-

Is This the British Pound's Running Correction, or a Reversal?

December 18, 2019, 7:57 AMGBP/USD

The cable has made a sizable spurt higher, breaking above a technical resistance that has been stopping its progress in many recent sessions. Yet GBP/USD has then declined several sessions in a row. What is going on?

Although GBP/USD extended gains and climbed above the upper border of the rising green trend channel, the 61.8% Fibonacci retracement stopped the buyers. A pullback at the end of the previous week followed.

The downside action took the exchange rate back into the trend channel, thus invalidating the earlier breakout. This is certainly a bearish development - especially when we factor in the sell signals generated by the daily indicators.

Let's take a closer look at the daily chart. It shows that the pair has approached the lower border of the blue consolidation and the green support zone created by the upper border of the purple consolidation and the previous peaks. This zone could inspire the buyers to a rebound attempt in the very near future.

However, should we see reliable signs of their weakness, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, USD/JPY and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Swiss Franc Is Going from Strength to Strength, Seemingly Unstoppable

December 17, 2019, 9:31 AMUSD/CHF

The Swiss franc certainly appears to be in high demand lately but can it keep strengthening? With today's candle being a bearish one, it seems one question too many. But let's take a thorough look at the situation for what it is.

USD/CHF moved lower once again earlier today, which brought about a breakdown below the lower border of the blue consolidation.

While this is a bearish development, the day is far from over, and the green support zone combined with the 61.8% Fibonacci retracement continues to keep declines in check.

Therefore, it's reasonable to expect a rebound from this area as long as there's no daily close below the mentioned supports. This is especially the case when we factor in the currently oversold and ripe-for-recovery position of the daily indicators.

Connecting the dots, should we see reliable signs of a potential reversal, we'll consider opening long positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

About Those Euro Bulls Dusting Themselves Off After Friday...

December 16, 2019, 10:24 AMEUR/USD

After a sharp upswing, the euro bulls met an equally strong response on Friday. They're staging a comeback today though - what are the chances of it sticking?

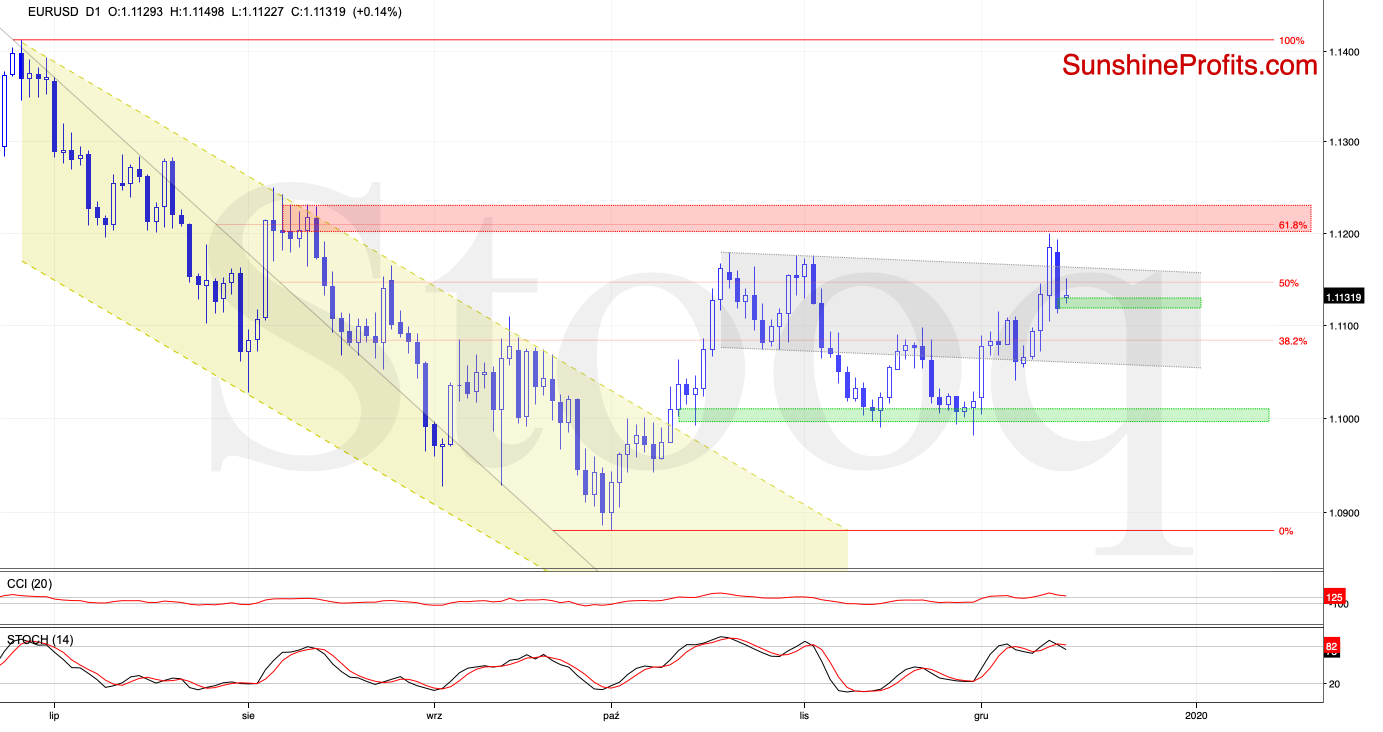

Let's recall our Friday's observations:

(...) The exchange rate has approached the red resistance zone that is created by the August peaks and the 61.8% Fibonacci retracement. Coupled with high readings of the daily indicators, this increases the likelihood of a reversal in the coming week.

The situation has indeed turned out as per the above, and EUR/USD moved sharply lower on Friday. This decline resulted in invalidation of the earlier breakout above the upper border of the declining grey trend channel. It also erased the entire pair's gain from Thursday.

While these are bearish developments, the exchange rate opened today with the green gap, which suggests upcoming improvement and a likely test of the previously-broken upper border of the grey channel in the coming day(s).

However, the extended position of the daily indicators suggests that even if we see such price action, the space for further gains is limited and another attempt to move lower is just around the corner.

Therefore, if the bulls fail to break above the trend channel, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in USD/JPY and USD/CAD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Australian Dollar At an Important Juncture

December 13, 2019, 10:21 AMAUD/USD

It can be certainly said that AUD/USD has surprised on the upside recently. Having reached several important resistances, and attempting breakout above them, what else can be said about the pair's current and upcoming performance?

Let's remember our yesterday's observations regarding the AUD/USD price action:

(...) A rebound followed, taking the pair sharply up right to the medium-term declining resistance line, which could trigger a reversal in the very near future however.

Nevertheless, taking into account the lack of the sell signals, another upswing and a test of the next declining resistance line can't be ruled out.

Again, AUD/USD has moved higher yesterday, in line with our expectations. The pair moved above the resistance line, and broke above the late-October and early-November peaks, which is a bullish development.

This is especially so when we take into account the fact that the exchange rate also broke above the orange resistance area created by both the 38.2% Fibonacci retracement (in red) and the 61.8% Fibonacci retracement (in green).

The bulls however didn't manage to hold gained ground, and the previously broken green line based on the October lows encouraged the sellers to act.

As a result, the exchange rate pulled back earlier today and invalidated the earlier breakout above the previous peaks and the 61.8% Fibonacci retracement. This suggests that a reversal and lower values of AUD/USD may be just around the corner.

The daily indicators haven't flashed any sell signals however. This means that a retest of the green line based on the October lows at the beginning of the coming week can't be ruled out.

Should we see reliable signs of the bulls' weakness, we'll consider going short.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CHF. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Euro Bulls Are Eyeing the Resistance Ahead

December 12, 2019, 8:14 AMEUR/USD

After Friday's downswing on the heels of strong U.S. jobs data, the euro has rebounded higher. And quite sharply so. Yesterday's FOMC also added to the bonfire. What shall the bulls look forward for?

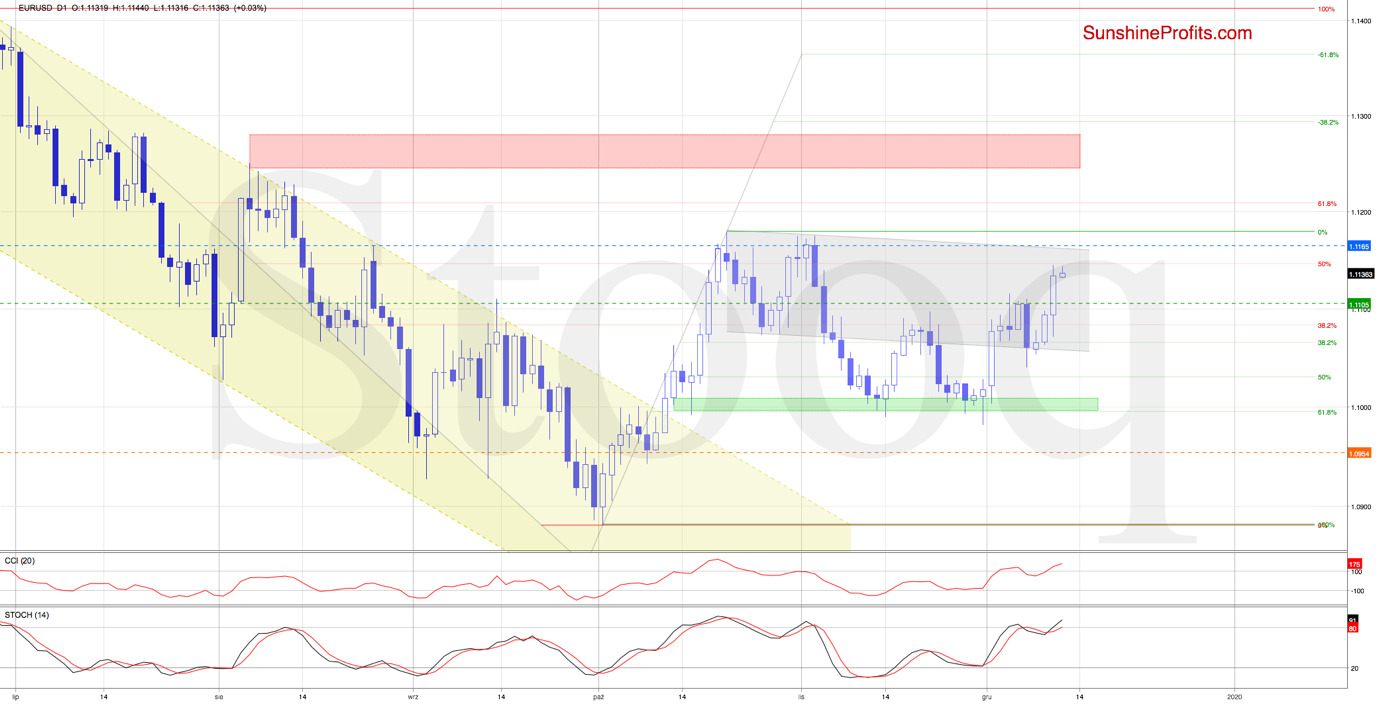

In our last commentary on this currency pair, we wrote:

(...) the pair pulled back a bit earlier today - but it still keeps trading inside the blue consolidation.

As there are no sell signals by the daily indicators, one more attempt to move higher may be just around the corner.

The situation has indeed developed in line with the above, and EUR/USD has staged an upside reversal recently.

Earlier today, the pair had been trading around yesterday's peak. Combined with the lack of the daily indicators' sell signals, it increases the probability that we'll see a test of the upper border of the grey declining trend channel in the very near future.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD, USD/JPY, USD/CAD, USD/CHF and also AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM