tools spotlight

-

Gold’s Rally - a Whole Lot of Nothing

October 3, 2022, 8:16 AMThe momentary role swap of the USDX and gold could raise some hopes for the bullish prospects of the yellow metal. Would they be justified?

The precious metals sector moved higher last week, and even though gold moved only a bit higher on Friday, miners’ daily upswing was more noticeable. Are miners showing strength here? If so, is this the start of a new, powerful uptrend?

As you have probably realized based on the title of today’s analysis, that’s not the case.

Let’s take a look at the charts and see what really changed.

Same Old

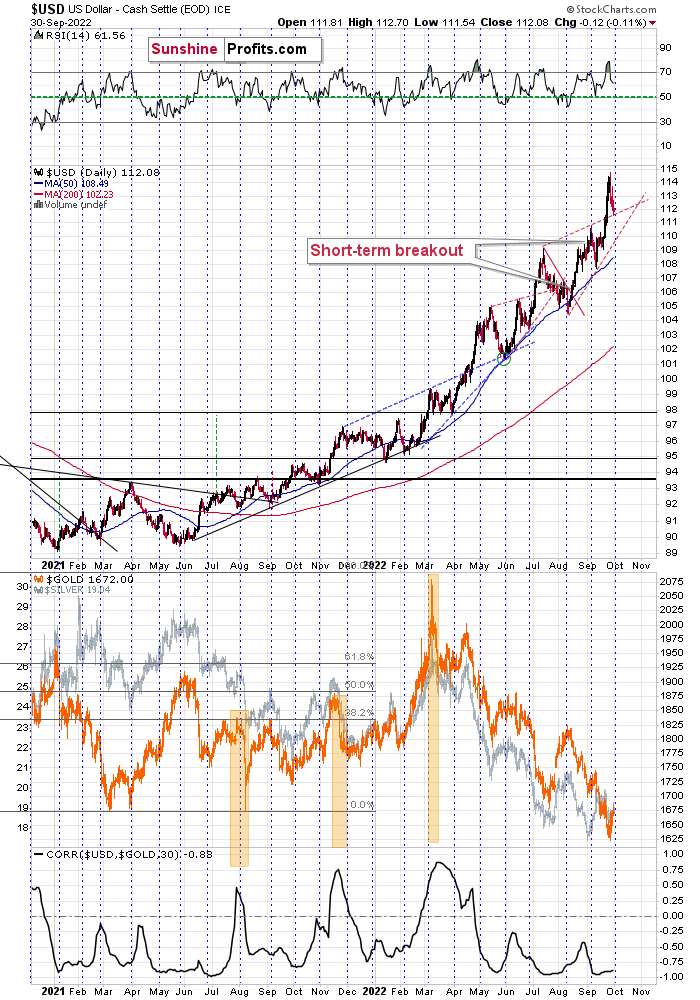

Nothing changed in the USD Index – it just verified the breakout above its rising support/resistance line. It declined close to the turn of the month, which is when it tends to reverse its course.

As the breakout held, the outlook for the U.S. dollar remains bullish, and given the above-mentioned monthly seasonality for the dollar, it seems that the rally is likely to resume any day now.

Given the strongly negative correlation between gold and the USD, the above is likely to translate into lower precious metals values.

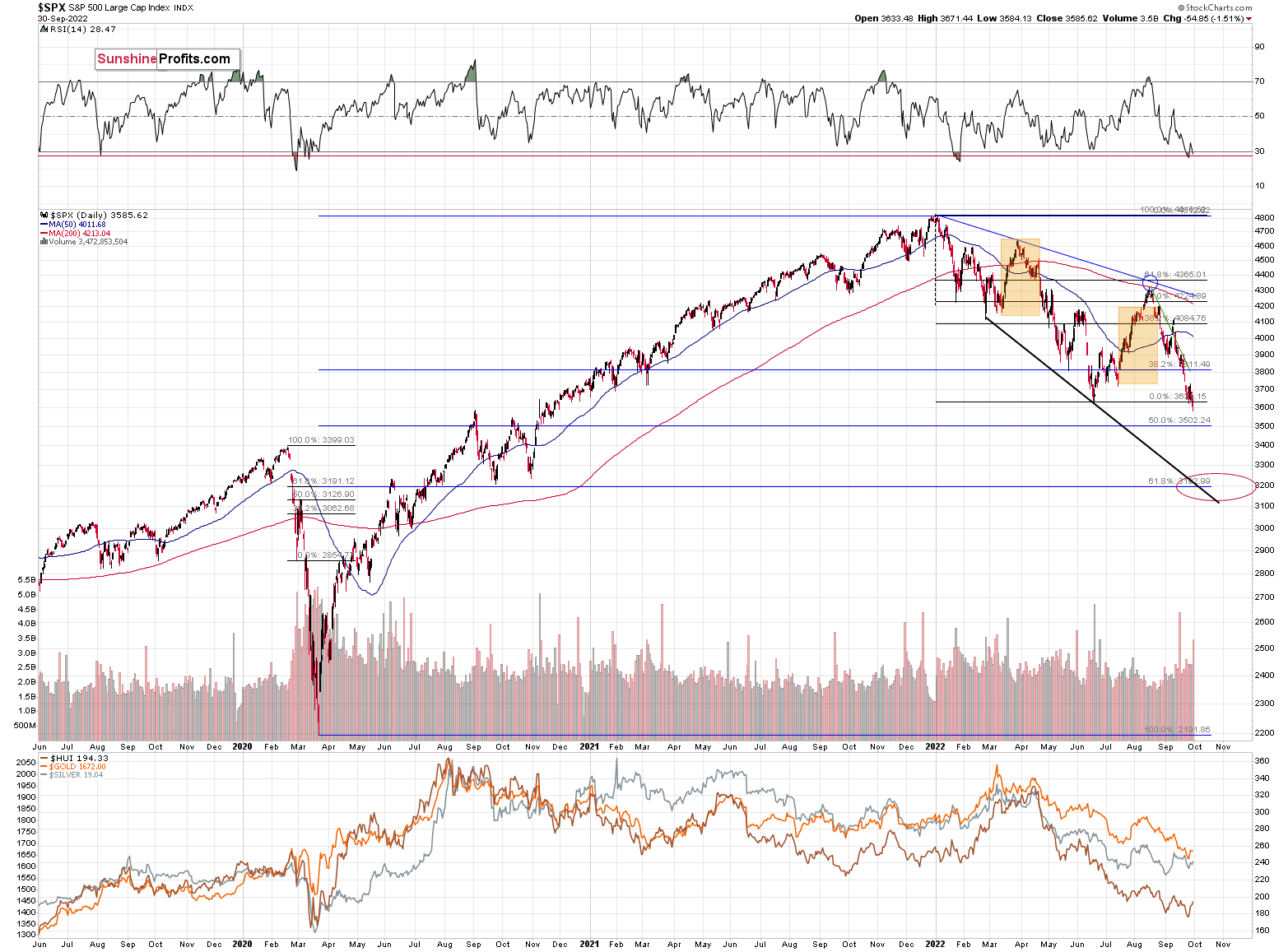

The general stock market just closed the day and the week at new yearly lows. This breakdown took place on strong volume, and the S&P 500 futures were lower in Monday’s pre-market trading.

This is a very bearish combination of factors for stocks. It’s also bearish for the parts of the precious metals market that are most aligned with stocks: silver and mining stocks. And, in particular, for junior mining stocks.

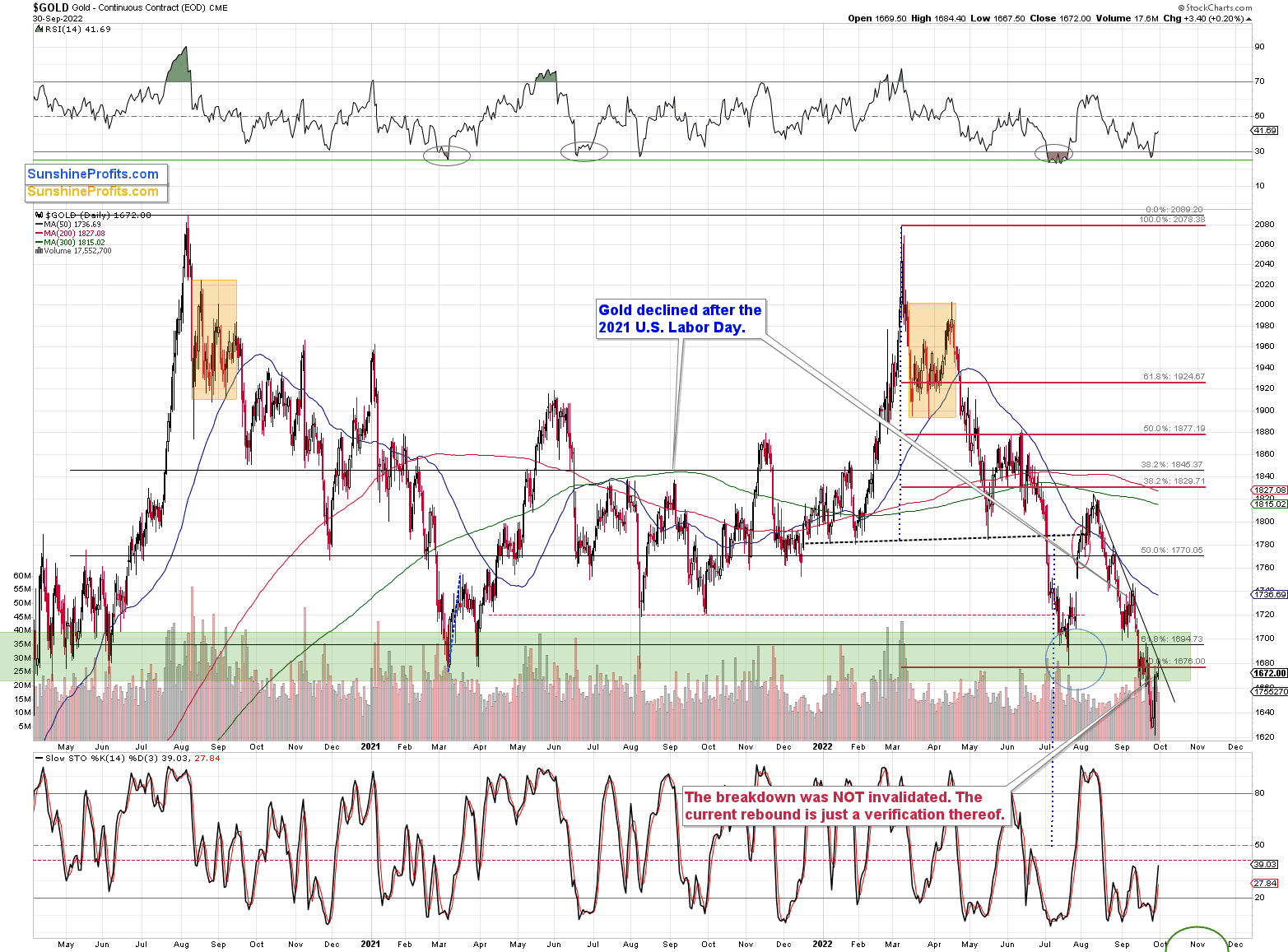

During Friday’s session, gold moved higher at first, but then reversed and ended the day only $3.40 higher. In other words, it formed a daily reversal.

Interestingly, the intraday high was very close to the declining, short-term resistance line. Do you remember what happened to the price of gold when it previously moved to this resistance line?

It happened in early September, and gold then declined by more than $100 in a rather sharp manner. I can’t promise any kind of performance, but the history tends to rhyme, right?

Actually, the situation is more bearish this time, as this time gold verified the breakdown below the green resistance zone, which opens the door wide open for really big declines – 2013 style.

Is It Strength?

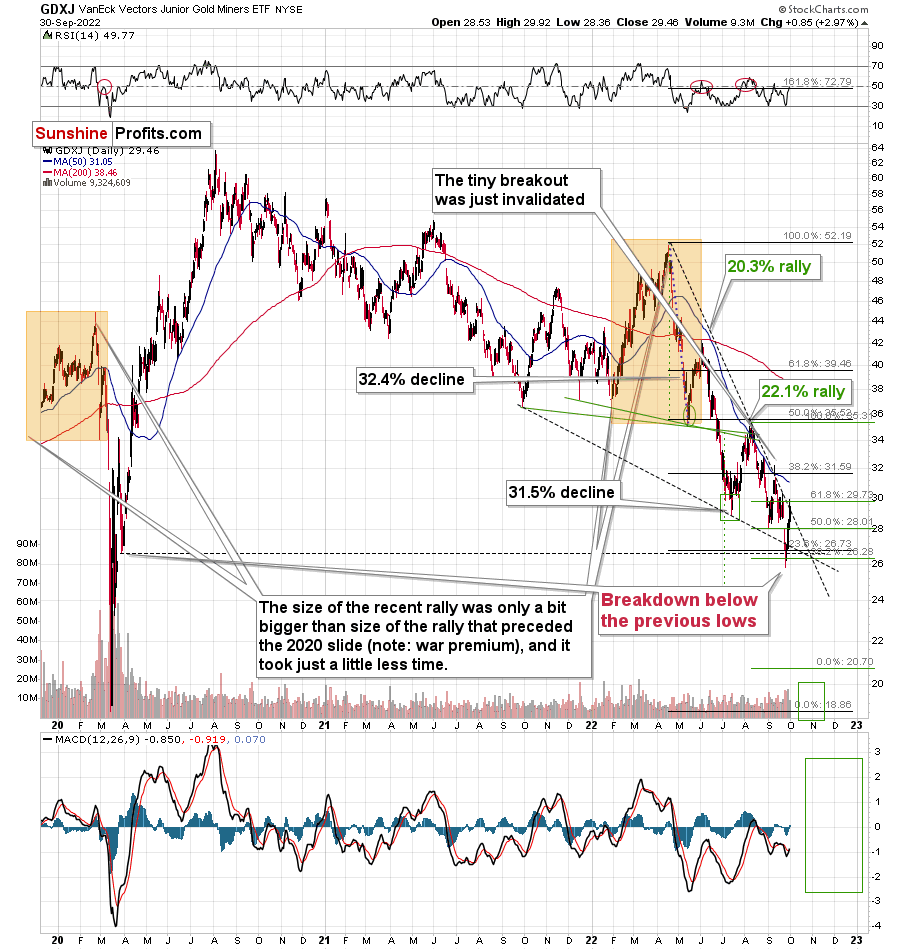

Junior mining stocks moved higher on Friday in a more visible manner, despite only a tiny rally in gold and an important decline in the general stock market.What gives? Are they really starting to soar here?

No. Junior miners were recently a ridiculously weak market, and there’s a tendency for the weakest parts of the market to perform relatively well right before declines. Gamestop’s share price didn’t move to a new 2022 low on Friday, by the way.

Why would this be the case? Because those who have very little idea about the trends tend to buy exactly at the wrong times, and it seems that it was the case on Friday as well.

Technically, just like gold, junior miners just moved to their declining resistance line without breaking it.

Therefore, not that much changed, despite the quick rally. The downtrend remains intact.

In my previous analyses, I wrote that the GDXJ was unlikely to break back above $30, and it didn’t. Friday’s intraday high was $29.92, and it declined a bit before the end of the day.

Given gold’s and stocks’ technical situations, it’s highly likely that junior miners will reverse their course and get back to their previous downtrend shortly (thus increasing profits on our short positions in this sector).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The USDX Fall Highlighted the Appeal of Gold and Silver

September 30, 2022, 9:43 AMAvailable to premium subscribers only.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Rallies in the Face of the BoE’s Quantitative Easing

September 29, 2022, 8:54 AMGold, silver, and mining stocks surged after the Bank of England announced QE. Does this have any impact on the precious metals market outlook though?

The precious metals sector rallied yesterday, but it didn’t change the short-term downtrend. It seems that the markets got scared of the consequences of QE in the U.K., as there was significant safe-haven buying. However, it’s unlikely that this will affect even the short-term trend.

In short, I don’t think that the GDXJ will rally above $30 before plunging, and it could be the case that the top is already in.

For more technical details, I recorded a video (yes, I’m back on the video front after a long break!) and I hope you like it.

I invite you to subscribe and read the full (premium) version of today’s analysis for more fundamental details,

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The U.S. 10-Year Real Yield Hits Its Highest in Over a Decade

September 28, 2022, 8:31 AMWhile the U.S. 10-Year real yield is at its highest level since 2010, gold remains uplifted. Despite this outperformance, the pair should reconnect again.

Real Problems

With gold and mining stocks enjoying oversold bounces on Sep. 27, the pace of the PMs’ recent drawdowns was poised to normalize at some point. Also, since asset prices don’t move in a straight line, daily declines of 1% or more often result in countertrend rallies along the way.

However, with the PMs’ medium-term technical and fundamental outlooks supremely ominous, a hawkish Fed, higher real yields, and a stronger USD Index are poised to inflict more pain. To explain, I wrote on Apr. 11:

With real interest rates poised to turn positive in the coming months, gold should suffer profoundly once its war premiums unravel.

The historical fundamental playbook shows:

- When a crisis erupts, the Fed cuts interest rates and commences QE;

- Real yields turn deeply negative;

- Gold rallies sharply;

- The Fed normalizes monetary policy, real yields surge, and gold plunges.

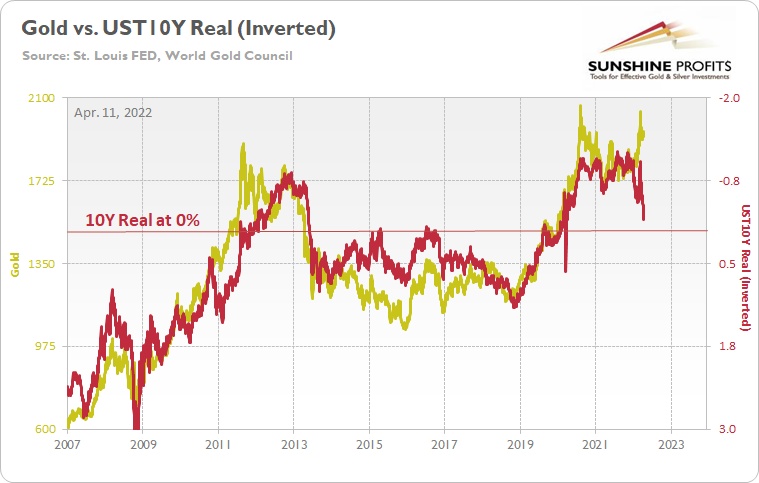

Please see below:

To explain, the gold line above tracks the price tallied by the World Gold Council, while the red line above tracks the inverted U.S. 10-Year real yield. For context, inverted means that the latter's scale is flipped upside down and that a rising red line represents a falling U.S. 10-Year real yield, while a falling red line represents a rising U.S. 10-Year real yield.

Moreover, while I've shown variations of this chart before, the long-term implications are profound. For example, if you analyze the left side of the chart, you can see that the U.S. 10-Year real yield soared and gold plunged during the global financial crisis (GFC). However, when the Fed launched QE and the U.S. 10-Year real yield sank to an all-time low, gold hit a new all-time high along the way.

Furthermore, the current situation is a spitting image. When Fed Chairman Jerome Powell performed a dovish pivot in late 2018, the U.S. 10-Year real yield suffered. Then, when the Fed fired its liquidity bazooka in March 2020, it pushed the metric to another all-time low. And surprise, surprise, gold hit another all-time high.

However, we're now in stage four of the historical fundamental playbook. With the Fed normalizing policy, the U.S. 10-Year real yield has surged in recent weeks. Moreover, the Fed needs to push the metric above 0% to curb inflation.

To that point, with long-term Treasuries continuing their sell-offs on Sep. 27, the U.S. 10-Year Treasury yield closed at another 2022 high of 3.97%.

Please see below:

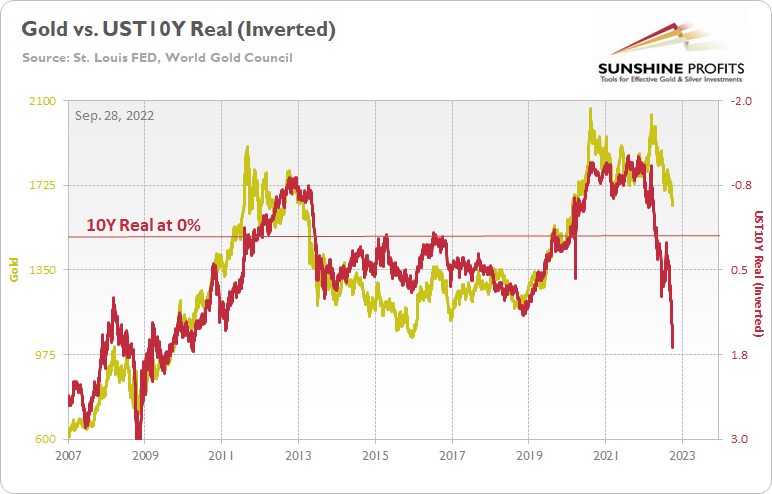

More importantly, the U.S. 10-Year real yield ended the Sep. 27 session at 1.64%, its highest level since 2010. Therefore, my prediction has proved prescient, even though gold has been a relative outperformer amid the chaos.

Please see below:

To explain, the U.S. 10-Year real yield is at its highest level in a decade-plus, while gold is relatively uplifted. Furthermore, a U.S. 10-Year real yield of 0% implies a gold price of $1,500, while the current reading of 1.64% should have gold south of $1,300.

So, what gives?

Well, for one, it’s not uncommon for assets to operate with a lag, meaning that gold will reconnect with the U.S. 10-Year real yield at some point, only the timing remains uncertain. As evidence, remember when I presented this chart throughout 2021 and 2022?

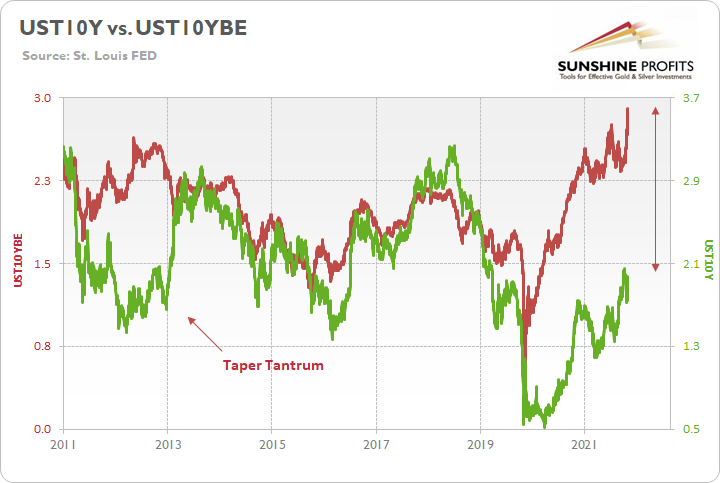

To explain, the green line above tracks the U.S. 10-Year Treasury yield, while the red line above tracks the U.S. 10-Year breakeven inflation rate. The unprecedented gap on the right side of the chart shows how a low nominal rate (the green line) and a high breakeven rate (the red line) created a major imbalance and pushed the U.S. 10-Year real yield into deeply negative territory. For context, the latter sank to an all-time low of -1.17% in August 2021 and hit -1.04% on Mar. 8 during the Russia/Ukraine conflict.

However, significant imbalances don’t last forever. In fact, if you analyze the middle of the chart, you can see that the two lines reconnected after the 2013 taper tantrum and remained in contact for years after that. Therefore, when the U.S. 10-Year real yield hit 0% in April 2022, the reconnection was complete, and the 2020-2022 imbalance was erased.

As such, we find ourselves in an identical situation now. While gold has outperformed the U.S. 10-Year real yield, the pair should reconnect once again; and with the Fed forced to play catch-up due to 40+-year high inflation, gold is much more likely to collapse than the U.S. 10-Year real yield. Remember, I wrote the Fed needs to push the metric above 0% to curb inflation.

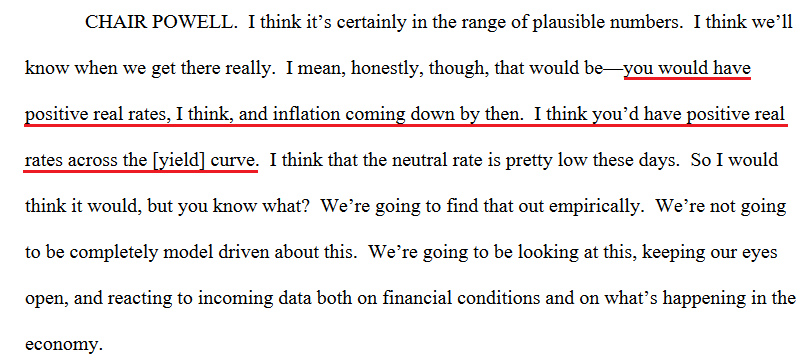

However, there is no magic real yield that sinks inflation. In reality, the Fed needs to keep pushing the metric higher until progress materializes. Moreover, I noted that Powell understands this and made the point for me during his June FOMC press conference.

Please see below:

Thus, while Powell has achieved his objective of “positive real rates across the [yield] curve,” it only matters if real rates are high enough to reduce demand and alleviate inflation. If not, they need to go higher.

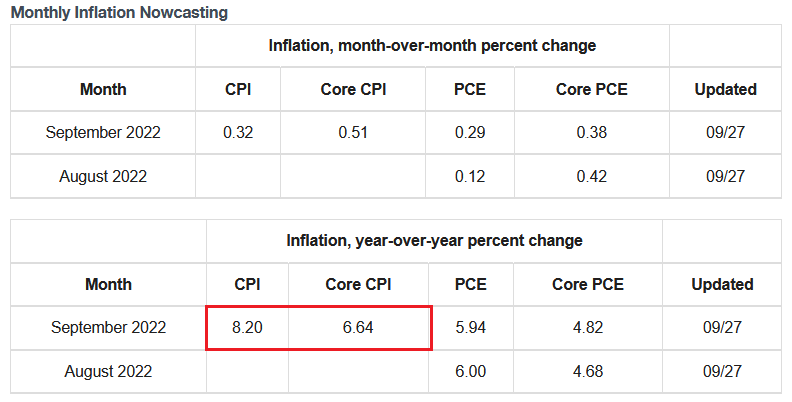

To that point, with the Cleveland Fed projecting the headline and core Consumer Price Indexes (CPI) to rise by 8.20% and 6.64% year-over-year (YoY) in September, the metrics are nowhere near normalized. As a result, the U.S. 10-Year real yield has the wind at its back, and gold should fall to restore the imbalance.

Please see below:

Also, please note that while gold has showcased immense resiliency in the face of elevated real yields and a soaring USD index, the GDXJ ETF hasn’t been so lucky.

Please see below:

To explain, the gold line above tracks the gold futures price, while the black line above tracks the GDXJ ETF. If you analyze the relationship, you can see that the pair remained close pre-pandemic. Conversely, with the junior miners materially underperforming gold post-pandemic, shorting the GDXJ ETF has proven profoundly wise and lucrative, as the junior miners have followed the real-yield roadmap to a greater extent.

In addition, the USD Index paints a similar portrait.

Please see below:

To explain, the gold line above tracks the gold futures price, while the black line above tracks the USD Index. If you analyze the middle of the chart, you can see that when the USD Index hit its ~2017 high, gold sank below $1,200.

However, while the USD Index closed well above its ~2017 high on Sep. 27, the yellow metal is much higher.

In contrast, the GDXJ ETF’s price action has been more formulaic.

Please see below:

To explain, the gold line above tracks the GDXJ ETF, while the black line above tracks the USD Index. If you analyze the right side of the chart, you can see that the junior miners’ Sep. 27 closing price is much nearer the low set when the USD Index hit its ~2017 high. Thus, it’s another example of why choosing the right asset to short is just as important as being correct in your investment thesis.

Hawk Talk

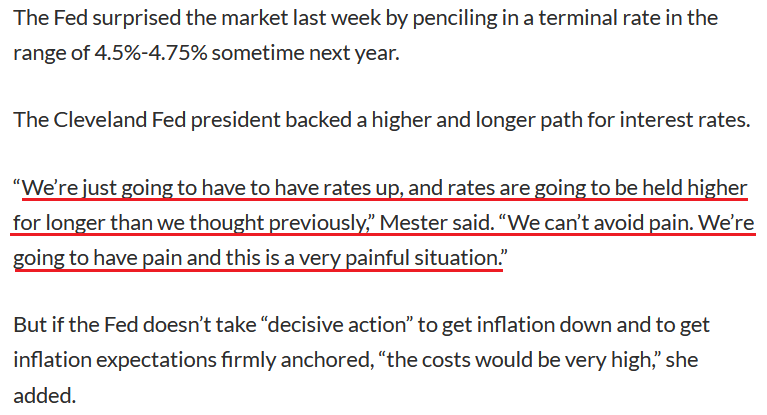

With Fed officials back to parroting Chairman Jerome Powell's future plans, his deputies reiterated his hawkish message. For example, Cleveland Fed President Loretta Mester said on Sep. 26:

“We have to understand that inflation is going to be continuing to be hard to predict (…). We can’t have wishful thinking replace really compelling evidence. So before I conclude that inflation has peaked, I will need to see several months of declines in the month-over-month (MoM) readings.”

As a result, Mester was ominously honest about the economic challenges that lie ahead.

Please see below:

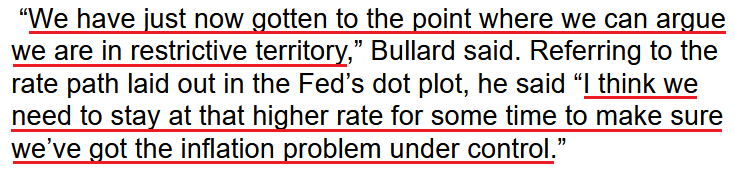

Likewise, St. Louis Fed President James Bullard said on Sep. 27:

“[Inflation] is a serious problem and we need to be sure we respond to it appropriately. We have increased the policy rate substantially this year and more increases are indicated.”

He added that the U.S. federal funds rate (FFR) may need to reach “the 4.5% range,” as inflation is more resilient than Fed officials expected. As such, with the U.S. labor market on solid footing, officials remain focused on the other half of their dual mandate.

Please see below:

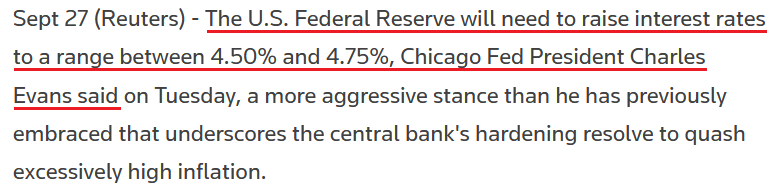

Finally, Chicago Fed President Charles Evans said on Sep. 27 that “My own viewpoint is roughly in line with the median assessment” from the Summary of Economic Projections (SEP).

“I had a sobering assessment that we've got more work ahead,” Evans said. “I'm optimistic that the peak that we’ve set out is going to be sufficiently restrictive that it could be enough.”

Thus, while I warned for months that reality would re-emerge, suddenly, a 4.5% FFR is the low-end of the consensus range.

The Bottom Line

While gold has relatively outperformed the U.S. 10-Year real yield and the USD Index, the GDXJ ETF has not. Moreover, the prior imbalance between the U.S. 10-Year Treasury and breakeven inflation rates is a cautionary tale of how history is undefeated. Therefore, the yellow metal should reconnect with the U.S. 10-Year real yield at some point, and we expect the normalization to occur through lower gold prices.

Furthermore, with Fed officials hawked up and pressing ahead with further rate hikes, the medium-term outlooks are bullish for the USD Index and the U.S. 10-Year real yield. Absent short-term sentiment rallies, gold, silver, and mining stocks should struggle in the following weeks and months.

In conclusion, the PMs were mixed on Sep. 27, as silver ended the day in the red. However, while oversold conditions may provide some short-term relief, the medium-term implications are unchanged: the precious metals remain in downtrends, and the technicals and the fundamentals signal lower lows in the months ahead. While I’m not making any promises with regard to price moves or profitability, in my opinion, the above also indicates that profits on our short positions in junior mining stocks are going to increase even further.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM