Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Small (50% of the regular positions size) short positions are justified from the risk-reward perspective with stop loss $38.63 at and $30.22 as the initial target price.

Crude oil managed to finish above the strong resistance provided by the 50% Fibonacci retracement level once again, but it's still underperforming the general stock market.

This doesn't bode well for crude oil in the short term, especially that the later seems to be forming a local top.

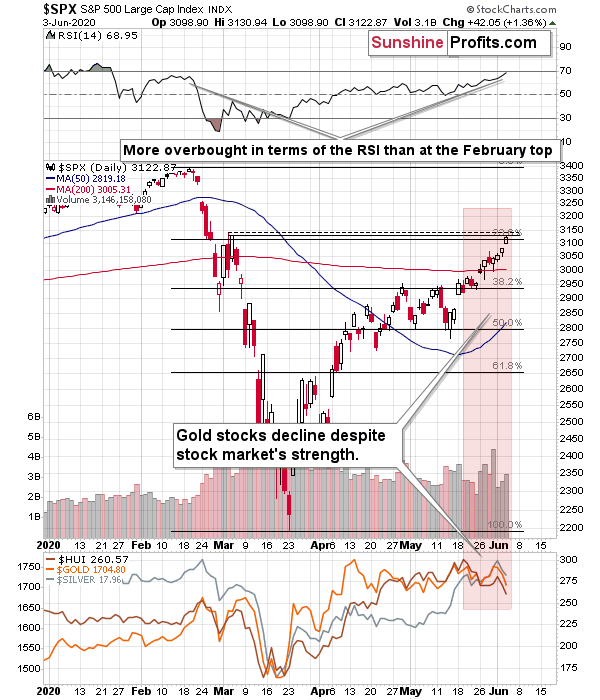

You will find more detailed stock market analysis in our Stock Trading Alerts, but in my opinion, a decline from here is likely. The S&P 500 reached a less popular, but still, a Fibonacci retracement level (78.6%) and it moved to its March highs. It's also declining in the pre-market trading.

The decline in the stock market is what would likely cause crude oil to move lower, as the two moved in tune with each other in the past few weeks.

Once crude oil closes back below the 50% Fibonacci retracement and - ideally - the early-March high in terms of the closing prices (we mean the $34.36 level here), the odds for seeing a sizable decline will increase significantly. That's when we would probably increase the size of our small short position. For now, it remains limited.

Summing up, we continue to think that small short positions in crude oil are justified right now.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Small (50% of the regular positions size) short positions are justified from the risk-reward perspective with stop loss at $38.63 and $30.22 as the initial target price. The July contract is trading at about $34.98 at the moment of writing these words.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager