Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. We are adjusting the profit-take levels for GDX and GDXJ, but not for the leveraged ETNs (DUST and JDST) - this is not a typo.

Welcome to this week's flagship Gold & Silver Trading Alert. As we promised you previously, in our flagship Alerts, we will be providing you with bigger, more complex analyses (approximately once per week) and it will usually take place on Monday.

Practically, the most important analogies and long-term trends didn't change during the previous week and most of our previous extensive comments still remains up-to-date. The mining stocks topped in the lower border of the target areas that we featured last week, but within them. The bullish reaction to an excessive decline seems to have already taken place. It didn't invalidate most points that we've been making previously. Conversely, it confirmed many of them. Of course, in today's analysis, we will update whatever needs to be updated or added. The parts that we didn't change (or changed only insignificantly) since last week, will be put in italics.

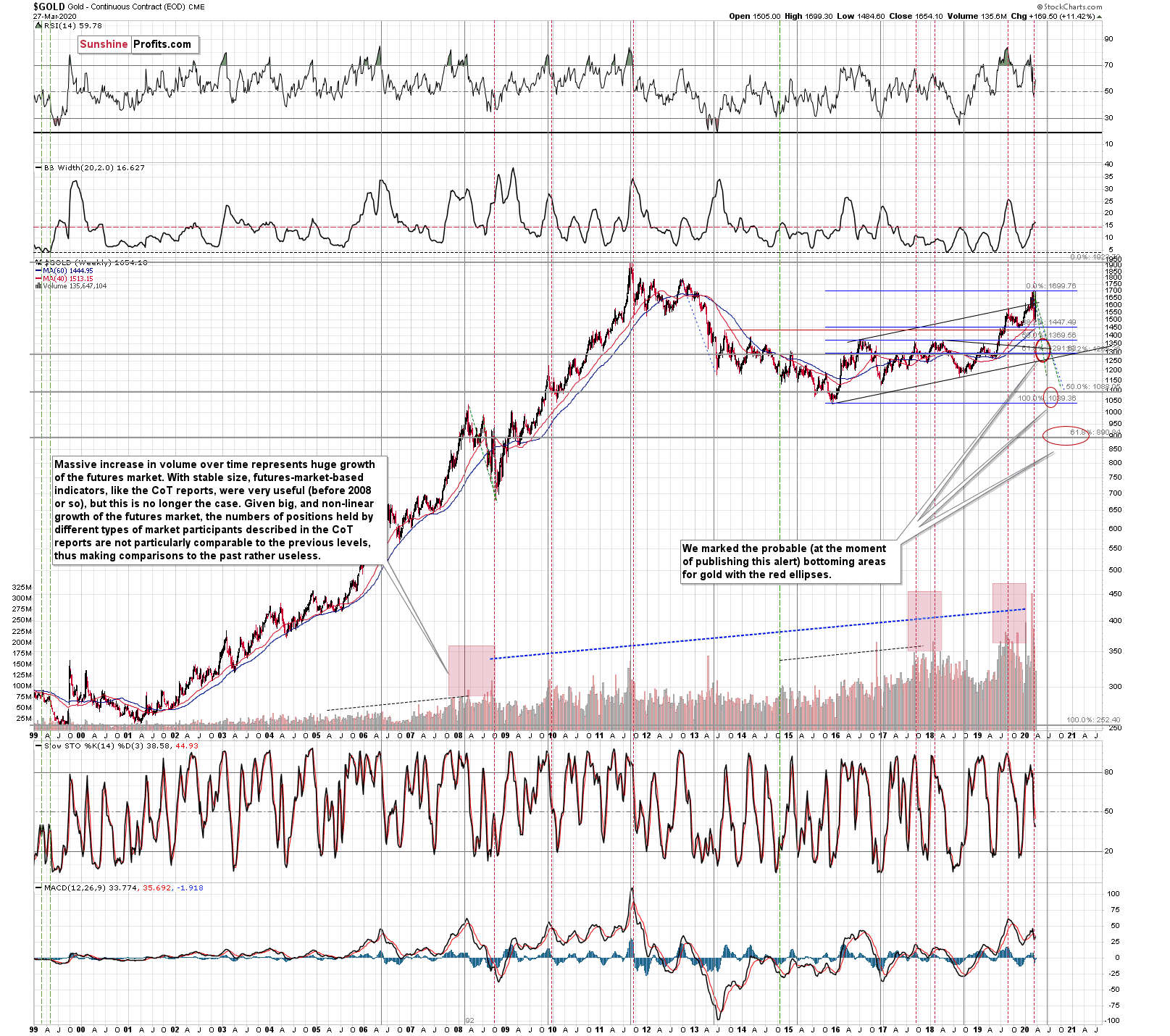

While we once again (just as we did in the previous week) made tremendous amounts of profits last week, we have to admit that we will probably have to adjust our long-term forecast for gold. Perhaps admitting is not the best word here, as it implies that something was done incorrectly.

For many months we've been writing that gold, silver, and mining stocks have not bottomed in 2015/2016. Almost all of our colleagues have been writing that gold, silver, and mining stocks have bottomed in 2015/2016.

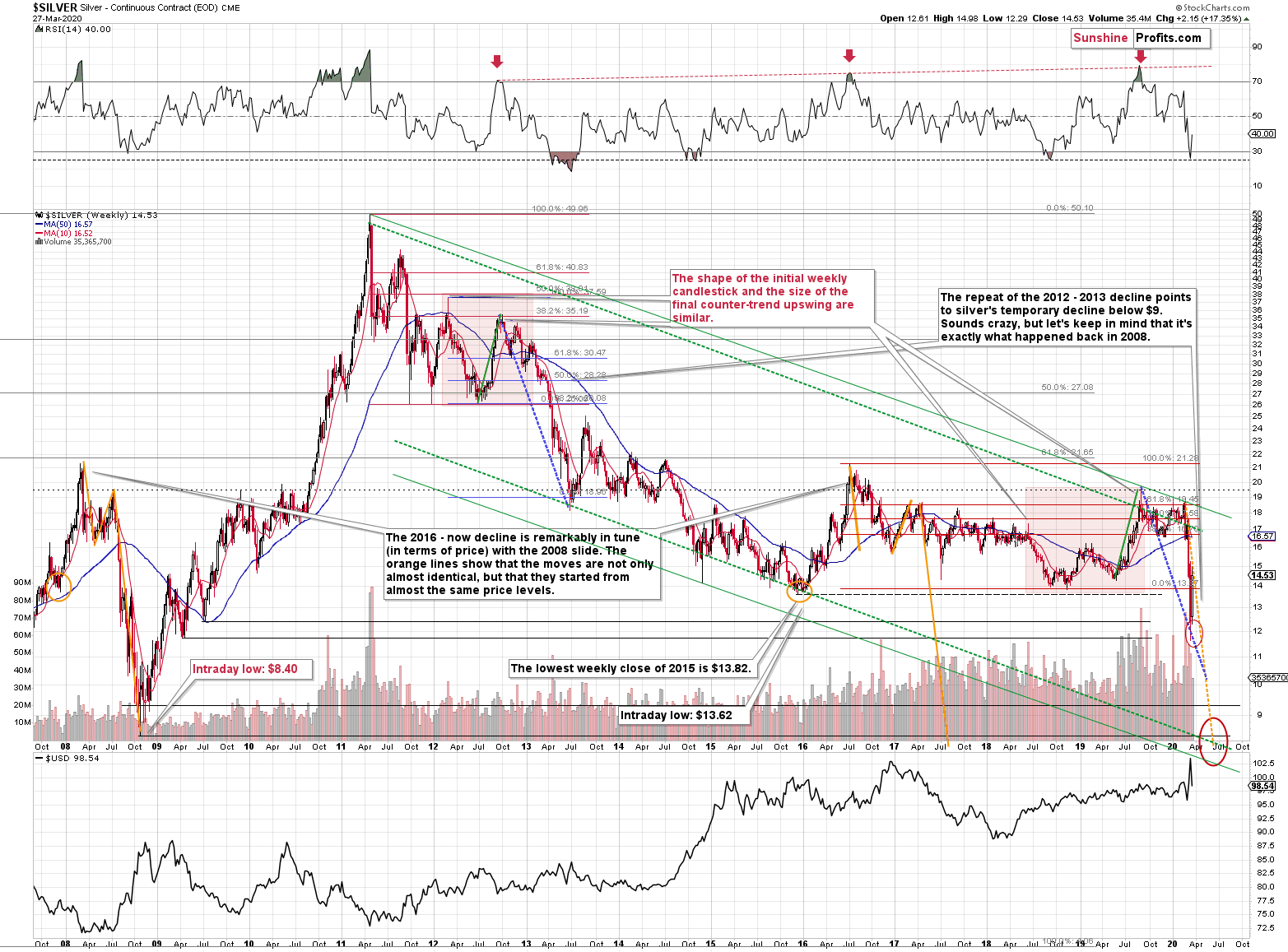

Silver already proved us right in case of this part of the precious metals market - it declined dollars below its 2015 bottom, and its declining also today. We were certainly right on this one.

Gold didn't decline profoundly, despite the above, and - more precisely - it did, but it came back up with vengeance. It's still likely to slide in a rather extreme manner, but it seems that it's not likely to slide below its 2015 bottom. The odds are (based on the information that we have available right now) that our prediction from months ago regarding gold will not turn out to be correct after all. Point for our colleagues. But is it really? If the fundamental outlook hadn't changed, gold would have probably declined in a less volatile manner, but likely more significantly, quite likely breaking below its 2015 low after all.

Mining stocks didn't decline below their 2016 lows, but given how weak they were on Thursday relative to gold and the general stock market, how difficult the current times are for the mining stock companies (fundamentally)? Also, due to many other technical factors that we outlined on Friday, it seems that miners will move below their 2016 highs soon. Perhaps very, very soon. While the jury is still out in case of the miners, we expect to be proven correct shortly.

It's too early to summarize, so we won't, but if miners do indeed decline to new lows, it will turn out that our long-term predictions for the precious metals market - while not being perfect - were still better than almost everyone else's. And since in this business it's impossible to get everything right at all times, isn't the above actually the best that one could hope for? Again, it's too early to summarize, and you be the judge. But please judge only once we're clear on this trade in the mining stocks.

Wait. What? You just changed your mind on gold?! After all those years?

Yes, the time that a given forecast remains in place is relevant only from the psychological point of view. That's not something that the "ego" wants to hear, but it's exactly what the size of one's investment account loves. Our procedure is to always look at the market fresh, as if we didn't have any position in it, and then decide whether we would open a position "right now". If the answer suggests a position different than we already have - we change it. Simple as that. And as difficult as that for non-professional investors (actually, it's challenging for professionals as well), due to the above-mentioned "ego" factor, "cognitive dissonance", and "myopic loss aversion".

Gold doesn't care about our past views, so neither should we. What we should care about is the multitude of factors that are likely to contribute to gold's movement in the future.

And these are: gold's technical picture, and gold's fundamental picture.

We will elaborate on gold, silver's, miners' and related markets' and ratios' technical picture below.

What we will not elaborate on today (well, we will somewhat, but not to the full extent) is the fundamental picture for gold. Why would we change our mind right now? Because of the extreme shift in the fundamental situation due to the Covid-19 outbreak. The post-Covid-19 world is very likely to be a very stagflationary place. Gold loves stagflationary places.

It's 2008 on steroids.

Also fundamentally.

And while the general stock market continued to slide well into 2009 (bottoming in March 2009), that's not what happened in gold, silver, and mining stocks. They all bottomed sooner. By the time the S&P 500 bottomed in March 2009, gold miners were already after a 100%+ gain from their final lows. That's not when we'd prefer to enter the market, and we guess that you'd prefer to enter it much closer to the bottom as well.

Consequently, while it seems that the S&P 500 Index might slide all the way down to its 2008 lows, gold, silver, and mining stocks would be likely to bottom well before that takes place.

For details regarding the fundamental picture and all the stagflationary details that change the golden landscape, we strongly encourage you read the April Gold Market Overview report by Arkadiusz Sieron, PhD. In my - PR - view, it's one of the best, if not the best issue that we ever published. And it's definitely the most timely one. In fact, it's so timely that we published it a few days ahead of our regular schedule - we published it yesterday. Also, we launched a promotion for this product that allows one to read it for $1. That's for the first 10 days of subscription (which renews normally), but effectively this means that you can read this issue for next to nothing, and if you don't like it (or for any other reason), you can cancel the subscription before it renews (it's regular price is $49 per month). This promotion will be on for just a few days. Of course, the All-inclusive subscribers were notified about this report yesterday.

After the lengthy (hopefully, you found it informative) introduction, let's move to the main part of today's analysis. We'll start today's issue with quoting what we wrote about the Covid-19 previously, as that continues to be the key issue driving the markets right now.

Our previous prediction regarding the number of confirmed cases in the US was already realized - this number is now almost twice as big as the analogous number in China. Last week, we wrote that the number of total confirmed cases in the US was likely to exceed the number from China later during the week. The number stands at 143k at the moment of writing these words, and the total number for the entire world is 724k. Our prediction for the next week is about 500k of confirmed cases in the US alone. To clarify, it's not a precise, but a ballpark prediction -the minimum that we expect to see is 300k, but likely not more than 1M. At least not yet.

This will make it even clearer just how serious the situation in the US is going to become. Last week, we wrote that technically, the markets looked ripe for a corrective upswing, but it was very likely that this upswing wouldn't last long. It seems that this corrective upswing is already over.

People know that this is serious, but they don't fully grasp the extent yet. Once they do, the real panic will kick in, and we'll see price moves bigger and more profound than we saw in 2008. At least that's how we see it.

Why? Generally, our take on the situation didn't change since last week, so quoting our previous analysis, seems appropriate.

The situation in the world is unlike anything we've seen in the last few decades. In terms of the total death count it's still not much more of a deal than regular flu, but the problem is that what we see right now it's just the very tip of the iceberg. An iceberg that is not only under water, but also almost entirely beyond horizon.

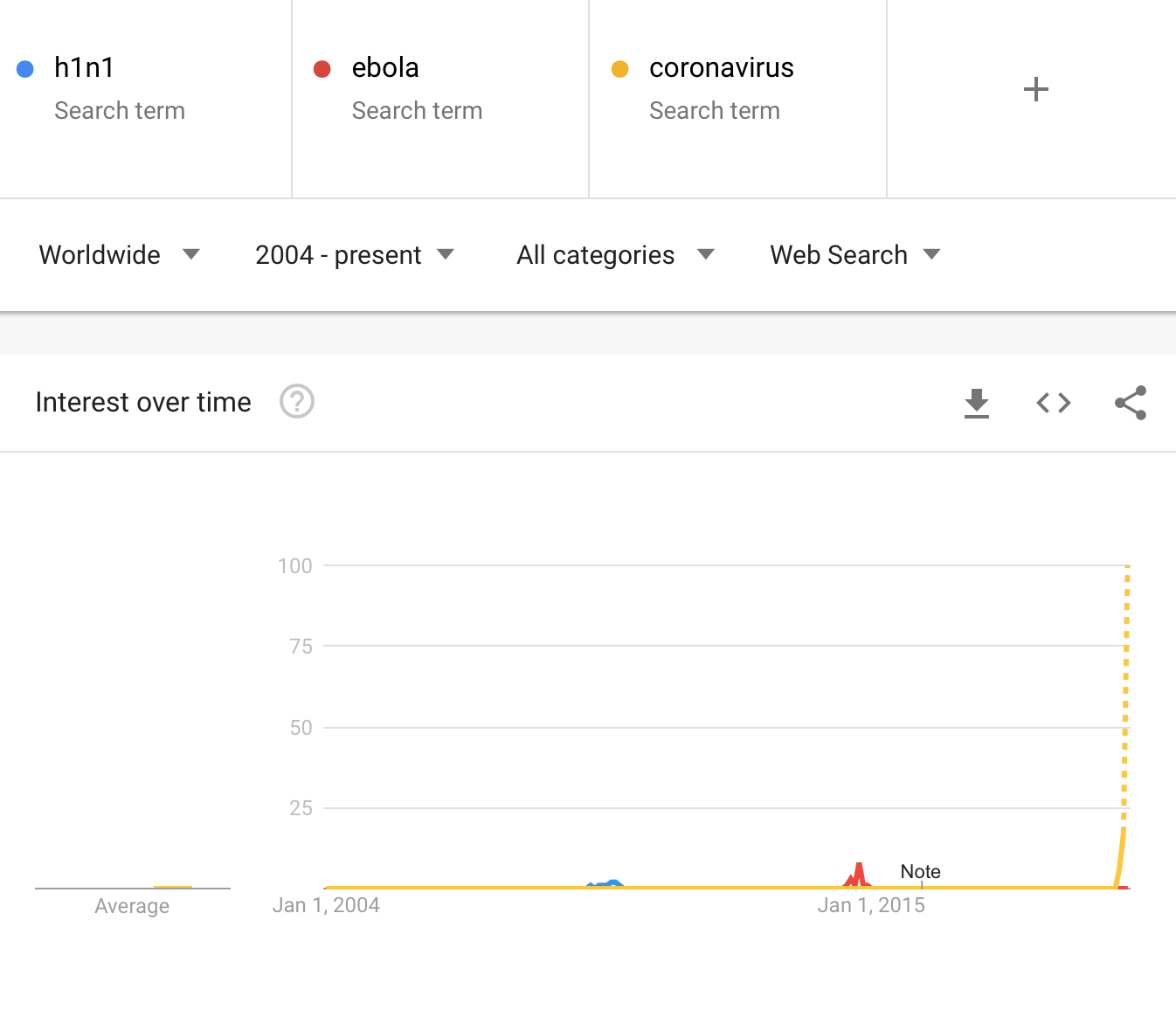

The fear of the virus (chart courtesy of Google Trends) went through the roof and is headed to the moon.

This implies a couple of things, and the most important one is that the analysis of what's likely to happen is increasingly more important compared to technical signals. Why? Because technical analysis is all about checking how things worked previously and assuming that most of the time history repeats itself to a considerable degree.

Sometimes, technicals alone trigger reversals and trends that then proceed based on technical rules.

Sometimes, fundamentals alone trigger reversal and trends that then proceed based on technical rules.

And sometimes, they both interact with each other in a yin-yang fashion creating a cocktail of triggers and psychological/technical mechanisms.

Right now, we are in the third, most complex situation, with news being a very important trigger for the markets.

This means that the market analysis right now cannot focus only on technicals (except for day trading, of course, where it's perfectly justified), but has to deal with how the situation develops also in the real world.

The most similar situation to what we have right now from the medium-term point of view, is the 2008 decline, so it's our main point of reference.

Before discussing the analogies and similarities, let's consider how the situation is evolving and - most importantly - how the situation is likely to evolve going forward.

The Europe is on biological fire, at least its Western part. Countries are implementing various lockdown procedures, and some of them might actually manage to deal with the threat.

Already a lot is being done in the US, but not enough to really contain the outbreak - the actions still seem relatively small compared to what measures were already implemented in Europe and Asia.

Note: we don't want to discuss whether severe lockdown measures should be implemented or not. Our focus is on estimating what is the likely course of action, and how the markets are likely to respond. And to be ahead of them.

This is the election year, and Trump really doesn't want to be the person who locked the entire country up and sent troops out on the streets to ensure that the lockdown is indeed enforced. He also refuses to take the responsibility for downplaying the virus threat for so long, and this sentence might be the key observation from this report. This is the case because a lot will depend on how Trump deals with the situation in the following days and weeks, and the above gives us a hint.

The hint is that there will be a lot of finger-pointing, some people will get fired, and there will be speeches about how the US is doing great overall, and that the virus is not really a big threat compared to other threats. Decisions will be made, but they will be made only after it is clear that the general (and voting) public wants those decisions [This entire paragraph is a quote from the previous issues, but we see that this is indeed taking place]. And they won't be dramatic. And the decisions will aim to ensure that it looks like the President is doing a great job (which might or might not be the case - the point is not to criticize the decisions that were not even made yet, the point is to see that the outside appearance of a given decision is and will be an important factor). These techniques to influence people and this approach overall tends to work under normal circumstances. But these are not normal circumstances.

All the money being pumped into the system is a good example of the above - it is a lot of money, and it's visible (!) that the President and other officials are definitely doing something. But still...

Viruses care about very few things. They care about replication. They don't care about borders, politics, politicians, and egos. And they are not negotiating.

If you have some time now, we encourage you to read this article on coronavirus - I find it to be the most informative piece on that topic that I've read so far (not in financial terms, but in general). If you don't have time right now, I strongly encourage you to get back to this article later today. Long story short, things are very far from ok in the US and unless some really dramatic measures are taken (some ideas are quite extreme), the virus will spread throughout the country. And we don't think that these measures will be taken in the US shortly, which is only likely to make things worse several days or weeks later.

Note: there is a follow-up to the above-mentioned article on coronavirus - it's also highly informative. If you decide to read it (it might really be worth your time), please compare the efficiency of "mitigation" (which pumping money more or less is) and "doing nothing".

Regardless of the way the situation is handled, it'll quite probably trigger further weakness in the US stock market. Still, the implications for the currency market are relatively unclear. Depending on how quickly the situation develops in various parts of the world, the currency exchange rates can behave differently.

It seems that the US is still in the early stage of epidemic, while the Europe is in a comparatively latter one. This means that for some time (several days or more, but not as long as several weeks) people are likely to flock to the US dollar as a safe haven. However, once the US "catches up" with the rest of the world, or the situation gets worse as it is not dealt with soon enough, the situation could reverse as investors want to get out of the US dollar.

This might be when they turn to gold. They key word here is "might".

The additional caveat is "when".

Based on last week's developments, it seems that people might prefer the US dollar as a safe haven of choice - initially. After all, gold won't be used as money during the Covid-19 outbreak - electronic payments don't transmit viruses in general, while physical objects, like gold bars or coins - do. Consequently, the USD Index seems likely to soar in the following weeks after all.

As that happens, gold is likely to slide.

But.

Once the focus on liquidity and raising cash (getting out of everything) subsides, people will realize that "it's the 70s all over again". Not because of oil shocks, but because of the stagflationary results. Some will anticipate what's likely to happen and they will buy gold. Others will probably buy silver. And some will buy gold and silver miners that were previously hammered very hard. In one way it's like the 70s, but in another way - more technically - it's like 2008. Just like back then, gold is likely to rise back up like a phoenix reborn and rising from the ashes.

The key thing from the articles to which we linked above is that there is a significant delay between when a person gets infected with Covid-19, to the moment when they finally get tested. Plus, most people, who are infected don't have any visible symptoms, but are already spreading the virus. This means that the situation is currently exponentially more severe than its being reported. And it will get much more severe in the following days and weeks unless it is contained in a really decisive way.

It's unlikely that this decisiveness will come soon in the US. It will probably arrive when it's already too late, or it won't arrive at all as the problem was downplayed at the official level for too long. The relatively easy measures will be taken (that's already happening) - such as pumping money into the system, and so on. But that won't stop the virus. Really decisive actions would be required for that. The actions that are relatively unlikely to be seen in the US - at least not at the national level.

The mortality rate is between 0.5% and several percent, depending on how well prepared the health system is in a given country. Let's say that the mortality rate in the US will be 0.5%, which seems to be a conservative assumption. Given the delay in implementing decisive actions, a lot of people already are infected, and much more will become infected in the following days and weeks. Ultimately it could spread to, say 20% of the US population. And we're being conservative here - there are statistical models that point to about 50%-70% infection rate in the end.

With the US population at 327 million, this means that 327,000,000 * 20% * 0.5% = 327,000 Americans are likely to die from the Covid-19.

And what if the numbers were not that conservative? 1.5% mortality rate and 40% infection rate?

327,000,000 * 40% * 1.5% = 1.962 million Americans

Things could get even worse than that. The mortality rate calculation is based on how well the healthcare system is prepared and how gradual can the outbreak of Covid-19 be. 5% of those infected, require intensive care. If 40% of Americans get infected and 5% of them require intensive care, this means that 327,000,000 * 40% * 5% = over 6.5 million Americans will need intensive care. If people, who need intensive care, don't get it, their mortality rate is about 90%.

But the US healthcare system is prepared, right?

It is estimated that there are about 45,000 intensive care unit (ICU) beds in the US.

Perhaps over 6,500,000 Americans will need intensive care, and there are only 45,000 ICU beds. About 90% of those, who don't get intensive care and need it due to Covid-19 infection, are likely to die.

Of course, the above assumes that everyone would need the ICU beds at the same time, which won't be the case. The more the Covid-19 outbreak is spread over time, the more people could be cured per one ICU bed. But still, it will likely be far too little to help even a third of those who might need it.

We really want to be wrong on this one, because it would be an unspeakable tragedy.

On the analytical front - if we're at least somewhat close to the final numbers, there will be a real carnage on the markets. The markets have already declined severely and the total death count in the US was below 500 at that time. This might be less than 0.1% of the final number. Right now, the Covid-19 US death toll is about 2,500.

It's not the point to predict the exact death toll figure. The point is to show you how serious things are likely to get before this is all over.

And the death toll is going to increase exponentially until a major lockdown (or any other critical measure is taken), which might never arrive. The death toll will not be counted in tens or hundreds. And not even thousands. And not tens of thousands. The best-case scenario that we see is that the death toll would be below 100,000 in the US.

Now, the markets are forward-looking, so they should be discounting all the above right now. But they are not, as it's not intuitive for people to make such complicated calculations, especially since that they are being reassured that everything is or will soon be under control. Ultimately people will act on emotions just as they did recently.

Recently, the death toll in the US was "just" below 500 and the stock market was already down over 20%, and there were signs of real estate market prices moving lower as people were unwilling to even watch new homes right now.

If people got scared out of their stock positions based on fewer than 500 deaths in the US and about 15000 deaths worldwide, then how bad can things go, when the death count is going to up in tens or hundreds (worldwide) of thousands daily?

Extremely bad.

We expect things to get worse than they were in 2008. Of course, the question is how one defines "worse". Imagine what would happen if stocks dropped similarly as in 2008 but more and faster - and that's the likely scenario.

The problem with the 2008 slide was that it was relatively unpredictable, especially in case of gold. The corrective upswings were very fast and they didn't last for long. Overall, this kind of movement is also likely this time. The two parts of the precious metals market that were hit particularly strongly, were silver and mining stocks.

Three weeks ago, miners declined more during the week, then they ever had previously - at least as long as the XAU Index exists. And silver broke below the 2015 lows, finally confirming what we've been writing for years - the precious metals bear market didn't end in 2015 or 2016.

It's 2008 all over again, but supercharged.

It might even be the case that the 1929 slide is a better analogy... But it's too early to say so.

Of course, even if the market is going to slide, it doesn't mean that it will slide without periodic corrections.

In fact, it seems that one of the corrective upswings has just ended.

Let's get back to the big picture and think about the future. In several weeks, the situation in the US will probably be much worse than it is right now, a lot of people will die, and the stock market will already be trading much lower, likely taking precious metals sector with it. Gold is likely to be an exception, but not initially.

What then? Then the realization will come with regard to what really happened.

More or less (very rough approximate) as many people will die from the Covid-19 as they die from heart disease each year. People die due to many reasons and Covid-19 will increase the total death toll this year (say by 10% - 30% or so), but not multiply it in general. Those who die will be mostly retired seniors, and those who already had other diseases. As brutal and as harsh as it sounds (and we apologize for writing this, but still, it's our job to analyze the situation and report to you as we see it), this will be a huge personal loss, but not a huge economic loss for companies traded on the US exchanges. Almost everyone (in global terms) will still be around and companies will be able to operate as they had previously (for instance in 2019). The life will go on.

The buildings, the factories, the machinery - it will all still be there and there will be people, who are already immune to the Covid-19 disease that will be eager to get back to work full time (or overtime) and the central banks around the world will likely be providing support and cheap credit to get things up and running soon.

And people will realize that in the previous weeks - focused on deaths and their emotional aspect - they priced everything - stocks, commodities, real estate way too low. And new bull markets will start.

We have to get through many more individual tragedies, and through much more pain and panic in general before we get there. This means many more declines, especially for silver and mining stocks on the horizon.

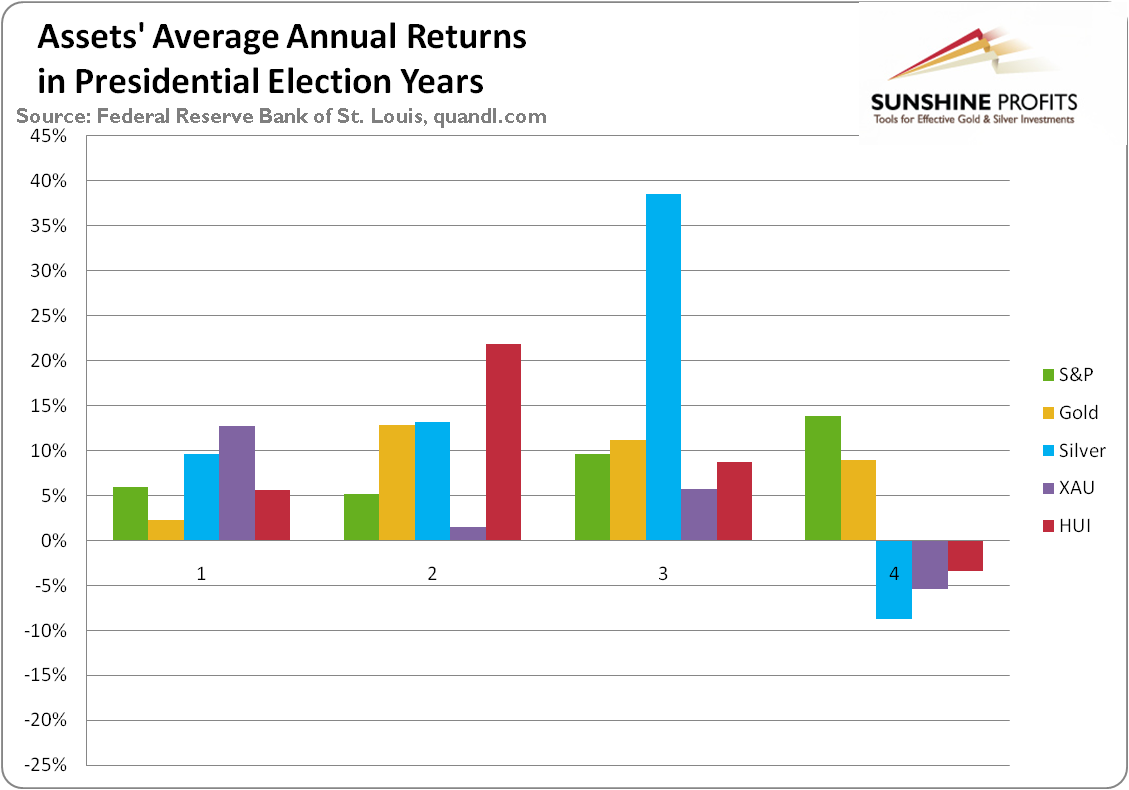

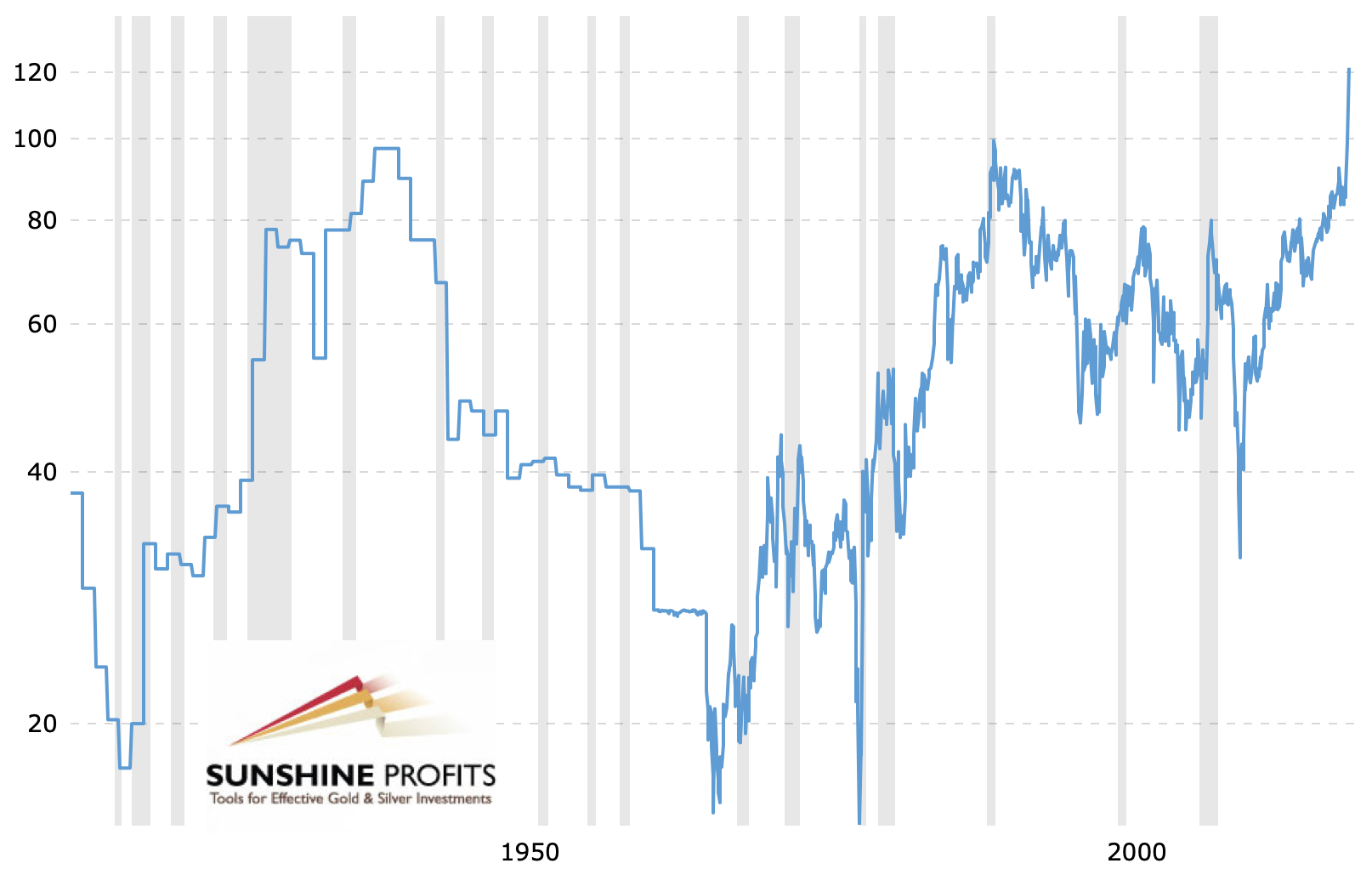

The US Presidential cycle is not as important as the above, but it's worth keeping it in mind, anyway.

Assets' Returns and Presidential Cycle

Average annual return of S&P (1948-2015, green line), gold (London P.M. Fix, 1972-2015, yellow line), silver (London Fix, 1972-2015, blue line), XAU Index (1984-2015, purple line) and HUI Index (1997-2015, red line) in presidential election cycles.

Gold's performance is more or less average in the election year, but in case of silver and mining stocks, we see something very different. Namely, the election year is the only year when - on average - they all decline.

So, does it mean that gold won't be affected by this specific cyclicality, but silver and miners will be? Not really. It seems that the above chart shows that silver and miners - on average - lead gold lower. They perform worst in the election year and the yellow metal is the worst choice in the following year - the first year of presidency.

Silver is already at new multi-year lows and miners just declined the most during the previous week...Ever. The above-mentioned analogy seems to have worked quite well.

We previously supplemented the above with the discussion of interest rates and QE4. We argued that the lower rates are not likely to help in a sustainable manner and neither will QE4. But we could see a temporary rally based on this factor.

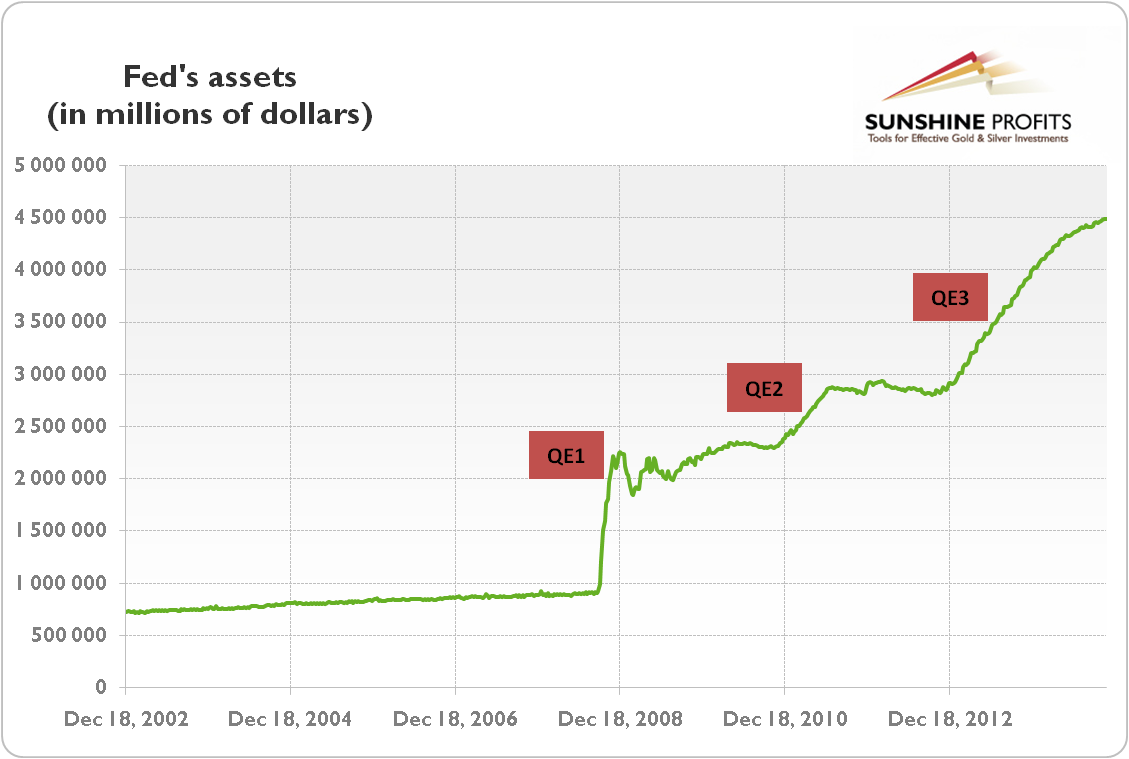

Well, let's see what the previous quantitative easing programs did.

Quoting from our explanation of the link between QE and gold:

"The effects of quantitative easing on the gold market depended on how it was perceived by investors. Initially, after the financial crisis of 2008, quantitative easing was positive for the price of gold. It was a new and unprecedented program, which undermined the investors' confidence and caused a fear of inflation or even hyperinflation. However, the U.S. economy recovered after some time and there was no inflation on the horizon. In consequence, the price of gold entered a decline in September 2011, just two months after the end of the QE2. As the confidence in the Fed and the U.S. economy was restored, the third round of the quantitative easing was welcomed by the investors. The increased confidence reduced risk premia and the bidding for tail risk insurance. Consequently, the stock market rose, while the price of gold declined."

QE1 was very bullish for the precious metals sector - the market was surprised, and the precious metals market was already after a huge decline.

QE2 was still bullish for the PMs and miners, but not as much as the first round.

QE3 started in the final part of 2012 and as it continued, PMs and miners declined profoundly. QE3 didn't prevent the decline.

Each round of the QE program was less bullish than the previous one. This trend doesn't suggest placing a lot of bullish faith in QE4 with regard to the precious metals market.

The most bullish QE was the one that was launched after gold had already declined severely for months. This is definitely not the case right now. What is the case right now is that gold just declined tens of dollars despite the dovish change in investors' expectations toward interest rates. This suggest than neither rate cuts, nor QE4 may be able to stop the decline that just started - at least not on their own and not until gold drops much further.

One more thing regarding the elections. Trump is the anti-establishment President. Perhaps the "establishment" actually wants the stock market to tumble this year, to make sure that the next U.S. President will be pro-establishment. Consequently, perhaps the stock market won't be saved until it drops much lower, and until the U.S. dollar is soaring much higher, proving that pro-lower-dollar-Trump was unable to get what he aimed for.

Rhodium Update

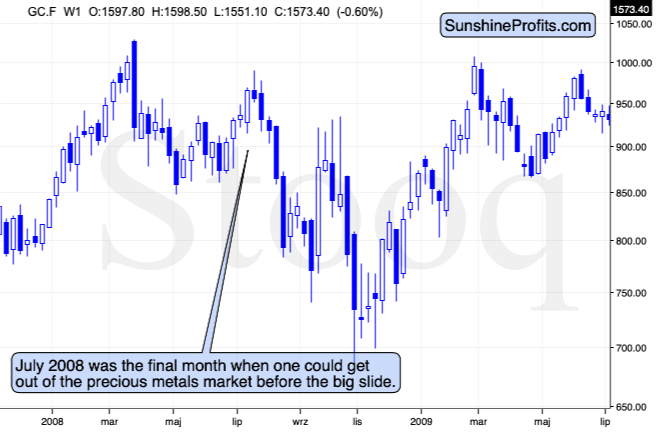

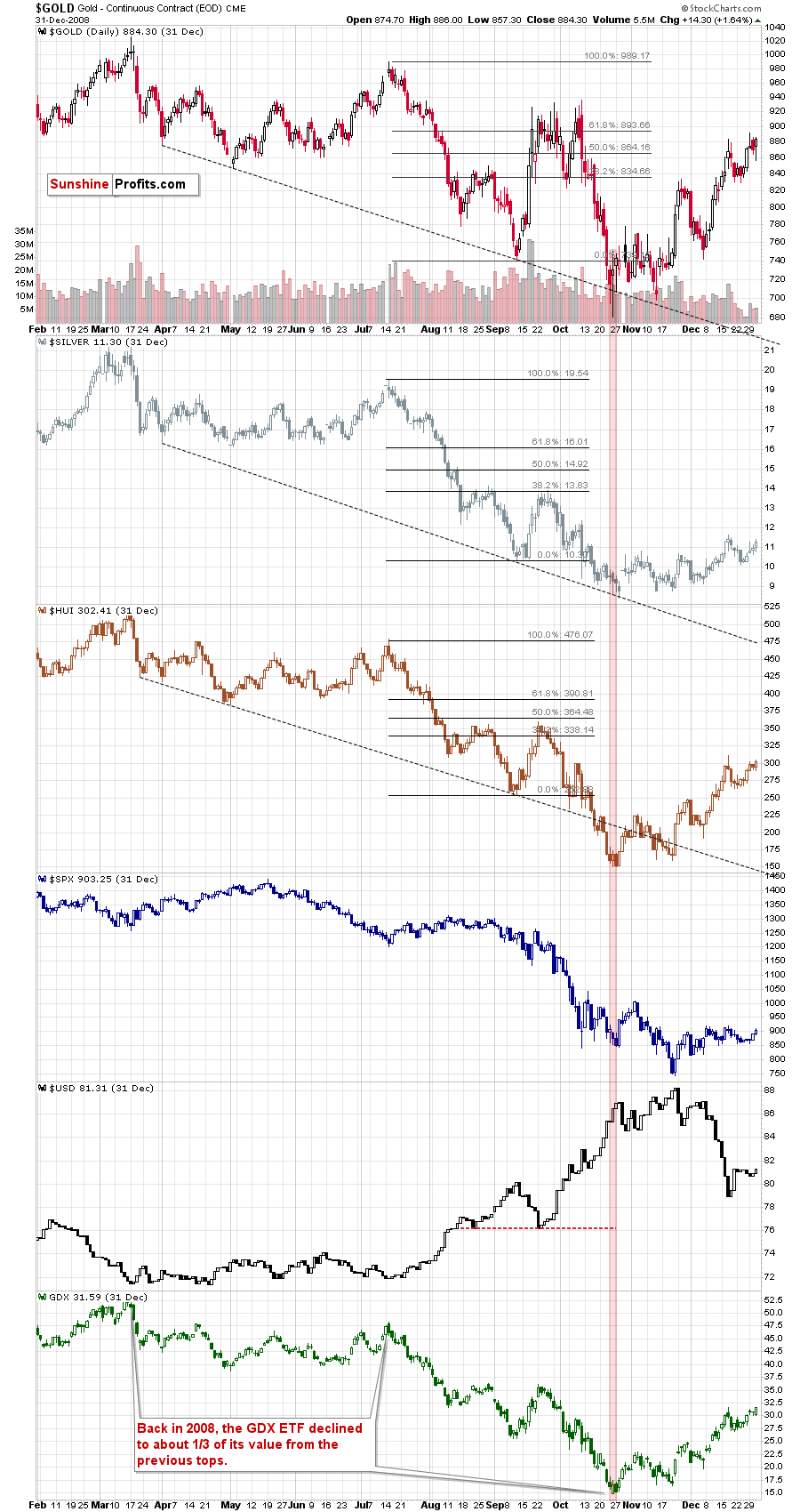

We previously discussed the rhodium market in detail, and we argued that a sudden explosion in rhodium's price was an indication that things were very similar to 2008 right now. We also wrote that the rally in rhodium was unsustainable. Indeed, its price collapsed from above $10,000 to about $2,000. That was well before the biggest part of the slide and we now know that it was indeed the case. Why are we mentioning it today? To further emphasize the analogy between 2008 and 2020 and to show you that the previous top in gold was analogous to the July 2008 top. It is not only gold's price shape that confirms it.

Rhodium topped in July, 2008 and that was when gold formed the final high before one of the sharpest and biggest plunges of the past decades. In case of silver and mining stocks, it was the beginning of THE sharpest decline of the recent decades.

There are very few analogies that could be more bearish than the one that rhodium is now featuring.

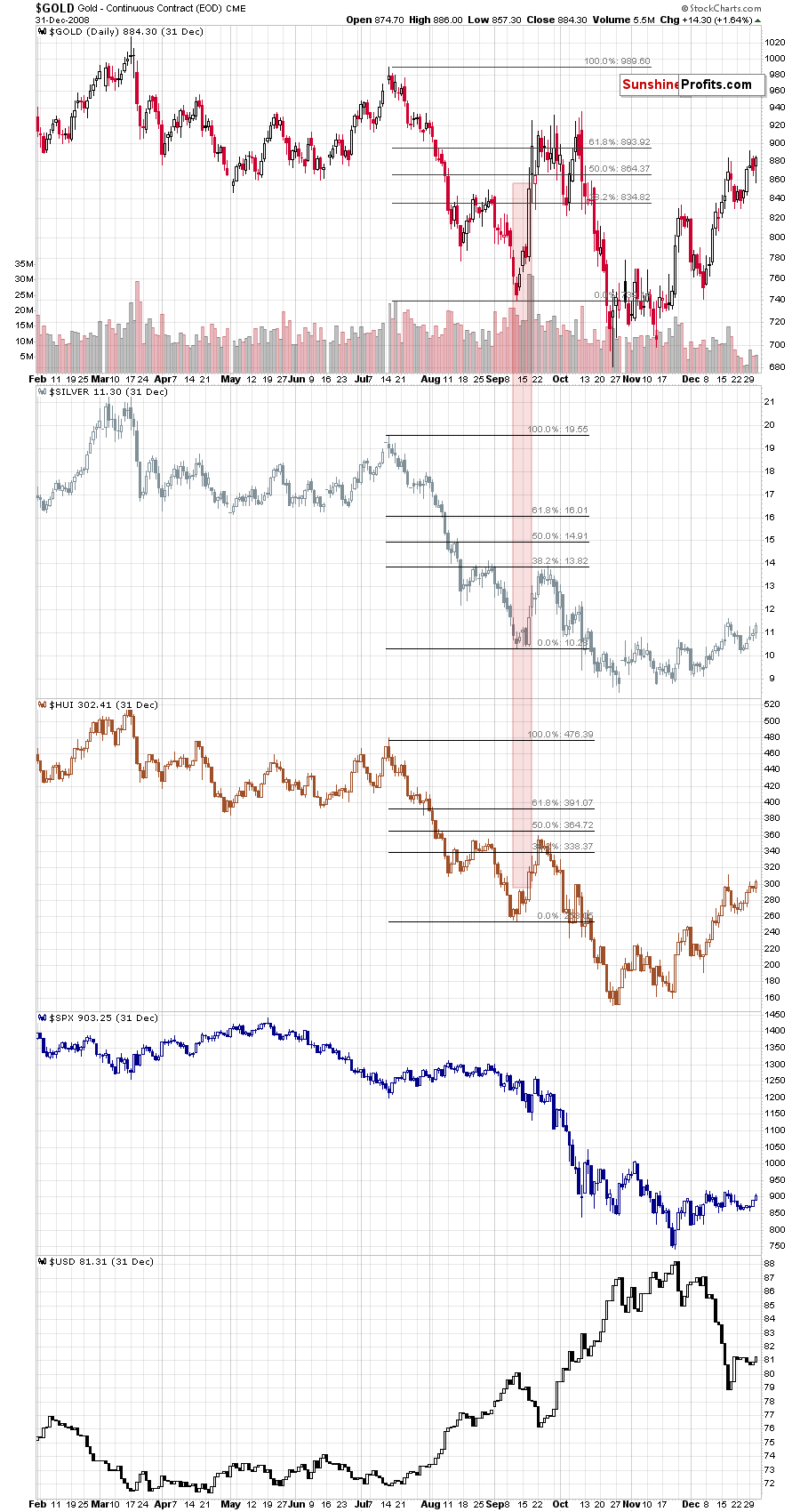

Actually, given the fact that volume on which the 2008 top formed and volume on which gold topped recently are relatively similar (gold volume spiked in both cases), the above analogy is confirmed. Additional confirmation comes from the fact that in both: 2008 and 2020, gold tried to rally to the previous highs, and failed to reach them. In 2008, rhodium soared during this second attempt, and this is exactly the case right now. The analogy is clear and extremely bearish.

Let's dig deeper.

The 2008 - Now Link

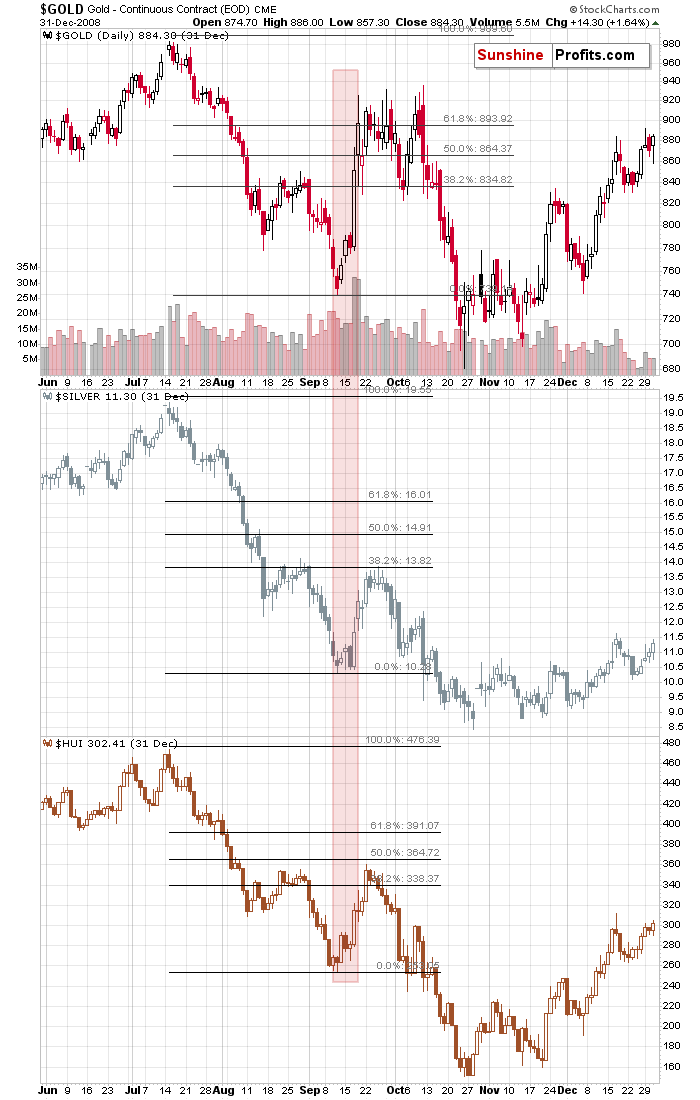

We already had gold reversing on huge volume, and we saw it decline very strongly in the first week after the top. We already had another attempt to break above that high and we saw it fail. We also saw rhodium at about $10,000. We already saw silver and miners plunging much more severely than gold did. In fact, silver just plunged almost exactly as it did in 2008 during the analogous part of the slide.

All these factors make the current situation similar to how it was in 2008, at the beginning of one of the biggest declines in the precious metals sector of the past decades.

But the very specific confirmation came from the link between gold and the stock market. Stocks plunged along with gold, silver, and mining stocks. That's exactly what was taking place in 2008. The drop in 2008 was very sharp, and silver and miners were hit particularly hard. We expect this to be the case this time as well.

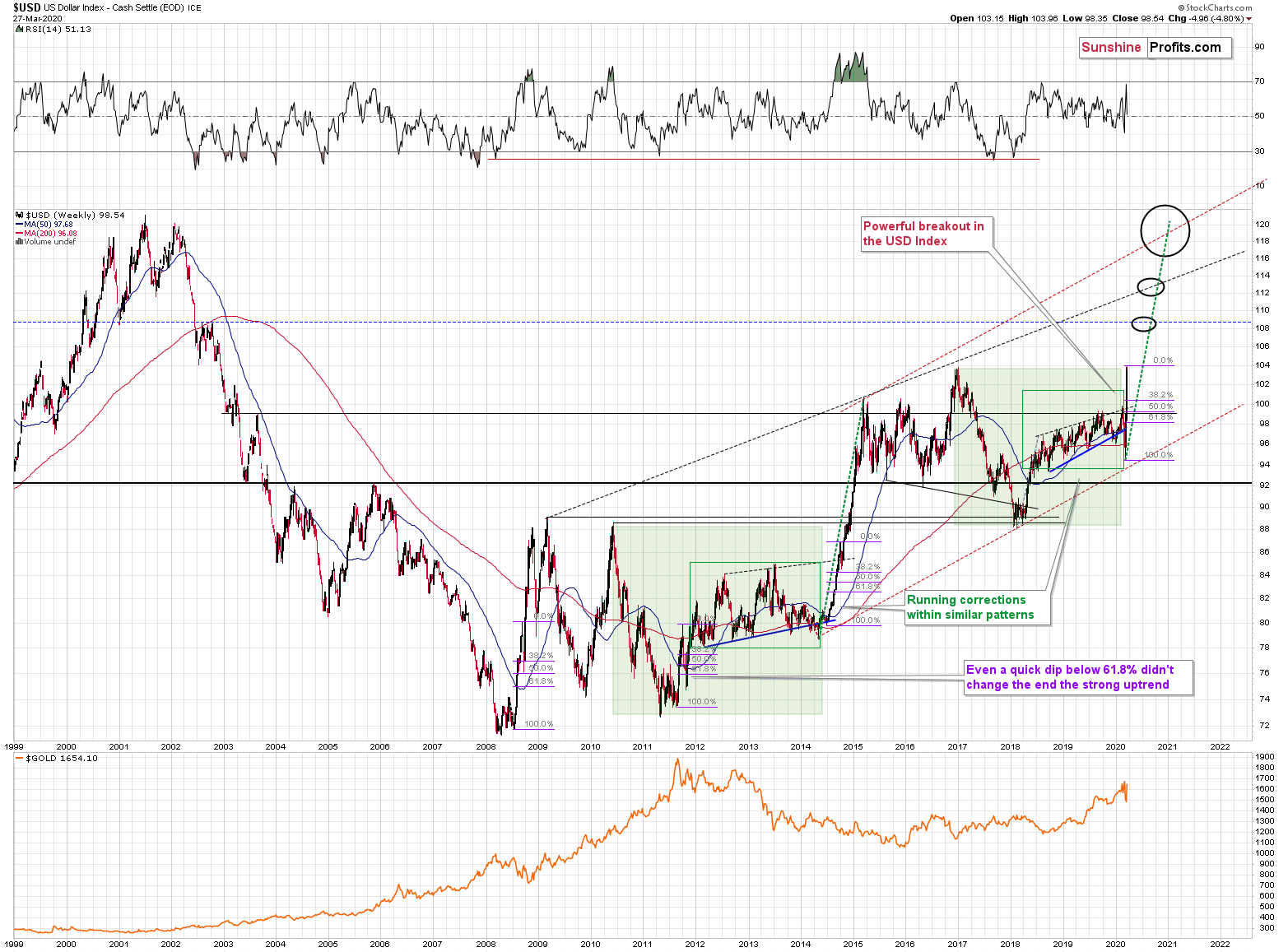

In 2008, the temporary rallies were particularly visible in case of gold, not that much in case of silver, mining stocks, or the general stock market. Gold declined particularly hard only after the USD Index started its powerful rally.

The 2008 decline in the PMs ended only after a substantial (about 20%) rally in the USD Index.

The USDX has just corrected almost 61.8% of its previous decline, and it could be the case that it's now ready to soar much higher. Last week, we wrote that the USD Index could correct based on the 2T stimulus and other monetary, and fiscal steps taken by the US officials.

That's exactly what happened. Yet, it's not likely that these steps will prevent people from raising cash when their fear reaches extreme levels. We're getting there. And we're getting there fast.

As the situation is more severe, the USD Index might rally even more than 20% and the 120 level in the USD Index (comeback to the 2001 high) has become a quite likely scenario.

Let's keep in mind that it was not only the 2008 drop that was sharp - it was also the case with the post-bottom rebound, so if there ever was a time, when one needed to stay alert and updated on how things are developing in the precious metals market - it's right now.

Last week, we supplemented the above with description of the 2008 analogy in terms of the shape of the price moves. On Wednesday, we supplemented it with a more detailed time analysis. It's very important today (and for the rest of the week), so we're quoting our Wednesday's comments:

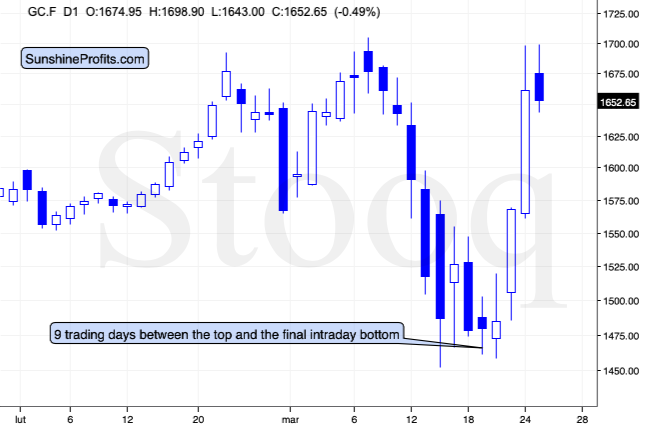

It took 9 trading days for gold to decline from its top to the final intraday bottom, before starting the powerful comeback.

In 2008, it took 41 days. It seems that things are developing about 4.5 times faster now, than they were developing in 2008. More precisely: 41/9 = 4.56 times.

Please note that the decline that preceded the sharp upswing in gold, is also somewhat similar to what we saw recently. There was an initial slide in gold that ended in mid-August 2008, then we saw a correction and then another slide and a bottom in early September. This year, we saw an initial bottom in mid-March, and the final one a few days ago.

Back in 2008, it took 23 trading days for gold to reach its initial bottom and it then took another 18 days for the final short-term bottom to form. 56.1% of the downswing was to the initial bottom, and the 43.9% of the downswing was between the initial and final bottom.

And now? It took 5 out of 9 trading days for gold to reach the initial bottom, and the remaining 4 days were the time between the bottoms. That's 55.6% and 44.4% respectively.

This is very important, because it shows that the shape of the move is indeed very similar now.

This means that we can most likely draw meaningful conclusions for the current situation based on how the situation developed back in 2008.

Back then, gold moved back and forth close to the initial top. That's what gold has been doing so far today - which serves as another confirmation for the analogy.

Back in 2008, gold topped over the period of 16 trading days. Dividing this by 4.56 provides us with 3.5 days as the target for the end of the topping pattern since its start. The pattern started yesterday, which suggests that gold could top tomorrow [Thursday, March 26th] or on Friday.

EDIT: That's exactly what happened - in terms of the daily closing prices, gold has indeed topped on Thursday.

The situation gets more interesting as we dig in more thoroughly...

There are 24 hours in a day. Dividing this by the factor of 4.56 provides us with 5.26. This means that if we could create a chart with 5.26 hour candlesticks, the price moves in gold should be analogous (in terms of how we see them on the chart) to their daily performance from 2008. The closest that we have available are the 4-hour candlesticks.

Let's check how gold performed recently from this perspective, and compare it to its daily performance from 2008.

The price moves are remarkably similar.

Even the March 17, 2020 upswing took gold to analogous price level! Gold temporarily topped very close to the previous (Feb 28) low. That's in perfect analogy to how high gold corrected in late August 2008 - it moved up to the early May 2008 high.

The link to 2008 truly is the key right now.

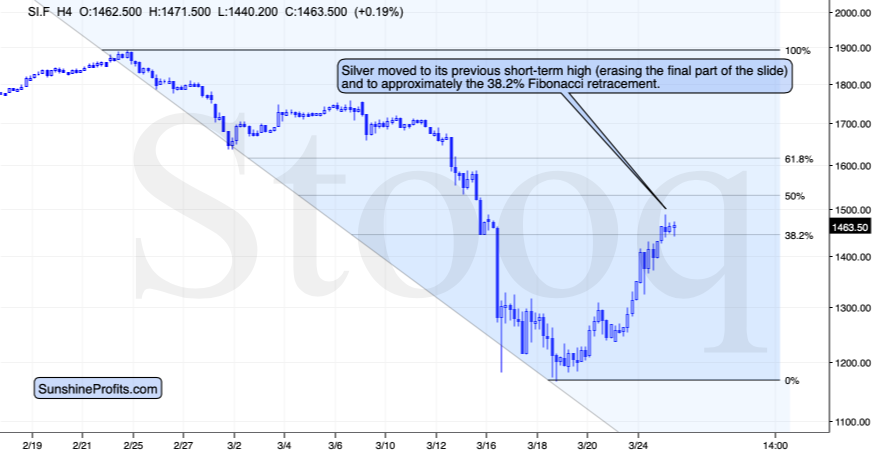

Ok, so when are silver and miners likely to top?

Sooner than gold.

Please note that both: silver and mining stocks topped more or less in the middle of gold's topping formation... Which suggests that they should be topping today.

And for the final confirmation - please take a look at what the stock market and the USD Index have been doing at that time. The USD Index was within a pullback while the stock market formed a very short-term upswing. Silver and miners topped along with the stock market.

Silver just moved to its previous short-term high (a small high, but the one that preceded the final part of the decline) and it's approximately at its 38.2% Fibonacci retracement.

That's exactly where silver topped in 2008. Back then the analogous high was the late-August high, and it also topped close to its 38.2% Fibonacci retracement.

We are probably looking at a top in silver right now.

This means that miners are likely to top today as well.

EDIT: That's exactly what happened in terms of the daily closing prices. Both: silver and GDX formed the highest daily closing prices on Wednesday - the same day we had published the above.

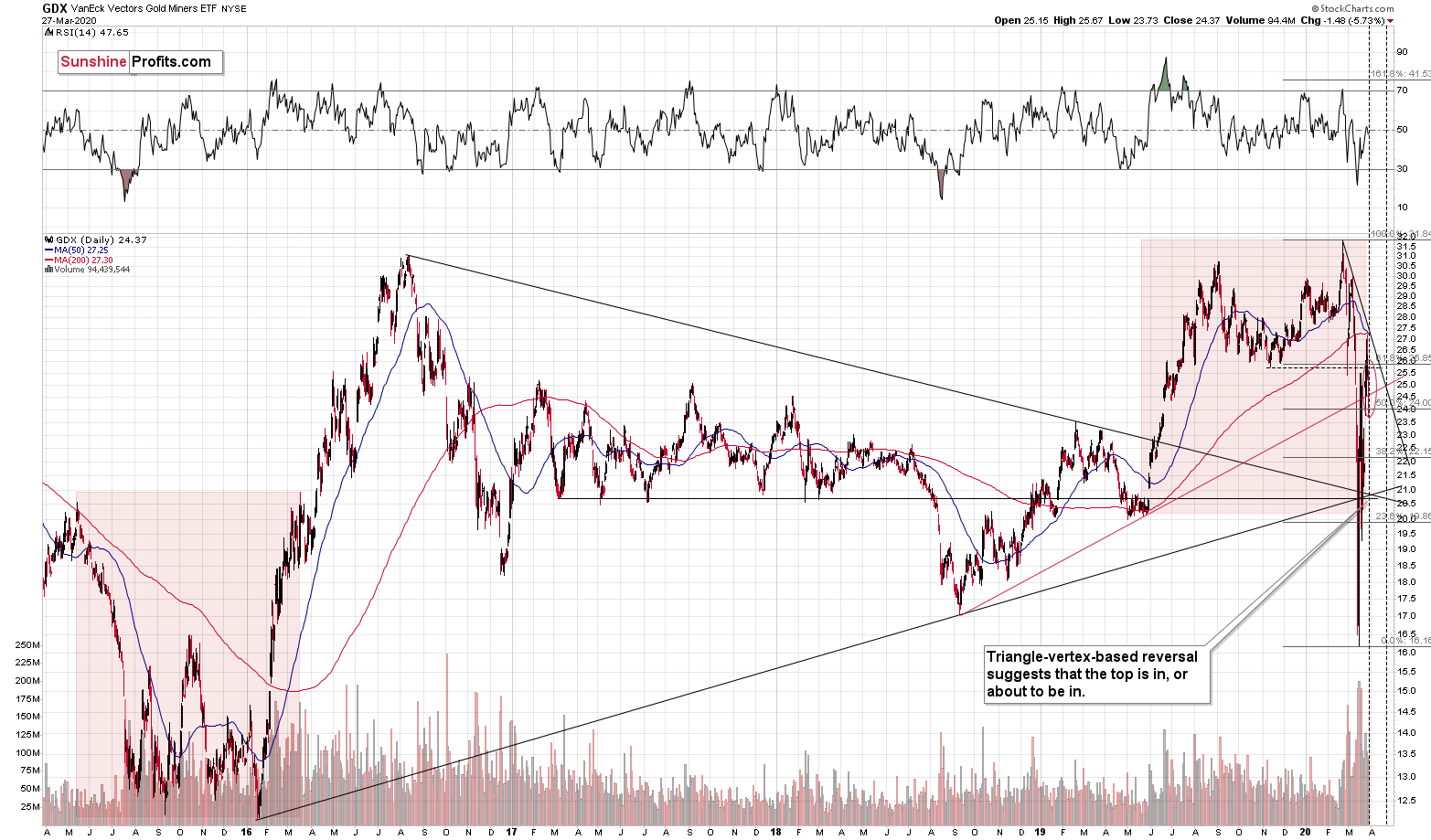

Please keep in mind that after the 2008 bottom in stocks, it took only two days before they formed an intraday top. Given that this time, the price moves are more volatile, it seems that we could (far from certain) see a powerful reversal (top) asearly as tomorrow. This estimate is in perfect tune with the triangle-vertex-based reversal that we see on the GDX and GDXJ charts.

EDIT: Again, that's exactly what happened. The GDX index formed the intraday high on Thursday, one day after we wrote the above. The GDXJ formed the intraday high on Wednesday.

How much clearer could it get that the precious metals market is re-creating its 2008 slide?

Ok, so what does it tell us going forward?

It tells us that the precious metals market is likely going to slide very profoundly, and very quickly. And it might happen as early as this, or the next week.

The final part of the 2008 decline was sharper than the initial part. In fact, counting from the end of the topping formation in gold, it took 7 trading days. Since things are now developing about 4.56 times faster, this provides us with 7 / 4.56 = about 1.5 days.

That's probably shocking, so let's connect the dots once again.

It's 2008 on steroids, and the markets are moving more than 4x faster than they did back then.

In a relatively similar environment, gold plunged quickly, but reversed after a week. During that time, silver plunged, miners plunged, and stock market declined, while the USD Index soared.

As we outlined earlier, soaring USD Index was the likely reason behind gold's huge decline.

This time, the corrective downswing was bigger, but overall the upswing was more volatile. This means that perhaps the rally in the USDX will not be as big as it was in 2008 (at least not initially), but it's likely to take place very fast anyway.

This would be likely to correspond to plunging gold. Gold would be likely to slide really fast, perhaps declining and reaching its bottom in about 2 trading days. This would be unbelievable and totally ridiculous... If the analogy in terms of time, didn't just prove to be spot-on. But it did. And consequently, we have to consider the good possibility that gold could slide for just a few days and... Form THE bottom.

Now, it could be the case that gold still soars today and/or tomorrow and attempts to move to new 2020 highs as the USDX slides to the 61.8% Fibonacci retracement based on its decline, and if that happens, it would create a new point of reference for the above-mentioned time analogy and it would slow everything down. However, the change would be likely to prolong the expected time for the decline by about 2-5 times, which would still mean that the final bottom might be just around the corner. That's why we wrote about the period of 1-2 weeks.

The million-dollar question is, how low could gold go during this decline, and what's the most likely price level at which the buying opportunity will present itself with an excellent risk to reward ratio.

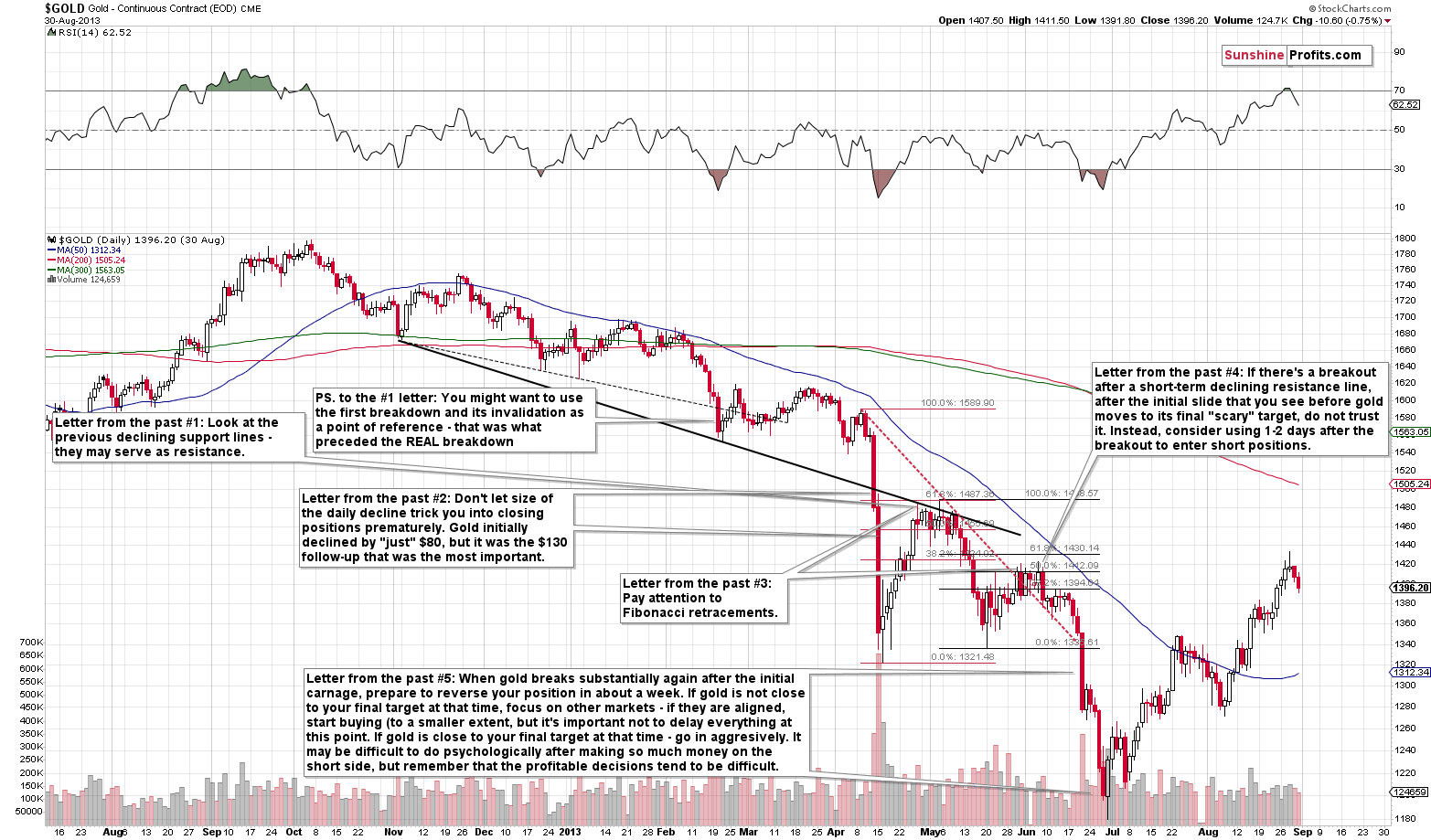

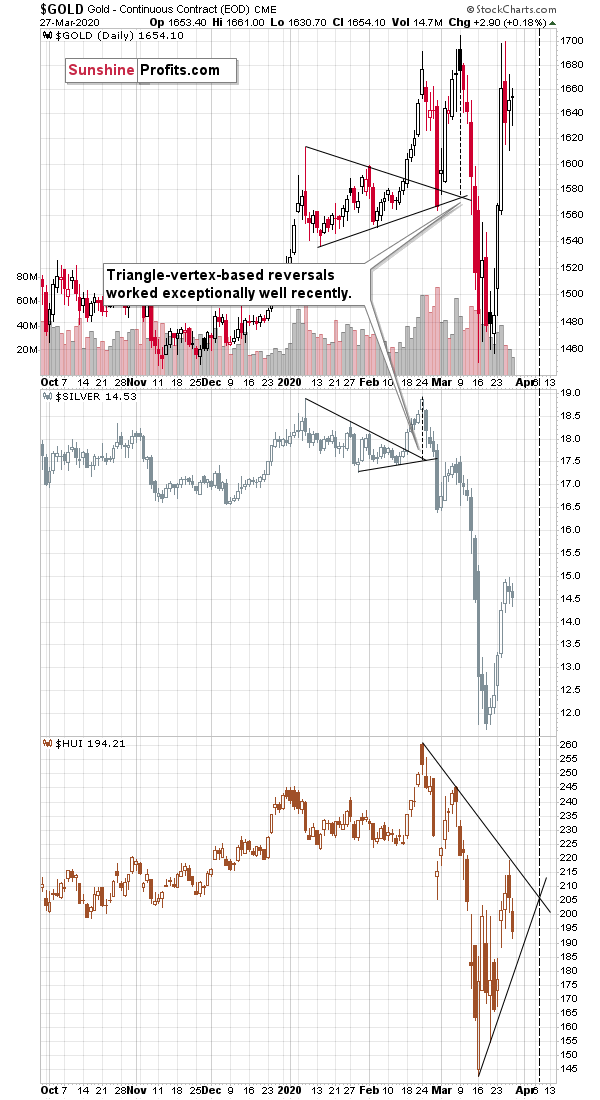

The above chart provides us with some hints. There are five key take-aways from it.

- Gold is likely to decline in a volatile manner, until it breaks below the declining support line that is based on the most recent two lows.

The very important confirmation of the usefulness of this trading technique comes from the 2012-2013 slide.

Over a year ago, we created a chart based on the possible similarity of the final slide in the PMs to the 2012-2013 slide. We wrote comments on it and we called them "Letters" to the future investors. While the situation is not as similar to the 2012-2013 slide, as it is to the 2008 one, this chart seems useful anyway.

The key thing visible above is the slide well below the declining support line that was based on the previous local lows. It's not that important how much gold broke below this line, but that it provided a great temporary buying opportunity just a day after the breakdown.

This is very similar to what we see on the 2008 gold chart.

Now, the 2008 decline was faster (overall) than the 2013 decline, and the current slide is even faster, so it seems that it would not take two trading days to form the bottom after the breakdown, but that it would rather take place on the intraday basis.

- The area marked with red rectangle - the bottom in gold - was characterized by a clear show of strength in gold. Gold reversed and closed the day higher despite a move higher in the USD Index. We will be on a lookout for this kind of confirmation as it might prove extremely important also this time.

- The precious metals market formed its final bottom when stocks formed their local bottom at their previous local low. This might be a useful clue, but it doesn't have to be. It's not as important as the previous point.

- The precious metals market bottomed after the USD Index was already after a sizable rally, but it didn't wait for the USD Index to form its top. The relative strength was the critical sign - waiting for the USDX to reach its target or critical resistance level was not that important. Consequently, the first two points seem most important.

- Silver and mining stocks bottomed along with gold and silver bottomed practically right at is declining support line while miners - just like gold - broke temporarily below it. In case of the miners, the breakdown was not immediately invalidated, though.

The first point iswhat we are going to apply to the current technical picture and we're going to use the remaining ones as confirmations.

Connecting the previous two lows in gold provides us with a very quickly descending line that's going to be between $1,300 and $1,350 this week.

The interpretation is simple. Once gold breaks below this line, it creates a buying opportunity.

However, just in case gold drops heavily below this line (like it did in 2013), it will be better to wait for some kind of confirmation before saying that the bottom is definitely in (or at least most likely in). This could come in the form of silver or miners reaching their target levels, or it could be based on gold's strength relative to the USD Index. Please note that since the price moves are likely to be quicker, we might need to consider intraday strength or weakness of gold relative to the USDX, instead of the one based on the daily price changes.

If gold is to slide below the support line, then the odds are that the rebound would be triggered by some other support. Let's see what kind of strong support levels gold has just below the $1,300 - $1,350 area.

There are three support levels that fulfill the above-mentioned requirement but that are still relatively close to the sharply declining support line:

- The 61.8% Fibonacci retracement based on the 2015 - 2020 rally (at about $1,290)

- The rising medium-term support line based on the 2015 and 2018 lows (currently at about $1,250)

- The 2019 bottom of about $1,270

There's also the support provided by the 2018 lows at about $1,170, which we view as the maximum size of the next short-term decline. As you can see, taking also the $1,170 the discrepancy between the highest and lowest support levels is quite high - that's why bullish confirmations will be so important.

What about silver and it's confirmations?

If the white metal bottoms at its declining support line shortly, it's likely to bottom below $9, likely closer to $8. Sounds familiar? It should, because that's in perfect tune with the analogy to 2008 in terms of medium-term price moves in silver that we've been describing for months.

Silver just plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we told them that silver was likely to slide below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

Also, if you didn't profit on the recent decline in silver, don't despair - this decline seems to be far from over and there will be plenty of room for profits, especially that silver seems to be starting a corrective upswing now. Just like it did in the 2008. Back then, it corrected to about $14 before moving lower and this might be a realistic target also this time. This would serve as a verification of the breakdown below the 2015 low, and it would open the way for even lower silver prices.

Silver moved above its 2015 bottom, but it didn't change much in terms of the above-mentioned analogy. It moved a bit higher than it did in 2008, nothing more. It moved up, just like gold and the general stock market did, but it didn't really magnify their gains in a way that would indicate true strength.

In 2008, silver bottomed at $8.40, but... It started the entire decline from higher levels, so if the price moves are to remain similar in terms of their sizes, we should expect silver below $8.40 at its final bottom. The fact that the most recent bottom formed a bit below its counterpart - the interim 2008 low confirms the above.

Back in 2008, the final top from which silver declined below $9 was $19.55. This year, it was $18.92. As the starting point was $0.63 lower this time, perhaps the bottom would also be $0.63 lower.

This would provide us with $7.77 as the final downside target for the white metal. And this level is almost right in the middle of our target area on silver's short-term chart, at the sharply declining support line.

If we were shorting silver right now, we would place our binding profit-take level at $8.58, just in case the white metal reverses sooner. We would also consider buying heavily once silver falls below $8. Please note that the only reason we are not shorting silver right now is that we think that the shorting opportunity is even greater in case of mining stocks.

Having said that, let's consider the situation in mining stocks. In this case, our Friday's comments are the most up-to-date analysis that we have already written, so we'll base the following several paragraphs on it, while expanding and updating the analysis where necessary.

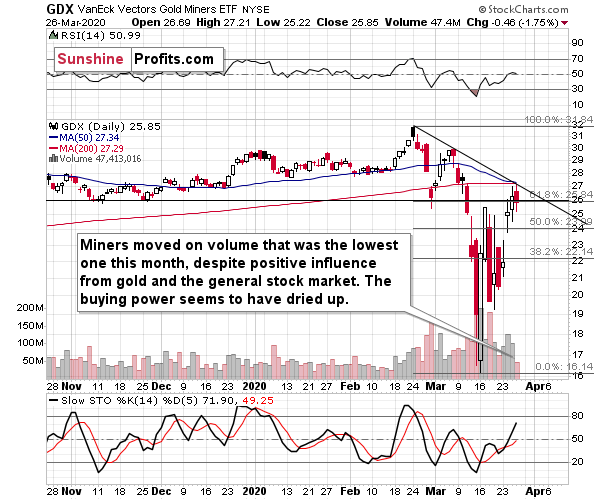

Before moving to targets for the miners, let's check the bearish confirmation that we saw after the markets closed on Thursday.

The confirmation came from the volume level. It was the lowest value that we saw since late February. The GDX ETF declined yesterday, which could mean that people were reluctant to sell, and it could be viewed as something bullish. However, context is critical in order to correctly see what really happened.

And the context is that yesterday, the general stock market, and gold were moving higher. Most importantly, the related ETFs (SPY and GLD) were moving higher. That's important, because we want to have an apple-to-apple comparison, which in this case means that we want to have the same exchange and - most importantly - the same session closing times.

Miners had a very good reason to rally, especially that they have been multiplying stock market gains recently. And what happened? Practically nothing. They moved a bit lower on low volume. This means that the buying power simply dried up. All those, who were inclined to get back into miners, have already done so and there were very few people left to buy.

This, combined with the overall fear and the level of volatility, has profound implications. It means once things start moving south once again, those who bought recently will probably get easily spooked and there will be nobody else to take over the baton and buy from them. This means a volatile price drop. And that price drop will indicate to others - who haven't sold their miners previously - that "hey, this is for real, it was not just a temporary bad dream". And about a second after thinking the above, people will want to sell, securing whatever price they can still get. With falling gold, and falling stock market, miners are likely to be severely hit.

The important detail is that due to the above-mentioned psychological mechanism, more people are likely to sell now than had sold in the first half of the month.

This means that the March low is not likely to stop the next wave down. Perhaps only very briefly, but the upswing might be too short-lived to be tradable.

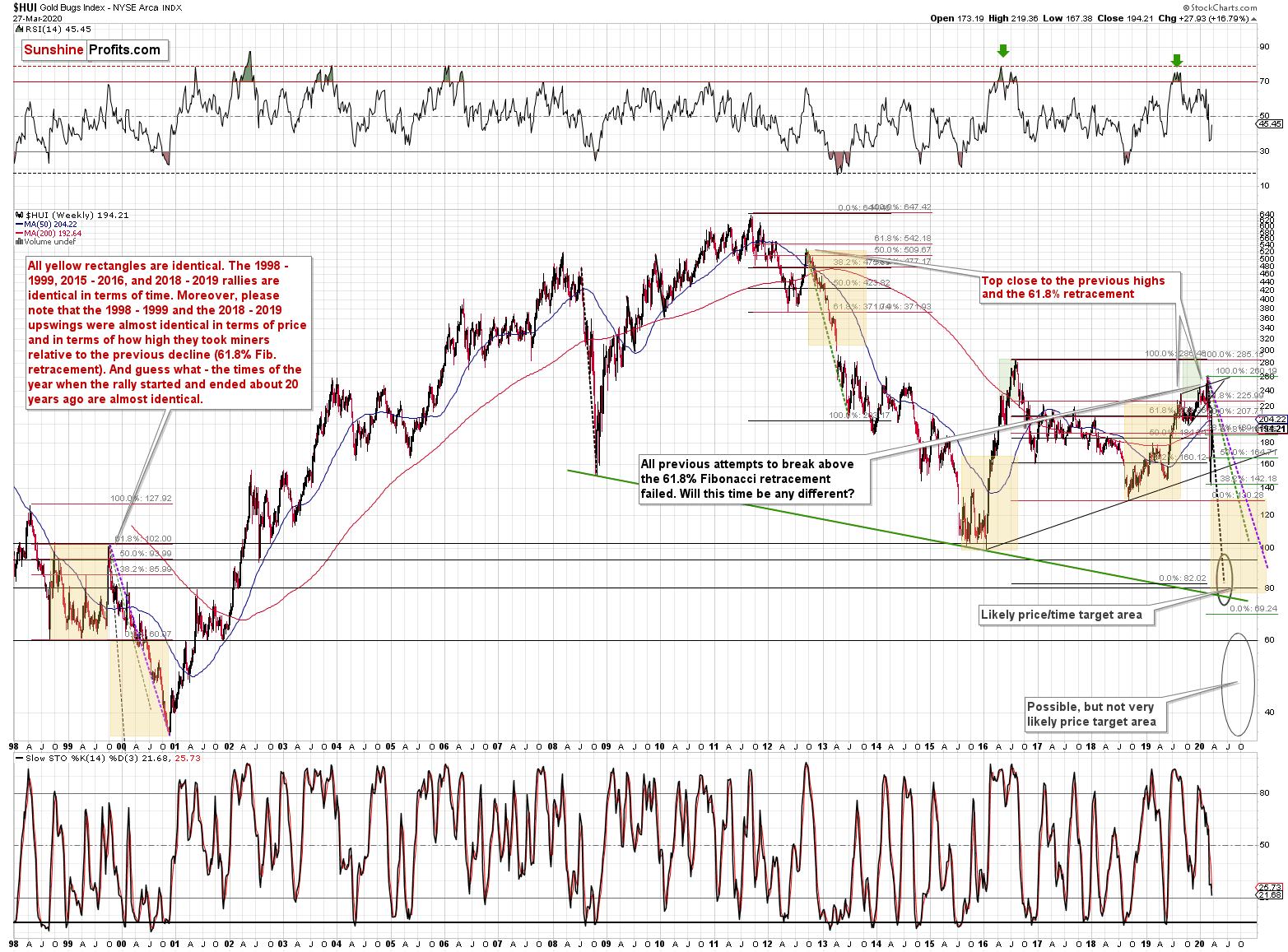

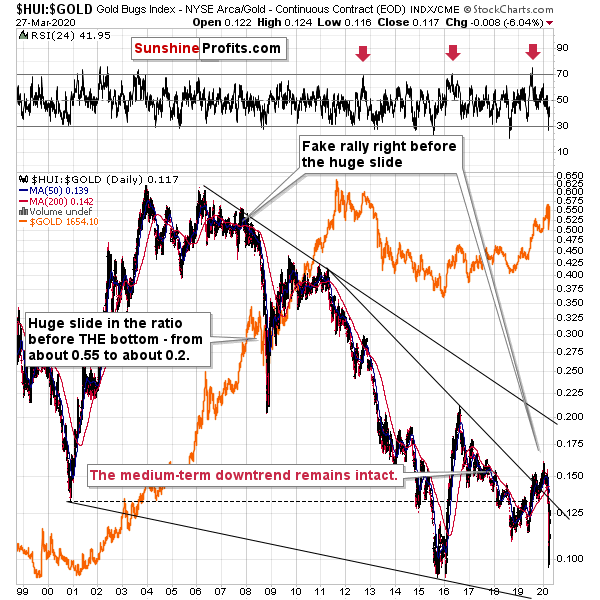

The long-term HUI Index chart shows that there's the 2018 low that could stop the decline, but... It was already broken in case of the GDX, and GDXJ. Consequently, miners are likely to drop more than to just these levels. The next support is provided by the 2015 / 2016 lows, and there's also the long-term declining support line that's currently at about 80 in case of the HUI Index.

What about the GDX?

Based on three types of Fibonacci extensions, we created a target area that's approximately between $10 and $12.50. Yes, this is really our expectation for this slide. We expect the slide to be enormous and it might appear unbelievable. But the early-March decline was also unbelievable, right? And yet, it happened.

Also, zooming in (to 4-hour candlesticks) allows us to see where the very sharply declining support line is at this time. And more importantly - when it will be in a week or so.

Very close to $10. That's the lowest that we think GDX could slide in the next 2 weeks or so (actually, 1 week is even more likely).

Why would the decline take so little? Two reasons:

- The most recent slide was very sharp, and as we wrote above, the upcoming slide is likely to be even worse.

- As we explained on Wednesday, things are now developing about 4.56 times faster than they did in 2008. This means that what took place in terms of weeks back then, is now likely to take place in terms of days. After the analogous correction, gold miners declined for 24 trading days. 24 / 4.56 = 5.26 trading days. Miners are declining in today's pre-market trading, so it seems that they have topped either yesterday (intraday), or on Wednesday (in terms of closing prices). This means that miners could form their next local bottom in about a week (on Thursday or Friday).

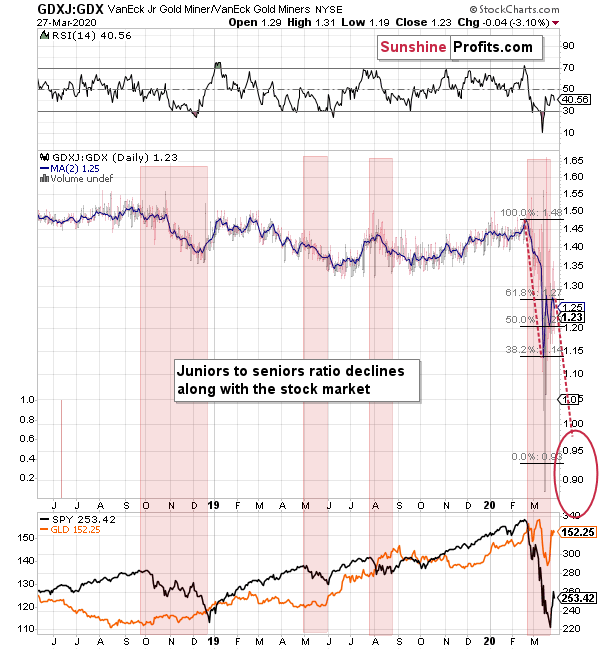

If GDX could bottom at about $10 - $12.50, then how low could the GDXJ drop? As surprising as it may seem... We expect GDXJ to decline below GDX in absolute terms. Here's why.

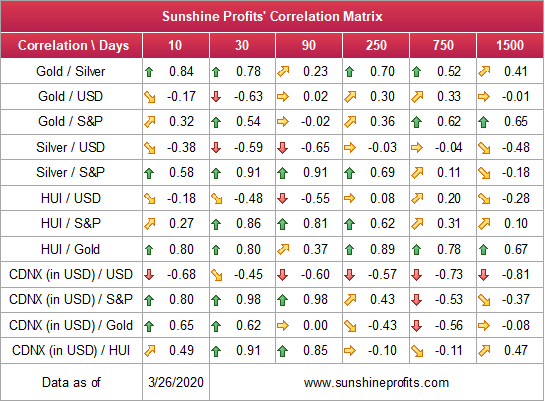

The ratio between GDXJ and GDX is moving relatively in tune with the general stock market. We've been describing that for many years (not very frequently, though) that juniors are more dependent on the general stock market than any other part of the precious metals sector. The areas that we marked with red prove it.

Here's another proof.

Please focus on the third row from the bottom. It shows the correlation between the TSE Venture Index (another proxy for the junior mining stocks) and the S&P 500 Index. The two highest values of correlation from the entire table are the ones between juniors and the general stock market. It's 0.98. The closer a given number is to 1, the stronger the link becomes. 0.98 is an extremely strong correlation (it's even stronger than the link between gold and silver, and the one between gold and gold miners!) and that's how correlated juniors really are with stocks, when taking into account the past 30 and 90 trading days. These are exactly the periods that we're interested in, given the likely short-term nature of the following decline.

So, since the general stock market is likely to slide further, the junior mining stocks are likely to slide really low, also relative to senior mining stocks.

This means a visible drop in the GDXJ to GDX ratio. Based on the technical principles, we applied to the ratio, it seems that it would decline at least below 1. Based on the ratio alone, the move to 0.93 appears more probable, and based on how far the general stock market could slide, it might not even be the final low.

With $10 - $12.50 as the target for GDX, and the target for the ratio at 0.93 - 1, the target area for the GDXJ is $9.30 - $12.50.

What we already wrote about gold and silver suggests that the above target area for the GDX ETF might be correct or it might be even too high. After all, it's based on the declining support line, and back in 2008, miners first declined below this line, and then kept on moving lower. In 2008, miners bottomed only once gold moved below its own declining support line.

Still, this time, the initial slide in the miners was huge and sharp, which suggests that perhaps this time the mining stocks won't move below the declining support line, but rather bottom at it.

This is where the analysis of the key mining-stock ratio might be particularly valuable.

The gold stocks to gold ratio declined substantially recently, and it did so after invalidating the breakout above the declining resistance line, just like what we described as the likely outcome months ago.

While being quite big, this decline is still relatively small compared to how huge it was in 2008. Since it's 2008 on steroids, the decline that we see this time, could be even bigger, but let's assume that it will be "just" similar.

Back then, the ratio declined from about 0.55 to about 0.2. This means that its value declined by about 63.6%. Applying the same size of the decline to the most recent high (at about 0.16) provides us with 0.058 at the next target.

With gold at $1,170 - $1,300, the above ratio would translate into 68 - 75 target area for the HUI Index. In other words, the HUI Index would be likely to slide to the declining green support line that's based on the 2008 and 2015 lows. This means that the value of the HUI Index would be more than cut in half. Approximately, 61% - 65% lower.

The GDX ETF just closed at $24.37. By decreasing this price by 61% - 65%, we would get $8.53 - $9.50 as the next target area. This more or less fits the previous estimates.

Speaking of GDX's relative valuations, let's also consider something else.

(it's the same chart that you've seen above, but seems more convenient to copy it also here)

Back in 2008, the GDX ETF formed the very first top a bit above $50, and the second top, a bit below $50. It then bottomed at about $15 - a bit less than a third of the average of these highs.

The most recent two highs for the GDX ETF were $31.84 (Feb 24) and $29.96. Rounding it conservatively, we get $30 as the starting point. The third of this value is $10, and to repeat its 2008 performance, GDX would have to slide a bit below it.

This perfectly fits the previous techniques, and provides us with $10 as the next target for the GDX ETF. This means that $9.2 for the GDXJ ETF might very well be in the cards.

Will the above-mentioned scenario get help from soaring USD Index? This seems quite likely.

More on the USD Index and Gold

The USD Index was previously (for the entire 2019 as well as parts of 2018 and 2020) moving up in a rising trend channel (all medium-term highs were higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel was actually a running correction, which was the most bullish type of correction out there.

If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

We previously wrote that the recent temporary breakdown below the rising blue support line was invalidated, and that it was a technical sign that a medium-term bottom was already in.

The USD Index soared, proving that invalidation of a breakdown was indeed an extremely strong bullish sign.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

In fact, given this month's powerful run-up, it seems that nobody will doubt the possibility of the USD Index soaring much higher. Based on how things are developing right now, it seems that the USD Index might even exceed the 117 level, and go to 120, or even higher levels. The 120 level would be an extremely strong resistance, though.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

On a short-term note, it seems that the USD Index has just completed its correction or that it's about to form its next short-term bottom shortly - perhaps even later today.

At the moment of writing these words, the USD Index is at its immediate-term declining resistance line, and after forming a bottom a bit above its 61.8% Fibonacci retracement. Since it already broke below the 50% retracement, it seems quite likely that it would move to the 61.8% retracement before bottoming. This means that gold could still rally today, but this move - just as USD's decline - would likely be short-lived.

If the USD Index just repeated its March rally, starting from the 61.8% retracement, it would provide us with 107 - 108 as the next target. We would view it as the minimum target for the next upswing. That's more or less where the USD Index topped for a few months in 2002, so this level could provide strong resistance also this time.

Let's keep in mind that we are not waiting for the USD Index to form a top, but rather for the PMs to slide in a volatile manner and for gold to show strength relative to the USD Index. This could happen with the USDX below or above the 107-108 area. Still, knowing that the USDX is likely headed there, gives one a good overview of the situation.

There are two ratios that we would like to feature today before summarizing.

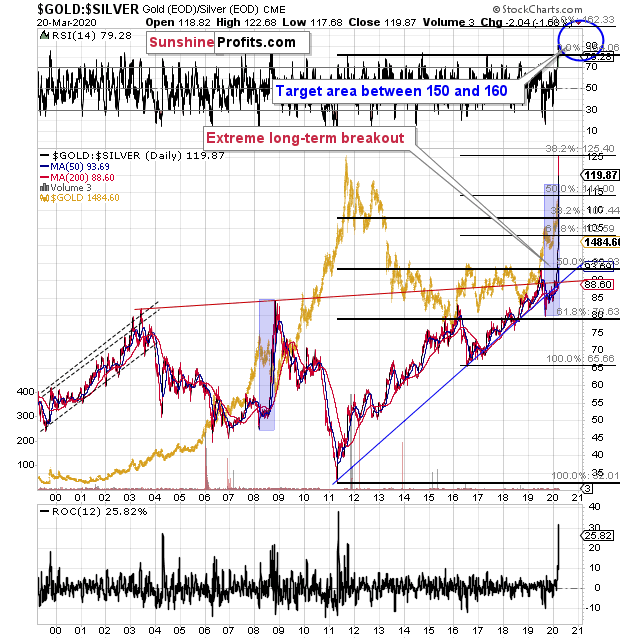

The first one is the gold to silver ratio.

Remember the time, when the gold to silver ratio moved to 80 and practically everyone (well, we didn't) told you to buy silver? We told you that the real long-term resistance was at the 100 level, and that should the gold to silver ratio break above the previous highs, it was likely to shoot up. That's exactly what happened.

Three weeks ago we wrote about the move to the 100 level in the following way:

We've been writing the above for weeks, despite numerous calls for a lower gold to silver ratio. And our target of 100 was just hit today. It was only hit on an intraday basis, not in terms of the daily closing prices, but it's still notable.

We had been expecting the gold to silver ratio to hit this extreme close or at the very bottom and the end of the medium-term decline in the precious metals sector - similarly to what happened in 2008. Obviously, that's not what happened.

Instead, the ratio moved to 100 in the situation where gold rallied, likely based on its safe-haven status, and silver plunged based on its industrial uses.

Despite numerous similarities to 2008, the ratio didn't rally as much as it did back then. If the decline in the PMs is just starting - and that does appear to be the case - then the very strong long-term resistance of 100 might not be able to trigger a rebound.

It might also be the case that for some time gold declines faster than silver, which would make the ratio move back down from the 100 level. The 100 level could then be re-tested at the final bottom.

Or... which seems more realistic, silver and mining stocks could slide to the level that we originally expected them to while gold ultimately bottoms higher than at $890. Perhaps even higher than $1,000. With gold at $1,100 or so, and silver at about $9, the gold to silver ratio would be a bit over 120.

If the rally in the gold to silver ratio is similar to the one that we saw in 2008, the 118 level or so could really be in the cards. This means that the combination of the above-mentioned price levels would not be out of the question.

At this time it's too early to say what combination of price levels will be seen at the final bottom, but we can say that the way gold reacted recently and how it relates to everything else in the world, makes gold likely to decline in the following months. Silver is likely to fall as well and its unlikely that a local top in the gold to silver ratio will prevent further declines.

Indeed, gold to silver ratio didn't stop the decline and it's unlikely to stop it anytime soon. The reason is that the ratio decisively broke above the 100 level, and then it soared above it even more. At the moment of writing these words, the gold to silver ratio is trading at about 118.5.

Breakout above the resistance level as extremely important, is very likely to be followed by at least a pullback. At the moment of writing these words, the ratio is trading at about 115, which means that it did correct some of the previous rally, but it was not even close to invalidating the previous breakout. The latter is confirmed.

As far as the medium-term upside target for the ratio is concerned, we view the 150 - 160 level as likely. Yes, crazy, we know. Remember these are crazy times, though.

We created this target area based on the Fibonacci extension technique that we applied to the previous upswings. It's based on doubling the 2011 - 2019 upswing, and by multiplying the 2016 - 2020 (so far - taking the recent high into account) by a factor of 1.618.

Please note that with gold at $890 and silver at $5 - $6, the ratio would be between 148 and 178. Yes, we know, it sounds crazy...

Gold at $1,300 and silver at $9 would imply the gold to silver ratio at 144 - very close to the above-mentioned target area.

Gold at $1,280 and silver at $7.77 would imply the gold to silver ratio at about 165. Still fits the above target area.

The reason we featured the gold and silver ratio today is to show you two things:

- The breakout in the ratio was not invalidated, so the previous trends (lower in the PMs) are likely to continue

- Our extreme target prices are not so crazy after all (assuming that confirmation of another crazy target in crazy times is a valuable tool... But it likely is).

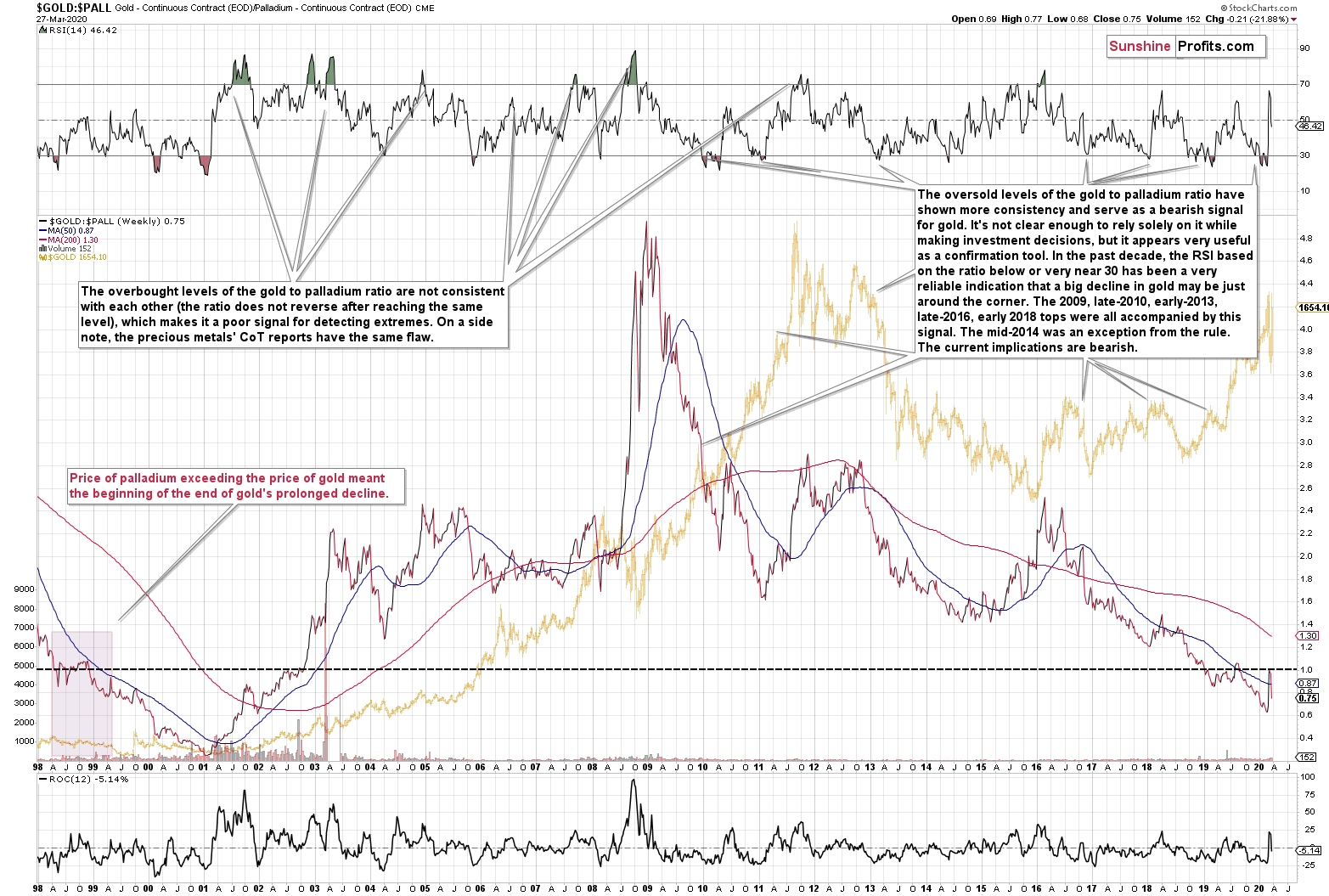

The second ratio that we would like to feature is the one between gold and palladium.

There was only one situation when palladium became more expensive than gold and the gold to palladium ratio fell below 1. Once that happened, the ratio then corrected for a few months and then declined to new lows. The same thing happened in the past months. The previous time when we saw that was... early 1999.

The oversold status of the ratio - with RSI below 30 - suggests weakness in gold in the medium term. We marked similar cases on the above chart. And yes - the late-2012 top was also confirmed by this indication.

Please note that in the first half of 1999, there was a sudden spike in the ratio when it moved back to approximately 1. So far, this move seems normal and it doesn't invalidate the above-mentioned bearish analogy.

And even if it is invalidated, it will likely be due to the global economic slowdown or expectation thereof, courtesy of the Covid-19 threat. Consequently, other bearish points would come into effect anyway.

The ratio moved back to 1 and then it declined once again. The same thing happened in 1999 and it was the final stop for gold before the final decline to THE bottom.

The "When" Aspect

When is all this likely to take place? Based on the analogy to 2008 - soon, likely very soon. Based on this analogy's details that we have right now, it seems that THE final bottom in the precious metals market could take place as early as this or the next week.

Let's take a look at the indications from the nearby triangle-vertex-based reversal dates. After all, this technique worked exceptionally well in the previous months and (in particular) weeks.

In case of the long-term GDX ETF chart, we have one reversal that is scheduled right about now (perhaps miners will re-test their highs if gold rallies along with a quick dip in the USDX).

Additionally, we have one in the third week of April. This might be an important reversal date, but given the current volatility, it might be already after THE bottom.

Zooming in, and changing the proxy,

We get a target that's a week and a day away.

April 7th, 2020- this could be THE date that you should be paying attention to.

Then again, this date is based on just one technique, and while it is approximately confirmed by other techniques applied today, especially everything based on the 2008-2020 similarity, it might or might not be very precise.

Overall, it seems that the next major reversal will take place during this or in the next week, relatively close to April 7th. This might even be THE bottom for the precious metals sector.

Summary

Summing up, while it might be the case that gold will attempt to break above the recent highs today and tomorrow, it seems that the true tops in gold, silver, and mining stocks are already in. Any moves above the very recent highs should be viewed as temporary. In fact, they might be viewed as a good opportunity for entering or adding to one's positions aimed at profiting from lower precious metals values.

The next slide lower could be very sharp and very deep.

Overall, it seems that the next major reversal will take place during this or in the next week, relatively close to April 7th. This might even be THE bottom for the precious metals sector.

This rally might have made one feel bullish - after all, the prices of miners seem to have recovered to a large extent. Please be sure to keep in mind that what we saw, was the first big wave down of a much bigger move lower, also in the stock market. The coronavirus stock-market decline has likely just begun and once it continues - and as the rally in the USD Index resumes - the precious metals market is likely to suffer. Silver and miners are likely to be hit particularly hard.

The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. It might peak when the death toll is in tens of thousands per day. We hate to be right on this prediction, but we expect the number of the total confirmed cases in the US to be multiple times greater than the analogous number in China. At the moment of writing these words, the number of total confirmed cases in the US is about 143k - first in the world.

It's 2008 on steroids.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

On a trading note, we initially wanted to adjust the profit-take levels for the leveraged ETNs: DUST and JDST, because the leverage on them was is going to be decreased from 3x to 2x effective April 1. Direxion initially wanted to make this change on May 17, but they accelerated this date to April 1st. The effective date is March 31st after the markets close, which effectively means that it comes into effect on April 1st.

We initially wanted to do it, but we are not doing so.

We are adjusting the profit-take levels for GDX and GDXJ based on more bearish target prices, but we are not adjusting the profit-take levels for DUST and JDST. The change in the profit targets for the GDX and GDXJ, and the likelihood that the decline will take place until April 7th has approximately offset the decline in the leverage. The important detail here is that we didn't realize that until writing everything else in today's analysis, so it was absolutely NOT the case that we "fitted" the targets for GDX and GDXJ so that we wouldn't have to change the targets for DUST or JDST, even though it might appear to be the case.

Finally, we would like to remind you about today's very important and very timely April Gold Market Overview report, which we have just posted. For the next few days, it's available for just $1 (subscriptions - including this one - renew normally unless cancelled), so we strongly encourage you to read it, even if you previously didn't have access to these reports. Naturally, the All-inclusive subscribers have already received the notification about it yesterday, as soon as it was posted.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks (but not in gold nor silver) are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $11.97; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $16.27; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager