In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

After a sharp upswing, the euro bulls met an equally strong response on Friday. They're staging a comeback today though - what are the chances of it sticking?

Let's recall our Friday's observations:

(...) The exchange rate has approached the red resistance zone that is created by the August peaks and the 61.8% Fibonacci retracement. Coupled with high readings of the daily indicators, this increases the likelihood of a reversal in the coming week.

The situation has indeed turned out as per the above, and EUR/USD moved sharply lower on Friday. This decline resulted in invalidation of the earlier breakout above the upper border of the declining grey trend channel. It also erased the entire pair's gain from Thursday.

While these are bearish developments, the exchange rate opened today with the green gap, which suggests upcoming improvement and a likely test of the previously-broken upper border of the grey channel in the coming day(s).

However, the extended position of the daily indicators suggests that even if we see such price action, the space for further gains is limited and another attempt to move lower is just around the corner.

Therefore, if the bulls fail to break above the trend channel, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/JPY

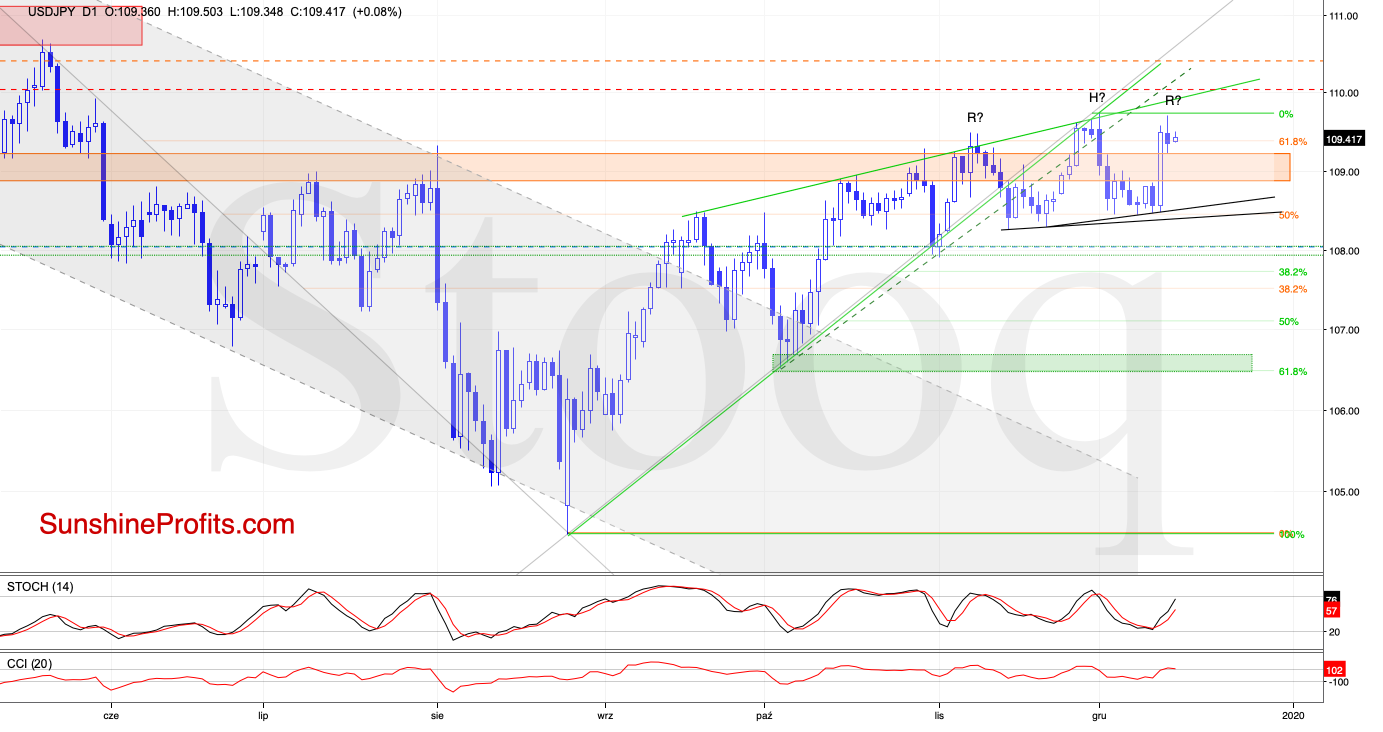

USD/JPY moved sharply higher on Thursday, erasing the entire preceding decline in the process. As a result, the exchange rate came back to its recent peaks.

Despite the upswing however, the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by last week's lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.40 (we decided to move it a bit higher should the pair test the upper border of the rising green wedge) and the initial downside target at 108.04 are justified from the risk/reward perspective.

USD/CAD

Let's recall our Thursday's commentary:

(...) the pair erased the entire rebound and again approached last week's lows.

Additionally, the Stochastic Oscillator flashed its sell signal again, which suggests that we could see another attempt to move lower in the coming day(s). Should it be the case, the first downside target for the bears would be the green support zone based on the lows at the turn of October and November.

The daily chart shows that USD/CAD has indeed extended losses and tested the above-mentioned support area - in line with our expectations.

The pair's price action has also reached the potential neck line of the head-and-shoulders formation, which means that if the bulls manage to hold it, the probability of reversal would increase.

Should they fail however and USD/CAD moves below this neckline and the green support zone, we'll likely see further deterioration. Then, the way to the next green support zone and the October low would be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist