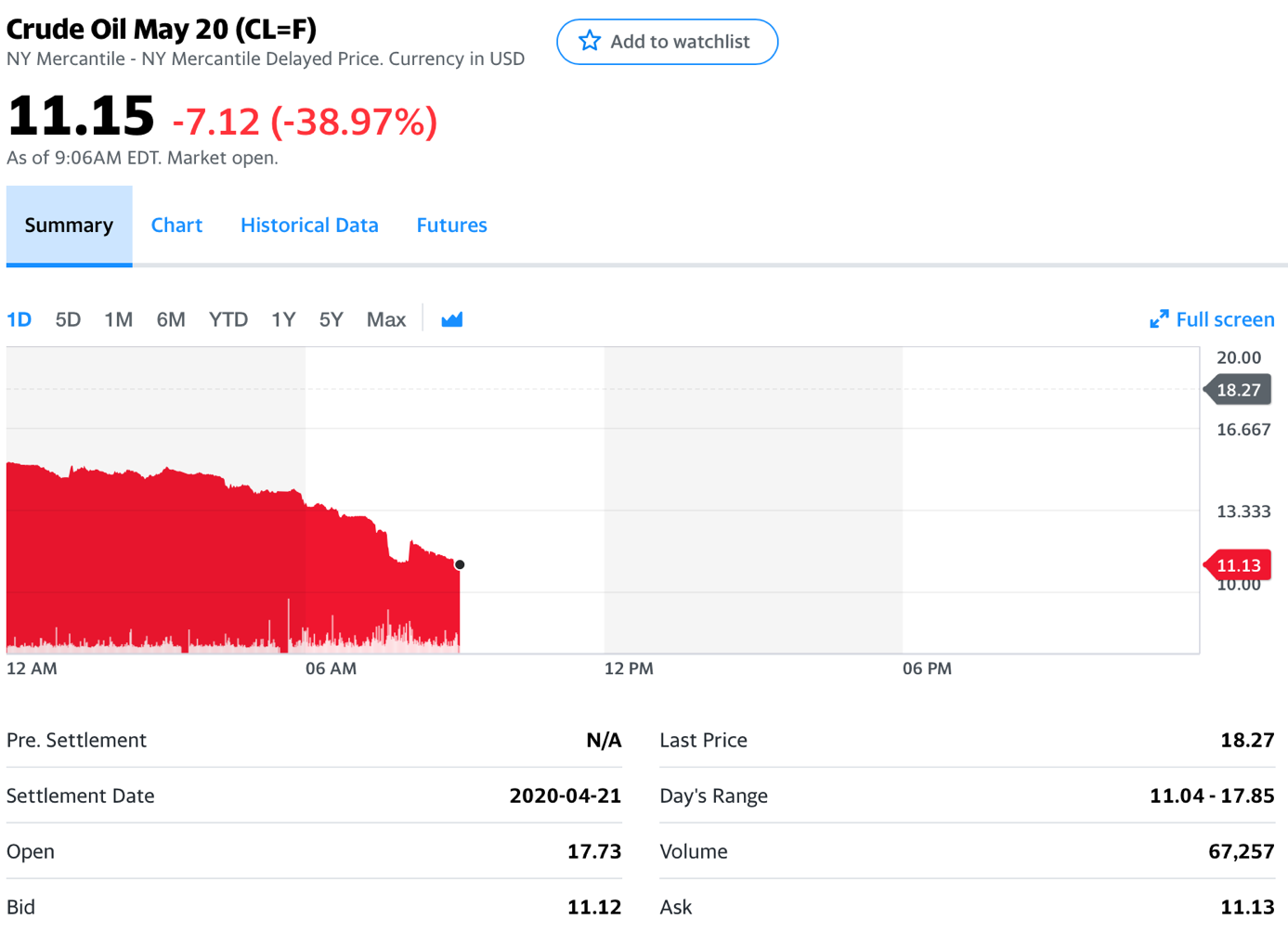

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view. Our binding profit-take level for the crude oil futures with the nearest expiration date (May contract) of $11.22 was just reached, so profits should have been automatically taken off the table. If one was using any other instrument, we think that the short position should be closed, and profits should be taken off the table right away. As a reminder, we had opened this position on March 26th, when crude oil was trading at $23.43.

The situation in crude oil has just become extremely extreme (we know it doesn't sound right, but that's exactly what happened) and our ridiculously low downside target for crude oil futures was just reached.

At this moment, it's unclear where the next bottom will form, but in case the drop is very volatile, we can't rule out a situation in which crude oil slides all the way to its 1998 bottom. If that takes place, we'll be more than happy to take enormous profits off the table.

Indeed, we are more than happy to be taking these enormous profits off the table.

The (chart courtesy of finance.yahoo.com) chart below shows the May 2020 futures contract prices for crude oil.

Meanwhile, the continuous futures contract is showing a much higher price and a sudden jump in the prices. How could that be?

The reason is the way the continuous futures contracts are created. They are an average of the upcoming futures contracts and at some point, one contract has to substitute the other - that just happened. Normally, the differences in prices are not that big (they are only a few dollars in case of gold for instance), but in case of crude oil, the difference is huge - several dollars. This technical change made it look like crude oil moved higher, while it actually decreased in value - and dramatically so.

This has an unpleasant consequence, though. Right now, it's difficult to apply the regular technical analysis tools to crude oil's continuous contract, and we have to wait for the situation to stabilize a bit before we can move to these very useful techniques once again.

However, it's quite obvious that the sentiment regarding crude oil is extremely bad today and it's also clear that a major support level is being reached - the 1998 lows - in the futures contract that we've been paying extra attention to. This means that we would definitely not want to open a short position today. Consequently, keeping an open short position right now is not justified either.

Is it a good time to open a long position? It's relatively unclear. Stock market could decline further, which might prevent crude oil from rallying. On the other hand, the sentiment is so extreme that a rebound seems relatively likely.

Given this lack of clarity - and the temporary decrease in the ability to utilize technical details, it seems that staying out of the market is a great idea right now.

Summing up, you just made enormous and unbelievable profits in crude oil - congratulations. Since the situation is now relatively unclear, with regard to both: the outlook, and the level of trust that we can put in our regular technical techniques, it seems that staying out of the crude oil for the time being is justified from the risk to reward point of view.

There will be another trading opportunity in the future, but right now, the lack of clarity is too extreme for us to suggest opening a position.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view. Our binding profit-take level for the crude oil futures with the nearest expiration date (May contract) of $11.22 was just reached, so profits should have been automatically taken off the table. If one was using any other instrument, we think that the short position should be closed, and profits should be taken off the table right away. As a reminder, we had opened this position on March 26th, when crude oil was trading at $23.43.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager