In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.6909; the initial downside target at 0.6808)

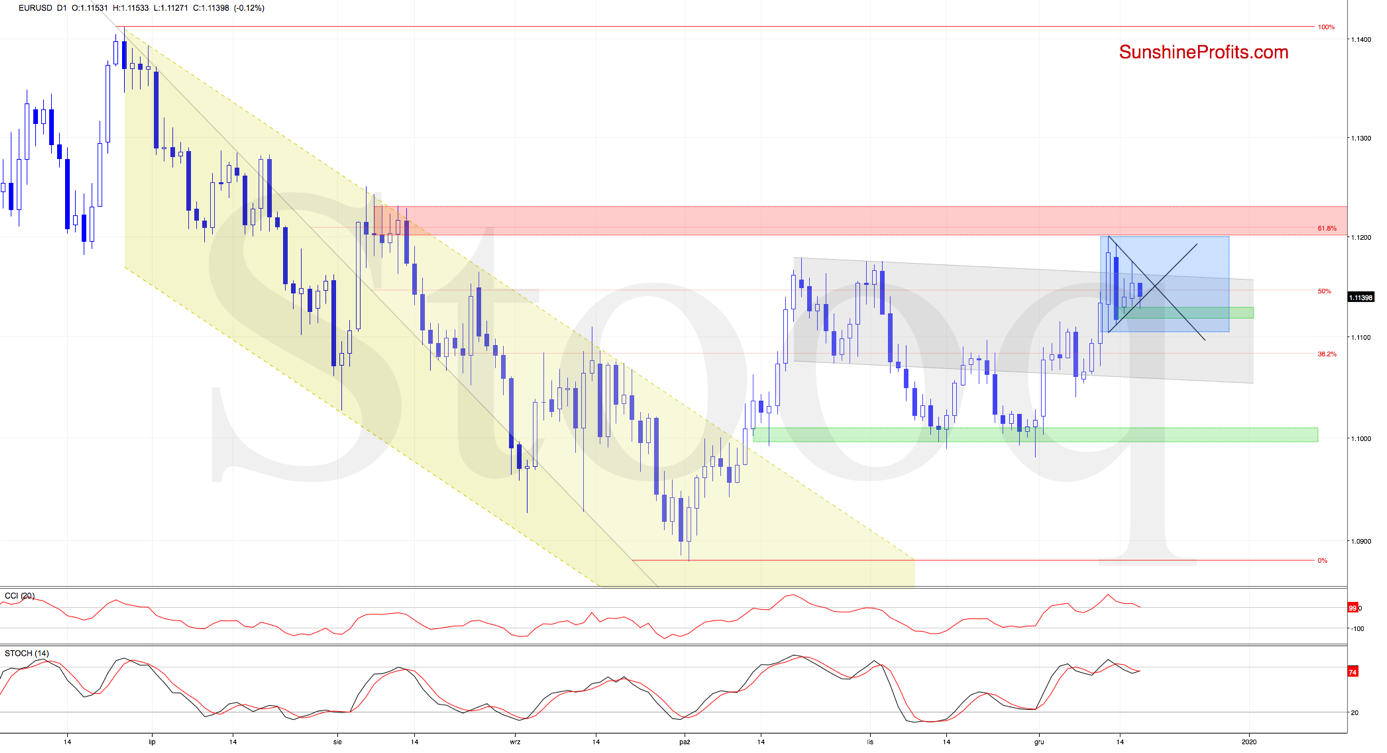

EUR/USD

The overall short-term situation hasn't changed much as EUR/USD is still trading both inside the blue consolidation and the black triangle. This is slightly above the green gap created on Monday.

As long as there is no breakout above the upper border of the formation or breakdown below its lower border, another bigger move is questionable.

However, the bearish position of the daily indicators suggests that lower values of the exchange rate are just around the corner. This bearish scenario will be even more likely and reliable if the sellers manage to close the green gap formed at the beginning of the week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

GBP/USD

The cable has made a sizable spurt higher, breaking above a technical resistance that has been stopping its progress in many recent sessions. Yet GBP/USD has then declined several sessions in a row. What is going on?

Although GBP/USD extended gains and climbed above the upper border of the rising green trend channel, the 61.8% Fibonacci retracement stopped the buyers. A pullback at the end of the previous week followed.

The downside action took the exchange rate back into the trend channel, thus invalidating the earlier breakout. This is certainly a bearish development - especially when we factor in the sell signals generated by the daily indicators.

Let's take a closer look at the daily chart. It shows that the pair has approached the lower border of the blue consolidation and the green support zone created by the upper border of the purple consolidation and the previous peaks. This zone could inspire the buyers to a rebound attempt in the very near future.

However, should we see reliable signs of their weakness, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

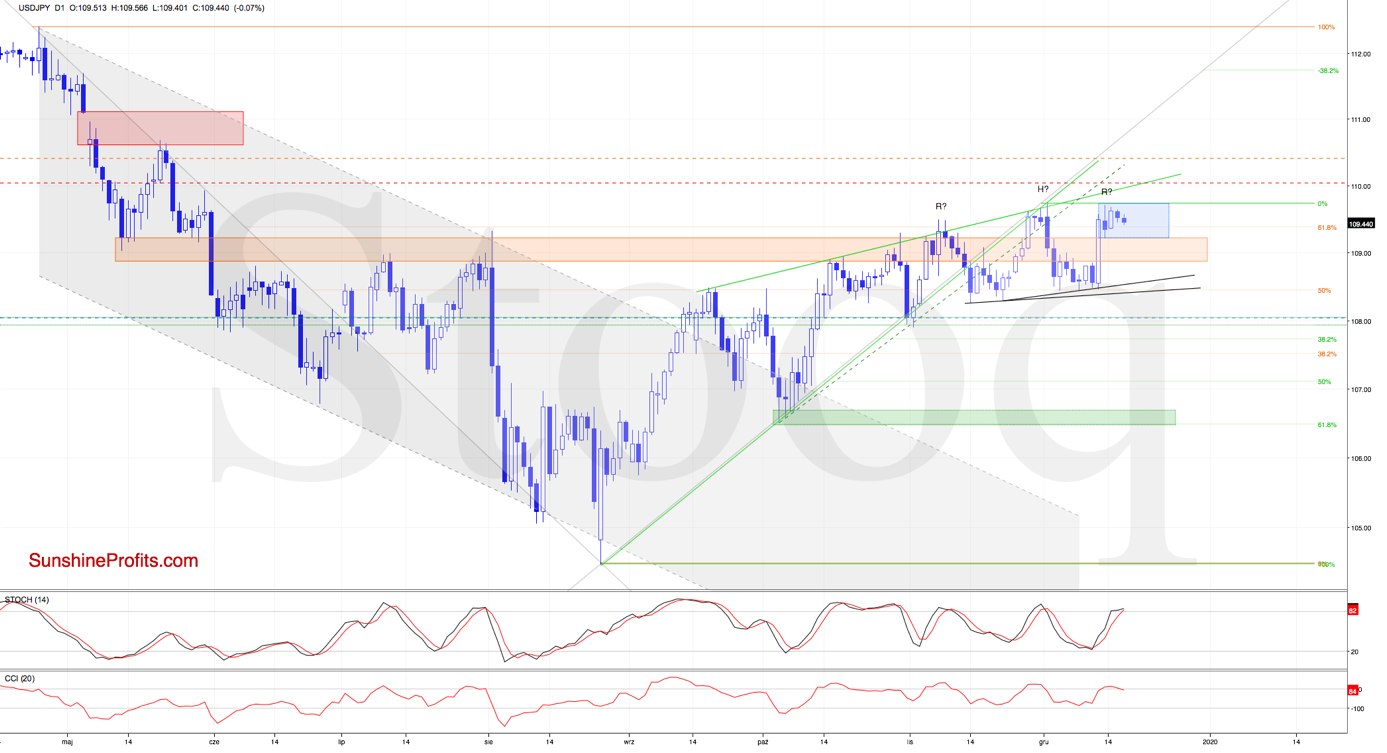

USD/JPY

USD/JPY's short-term situation hasn't changed since our last commentary. The pair keeps trading inside the blue consolidation slightly below the recent peaks and below the rising green wedge.

Let's quote our Monday's observations as it is still up-to-date also today:

(...) the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by last week's lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.40 and the initial downside target at 108.04 are justified from the risk/reward perspective.

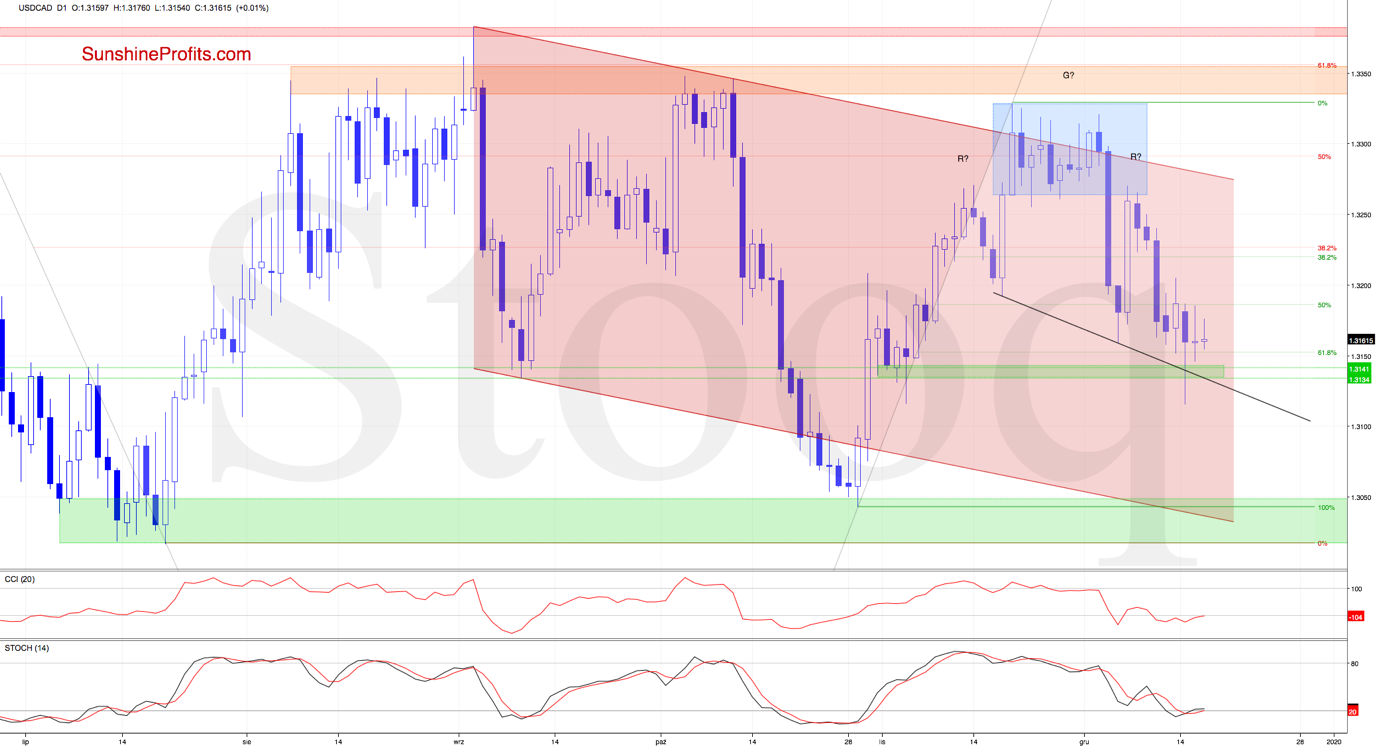

USD/CAD

Let's recall our Monday's words:

(...) USD/CAD has indeed extended losses and tested the above-mentioned support area - in line with our expectations.

The pair's price action has also reached the potential neck line of the head-and-shoulders formation, which means that if the bulls manage to hold it, the probability of reversal would increase.

Although USD/CAD moved below the said neck line (marked in black on the above chart) after our Alert was posted, this deterioration turned out only temporary. Before the day was over, the exchange rate returned to trade not only above the black line, but also above the previously broken green support zone that is based on the early-November lows.

Such an invalidation of an earlier breakdown is a bullish development. Additionally, the Stochastic Oscillator generated its buy signal, while the CCI is very close to doing the same. These events suggest that higher values of USD/CAD may be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist