Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGG22]

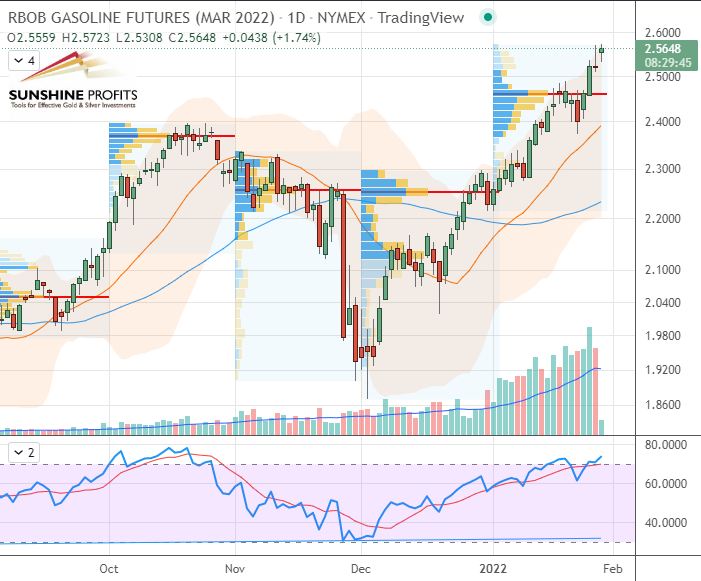

Long around the $4.250-4.300 support area (yellow band) with a stop just below $3.930 and targets at $4.820 & $5.290. - RBOB Gasoline [RBH22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLH22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNH22]

No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

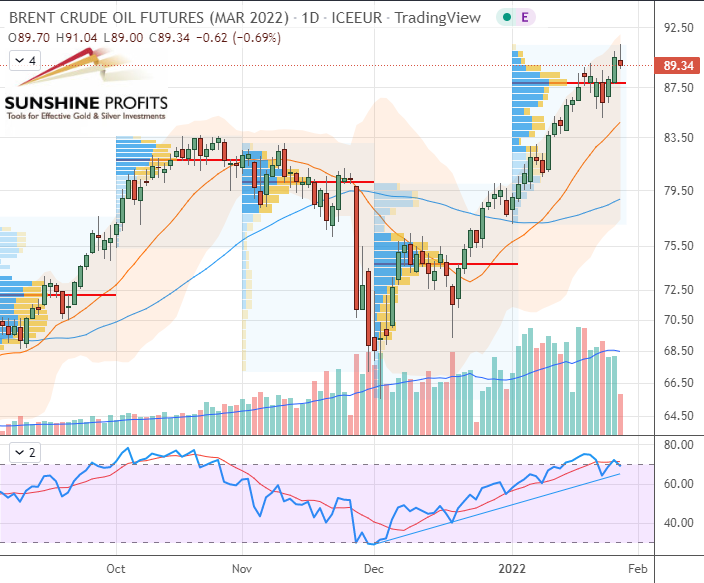

Brent Crude Oil (BRNH22) Futures (March contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

The Henry Hub Nat-Gas contract just picked up some volatility after a breakout of its previous swing high, which means that rally is likely set to pull-back prior to extending further.

Therefore, in the current market conditions, I would draw a plan to get long with the new upward trend developing, so the support level around $4.250-4.300 could represent a good floor to wait for the elevator. Given that our stop would be located just above the lower volume node, we have to target $4.820 to maintain a good profit-to-risk ratio (close to 1.5) and with a second target located within converging high volume areas.

On the fundamental side, as we could witness yesterday, a spike on the NYMEX gas front contract, which was due to a bullish US inventory report combined with February contract’s exiting front month and therefore, traders rolling onto the new front (March) contract. We had a bit of a technical rally on gas triggered, and this could potentially retrace with a little dip before extending further gains. This is where we would be looking to get into the lift-up.

That’s all folks for today – have a nice weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist