Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

The situation didn’t change much yesterday, and, consequently, everything that I wrote in yesterday’s flagship analysis remains up-to-date. This means that there will be only a few additions to the overview of the technical situation. However, there are quite a few fundamental things that I will cover in the final part of today’s analysis.

Gold & Dollar

Let’s start with the charts. What’s going on with the USD Index?

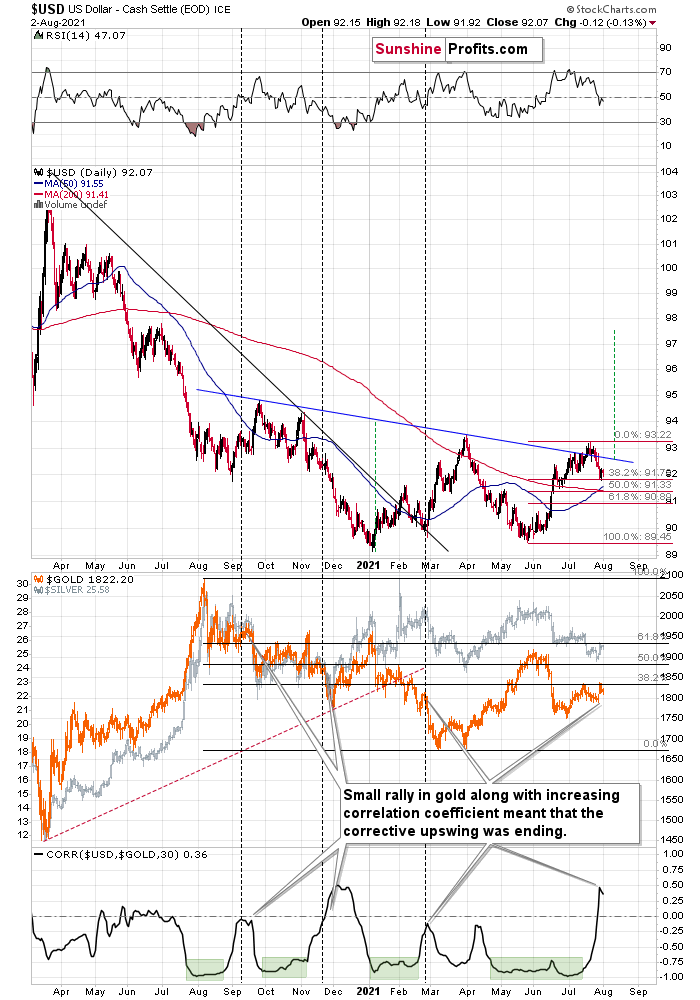

The U.S. currency moved slightly lower yesterday. It’s also slightly lower in today’s pre-market trading, but it’s not low enough to change anything on the technical front. The USD Index was at the 38.2% Fibonacci retracement after its short-term bottom, and it’s in the same place today as well. If it had moved below this threshold, it would change (only a little, but still) something, but since the USDX remains above this level, nothing changed.

And if the USD Index declines below the 38.2% Fibonacci retracement, it’s likely to find support just a little lower – at its 50% retracement, which coincides with the support provided by the previous lows.

What’s more, let’s take a look at the recent move higher in the value of the linear correlation coefficient between gold and the USD Index (bottom part of the chart). There were a few similar periods when it rallied and gold moved higher as well. I marked those cases with vertical dashed lines. In all three cases, it was right before gold turned south and declined in a quite profound manner. In one case (Sep. 2020), gold moved back and forth for several days before declining, but it then declined significantly anyway. The implications for gold and the rest of the precious metals sector are bearish.

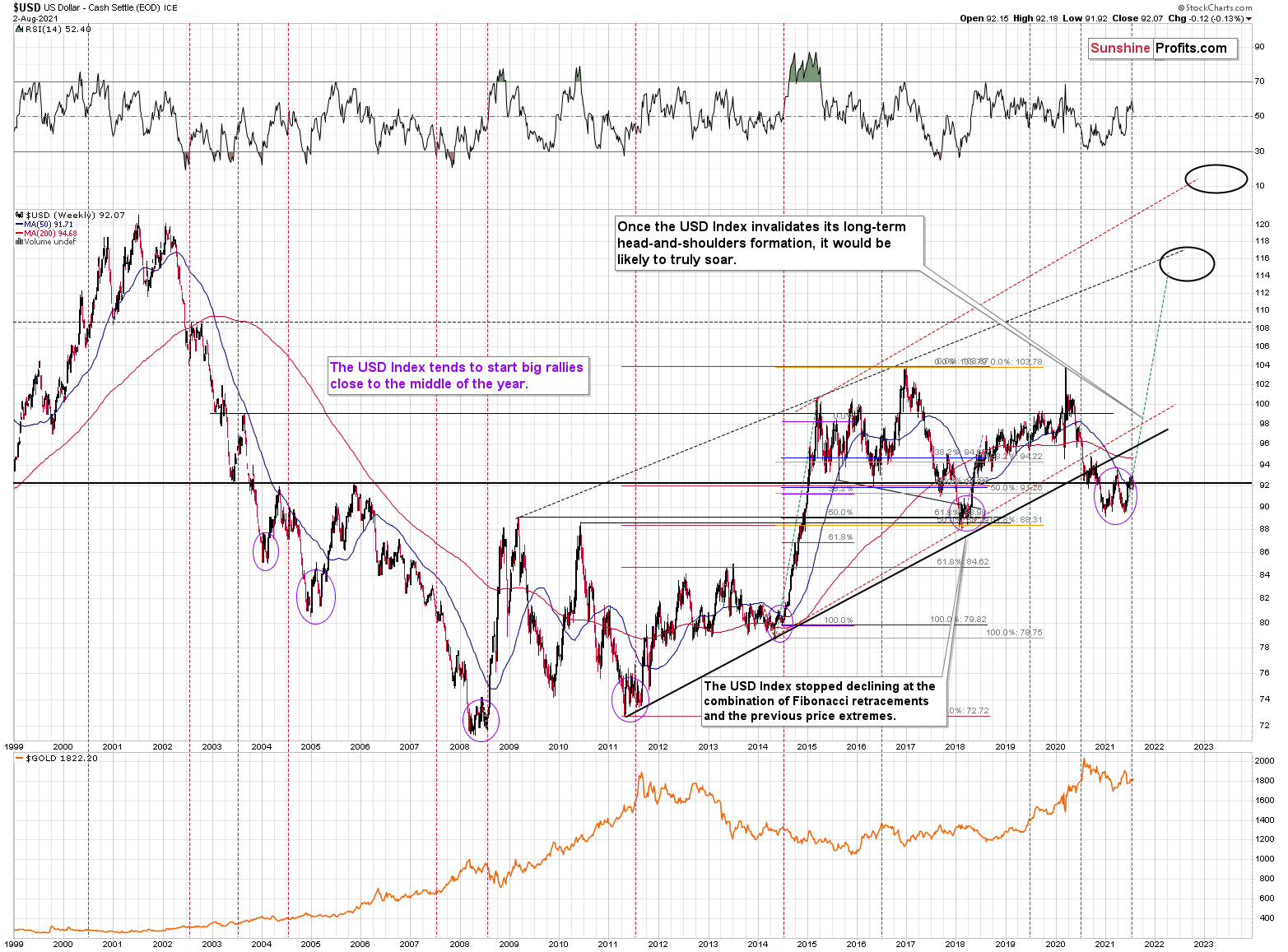

The fact that the USD Index tends to start major rallies after small declines in the middle of the year also plays an important, bullish role. I marked that with vertical, red, dashed lines below.

Consequently, the impact on the precious metals sector is likely to be very negative rather sooner than later.

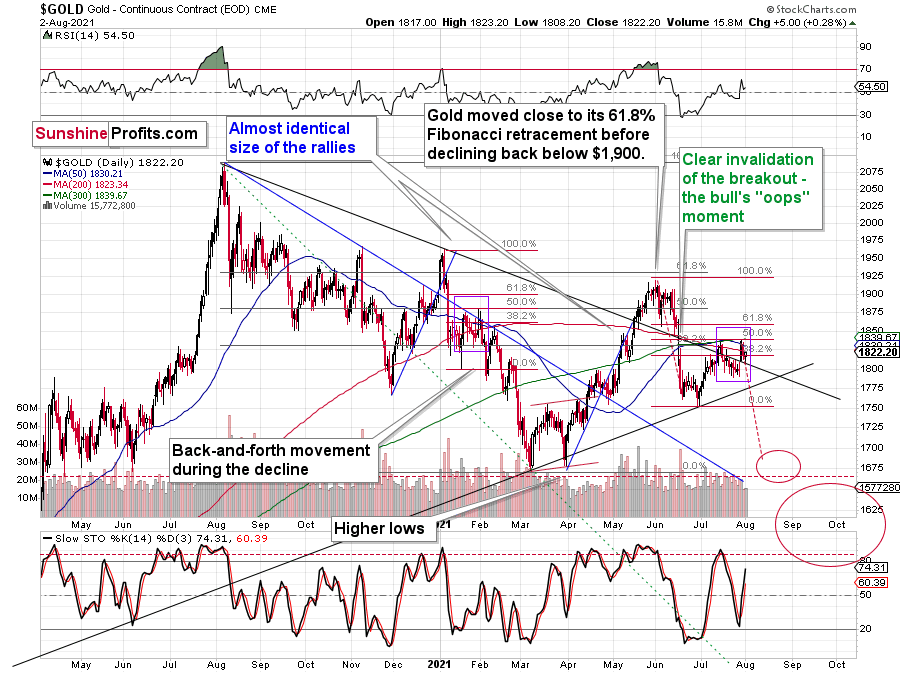

Gold moved higher by a few dollars yesterday, and it moved lower by a few dollars in today’s pre-market trading. Interestingly, while yesterday’s USD-gold link was normal, as the USDX declined (so it was normal for gold to move higher), today’s move lower in the gold price happened along with a small move lower in the USDX, which is bearish for the former.

Consequently, my yesterday’s comments on the above chart remain up-to-date:

Gold is demonstrating its early-2021 deception – back then, the yellow metal moved slightly above its previous highs following its initial collapse. And with the yellow metal correcting roughly 50% of its decline once again this time around (marked with purple rectangles), the price action is completely normal within the context of a medium-term downswing. Thus, while cooler heads have prevailed in July – following the yellow metal’s steep drawdown in June – a decline to the March lows (roughly $1,670) is likely the next stop along the bearish journey.

Mining Stocks and Silver

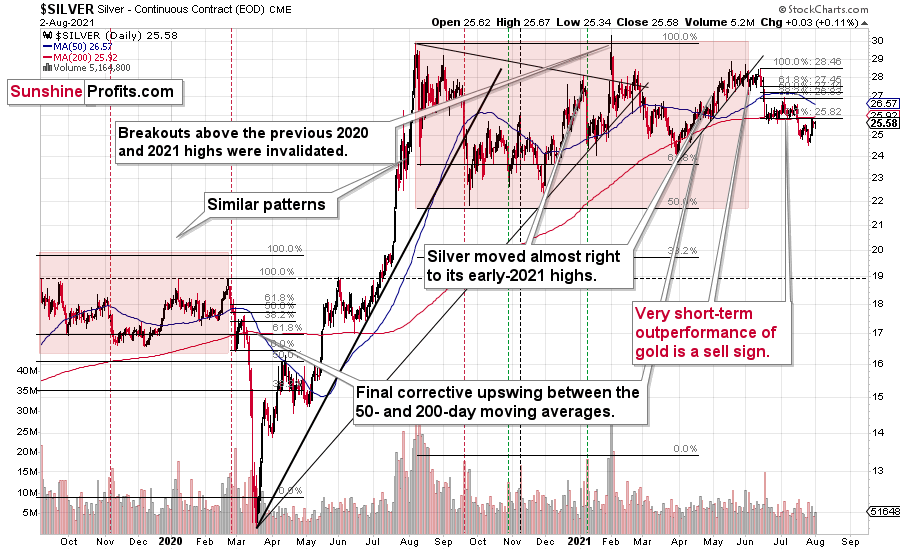

The situation in silver didn’t change either.

The white metal moved higher by just 3 cents, and it’s lower in today’s pre-market trading. It seems that the breakdown below the June lows was verified, as the silver price was unable to break back above them. Consequently, the next big move is likely to be to the downside.

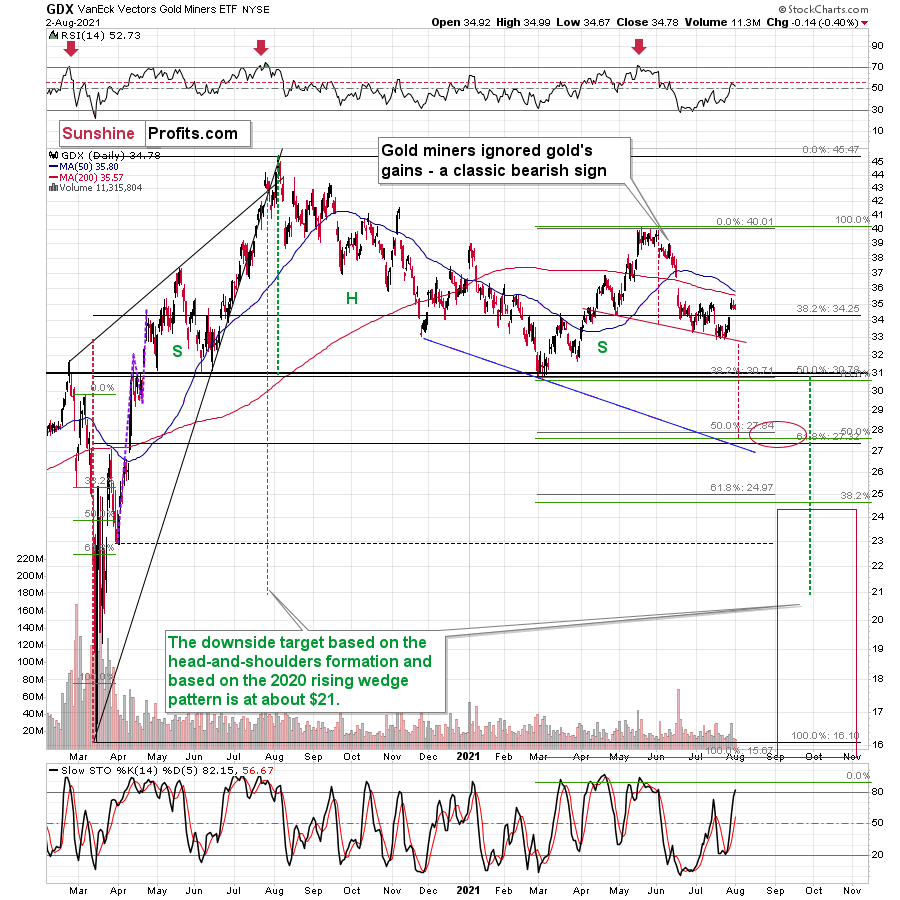

As far as mining stocks are concerned, I wrote about the key long-term developments yesterday. Namely, the situation in the HUI Index continues to develop just as it developed in 2008 and 2012-2013. The implications are extremely bearish for the following months.

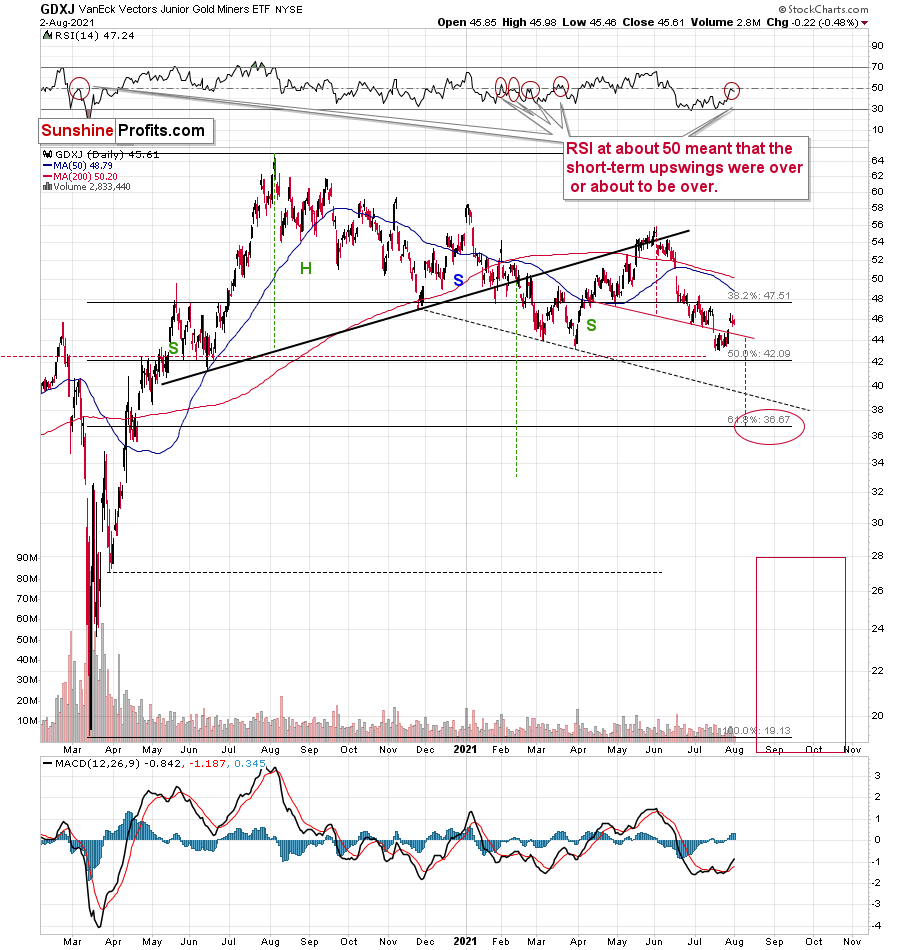

On a short-term basis, the GDX (seniors) and the GDXJ (junior miners) continue to consolidate, and with the RSI at the levels that previously triggered short-term reversals, it seems that it won’t take long for the miners to resume their downward path.

Being closest to their yearly lows, junior mining stocks continue to be the weakest part of the precious metals sector. Consequently, it seems that when the PMs decline, it will be the junior miners that will be affected most significantly.

Having said that, let’s take a look at the markets from the fundamental point of view.

Heads or Tails?

With investors eagerly awaiting the release of the U.S. nonfarm payrolls report on Aug. 6, a beat or a miss could cement the U.S. Federal Reserve’s (FED) taper timeline. Case in point: FED Governor Lael Brainard said on Jul. 30 that “the determination of when to begin to slow asset purchases will depend importantly on the accumulation of evidence that substantial further progress on employment has been achieved. As of today, employment has some distance to go.”

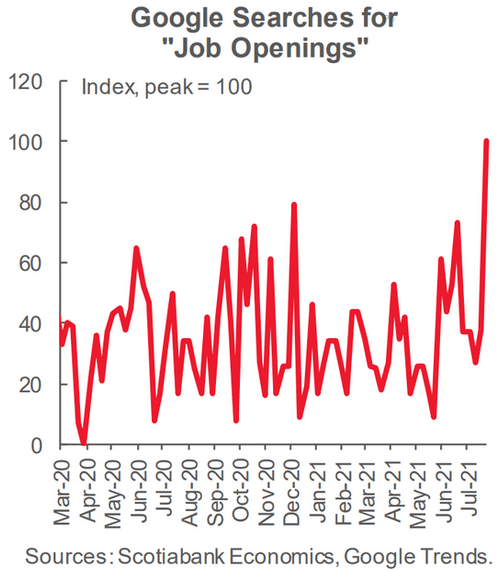

For context, data from Scotiabank shows that Google searches for “job openings” have jumped in July now that ~30% of claimants have lost enhanced unemployment benefits.

Please see below:

Contrasting Brainard, St. Louis FED President James Bullard said on Jul. 30 that the FED’s bond-buying program has fueled an “incipient housing bubble” and that failing to contain inflation could cause a "scramble" to hike interest rates in the future. “This is all about moving the supertanker and nudging the supertanker in the right direction at the right time," he said. “This is a big inflationary impulse. We have to have the right risk management to contain this if we need to in 2022."

And what is “the right risk management?”

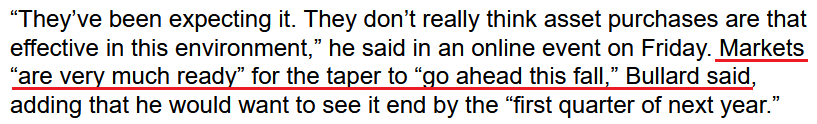

Upping the ante, FED Governor Christopher Waller told CNBC on Aug. 2 that “in my view, with tapering, we should go early and go fast in order to make sure we’re in position to raise rates in 2022 if we have to.” However, it all “depends on what the next two job reports do. If they come in as strong as the last one, then I think you’ve made the progress you need. If they don’t, then you’re probably going to have to push things back a couple months.”

Thus, if nonfarm payrolls perform, what does it mean for the FED’s taper timeline?

Most of It Is Unseen

Turning to inflation, while FED Chairman Jerome Powell blindly steers the Titanic, Bullard and Waller can clearly see the inflationary iceberg. For context, I warned on Jul. 29 that the FED’s assumptions still underestimate the inflationary fervor.

I wrote:

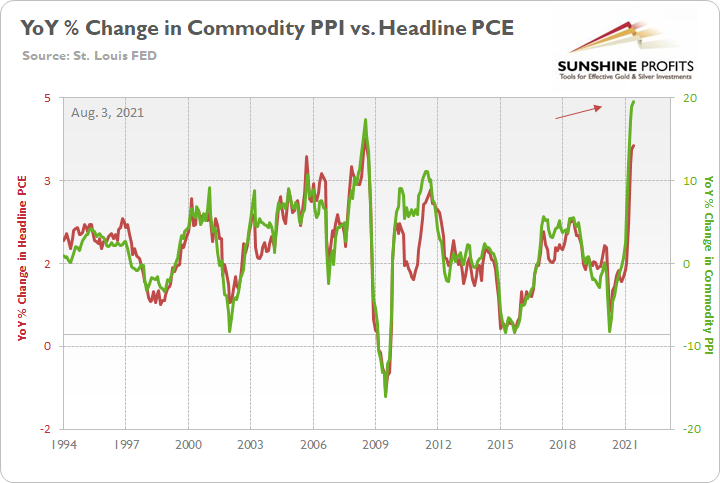

Even though the FED increased its headline Personal Consumption Expenditures (PCE) Index forecast from a 2.4% year-over-year (YoY) rise to a 3.4% YoY rise on Jun. 16, another dose of reality could be forthcoming. For example, with the PCE Index data scheduled for release on Jul. 30, the YoY percentage change in the Commodity Producer Price Index (PPI) implies a print of roughly 3.75% to 4.25%. As a result, inflation is still likely to overshoot the FED’s already drastically upgraded forecast.

And what was the verdict? Well, with the headline PCE Index rising by 3.99% YoY on Jul. 30, Powell’s favorite inflation metric is nearly double the standard 2% target.

Please see below:

To explain, the green line above tracks the YoY percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline PCE Index. If you analyze the right side of the chart, you can see that the headline PCE Index still has room to run.

Furthermore, Waller also highlighted the same cost-push inflationary concerns that I’ve been writing about for the last several months:

“My concern is just anecdotal evidence I’m hearing from business contacts who are saying they’re able to pass prices through. They fully intend to. They’ve got pricing power for the first time in a decade,” said Waller. “Those are the sorts of issues that make you concerned that this may not be transitory.”

Weighing in on the debate, the Institute for Supply Management (ISM) released its Manufacturing PMI on Aug. 2. And while the headline index declined from 60.6 in June to 59.5 in July, the report revealed:

“Business Survey Committee panelists reported that their companies and suppliers continue to struggle to meet increasing demand levels. As we enter the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products.”

What We See and What There Is

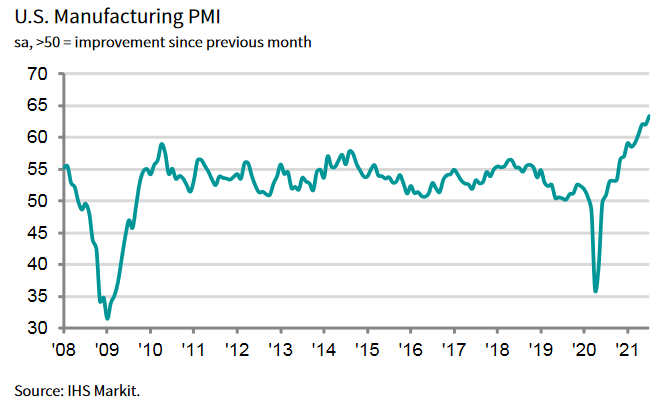

On top of that, while a Reuters headline read “U.S. manufacturing growth cooling; bottlenecks starting to abate,” investors’ anxiety on Aug. 2 has them blinded by banners. Case in point: while the ISM garnered all of the news media’s attention, IHS Markit also released its U.S. Manufacturing PMI on Aug. 2. And with the headline index rising from 62.1 in June to 63.4 in July, the report revealed that “the improvement in the health of the manufacturing sector was the strongest in the 14-year series history.”

Please see below:

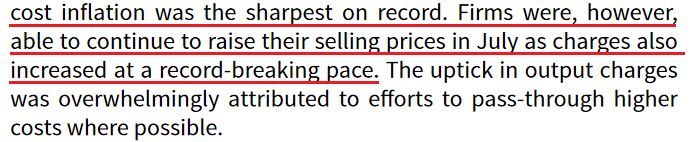

In addition, while investors bowed to the ISM narrative on Aug. 2, IHS Markit revealed:

“Output expectations remained upbeat amid hopes of further boosts to client demand over the coming year …. Contributing to the uptick in the headline figure was a sharper expansion in production at the start of the third quarter. The upturn was reportedly linked to stronger client demand and efforts to clear backlogs of work. The rate of growth was the steepest for six months and marked overall. New business at manufacturing firms rose at a robust rate that was close to the record pace set in May. Firms stated that greater new order inflows stemmed from stronger client demand from new and existing customers, as some sought to stockpile. At the same time, foreign client demand rose at one of the fastest rates since data collection began in 2007 amid the reopening of key export markets.”

And saving the best for last:

For even more context, Chris Williamson, Chief Business Economist at IHS Markit, wrote the following:

“Despite reporting another surge in production, supported by rising payroll numbers, output continued to lag well behind order book growth to one of the greatest extents in the survey’s 14-year history, leading to a near-record build-up of uncompleted orders.” To explain, when finished goods (output) lag businesses’ order books, it means that demand outweighs capacity and the development is inflationary.

He continued: “the result is perhaps the strongest sellers’ market that we’ve seen since the survey began in 2007, with suppliers hiking prices for inputs into factories at the steepest rate yet recorded and manufacturers able to raise their selling prices to an unprecedented extent, as both suppliers and producers often encounter little price resistance from customers.”

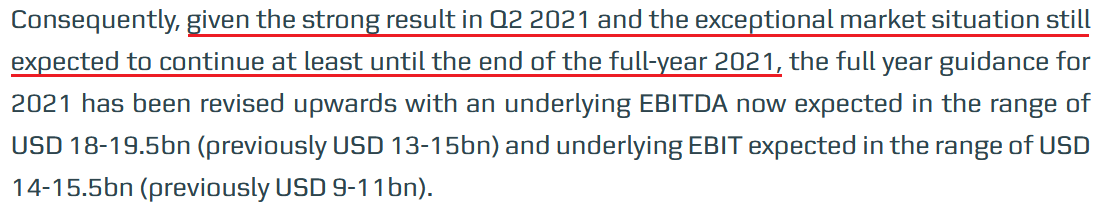

If that wasn’t enough, A.P. Moller-Maersk, the largest container shipping company in the world, also raised its full-year 2021 earnings guidance on Aug. 2. Its trading update read: “the outlook for the global market demand growth for the full-year 2021 has been revised up to 6-8% from previously 5-7%, primarily still driven by the export volumes out of China to the US.”

Please see below:

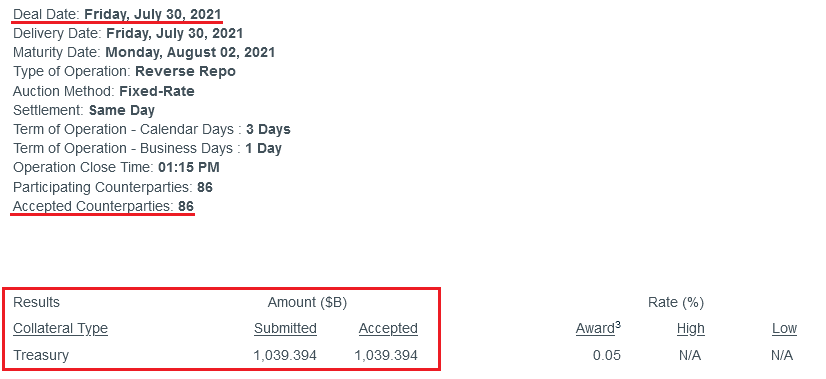

Finally, while the FED’s taper timeline is the most important fundamental catalyst that’s impacting the financial markets, I warned previously that the central bank’s daily reverse repurchase agreements are analogous to a reduction in QE (they don’t have the same psychological effect though). And with the FED selling more than $1 trillion of reverse repos on Jul. 30 – and more than $921 billion on Aug. 2 – the liquidity drain continues to accelerate.

In conclusion, the PMs remain extremely anxious, as the allure of lower U.S. real yields is the only thing holding them up at this point. However, this week’s U.S. nonfarm payrolls report will likely make or break their short-term performance. In a nutshell: if the print is weak, the USD Index will likely fall and the PMs will likely rally as investors push the FED’s taper timeline further into the future. However, with the medium-term implications still intact – as enhancement unemployment benefits end nationwide (planned) in September and students will also (planned) return to school – U.S. employment remains on the up and up. And with the labor market poised to head north over the next few months, the PMs will likely head in the opposite direction.

Overview of the Upcoming Part of the Decline

- The biggest corrective upswing in gold might already be over, and it seems that we won’t have to wait long for the current small correction to end either.

- After miners slide in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this would take place – perhaps with gold close to $1,600. I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,350 - $1,500 and the entire decline (from above $1,900 to about $1,475) would be likely to take place within 6-20 weeks, and I would expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,475, but it’s too early to say with certainty at this time.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, it seems that the bigger corrective upswing in gold might already be over and that we won’t have to wait for the current small correction to end either. While the next few days may (!) bring temporarily higher prices, it’s unlikely that they will hold. In particular, just as mining stocks had local corrections that didn’t change the nature of the huge medium-term declines in 2008 and 2012-2013, it’s unlikely that the current local correction will change anything.

It seems that our profits on the short position in the junior mining stocks are going to grow substantially in the following weeks.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $37.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $15.96; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $37.02; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,683

Gold futures upside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief