Briefly: in our opinion, full (100% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. As we promised you previously, in our flagship Alerts, we will be providing you with bigger, more complex analyses (approximately once per week) and it will usually take place on Monday.

Some of the most important analogies and long-term trends might have changed, but it's too early to say so, and most of our previous extensive comments still remain up-to-date in general.

As it is the case usually, we will quote last week's comments while updating everything that needs to be updated or changed. In the end, the entire below analysis is up-to-date at the moment of publishing. The parts that we didn't change (or changed only insignificantly) since last week, will be put in italics.

The most important fundamental factor right now remains the Covid-19 pandemic and what might be referred to as the Great Lockdown. The total US death count is about 80k, greatly exceeding the regular flu season deaths, and the death toll is quickly climbing in the UK (about 32k deaths) and - most rapidly - in the emerging / BRIC economies. New daily cases in Russia are now regularly over 10k per day, they are between 7k and 11k in Brazil, and in India they are about 4k daily, and still growing. The sum of these three countries' new daily cases is now somewhat bigger than the US daily increase in Covid-19 cases. The new daily cases in Pakistan, Bangladesh, and Mexico are also soaring. The pandemic is not over and neither is the Great Lockdown. Let's examine the implications for the labor markets and then move to the implications for the gold market.

Apocalypse in the US Labor Market

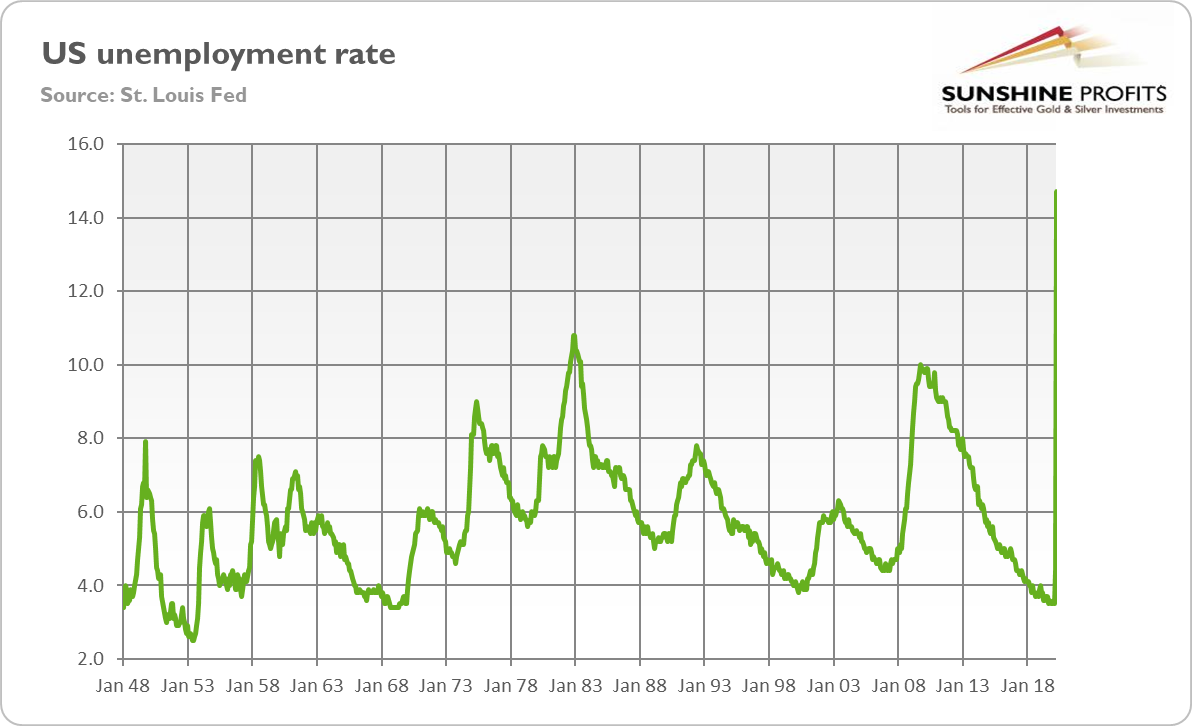

14.7 percent. Remember this value well, as it will go down in history. This is the official US unemployment rate for April calculated by the Bureau of Labor Statistics. The unemployment rate soared from 3.5 percent in February and 4.4 percent in March. As the chart below shows, the spike is really historic, as such high level has not been seen in modern history.

Chart 1: US unemployment rate from January 1948 to April 2020

Indeed, the number is much higher than the peak noted during the Great Recession, which was considered to be a catastrophically high value. The current unemployment rate is the highest since the Great Depression.

This mammoth increase in the unemployment rate was driven by the giant losses in the nonfarm payrolls. The coronavirus destroyed 20.5 million American jobs in April, an unprecedented monthly change. Indeed, as the chart below shows, the number of destroyed jobs has been the largest since the 1939, when the data series begins.

Chart 2: US nonfarm payrolls from February 1939 to April 2020

The job losses were widespread, but - unsurprisingly - leisure and hospitality was the hardest hit, losing 7.6 million of jobs. Interestingly, during the health crisis and the greatest pandemic since the Spanish flu, even healthcare and social assistance lost 2.1 million of jobs.

Importantly, the real situation in the US labor market is even darker than the Employment Report suggests. Why? First, although the Great Lockdown is gradually unwinding, investors should remember that in the establishment survey, "workers who are paid by their employer for all or any part of the pay period including the 12th of the month are counted as employed, even if they were not actually at their jobs." It means that the current report does not count workers who lost their jobs after April 12 nor people on temporary layoff. As the BLS admits itself, if millions of Americans who have been furloughed and expect to return to their jobs are counted as unemployed, the unemployment rate would have been almost 5 percentage points higher.

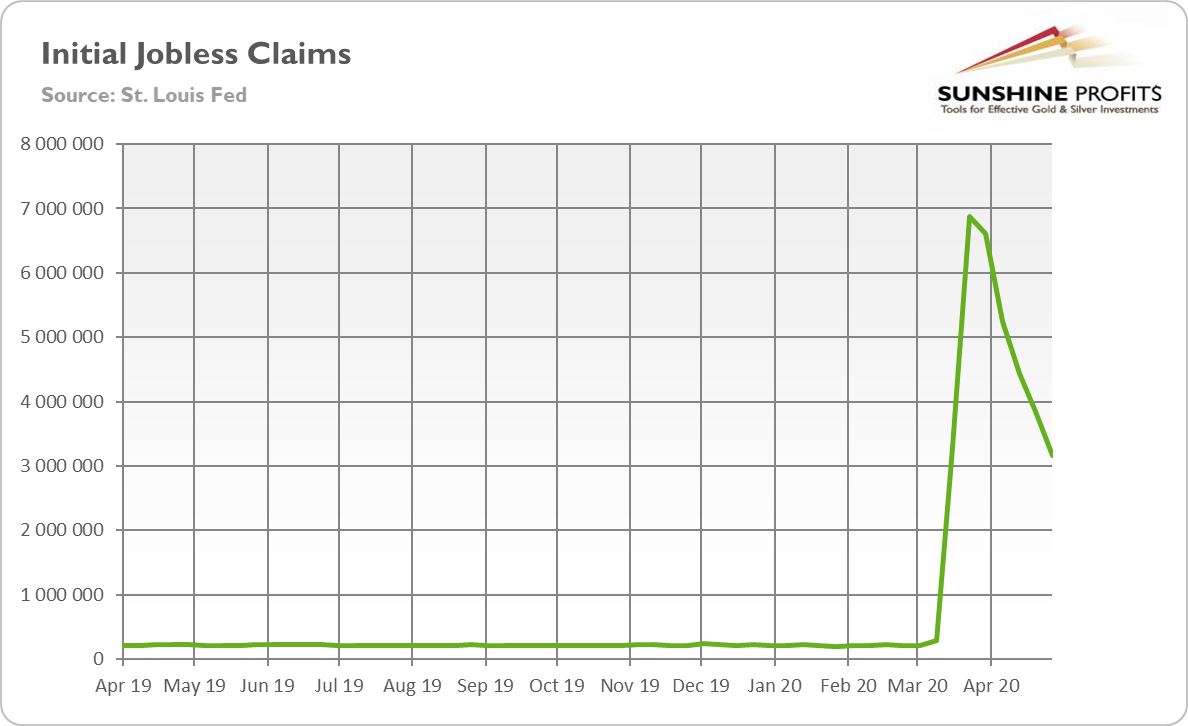

Second, the initial claims paints much grimmer picture of the US labor market. As the chart below shows, in the week between April 25 and May 2, about 3.2 million Americans applied for unemployment benefits. It means that about 20 million of people became unemployment in March and about 33.5 million since the beginning of the COVID-19 epidemic. Meanwhile, the Employment Situation Report shows that there are "only" 23.1 million of unemployed people in the US...

Chart 3: US initial jobless claims from April 2019 to May 2020

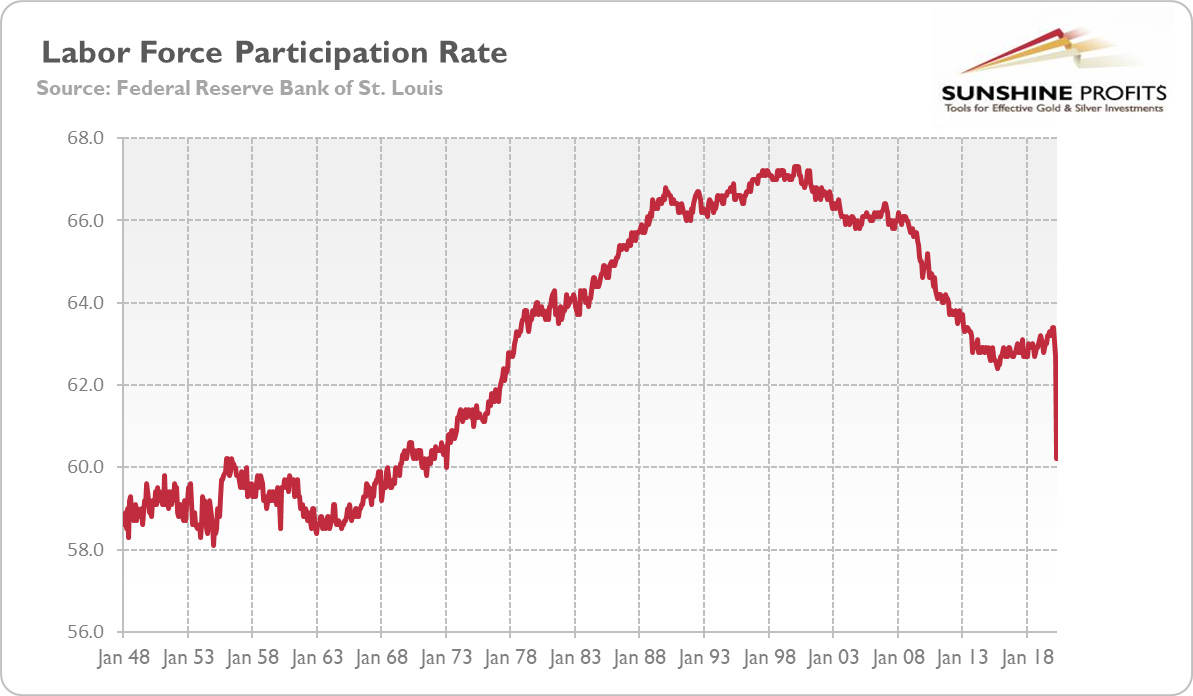

The partial explanation - and this is the next reason why the US labor market is worse than the official data shows - is that some people who lost jobs, are not counted as unemployed, because they dropped out from the labor market. Indeed, the participation rate, i.e., the ratio of people in the labor force to the civilian population, decreased from 63.4 percent in February and 62.7 in March to only 60.2 in April, as one can see in the chart below. It means that more than 8 million of Americans gave up and removed themselves from the labor market. Please note that the participation rate plunged to the lowest level since January 1973 when only a part of women entered the labor market.

Chart 4: US civilian labor force participation rate from January 1948 to April 2020

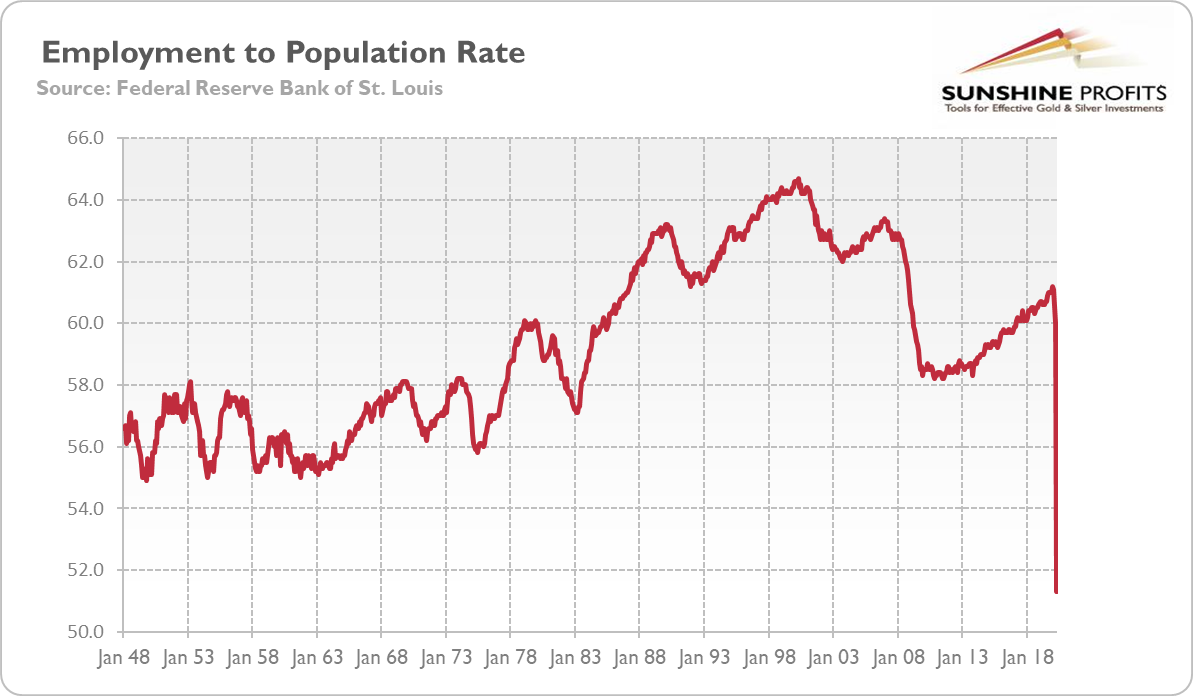

And the employment-population ratio, which measures the number of people employed against the total working-age population, also plunged from 60 in March to 51.3 percent in April, the lowest rate and largest over-the-month decline in the history of the series, as the chart below shows. It means that only half of the Americans in the working age have employment.

Chart 5: US employment to population ratio from January 1948 to April 2020

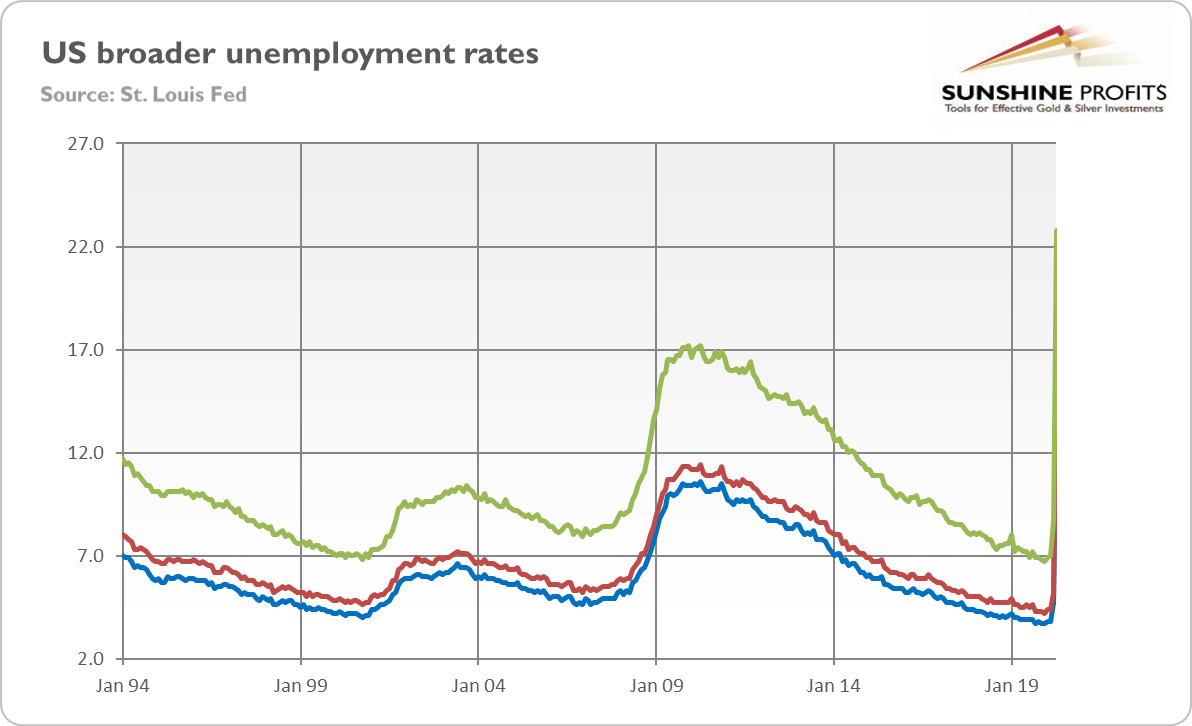

For all these reasons, a better picture of the havoc might be painted by the broader unemployment rates. For example, the U6 unemployment rate, which also includes people marginally attached to the labor force and people employed part time for economic reasons, soared from 7 percent in February and 8.7 percent in March to 22.8 percent in April, as the chart below shows.

Chart 6: US broader unemployment rates (U4 - blue line; U5 - red line; U6 - green line) from January 1994 to April 2020

What does it all mean for the gold market? The April Employment Report is the jobs report from hell. There is true horror in the US labor market right now. It will, of course, recover, after the Great Lockdown ends. However, we don't think that the labor market will return to the pre-crisis level. The plunge in the labor participation rate shows that some people already withdrew from the labor market. Some of them will return, but not all of them. And some of the unemployed people will also drop out from the labor market. It means that with so many people unemployed or out of the labor market, the economy will growth rather slowly (after initial recovery that looks statistically great due to low base), which should support the gold prices.

However, the most important consequences for the gold market will be through the economic policy and higher inflation. Let's be honest, already with record low unemployment rate, the Fed started to consider the change in its inflation target. Now, with the unemployment rate at 15 percent (and possibly higher), the doves will completely dominate the FOMC. In such a macroeconomic environment, all policymakers will focus on providing full employment. Nobody will care about a slightly higher inflation. Of course, the supposed slightly higher inflation could quickly get out of control. We do not say that this is going to happen for sure - what we mean here is that nobody will listen to monetary hawks, if any left, when the unemployment rate is so high, especially in the election year. Thus, the chances of higher inflation are higher, and they should support demand for inflation hedges such as gold.

Overall, the fundamental outlook for gold has been, and remains very positive. But the same is the case with regard to the US dollar at least in the short run, as the BRIC / developing countries are entering much worse periods of the pandemic. The above discussion of the labor market is also fundamentally very bearish for the general stock market.

While the above combination of factors is unlikely to prevent gold from rallying in the long- and medium-term, declining stocks and soaring USD Index are likely to trigger declines in gold in the short run - similarly to what they did in March.

Let's start with the reminder about USD's big picture and gold's performance during big upswings in the USD Index.

The Big Picture View of the USD Index

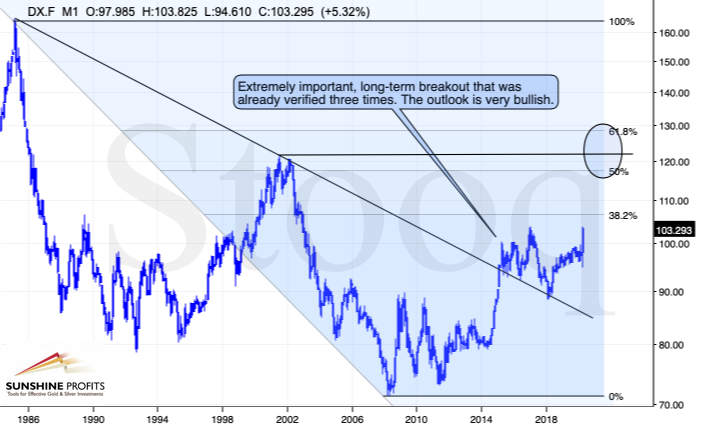

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

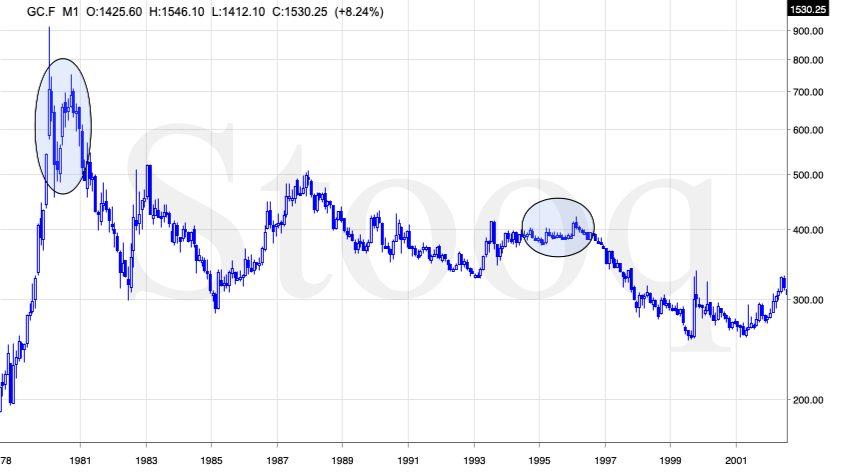

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Soars

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

Having covered the most important factor for the USD Index and gold, let's take a look at the other - also important - factors influencing both of these markets.

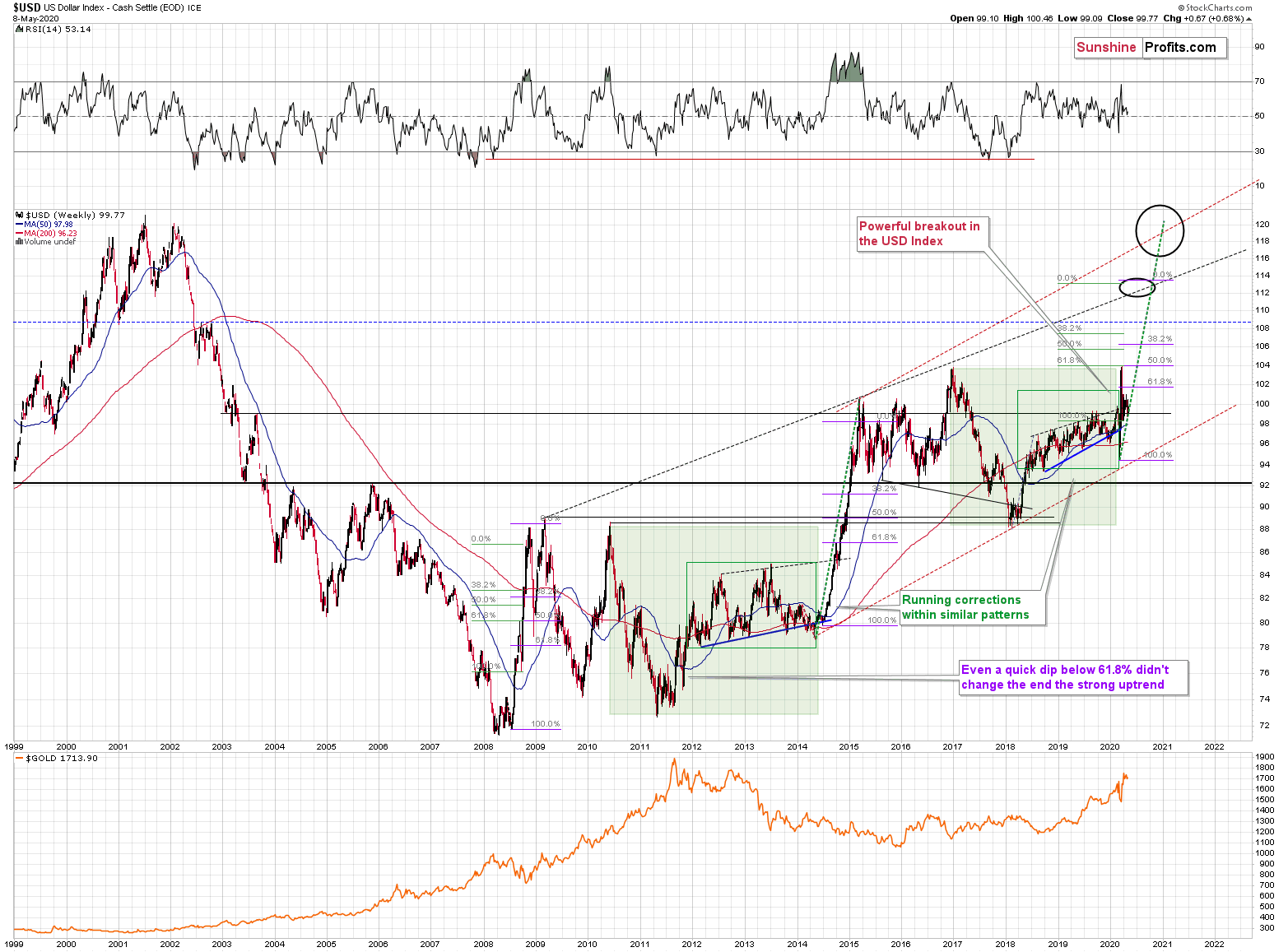

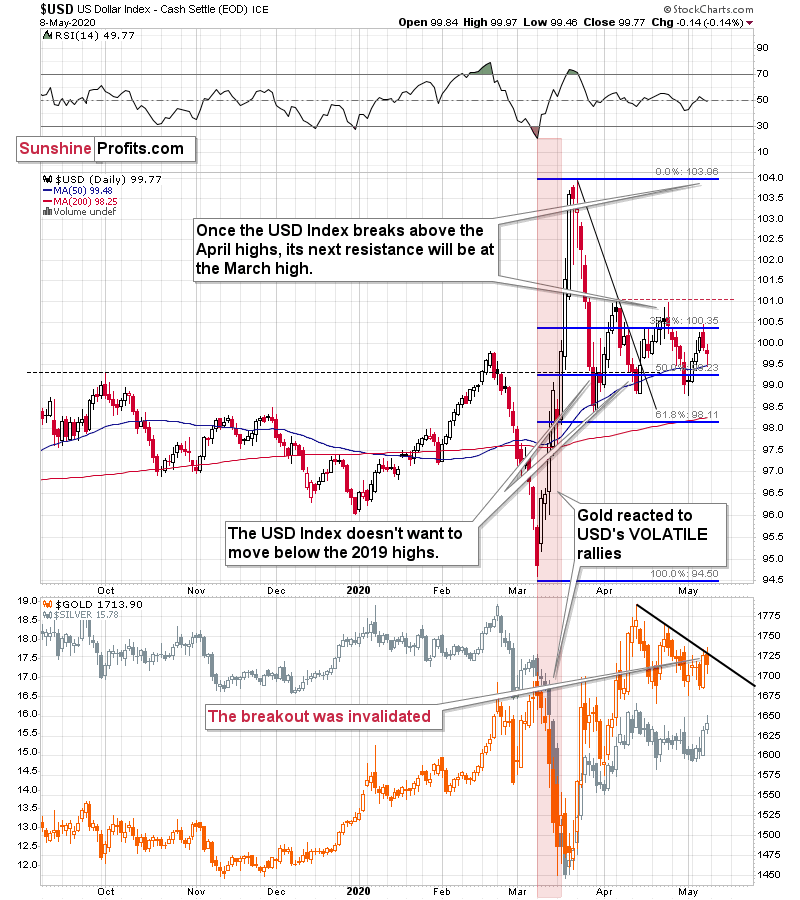

More on the USD Index and Gold

The USD Index was previously (for the entire 2019 as well as parts of 2018 and 2020) moving up in a rising trend channel (all medium-term highs were higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel was actually a running correction, which was the most bullish type of correction out there.

If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

We previously wrote that the recent temporary breakdown below the rising blue support line was invalidated, and that it was a technical sign that a medium-term bottom was already in.

The USD Index soared, proving that invalidation of a breakdown was indeed an extremely strong bullish sign.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

In fact, given this month's powerful run-up, it seems that nobody will doubt the possibility of the USD Index soaring much higher. Based on how things are developing right now, it seems that the USD Index might even exceed the 117 level, and go to 120, or even higher levels. The 120 level would be an extremely strong resistance, though.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

On the short-term note, it seems that the USD Index has finished or almost finished its breather after the powerful run-up. While the base for the move may be similar to what happened between 2010 and 2014, the trigger for this year's sharp upswing was similar to the one from 2008. In both cases, we saw dramatic, and relatively sudden rallies based on investors seeking safe haven. The recent upswing was even sharper than the initial one that we had seen in the second half of 2008. In 2008, the USDX corrected sharply before moving up once again, and it's absolutely no wonder that we saw the same thing also recently.

In fact, on March 23rd, just after the USDX closed at 103.83, we wrote that "on the short-term note, it seems that the USD Index was ripe for a correction".

But a correction after a sharp move absolutely does not imply that the move is over. In fact, since it's so in tune with what happened after initial (!) sharp rallies, it makes the follow-up likely as well. And the follow-up would be another powerful upswing. Just as a powerful upswing in the USD Index triggered gold's slide in 2008 and in March 2020, it would be likely to do the same also in the upcoming days / weeks.

Please note that the 2008 correction could have been used - along with the initial starting point of the rally - to predict where the following rally would be likely to end. The green lines show that the USDX slightly exceeded the level based on the 2.618 Fibonacci extension based on the size of the correction, and the purple lines show that the USDX has approximately doubled the size of its initial upswing.

Applying both techniques to the current situation, provides us with the 113 - 114 as the next target area for the USD Index. A sharp rally to that level (about 13-14 index points) would be very likely to trigger the final sell-off in gold, silver, and mining stocks.

On a short-term basis, we just saw a daily move lower in gold, while the USD Index declined and reversed before the end of the day. This - by itself - is a sign of gold's weakness, but it's a sign of strong weakness, when one takes into account gold's recent technical development.

Namely, gold recently moved above its declining resistance line - the upper border of the triangle / pennant. A decline in the USD Index was a bullish factor for gold and it should have easily held ground. Namely, it should have rallied further and confirmed the breakout. Gold didn't manage to do that. Instead, its decline invalidated the breakdown. This is a profound sign of weakness.

Interestingly, while gold showed weakness, silver showed daily strength by rallying higher despite a move lower in gold. That's exactly what we quite often see right before big declines in the precious metals market.

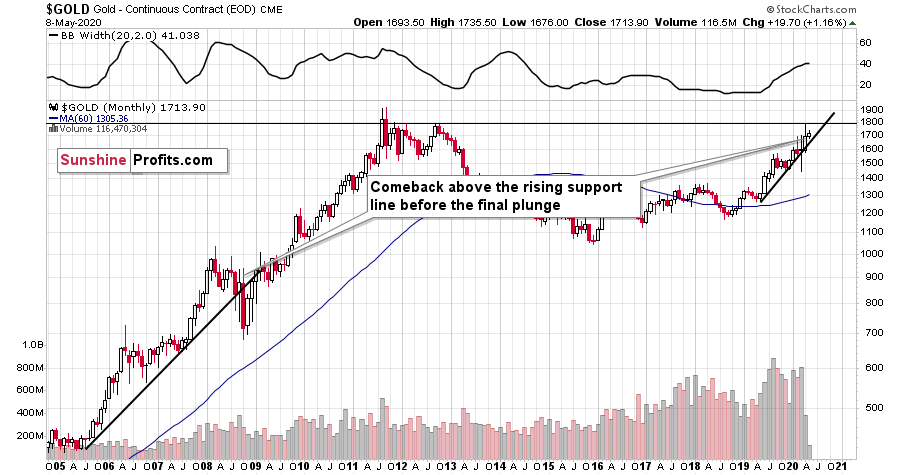

The above is the most important short-term technical development in gold, so we don't discuss it separately from this point of view, but we would like to draw your attention to the following monthly gold chart.

In 2008, after the initial plunge, and a - failed - intramonth attempt to move below the rising support line, gold came back above it and it closed the month there. The same happened in March 2020.

During the next month in 2008, gold rallied and closed visibly above the rising support line. The same was the case in April, 2020.

In the following month - the one analogous to May 2020 - gold initially moved higher, but then it plunged to new lows and finally closed the month below the rising support line. We might see something very similar this month.

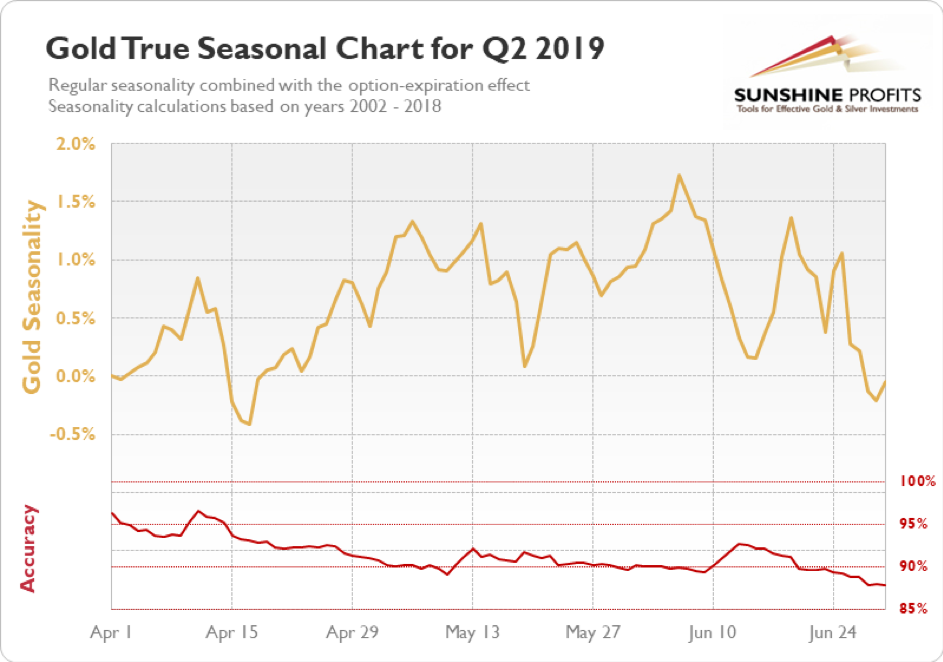

Speaking of this month in particular, let's check how gold usually performs in May.

In short, gold usually tops in the first half of the month, and bottoms in its second half. Then, it recovers - but moves to new highs only in June. This more or less fits what we expect to see later this month also this year.

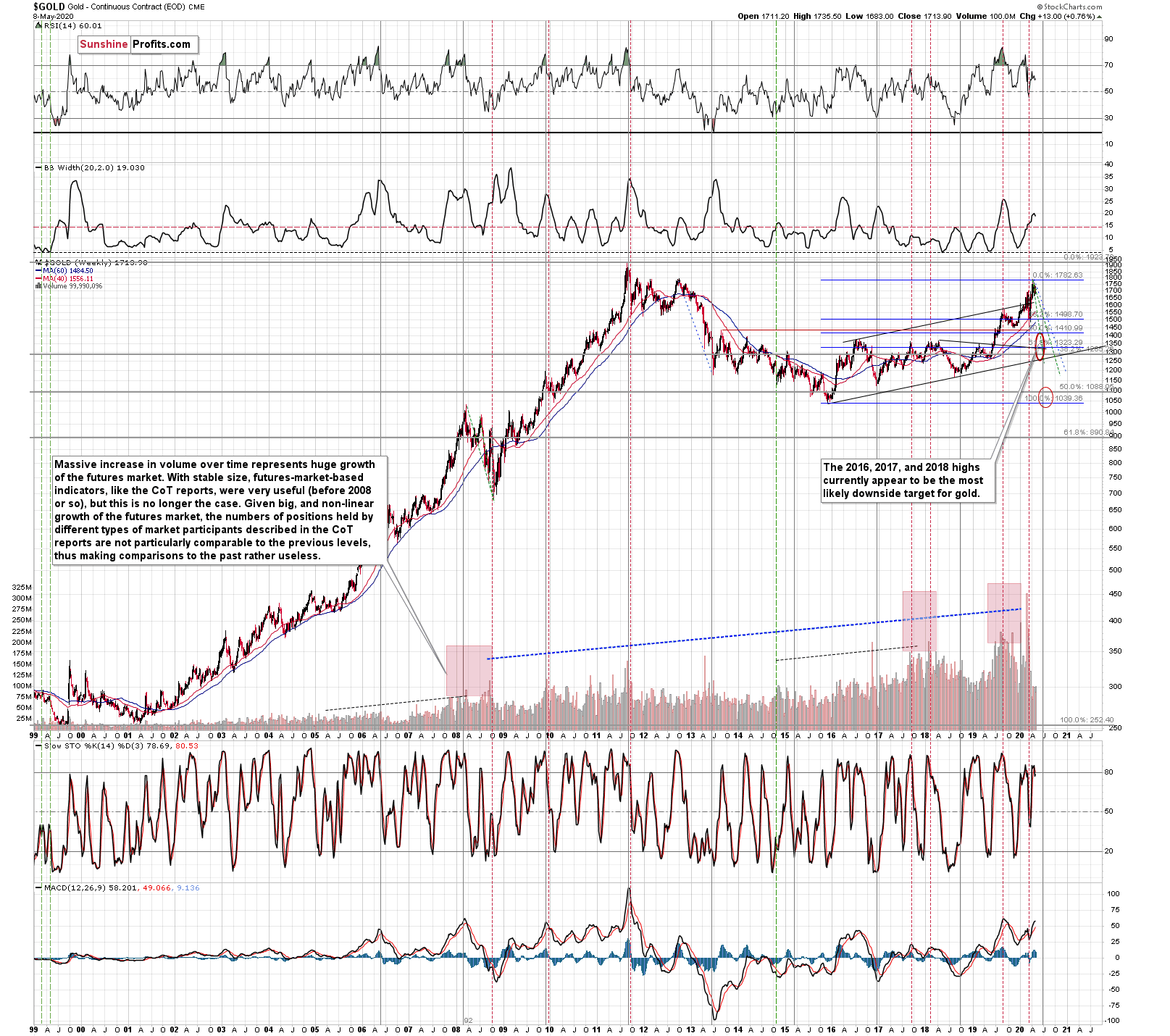

Let's check how low gold could decline during this slide. In short, the above is based on the long-term gold chart and it hasn't changed this week.

Our current (and it might change in the following days) estimate is that gold would decline to the 2016, 2017, and 2018 lows - slightly below $1,400. Why? Because this level is confirmed by several major highs, which makes it the strongest support that's below the previous 2020 lows.

Moreover, back in 2008, gold bottomed about 8% below its initial September bottom. The recent bottom in gold was about $1,451. If the history repeats itself, gold could decline to 92% x $1,451 = about $1,335.

In 2008, gold also declined by about 27% from its previous high. If the history repeats itself here, and gold topped yesterday (which seems quite likely), we can see gold's bottom at 73% x $1,789 = about $1,306.

The 2016, 2017, and 2018 highs are the strongest gold support that we have close to the above-mentioned price levels. Gold's fundamental situation is even better now than it was in 2008, so we think that looking for the support above the above-mentioned 2008-based price levels is more appropriate than basing it the above-mentioned gold trading tips. The 2016, 2017, and 2018 highs fulfill this requirement.

This means that gold would be likely to bottom between about $1,350 and $1,380.

Of course, neither the world, nor the precious metals market ends with gold. We'll examine also silver and mining stocks shortly, but for now let's take a look at something interesting in palladium.

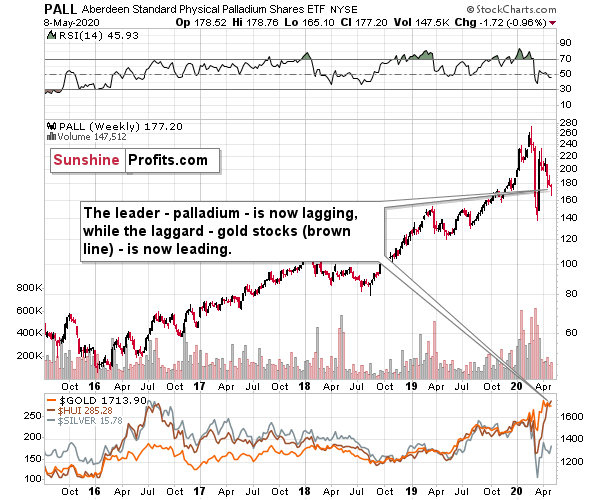

The interesting detail is palladium's weakness. This precious metal was the one that soared most profoundly in the past few years and while it recovered some of its 2020 declines recently, it appears to be back in the bearish mode as its unable to keep gained ground, even despite the move higher in the general stock market.

The previous leader is now definitely lagging. And you know what's leading? The previous laggard - gold stocks. The HUI Index is marked with brown in the bottom part of the chart. When leaders are lagging, and laggards are leading, one should recognize that the market is topping - and that's the key take-away from the palladium analysis right now.

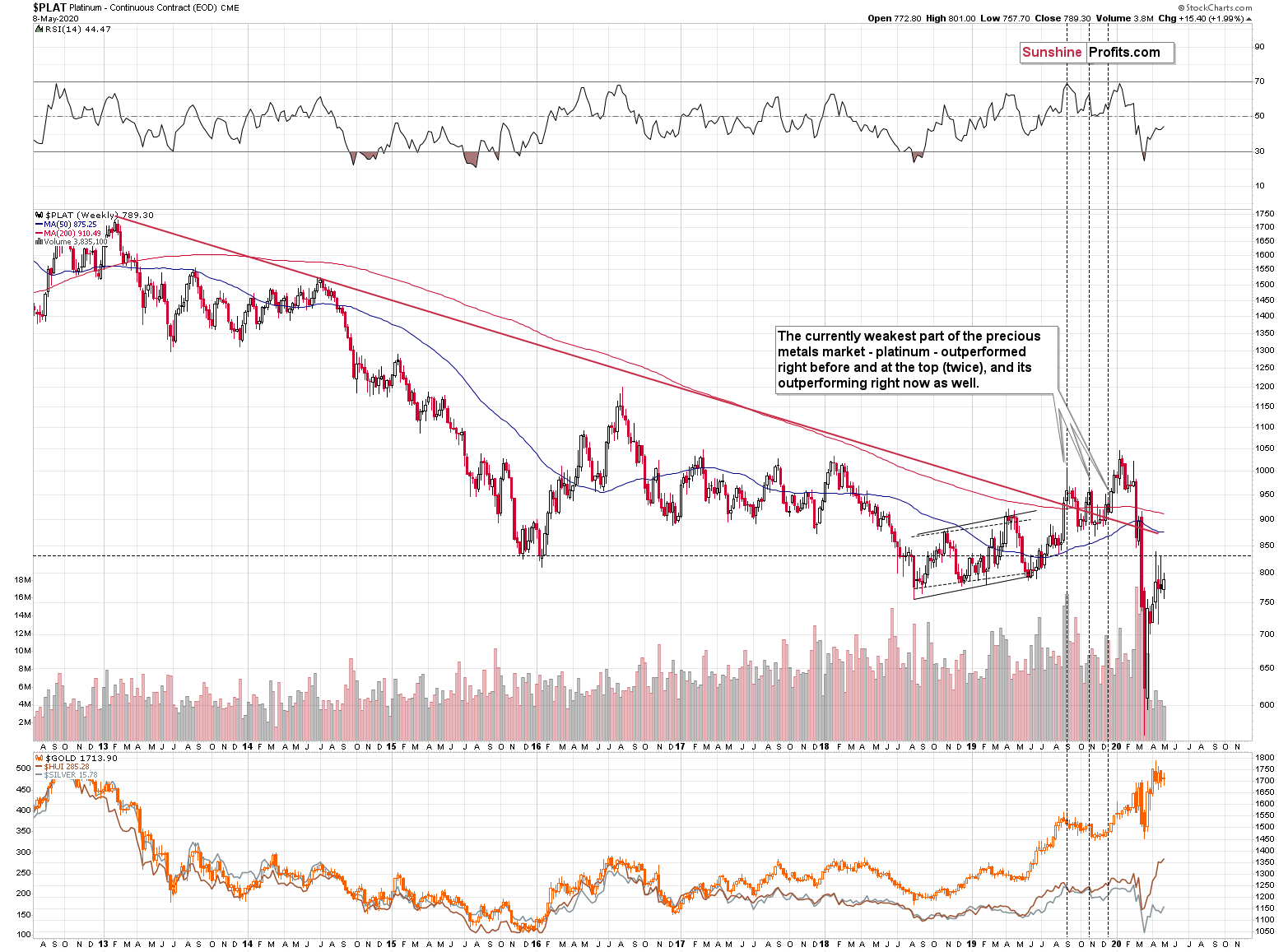

Platinum has been moving back and forth recently, unable to continue its rally. The reason? The previous support at about $800, has now turned into resistance. The previous slide and breakdown below $800 was followed by a rebound, but without the breakdown's invalidation, this rebound is merely the verification for the breakdown. It's not bullish, but bearish. It's yet another sign pointing to lower, not higher precious metals prices in the next few weeks.

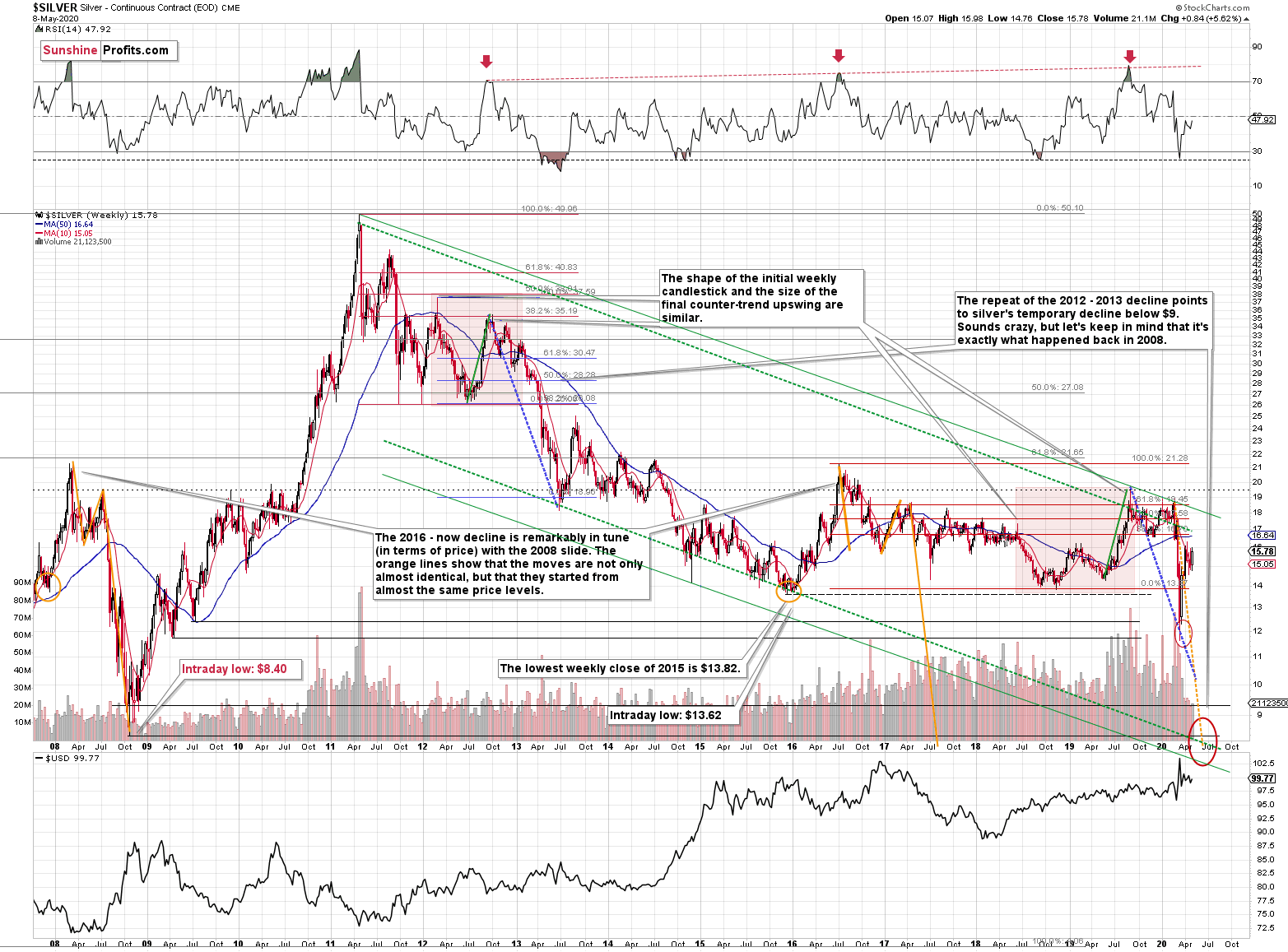

Having said that, let's take a look at silver. In case of the white metal, what we haven't seen, is more important than what we did see. And what we didn't see, is the invalidation of the similarity in terms of price to what happened in 2008.

Silver plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we predicted silver below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Note: Silver at or slightly below $8 seems most probable at this time.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Now, some may say that back in 2008, silver rallied only to about $14 and since now it rallied to about $16, so the situation is now completely different and that the link between both years is broken. But that's simply not true.

The nominal price levels are just one of the ways that one should look at the analogy - far from being the perfect or most important one.

Please note that back in 2008, there were two smaller bottoms in silver, and this time we saw just one. The decline before the bottom was sharper, so is it really that surprising that the rebound was sharper as well? Silver ended the 2008 corrective upswing once it moved visibly above the declining orange line and that's exactly what happened recently.

The situations are not perfectly identical in terms of nominal prices, but they remain remarkably similar given how different fundamental reasons are behind these price moves (in reality, what's behind both declines is fear that - itself - doesn't change).

The technique used for predicting silver price is clearer than the one that we applied for gold, so it seems useful to look not only at the USD Index for signs, but also at the white metal itself. Once silver moves to $8 or below it, it will likely serve as a strong buy sign for gold, regardless of the price at which gold will be trading at that time.

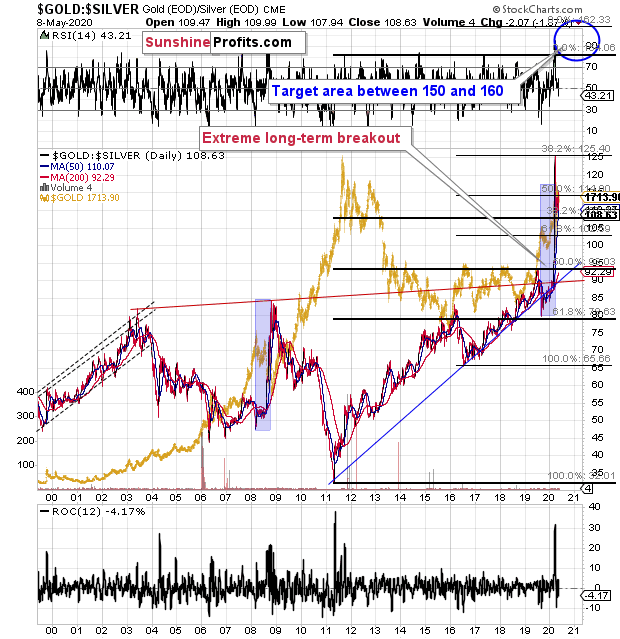

On a side note, please keep in mind that (as we have been indicating, and as most of our colleagues didn't) despite the recent upswing in gold, and the general stock market, the gold to silver ratio didn't invalidate its breakout above the 100 level. Conversely, the breakout was confirmed, and it means that we should expect even higher values of the ratio. And yes, the values near 150 level are quite possible.

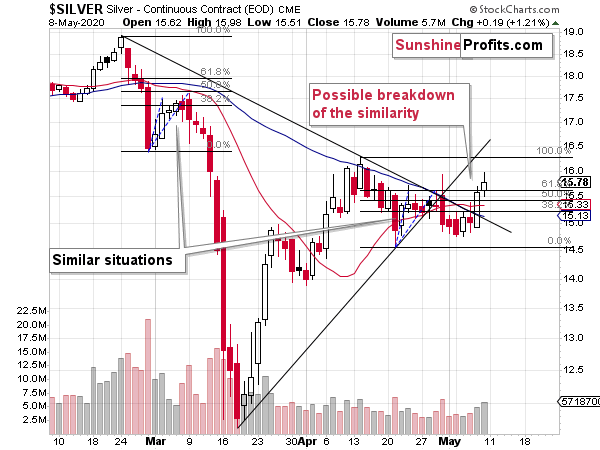

Let's take a look at silver's short-term chart.

In the previous Alerts, we wrote that the similarity to what happened in early March remained relatively clear and intact. Based on the upswings on Thursday and Friday, it might be that the similarity to March correction just broke down. They key word here is "might".

Even in late April, we saw that the back and forth movement that we witnessed since the mid-April bottom, was taking longer than what we saw in March. Based on the shape of the late-April daily decline and how high silver moved on an intraday basis, we knew that the analogy in terms of price is not perfect either. So, perhaps this consolidation simply takes longer in general, just as the topping pattern is the stock market is broad, as opposed to the quick pause that we saw in the first half of March. It's probably too early to discard the March-May similarity in its entirety, and it's definitely too early to discard the bearish outlook in general.

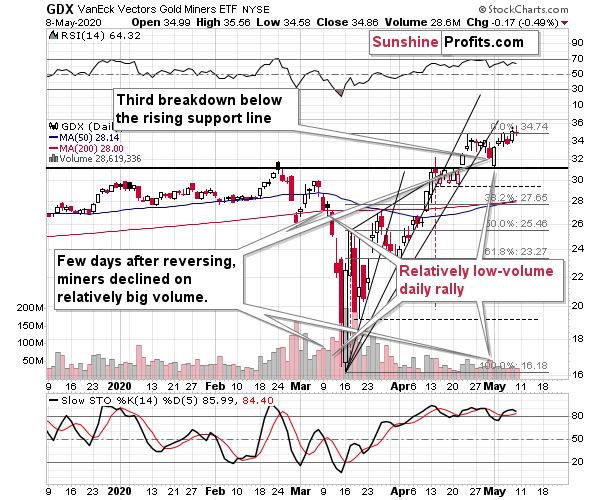

Both the mining stocks and silver tend to behave specifically during tops. Silver catches up, while miners don't perform as well as they did previously. Silver definitely caught up yesterday and is catching up today - what about miners' performance?

On Thursday, miners moved higher, but compared to silver, their upswing was not even similarly profound. On Friday, miners reversed and declined, while silver moved higher. Taking the last three trading days into account, miners are barely up (by just 0.2%), while silver is up significantly (3.66% in the SLV ETF). This could mean that silver is up, precisely because it's the final part of the upswing.

With decreased volatility, the times are becoming "more normal" and with this, "more normal" trading techniques become more useful. Looking at miners and silver's relative performance is one of them.

And what about mining stocks' big picture?

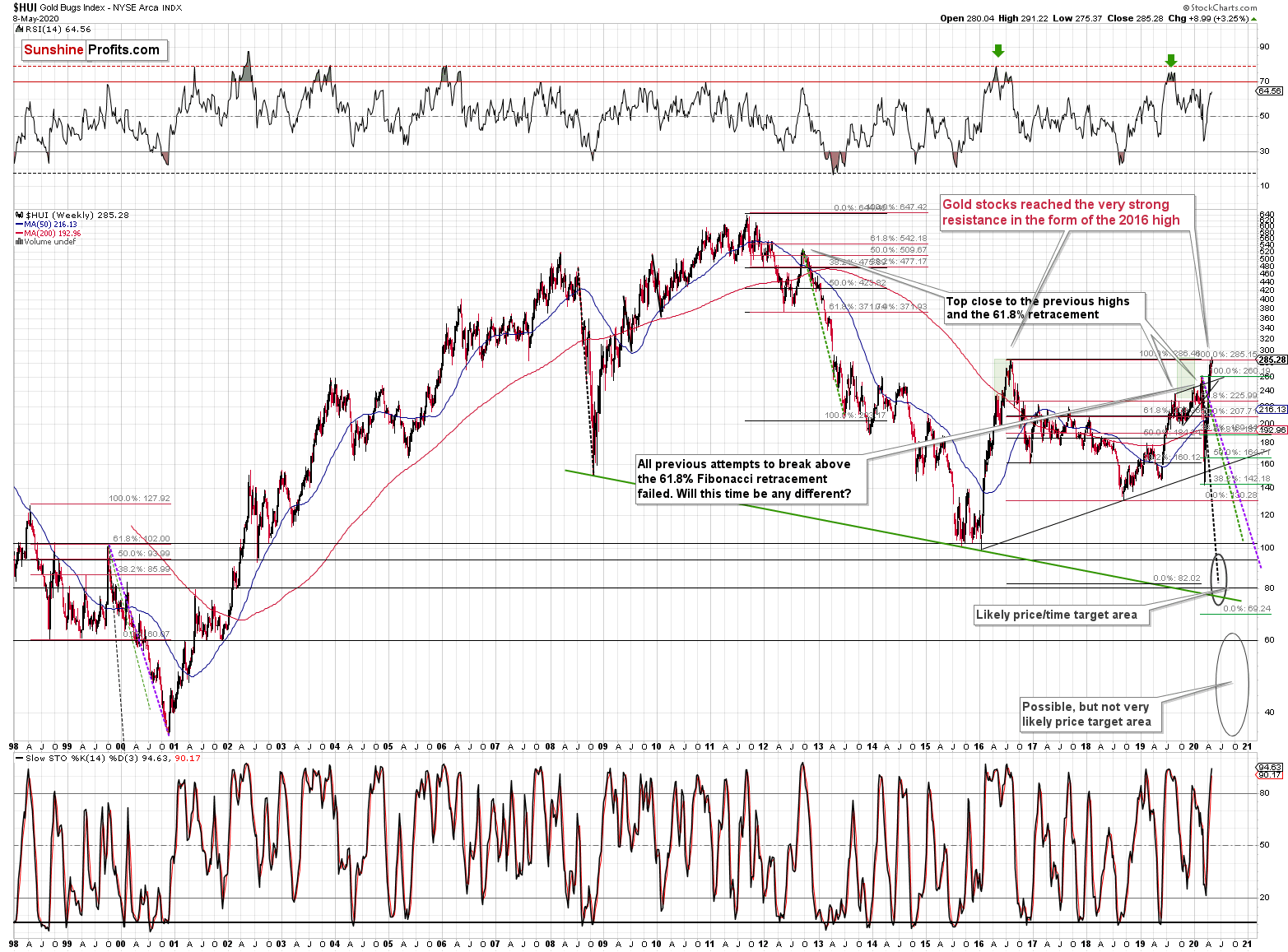

We previously described the above HUI Index chart in the following way:

The HUI Index declined significantly, and then it rebounded significantly.

Both are likely linked. Miners first declined more sharply than they did in 2008, so the rebound was also sharper. Based on the stimulus and gold reaching new yearly highs, miners also rallied and tried to move to new yearly highs. It's not surprising.

However, if the general stock market is going to decline significantly one more time, and so will gold - and as you have read above, it is very likely - then miners are likely to slide once again as well. This would be in tune with what happened in 2008.

At this time, it may seem impossible or ridiculous that miners could slide below their 2015 lows, but that's exactly what could take place in the following weeks. With gold below their recent lows and the general stock market at new lows, we would be surprised not to see miners even below their 2020 lows. And once they break below those, their next strong resistance is at the 2016 low. However, please note that miners didn't bottom at their previous lows in 2008 - they moved slightly lower before soaring back up.

Please note that the HUI Index just moved to its 2016 high which serves as a very strong resistance. Given the likelihood of a very short-term (1-2 days?) upswing in stocks and perhaps also in gold (to a rather small extent, but still), it could be the case that gold miners attempt to rally above their 2016 high and... Spectacularly fail, invalidating the move. This would be a great way to start the next huge move lower.

The gold miners have indeed moved slightly above the 2016 highs in intraday terms, and on Friday, they closed below the highest intraday price of 2016. They did close above the highest 2016 daily and weekly close, though. This breakout is not yet confirmed, but if it gets confirmed, the implications might be bullish. We doubt that this will be the case and we expect to see a clear invalidation of the breakdown instead. And as we wrote previously - it would be an excellent way for the final slide to start.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks, but since the self-similar (to March) pattern in the precious metals market might have just been broken, the outlook is not as bearish as it used to be in the previous days. Consequently, our trading position is not as sizable right now, but it is open, nonetheless. We expect to see the invalidation of the breakout in the HUI Index, as well as a profound move higher in the USD Index - these will be the signs that the final slide in the PMs is already underway.

We are very far from "getting married to the short position" or the bearish outlook in general, especially since we emphasized it many times that we view the fundamental picture for gold as excellent. Don't get us wrong - we still have many bearish signs for the precious metals market, it's just that we don't have as many today, as we had previously.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (100% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager