Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. We are moving the profit-take levels lower, and we are increasing the size of the position.

In the summary of last Friday's Gold & Silver Trading Alert, we wrote the following:

This rally might make one feel bullish - after all, the prices of miners are likely to soar soon. Please be sure to keep in mind that what we saw was the first big wave down of a much bigger move lower, also in the stock market. The coronavirus stock-market decline has likely just begun and once it continues - and as the rally in the USD Index resumes - the precious metals market is likely to be hit. Silver and miners are likely to be hit particularly hard.

The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. We hate to be right on this prediction, but we expect the number of the total confirmed cases in the US to be greater than the analogous number in China. At the moment of writing these words, the number of total confirmed cases in the US is 14,250, which is sixth in the world, just behind Germany (15,320 cases).

A week later, we see that indeed the total number of confirmed cases in the US is greater (86k) than the analogous number in China (82k). The death toll is not yet the biggest worldwide, but it's only a matter of time. Either slowly, or suddenly, the investors will start to realize that the stimulus money is not going to keep the economy running. The people are necessary for everything to work (both figuratively, and literally). And people will be quarantined, or self-quarantined in fear for their lives due to Covid-19 pandemic.

But we already elaborated on this in this week's flagship Gold & Silver Trading Alert, so we don't want to go into details once again today. We have very interesting technical things to tell you instead. Still, if you just joined our service and / or you haven't had the opportunity to read this week's flagship analysis, we strongly suggest that you do so today. You might also wait until Monday, as that's when we're going to update it.

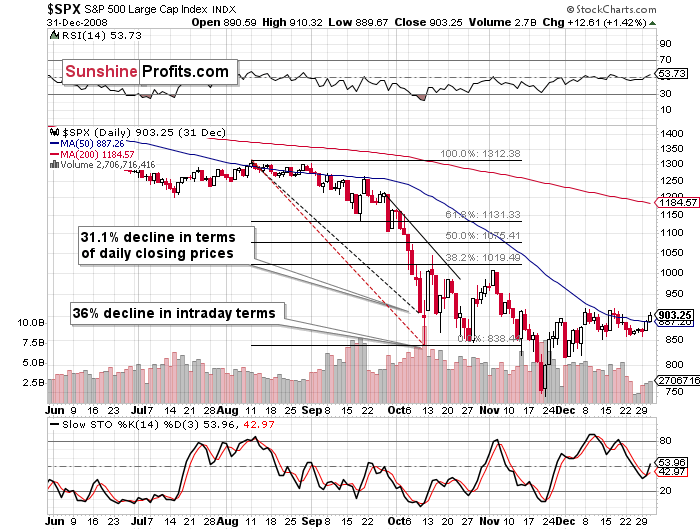

Decline to the 2008 lows in the general stock market is not out of the question. Yes, really.

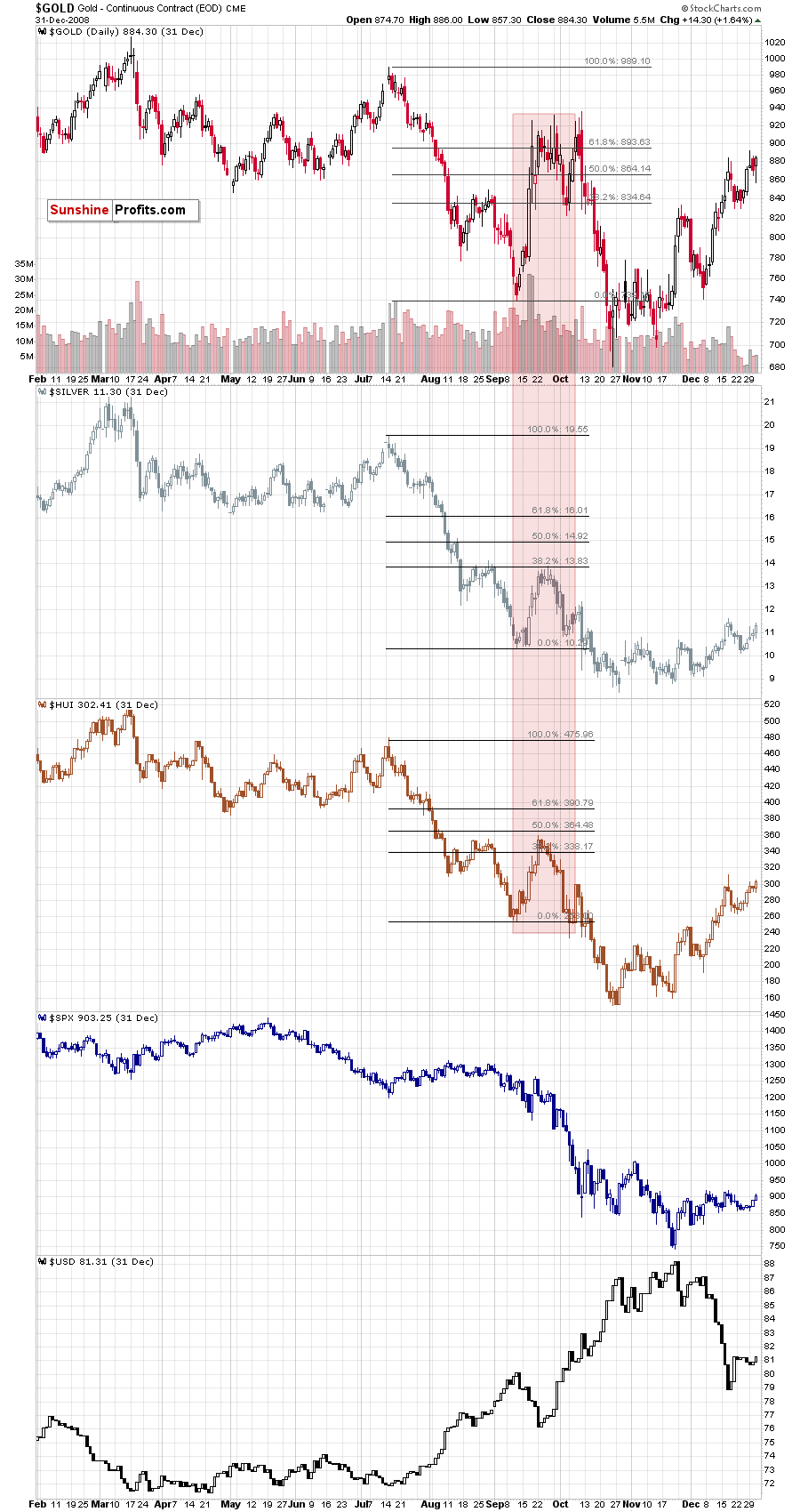

In Wednesday's analysis, we described the very specific time link with 2008 in case of gold, silver and mining stocks. Based on it, we explained why the mining stocks are likely to top on that day (and they did - in terms of the daily closing prices), why silver is unlikely to rally significantly as it was already in its topping zone (indeed, silver seems to have topped on Wednesday in terms of the daily closing prices), and we also let you know that it will likely take longer before gold tops. We wrote that gold would be likely to form its final top either on Thursday or today.

About Those Tops

The above was based on how prices moved in 2008 and how similar these moves were to what we saw recently (their shape and the intermarket relations that accompanied them).

Some of you may remember what was the general "feel" in the second part of September and in early October of 2008. It was that the worst is over, gold held it's purchasing power quite well, and that in general, it was all a bad dream. Gold seemed ready to resume its bull market and the same seemed likely for silver and miners. Neither silver, nor mining stocks moved as high as gold, but people were not paying attention to that.

What happened next? Blood-bath for the bulls.

So, did gold top yesterday, or not?

It's not perfectly clear, but the odds are that it has indeed topped.

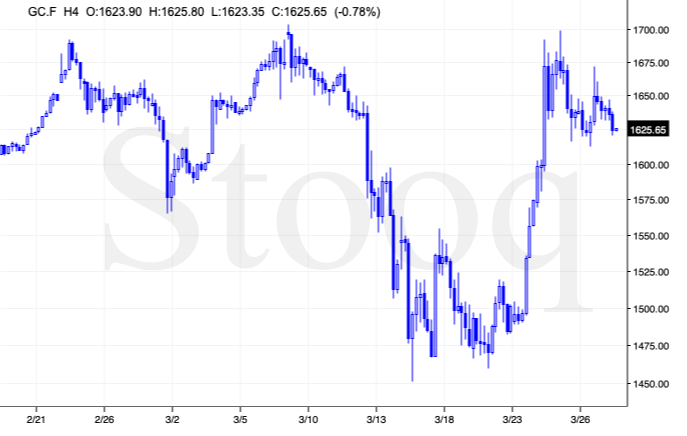

Two distinct tops, then a decline and then another quick rally - that failed. Then a move lower back to the most recent lows and a quick consolidation.

That's exactly what preceded the 2008 slide, so the odds are that we are looking at the beginning of another slide also this time.

Gold didn't manage to move to or above the previous highs during the most recent intraday run-up, which is not what happened in 2008, but overall, we think that the similarity in terms of shape of the moves is more important than the price level that was reached.

Besides, gold failed to rally despite a move lower in the USD Index, which showed that the buying power for the yellow metal is probably drying up for now. This is an important bearish confirmation for gold and the rest of the precious metals sector.

Meanwhile in the USDX and S&P 500

Speaking of the USD Index, in yesterday's analysis, we wrote the following:

The USD Index just broke below its 38.2% Fibonacci retracement level, which means that it's now likely to head toward the 50% retracement. This approximately corresponds to the March 18 low. It seems that the USDX could bottom at this retracement while gold tests its yearly highs.

We can't rule out a situation in which the USDX declines all the way down to the 61.8% Fibonacci retracement level at about 98, but this level seems less likely to stop the decline than the 50% level - the latter is more in tune with how the situation developed in 2008.

Indeed, the USDX corrected half of its previous powerful upswing and started to move back up.

And the stock market?

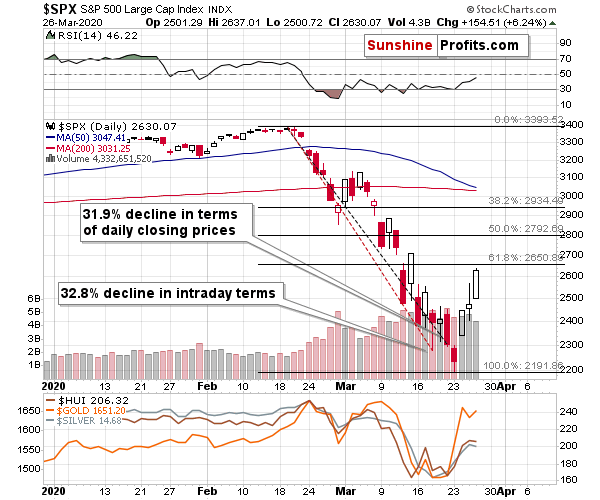

The S&P 500 futures are moving lower in today's pre-market trading (having declined about 3% at the moment of writing these words) after having moved very close to the 38.2% Fibonacci retracement level, which we previously described as our upside target for this counter-trend rally.

Back in 2008, we saw another corrective upswing after stocks moved to their most recent lows, which could also take place sometime next week, but we wouldn't bet the farm on this rebound. The Covid-19 death toll is going to start to climb at an accelerated pace and it won't stop its pace of rise just because stocks move to their previous lows. The Fed and Trump might come up with another rescue plan, but it seems they already did most (almost anything?) of what they could do. The only thing better would be to go back in time and order a near-total lockdown a few weeks ago, but this option is unavailable.

All in all, it seems that the price moves that we had been predicting previously, have all taken place and the downtrend in stocks and PMs is now likely to continue, while the USD Index moves higher.

With declining stock market and declining gold, mining stocks are likely to move considerably lower today. In fact, if the general stock market continues to decline, miners would be likely to decline (or at least not rally visibly) even if gold would still manage to soar to $1,700 later today.

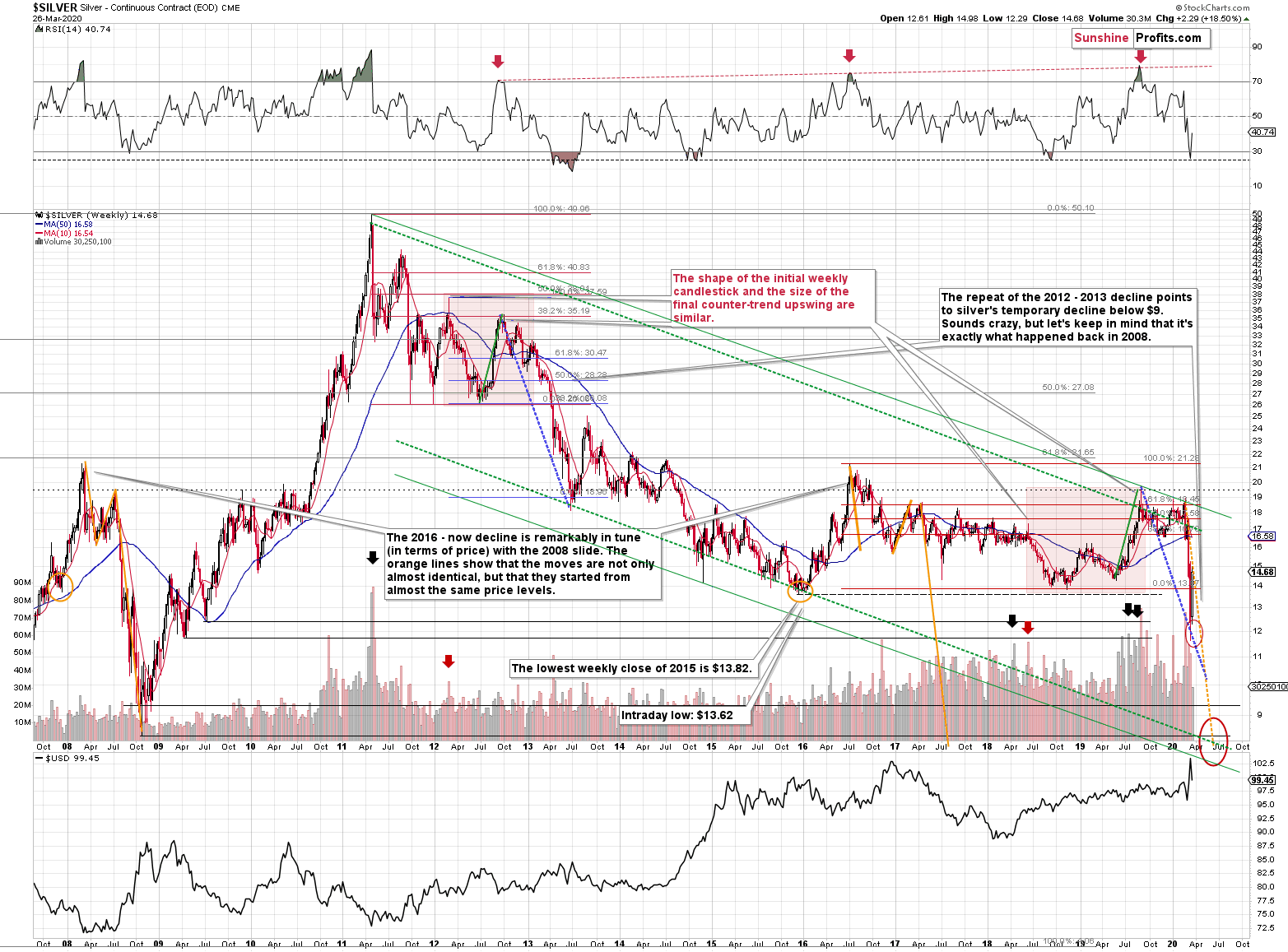

As far as gold is concerned, making price predictions right now is very difficult due to its safe-haven nature, which might come into play. However, in case of silver, it's relatively straightforward, because the white metal has been declining (and rallying back up) in a manner that's very similar to what happened in 2008. In fact, we've been writing about it for months. People were laughing at our prediction of silver below $10, but now, after silver broke below the 2015 lows and proved that this was not the final bottom, nobody is laughing anymore.

Back to PMs

The next silver target is relatively clear - it's at the 2008 low, slightly below $9. Actually, this target is so clear, that we're going to use it as a confirmation for exiting our short positions in the mining stocks.

By the way, you might be wondering, why are we not shorting silver, but mining stocks. The reason is that miners simply declined even more recently, and are likely to decline more also during this slide lower. However, if one prefers to trade silver instead of miners, then the white metal also provides an excellent shorting opportunity right now. Silver futures are trading at about $14.52 at the moment of writing these words.

Before moving to targets for the miners, let's check the bearish confirmation that we saw after the markets closed yesterday.

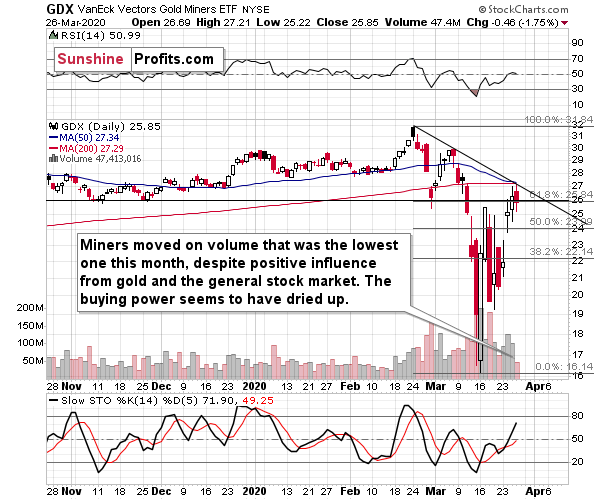

The confirmation came from the volume level. It was the lowest value that we saw since late February. The GDX ETF declined yesterday, which could mean that people were reluctant to sell, and it could be viewed as something bullish. However, context is critical in order to correctly see what really happened.

And the context is that yesterday, the general stock market, and gold were moving higher. Most importantly, the related ETFs (SPY and GLD) were moving higher. That's important, because we want to have an apple-to-apple comparison, which in this case means that we want to have the same exchange and - most importantly - the same session closing times.

Miners had a very good reason to rally, especially that they have been multiplying stock market gains recently. And what happened? Practically nothing. They moved a bit lower on low volume. This means that the buying power simply dried up. All those, who were inclined to get back into miners, have already done so and there were very few people left to buy.

This, combined with the overall fear and the level of volatility, has profound implications. It means once things start moving south once again, those who bought recently will probably get easily spooked and there will be nobody else to take over the baton and buy from them. This means a volatile price drop. And that price drop will indicate to others - who haven't sold their miners previously - that "hey, this is for real, it was not just a temporary bad dream". And about a second after thinking the above, people will want to sell, securing whatever price they can still get. With falling gold, and falling stock market, miners are likely to be severely hit.

The important detail is that due to the above-mentioned psychological mechanism, more people are likely to sell now than had sold in the first half of the month.

This means that the March low is not likely to stop the next wave down. Perhaps only very briefly, but the upswing might be too short-lived to be tradable.

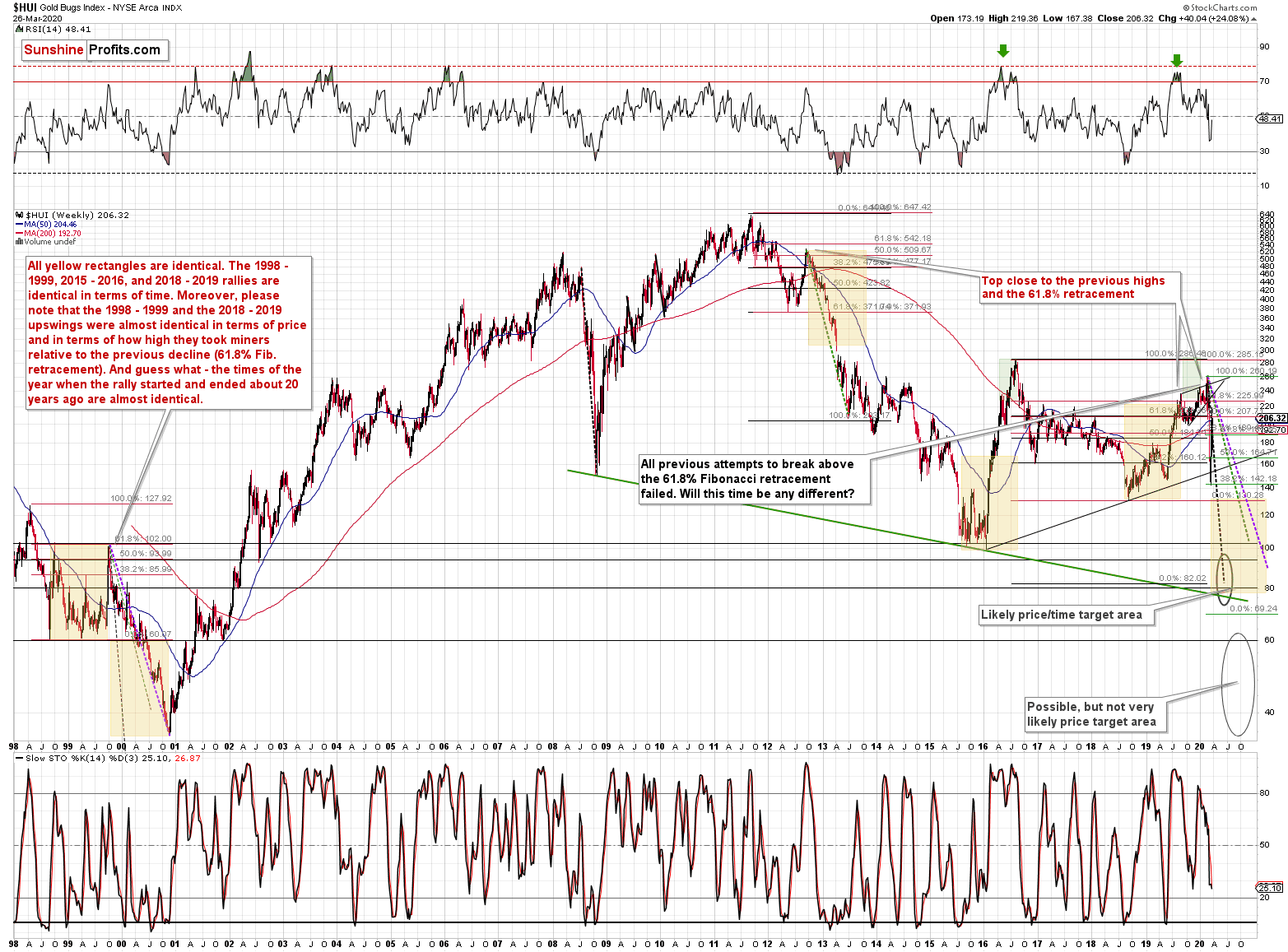

The long-term HUI Index chart shows that there's the 2018 low that could stop the decline, but... It was already broken in case of the GDX, and GDXJ. Consequently, miners are likely to drop more than to just these levels. The next support is provided by the 2015 / 2016 lows, and there's also the long-term declining support line that's currently at about 80 in case of the HUI Index.

What about the GDX?

Focus on the GDX ETF

Based on three types of Fibonacci extensions, we created a target area that's approximately between $10 and $12.50. Yes, this is really our expectation for this slide. We expect the slide to be enormous and it might appear unbelievable. But the early-March decline was also unbelievable, right? And yet, it happened.

Also, zooming in (to 4-hour candlesticks) allows us to see where the very sharply declining support line is at this time. And more importantly - when it will be in a week or so.

Very close to $10. That's the lowest that we think GDX could slide in the next 2 weeks or so (actually, 1 week is even more likely).

Why would the decline take so little? Two reasons:

- The most recent slide was very sharp, and as we wrote above, the upcoming slide is likely to be even worse.

- As we explained on Wednesday, things are now developing about 4.56 times faster than they did in 2008. This means that what took place in terms of weeks back then, is now likely to take place in terms of days. After the analogous correction, gold miners declined for 24 trading days. 24 / 4.56 = 5.26 trading days. Miners are declining in today's pre-market trading, so it seems that they have topped either yesterday (intraday), or on Wednesday (in terms of closing prices). This means that miners could form their next local bottom in about a week (on Thursday or Friday).

If GDX could bottom at about $10 - $12.50, then how low could the GDXJ drop? As surprising as it may seem... We expect GDXJ to decline below GDX in absolute terms. Here's why.

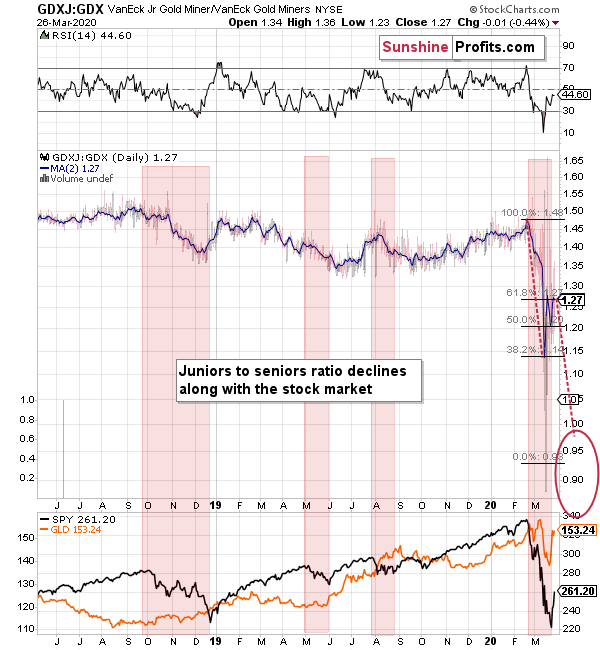

The ratio between GDXJ and GDX is moving relatively in tune with the general stock market. We've been describing that for many years (not very frequently, though) that juniors are more dependent on the general stock market than any other part of the precious metals sector. The areas that we marked with red prove it.

Here's another proof.

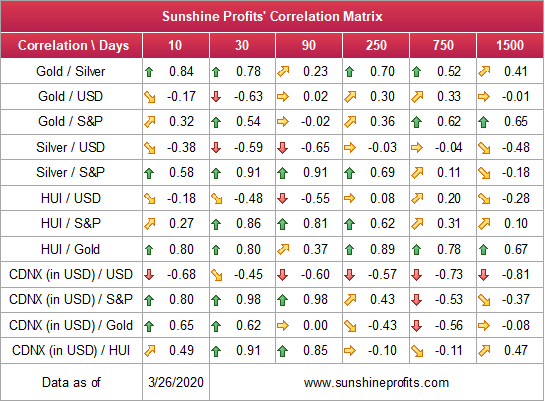

Please focus on the third row from the bottom. It shows the correlation between the TSE Venture Index (another proxy for the junior mining stocks) and the S&P 500 Index. The two highest values of correlation from the entire table are the ones between juniors and the general stock market. It's 0.98. The closer a given number is to 1, the stronger the link becomes. 0.98 is an extremely strong correlation (it's even stronger than the link between gold and silver, and the one between gold and gold miners!) and that's how correlated juniors really are with stocks, when taking into account the past 30 and 90 trading days. These are exactly the periods that we're interested in, given the likely short-term nature of the following decline.

So, since the general stock market is likely to slide further, the junior mining stocks are likely to slide really low, also relative to senior mining stocks.

This means a visible drop in the GDXJ to GDX ratio. Based on the technical principles, we applied to the ratio, it seems that it would decline at least below 1. Based on the ratio alone, the move to 0.93 appears more probable, and based on how far the general stock market could slide, it might not even be the final low.

With $10 - $12.50 as the target for GDX, and the target for the ratio at 0.93 - 1, the target area for the GDXJ is $9.30 - $12.50.

Summary

Summing up, it seems that the rally in the precious metals market is already over and it appears that taking the enormous profits from miners in the final part of Wednesday's session was a good idea. As unbelievable as this may sound, the upcoming slide, is likely to be even more profitable. Based on the bearish confirmation from the low volume in the miners, we are increasing the size of the short position in the mining stocks. Moreover, we are adjusting the profit-take levels, by moving them lower.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you just took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time. Please contact us, if you'd like to take advantage of this offer.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks (but not in gold nor silver) are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $12.86; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $11.97; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $12.27; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $16.27; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager