In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.6909; the initial downside target at 0.6808)

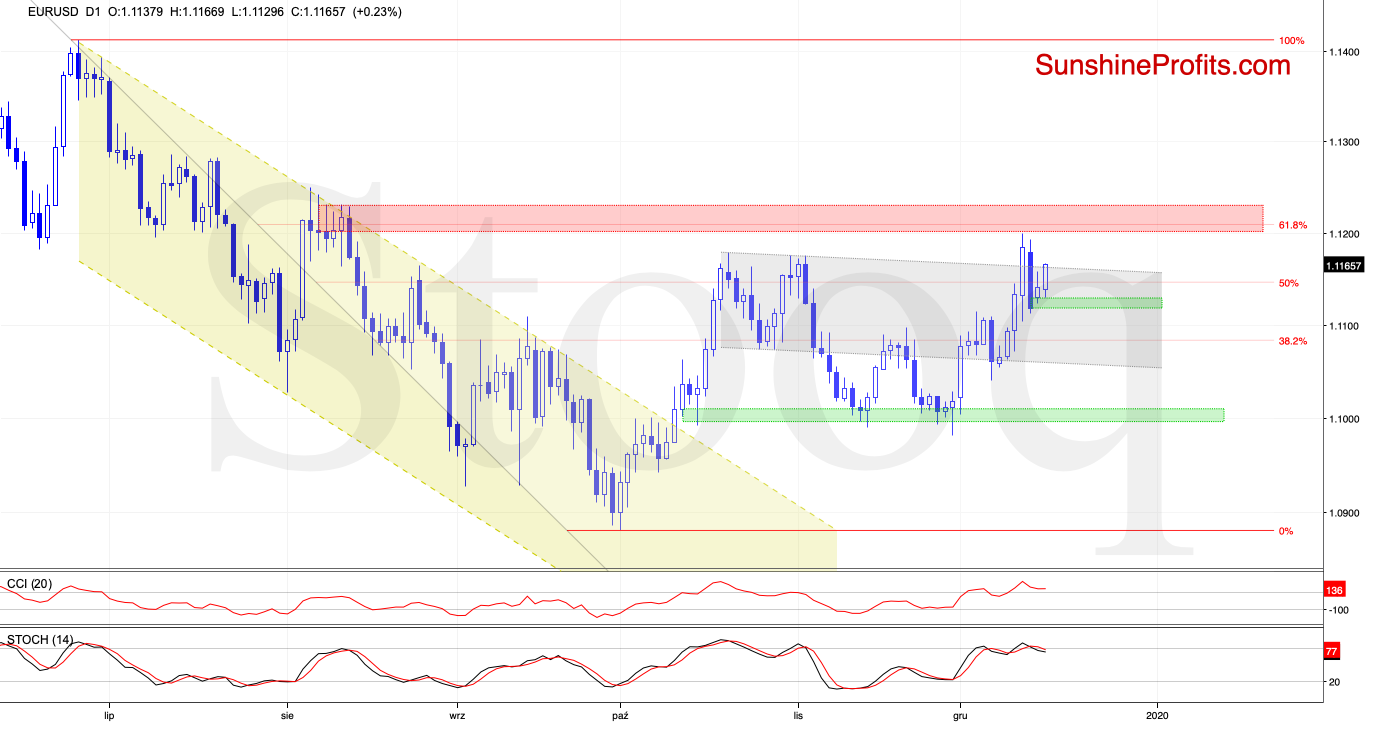

EUR/USD

EUR/USD went on to extend gains earlier today, and our yesterday's comments are therefore still up-to-date:

(...) the exchange rate opened today with the green gap, which suggests upcoming improvement and a likely test of the previously-broken upper border of the grey channel in the coming day(s).

However, the extended position of the daily indicators suggests that even if we see such price action, the space for further gains is limited and another attempt to move lower is just around the corner.

Therefore, if the bulls fail to break above the trend channel, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/CHF

The Swiss franc certainly appears to be in high demand lately but can it keep strengthening? With today's candle being a bearish one, it seems one question too many. But let's take a thorough look at the situation for what it is.

USD/CHF moved lower once again earlier today, which brought about a breakdown below the lower border of the blue consolidation.

While this is a bearish development, the day is far from over, and the green support zone combined with the 61.8% Fibonacci retracement continues to keep declines in check.

Therefore, it's reasonable to expect a rebound from this area as long as there's no daily close below the mentioned supports. This is especially the case when we factor in the currently oversold and ripe-for-recovery position of the daily indicators.

Connecting the dots, should we see reliable signs of a potential reversal, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

AUD/USD pulled back on Friday, invalidating the earlier breakout above the previous peaks and the 61.8% Fibonacci retracement. This event triggered a sharp move to the downside.

The exchange rate went on to drop and trade below both previously broken declining resistance lines, declining right to the 38.2% Fibonacci retracement. A small rebound that followed, was countered by the bears in short order.

This week's declines brought AUD/USD down to the 50% Fibonacci retracement. Additionally, the CCI and the Stochastic Oscillator generated their sell signals, which increases the probability of further deterioration in the following days.

Therefore, opening short positions is justified from the risk/reward perspective as the exchange rate could test the last week's lows in the very near future. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.6909 and the initial downside target at 0.6808 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist