-

Timing the Exit in the USD/CAD Fierce March Higher

November 13, 2019, 7:21 AMUSD/CAD

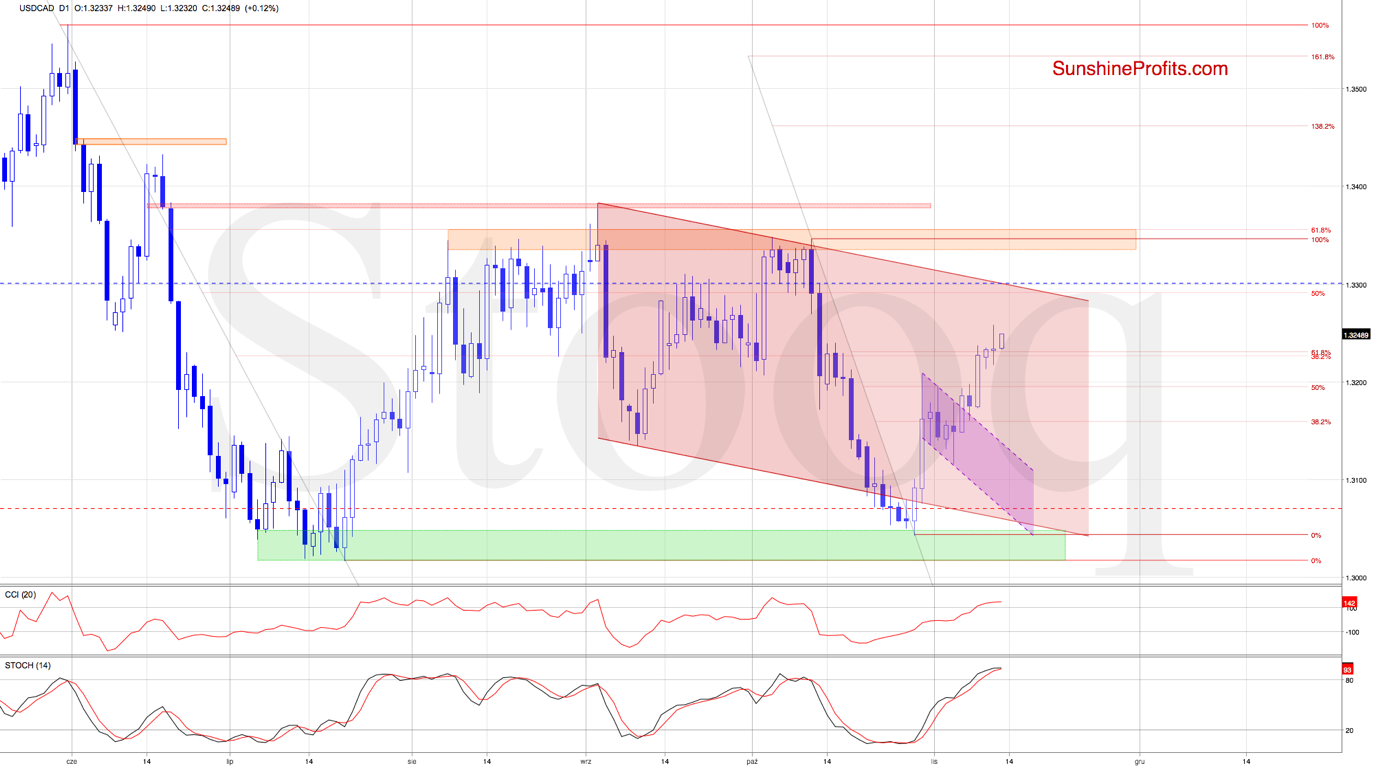

We've discussed the loonie on Friday, just when the pair spiked higher. What has happened with our profitable open position since then? Have the bulls been able to add to their gains even more?

These were our Friday's observations:

(...) Yesterday brought us verification of the breakout above the declining purple trend channel, suggesting that higher values of USD/CAD are just around the corner.

Should we see the pair rise from here, the first target for the bulls will be the last week's peak and then the 61.8% Fibonacci retracement (at around 1.3232).

The situation indeed developed in tune with the above, and USD/CAD overcame not only the late-Oct high, but also the 61.8% Fibonacci retracement, making our long positions even more profitable.

Despite the pair pulling back yesterday, the bulls managed to keep the price action above the previously broken retracements . This suggests that yesterday's drop could be nothing more than verification of the earlier breakout.

Should it be the case, the way to the 50% Fibonacci retracement (based on the entire May-July decline) or even the upper border of the declining red trend channel may be open.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Assessing the Likelihood of Another Bullish Surprise in USD/CHF

November 12, 2019, 9:26 AMUSD/CHF

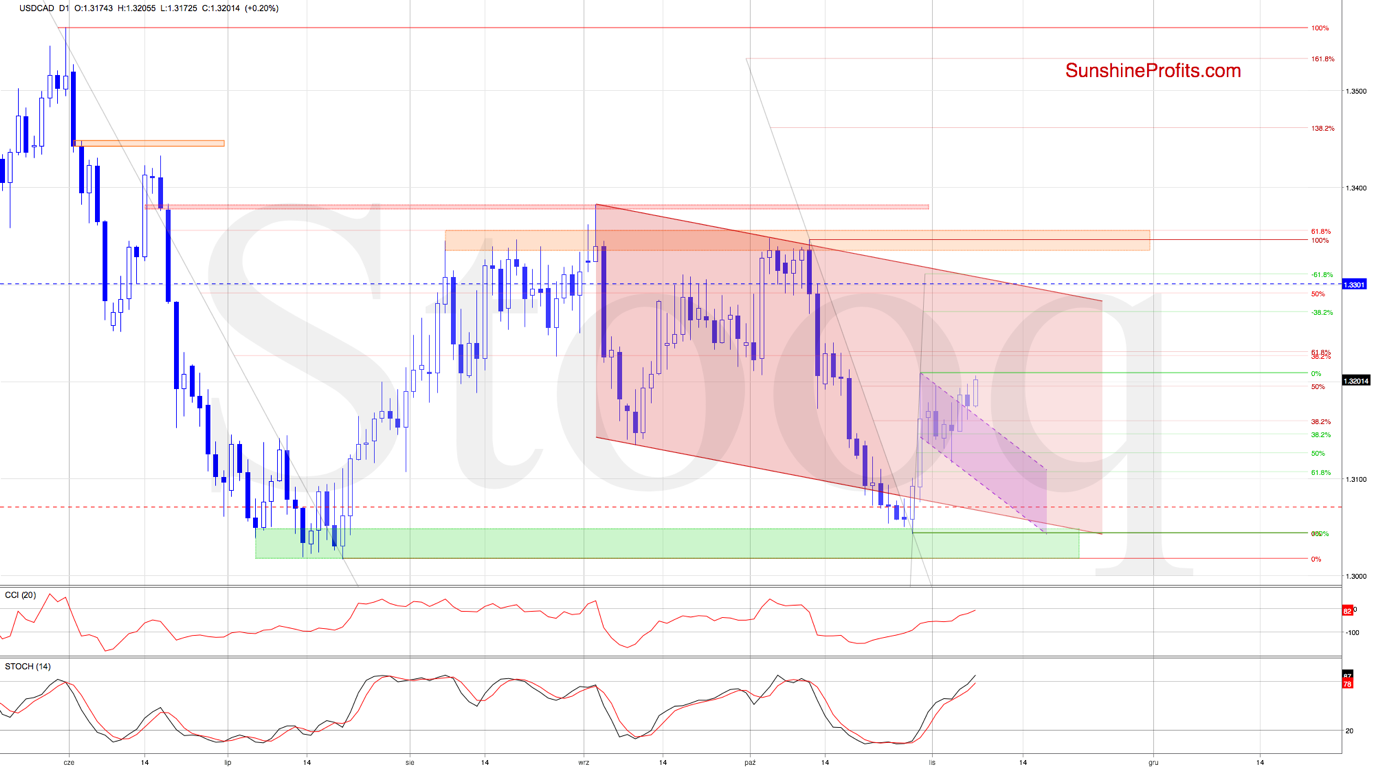

Our Thursday's analysis covered USD/CHF at the moment of its bumping into the upper border of the declining red trend channel. The pair went on to break above this resistance, yet plunged yesterday. Similarly to the end of last week, can the bulls deliver yet another surprise shortly?

USD/CHF has risen recently, all the way up to the upper border of the rising green trend channel. But its proximity encouraged the sellers to act.

As the pair moved sharply lower, its earlier breakouts above both the 61.8% and the 50% Fibonacci retracements have been invalidated.

The bulls didn't give up however, pushing the pair higher earlier today. Can they succeed in their efforts?

Looking at the current extended position of the daily indicators, and the upper border of the rising green trend channel, it seems that reversal and lower values of the exchange rate are just around the corner.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and AUD/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

In the Battle of Two Dollars, the Loonie Seems to Be on the Defensive

November 8, 2019, 7:39 AMUSD/CAD

Since rising from its lows in late October, the pair has been consolidating with a downward bias. Attempts to push higher were rejected, but in recent days, the exchange rate spiked higher. Can the bulls sustain their gains?

On Tuesday, we wrote that USD/CAD:

(...) remains trading inside the very short-term declining purple trend channel. It suggests that the next target for the sellers may be the lower border of the formation and the 50% Fibonacci retracement slightly below.

As long as there is no daily close below these supports, a reversal and another attempt to move higher should not surprise us.

The situation developed in tune with the above, and the exchange rate sharply erased almost the entire preceding decline. Yesterday brought us verification of the breakout above the declining purple trend channel, suggesting that higher values of USD/CAD are just around the corner.

Should we see the pair rise from here, the first target for the bulls will be the last week's peak and then the 61.8% Fibonacci retracement (at around 1.3232).

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Will the USD Leave Swiss Franc in the Dust?

November 7, 2019, 10:27 AMUSD/CHF

Since October, USD/CHF has been mostly trading within the declining red trend channel. No breakdown or breakout attempt has made it far. The pair is now bumping into the upper border of the said trend channel. Time for a breakout, or is downside action more likely?

Let's dive right into the chart below (chart courtesy of www.stooq.com ).

Recently, USD/CHF bounced off the green support zone once again, and came back to the upper border of the declining red trend channel on Tuesday.

While this is a bullish development, the bulls couldn't break above this resistance in any of the following days, similarly to the end of October.

We saw another attempt to move higher earlier today, but the 50% Fibonacci retracement stopped the buyers for the second time in a row. It suggests that another reversal in the very near future should not surprise us.

Therefore, should we see another daily close inside the trend channel, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/JPY. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

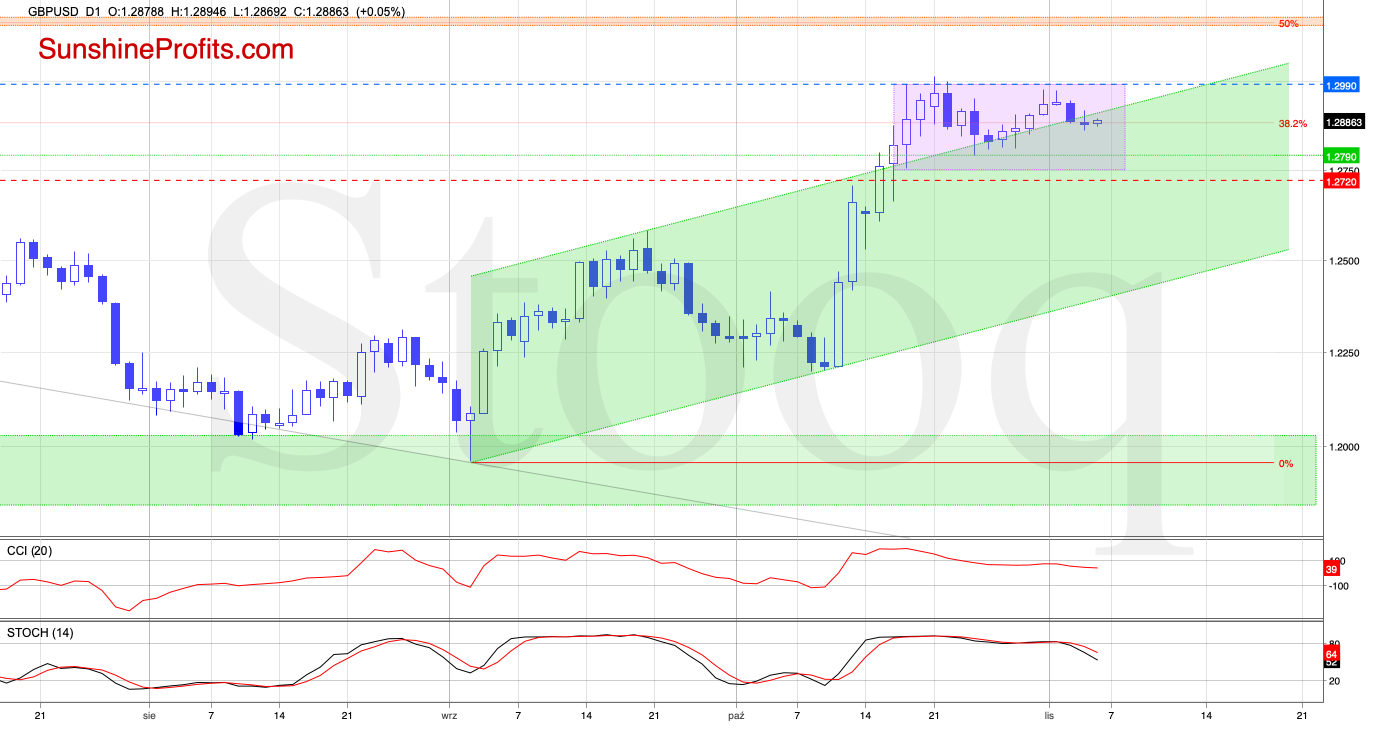

British Pounds' Consolidation: Calm Before the Storm

November 6, 2019, 10:04 AMGBP/USD

The combination of the previous peaks and the upper border of the purple consolidation triggered a pullback, taking GBP/USD below the previously broken upper border of the rising green trend channel.

While this is a bearish sign, the overall situation in the short term remains almost unchanged as the pair is still trading inside the purple consolidation and well above the Oct. 24 low.

Therefore, one more attempt to move higher may be just around the corner - especially when we take into account the short-term situation in the USD Index, as discussed further on.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD, AUD/USD and the USD Index. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Free Gold &

Forex Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM