oil will have a hard time confirming this breakout. Invalidating it, on the other hand, would serve as a strong sell signal. Given the recent relatively weak performance of crude oil compared to the stock market, we think that such an invalidation is likely. Once it takes place, it will make the outlook more bearish than it is today.

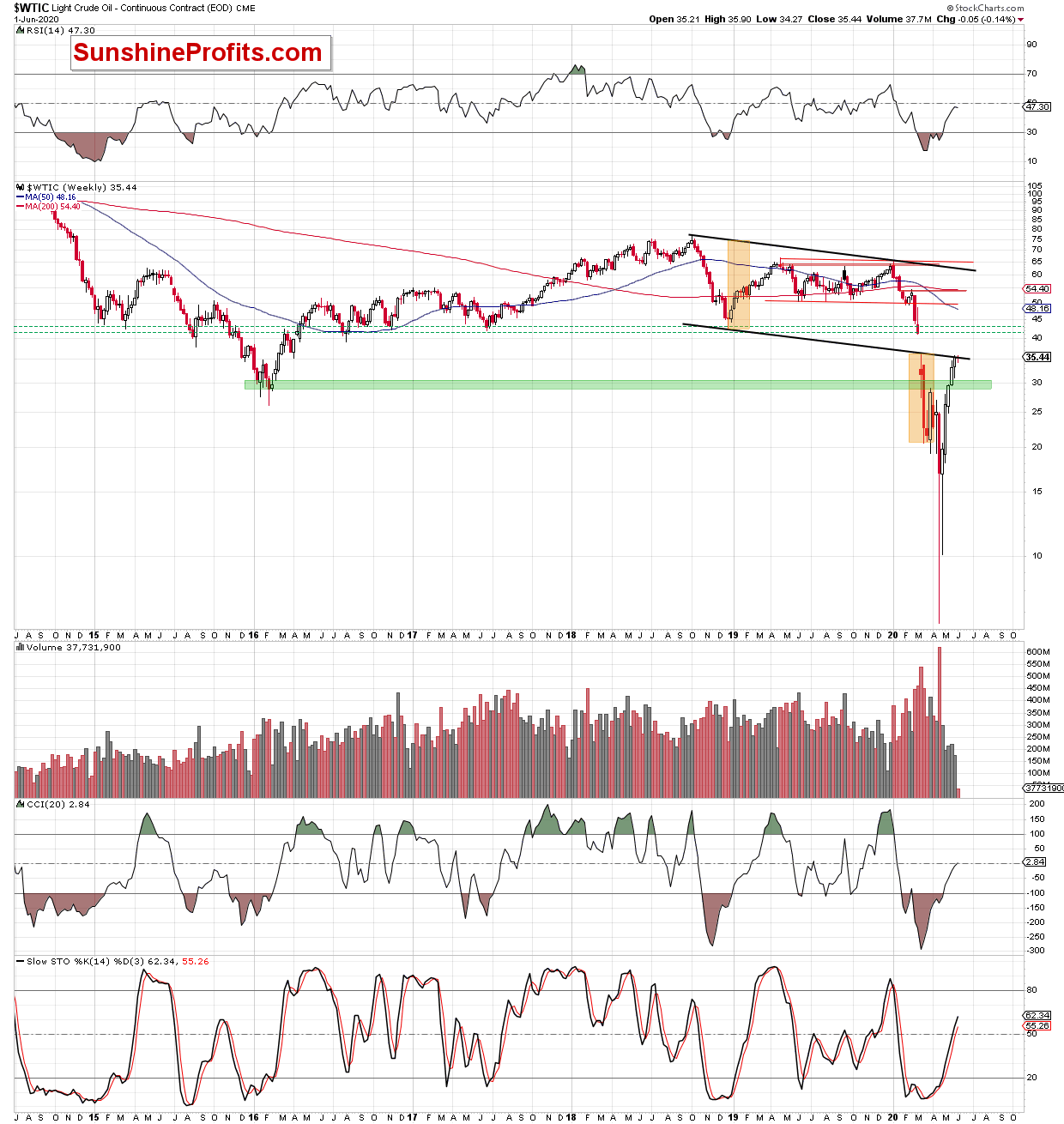

Moreover, let's keep in mind that crude oil is also right at the lower border of medium-term declining trade channel. This is a strong resistance line and crude oil approached it on relatively low weekly volume.

This is yet another reason to expect a short-term downturn in the following days and perhaps weeks, not another sizable rally. Of course, the situation will clarity once (if?) black gold invalidates its overnight breakout.

For now, the outlook for crude oil is bearish, but not significantly so.

Summing up, we think that small short positions in crude oil are justified right now.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

-

Crude Oil Keeps Bidding Its Time But We Act

June 1, 2020, 10:53 AMAvailable to premium subscribers only.

-

Ready for the Decisive Action in Crude Oil

May 29, 2020, 10:22 AMAvailable to premium subscribers only.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM