-

Behavior of Inflation and Bond Yields Seems… Contradictory

July 29, 2021, 12:50 PMThe bond yields dropped despite surging inflation. It’s not a usual thing on the market, so we have to ask: what does it mean for gold?

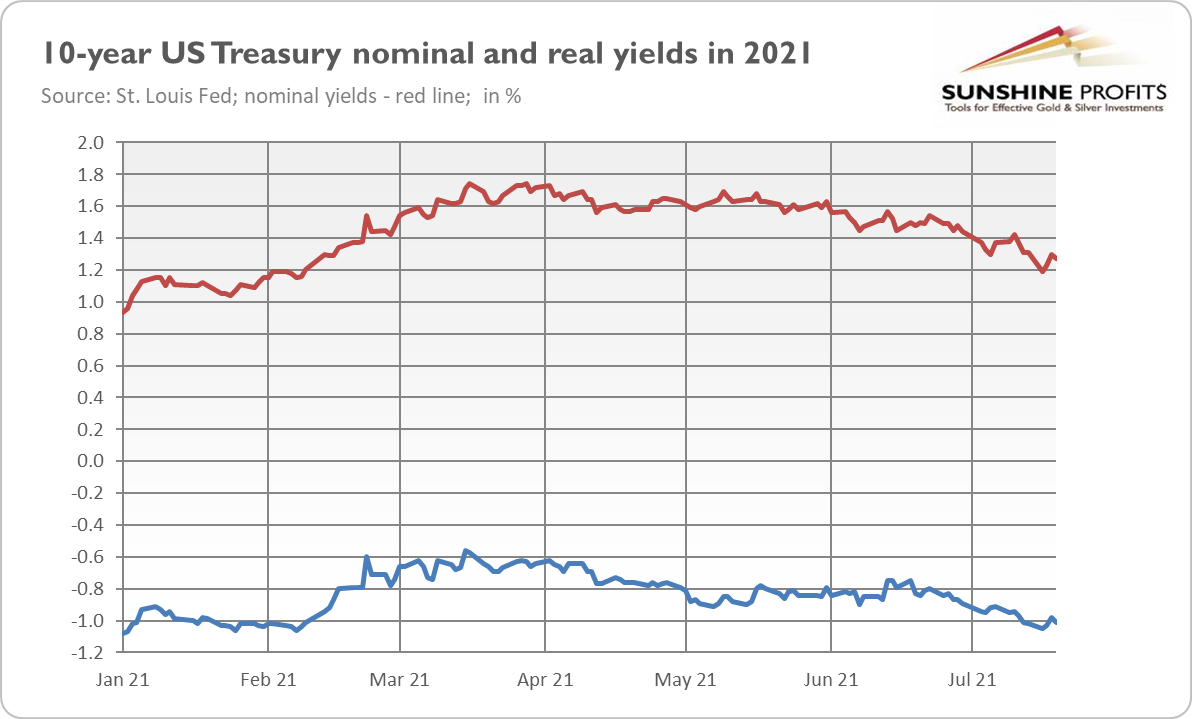

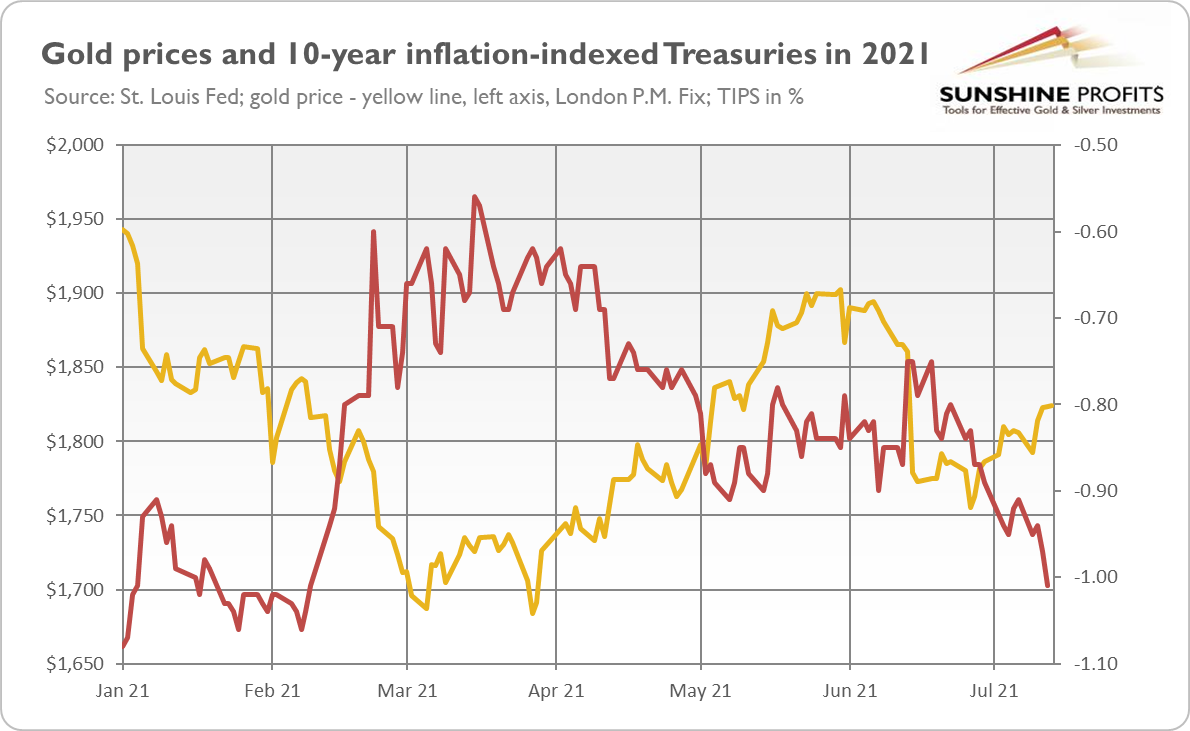

The markets hide many mysteries. One of them is the recent slide in the long-term bond yields. As the chart below shows, both the nominal interest rates and the real interest rates have been in a downside trend since March (with a short-lived rebound in June). Indeed, the 10-year Treasury yield reached almost 1.75% at the end of March, and by July it decreased to about 1.25%, while the inflation-adjusted yield dropped from -0.63% to about -1%.

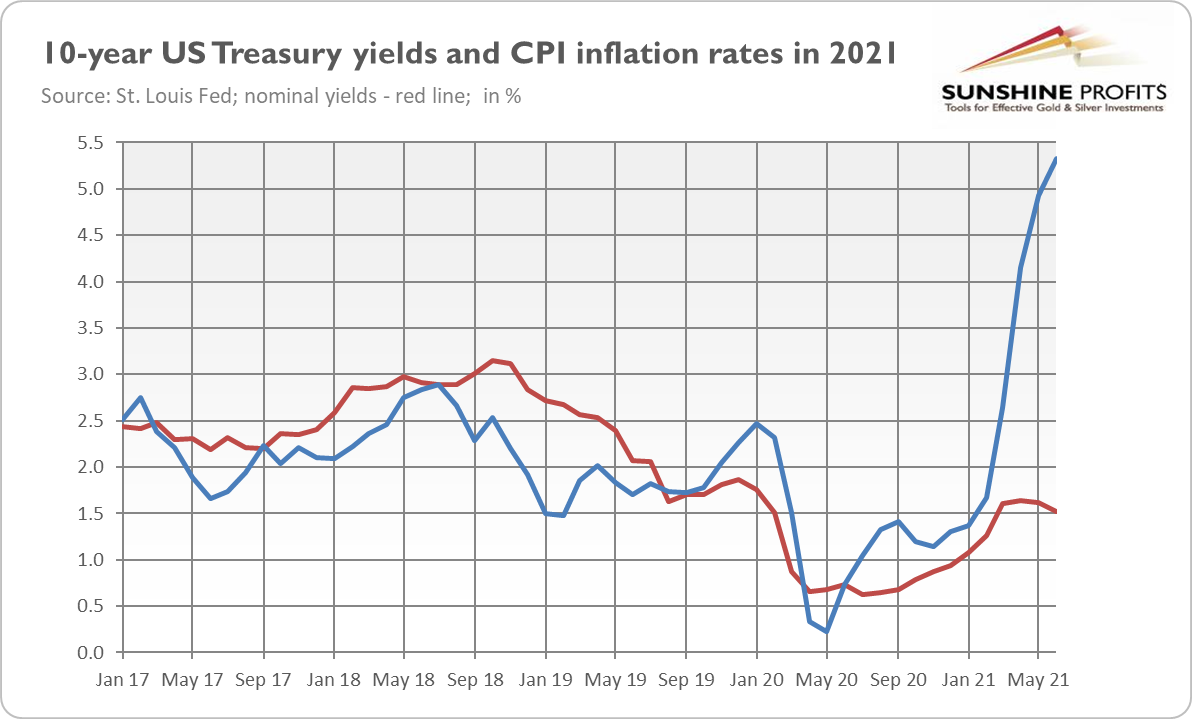

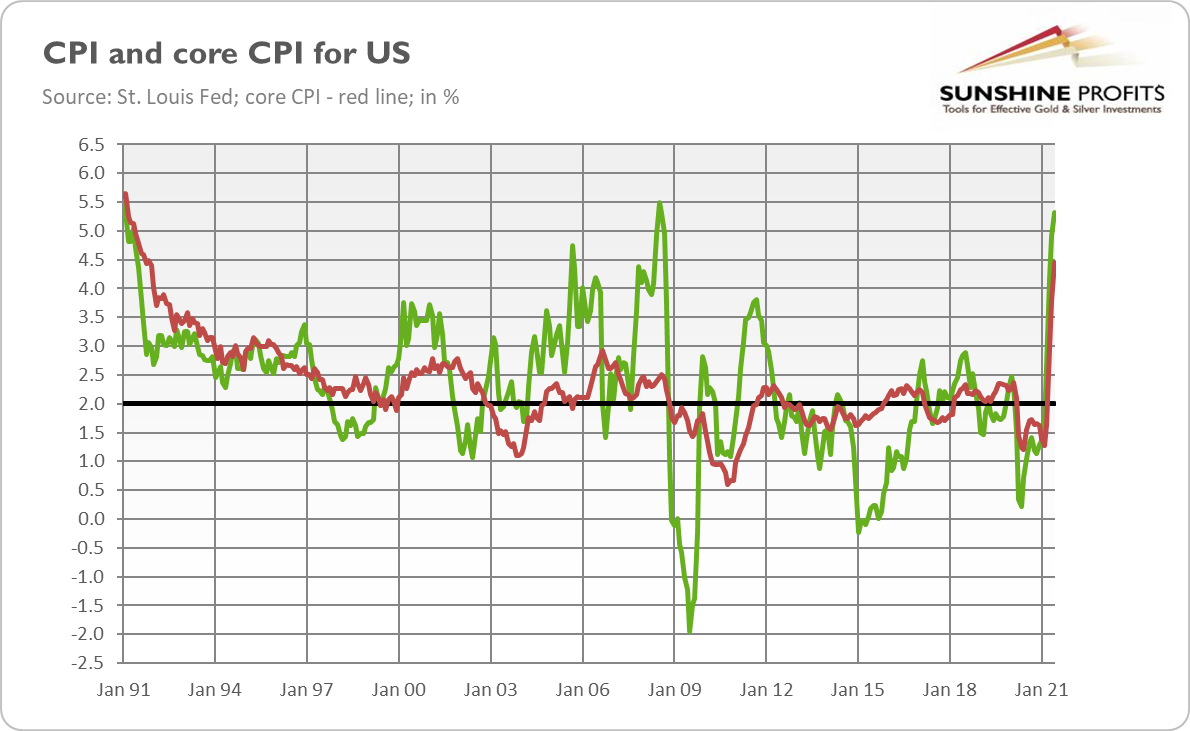

What’s intriguing, this drop happened despite the surge in inflation. As you can see in the chart below, the seasonally adjusted annual CPI inflation rate surged to 5.3% in June, the highest level since the Great Recession. Even as inflation soared, the bond yields declined.

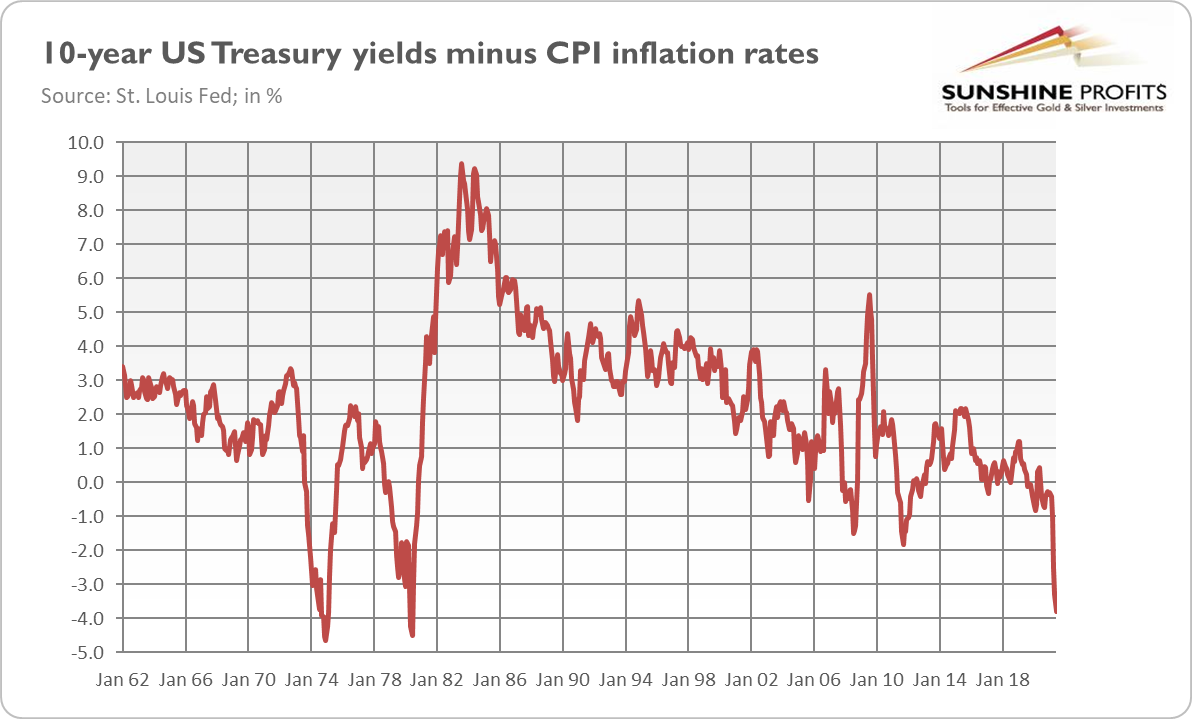

Why is that? Are bond traders blind? Don’t they see that the real interest rates are deeply negative? Indeed, the TIPS yields are the lowest in the history of the series (which began in 2003), while the difference between the nominal 10-year Treasury yields and the CPI annual rates is the lowest since June 1980, as the chart below shows.

The pundits say that the decline in the bond yields suggests that inflation will only be temporary and there is nothing to worry about. This is what the central bankers repeat and what investors believe. However, history teaches us that the bond market often lags behind inflation, allowing the real interest rates to plunge. This happened, for example, in the 1970s (see the chart above), when the bond market was clearly surprised by stagflation.

Another issue here is that the central banks heavily influence the bond markets through manipulation of interest rates and quantitative easing, preventing them from properly reacting to inflation. Actually, some analysts say that the bond market is the most manipulated market in the world. So, it doesn’t have to predict inflation properly.

Implications for Gold

What does the divergence between the bond yields and inflation imply for gold? Well, as an economist, I’m tempted to say “it depends”. You see, if inflation is really temporary, it will start declining later this year, making the real interest rates rise. In that case, gold would suffer (unless inflation decreases together with the pace of economic growth).

It might also be the case that the divergence will narrow as a result of the increase in the nominal interest rates. Such a move would boost the real interest rates and create downward pressure on gold.

However, if inflation turns out to be more persistent than expected, investors will fear an inflation tail risk, and they will be more eager to buy gold as an inflation hedge. As I’ve explained, the decline in the bond yields doesn’t have to mean low inflation expectations. It may also indicate expectations of slower economic growth. Combined with high inflation, it would imply stagflation, a pleasant environment for gold.

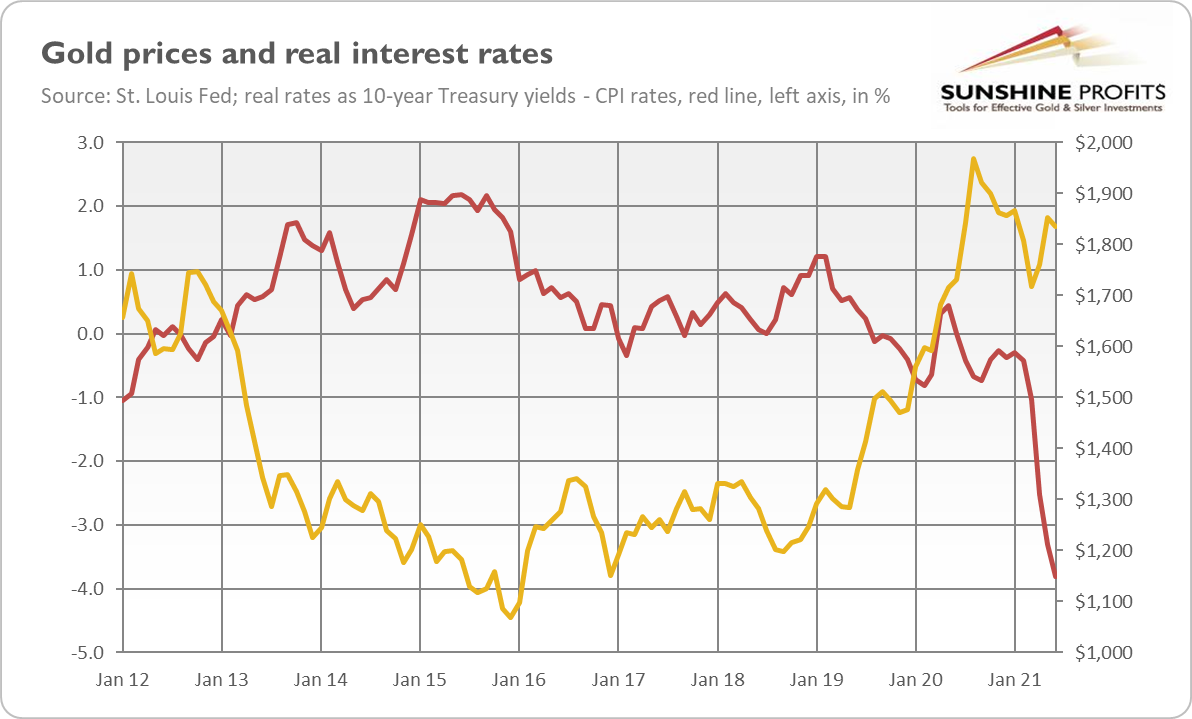

Another bullish argument for gold is the observation that the price of gold has recently lagged the drop in the real interest rates, as the chart below shows. So, it might be somewhat undervalued from the fundamental point of view.

However, given the upcoming Fed’s tightening cycle and the record low level of real interest rates, I would bet that the above-mentioned rates will increase later this year, which should send gold prices lower. But if they rise too much, it could make the markets worry about excessive indebtedness and release some recessionary forces. Then, the current reflation could transform into stagflation, making gold shine. So, gold could decline before it rallies again.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

ECB Turns Even More Dovish. Breakthrough for Gold?

July 27, 2021, 9:19 AMThe ECB has become the exact opposite of the FED in terms of monetary policy. This dovishness might actually be bad news for gold.

The European Central Bank held its monetary policy meeting last week. It was an important event, as it was the first meeting since the adoption of the new ECB’s strategy, and as the ECB has introduced some changes. It left the interest rates unchanged, but it modified its forward guidance.

Long story short, the ECB announced that it would keep its policy rates at ultra-low levels for even longer than previously pledged, as it doesn’t want to tighten prematurely:

In support of our symmetric two per cent inflation target and in line with our monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until we see inflation reaching two per cent well ahead of the end of our projection horizon and durably for the rest of the projection horizon, and we judge that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.

Previously, the ECB maintained that it would keep the interest rates unchanged until inflation expectations converge with the central bank’s target. The change implies that the ECB is unlikely to raise the interest rates until at least 2023, as this is when the projection horizon ends. Central bankers want inflation to be stable at the target, and they won’t hike without tapering quantitative easing earlier.

Additionally, the ECB has decided to keep the pace of its asset purchases under the Pandemic Emergency Purchase Programme at the current (faster than it was originated) pace over the third quarter of 2021:

Having confirmed its June assessment of financing conditions and the inflation outlook, the Governing Council continues to expect purchases under the pandemic emergency purchase programme (PEPP) over the current quarter to be conducted at a significantly higher pace than during the first months of the year.

So, the ECB’s monetary policy has become even more accommodative. The alteration could be explained by two factors: the ECB’s new strategy and the Delta variant of the coronavirus. But the real reason is, of course, protecting the European government from the market interest rates – however, this is a topic for another discussion.

I have covered both of the ‘official’ factors recently, warning my readers that the change in the strategy implies that the ECB has adopted an even more dovish stance and that the spread of Delta could prompt the central banks to further loosen their stance. This is exactly what has happened – as Christine Lagarde pointed out during her press conference:

The recovery in the euro area economy is on track. More and more people are getting vaccinated, and lockdown restrictions have been eased in most euro area countries. But the pandemic continues to cast a shadow, especially as the delta variant constitutes a growing source of uncertainty.

Implications for Gold

What does the change in the ECB’s monetary policy imply for the gold market? Well, one could say that more dovish central banks are positive for gold, which likes the environment of low interest rates and bond yields.

However, economics is about relative values. So, from the point of view of the comparative analysis, the ECB’s dovish shift is bad news for the yellow metal. This is why the Fed looks hawkish in comparison to the ECB, its main counterparty. After all, the Fed has actually started talking about tapering and monetary policy normalization, while the ECB has just announced that it would keep its quantitative easing at an elevated pace and would maintain its ultra-low interest rates for even longer.

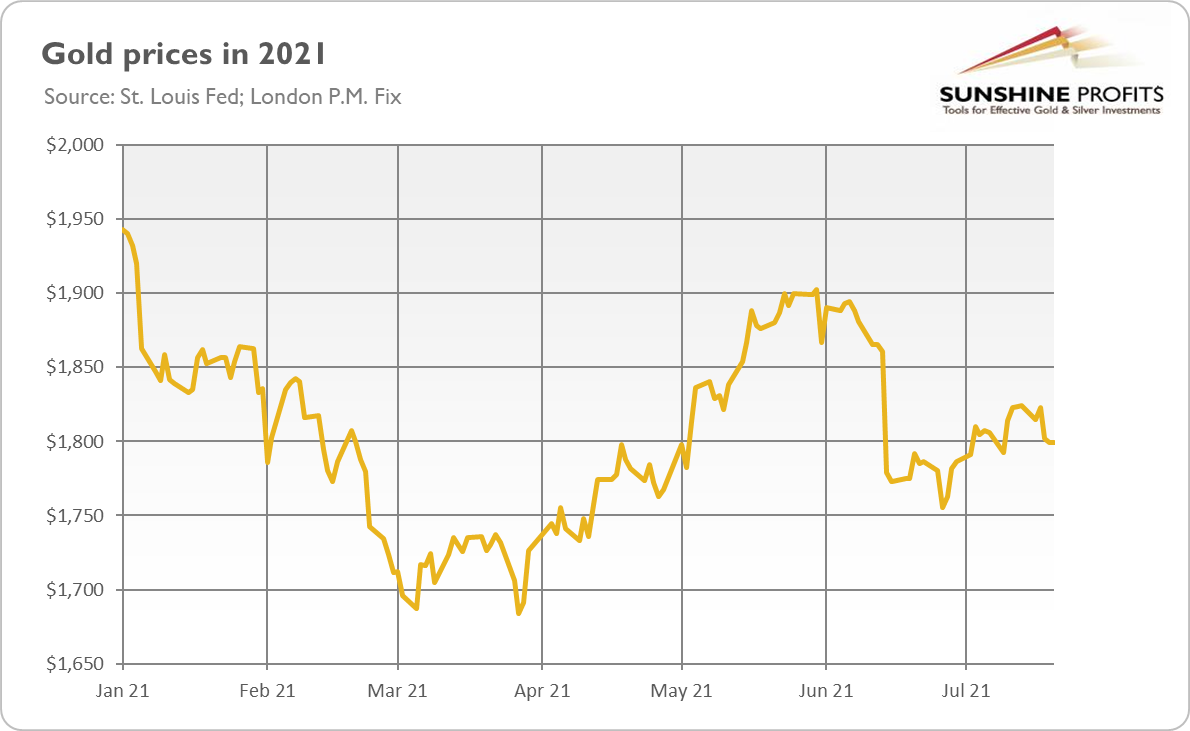

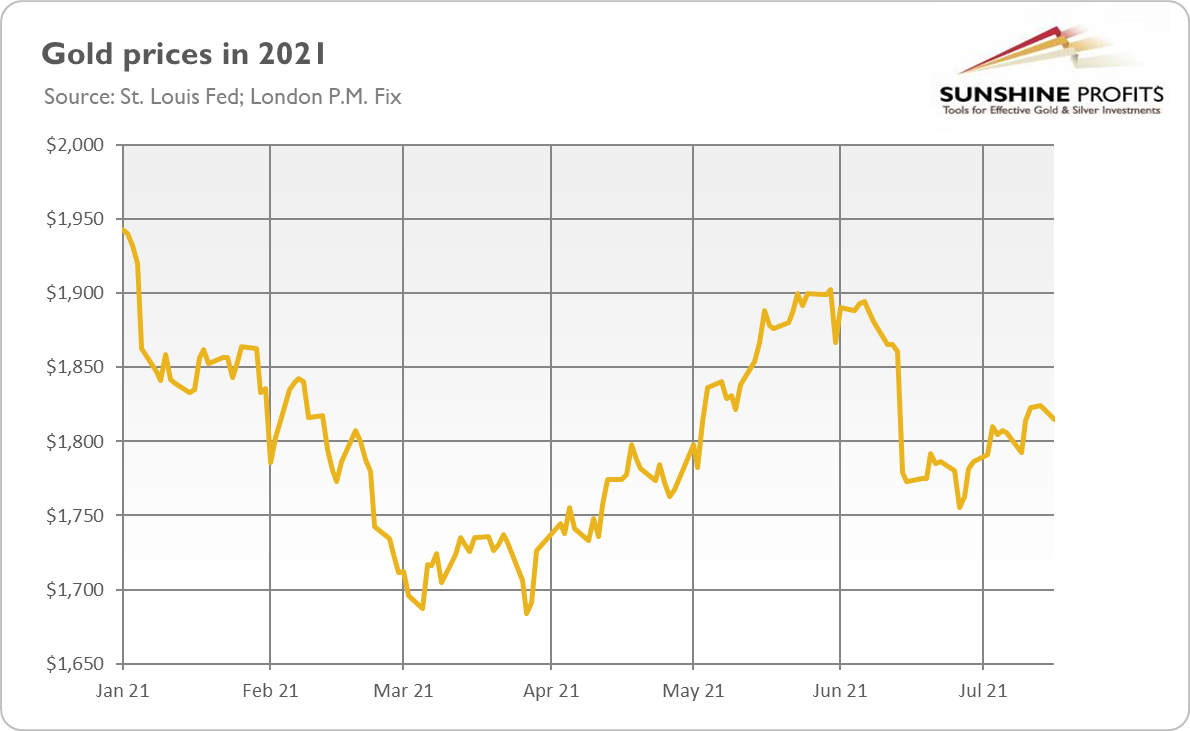

Hence, the greenback appreciated relative to the euro after the ECB’s monetary policy meeting. Although a stronger dollar creates downward pressure on the yellow metal, the price of gold barely moved and is still trading around $1,800, as the chart below shows.

However, there is a silver lining here. Some market participants were actually disappointed that the ECB didn’t provide a stronger adjustment. Indeed, no monetary bazookas this time. Moreover, the ECB’s decision was not unanimous, so there is some sort of a hawkish camp. Last but not least, it might be the case that the Fed will also loosen its stance if the Delta variant spreads in a dangerous way. Having said that, the divergence in monetary policy and interest rates across the pond should be a headwind for gold prices for a while.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Delta Variant Spreads. Will It Mutate Gold?

July 22, 2021, 8:09 AMThe coronavirus strikes back! It’s bad news for almost everyone and everything… except for merciless gold.

So, were you hoping that the epidemic was over? After all, millions of people got vaccinated, and the economy is booming. Restrictions have been generally lifted, the Fed removed the parts related to the pandemic from its monetary policy statement… why bother then?

The answer is: Delta. And I’m referring to the Sars-Cov-2 variant that causes Covid-19. As you know, viruses mutate from time to time as they spread and replicate. Delta is one of such mutations. Most mutations are not dangerous or even dumb (they weaken the viruses). But the problem with Delta is that it’s “the fastest and fittest” of all coronavirus variants, as the WHO described it. Just think about Rambo on steroids or a witcher that has just taken all his potions. Oh… Anyway, you got the point.

In particular, Delta is much more contagious than the original strain, and is spreading about twice as fast. A person infected with the classic version of the coronavirus can spread it to 2.5 other people, while a person with Delta can infect 3.5-4 other people. Delta might also be more severe and more lethal than the original strain.

The good news is that many people have been vaccinated and the vaccines (especially the mRNA-type) protect nicely against Delta. However, the bad news is that many people still haven’t gotten the shots, for many reasons. The tricky part here is that, given the high transmission rate of Delta, we would need 90% or even more people to be vaccinated to reach herd immunity, which is still a song of the future.

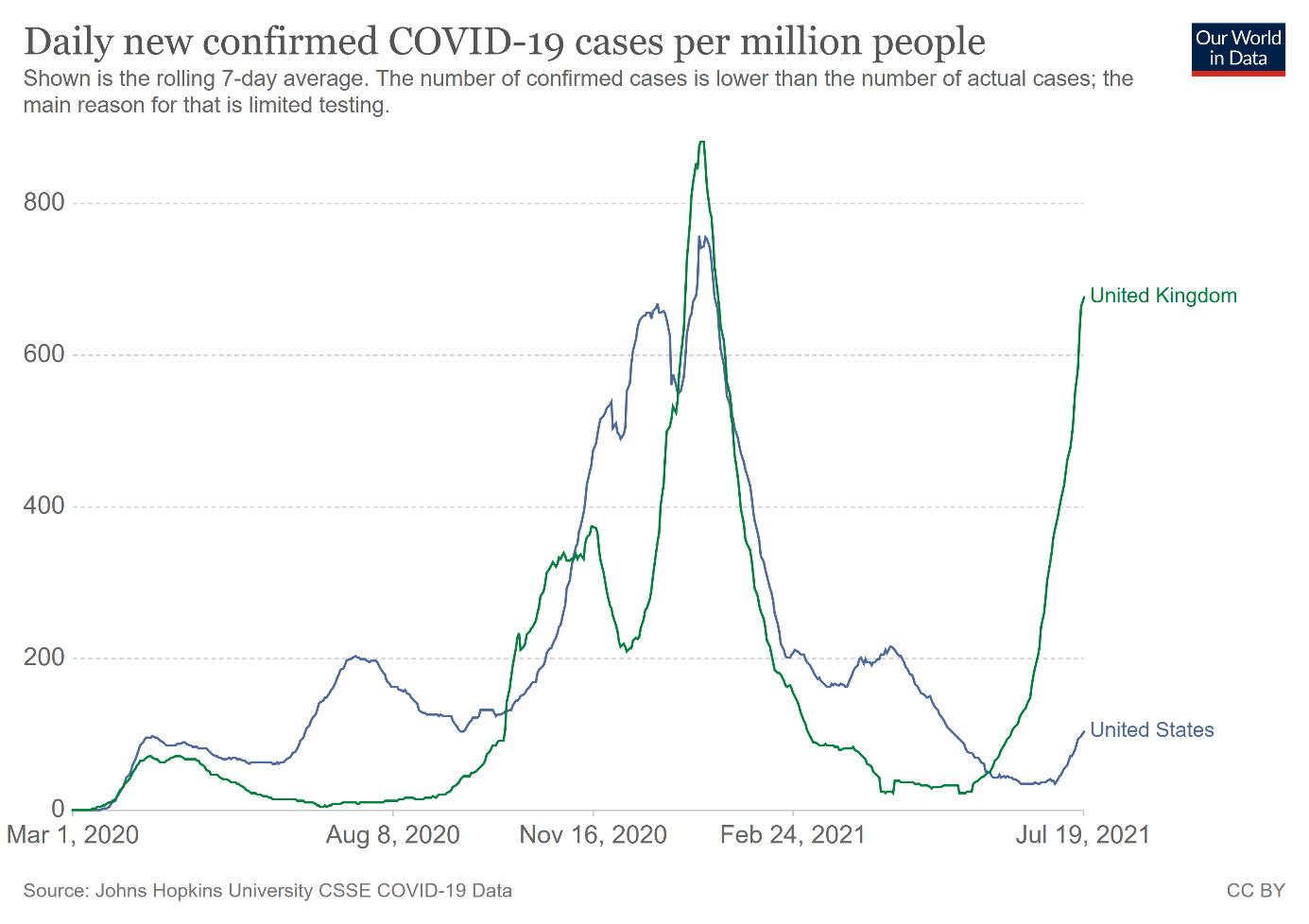

High transmissibility is the reason why Delta has become the dominant strain in the globe. It also increases the risk of further, potentially even more dangerous, mutations (more transmissions, more chances to evolve into Terminator). In other words, Delta’s fast transmission could reignite the pandemic. As the chart below shows, this is actually already happening.

As one can see, Delta reversed the trend of the declining number of new cases, spreading particularly quickly in the United Kingdom. But the U.S. Covid-19 cases also soared, surging 70% last week, while deaths went up 26%.

Implications for Gold

What do rising cases of Delta mean for gold? Well, I would say that Delta is fundamentally positive for gold and could mutate it into a more bullish strain. If the pandemic accelerates, governments may reintroduce some of the sanitary restrictions or even lockdowns. A new wave of the epidemic would also increase the chances of a big infrastructure bill in the US and other fiscal stimuli, while the Fed would likely remain dovish for longer than it would without Delta. So, inflation could intensify even further, while the real interest rates would drop. Therefore, concerned investors would turn to inflation hedges and safe havens such as gold.

However, what’s described above is the medium-term effects that Delta would cause if it triggered a new wave of cases and restrictions. In the short run, however, gold may decline, as worried investors would sell the assets and turn to the US dollar. This is what we saw in March 2020 but also on Monday (July 19, 2021). As the chart below shows, the London price of gold has declined, as the stronger greenback counterweighted the decline in the equities (Dow plunged more than 2%) and bond yields.

Furthermore, the next Great Lockdown is unlikely. Even if the government reintroduces some restrictions, their economic impact will be much smaller than during the earlier waves, as economies have adapted to operating under the epidemiological regime. Importantly, a new wave would be mainly limited to unvaccinated people, which would reduce the burden of health care systems and chances of hard lockdowns.

However, Monday’s equity selloff suggests a change in the market narrative. Investors have possibly realized that they had too optimistic expectations – economic growth may actually be slower than they thought. They have priced in a very strong recovery, which doesn’t have to materialize if a new pandemic wave hits the economy. Slower growth plus high inflation equals stagflation, gold’s favorite environment.

Having said that, it may take a while until gold rallies, as the end of reflation trade may also imply that some investors will sell commodities, including, to some extent, gold. Also, please note that the optimism and gains have quickly returned to the stock market, so the economic impact of Delta may be limited.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Powell Gave Congress Dovish Signs. Will It Help Gold?

July 20, 2021, 8:15 AMPowell admits that inflation is well above the Fed’s target, but he still considers it transitory. Gold increased in response – only to fall again.

Last week, Powell testified before Congress. On the one hand, Powell admitted in a way that inflation had reached a level higher than expected and is above the level accepted by the Fed in the longer run:

Inflation has increased notably and will likely remain elevated in coming months before moderating.

It means that the Fed was surprised by high inflation, but it doesn’t want to admit it explicitly. Instead, Powell admitted that inflation would likely stay at a high level for some time. The obvious question here is: why should we believe the Fed that inflation will really moderate later this year, given that the US central bank failed in forecasting inflation in the first half of 2021?

What’s more, Powell acknowledged that he hasn’t felt comfortable with the current level of inflation:

Right now, inflation is not moderately above 2%; it is well above 2%. The question is, where does it leave us six months from now? It depends on the path of the economy.

It means that, at some point in the future, if high inflation turns out to be more persistent than expected, the Fed will act to bring inflation back to lower levels. However, nobody knows when exactly it could happen – and I bet that, for political reasons, it would happen rather later than sooner.

Indeed, even though inflation turned out to be higher than previously thought, Powell downplayed the danger of rising prices, reiterating the view that inflation is transitory. In particular, Powell maintained that recent price hikes were closely related to the post-pandemic recovery and would fade after some time:

The high inflation readings are for a small group of goods and services directly tied to reopening.

I dare to disagree. It’s true that the hike in the index for used cars accounted for one-third of the June CPI jump. But two-thirds of 5.4% is 3.6%, still much above the Fed’s target! Anyway, in line with its narrative, the Fed doesn’t see a need to rush with its tightening cycle. After all, the US labor market is – according to Powell and his colleagues from the FOMC – still far from achieving “substantial further progress”, with 7.5 million jobs missing from the level seen before the start of the pandemic. So, the tapering of quantitative easing is – as Powell noted – “still a ways off”. So, overall, Powell’s remarks were dovish and positive for the yellow metal.

Implications for Gold

What does Powell’s recent testimony imply for the gold market? Well, the yellow metal initially rose after his appearance in Congress. This is probably because investors bought the narrative about transitory inflation and decided that monetary taps would stay open for a long time and tapering would start later than investors expected in the aftermath of the recent dot-plot. The rising cases of the Delta variant of the coronavirus is another reason why investors could bet that the Fed would maintain its accommodative monetary policy. So, the bond yields declined, while the price of gold increased as the chart below shows.

However, gold’s reaction was disappointingly soft given the dovishness of Powell’s remarks, and the yellow metal declined again later last week amid some better-than-expected economic data. It seems that there is hesitancy among precious metals investors about whether or not to take a more decisive step with purchases of gold. The reason is probably that, sooner or later, the interest rates will have to rise in response to inflation. It means that the opportunity costs of holding gold will increase, exerting some downward pressure on gold.

Nevertheless, the real interest rates should remain low, so gold prices shouldn’t drop like a stone. Actually, in the longer run, when inflation creates some economic problems while the economic growth slows down, the yellow metal could finally benefit from the stagflationary conditions.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Inflation Soars, Powell Remains Unmoved. What about Gold?

July 15, 2021, 5:41 AMThe CPI surged 5.4% in June, but Powell still sees inflation as transitory. For now, gold has risen under the dovish Fed’s wing amid higher inflation.

Did you think that 5% was high inflation? Or that inflation has already peaked? Wrong! Inflation rose even further in June, although it was already elevated in May. Indeed, the consumer price index surged 0.9% in the last month, following a 0.6% jump in May. It was the largest one-month change since June 2008, during the Great Recession.

Importantly, the Core Price Index, which excludes food and energy, also rose 0.9%(after a 0.7% increase in the previous month). It shows that inflation is accelerating not only because of higher energy prices but also due to more structural, underlying trends.

On an annual basis, the inflationary outlook is even scarier. The CPI soared 5.4% in June, following a 5% jump in May. It was the largest annual change since August 2008, just before the bankruptcy of the Lehman Brothers and the outbreak of the global financial crisis. As the chart below shows, the inflation annual rate has been trending up every month since the beginning of 2021. So, how much “temporality” can be found here?

However, the real shocker is that the core CPI surged 4.5%, the largest 12-month increase since November 1991 (see the chart above)! Ups, Houston, we have a problem, an inflationary problem! Or at least a surprise, as June inflation numbers came significantly above expectations.

Furthermore, high inflation could persist later this year, or it could even accelerate further – this is at least what the producer prices suggest. The PPI for final demand increased 1.0% last month after rising 0.8% in May. On an annual basis, it surged 7.3%, following a 6.6% rise in May. It was the largest gain since November 2010. Additionally, rising producer prices could translate (with some lag) into rising consumer prices.

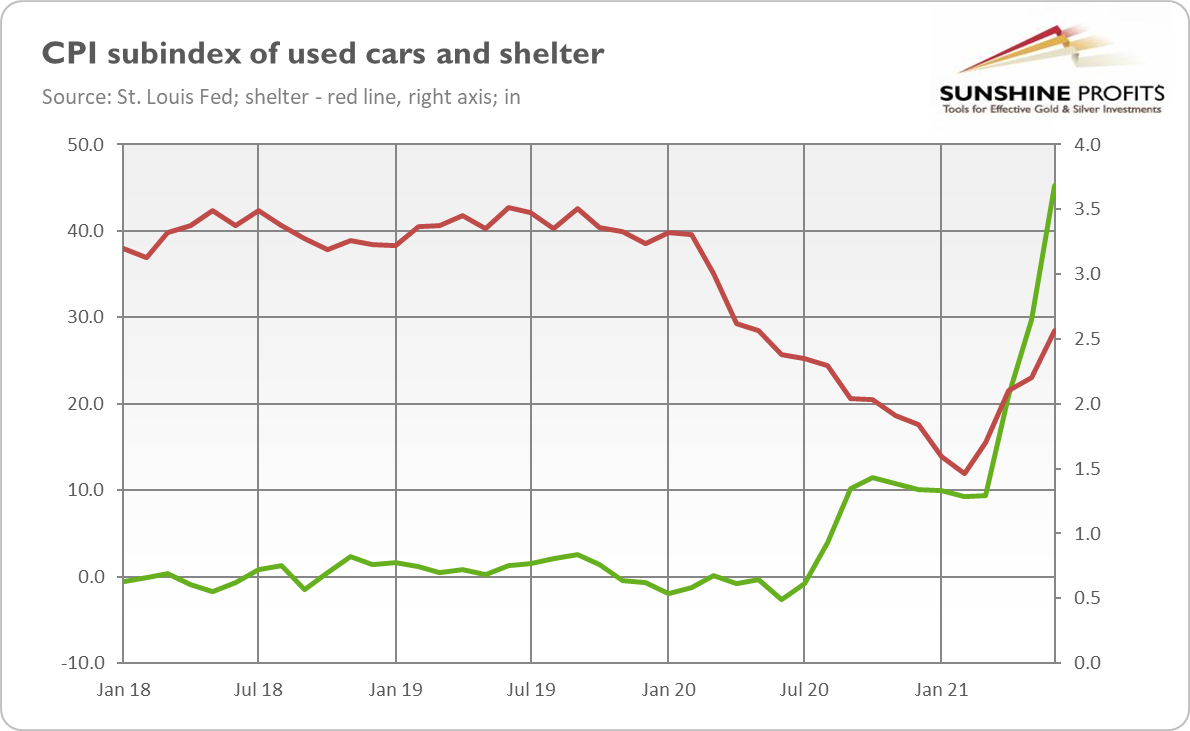

Of course, inflationary pressure may soften later this year. After all, the index for used cars and trucks soared 10.5% in June (MoM) and 45.2% (YoY), as the chart below shows, accounting for more than one-third of the surge. However, inflation is already more persistent than expected, and it could remain elevated for longer than believed.

In other words, although the surge in inflation is partially caused by the supply bottlenecks and the recovery from the pandemic, it has also structural origins that are not entirely linked to the epidemic. You can think about the increase in the broad money supply and easy fiscal policy with stimulus much larger than the output gap. As one can see in the chart above, the index for shelter – the biggest component of the CPI, not hit directly by the pandemic – has also been increasing recently.

Implications for Gold

What does the acceleration in inflation mean for the gold market? On the one hand, higher inflation should increase the demand for gold as an inflation hedge. It could also decrease the real interest rates and weaken the US dollar, also supporting the yellow metal. But on the other hand, higher inflation could translate into expectations of more hawkish Fed and higher interest rates, which could negatively affect gold.

Luckily for gold bulls, it seems that the acceleration in inflation won’t change the Fed’s course. Powell downplayed the inflation threat in his yesterday’s testimony to Congress. He continued seeing higher inflation as transitory and said that conditions to trigger a policy shift are “still a ways off.”

As a consequence, the price of gold increased yesterday to above $1,820, temporarily reaching $1,830. It’s not surprising, as an unmoved Fed amid higher inflation is a fundamentally positive factor for the yellow metal.

However, the upward move was very modest given the circumstances, which isn’t particularly encouraging. Investors seem to still believe that inflation is just transitory, and it won’t be a problem for the economy. But the Fed’s tightening cycle will come sooner or later (think about Bank of Canada or Reserve Bank of New Zealand which have already tightened their monetary policies), possibly with some hawkish twists later this year, so gold bulls should remain cautious.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM