Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions (updated)

- Short-term gas: in yesterday’s OTA (have a look there for price details!), we mentioned the possibility of going short on Natural Gas by taking a bearish convergence as a signal. This more aggressive trade was set by placing a stop order below the range where prices were moving in order to be triggered when the range gets broken through its lower levels. However, since this scenario did not happen and prices broke the range through its upper levels, our order, invalidated by yesterday’s spike up, should now be canceled.

- Medium-term gas: the recent extension of the gas rally makes our expected entry level further away and thus unlikely to be reached in the forthcoming days.

- So, for now, with these two scenarios being invalidated, no position is justified (fig.1) from the risk-to-reward point of view. We prefer waiting for new market data.

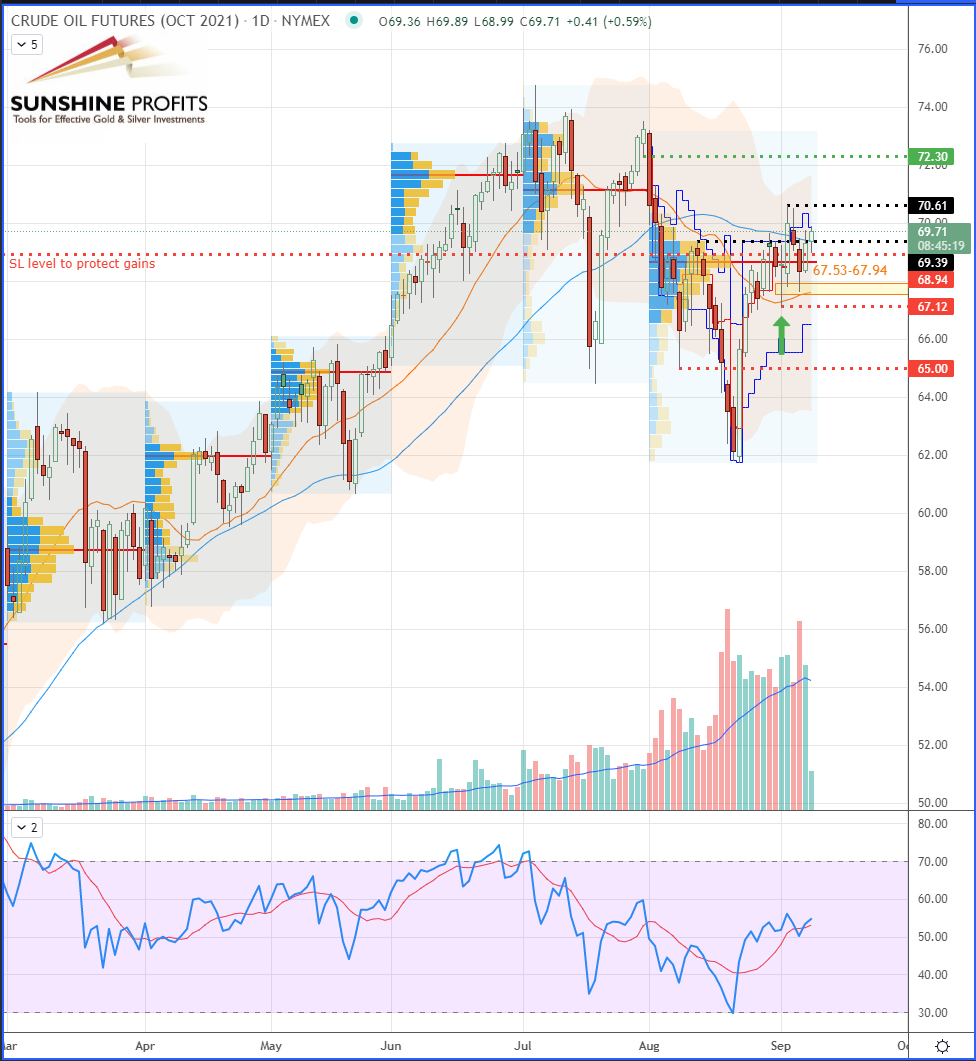

- Short-term oil: the market gave us a second chance to enter the trade (which was suggested and repeated in our previous OTAs) on Tuesday before the crude rebounded again. To make sure we save some gains from this trade, as prices have already broken yesterday’s high, we could now lift the stop-loss from below $67.12 up to the $68.94 level (fig.2). The next stop-loss adjustment should be made once the prices break through $70.61.

Figure 1 – Henry Hub Natural Gas (NGV21) Futures (October contract, daily)

Figure 2 – WTI Crude Oil (CLV21) Futures (October contract, daily)

In summary, we prefer staying neutral on Natural Gas at the moment. That market, while extending its gains, just invalidated a potential bearish divergence that was forming yesterday - in particular on its weekly chart. However, our Crude Oil position remains unchanged, although one more time we would like to provide you with some risk adjustments not to let any profits go away!

As always, we’ll keep you, our subscribers well-informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist