Briefly: Outlook for the precious metals market remains bearish for the following few weeks, and bullish for the following months and years.

Welcome to this week's Gold Investment Update.

Quite a few things happened recently, including the last several hours, so today's analysis will feature mostly new comments. However, there are still some parts of the analysis that didn't change in the previous days, and we will put them in italics.

This time, we'll start not with the short-term news, but with discussing the long-term potential of gold and gold stocks.

In short, this bull market can be more positive than the previous one both for gold and the mining stocks, and we'll discuss some of the reasons by commenting on the recent issues of Alchemist - the flagship publication of the London Bullion Market Associations.

We'll start with the article "Is there a place of Gold Equities in a Gold Allocation?" by James Luke from issue no. 96. The Author poses title question because gold equities performed poorly relative to the gold prices over the last 10 or even 20 years, and "investors would have been better served staying well away." Indeed, while the gold price is up more than 250 percent since 2005, the HUI Gold Index is just about 20 percent higher.

Wow, it was a harsh criticism! But justified given the fact that although in theory mining stocks provide a leveraged way to own exposure to movements in commodity prices, in reality many miners lag behind the physical market in the long term. One might think that gold and gold stocks will always move in the same way with the same magnitude, but in reality, investing in miner's equity is a whole different kettle of fish, as "the stocks are not a safe haven against market turmoil, but a bet on company's operating earnings and the management team which controls it". Indeed, the problem of gold equities over the last decades was - according to Luke - that "yes, you had higher prices, but no, the industry did not capture margin, and no, the industry did not generate returns".

However, that may change now. The Author believes that producers are facing now a friendlier environment in which they could be able to capture profit margins far greater than in the past. You see, in the 2000s, gold was rallying together with other commodities and with its own input cost base, which cannibalized the margins. But the current gold's rally is more a monetary-based than a commodity-based, which supports gold prices but remains cost inflation limited.

Gold Resilient in Adversity

Another interesting article from the Alchemist, this time from issue no. 97, is "Gold Resilient in Adversity" by Rhona O'Connel. She compares gold with other commodities, pointing out gold has been the outperformer within the sector. While other metals suffered massive demand destruction and price falls of several percent amid the coronavirus crisis, gold has been a "sanctuary from the vicissitudes of the economic environment". The conclusion is simple: the impressive gold performance compared to its commodity peers underlines the safe-haven status of the yellow metal and the fact, emphasized by me for a long time, that gold is more of a monetary asset than a mere commodity.

The Rational Case for $7,000 Gold by 2030

We left the most controversial article from Alchemist issue no. 97 - The Rational Case for $7,000 Gold by 2030 written by Charlie Morris - for last. The Author starts with the observation that gold has been the leading major asset class in the 21st century, which is an extraordinary achievement given that gold doesn't pay a yield.

Some people believe that because gold doesn't pay a yield, gold can't be valued. But Morris disagrees - and he models gold, very interestingly, as a bond with the following characteristics: it is zero-coupon because it pays no interest; it has a long duration because it lasts forever; it is inflation linked, as historic purchasing power has demonstrated; it has zero credit risk, assuming it is held in physical form; it was issued by God.

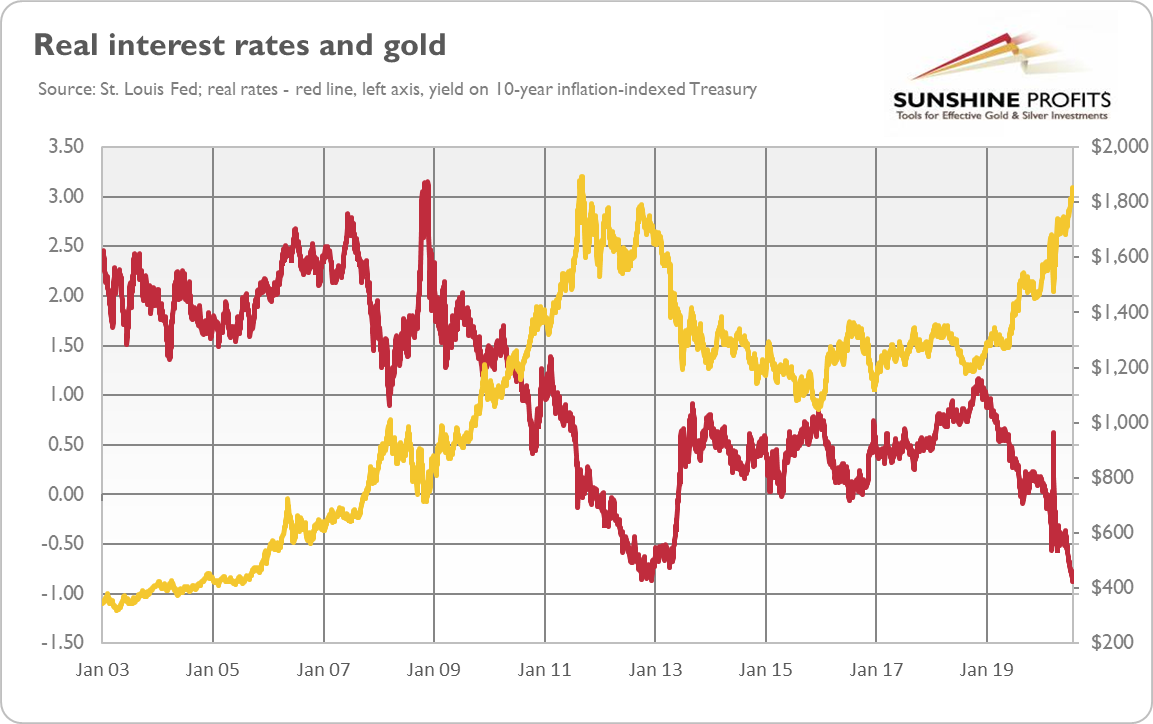

Wow, what an original bond! The model makes clear why the main driver behind gold's gains in this century was the fall in the U.S. real interest rates, as the chart below shows. According to the Author's model, gold is traded now with premium over its fair value, but investors should not worry, as "it is more likely to rise from here than reverse. That's because gold is in a bull market and the forces driving it higher far outweigh the forces holding it back."

In particular, Morris believes that gold simply sees inflation coming in 2021. After all, contrary to the quantitative easing that occurred in the aftermath of the Great Recession, this time the surge in money supply flows into the real economy. Hence, according to the Author, if the long-term inflation expectations rise, together with the gold's premium, while the bond yields remain ultra low, the price of gold could rationally achieve the level of $7,000. After all, "the huge gains in the 21st century have occurred in an environment with falling rates, while long-term inflation expectations have barely moved. With higher inflation on the horizon, things start to get interesting."

Although $7,000 may sound like an exaggeration, there are some other reasons to think that gold might move as high and we agree with the article's main premises: the repercussions of the coronavirus recession could be more inflationary than the Great Recession, and that gold is in the bull market that could last for a while.

However, even the most profound bull markets can't move up in a straight line and some corrections will take place. After big rallies, we're likely to see big corrections, and one is long-overdue in case of the precious metals market.

Just as it was in March, it seems that the visible worsening in the economic situation might trigger a sell-off.

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

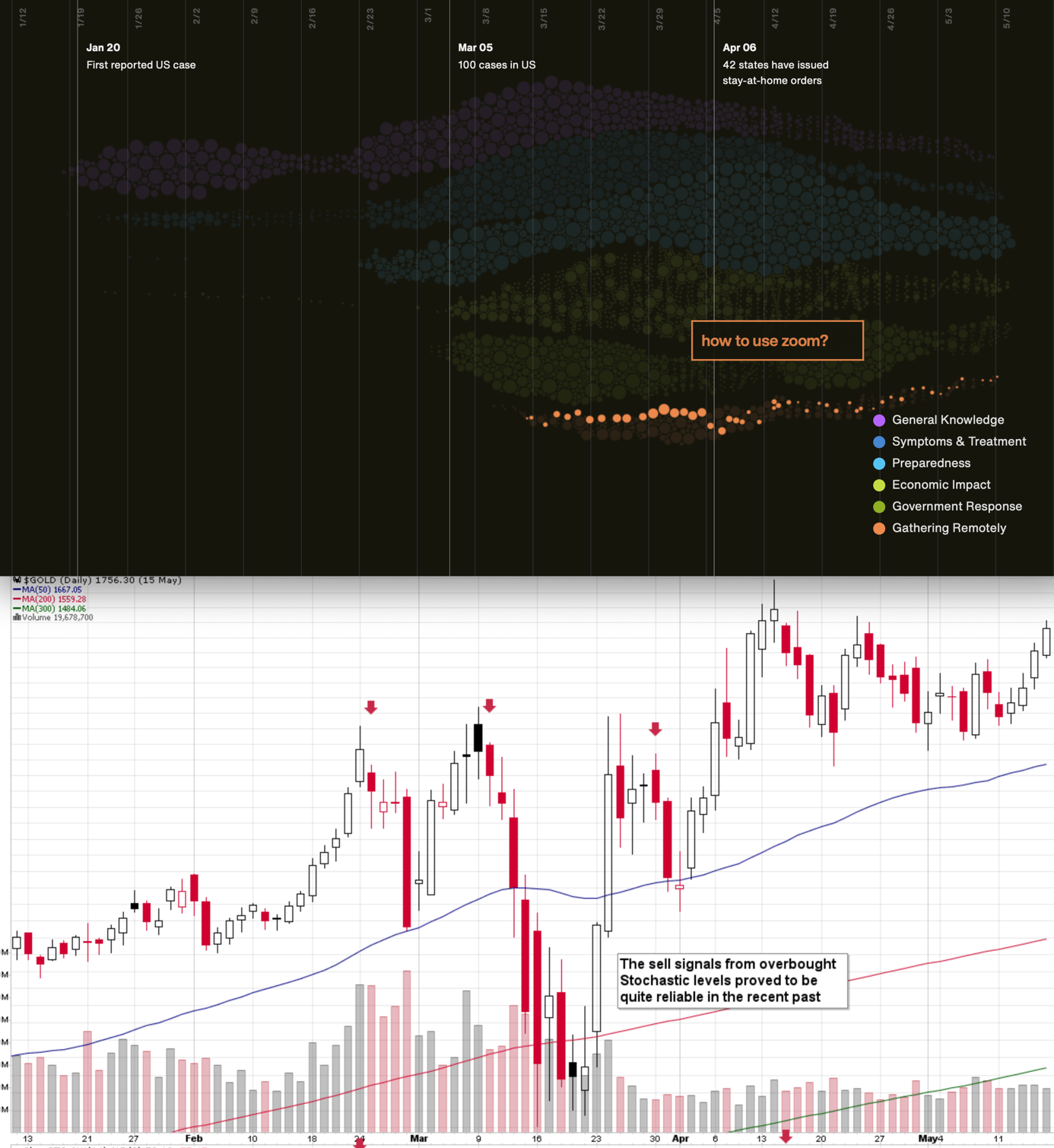

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it's vulnerable to a sizable decline, when the economic implications of the pandemic's continuation become obvious to investors.

The S&P 500 is trading around its June high and it also broke below (and closed two weeks below it) its rising support line. This breakdown is likely to indicate trouble for the stock bulls, even though the decline still hasn't started yet.

Do you remember what happened in February when the S&P 500 lost its upward momentum? They plunged, and that was when tops in mining stocks and silver formed. Gold made another attempt to move higher but ultimately declined profoundly in the following days.

Back then, crude oil was relatively weak - and we see this weakness also this time. The black gold's upswing seems to have ended in June, but it made another attempt to move higher recently. It failed to move above the 61.8% Fibonacci retracement based on the entire 2020 decline and it seems to be ready to move lower shortly.

It appears that on one hand, everything that could have gone well for gold on the fundamental front, has already one well, and it already rallied, and on the other hand, we have many signals pointing to the situation being excessive. This means that as some of the bullish factors ease (perhaps temporarily) and investors get scared about economy's ability to really recover, gold is likely to correct significantly, before continuing its upward march.

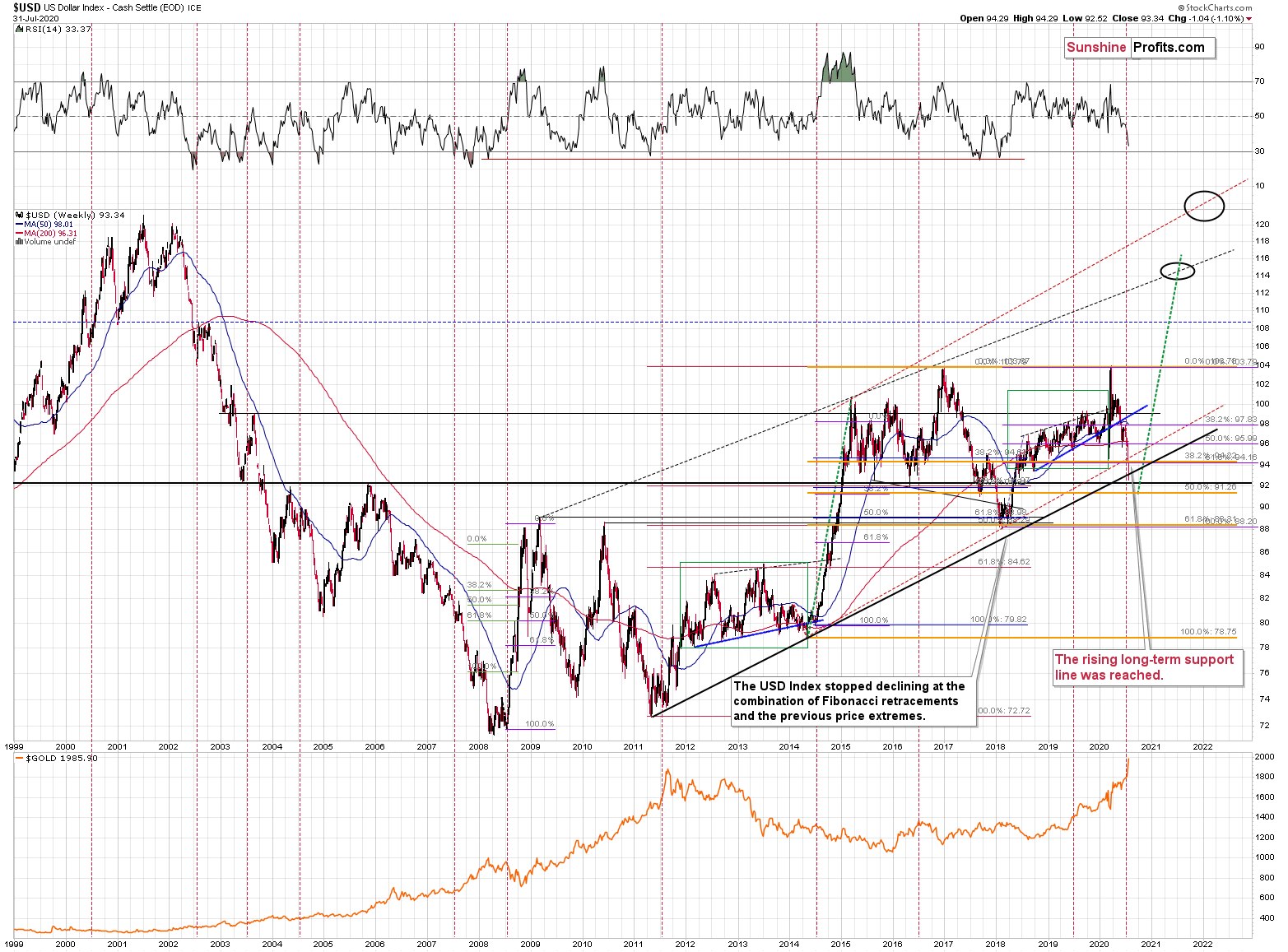

Speaking of indications pointing to the situation being excessive, let's take a look at the USD Index.

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone "knew" that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it's the same right now.

The USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line that's based on the 2011 and 2014 bottoms.

The other major, long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when the USDX formed major bottoms on many occasions. This makes a short-term rally here very likely.

We even saw a confirmation from USD's short-term chart.

The U.S. currency finally after a decisive short-term breakout. Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market.

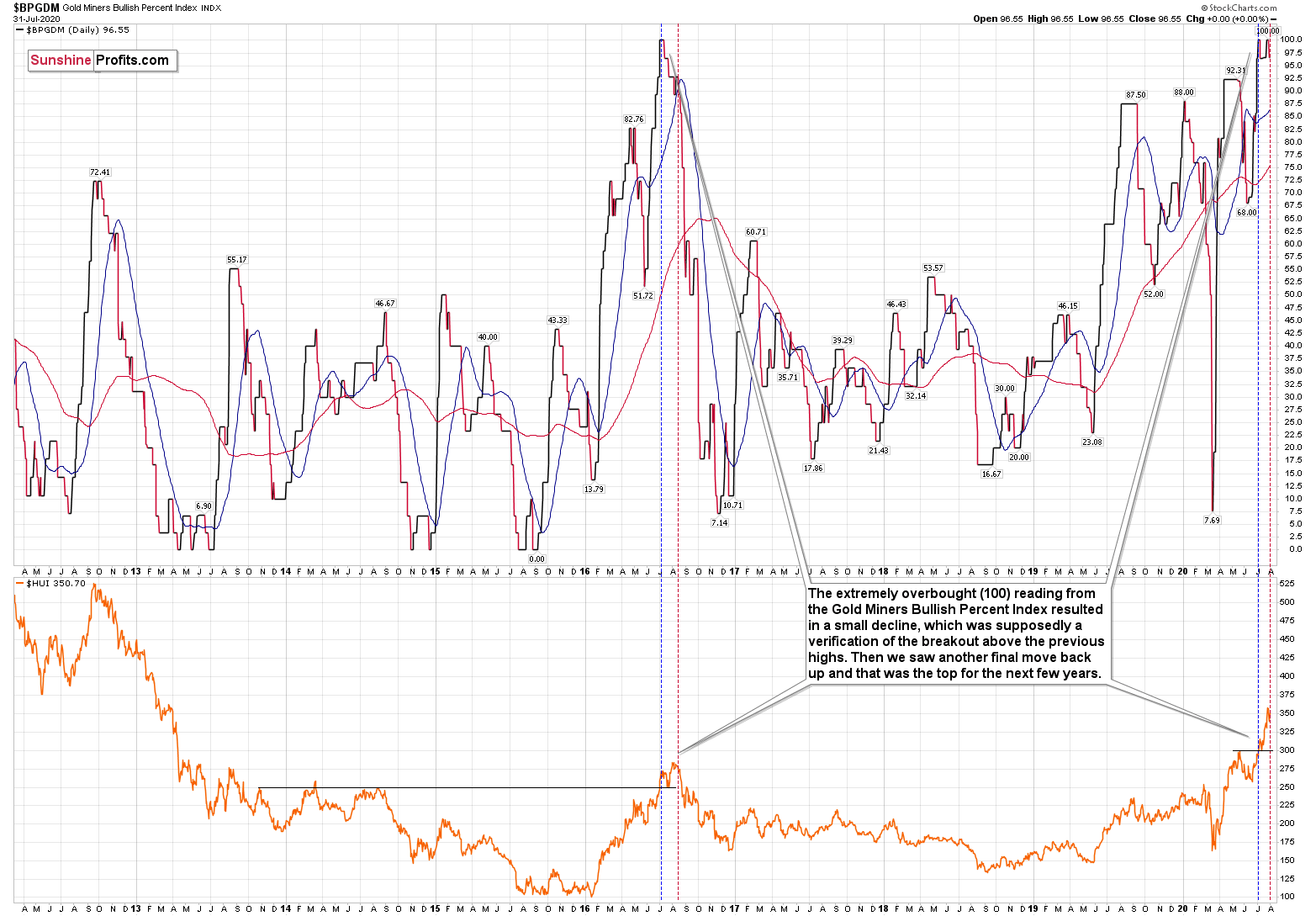

Consequently, based on this analogy, the implications for the near term are bearish for the PMs. Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn't cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing has caused the Gold Miners Bullish Percent Index to move up once again for a few days. It then declined once again. We saw something similar also this time. In this case, this move up took the index once again to the 100 level, while in 2016 this wasn't the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline. Given the situation in the USD Index, it seems that we're seeing the same thing also this time.

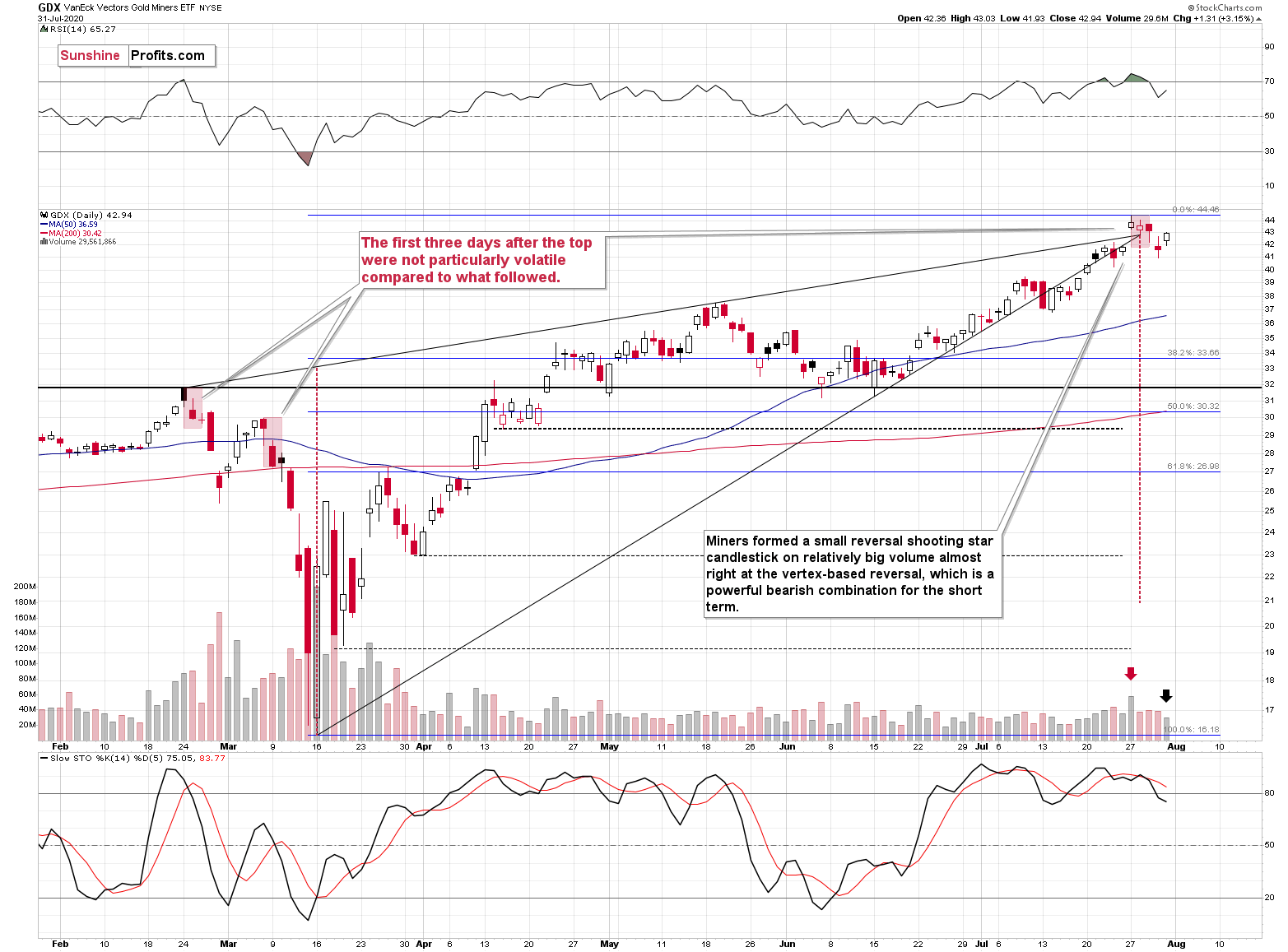

On Friday, gold moved higher once again, but senior mining stocks refused to move to new highs. They didn't manage to even erase their Thursday's decline. The volume that accompanied this daily upswing was relatively low. This means that it's likely that this is a counter-trend bounce, and not the bigger move higher.

Miners were the first to top, and the short-term breakout in the USD Index indicates that other PM markets are likely to follow.

Please note that the miners topped almost right at the vertex of the huge rising wedge pattern. Quoting last week's analysis:

(...) huge rising wedge pattern is about to form a vertex today or tomorrow. The same rule that applies to triangles has implications also here. The vertex is quite likely to mark a reversal date. Given the overbought status of the RSI (given today's upswing, it's almost certain to move above 70 once again) as well as miners recent unwillingness to track gold during its continuous rally, it's highly likely in my view that this will be a top.

Let's turn to metals themselves.

Gold just moved above its previous 2020 high in a volatile manner mere just minutes after writing this, the yellow metal moved back below this level, thus invalidating the breakout.

The invalidation of the breakout is a bearish sign, but at the same time, one should keep in mind that the breakout above the 2011 high was already confirmed. The latter is very bullish.

Still, given what's going on in the USD Index - its own breakout - it seems that one should wait to see how gold really reacts to USD's strength before predicting that there will be no corrective downswing based on gold's breakout above the 2011 highs.

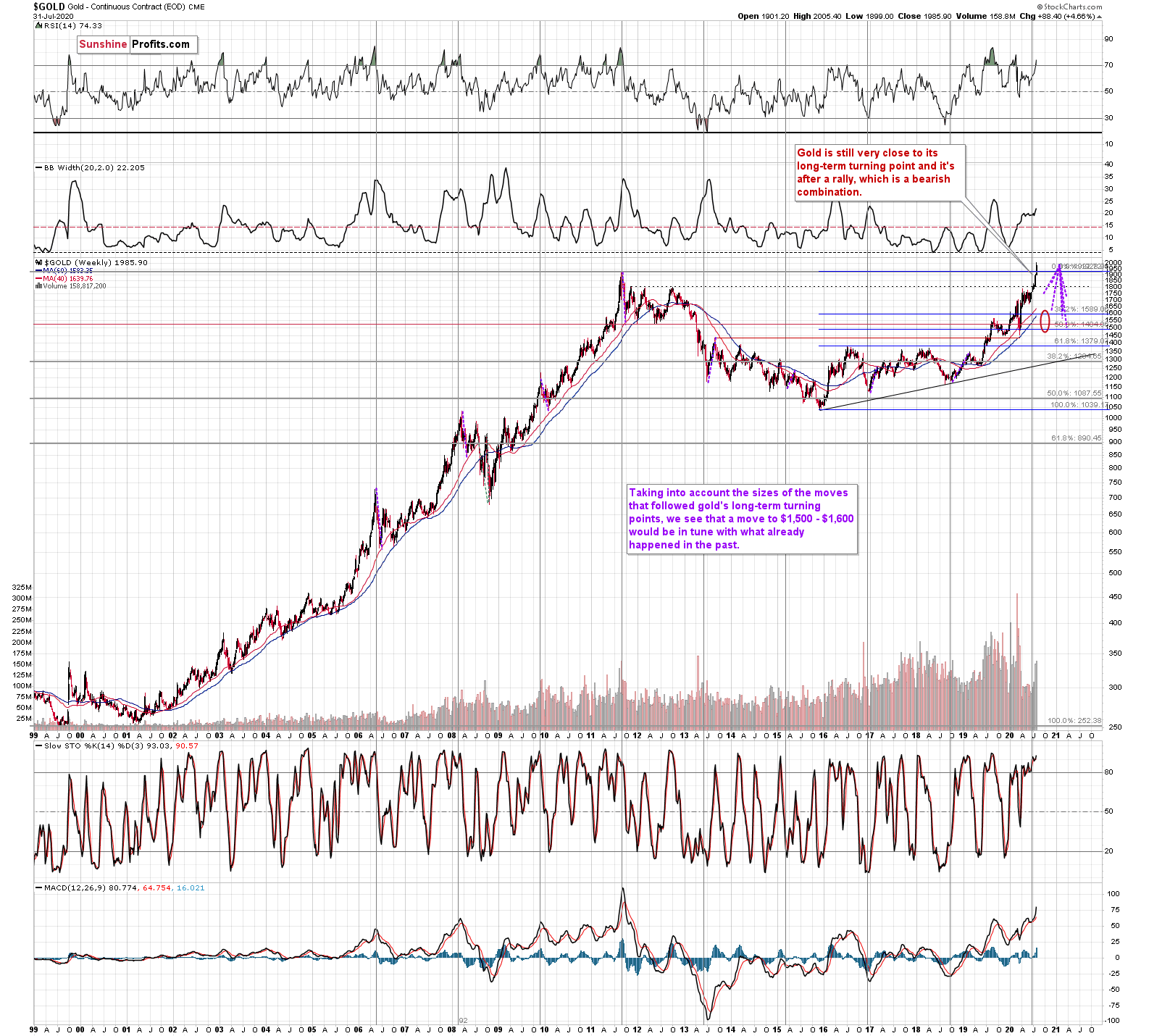

Gold's very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold's big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom in the $1,500 - $1,600 area. That's very much in tune with how much gold moved after the previous long-term turning points. It's also very much in tune with how low gold moved in 2011 after trying to break above $1,900.

Also, while we're discussing the long-term charts, please note the most important detail that you can see on the gold, silver, and mining stock charts, is hidden in plain sight. Please note how much silver and miners rallied.

Gold just moved above its 2011 high. And silver?

Silver corrected to the first of the classic Fibonacci retracement levels (38.2%) based on the entire 2011 - 2020 decline. And then it moved lower - back below its late-2013 high.

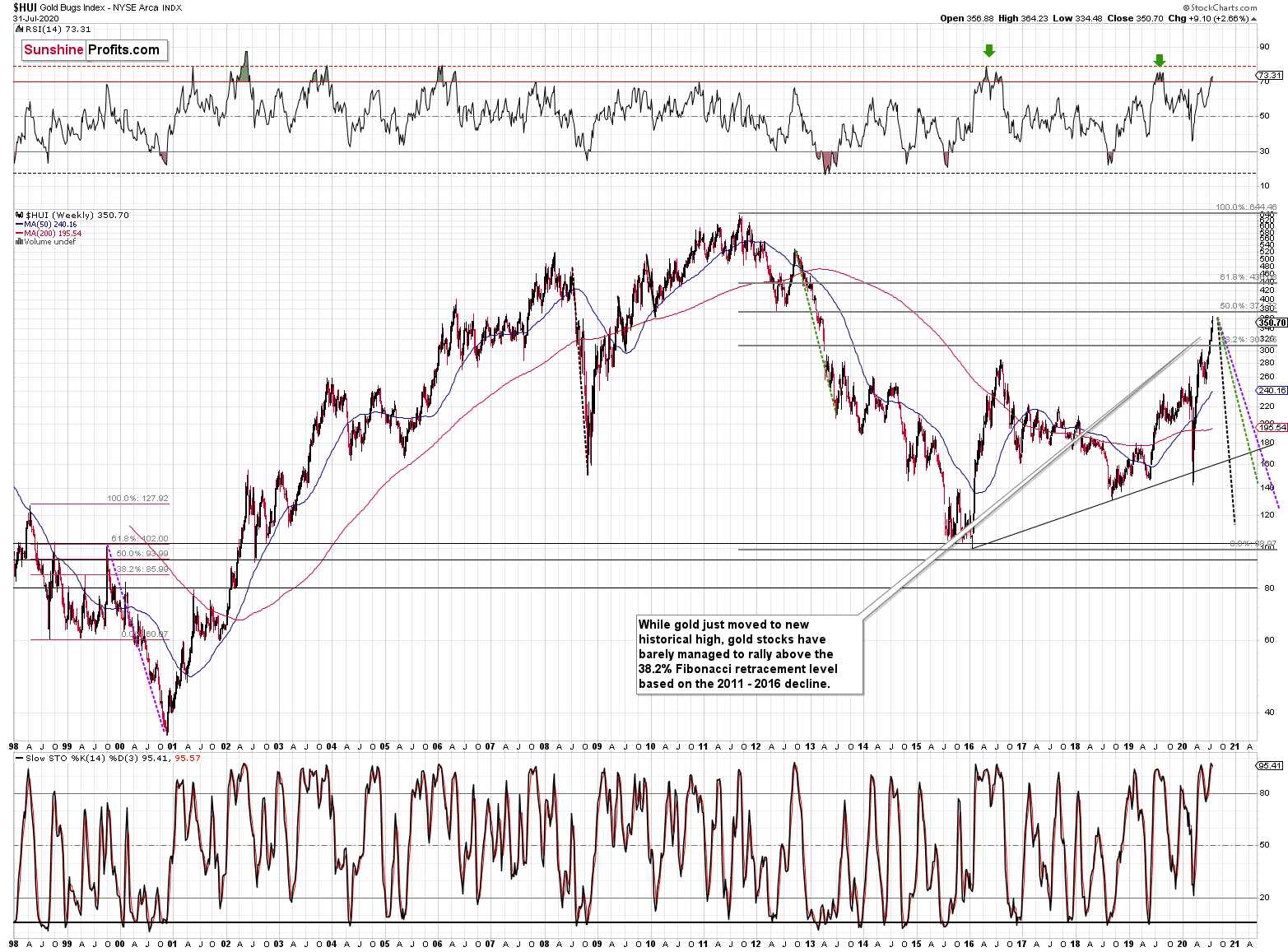

Meanwhile, despite their recent run-up, gold stocks - HUI Index - are just a bit above the 38.2% Fibonacci retracement based on the 2011 - 2016 decline. They didn't correct half of the decline so far.

It's mostly gold that is making the major gains - not the entire precious metals sector.

Moving back to silver's forecast, it's good to note that the time the current rally is taking, is still very similar to the time that the final part of the 2016 run-up took. The current move is bigger, but in terms of time, they are still very alike. This adds to the bearish implications of the situation in the USD Index and gold miners' extremely overbought condition along with their vertex-based reversal that's due today or tomorrow.

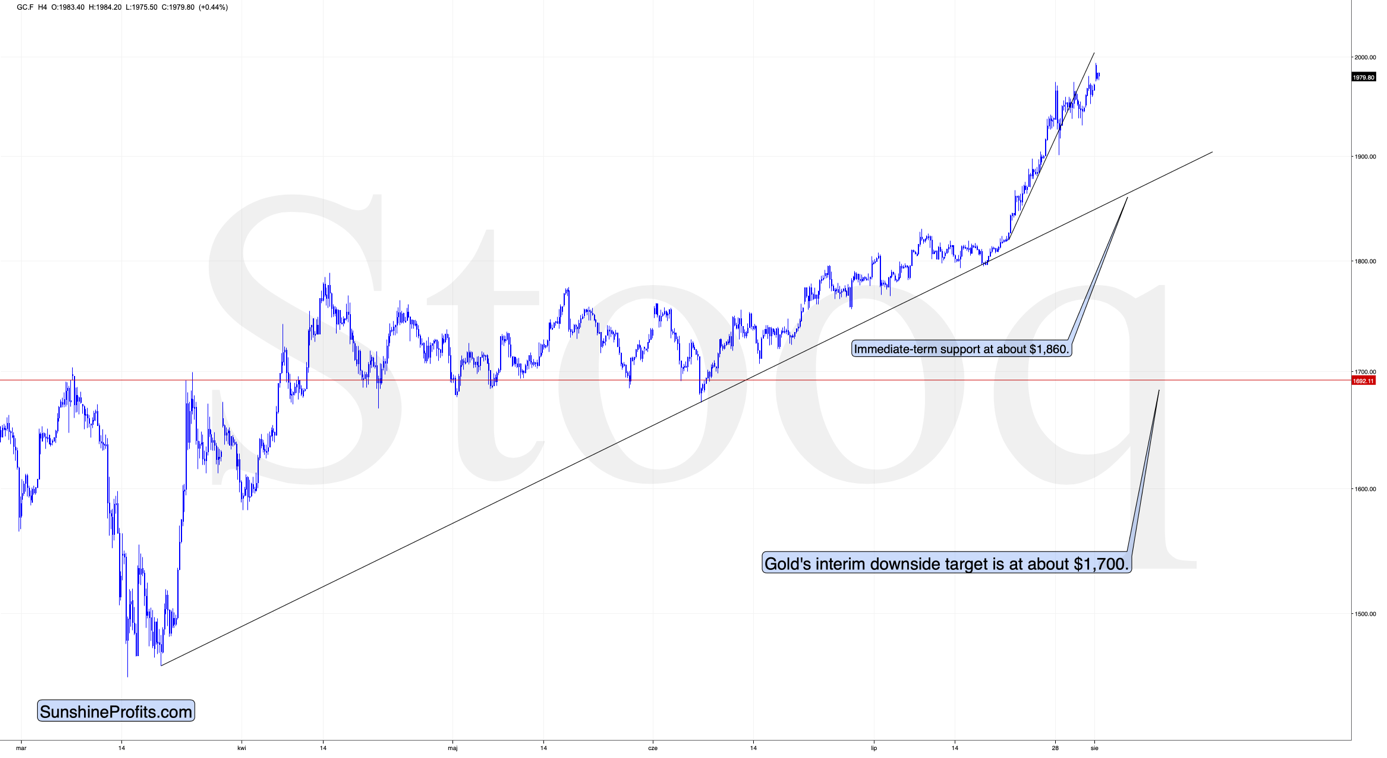

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think that after bottoming temporarily at about $1,700, gold, silver and miners will bounce back - perhaps $30-$50 or so in gold, and then we will probably see another move lower, with silver declining more than miners. That would be in tune with how the markets initially reacted to the Covid-19 threat.

At this time it seems that after the initial decline to $1,700, gold could correct and then decline to $1,500 - $1,600 and that would be the final bottom - one that would hold for years, perhaps decades.

Still, it's possible that the $1,700 bottom in gold would be the final bottom.

How will we tell, which scenario is more likely - a decline visibly below $1,700 or just to it? Based on the way different parts of the precious metals sector react to the decline and to the initial rebound. If silver catches up with the decline when gold moves to $1,700, but miners lead on the way back up (strongly so), it will be more likely that the bullish scenario prevails. If we see the opposite - miners are weak during the rebound and silver doesn't catch up with the decline once gold approaches $1,700, the bearish case will prevail. Anything in between will require additional confirmations and we will keep you - our subscribers - updated in any case.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is very positive in the long run, but it doesn't make the short-term decline unlikely. In the very near term, markets can and do get ahead of themselves and then need to decline - sometimes very profoundly - before continuing their upward march.

Summary

Summing up, it seems that gold has formed a triple-top pattern (taking into account today's attempt to break to new highs), just as the USD Index seems to have finally bottomed. The extremely overbought reading from the Gold Miners Bullish Percent Index and the individual price moves make the current case very similar to the 2016 topping pattern, and other important indications (especially gold's and USD's long-term cycles) point to likely - sizable - decline in the following several weeks.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

After the sell-off (that takes gold below $1,600), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can't promise that it will be the case each week.

Please note that this service does not include daily or intraday follow-ups. If you'd like to receive them, we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager