Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

Our short position in junior miners remains profitable despite the small counter-trend upswing that we saw recently.

Let’s start today’s analysis with a recap of what recently happened on the fundamental front.

The Weekly Fundamental Roundup

With inflation and the Fed headlining the bearish developments this week, financial markets imploded as the hawkish realities rattled the bulls. Moreover, while a short squeeze uplifted sentiment on Jun. 15, investors woke up to the recession fears that I warned would manifest during periods of unanchored inflation.

Please see below:

Moreover, with the perma-investors finally realizing that the Fed isn’t bluffing, I noted on May 25 that enlightenment would eventually arise. I wrote:

A decade of dovish pivots has left a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

The bottom line? We’ve officially entered the monetary version of The Boy Who Cried Wolf. With Fed officials running to the rescue each time the financial markets show signs of stress, investors are programmed to ignore their hawkish threats. However, while these post-GFC pivots occurred with inflation perched near 2%, investors are so steadfast in their belief that they ignore the climactic consequences of unanchored inflation.

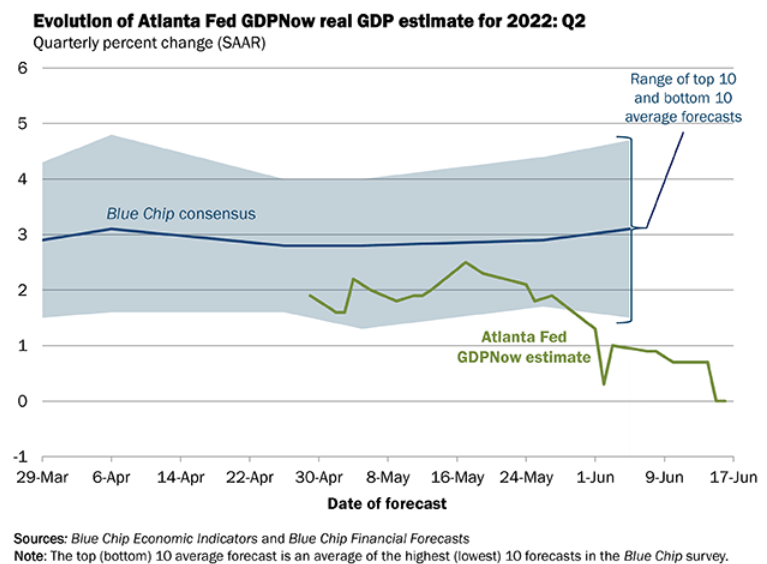

Thus, while the GDXJ ETF remained uplifted while the S&P 500 sank on Jun. 16, the former should look more like the latter over the medium term. For example, the Atlanta Fed updated its GDPNow forecast on Jun. 16. Moreover, the regional Fed bank expects 0% growth in the second quarter.

Please see below:

To explain, the blue line above tracks the Blue Chip (investment banks) consensus estimate (~3%), while the green line above tracks the Atlanta Fed’s projection. If you analyze the right side of the chart, you can see that the green line has sunk to zero. As such, the U.S. economy’s recent momentum has likely slowed materially.

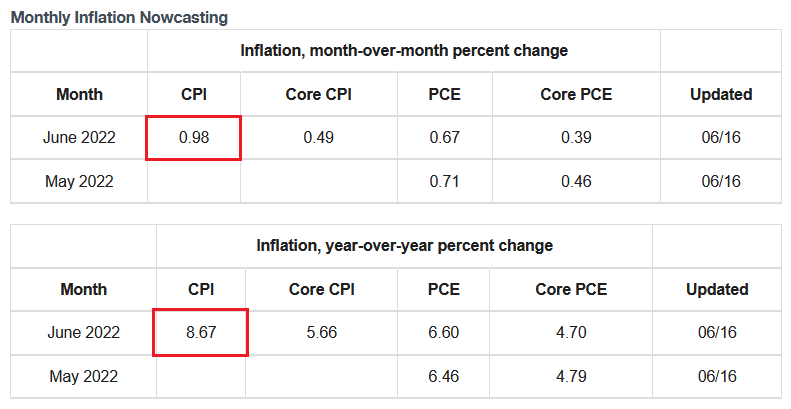

More importantly, the Cleveland Fed also updated its inflation “Nowcast” on Jun. 16. The table below shows that forecasters expect the headline Consumer Price Index (CPI) to increase by 0.98% month-over-month (MoM) and by 8.67% year-over-year (YoY) in June. Therefore, unanchored inflation is still nowhere near levels that could allow the Fed to pause.

Please see below:

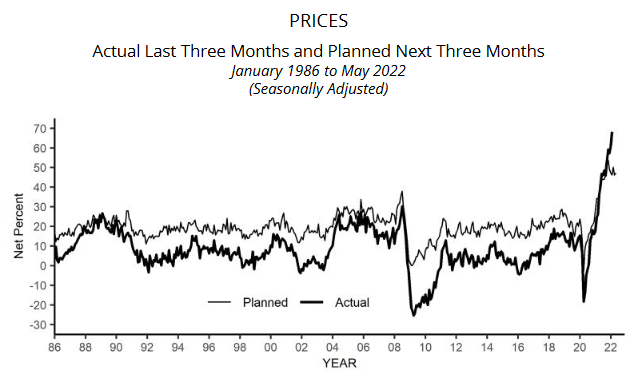

Likewise, the NFIB released its Small Business Optimism Index on Jun. 14. The headline index declined from 93.2 in May to 93.1 in June. More importantly:

“The net percent of owners raising average selling prices increased two points to a net 72% (seasonally adjusted), back to the highest reading in the 48-year-history of the survey last reached in March and 32 points higher than May 2021.”

As a result, inflation’s ominous reign still has room to run. Thus, the Fed needs to continue its hawkish assault, and the prospect is profoundly bearish for the S&P 500 and the PMs.

Bank of America’s FMS

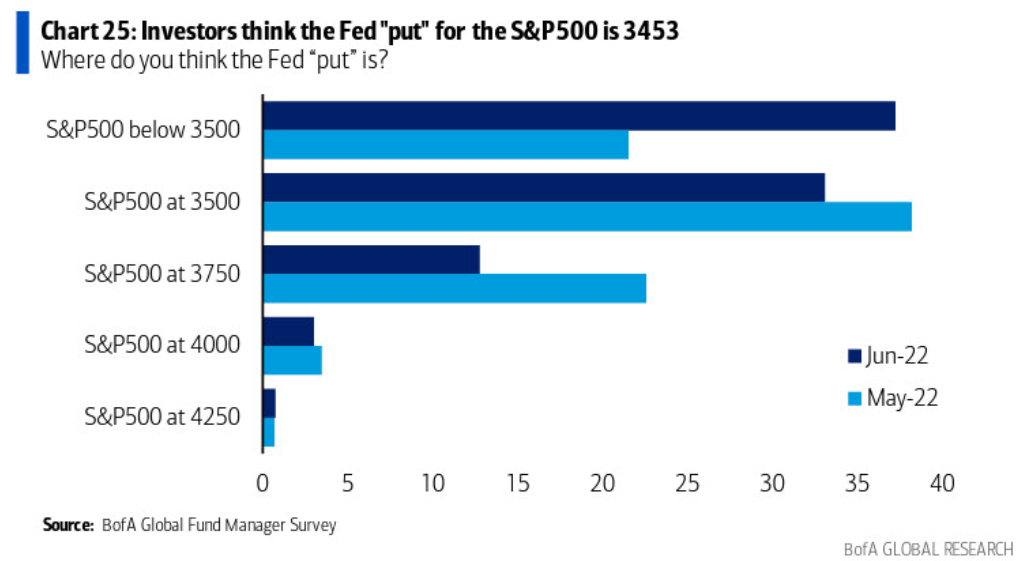

With the bulls struggling to find their footing, more S&P 500 downside should culminate with lowers lows for the GDXJ ETF. To that point, Bank of America’s latest Global Fund Manager Survey (FMS) shows that the consensus expects the Fed to put – the level at which the central bank steps in and bails out investors – lies below 3,500.

Moreover, the dark blue bars highlight how fund managers reduced their expectations from May to June. As a result, they too realize that inflation keeps the Fed on the sidelines.

Please see below:

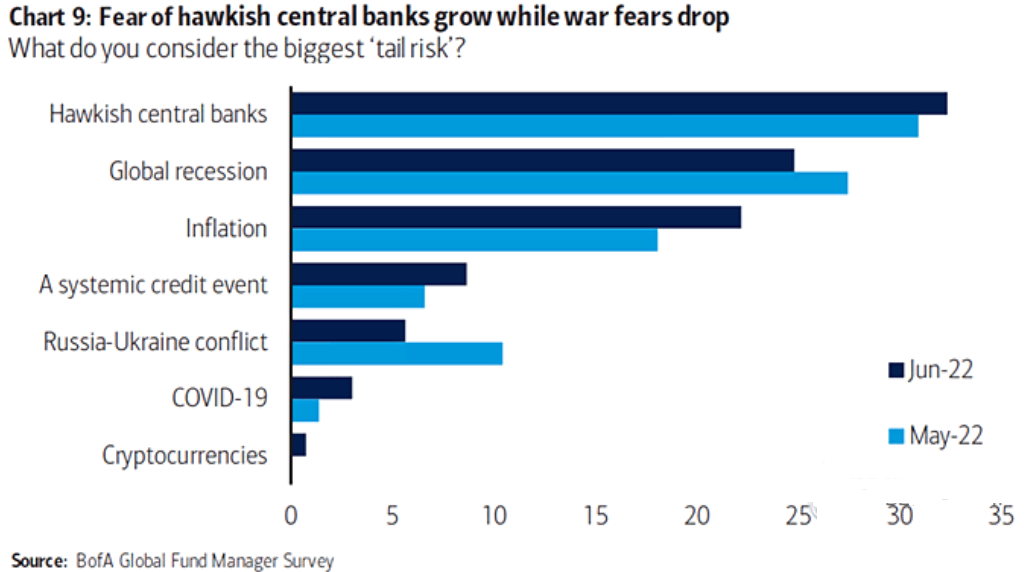

Likewise, Bank of America found that fear of hawkish central banks is fund managers’ greatest concern. Moreover, with inflation anxiety also increasing in June, the bearish cocktail has the financial markets on edge.

As such, while the newest narrative on Wall Street finally makes sense, I warned on Apr. 6 that the Fed’s war against inflation was antithetical to higher asset prices. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. If that occurs, investors should suffer a severe crisis of confidence.

Where Do We Go from Here?

Since investors are forward-looking, the above issues are now largely priced into assets. However, with the medium-term fundamentals poised to worsen, more bouts of panic should materialize.

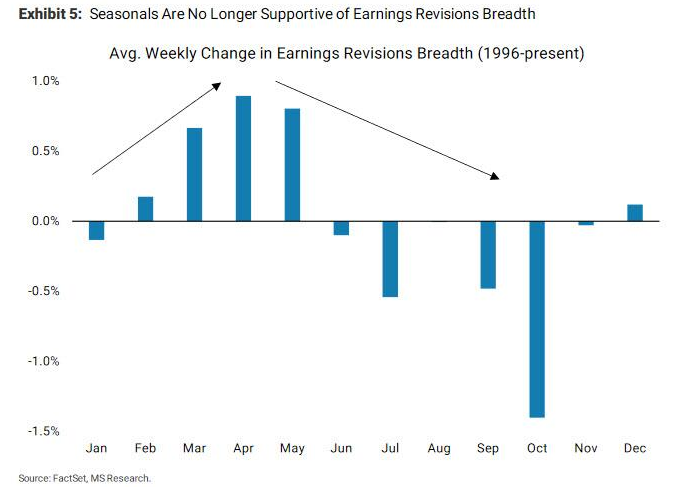

For example, I wrote on Jun. 8 that seasonal factors point to more earnings woes in the coming months.

Please see below:

To explain, the blue bars above track the average percentage change in earnings revision breadth since 1996. If you analyze the left side of the chart, you can see that earnings estimates tend to increase leading up to late spring/early summer. However, once the economic boost of warmer weather fades, revisions tend to turn negative as analysts make their fall and winter projections.

For context, analysts and markets are forward-looking. So the upward revisions in February, March, April, etc. reflect expected performance three and six months later. Likewise, the downward revisions in July, September, October, etc. also reflect expected performance three and six months later. Therefore, with the peak summer months soon to be here and gone, bearish estimates for fall and winter should materialize.

Furthermore, while the S&P 500’s price-to-earnings (P/E) ratio has declined, investors haven’t acknowledged the degree to which higher interest rates will slow down corporate earnings. Therefore, while the ‘P’ in the P/E ratio has suffered, weakness in the ‘E’ should help facilitate more downside.

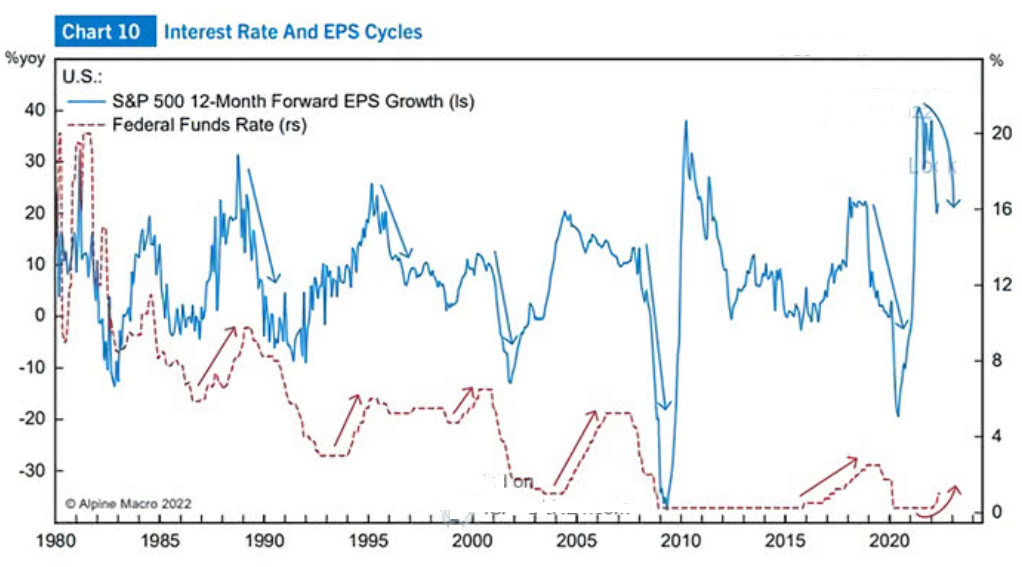

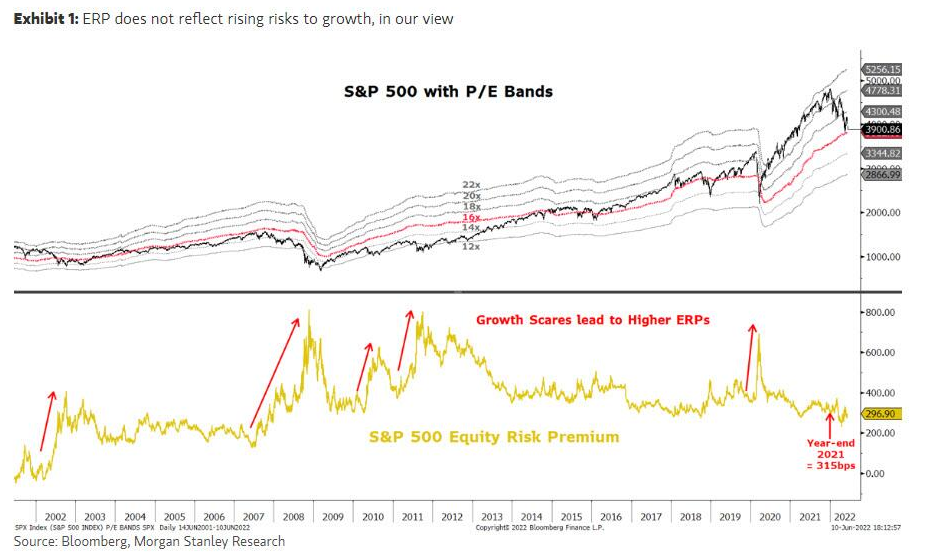

Please see below:

To explain, the blue line above tracks the YoY percentage change in the S&P 500's 12-month forward EPS growth, while the red line above tracks the U.S. federal funds rate. If you analyze the relationship, you can see that increases in the latter often lead to decreases in the former. As a result, with the Fed on a hawkish crusade to crush inflation, higher interest rates mean less disposable income for consumers. Therefore, a material slowdown in corporate earnings should be the next shoe to drop.

In addition, the 'P' isn't out of the woods either. Often, bear market bottoms occur with P/E multiples at 12x to 14x. As evidence, I wrote on Jun. 14:

To explain, the black line at the top half of the chart tracks the S&P 500, while the various bands represent potential prices given forward price-to-earnings (P/E) multiples that range from 12x to 22x. For context, this data was compiled before the sell-off on Jun. 13, but the implications are important.

If you analyze the relationship, you can see that bear market bottoms in 2018 and 2015/2016 occurred near 14x. Moreover, bear market bottoms in 2008 and 2011/2012 occurred near 12x. Therefore, with the current P/E at roughly 16x, there is still room for further downside.

To that point, with the S&P 500 ending the Jan. 15 session at 15.8x – though it’s closer to 15.3x after the Jun. 16 sell-off – there is room for further deceleration. On top of that, inflation is much higher now than during those historical periods. Thus, the 2008 bottom near 12x may be more appropriate.

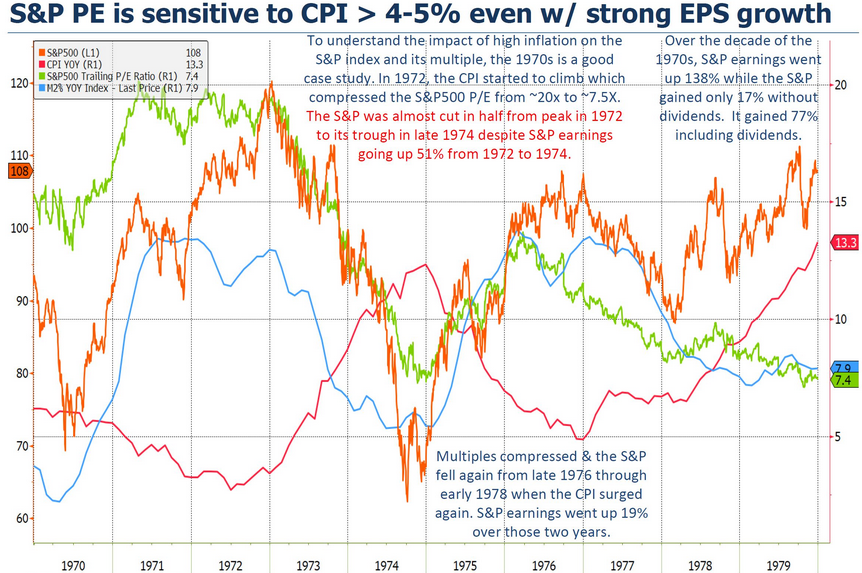

Please see below:

To explain, the orange line above tracks the S&P 500 during the 1970s, while the green line above tracks its trailing P/E. For context, a forward P/E uses analysts’ 12-month earnings estimates, while a trailing P/E uses realized 12-month earnings. Also, the red line above tracks the YoY percentage change in the headline CPI.

If you analyze the divergence, you can see that the orange and green lines declined materially as the red line increased from 1972 to 1975. During that timeframe, the S&P 500’s trailing P/E declined from ~20x to ~7.5x. As a result, history shows that unanchored inflation materially compresses market multiples.

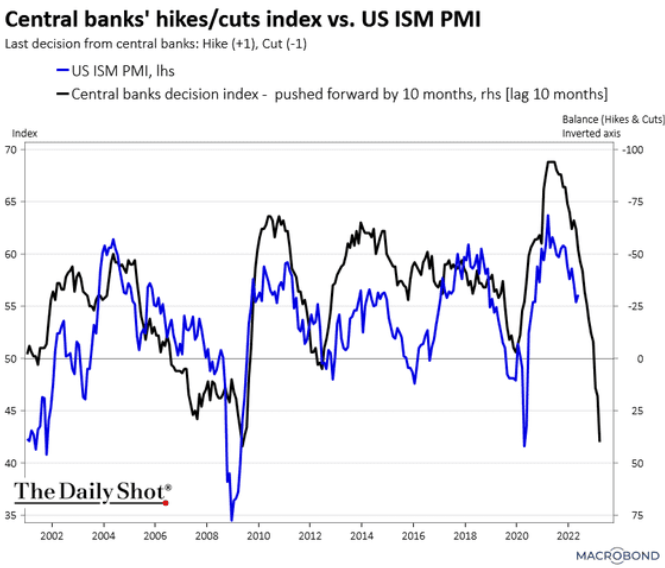

Finally, central banks’ liquidity drains also impact PMIs. For example, Purchasing Managers Index (PMI) surveys are often leading indicators of economic trends. Moreover, when central banks hike interest rates, demand destruction often occurs with a lag. Therefore, while things are relatively smooth now, the future outlook isn’t so optimistic.

Please see below:

To explain, the blue line above tracks the ISM’s U.S. PMI, while the black line above tracks the inverted 10-month forward tally of rate hikes minus cuts. In a nutshell: when the black line is falling, it means that more central banks are hiking rates than cutting rates.

Moreover, if you analyze the relationship, you can see that when hikes materially outpace cuts, the ISM’s U.S. PMI often drops below 50, which indicates a contraction in economic activity. As a result, it’s another indicator of why rate hikes and quantitative tightening (QT) should profoundly impact the U.S. economy and the S&P 500.

The Bottom Line

The performance of the S&P 500 is critical because the GDXJ ETF is highly correlated with the general stock market. Moreover, liquidation-like sell-offs impact all assets, so sharp declines in risk sentiment often culminate in large drawdowns of the PMs – especially mining stocks and silver. In addition, with the Fed’s rate hike cycle poised to uplift the USD Index and U.S. real yields, the PMs’ medium-term fundamental outlooks remain profoundly bearish. As a result, more pain should materialize before long-term buying opportunities emerge.

In conclusion, the PMs rallied on Jun. 16, as commodities outperformed. However, the Fed’s rate hike cycle should suppress demand, stifle the U.S. economy and negatively impact commodities. Thus, while the bulls believe that high inflation is a green light to buy materials and energy, history shows that severe drawdowns occur when the U.S. economy sours.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Jun. 23: S&P Global Composite PMI, KC Fed manufacturing index.

With S&P Global’s data derived from a nationwide survey in June, the growth, employment and inflation results will be early indicators of future government data. In addition, the KC Fed’s results will highlight the growth, employment, and inflation developments in Missouri.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment, and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Technically Speaking

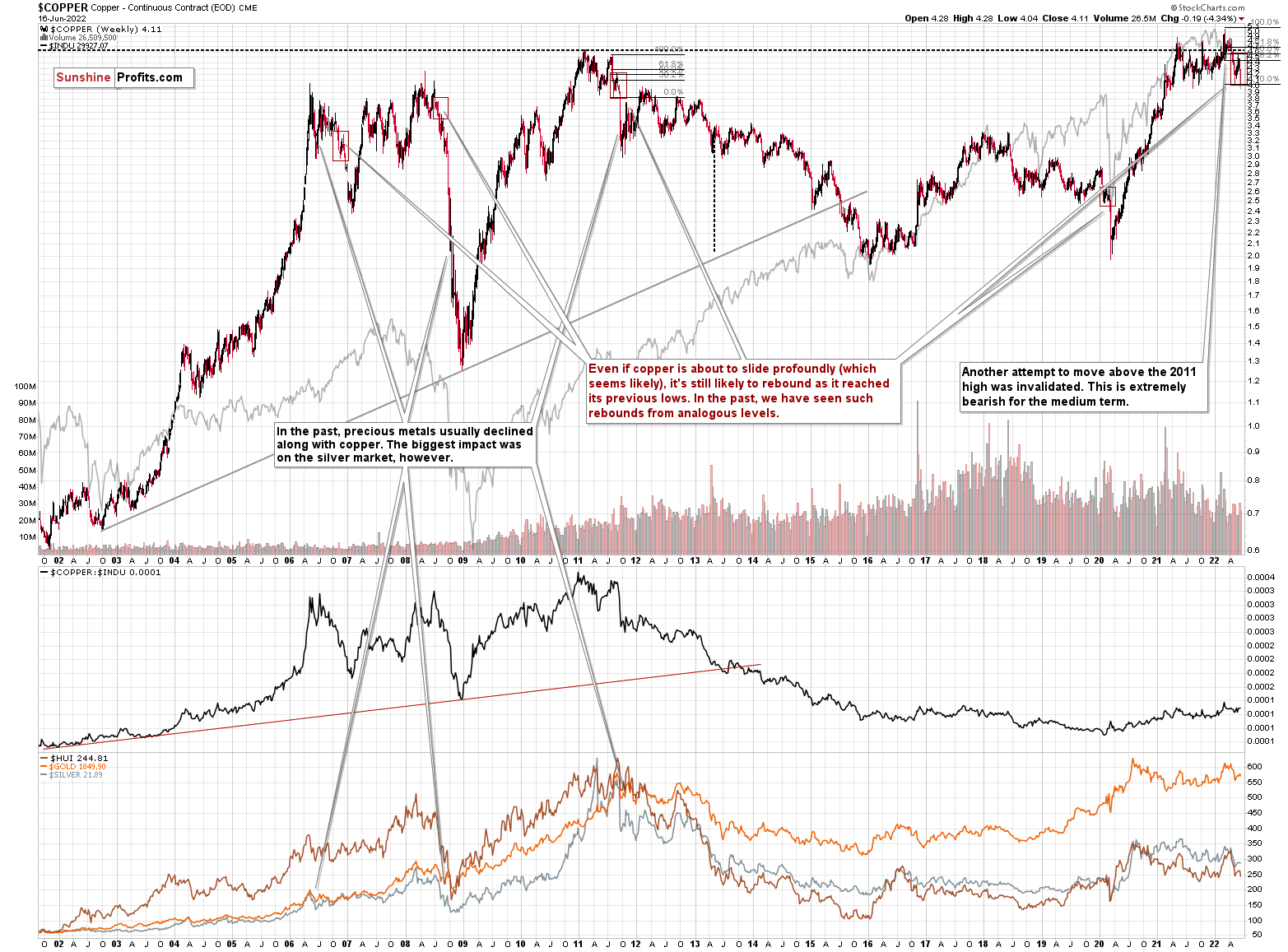

Let’s start today’s technical discussion with a quick check on copper prices.

Practically, everything that I wrote about it last week remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

The interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged. The GDXJ was not trading at the time, so we’ll have to use a different proxy to see what this part of the mining stock sector did.

And since the short-term corrective upswing appears to be over, the copper price is likely about to slide. That’s what happened before previous huge declines as well, and I marked those cases with red rectangles.

Consequently, what we saw recently is just a confirmation of the bearish analogy.

Having said that, let’s check junior miners’ really big picture.

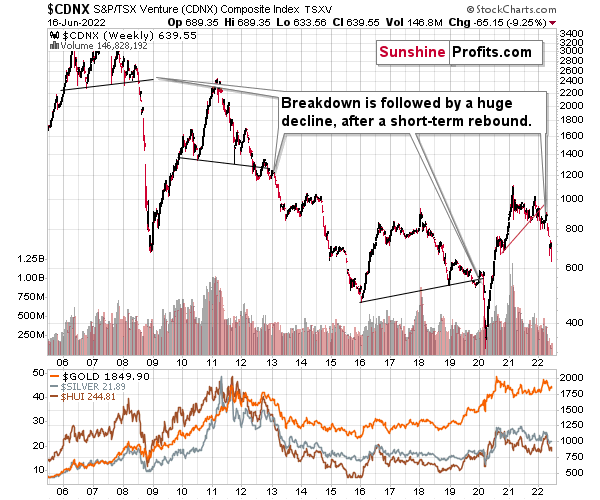

I previously commented on the above chart in the following way:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

The index corrected just like the PMs, but it didn’t change anything with regard to the medium term.

What has happened recently?

Gold declined heavily when the word hit the street that the Fed was going to increase rates by 0.75%, and then it corrected once the rates were indeed increased. That’s normal – markets tend to act on rumors and then reverse on facts. It’s commonly stated that the market buys on rumor and sells on fact, but since we got a bearish indication, we could say that the market sells on rumor and corrects the fact.

This means that the correction that started in mid-May continues. This means that the implications of the above chart haven’t changed. Once gold breaks above (unlikely) or below (likely) the consolidation borders (so, below the May low), it’s then likely to repeat (to a considerable extent) the decline that preceded the consolidation.

A repeat of the preceding decline will imply a move to more or less the 2021 lows, where gold has strong medium-term support. That’s when I think gold’s next interim (not final!) bottom is likely to form. The long-term gold chart explains why gold is likely to fall further, but before I move to it, I would like to remind you that there’s still a war in Europe and gold is not soaring despite it.

On May 20, I wrote the following:

Gold erased almost the entire war-tension-based rally, and it’s now correcting this decline.

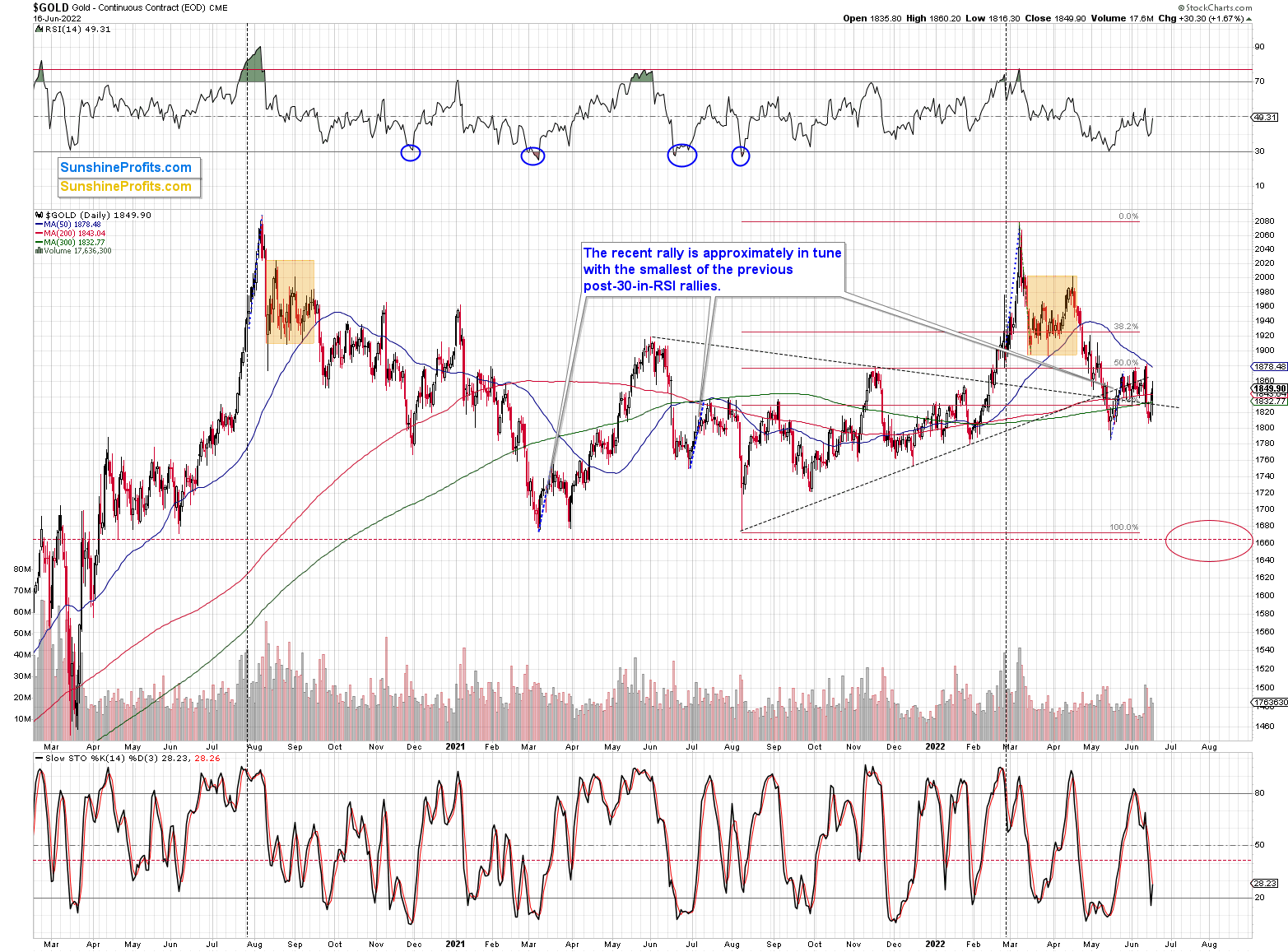

The RSI based on gold’s daily price changes was close to 30, which is a classic short-term buy signal. Based on how much gold usually rallies after this signal, it seems that it hasn’t rallied enough so far.

I marked the smallest rallies that followed an analogous signal with blue, dashed lines, and I copied them to the current situation. They point to gold rising above $1,880 in the near future.

The recent intraday high was $1,878.60 – that’s definitely close enough to the above-mentioned target to mark a top, or at least to say that the analogy to the previous cases has already materialized. Consequently, it’s no longer likely that gold will continue to rally just for the sake of correcting the preceding decline, as it fell too far too fast.

The RSI just moved above 50, and this likely marked the end of the correction, just like it did a few times in early 2021. Moreover, please note that we saw a clear sell signal from the Stochastic indicator.

Before continuing with the analysis of the recent events – since the war-tension-based rally is over – I would like to quote what I wrote about war and gold’s “imminent” price rise at the end of February, when titles like “gold to $3000!” were common on various media sites.

Here's what I wrote on February 28, 2022, in the Gold & Silver Trading Alert entitled “Since There is a War, Gold Will Rise, Right? Wrong.”:

Let’s keep in mind that for gold to decline, the war doesn’t have to end, and it doesn’t have to be won by either side. The only thing that matters with regard to it, is how big the uncertainty and concern are, and the peak uncertainty/concern might be today, as everything is new, and the situation is dramatically changing the geopolitical environment in Europe.

For comparison, remember COVID-19 cases and deaths in early 2020? That was just a tiny fraction of what we saw later. However, it was new and unknown. People were particularly scared then, and the markets moved particularly significantly then – not based on additional millions of cases and thousands of deaths next year.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on rumor and sell the fact. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. And junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

That wasn’t the peak uncertainty - it peaked about a week later, but that’s not crucial. What is crucial is that the war is still taking place (months later), so it seems that one could say that the above proved correct.

Since junior miners just moved to new 2022 lows, it was also profitable not to chase the “emotional stampede”, but rather focus on the analogies to the previous situations from the past. Based on how the situation has developed in the markets so far, it seems that the clearest analogy is to how the gold market performed in 2001, based on the U.S.-Afghanistan war. I provided the chart in my Feb. 28, 2022, analysis, but here it is again:

The decline had been big and sharp, but please note when it ended. Gold formed an initial, and then final, short-term bottom, very close to the price levels at which the rally started before the outbreak of the war.

So, gold corrected, and then it did what it was likely to do based on the previous trends.

That’s exactly what we’re seeing right now. Gold has either completed its correction, or it’s still correcting. However, given the strength of the medium-term downtrend, I wouldn’t expect gold to rally much further or for this rally to take particularly long.

When gold is done correcting, it’s likely to return to its previous trend. This time, the medium-term trend is down.

The major takeaway from this situation is that when things get hot, it’s absolutely necessary to check what happened previously in similar situations before acting based on emotions.

Before looking at mining stocks, let’s take a look at gold from a broader point of view.

Let’s keep in mind that between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet, gold failed to rally to new highs.

In fact, it’s trading very close to its 2011 high, which tells you something about the strength of this market. It’s almost absent.

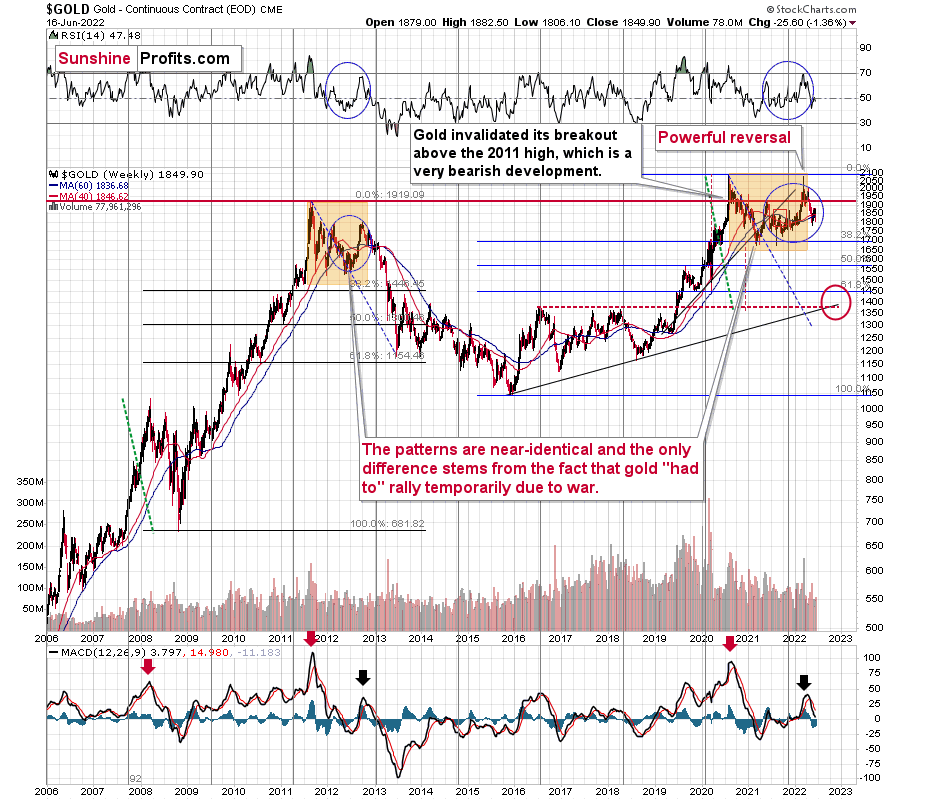

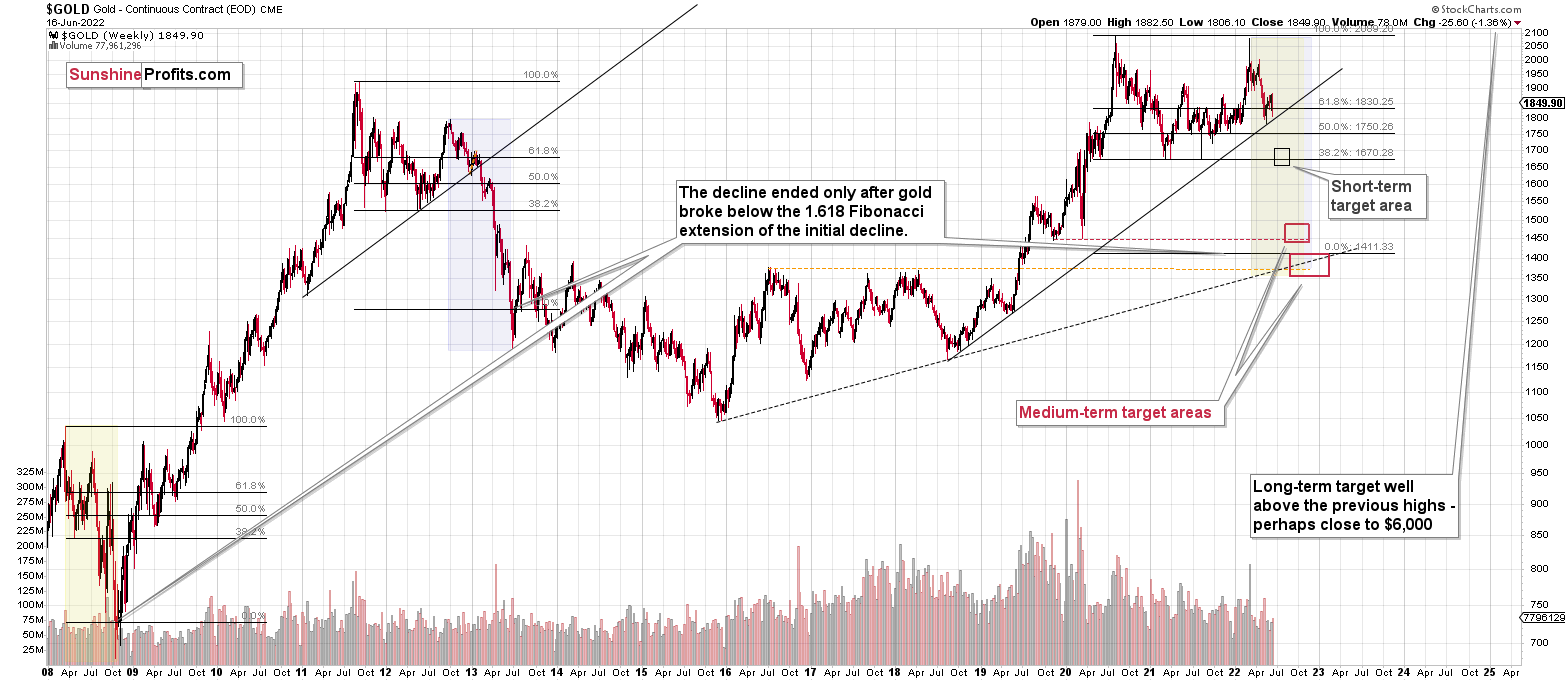

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. The long-term gold price chart below provides details.

It seems that if it weren’t for the war in Europe, gold wouldn’t have been able to move above $2,000 and instead it would have topped close to its previous highs, which provided strong resistance.

The extraordinary thing about that is that that’s exactly what happened in 2012. Gold moved higher but only until it reached its previous highs, which happened in the second half of 2012.

This time the RSI was a bit higher, but it was close to 70, just like what we saw in 2012.

Yes, this time gold moved back to the previous high, but:

- This happened as a result of a geopolitical event (the war in Europe) and geopolitically-driven rallies are generally unsustainable;

- When gold reached its previous highs, it also formed a profound weekly reversal, which formed on huge volume, and that’s very bearish.

So, the current medium-term outlook for gold is very bearish.

There are also very interesting short-term takeaways from the above chart.

If the 2012-2013 is currently being replayed (at least to a significant extent), then let’s not forget that this decline initially took the shape of a back-and-forth decline with lower lows and lower highs (but there were notable short-term rallies within the decline).

One of those counter-trend rallies took place when gold touched its 40- and 60-week moving averages (marked with blue and red) in late 2012. The RSI was trading at about 50 at that time, and that’s more or less when we saw the clear sell signal from the MACD indicator (lower part of the above chart).

Let’s see how this applies to the current situation.

Basically, we saw the same thing. Gold has corrected, as it did in 2012. However, the correction didn’t last very long (it’s just a correction, after all).

Back then, it had ended a bit above the 40- and 60-week moving averages after the RSI moved back close to the 50 level (I mean the second rebound, not the first one). We’re seeing the same thing.

The difference now is that gold declined more in the short term before correcting, whereas back in 2012, it corrected twice. However, let’s not forget that this time the preceding rally was bigger (war tensions), so it’s no wonder that gold had more to correct in a shorter time. Consequently, it seems that the current correction is taking place “instead of” two 2012 corrections.

Anyway, after the correction was over, gold plunged, and the next rebound started once gold moved close to its previous medium-term lows. The analogous lows right now are the 2021 bottoms, which are below $1,700. That’s where I think gold is headed next.

Also, if the situation is now going to be more similar to what we saw in 2008, then we might expect gold to decline faster than in 2013. Silver and mining stocks are likely to be affected even more than gold, though.

Let’s take a look at the silver market.

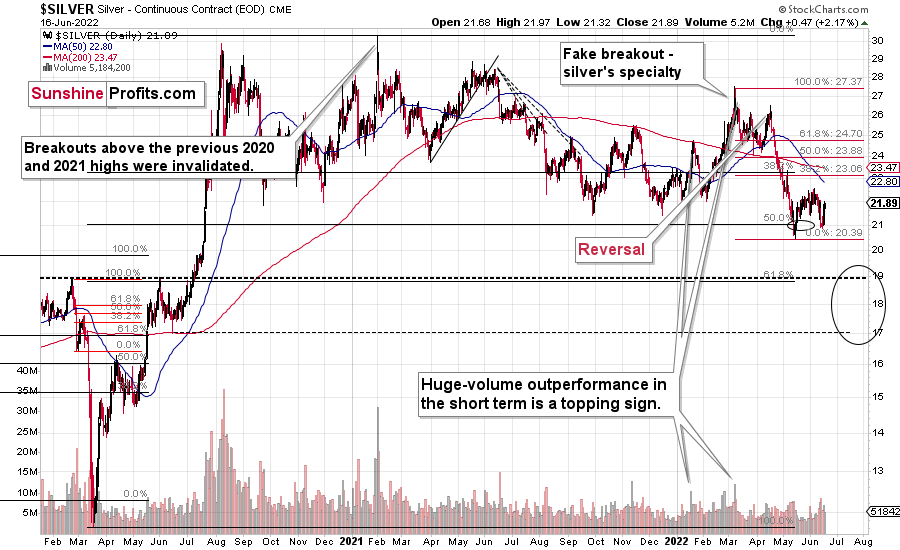

Just like gold, silver hit my target area and then moved slightly below it. Then it rallied, but it could be the case that the rally is already over. In fact, it seems quite likely.

Silver didn’t correct significantly, somewhat in line with what we saw in early 2020. No wonder – the silver market is more correlated with the general stock market, and the latter hasn’t been the top performer recently (except for the very recent run-up).

Why would silver be more aligned with stocks than gold is? Because it has more industrial applications than gold. Therefore, the demand for the white metal is more aligned with how the economy is performing.

How low will silver slide now? Ultimately, I wouldn’t rule out a move to or below the 2020 low, but as far as the next short-term downswing is concerned, the $17-$19 area becomes the likely target. Yes, it’s quite wide, but it really is unclear how silver will perform now.

The support provided by the 2020 highs and the 61.8% Fibonacci retracement based on the entire 2020-2021 rally is very strong. However, this support is not that much below the current price levels, and if gold and miners are about to more or less repeat their recent declines (and stocks do too), then silver could also repeat its previous decline. In this case, it would be likely to fall below the above-mentioned support.

The next support is provided by the mid-June 2020 low (~$17).

Please note that silver recently outperformed gold on a very short-term basis, which was an indication that the rally is over or about to be over. Lower silver prices are likely to follow.

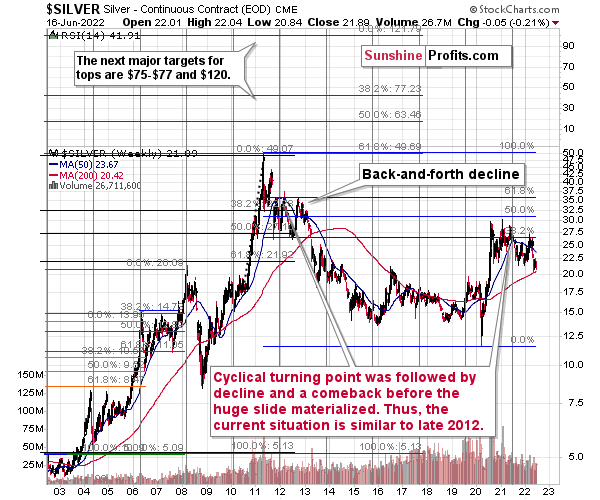

Let’s not forget that gold is not the only precious metal that is repeating its 2012 performance right now, and you can see more details on silver’s long-term chart.

As you can see on the above chart, silver corrected about 50% of the previous downswing, and this correction ended at about $30, a long time ago. Ever since, silver has been declining, and even the outbreak of war in Europe didn’t make silver rally above that level.

On the above chart, you can see how silver first topped in 2011, then declined and formed another top at the cyclical turning point. Next, it declined once again – to the previous lows. After that, silver rallied (in 2012 and 2022), and it topped between its 50-week moving average (marked in blue) and the previous top. Now silver is declining in a back-and-forth manner (you can see it more clearly on the previous short-term silver chart).

Back in 2012, these were just the early days of a gargantuan decline, and the same appears likely to be the case this time. Interest rates are going up after all, and the Fed is determined to quench inflation.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Besides, please note that silver didn’t even manage to rally as much as copper (which tried to move to new highs recently) or most other commodities, thus being rather weak.

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in junior mining stocks.

In short, it’s now trading about $1 lower than it traded a week ago. The longer version is that my June 14 comments remain up-to-date:

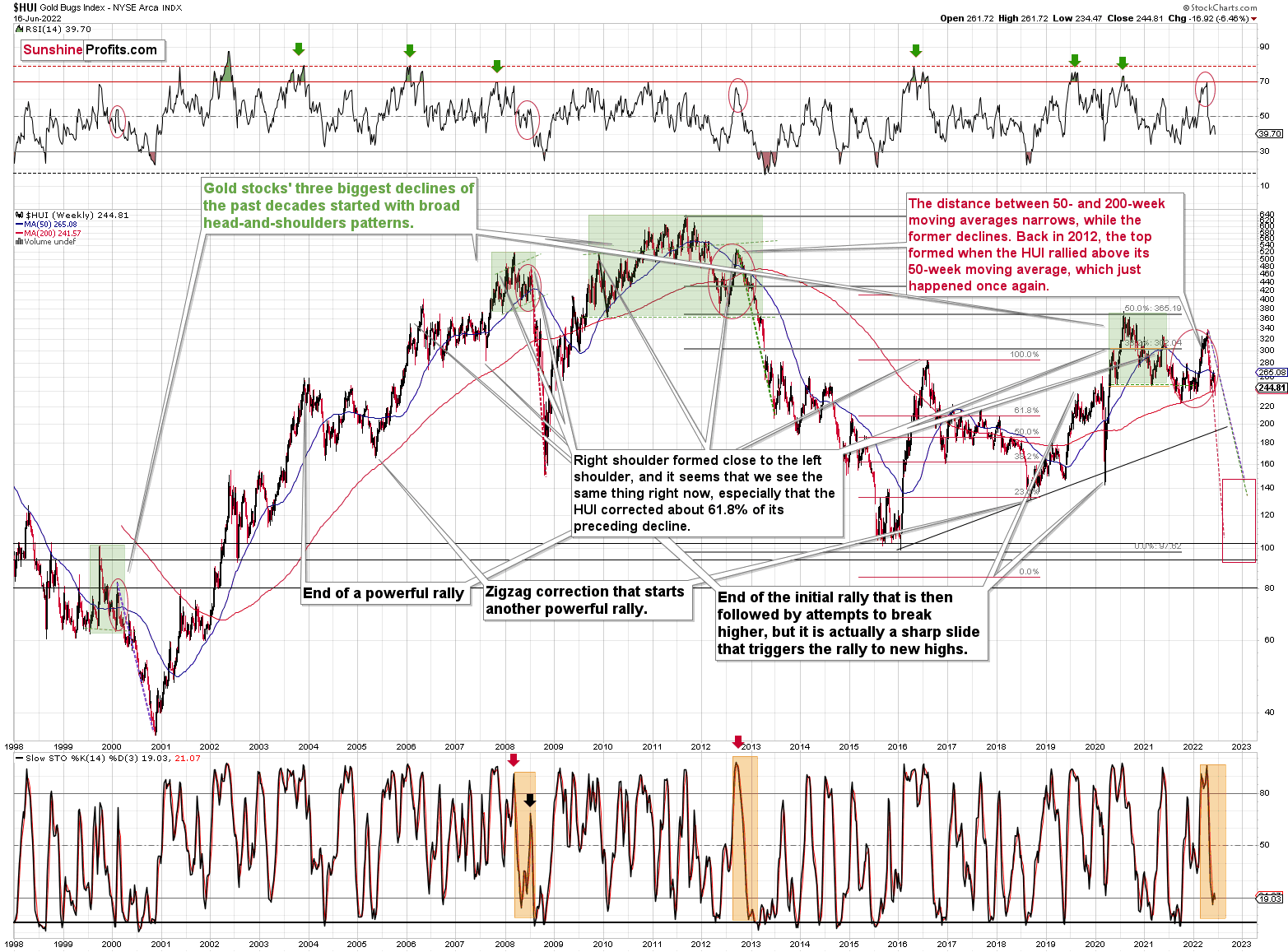

First, let me emphasize that gold stocks are declining similarly to how they did in 2008.

The Russian invasion triggered a rally, which was already erased, and if it wasn’t for it, the self-similarity would be very clear (note the head-and-shoulders patterns marked with green). Since the latter happened, it’s not as clear, but it seems that it’s still present. At least that’s what the pace of the current decline suggests.

I used a red dashed line to represent the 2008 decline, and copied it to the current situation. They are very similar. We even saw a corrective upswing from more or less the 200-week moving average (red line), just like what happened in 2008.

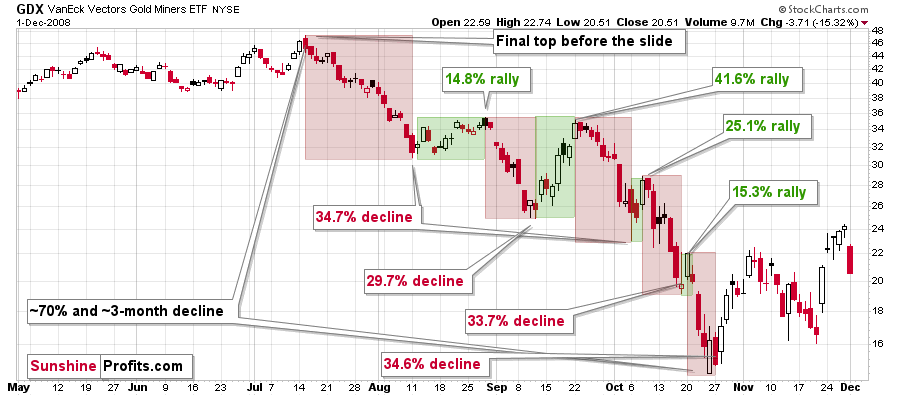

All right, let’s zoom in and see how mining stocks declined in 2008.

Back then, the GDXJ ETF was not yet trading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and it erased about 70% of the miners’ value. The biggest part of the decline happened in the final month, though.

However, the really interesting thing about that decline – that might also be very useful this time – is that there were five very short-term declines that took the GDX about 30% lower.

I marked those declines with red rectangles. After that, a corrective upswing started. During those corrective upswings, the GDX rallied by 14.8-41.6%. The biggest corrective upswing (where GDX rallied by 41.6%) was triggered by a huge rally in gold, and since I don’t expect to see anything similar this year, it could be the case that this correction size is an outlier. Not paying attention to the outlier, we get corrections of between 14.8% and 25.1%.

The interesting thing was that each corrective upswing was shorter (faster) than the preceding one.

The first one took 12 trading days. The second one took seven trading days. The third one took 2 trading days, and the fourth and final one took just 1 trading day.

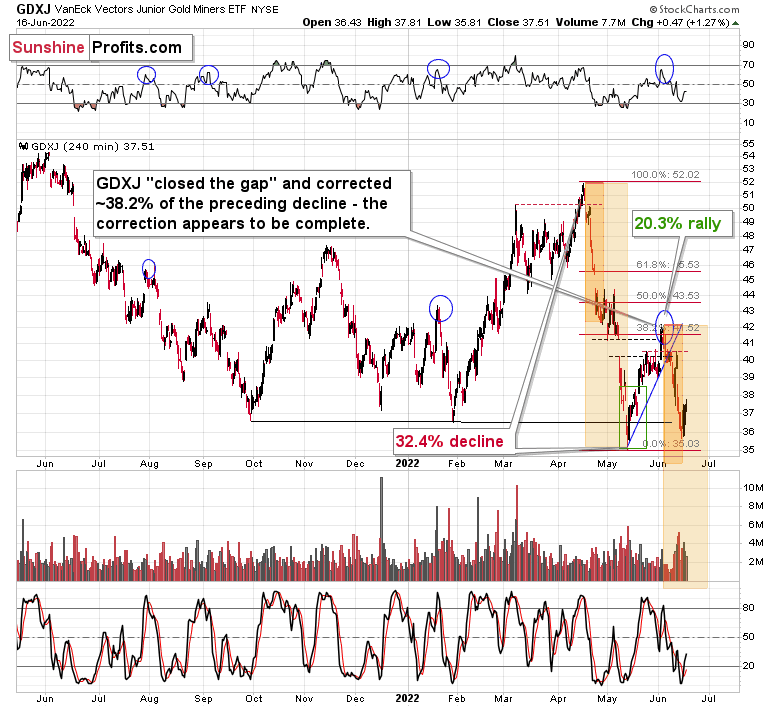

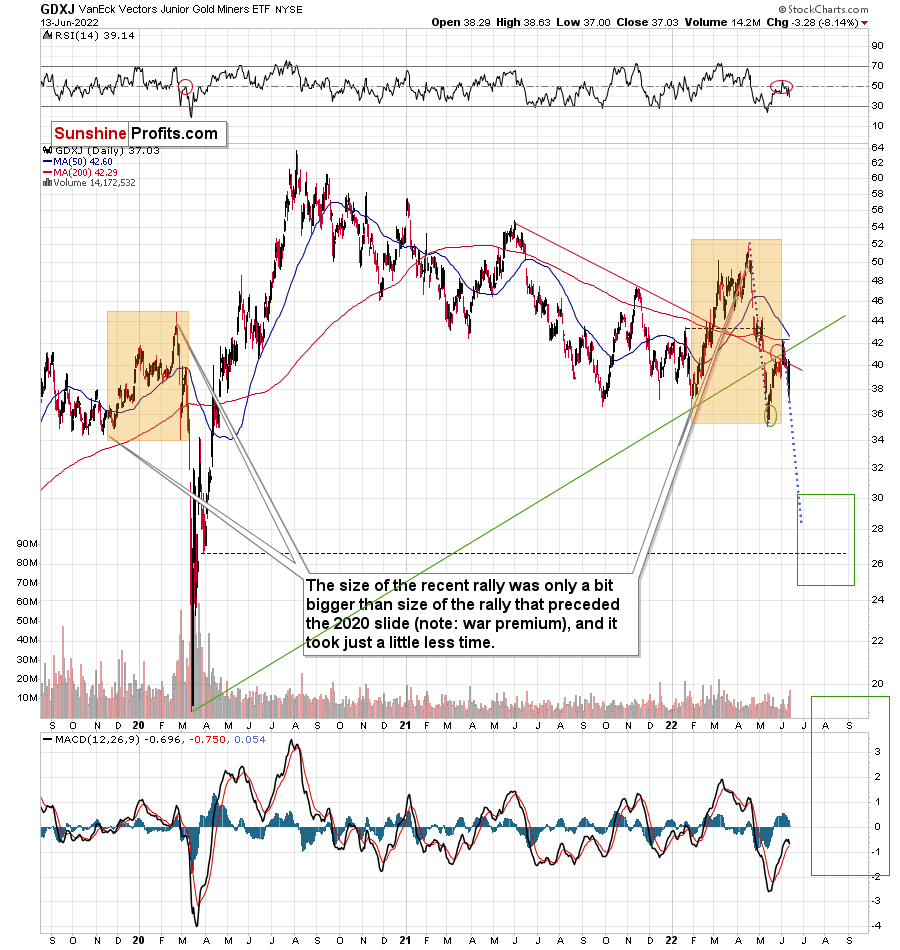

Fast forward to the current situation. Let’s take a look at the GDXJ ETF.

The GDXJ ETF declined by 32.4% and then corrected – it rallied by about 20.3%. The corrective upswing took 14 trading days.

The above is in perfect tune with the previous patterns seen in the GDX during the 2008 slide.

What does it tell us? It indicates that history can be rhymed, and while it will not be identical, we should pay attention to the indicators that worked in 2008. The next corrective upswing (a notable one, that is) might start when the GDXJ ETF declines by about 29-35% from its recent top. To clarify, I don’t claim that the above technique would be able to detect all corrective upswings, or that I aim to trade all of them. For instance, in my view, it was a good idea to enter a long position on May 12 and switch to a short position on May 26, but I wasn’t aiming to catch the intraday moves.

GDXJ could also decline a bit more than 29-35%, as let’s keep in mind that previous statistics are based on the GDX ETF and we are discussing the GDXJ here, and the latter is likely to decline even more than GDX as juniors are more correlated with the general stock market (and the latter is likely to slide).

So, let’s say that the GDXJ might decline between 29% and 40% from the recent high before triggering another notable corrective upswing (one that could take between 5 and 10 trading days based on how long the last one took and how big those corrections were in 2008).

The recent high was formed with the GDXJ ETF at $42.19. Applying the above-mentioned percentages to this price provides us with $24.78-29.32.

Now, is there any meaningful support level in this area that could stop the decline?

Yes!

The late-March 2020 low is at $26.62, and it provides significant short-term support within the analogy-based target area.

Additionally, the above corresponds – more or less – to the size of the decline that would match the size of the April-May decline. It would be only somewhat bigger.

Let’s keep in mind that gold stocks don’t necessarily move on their own, but rather move along with gold. So, if gold moves to its strong medium-term support provided by the 2021 lows and then starts a brief rally, the same action would be likely in mining stocks.

Here Comes the Replay

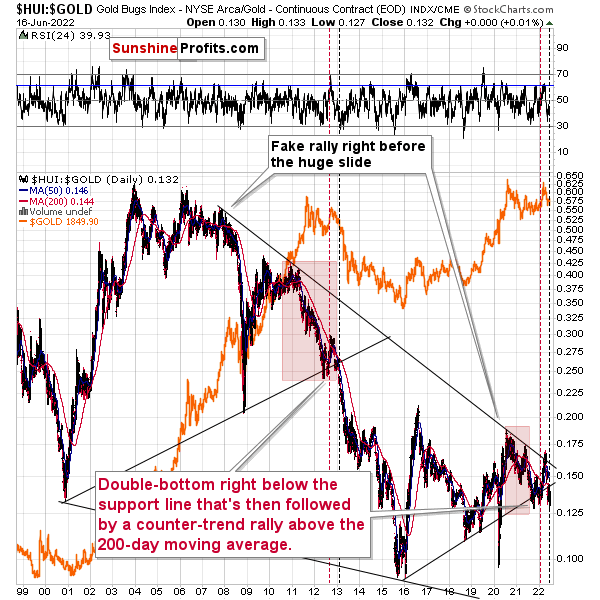

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI to gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

If the history is to rhyme, we’re about to see a profound decline.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices of gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… stocks) and that’s exactly what’s likely to happen.

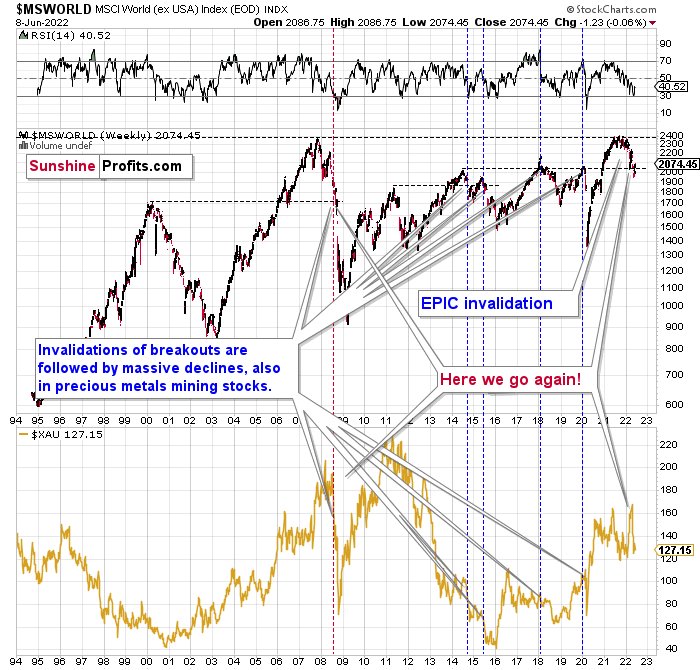

The technical picture in the case of world stocks remains extremely bearish, and my previous comments on it were just confirmed. Here’s what I’ve been writing about the above chart for quite a few weeks now:

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high they managed to do so, and… failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium - and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not a “logarithmic” scale. You probably still remember how significant and painful (if you were long, that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

World stocks have declined below their recent highs, and when something similar happened in 2008, it meant that both stocks and gold and silver mining stocks (lower part of the chart) were about to slide much further.

The medium-term implications for mining stocks are extremely bearish.

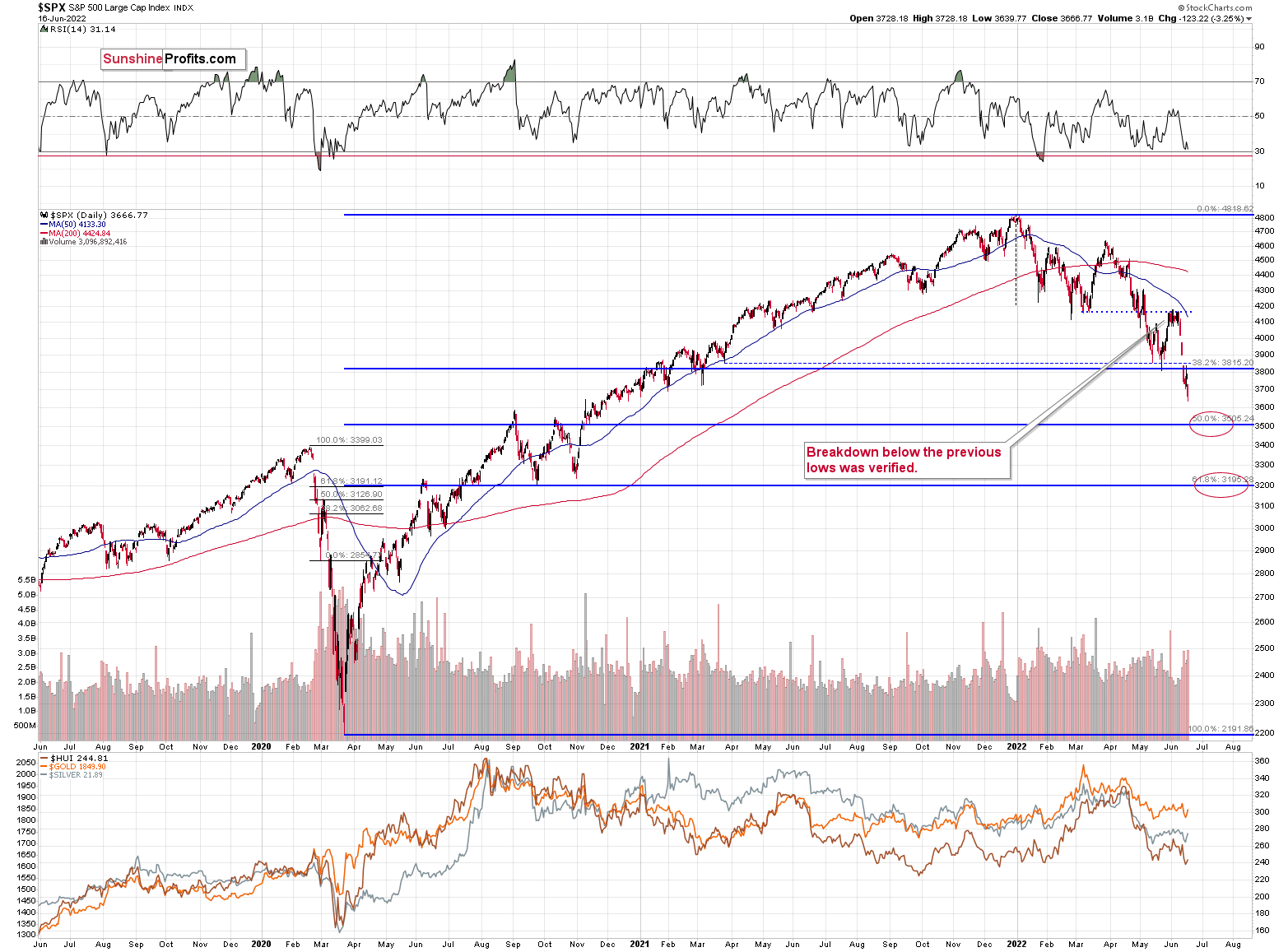

Let’s take a look at the U.S. stock market.

Stocks verified their breakdown below the Q1 2022 low and then they declined. They broke below the May low, and they corrected a bit after the rate hike announcement, but they didn’t invalidate the breakdown. This means that the breakdown is almost fully confirmed.

The S&P 500 is unlikely to fall below 3,700 this week due to specific positioning in the options market, but it may do so next week.. At the time of writing these words, the S&P 500 futures are trading at around 3,704.

A weekly close below the May lows would be a very bearish indication for the following days and weeks, and as investors have more time to digest this critical information, their willingness to sell in the following week would likely grow.

The implications for the precious metals market, especially for silver and mining stocks, are very bearish.

From a broader point of view, let’s keep in mind what happened in the previous cases when stocks declined profoundly – in early 2020 and in 2008. Miners and silver declined in a truly epic manner, and yes, the same is likely to take place in the following months, as markets wake up to the reality, which is that the USD Index and real interest rates are going up.

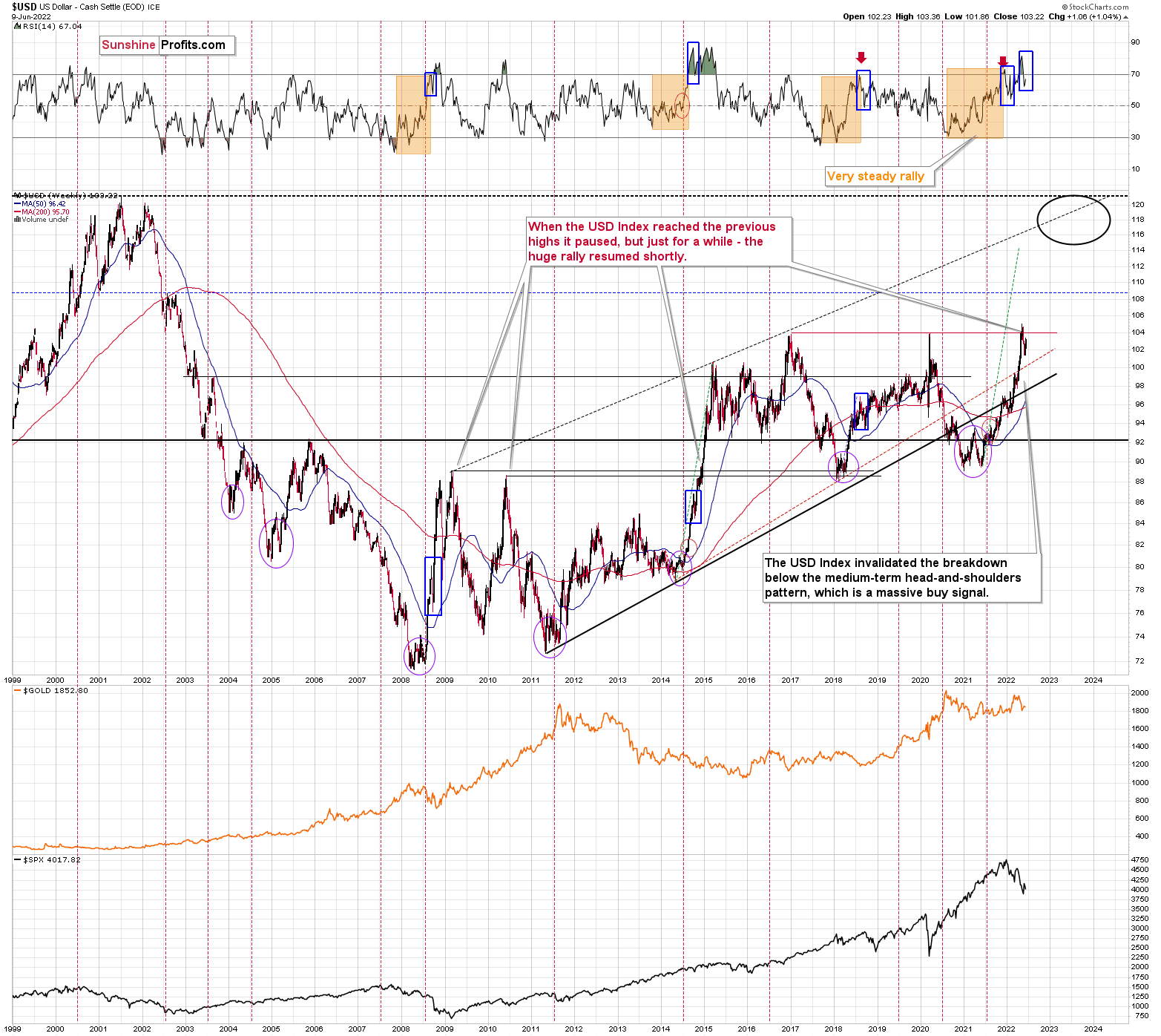

Speaking of the USD Index, after invalidating the breakout below the multi-year head-and-shoulders pattern, the USDX was poised to soar, just like I’ve been expecting it to do for more than a year, and that’s exactly what it did.

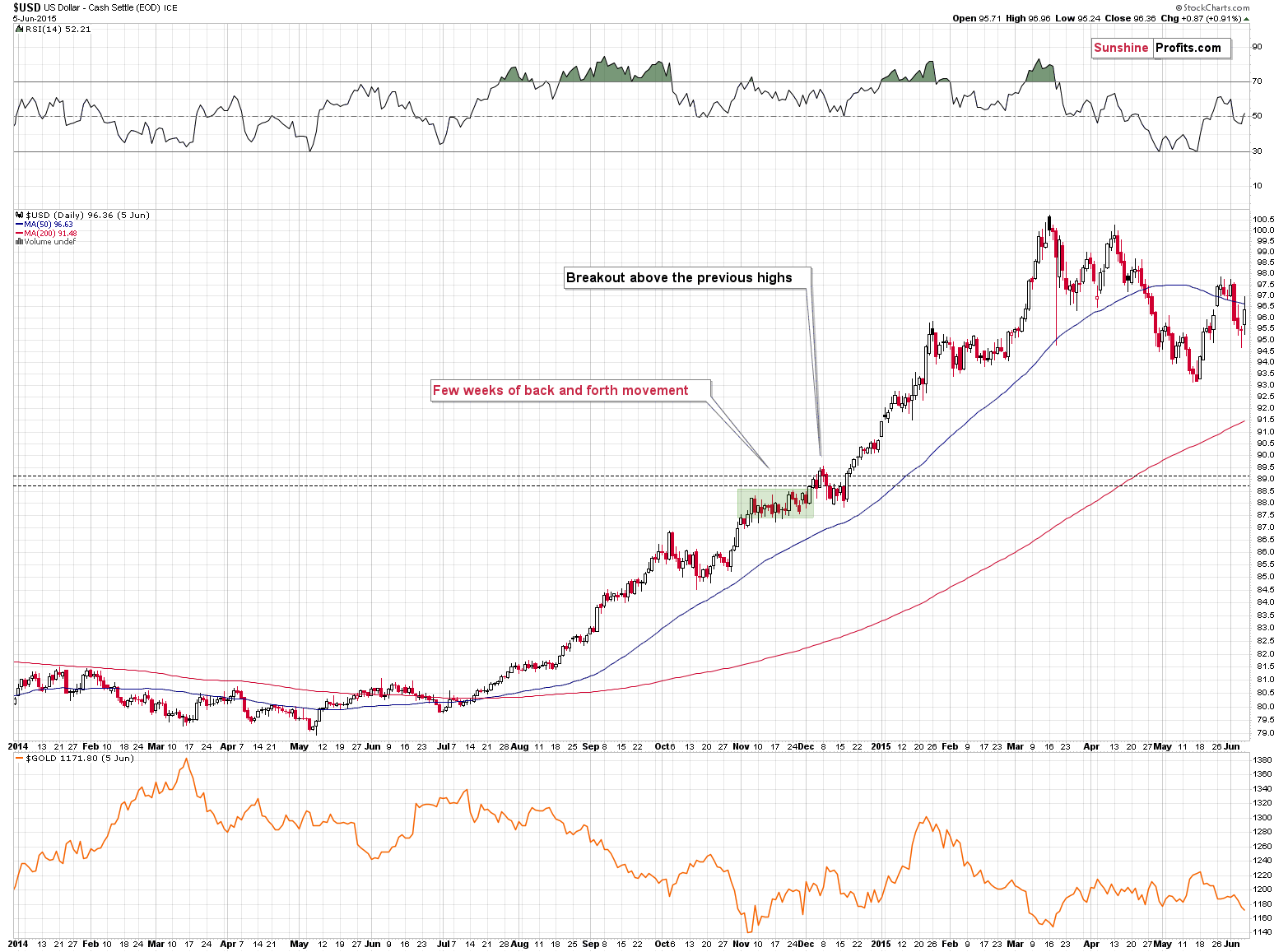

The RSI is currently slightly below 70, but since the USDX is in a medium-term rally and is already after a visible correction, it can rally further. Please note that we saw the same thing in 2008 and 2014. I marked the corrections with blue rectangles.

Back in 2014, the USD Index invalidated the breakout above the previous major highs, but then it soared once again, ignoring the invalidation. Consequently, I’m not taking the recent invalidation at its face value.

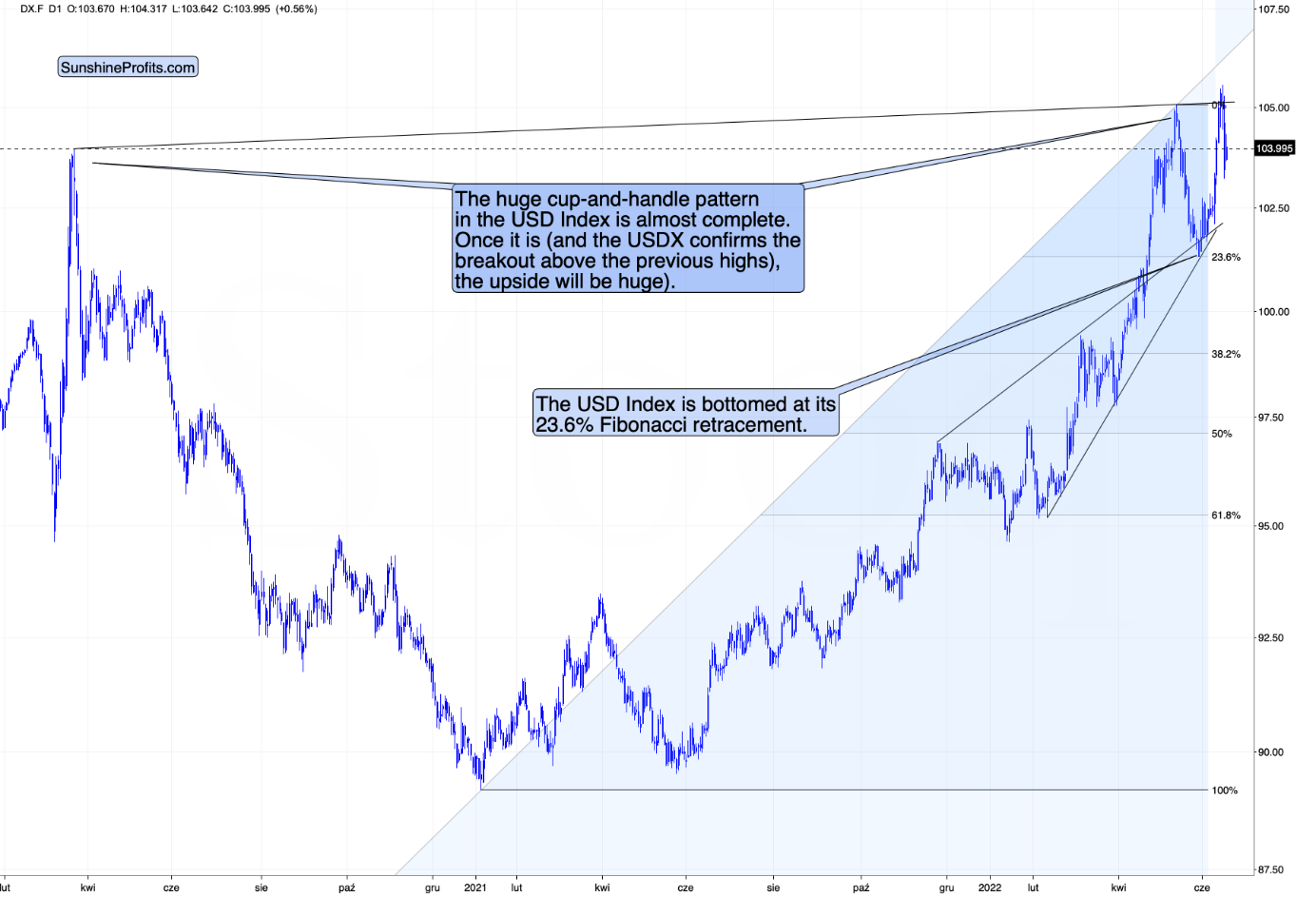

From the short-term point of view, we see that the USD Index’s correction was actually a handle of a massive cup-and-handle formation. Once we see a confirmed breakout above the recent highs, the USD Index is likely to soar based on this formation.

Interestingly, based on this week’s decline, the USD Index is forming a cup-and-handle pattern as a part of the handle of the bigger pattern. This doesn’t change anything – once the USD Index confirms a breakout above the previous highs, both cup-and-handle patterns will be completed, and the value of the USD Index will be very likely to soar.

However, even if the USD Index moves slightly lower here, it’s likely to rally significantly in the following weeks and months.

The opposite is likely to take place in the precious metals sector. Gold, silver, and mining stocks are likely to decline profoundly in the following months, even if they move slightly higher here.

Consequently, in my view, the risk-to-reward ratio strongly favors short positions in junior mining stocks at this time.

Naturally, as always, I’ll keep you – my subscribers – informed.

Overview of the Upcoming Part of the Decline

- It seems to me that the very-short-term rally in the precious metals market is either over or very close to being over. It’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

- We’re likely to (if not immediately, then soon) see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Q: Thanks for keeping us updated. In your previous analysis, you mentioned that gold historically bottoms 3.5 months (on average) after the S&P 500 is picked. We are now six months after the S& P500 was picked, and it does not appear that gold bottoms, according to your analysis. Secondly, it also seems that true gold value should be $400 less than today's level based on the US dollar and real yield. Is it possible that the gold market sees through the Fed bullshit and already prices a pivot after the election? It appears that the US needs a rate below inflation to inflate their way out of the massive debt issue it has.

A: You’re very welcome.

Yes, I did previously mention that there were cases when gold bottomed about 3.5 months after stock market tops. However, as you noted, this pattern was not present during this decline.

In general, not every analogy can be materialized, simply because there are too many of them and because – of course – not every situation is 100% identical. The thing here is that other powerful analogies (especially in gold and the HUI Index, as well as the ratio between them) to 2012-2013 and 2008 are being repeated, and this prolonged the current decline pattern in gold.

Moreover, it’s likely that the war in Europe delayed the decline, as gold was practically forced to rally because of it.

Moving to the second point, I would frame it differently. The market probably thinks it sees through the Fed’s BS, thinking that it’s bluffing and that it will reverse the rates shortly. In my opinion, this time the Fed is not joking, and the reason is that the voters are now more concerned with inflation than with anything else. Since we have elections, it’s practically guaranteed that the pressure on the Fed will be to deal with what the public is most concerned with.

Also, please note that thanks to the introduction of cryptocurrencies, the powers that be now have an alternative to inflating the debt.

What if the interest rates soar so much that they trigger defaults, massive unemployment, etc., and the prices are still high? What will the people demand then that the authorities do? Somehow “fix” the situation, right? What if the authorities then say:

Well, we tried our best, and we always did what was our job and what you (the public) expected of us. We helped you through the pandemic with extra cash and low rates, and then we fought the inflation just as you wanted. However, apparently, this “money system” just doesn’t work, and you can see it with your own eyes! In order for things to change, we need to change it. That’s why, in order to fix this broken situation, we are introducing the CryptUS (I just made it up; if something like that already exists somewhere, it’s a coincidence) – the U.S. official cryptocurrency, which will be controlled through “official means”. Non-gov’t cryptos are too volatile and don’t provide enough stability – the narrative would go.

The debts would be revalued in one way or another, but given how chaotic everything would get based on this change, it would be easy to get away with it without much blame.

There would be some backlash, of course, but as long as the media provided a good narrative for it (we’re moving toward the future, finally!), most people would likely accept it. And those who wouldn’t, would have to use it anyway, as it would be too inconvenient not to.

This would have some useful implications, like it wouldn’t be possible to use money provided to the less fortunate as support to buy alcohol, etc., but it could also be used to keep the opposing politicians or voters of the “other” parties in check. “You didn’t vote for us? Whoosh goes the magic monetary wand, and your money is now worth 30% less. Consider re-thinking your choices next time.”

This would be a good starting point for a much longer debate (or a book), and it goes beyond the scope of this publication. My point here is that due to cryptocurrencies being so popular recently, the powers that be now have other options than just inflating the debts.

How does it translate into our current trading positions? It doesn’t. If the above happens (or something similar), it would be only after the public is more concerned with the consequences of fighting inflation than with inflation itself, and/or if people are literally, massively, getting out on the streets (riots, etc.). For now, we’re still relatively early (in my view) in the rate-hiking cycle.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is either over or close to being over. In fact, it’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

I previously wrote that the profits from the previous long position (congratulations once again) were likely to further enhance the profits on this huge decline, and that’s exactly what happened. The profit potential with regard to the upcoming gargantuan decline remains huge.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Friday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief