Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions are justified from the risk-reward perspective.

In our Friday's Alert, we asked the question whether the crude oil rally is over now. That day, black gold had declined by well over 5% in intraday terms, making the above a very valid question.

Let's open today's Alert with the following Friday's reply as to whether we saw a top:

(...) did we certainly see it? Will crude oil be trading lower shortly?

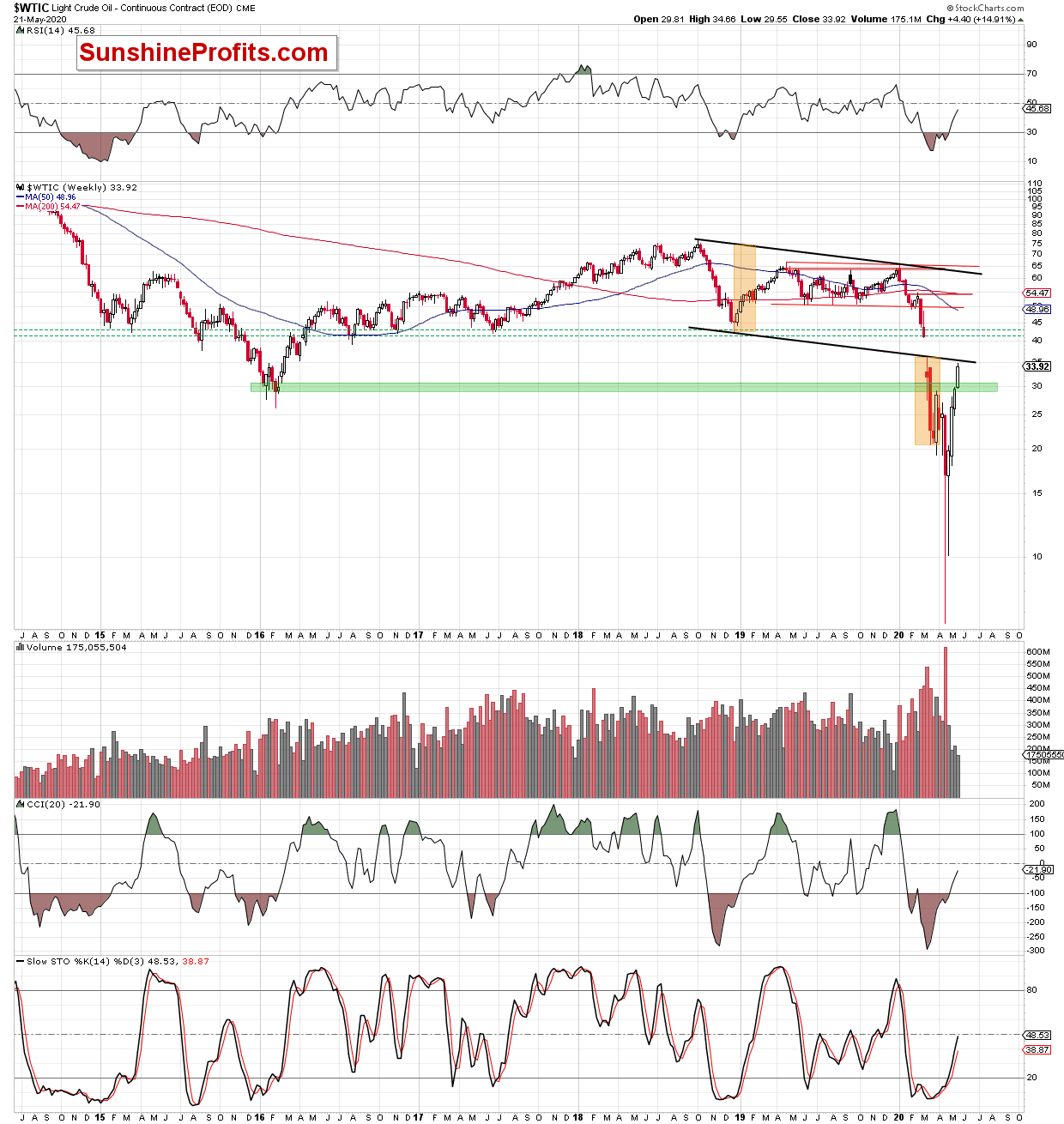

Crude oil reversed without moving to the 50% Fibonacci retracement. It did encounter a resistance, though. The resistance was the highest daily close that we saw in the first half of March, right after the huge price gap.

That (March 10th) closing price was $34.36 and crude oil closed at $33.92 yesterday, after temporarily rallying to $34.66. This means that crude oil attempted to move above the above-mentioned resistance, and that it had failed.

This is a bearish sign, especially since it was followed by a sizable overnight decline.

Still, it's not a proof that the next sizable decline is already underway - not yet. The close below the 38.2% Fibonacci retracement would make subsequent declines very likely, but given that the 50% retracement and the intraday, mid-March highs were not reached, it seems that crude oil could still launch another intraday rally before truly topping.

The monthly crude oil chart also suggests that crude oil hasn't reached its key resistance level just yet, and therefore it's not particularly likely to have topped right now.

As the sideways trading action doesn't bring materially new information, the above observations ring true also today. While it's possible that crude oil is forming an extended topping formation, that fact alone is not enough for us to justify opening a trading position just yet.

Summing up, we might get an opportunity to enter long, or short positions very soon, and increase our 2020 profits, but such opportunity remains absent at this time.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions are justified from the risk-reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager