-

Stock Pick Update: November 18 – November 24, 2020

November 18, 2020, 8:05 AMIn the last five trading days (November 11 – November 17) the broad stock market has fluctuated following November 9 run-up to new record high of 3,645.99 after news about Pfizer’s coronavirus vaccine and the U.S. Presidential Election outcome. The S&P 500 index got closer to the high on Monday and it currently trades along 3,600 mark.

The S&P 500 index has gained 1.30% between November 11 and November 17. In the same period of time our five long and five short stock picks have gained 0.51%. Stock picks were relatively weaker than the broad stock market. However, our long stock picks have gained 3.55% as they’ve outpaced the S&P 500 index on the long side. Short stock picks have resulted in a loss of 2.52%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

Starting this week, we will modify our stock-picking strategy. Its year-long performance record shows that non-contrarian (pro-market) stock picks were outperforming contrarian (against-market) stock picks by a large margin. Non-contrarian stock picks gained 8.8% since Nov 19, 2019, and contrarian stock picks lost 10.6% in the same period of time. Therefore we will stop picking stocks on a contrarian basis. Our 5 long and 5 short stocks portfolio will be based solely on the trend-following approach.

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, November 18 – Tuesday, November 24 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (November 18) and sold or bought back on the closing of the next Tuesday’s trading session (November 24).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our 5 long and 5 short candidates using trend-following approach:

- buys: 2 x Energy, 2 x Financials, 1 x Industrials

- sells: 2 x Technology, 2 x Consumer Discretionary, 1 x Consumer Staples

Buy Candidates

WMB Williams Cos., Inc. - Energy

- Stock broke above medium-term downward trend line - uptrend continuation play

- The resistance level of $21.50 and support level of $20.00

PXD Pioneer Natural Resources Co. – Energy

- Short-term uptrend continuation play

- The resistance level of $98-108

- The support level is at $84-90

WFC Wells Fargo & Co. – Financials

- Stock broke above downward trend line, uptrend continuation play

- The resistance level is at $25.50

- The support level is at $23.50

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Energy and Financials sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Stock Pick Update: November 11 – November 17, 2020

November 11, 2020, 8:27 AMIn the last five trading days (November 4 – November 10) the broad stock market has extended its over eleven-year long bull market. On Monday, November 9 the S&P 500 index reached new record high of 3,645.99 following news about Pfizer’s coronavirus vaccine and the U.S. Presidential Election outcome.

The S&P 500 index has gained 4.08% between November 4 and November 10. In the same period of time our five long and five short stock picks have lost 2.33%. So stock picks were relatively weaker than the broad stock market. Our long stock picks have gained 1.39% but short stock picks have resulted in a loss of 6.05%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

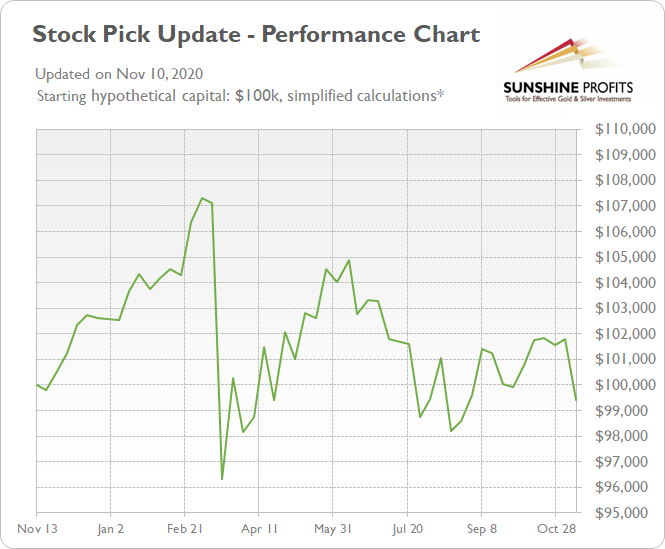

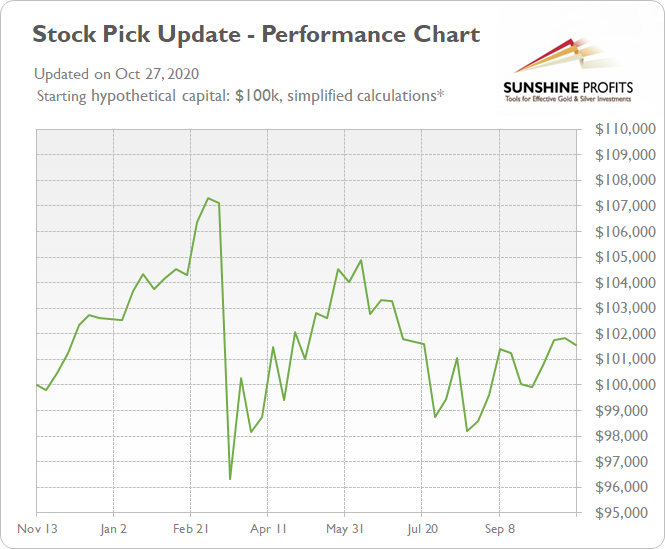

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- November 10, 2020

Long Picks (November 4 open – November 10 close % change): PEG (+2.17%), IFF (+4.81%), LMT (+0.06%), CSCO (+4.56%), PHM (-4.68%)

Short Picks (November 4 open – November 10 close % change): ADI (+10.12%), APTV (+7.60%), CBRE (+9.51%), WEC (+1.03%), FMC (+1.98%)

Average long result: +1.39%, average short result: -6.05%

Total profit (average): -2.33%- November 3, 2020

Long Picks (October 28 open – November 3 close % change): D (+2.09%), FB (-4.84%), WYNN (+5.46%), BKR (+15.24%), ARE (+1.53%)

Short Picks (October 28 open – November 3 close % change): PXD (+1.27%), DRE (+8.66%), ITW (+7.09%), CMS (+0.72%), CMCSA (-0.63%)

Average long result: +3.90%, average short result: -3.42%

Total profit (average): +0.24%- October 27, 2020

Long Picks (October 21 open – October 27 close % change): PPL (+1.96%), WDC (-3.40%), WYNN (-0.25%), XOM (-2.06%), LIN (-3.02%)

Short Picks (October 21 open – October 27 close % change): WMB (-1.12%), SHW (-0.23%), TROW (-2.61%), WEC (+1.63%), NVDA (-1.68%)

Average long result: -1.35%, average short result: +0.80%

Total profit (average): -0.27%Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, November 11 – Tuesday, November 17 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (November 11) and sold or bought back on the closing of the next Tuesday’s trading session (November 17).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Energy, 1 x Financials, 1 x Materials

- sells: 1 x Real Estate, 1 x Consumer Discretionary, 1 x Technology

Contrarian approach (betting against the recent trend):

- buys: 1 x Real Estate, 1 x Consumer Discretionary

- sells: 1 x Energy, 1 x Financials

Trend-following approach

Top 3 Buy Candidates

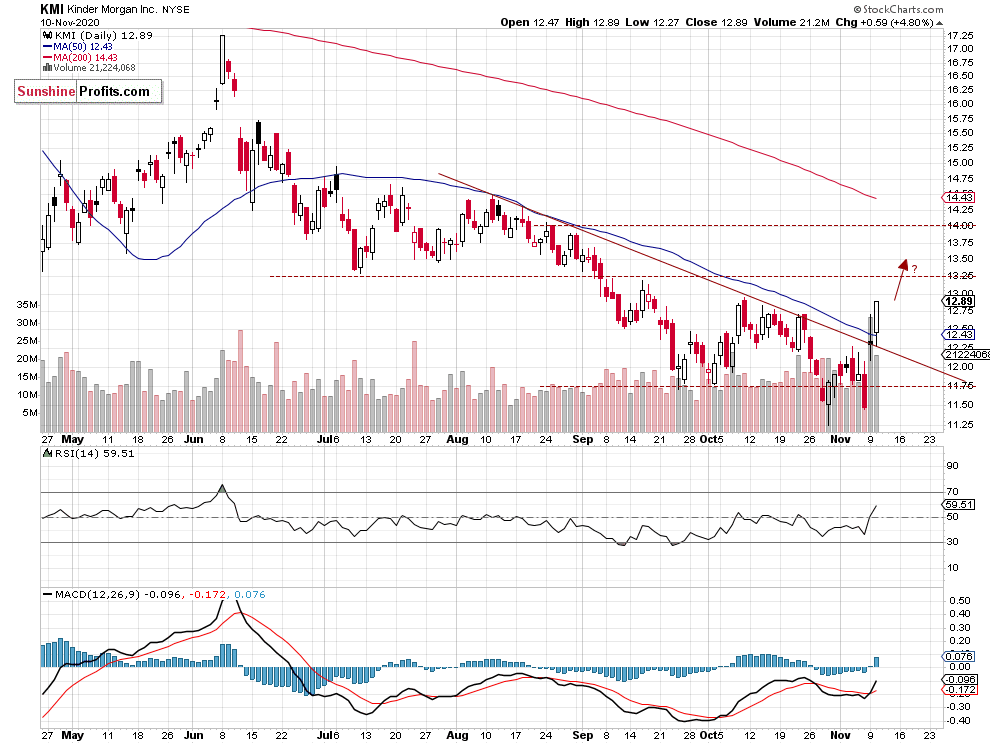

KMI Kinder Morgan Inc. - Energy

- Stock broke above medium-term downward trend line - uptrend continuation play

- The resistance level of $13.25 and support level of $11.75

WFC Wells Fargo & Co. – Financials

- Short-term uptrend continuation play

- The resistance level of $25.00-25.50

- The support level remains at $22.50

IFF Intl Flavors & Fragrances – Materials

- Stock broke above downward trend line, possible uptrend continuation

- The resistance level is at $114

- The support level is at $104

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Energy, Financials and Materials sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Stock Pick Update: November 4 – November 10, 2020

November 4, 2020, 7:33 AMIn the last five trading days (October 28 – November 3) the broad stock market has extended its short-term downtrend, as it fell below 3,250 mark on Friday. But then on Tuesday, the market has retraced all of its decline ahead of the U.S. Presidential Election. The S&P 500 index set new record high of 3,588.11 on September 2. Then it fell below February 19 high of 3,393.52 again. In late September it set a local low of 3,209.45 before going back above 3,500 mark. On October 12 it reached 3,549.85. So far, it looks like a medium-term consolidation following 63.7% rally from March 23 corona virus low at 2,191.86.

The S&P 500 index has gained 0.80% between October 28 and November 3. In the same period of time our five long and five short stock picks have gained 0.24%. So stock picks were relatively slightly weaker than the broad stock market. Our long stock picks have gained 3.90%. However, short stock picks have resulted in a loss of 3.42%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

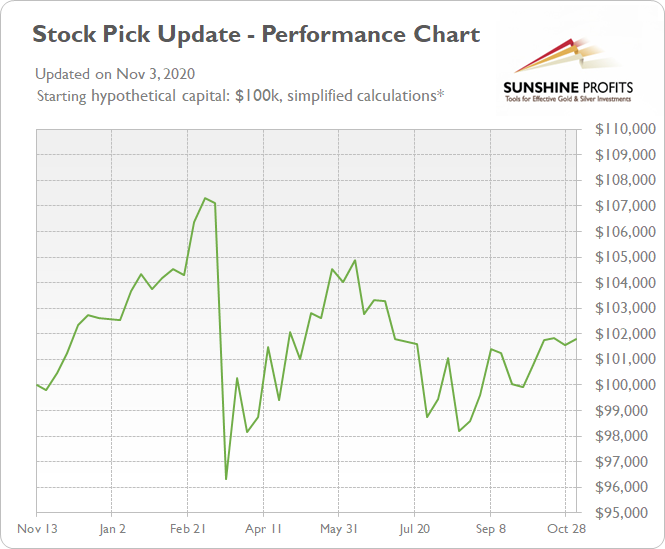

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- November 3, 2020

Long Picks (October 28 open – November 3 close % change): D (+2.09%), FB (-4.84%), WYNN (+5.46%), BKR (+15.24%), ARE (+1.53%)

Short Picks (October 28 open – November 3 close % change): PXD (+1.27%), DRE (+8.66%), ITW (+7.09%), CMS (+0.72%), CMCSA (-0.63%)

Average long result: +3.90%, average short result: -3.42%

Total profit (average): +0.24%- October 27, 2020

Long Picks (October 21 open – October 27 close % change): PPL (+1.96%), WDC (-3.40%), WYNN (-0.25%), XOM (-2.06%), LIN (-3.02%)

Short Picks (October 21 open – October 27 close % change): WMB (-1.12%), SHW (-0.23%), TROW (-2.61%), WEC (+1.63%), NVDA (-1.68%)

Average long result: -1.35%, average short result: +0.80%

Total profit (average): -0.27%- October 20, 2020

Long Picks (October 14 open – October 20 close % change): CSCO (-1.63%), NI (+2.03%), CMG (+1.38%), XOM (-1.06%), SHW (-3.41%)

Short Picks (October 14 open – October 20 close % change): WMB (+1.33%), APD (-1.83%), JPM (+0.07%), NVDA (-4.51%), WEC (+1.47%)

Average long result: -0.54%, average short result: +0.69%

Total profit (average): +0.08%Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, November 4 – Tuesday, November 10 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (November 4) and sold or bought back on the closing of the next Tuesday’s trading session (November 10).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Utilities, 1 x Materials, 1 x Industrials

- sells: 1 x Technology, 1 x Consumer Discretionary, 1 x Real Estate

Contrarian approach (betting against the recent trend):

- buys: 1 x Technology, 1 x Consumer Discretionary

- sells: 1 x Utilities, 1 x Materials

Trend-following approach

Top 3 Buy Candidates

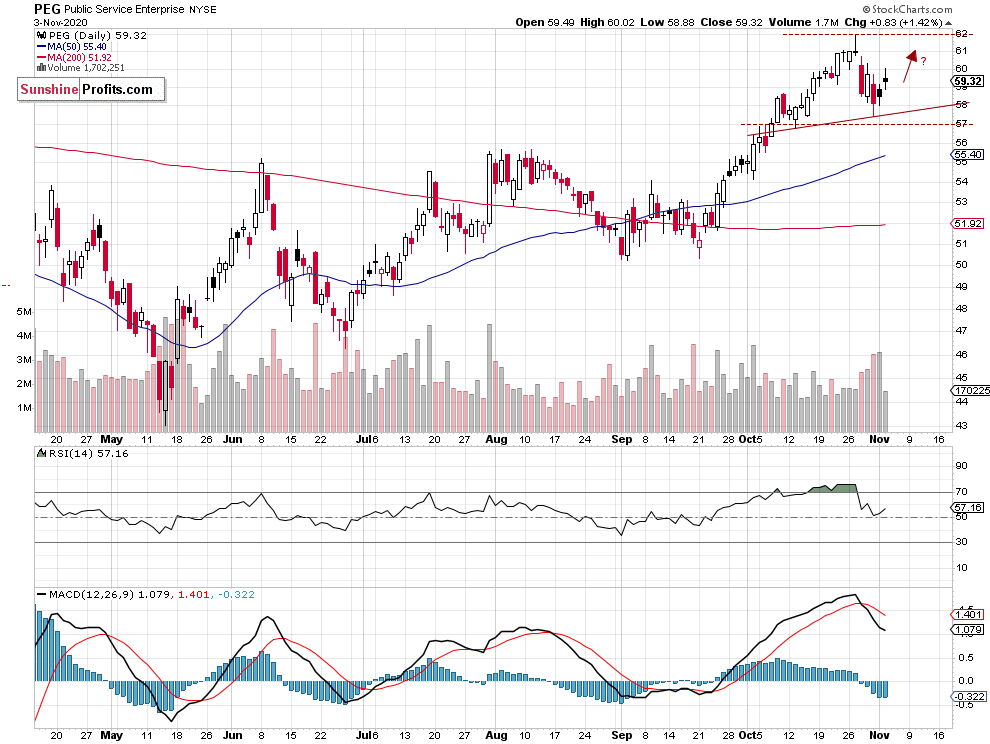

PEG Public Service Enterprise - Utilities

- Stock remains above month-long upward trend line - uptrend continuation play

- The resistance level of $62 and support level of $57

IFF Intl Flavors & Fragrances – Materials

- Short-term uptrend continuation play and a possible breakout about downward trend line

- The resistance level of $114

- The support level remains at $100

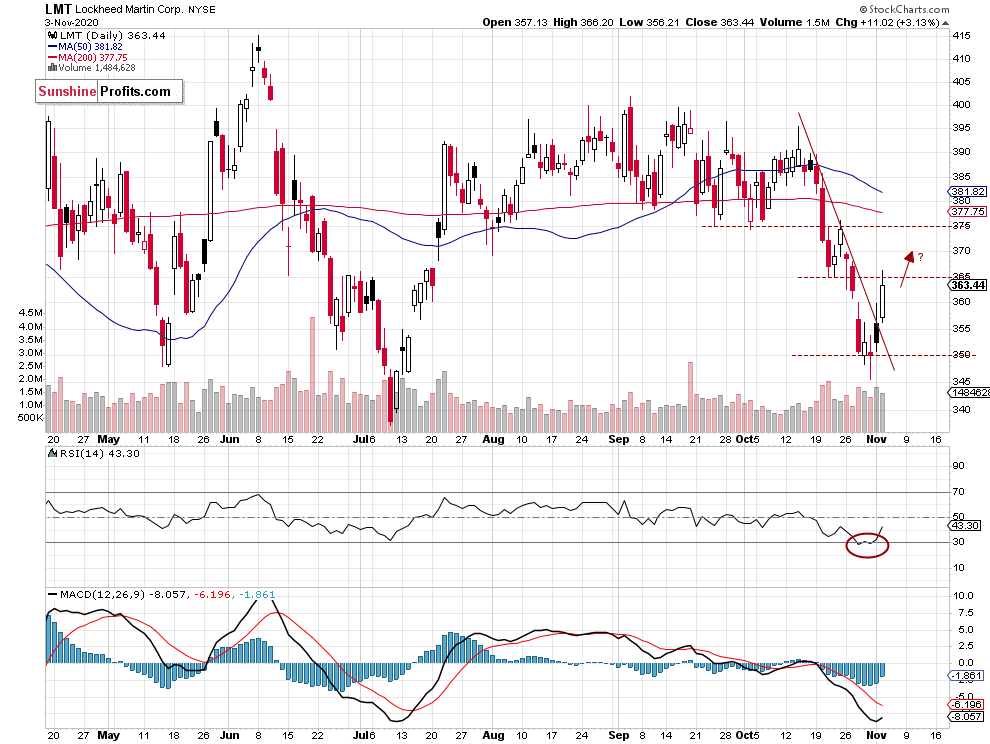

LMT Lockheed Martin Corp. – Industrials

- Stock broke above downward trend line, possible short-term uptrend continuation

- The resistance level is at $365-375

- The support level is at $350

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Utilities, Materials XLB and Industrials sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Stock Pick Update: October 28 – November 3, 2020

October 28, 2020, 7:54 AMIn the last five trading days (October 21 – October 27) the broad stock market has extended its short-term downtrend from October 12 local high. The S&P 500 index set a new record high of 3,588.11 on September 2. But then the market fell below February 19 high of 3,393.52 again. In late September it set a local low of 3,209.45 before going back above 3,500 mark. On October 12 it reached 3,549.85. So far, it looks like a medium-term consolidation following 63.7% rally from March 23 corona virus low at 2,191.86.

The S&P 500 index has lost 1.43% between October 21 and October 27. In the same period of time our five long and five short stock picks have lost 0.27%. So stock picks were relatively stronger than the broad stock market again. Our long stock picks have lost 1.35% but short stock picks have resulted in a gain of 0.80%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

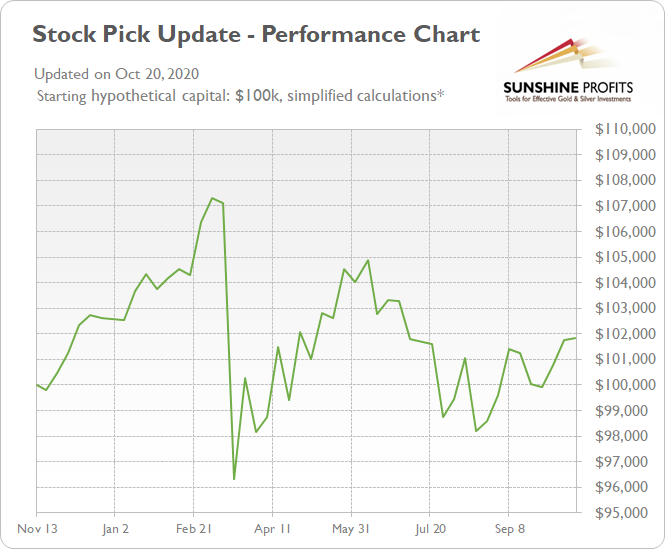

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- October 27, 2020

Long Picks (October 21 open – October 27 close % change): PPL (+1.96%), WDC (-3.40%), WYNN (-0.25%), XOM (-2.06%), LIN (-3.02%)

Short Picks (October 21 open – October 27 close % change): WMB (-1.12%), SHW (-0.23%), TROW (-2.61%), WEC (+1.63%), NVDA (-1.68%)

Average long result: -1.35%, average short result: +0.80%

Total profit (average): -0.27% - October 20, 2020

Long Picks (October 14 open – October 20 close % change): CSCO (-1.63%), NI (+2.03%), CMG (+1.38%), XOM (-1.06%), SHW (-3.41%)

Short Picks (October 14 open – October 20 close % change): WMB (+1.33%), APD (-1.83%), JPM (+0.07%), NVDA (-4.51%), WEC (+1.47%)

Average long result: -0.54%, average short result: +0.69%

Total profit (average): +0.08%

- October 13, 2020

Long Picks (October 7 open – October 13 close % change): CMS (+2.71%), RTX (+0.35%), EQIX (+4.46%), OKE (+8.35%), FB (+6.53%)

Short Picks (October 7 open – October 13 close % change): COP (+4.21%), TWTR (+2.02%), NVDA (+1.78%), AWK (+1.39%), FDX (+3.37%)

Average long result: +4.48%, average short result: -2.55%

Total profit (average): +0.96%

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, October 28 – Tuesday, November 3 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (October 28) and sold or bought back on the closing of the next Tuesday’s trading session (November 3).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Utilities, 1 x Communication Services, 1 x Consumer Discretionary

- sells: 1 x Energy, 1 x Real Estate, 1 x Industrials

Contrarian approach (betting against the recent trend):

- buys: 1 x Energy, 1 x Real Estate

- sells: 1 x Utilities, 1 x Communication Services

Trend-following approach

Top 3 Buy Candidates

D Dominion Energy, Inc. - Utilities

- Stock broke above short-term downward trend line - uptrend continuation play

- The resistance level of $85 and support level of $80

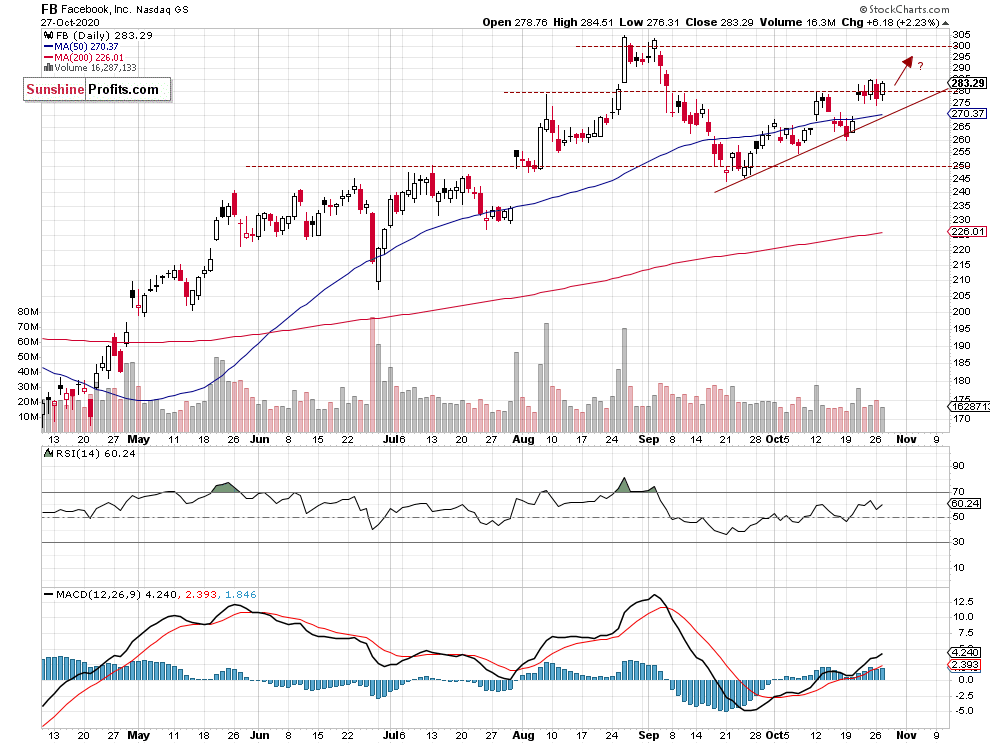

FB Facebook, Inc. – Communication Services

- Stock remains above upward trend line – possible short-term uptrend continuation

- The resistance level of $300

- The support level is at $260-270

WYNN Wynn Resorts Ltd – Consumer Discretionary

- Possible advance within an over month-long consolidation

- The resistance level is at $77.50

- The support level is at $67.50-70.00

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Utilities, Communication Services and Consumer Discretionary sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care - October 27, 2020

-

Stock Pick Update: October 21 – October 27, 2020

October 21, 2020, 8:06 AMIn the last five trading days (October 7 – October 13) the broad stock market has retraced a half of its previous week’s advance of almost 4%. The S&P 500 index set a new record high of 3,588.11 on September 2. But then the market fell below February 19 high of 3,393.52. Recently it set a local low of 3,209.45 before going back above 3,500 mark. So, the decline still looks like a downward correction of a 63.7% rally from March 23 corona virus low at 2,191.86.

The S&P 500 index has lost 2.06% between October 14 and October 20. In the same period of time our five long and five short stock picks have gained 0.08%. So stock picks were relatively stronger than the broad stock market. Our long stock picks have lost 0.54% and short stock picks have resulted in a gain of 0.69%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- October 20, 2020

Long Picks (October 14 open – October 20 close % change): CSCO (-1.63%), NI (+2.03%), CMG (+1.38%), XOM (-1.06%), SHW (-3.41%)

Short Picks (October 14 open – October 20 close % change): WMB (+1.33%), APD (-1.83%), JPM (+0.07%), NVDA (-4.51%), WEC (+1.47%)

Average long result: -0.54%, average short result: +0.69%

Total profit (average): +0.08%- October 13, 2020

Long Picks (October 7 open – October 13 close % change): CMS (+2.71%), RTX (+0.35%), EQIX (+4.46%), OKE (+8.35%), FB (+6.53%)

Short Picks (October 7 open – October 13 close % change): COP (+4.21%), TWTR (+2.02%), NVDA (+1.78%), AWK (+1.39%), FDX (+3.37%)

Average long result: +4.48%, average short result: -2.55%

Total profit (average): +0.96%- October 6, 2020

Long Picks (September 30 open – October 6 close % change): SO (+7.13%), SEE (+9.80%), MAS (-2.17%), EOG (-1.23%), FB (-1.27%)

Short Picks (September 30 open – October 6 close % change): CVX (+0.07%), VZ (0.00%), MS (+0.15%), PPL (+5.90%), NEM (-2.67%)

Average long result: +2.45%, average short result: -0.69%

Total profit (average): +0.88%Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, October 21 – Tuesday, October 27 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (October 21) and sold or bought back on the closing of the next Tuesday’s trading session (October 27).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s.

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Utilities, 1 x Technology, 1 x Consumer Discretionary

- sells: 1 x Energy, 1 x Materials, 1 x Financials

Contrarian approach (betting against the recent trend):

- buys: 1 x Energy, 1 x Materials

- sells: 1 x Utilities, 1 x Technology

Trend-following approach

Top 3 Buy Candidates

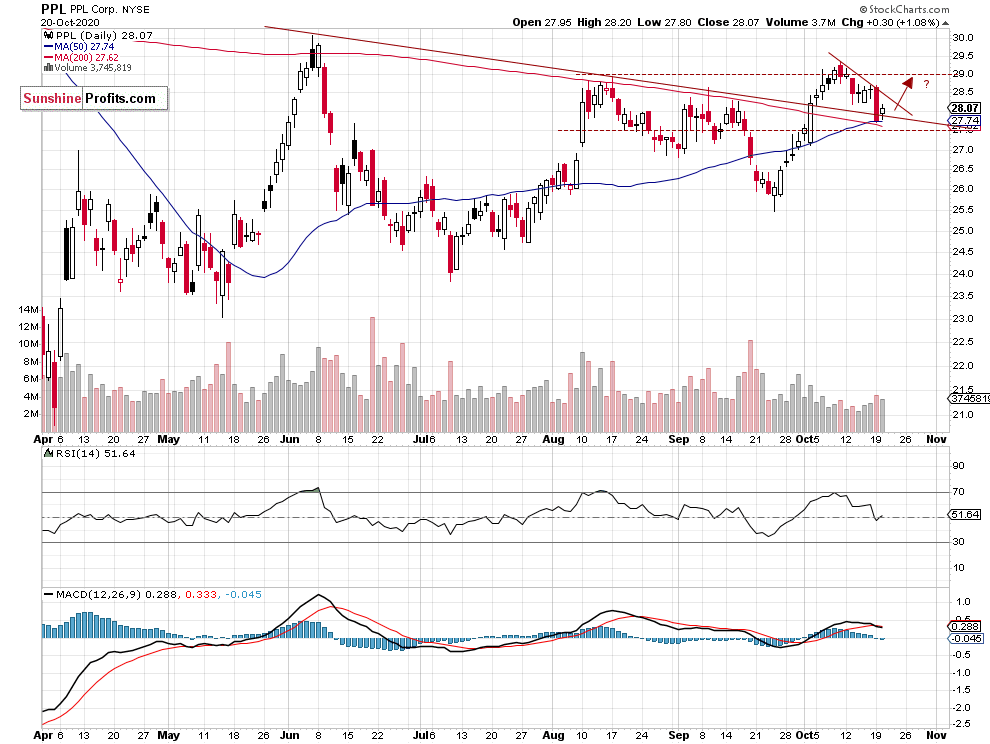

PPL PPL Corp. - Utilities

- Stock broke above medium-term downward trend line - uptrend continuation play

- Possible short-term uptrend continuation pattern – bull flag

- The resistance level is at $29 and a close support level is at $27.50

WDC Western Digital Corp. – Technology

- Stock broke above its recent downward trend line – possible short-term uptrend continuation

- The resistance level of $45

- The support level is at $39

WYNN Wynn Resorts Ltd – Consumer Discretionary

- Possible breakout above short-term downward trend line

- The resistance level of $77.50

- The support level is at $67.50-70.00

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update. The Utilities, Technology and Consumer Discretionary sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Stock Pick Update - this analysis' full version. There, we include the stock market sector analysis for the past month and remaining long and short stock picks for the next week. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Daily Newsletter

Delivered To Your Inbox

Free Of Charge

Bonus: Day Trading Signals, Gold & Silver, Oil, Forex Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM