Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

After a successful start on Monday triggered my entry levels on Natural Gas, I’m updating the WTI Crude Oil projections.

Trading positions

- Crude Oil [CLZ21] Long around $78.57-79.65 support (yellow rectangle) – with stop below $76.48 and targets at $81.80 and $83.40 – See Fig. 1

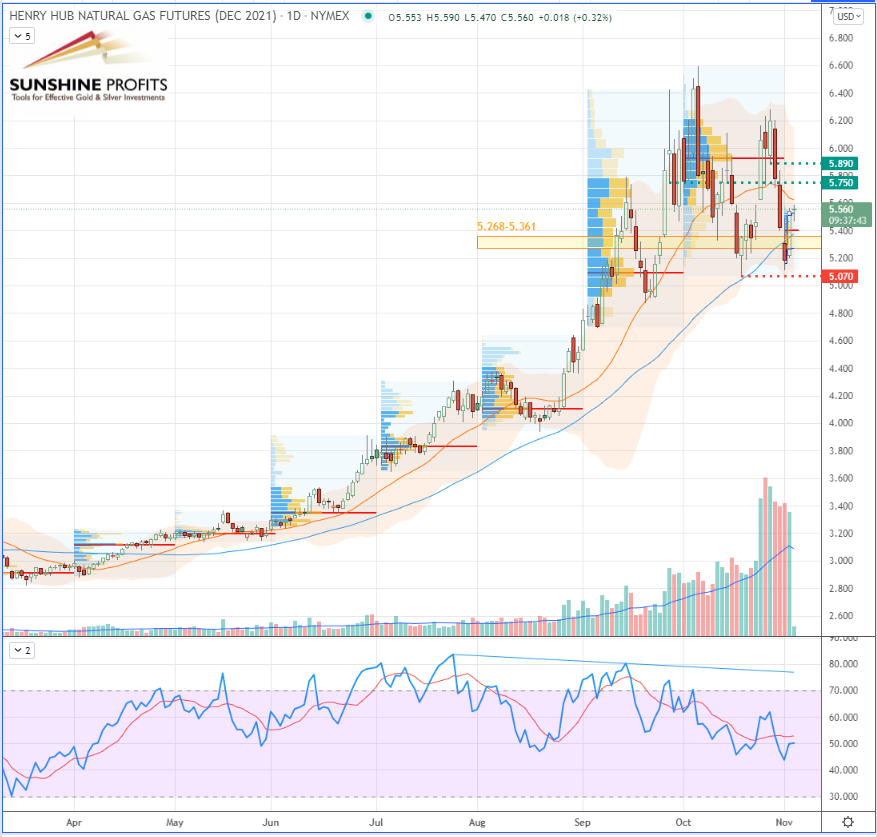

- Natural Gas [NGZ21] Long around $5.268-5.361 support (yellow rectangle) – with stop below $5.070 and targets at $5.750 and 5.890 – See Fig. 2

Did you miss my last article about the spiciest MLP to trade? No problem, you can have a look at my selection through the dynamic stock watchlist.

Fundamental Analysis

Crude oil prices have started their corrective wave, as we are approaching the monthly OPEC+ group meeting on Thursday, with some market participants now considering the eventuality of a larger-than-expected rise in production.

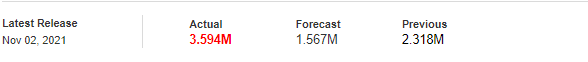

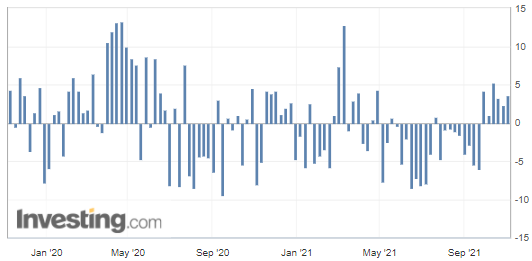

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing.com

Regarding the API figures published Tuesday, the increase in crude inventories (with 3.594 million barrels versus 1.567 million barrels expected), consequently, implies weaker demand and is normally bearish for crude prices.

Meanwhile, in the United States, the average price of fuel stabilized on Tuesday after several weeks of increase, according to data from the American Automobile Association (AAA), however, that’s 60% higher than a year ago.

Figure 1 – WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

Figure 2 – Henry Hub Natural Gas Futures (NGZ21) Futures (December contract, daily chart)

In summary, we are now getting some context on how the oil market might develop in the forthcoming days, with some crucial events to monitor as they could have a strong impact on the energy markets, and particularly on the supply side.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist