-

Stock Pick Update: July 1 - July 7, 2020

July 1, 2020, 8:41 AMThe broad stock market has extended its short-term consolidation in the last five trading days (June 24 - June 30). More than three months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The corona virus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw huge come-back rally, as the index got back above 3,200 mark. In the first half of June the broad stock market has broken below its short-term upward trend line. Since then it has been trading within a consolidation following bouncing off 3,000 mark.

The S&P 500 index has lost 0.45% since last Wednesday's open. In the same period of time our five long and five short stock picks have lost just 0.04%. Stock picks were relatively slightly stronger than the broad stock market last week. Our long stock picks have lost 0.23% and short stock picks have resulted in a gain of 0.16%. The overall results remain relatively better than the S&P 500 index over last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

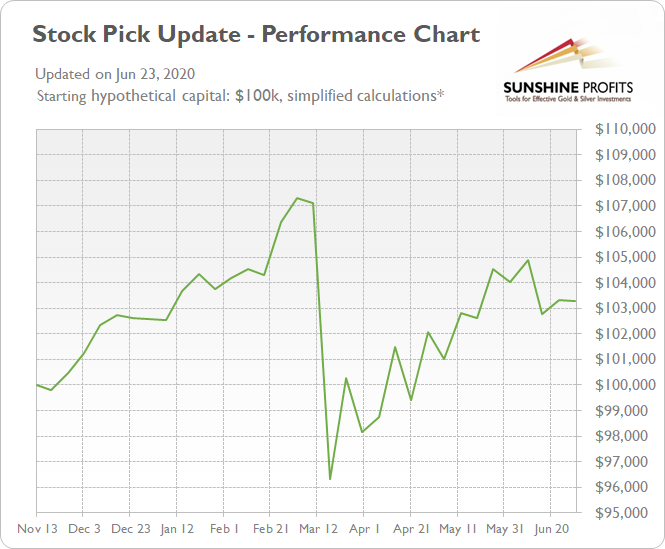

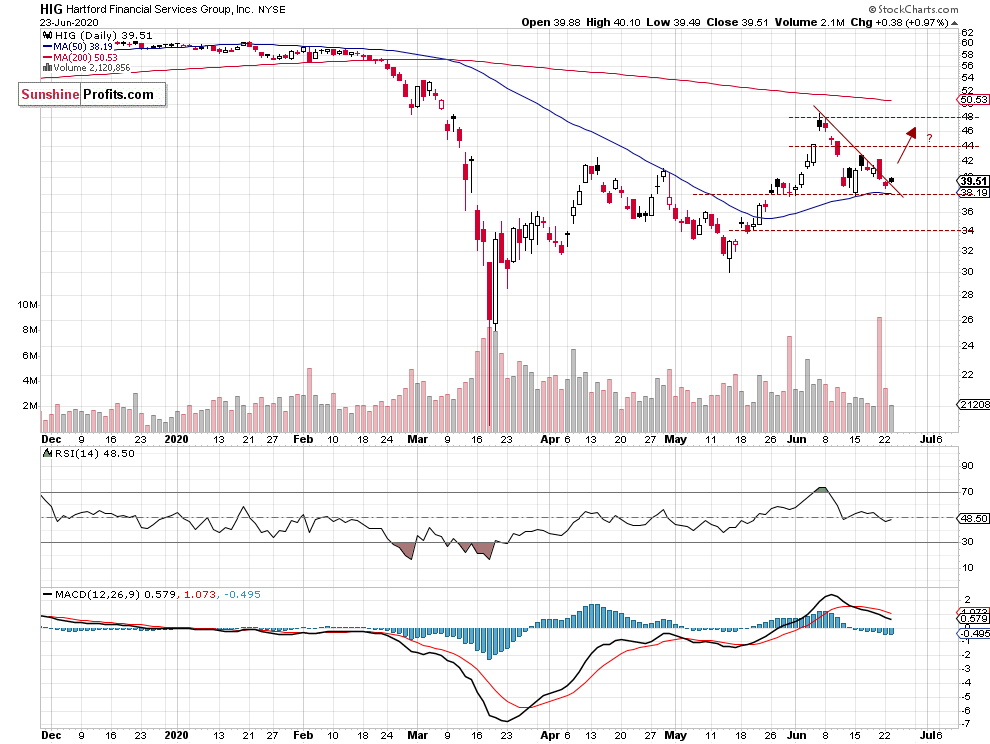

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- June 30, 2020

Long Picks (June 24 open - June 30 close % change): WY (+0.36%), CTSH (+3.76%), HIG (-0.57%), BSX (-2.39%), COP (-2.28%)

Short Picks (June 24 open - June 30 close % change): EW (-1.51%), WMB (0.00%), ETR (-0.27%), CCI (+2.04%), ADBE (-1.07%)

Average long result: -0.23%, average short result: +0.16%

Total profit (average): -0.04% - June 23, 2020

Long Picks (June 17 open - June 23 close % change): BA (-3.41%), DLR (-0.81%), WLTW (+1.27%), BMY (+2.05%), HSY (-2.03%)

Short Picks (June 17 open - June 23 close % change): DHR (-0.23%), CLX (+1.76%), AEP (-1.58%), MMM (-1.47%), PLD (-6.67%)

Average long result: -0.58%, average short result: +1.64%

Total profit (average): +0.53% - June 16, 2020

Long Picks (June 10 open - June 16 close % change): SLB (-11.06%), IEX (-4.63%), L (-10.45%), BSX (-4.33%), KR (-1.69%)

Short Picks (June 10 open - June 16 close % change): ABBV (-0.96%), COST (-1.67%), ADBE (+3.02%), VLO (-7.62%), NOC (-4.84%)

Average long result: -6.43%, average short result: +2.41%

Total profit (average): -2.01%

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, July 1 - Tuesday, July 7 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (July 1) and sold or bought back on the closing of the next Tuesday's trading session (July 7).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Technology, 1 x Consumer Discretionary, 1 x Materials

- sells: 1 x Utilities, 1 x Financials, 1 x Energy

Contrarian approach (betting against the recent trend):

- buys: 1 x Utilities, 1 x Financials

- sells: 1 x Technology, 1 x Consumer Discretionary

Trend-following approach

Top 3 Buy Candidates

INTC Intel Corp. - Technology

- Stock broke above month-long downward trend line

- Potential medium-term uptrend continuation

- The resistance level of $61-65 (initial upside profit target level)

F Ford Motor Co. - Consumer Discretionary

- Stock is above its June downward trend line

- The resistance level and upside profit target level at $65

- The support level is at $5.75

PPG PPG Industries, Inc. - Materials

- Potential advance after breaking above downward trend line

- The resistance level of $115 (short-term upside profit target)

- The support level is at $100

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Technology, Consumer Discretionary and Materials sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - June 30, 2020

-

Stock Pick Update: June 24 - June 30, 2020

June 24, 2020, 8:00 AMThe broad stock market has been trading within a short-term consolidation in the last five trading days (June 17 - June 23). Three months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The corona virus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw huge come-back rally, as the index got back above 3,200 mark. In the first half of June the broad stock market has broken below its short-term upward trend line. Since then it has been trading within a consolidation following bouncing off 3,000 mark.

The S&P 500 index has lost 0.15% since last Wednesday's open. In the same period of time our five long and five short stock picks have gained 0.53%. Stock picks were relatively stronger than the broad stock market last week. Our long stock picks have lost 0.58% but short stock picks have resulted in a gain of 1.64%. The overall results remain relatively better than the S&P 500 index over last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

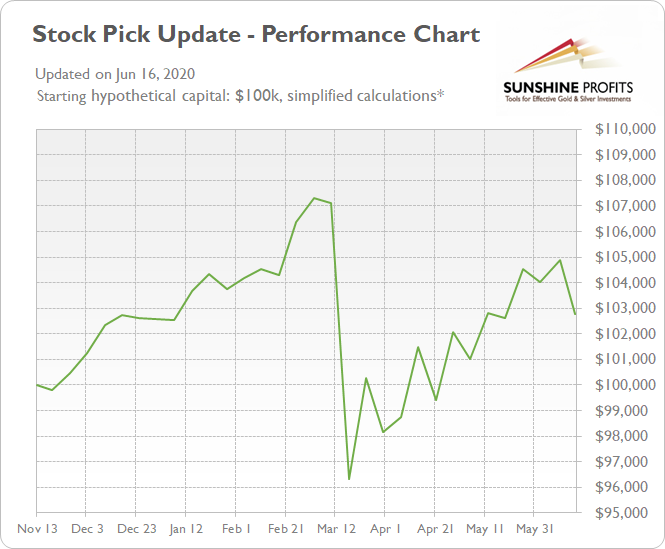

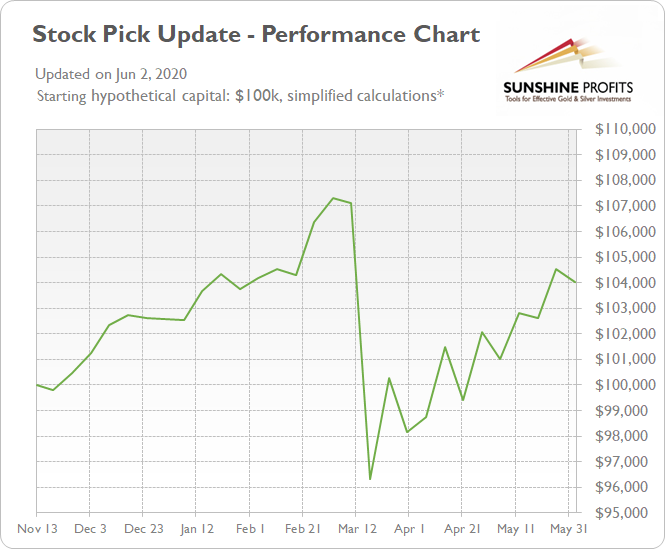

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- June 23, 2020

Long Picks (June 17 open - June 23 close % change): BA (-3.41%), DLR (-0.81%), WLTW (+1.27%), BMY (+2.05%), HSY (-2.03%)

Short Picks (June 17 open - June 23 close % change): DHR (-0.23%), CLX (+1.76%), AEP (-1.58%), MMM (-1.47%), PLD (-6.67%)

Average long result: -0.58%, average short result: +1.64%

Total profit (average): +0.53% - June 16, 2020

Long Picks (June 10 open - June 16 close % change): SLB (-11.06%), IEX (-4.63%), L (-10.45%), BSX (-4.33%), KR (-1.69%)

Short Picks (June 10 open - June 16 close % change): ABBV (-0.96%), COST (-1.67%), ADBE (+3.02%), VLO (-7.62%), NOC (-4.84%)

Average long result: -6.43%, average short result: +2.41%

Total profit (average): -2.01% - June 9, 2020

Long Picks (June 3 open - June 9 close % change): VMC (+5.25%), DISCK (+7.87%), HAS (+6.62%), HSY (-2.90%), MRK (+1.56%)

Short Picks (June 3 open - June 9 close % change): MNST (-3.00%), ABBV (+5.14%), EQIX (-0.07%), ECL (+5.14%), FB (+2.83%)

Average long result: +3.68%, average short result: -2.01%

Total profit (average): +0.84%

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, June 24 - Tuesday, June 30 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (June 24) and sold or bought back on the closing of the next Tuesday's trading session (June 30).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Real Estate, 1 x Technology, 1 x Financials

- sells: 1 x Health Care, 1 x Energy, 1 x Utilities

Contrarian approach (betting against the recent trend):

- buys: 1 x Health Care, 1 x Energy

- sells: 1 x Real Estate, 1 x Technology

Trend-following approach

Top 3 Buy Candidates

WY Weyerhauser Co. - Real Estate

- Stock continues to trade above month-long upward trend line

- Potential uptrend continuation

- The resistance level of $24-25 (upside profit target level)

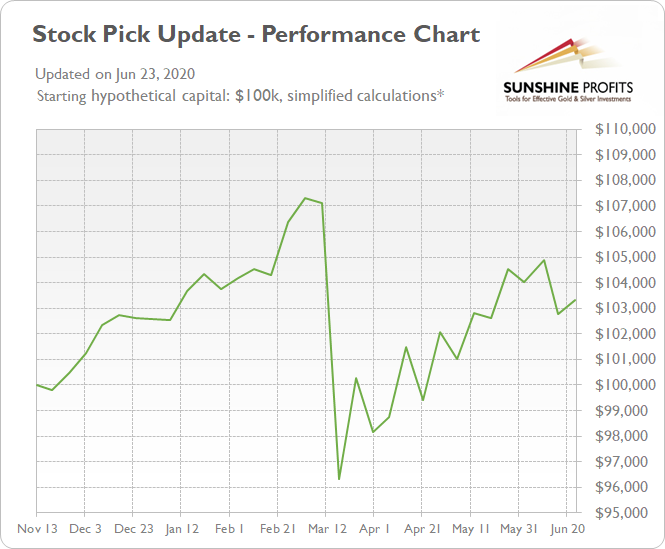

CTSH Cognizant Technology Solutions Corp. - Technology

- Stock trades within a medium-term consolidation following April's advance

- Upside profit target level of $58-60 (the resistance level)

- The support level remains at $50-52

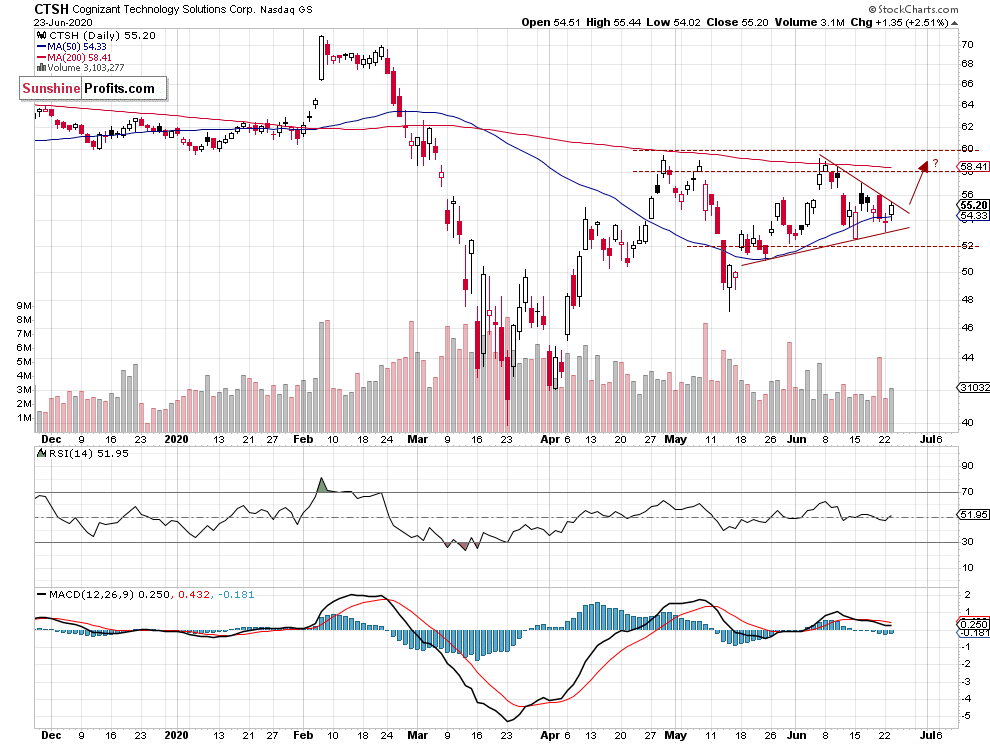

HIG Hartford Financial Services Group, Inc. - Financials

- Potential uptrend resuming after breaking above downward trend line

- The resistance level of $48 (short-term upside profit target)

- The nearest important support level remains at $38

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Real Estate, Technology and Financials sectors were relatively the strongest in the last 30 days. And they all have gained much more than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - June 23, 2020

-

Stock Pick Update: June 17 - June 23, 2020

June 17, 2020, 8:09 AMWhich stocks could magnify S&P's gains in case it rallies? Take a look at a part of our Stock Pick Update. We have included Industrials, Real Estate and Financials stocks this time.

The broad stock market has retraced some of its recent advance in the last five trading days (June 10 - June 16). More than two months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The corona virus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw huge come-back rally, as the index got back above 3,200 mark. Last week the S&P 500 retraced a bit of that surge. It fell below 3,000 mark before going back up on Monday and Tuesday this week.

The S&P 500 index has lost 2.76% since last Wednesday's open. In the same period of time our five long and five short stock picks have lost 2.01%. Stock picks were relatively slightly stronger than the broad stock market last week. Our long stock picks have lost 6.43% and short stock picks have resulted in a gain of 2.41%. The overall results remain relatively better than the S&P 500 index over last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- June 16, 2020

Long Picks (June 10 open - June 16 close % change): SLB (-11.06%), IEX (-4.63%), L (-10.45%), BSX (-4.33%), KR (-1.69%)

Short Picks (June 10 open - June 16 close % change): ABBV (-0.96%), COST (-1.67%), ADBE (+3.02%), VLO (-7.62%), NOC (-4.84%)

Average long result: -6.43%, average short result: +2.41%

Total profit (average): -2.01% - June 9, 2020

Long Picks (June 3 open - June 9 close % change): VMC (+5.25%), DISCK (+7.87%), HAS (+6.62%), HSY (-2.90%), MRK (+1.56%)

Short Picks (June 3 open - June 9 close % change): MNST (-3.00%), ABBV (+5.14%), EQIX (-0.07%), ECL (+5.14%), FB (+2.83%)

Average long result: +3.68%, average short result: -2.01%

Total profit (average): +0.84% - June 2, 2020

Long Picks (May 27 open - June 2 close % change): OXY (+0.34%), DISCK (-1.60%), HAS (-0.39%), PPL (+8.41%), SYY (+1.14%)

Short Picks (May 27 open - June 2 close % change): AEP (+6.10%), CAG (+4.84%), ABBV (+0.55%), COP (-0.32%), FB (+1.59%)

Average long result: +1.58%, average short result: -2.55%

Total profit (average): -0.49%

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, June 17 - Tuesday, June 23 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (June 17) and sold or bought back on the closing of the next Tuesday's trading session (June 23).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Industrials, 1 x Real Estate, 1 x Financials

- sells: 1 x Health Care, 1 x Consumer Staples, 1 x Utilities

Contrarian approach (betting against the recent trend):

- buys: 1 x Health Care, 1 x Consumer Staples

- sells: 1 x Industrials, 1 x Real Estate

Trend-following approach

Top 3 Buy Candidates

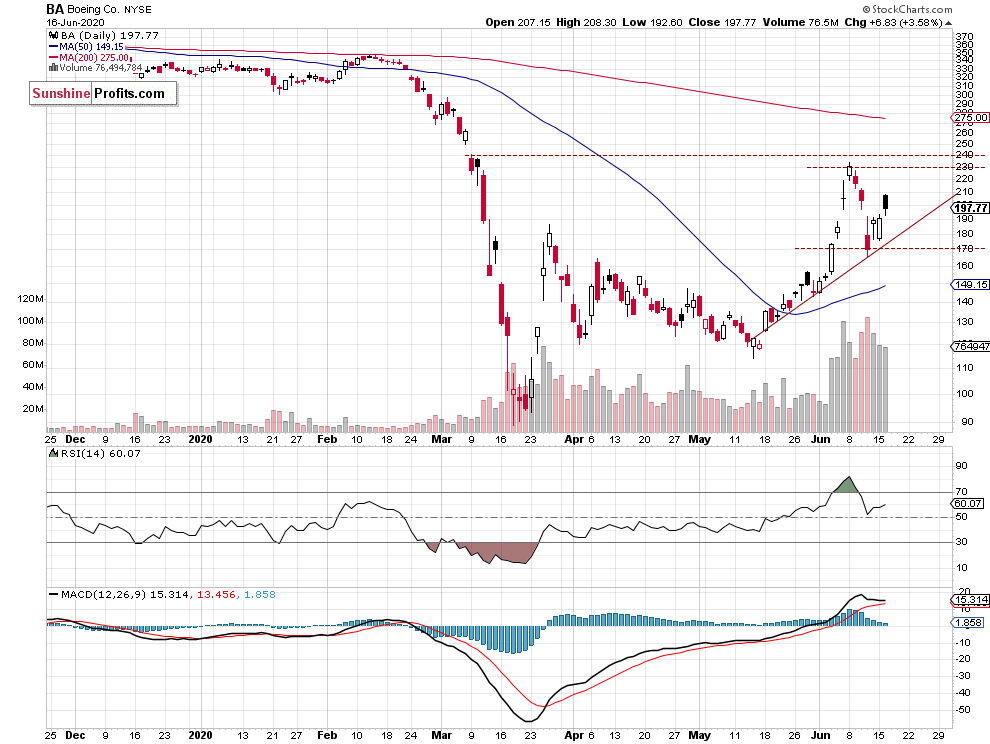

BA Boeing Co. - Industrials

- Stock remains above month-long upward trend line

- Potential uptrend continuation

- The resistance level of $230-240 (upside profit target level)

DLR Digital Realty Trust, Inc. - Real Estate

- Stock broke above its upward trend line

- Upside profit target level of $152.50-155.00 (the resistance level)

- The support level remains at $130.00-132.50

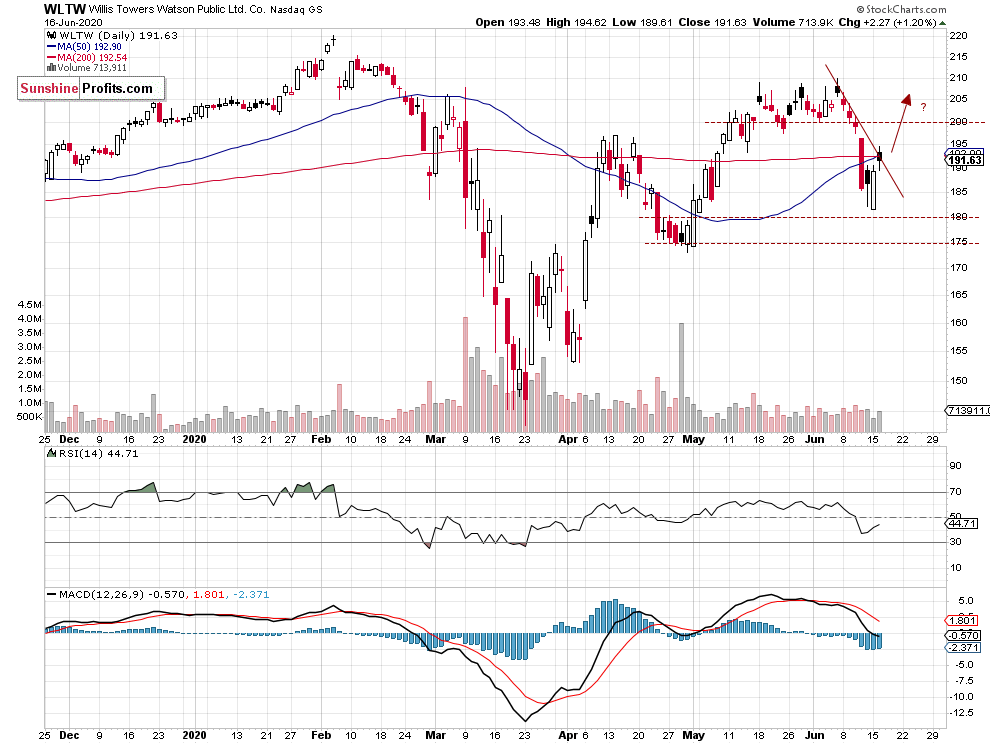

WLTW Willis Towers Watson Public Ltd. Co. - Financials

- Potential breakout above downward trend line

- The resistance level of $200-210 (upside profit target)

- The support level remains at $175-180

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Industrials, Real Estate and Financials sectors were relatively the strongest in the last 30 days. And they all have gained much more than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - June 16, 2020

-

Stock Pick Update: June 10 - June 16, 2020

June 10, 2020, 8:34 AMThe broad stock market has accelerated its uptrend in the last five trading days (June 3 - June 9). More than two months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The corona virus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw huge come-back rally, as the index got back above 3,200 mark. However, the index remains 5.8% below the mentioned record high.

The S&P 500 index has gained 3.49% since last Wednesday's open. In the same period of time our five long and five short stock picks have gained 0.84%. Stock picks were relatively weaker than the broad stock market last week. Our long stock picks have gained 3.68%, so they have been relatively stronger than the S&P 500 index. However, short stock picks have resulted in a loss of 2.01%. The overall results remain relatively better than the S&P 500 index over last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

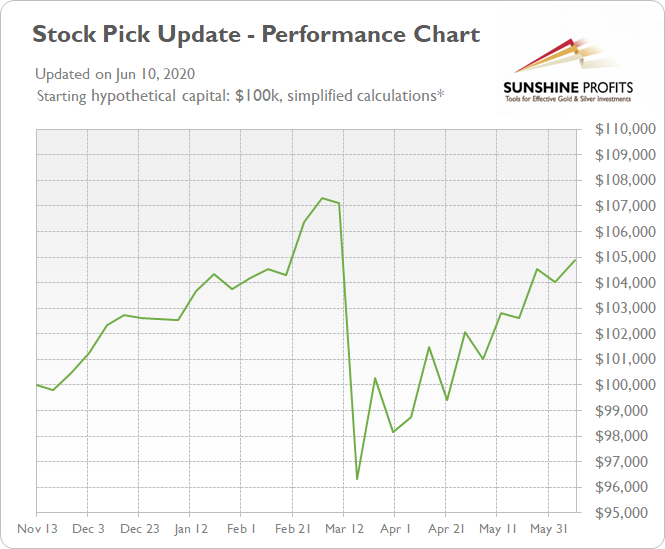

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- June 2, 2020

Long Picks (June 3 open - June 9 close % change): VMC (+5.25%), DISCK (+7.87%), HAS (+6.62%), HSY (-2.90%), MRK (+1.56%)

Short Picks (June 3 open - June 9 close % change): MNST (-3.00%), ABBV (+5.14%), EQIX (-0.07%), ECL (+5.14%), FB (+2.83%)

Average long result: +3.68%, average short result: -2.01%

Total profit (average): +0.84% - June 2, 2020

Long Picks (May 27 open - June 2 close % change): OXY (+0.34%), DISCK (-1.60%), HAS (-0.39%), PPL (+8.41%), SYY (+1.14%)

Short Picks (May 27 open - June 2 close % change): AEP (+6.10%), CAG (+4.84%), ABBV (+0.55%), COP (-0.32%), FB (+1.59%)

Average long result: +1.58%, average short result: -2.55%

Total profit (average): -0.49% - May 26, 2020

Long Picks (May 20 open - May 26 close % change): SLB (+5.32%), TWTR (+11.51%), CSCO (-0.47%), SPG (+1.13%), DTE (+1.06%)

Short Picks (May 20 open - May 26 close % change): AMT (+5.15%), SO (+0.87%), K (-0.34%), HES (+3.07%), NFLX (-8.69%)

Average long result: +3.71%, average short result: -0.01%

Total profit (average): +1.85%

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, June 10 - Tuesday, June 16 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (June 10) and sold or bought back on the closing of the next Tuesday's trading session (June 16).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Energy, 1 x Industrials, 1 x Financials

- sells: 1 x Health Care, 1 x Consumer Staples, 1 x Technology

Contrarian approach (betting against the recent trend):

- buys: 1 x Health Care, 1 x Consumer Staples

- sells: 1 x Energy, 1 x Industrials

Trend-following approach

Top 3 Buy Candidates

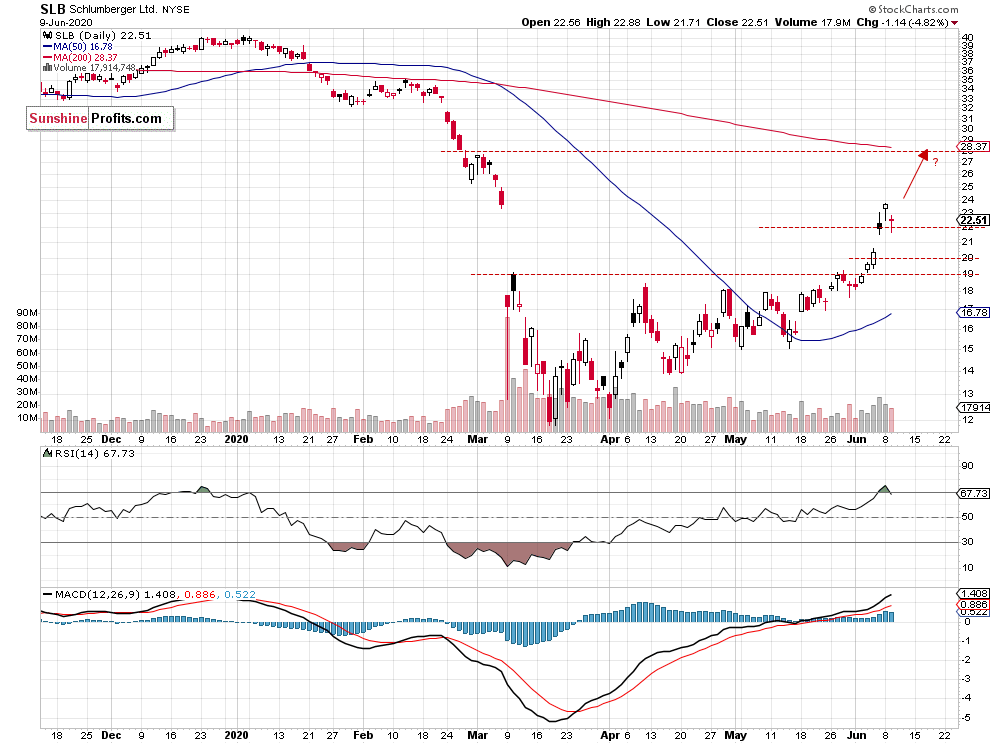

SLB Schlumberger Ltd. - Energy

- Stock trades within a consolidation following breaking higher

- Potential short-term uptrend continuation/ further acceleration

- The resistance level of $28 (upside profit target level)

IEX Idex Corp. - Industrials

- Stock trades along its upward trend line

- Upside profit target level of $170-175 (the resistance level)

- The support level remains at $150-160

L Loews Corp. - Financials

- The market trades along upward trend line

- The resistance levels of $44 (upside profit target)

- The support level remains at $26

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Energy, Industrials and Financials sectors were relatively the strongest in the last 30 days. And they all have gained much more than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - June 2, 2020

-

Stock Pick Update: June 3 - June 9, 2020

June 3, 2020, 8:14 AMThe broad stock market has slightly extended its uptrend in the last five trading days (May 27 - June 2) again. More than two months ago on March 23, the S&P 500 index sold off to new medium-term low of 2,191.86. It was a stunning 35.4% below February 19 record high of 3,393.52. The corona virus and economic slowdown fears have erased more than a third of the broad stock market value. Then we saw huge come-back rally, as the index got back firmly above 3,000 mark. However, the index remains 10.1% below the February 19 record high of 3,393.52.

The S&P 500 index has gained 2.16% since last Wednesday's open. In the same period of time our five long and five short stock picks have lost 0.49%. Stock picks were relatively weaker than the broad stock market last week. Our long stock picks have gained 1.58%, so they have basically followed the market. However, short stock picks have resulted in a loss of 2.55%. The overall results remain relatively better than the S&P 500 index over last months.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it's not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- June 2, 2020

Long Picks (May 27 open - June 2 close % change): OXY (+0.34%), DISCK (-1.60%), HAS (-0.39%), PPL (+8.41%), SYY (+1.14%)

Short Picks (May 27 open - June 2 close % change): AEP (+6.10%), CAG (+4.84%), ABBV (+0.55%), COP (-0.32%), FB (+1.59%)

Average long result: +1.58%, average short result: -2.55%

Total profit (average): -0.49% - May 26, 2020

Long Picks (May 20 open - May 26 close % change): SLB (+5.32%), TWTR (+11.51%), CSCO (-0.47%), SPG (+1.13%), DTE (+1.06%)

Short Picks (May 20 open - May 26 close % change): AMT (+5.15%), SO (+0.87%), K (-0.34%), HES (+3.07%), NFLX (-8.69%)

Average long result: +3.71%, average short result: -0.01%

Total profit (average): +1.85% - May 19, 2020

Long Picks (May 13 open - May 19 close % change): SLB (+1.42%), CSCO (+2.74%), NWSA (+6.12%), CCI (-1.04%), CB (+1.46%)

Short Picks (May 13 open - May 19 close % change): AVB (+2.72%), C (+5.79%), AEP (-0.45%), COP (+4.02%), AAPL (+0.32%)

Average long result: +2.14%, average short result: -2.48%

Total profit (average): -0.17%

Let's check which stocks could magnify S&P's gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, June 3 - Tuesday, June 9 period.

We will assume the following: the stocks will be bought or sold short on the opening of today's trading session (June 3) and sold or bought back on the closing of the next Tuesday's trading session (June 9).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF's.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Materials, 1 x Communication Services, 1 x Consumer Discretionary

- sells: 1 x Consumer Staples, 1 x Health Care, 1 x Real Estate

Contrarian approach (betting against the recent trend):

- buys: 1 x Consumer Staples 1 x Health Care

- sells: 1 x Materials, 1 x Communication Services

Trend-following approach

Top 3 Buy Candidates

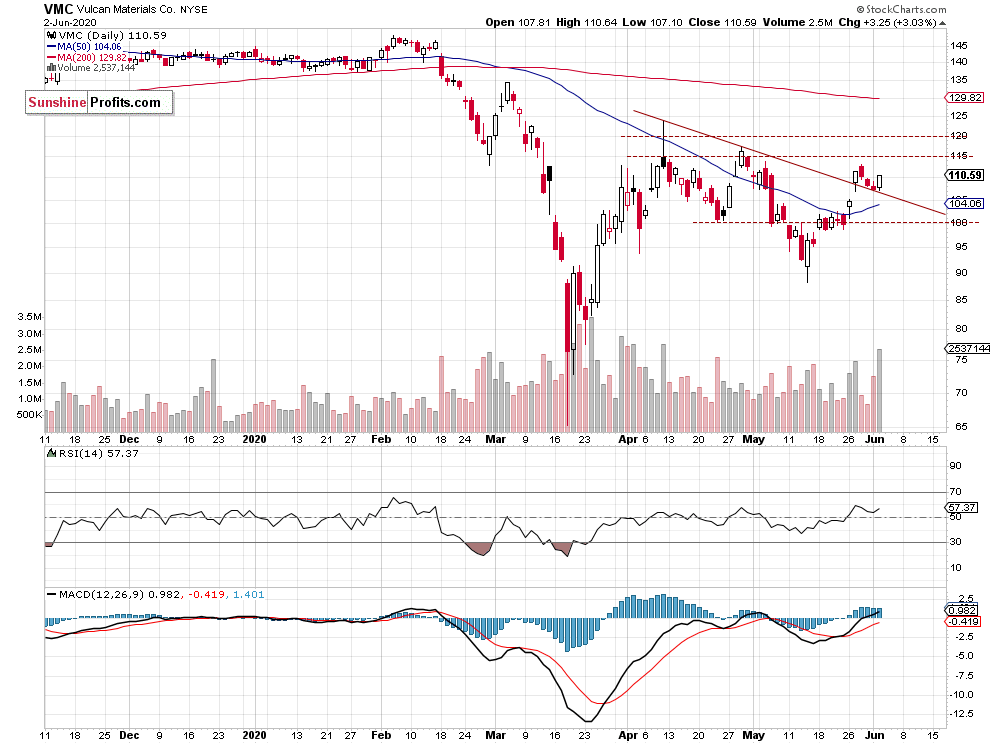

VMC Vulcan Materials Co. - Materials

- Stock trades above its two-month-long downward trend line

- Potential breakout above bull flag pattern

- The resistance level of $115-120 (upside profit target level)

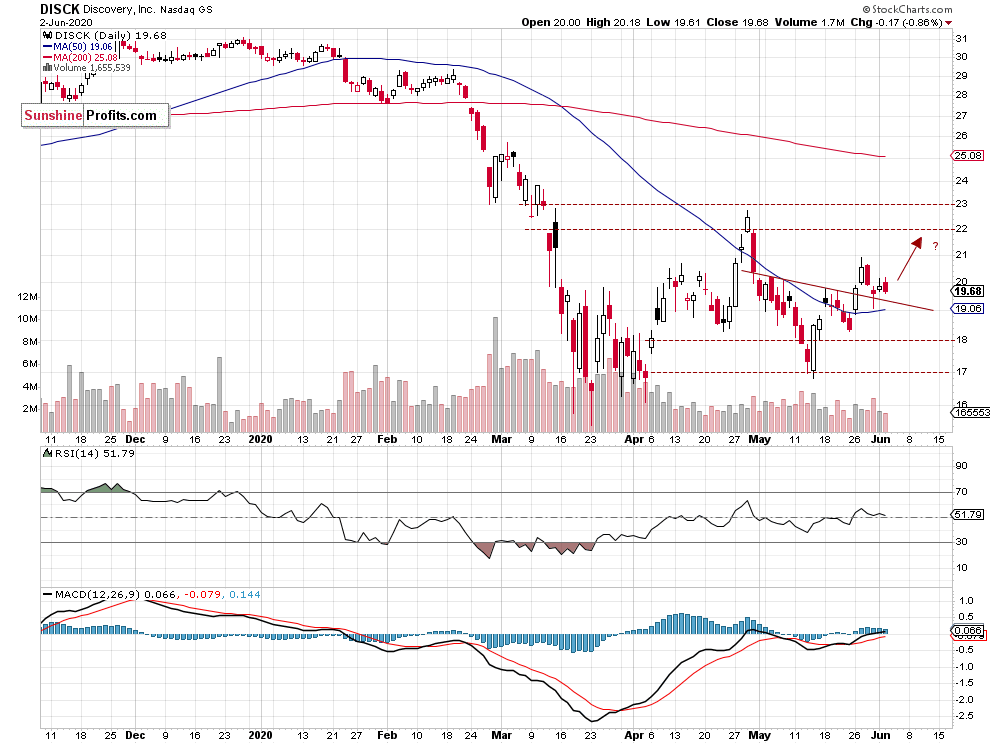

DISCK Discovery, Inc. - Communication Services

- Stock trades above its downward trend line

- Upside profit target level of $22-23

- The support level remains at $17-18

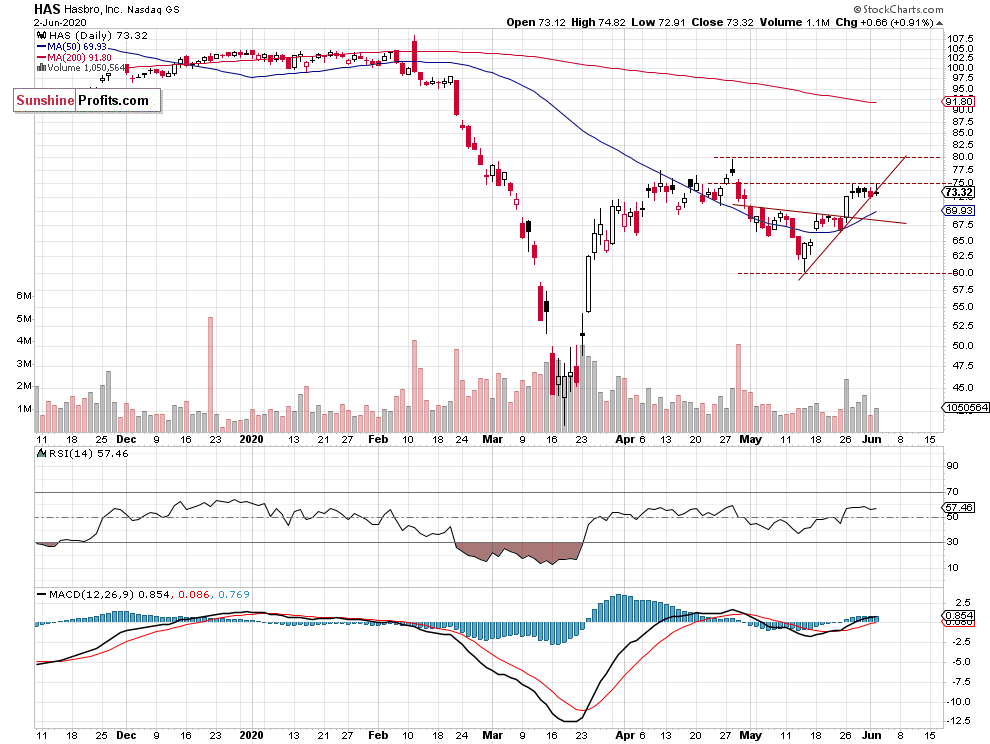

HAS Hasbro, Inc. - Consumer Discretionary

- The market trades along its short-term upward trend line following breaking above the resistance level of $70

- The resistance levels of $80 (upside profit target)

- The support level remains at $60

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Materials, Communication Services and Consumer Discretionary sectors were relatively the strongest in the last 30 days. And they all have gained more than the S&P 500 index in the same period. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - June 2, 2020

Free Daily Newsletter

Delivered To Your Inbox

Free Of Charge

Bonus: Day Trading Signals, Gold & Silver, Oil, Forex Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM