Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

First a pandemic, then inflation, and now an energy crisis. Should you buy gold when preparing for the winter?

Brace yourselves, winter is coming! And this time I’m deadly serious, as there is a global energy crisis. Not only does gold lack energy to fuel its rally right now, but people from all over the world lack it to fuel their operations and to heat their houses. Apparently, the coronavirus pandemic wasn’t enough, so we also have to deal with inflation, supply bottlenecks, and the energy crisis. I guess there is nothing else to do now but wait for the frogs to start falling from the sky.

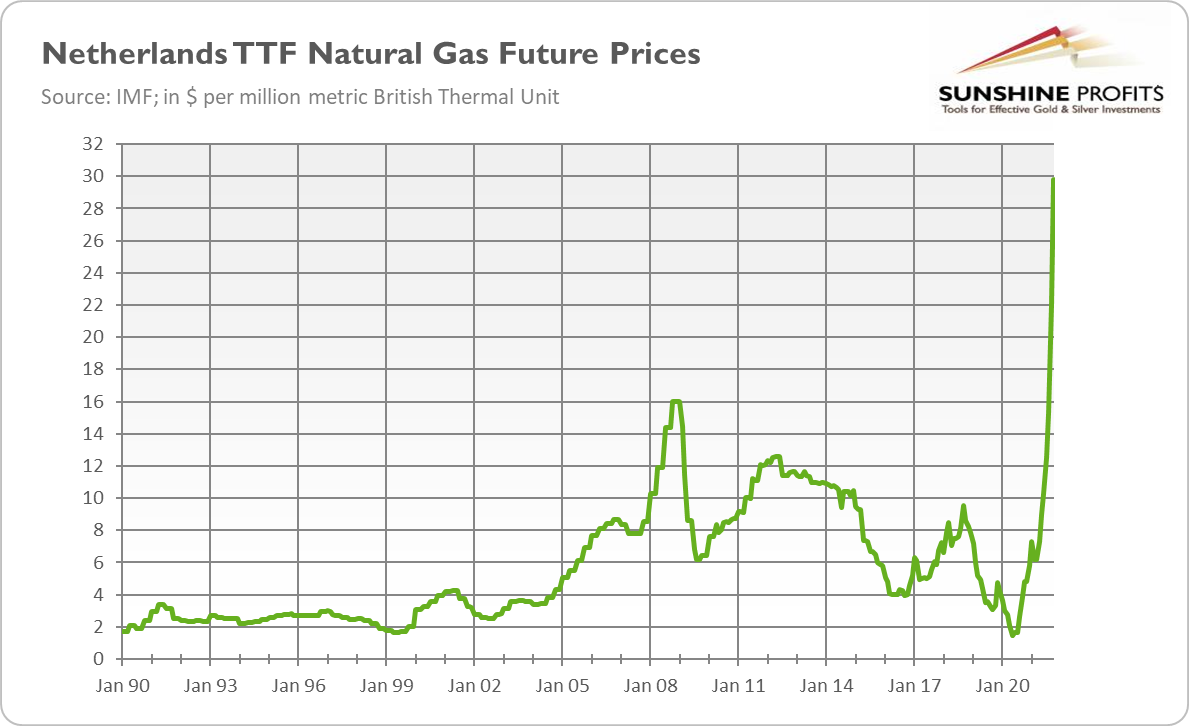

But let’s not give the gods ideas and focus on the energy crisis today. What is it about? A picture is worth a thousand words, so please take a look at the chart below, which presents the Dutch Title Transfer Facility, Europe’s leading benchmark for natural gas prices. As you can see, future prices for European natural gas have skyrocketed to a record level in October 2021, surging several times from their low in May 2020. The persistence and global dimension of these price spikes are unprecedented, as natural gas prices have also surged in Asia and America (although to a lesser degree).

What caused such a spike? Well, as a trained economist, I cannot resist answering that it’s a matter of demand and supply! Yeah, thank you, Captain Obvious, but could you be a little more specific? Sure, so on the demand side, we have to mention a fast recovery from the epidemic and cold fall that increased the use of energy. Oh, and don’t forget about the ultra-low interest rates and the increase in the money supply that boosted spending on practically everything. The increased demand for energy is hardly surprising in such conditions.

On the supply side, there were unpredictable breakdowns of gas infrastructure in Russia and Norway that decreased deliveries. The former country reduced its exports due to political reasons. What’s more, the reduction in the supply of CO2 emission rights and unfavorable weather didn’t help. The windless conditions in Europe generated little wind energy, while drought in Brazil reduced hydropower energy.

More fundamentally, the decline in energy prices in response to the economic crisis of 2020 prompted many producers to stop drilling and later supply simply didn’t catch up with surging demand. You can also add here the political decisions to move away from nuclear and carbon energy in some countries.

Last but not least, the butterfly’s wings flapped in China. Coal production in that country plunged this year amid a campaign against corruption and floods that deluged some mines. Middle Kingdom therefore began to buy significant amounts of natural gas, sharply increasing its prices. China’s ban on importing coal from Australia, of course, didn’t help here.

Great, but what does the energy crisis imply for the global economy and the gold market? First, shortages of energy could be a drag on global GDP. The slowdown in economic growth should be positive for gold, as it would bring us closer to stagflation. Second, the energy crisis could cause discontent among citizens and strengthen the populists. People are already fed up with pandemics and high inflation, and now they have to pay much higher energy bills. Just imagine how they will cheer when blackouts occur.

Third, the surge in natural gas prices could support high producer and consumer inflation. We are already observing some ripple effects in the coal and oil markets that could also translate into elevated CPI numbers. Another inflationary factor is power shortages in China, as they will add to the supply disruptions we are currently facing. All this implies more persistent high inflation, which should provide support for the yellow metal as an inflation hedge, although it also increases the odds of a more hawkish Fed, which is rather negative for gold.

It’s true that a replay of the 1970s-like energy crisis is remote, as today’s economies are much less energy-consuming and dependent on fossil fuels. However, the worst is possibly yet to come. After all, winter hasn’t arrived yet – and it could be another harsh one, especially given that La Niña is expected to be present for the second year in a row. Meanwhile, gas stocks are unusually low. You can connect the dots.

So far, gold has rather ignored the unfolding energy crisis, but we’ve already seen that market narratives can change quickly. It’s therefore possible that prolonged supply disruption and high inflation could change investors’ attitude toward the yellow metal at some point. The weak gold’s reaction stems from the limited energy crisis in the US and from the focus on the Fed’s tightening cycle. But investors’ attention can shift, especially when the Fed starts hiking federal funds rate. Brace yourselves!

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the December Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.