Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. As we promised you previously, in our flagship Alerts, we will be providing you with bigger, more complex analyses (approximately once per week) and it will usually take place on Monday.

Most of the things that we discussed in the previous flagship analysis, didn't change. As it is the case usually, we will quote last week's comments while updating everything that needs to be updated or changed. In the end, the entire below analysis is up-to-date at the moment of publishing. The parts that we didn't change (or changed only insignificantly) since last week, will be put in italics.

The most important fundamental factor right now remains the Covid-19 pandemic and the serious economic implications. As far as the price changes are concerned, what matters the most is how the market views the data and news that hit it. Let's start with discussing the most recent fundamental development and then we'll move to discussing what happened and what does it imply for the next few weeks.

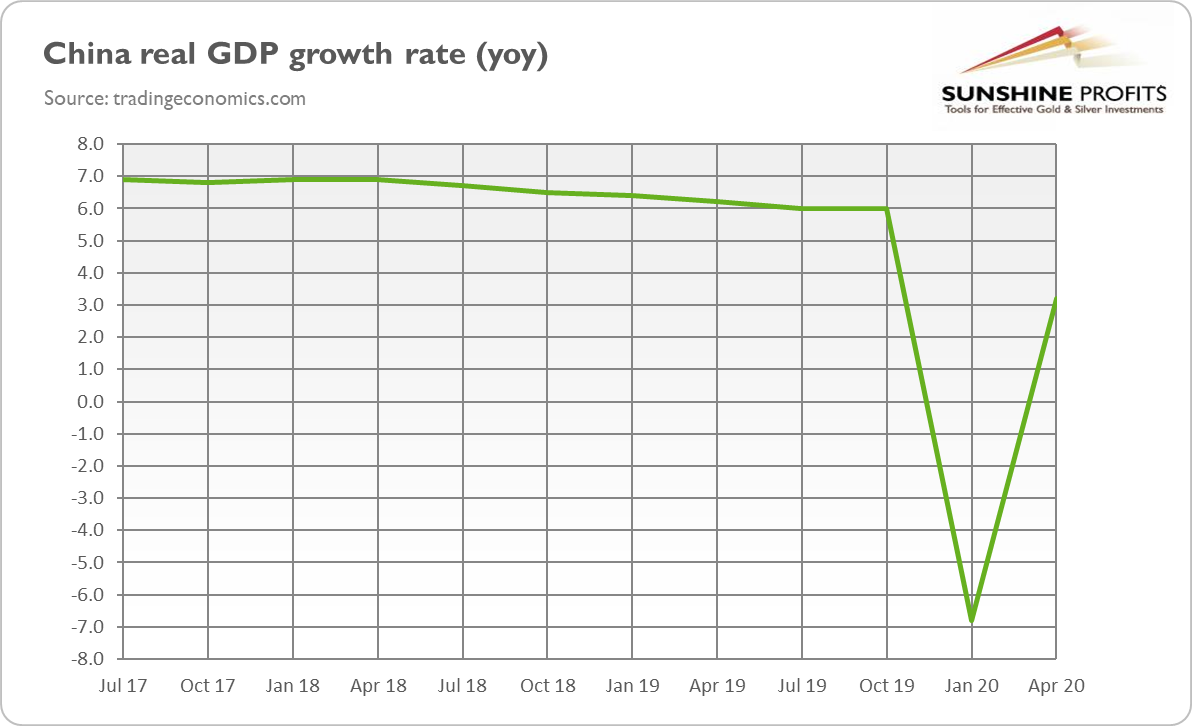

The key news is how the coronavirus is spreading, but let's start with something that also seems to be very important. Namely, last week, China reported that its economy grew 3.2 percent year-on-year in the second quarter of this year, following a 6.8 percent contraction in the previous quarter, as the chart below shows. Importantly, the actual growth rate beat the market expectations of a 2.5 percent expansion. The number is of great importance also because China is the first major economy to report positive growth after the coronavirus pandemic and the Great Lockdown. So, the Chinese data bode well for the U.S. and other countries, where the epidemic started later.

Does it really? After all, there are doubts about the accuracy of China's official reports. Moreover, although the economy partially rebounded, it still contracted 1.6 percent in the first half of 2020. And consumption remains weak in China. Retail sales were down 1.8 percent in June on an annual basis, which is below forecasts. It clearly shows that there are still significant headwinds ahead of the second largest economy in the world and that there is still a way to go for a full and sustainable recovery. So far, the economic revival in China is a story of government stimulus and debt-led rebound. According to the Institute of International Finance, China's total debt rose from 300 percent in late 2019 to 317 percent of GDP in the first quarter of 2020.

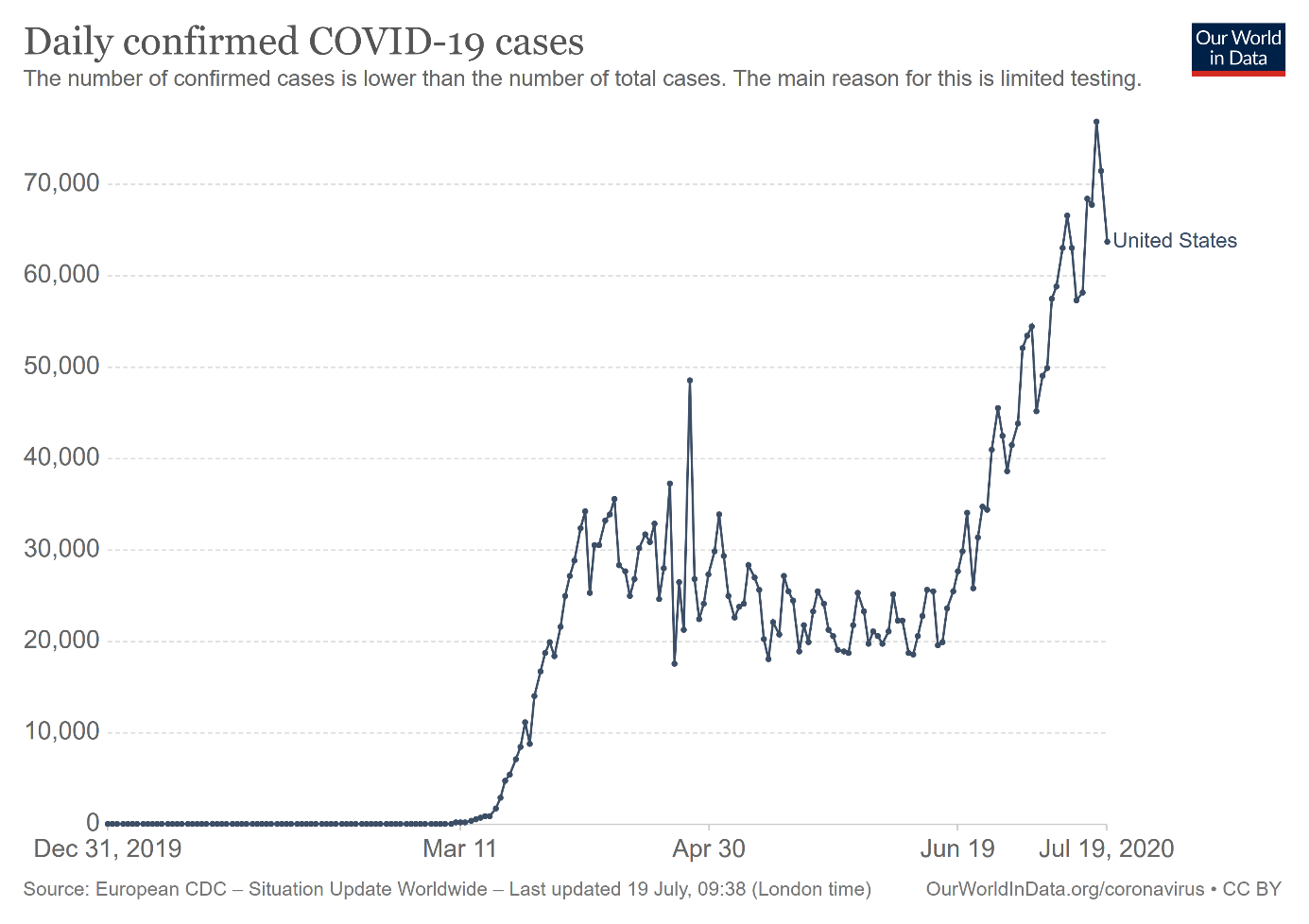

What is important is that China's official data - even if we take it at face value - does not translate so simply into the American reality. The obvious reason is that while China has contained the epidemic (abstracting the second wave in Hong Kong, where a new outbreak forced the authorities to implement the strictest-ever social distancing measures), the U.S. still struggles with the coronavirus, as the chart below shows.

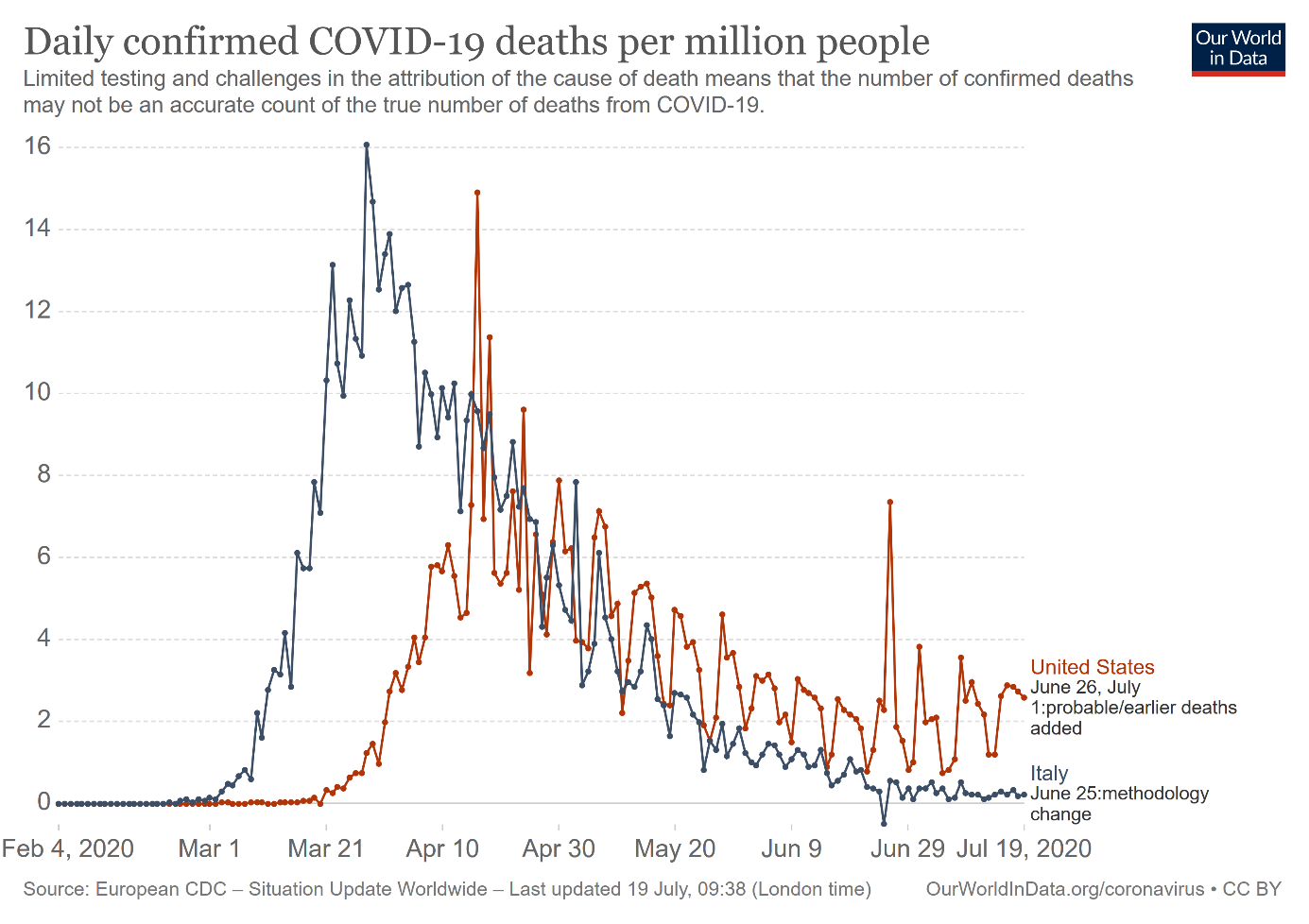

What is crucial here is that not only the number of new cases have been rising in the United States, but also the number of deaths because of Covid-19. As the chart below shows, it has been increasing for several days to reach almost 3 deaths a day per million inhabitants. It is still less than in April, but more than in the previous weeks and significantly higher than in other countries, including Italy.

What does it all mean for the gold market? Well, on surface, it seems that everything is fine. China's economy has rebounded in the second quarter, and America is also on track to recovery. After all, industrial production rose 5.4 percent in June, following 1.4 percent in May, while the Empire State Index, which measures business activity in New York state, increased 17.2 percent in July from negative 0.2 percent in June, crossing back into positive territory.

However, the sad truth is that economic activity remains well below the pre-pandemic level. As we acknowledged earlier, the upcoming data will be very positive because of the very low base. But later data may be less impressive, especially if the new outbreak in the U.S. spreads wider and further reduces consumer spending.

It is, of course, very possible (and we hope for) that the second wave of infections will be eventually contained, just as the first wave was, but until then it may have a negative effect on the pace of economic recovery - and positive on the yellow metal (not necessarily initially as gold plunged first in March).

So, although positive economic news from China could boost risk appetite, hitting the safe-haven demand for gold, the fundamental outlook for gold prices remains intact. After all, the economic recovery in America will we weaker than in China, partially because of worse epidemiological situation. But even if the pandemic is contained soon, the easy monetary policy will remain in America for years. The U.S. central bankers will remain dovish and more tolerant of inflation. Indeed, just last week, Patrick Harker, Philadelphia Fed President, said "I'm supportive of the idea of letting inflation get above 2% before we take any action with respect to the federal funds rate." It goes without saying that such ideas are supportive for gold prices. At the same time, it doesn't change the possibility of gold sliding initially, when stocks decline again.

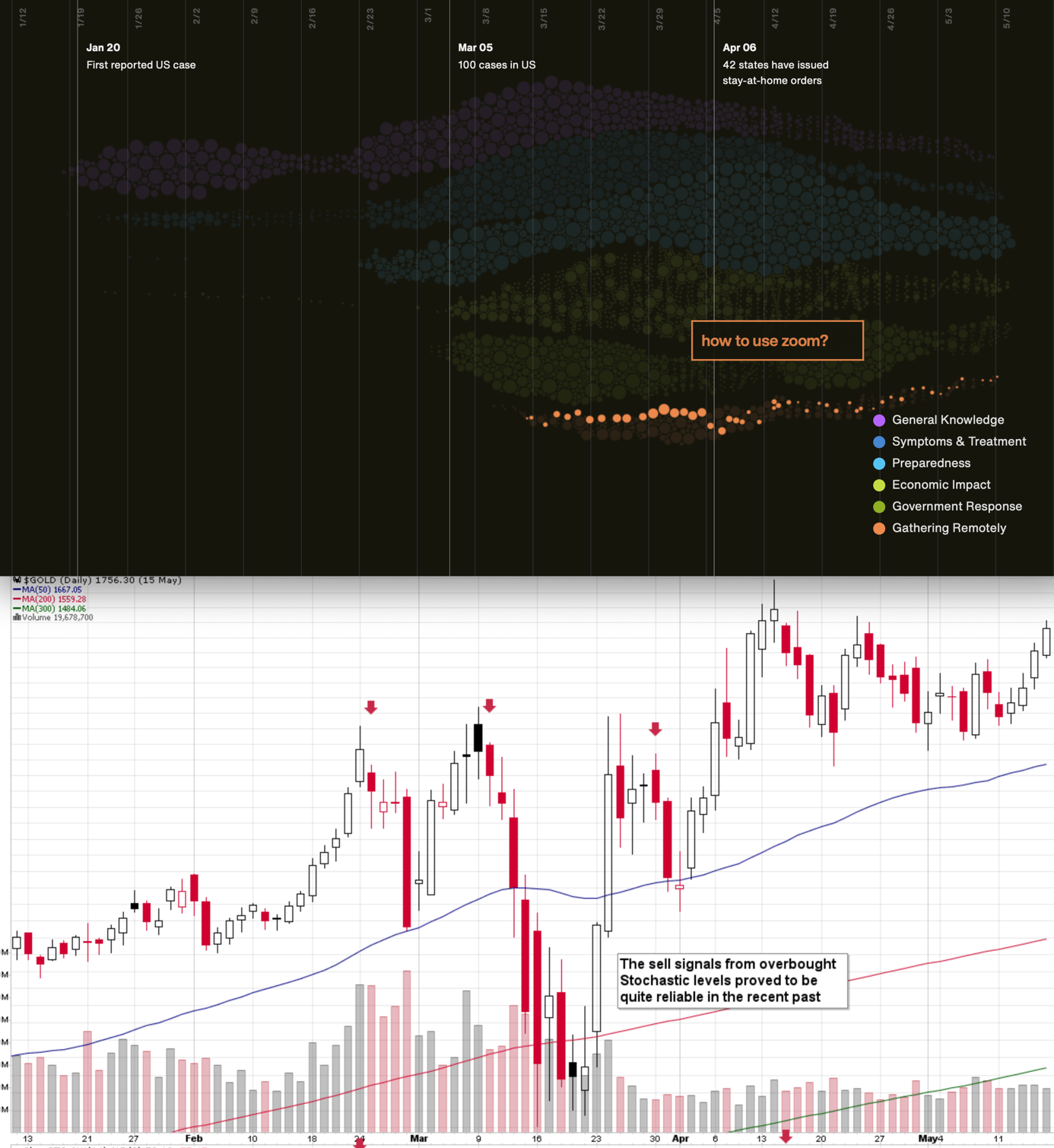

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it's vulnerable to a sizable decline, when the economic implications of the pandemic's continuation become obvious to investors.

Moreover, let's keep in mind that big moves up in the USDX practically always correspond to big moves down in gold - sooner or later. And that the USD Index is likely to move much sooner based on the epic technical breakout anyway.

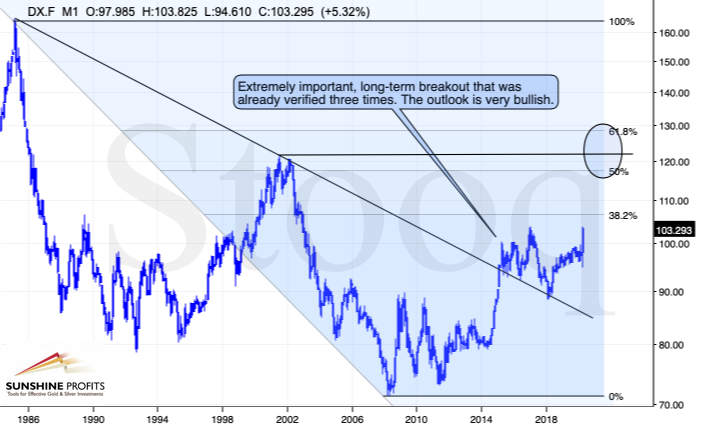

The Big Picture View of the USD Index

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

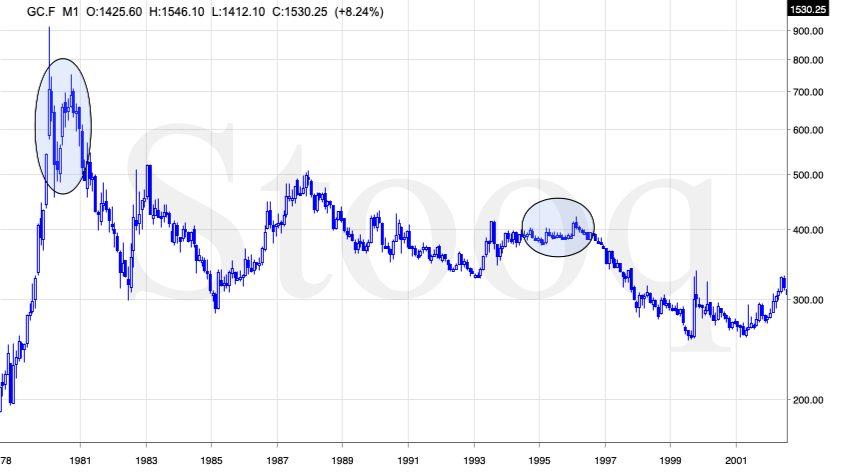

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Soars

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

Having covered the most important factor for the USD Index and gold, let's take a look at the other - also important - factors influencing both of these markets.

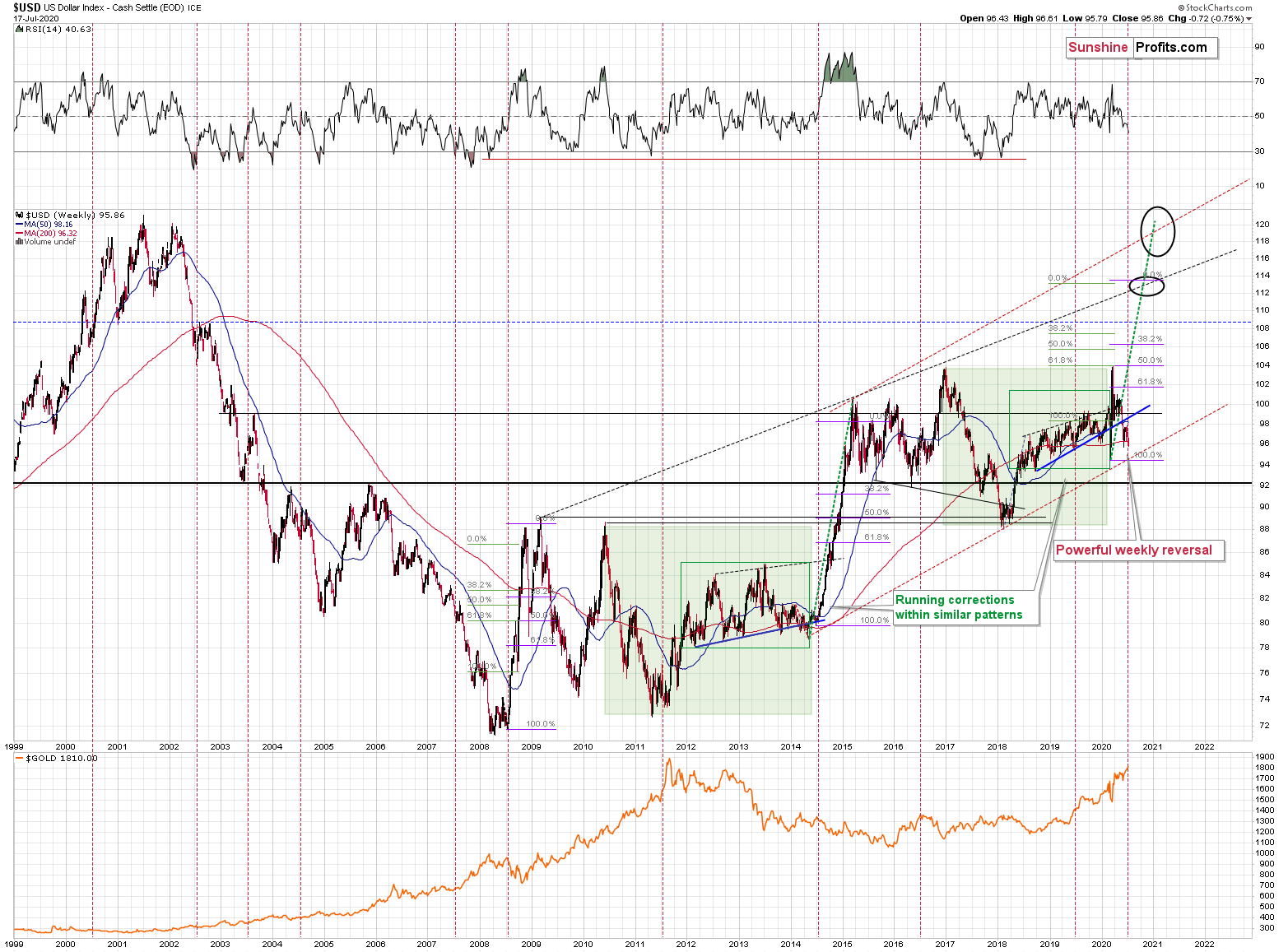

More on the USD Index and Gold

The USD Index was previously (for the entire 2019 as well as parts of 2018 and 2020) moving up in a rising trend channel (all medium-term highs were higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel was actually a running correction, which was the most bullish type of correction out there.

If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

We previously wrote that the recent temporary breakdown below the rising blue support line was invalidated, and that it was a technical sign that a medium-term bottom was already in.

The USD Index soared, proving that invalidation of a breakdown was indeed an extremely strong bullish sign.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

In fact, given this month's powerful run-up, it seems that nobody will doubt the possibility of the USD Index soaring much higher. Based on how things are developing right now, it seems that the USD Index might even exceed the 117 level, and go to 120, or even higher levels. The 120 level would be an extremely strong resistance, though.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

On the short-term note, it seems that the USD Index has finished or almost finished its breather after the powerful run-up. While the base for the move may be similar to what happened between 2010 and 2014, the trigger for this year's sharp upswing was similar to the one from 2008. In both cases, we saw dramatic, and relatively sudden rallies based on investors seeking safe haven. The recent upswing was even sharper than the initial one that we had seen in the second half of 2008. In 2008, the USDX corrected sharply before moving up once again, and it's absolutely no wonder that we saw the same thing also recently.

But a correction after a sharp move absolutely does not imply that the move is over. In fact, since it's so in tune with what happened after initial (!) sharp rallies, it makes the follow-up likely as well. And the follow-up would be another powerful upswing. Just as a powerful upswing in the USD Index triggered gold's slide in 2008 and in March 2020, it would be likely to do the same also in the upcoming days / weeks.

Please note that the 2008 correction could have been used - along with the initial starting point of the rally - to predict where the following rally would be likely to end. The green lines show that the USDX slightly exceeded the level based on the 2.618 Fibonacci extension based on the size of the correction, and the purple lines show that the USDX has approximately doubled the size of its initial upswing.

Applying both techniques to the current situation, provides us with the 113 - 114 as the next target area for the USD Index. A sharp rally to that level (about 13-14 index points) would be very likely to trigger the final sell-off in gold, silver, and mining stocks.

For now, however, we see that the USD Index formed a clear and powerful weekly reversal, bottoming relatively close to its March bottom. This bodes very well for the next 1-6 weeks. The implications for gold are very bearish.

Two weeks ago, we emphasized that while the above remains up-to-date, we couldn't rule out a scenario in which the USD Index declined somewhat. We wrote that this would be in tune with what the USDX did before the biggest upswings of the past years.

In mid 2008, the USDX first moved lower before truly soaring.

In Q3 2011 (close to the middle of the year), the USDX also moved lower, forming a broad bottom, before soaring sharply.

In mid 2014, the USD Index also dipped while being between the 50-day moving average (marked with blue) and the 200-day moving average (marked with red) - exactly where they are right now.

In 2016, the USD Index moved a bit lower and reversed (at about 93) before the middle of the year. That was also when gold topped.

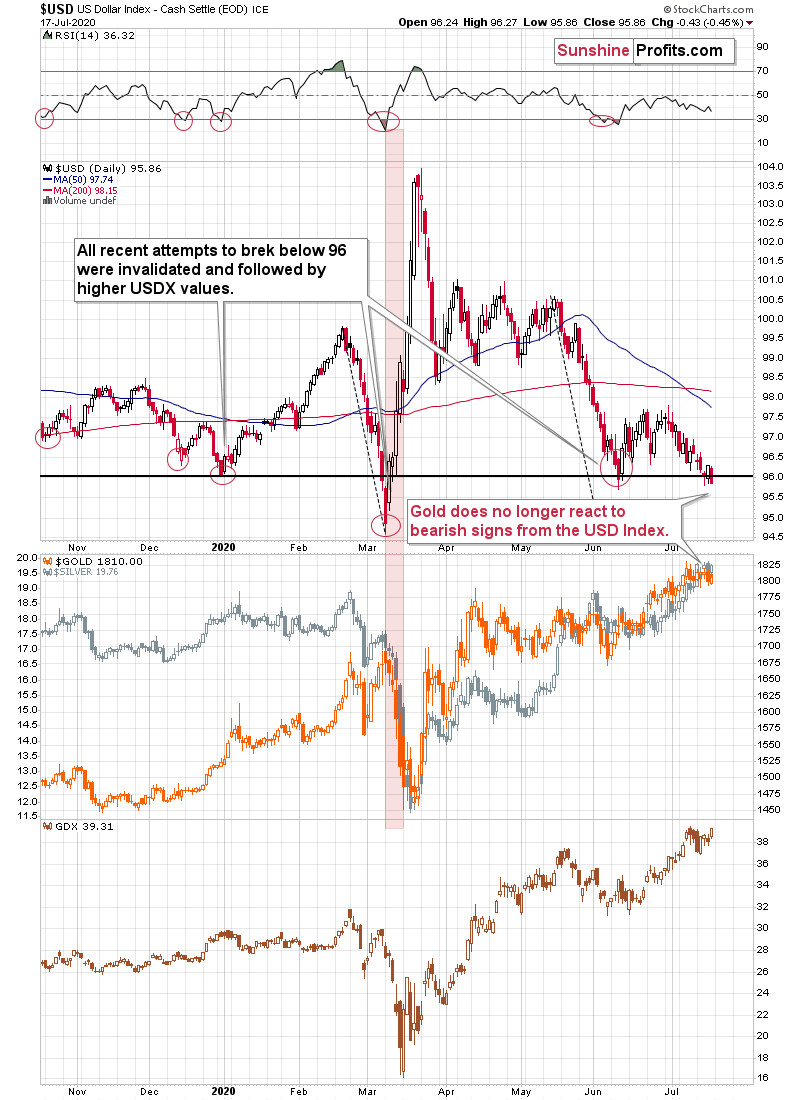

The USD Index did move lower recently and it's currently trading back and forth around the 96 level, while gold is not doing much. While the USD Index is testing its June low, gold is not testing its June high, which is a bearish sign for gold.

The lack of reaction to bullish indications from the USD Index also suggest that PMs might be vulnerable to strong reaction given a bearish lead from the USDX. And since the USDX just moved below 96, it seems that we're likely to see another USD upswing shortly. In fact, it might already be underway. After all, all recent attempts to break below the 96 level were followed by invalidations and rallies. That's how the huge March rally in the USDX and the huge downswing in the PMs started.

The USD Index has indeed invalidated the breakdown below the 96 level. This time, the breakdown was not significant, so the comeback was not clearly visible either. Just like if you put a ball underwater - it shoots back up, but if you put it just a bit below the surface, it will still go back, but not as quickly and that's perfectly normal.

The important thing is that it comes back at all and the same thing is with the USD Index right now. In March, the initial move back up was sharp, but that was not when gold rallied the most. After moving back above 96, it then paused for a while and moved higher shortly thereafter. It was this post-pause move that wreaked the greatest havoc in gold, silver, and mining stocks.

And you know what the USD Index has been doing in the last several hours?

It's been consolidating around the 96 level. The moves are not as big as they were in mid-March, which is in tune with the current volatility and the fact that the USDX didn't move much below the 96 level previously.

At the same time, the USD Index is moving around the neck level of the previous head-and-shoulders formation. Since the breakdown below this line was already invalidated, we view this action as neutral-to-bullish - definitely not bearish.

Last Monday, we wrote the following:

The USD Index did move lower and right now it's in the situation where it could still move slightly lower before soaring. The reason is the incomplete head-and-shoulders formation. Theoretically, this formation is bearish once its completed, but based on what we wrote with regard to USD's long-term picture, it seems more likely that the USD Index will attempt to break lower and then invalidate this breakdown. We saw this kind of performance multiple times and invalidated H&S pattern is a very bullish phenomenon. In fact, all invalidations are strong signs to the opposite direction, but the signals coming from invalidated H&S patterns appear particularly strong.

That's exactly what's taking place. The overall implications are bullish for the USD Index and bearish for the precious metals market.

Gold's Major Reversal

The gold price is almost flat this month (up by just $9.50 in terms of the closing prices). After the early rally, we saw a decline and gold is about to test the first of the rising support lines. Given gold's long-term turning point and because of USD's mid-year turning point, it's likely that we are going to see a more decisive move lower shortly.

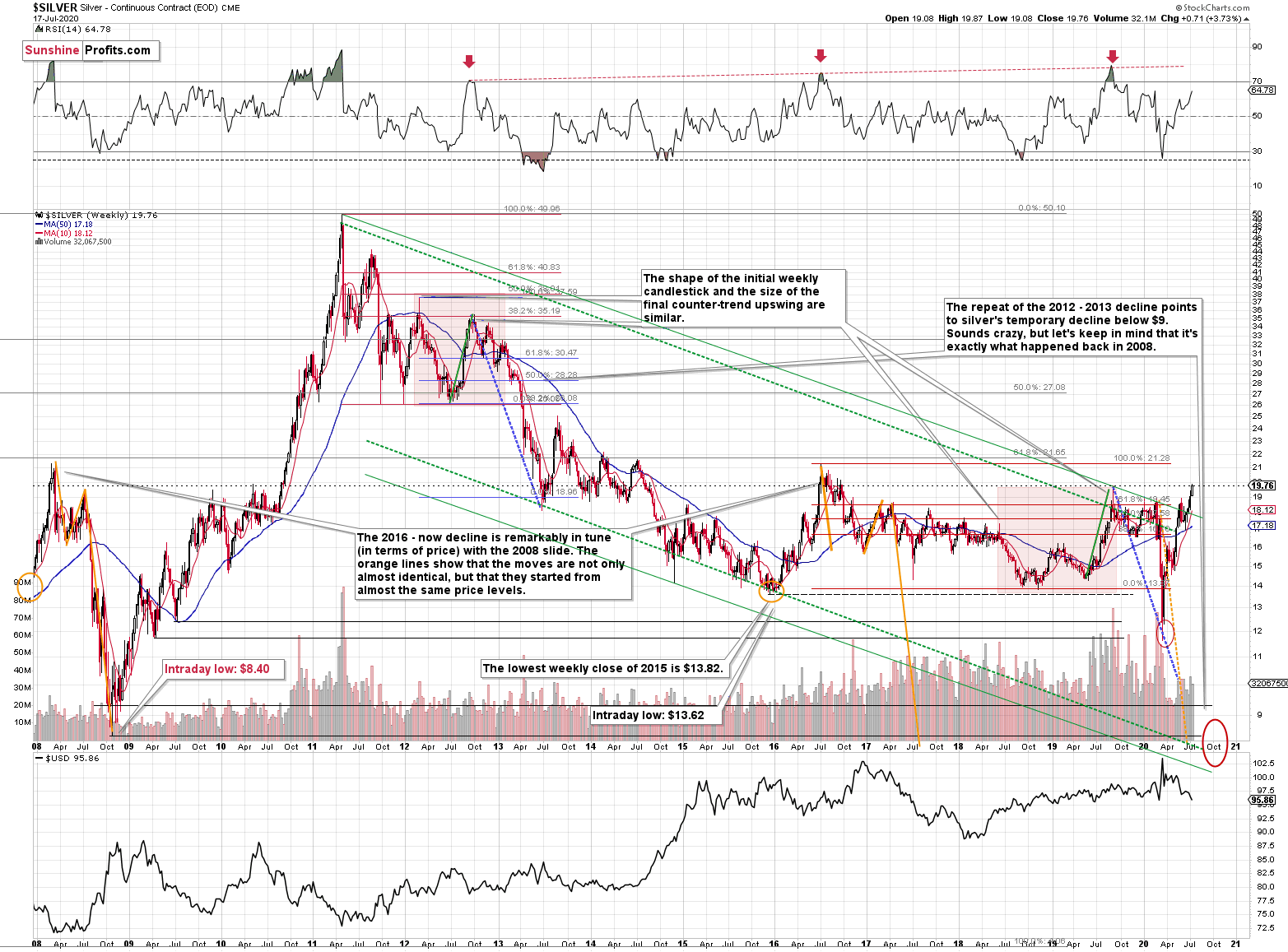

Before recalling gold's long-term turning point analysis, let's take a look at silver and its own long-term turning points, to see how well this technique worked.

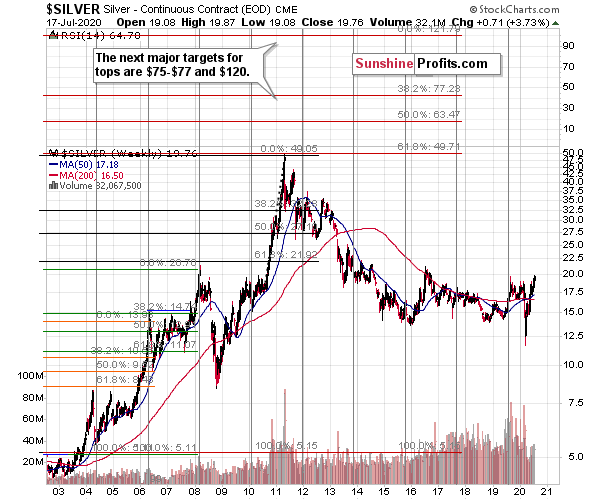

The 2019 top took place almost right at the long-term turning point, and the high that was formed back then, wasn't exceeded ever since. Besides showing you how useful the long-term turning points were, and how dangerous ignoring them would have been, it shows in a clear way just how little silver rallied recently compared to gold. Silver is just several dollars above its 2015 lows and tens of dollars away from its 2011 high.

Is it really a true bull market in the precious metals sector if it's practically only gold that is showing substantial strength?

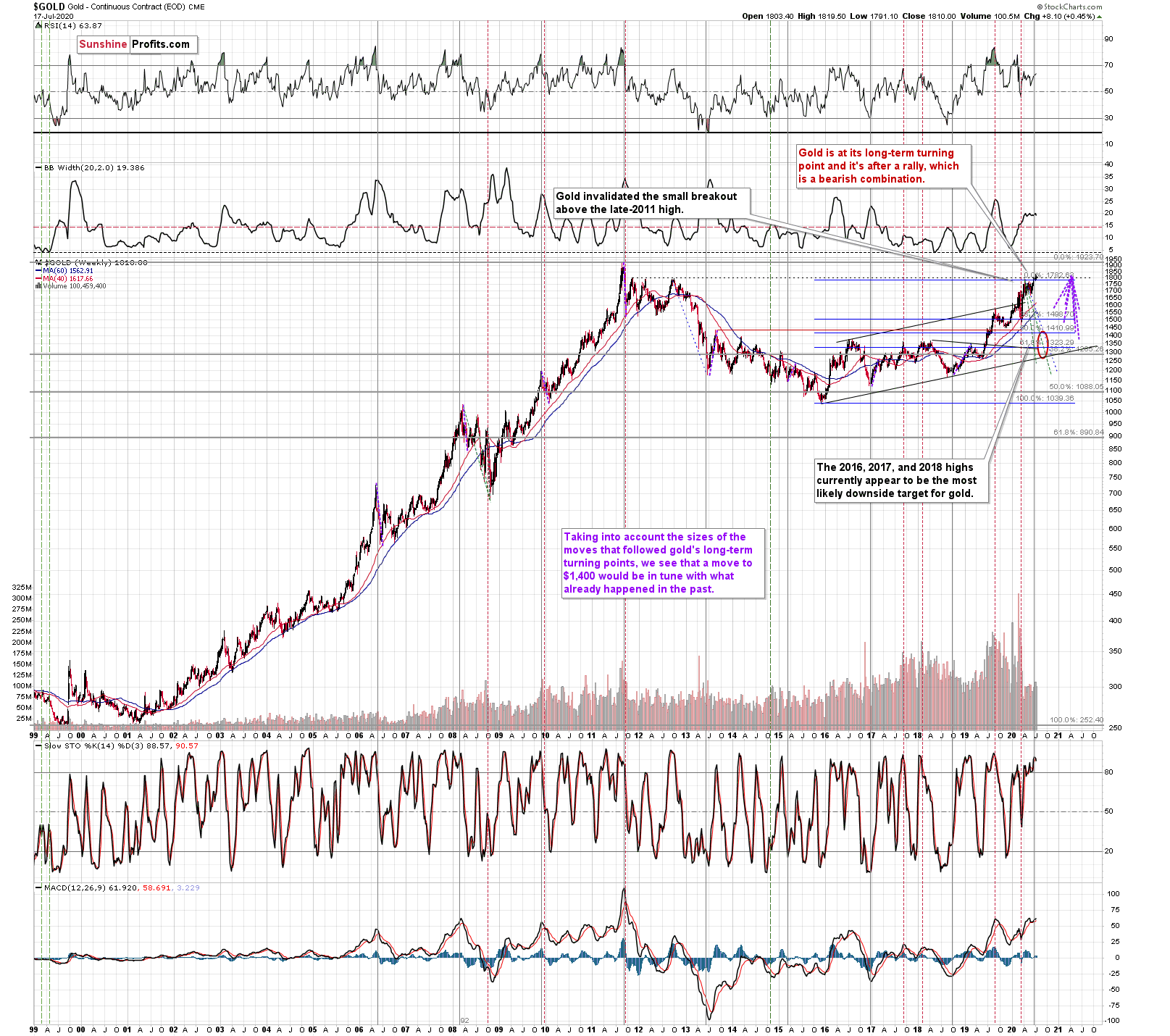

Gold's very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

They are particularly bearish since gold recently invalidated the tiny breakout above its November 2011 high. It's now trading once again above it, but just as was the case previously, we expect the tiny breakout to be invalidated shortly.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The take-away is that the long-term turning point is a big deal, and that gold could fall significantly before it soars due to its extremely positive fundamental outlook. This also means that the downside target of $1,400 or slightly lower (the 2016 - 2018 highs) is well within the range of the possible moves.

The initial move lower is likely to end at about $1,700, though as that's where we have support that had already proved to be strong several times.

So far, gold has been moving more or less in tune with the way it was behaving after the previous tops (with significantly smaller volatility, though). The early part of the decline is usually characterized by some back-and-forth action as many investors don't realize that it's a top yet.

The dashed lines represent the recent declines and they make the comparison of the declines' pace easier. When will gold's decline be more decisive? When it breaks below the rising support lines and the April low. This means that once gold slides below $1,805, the pace at which declines, is likely to accelerate.

Based on the declines that were similarly big as the move that would take gold to about $1,700, we can expect gold to reach this level sometime this or next week. That's when we might exit the current short positions in order to re-open them after the rebound.

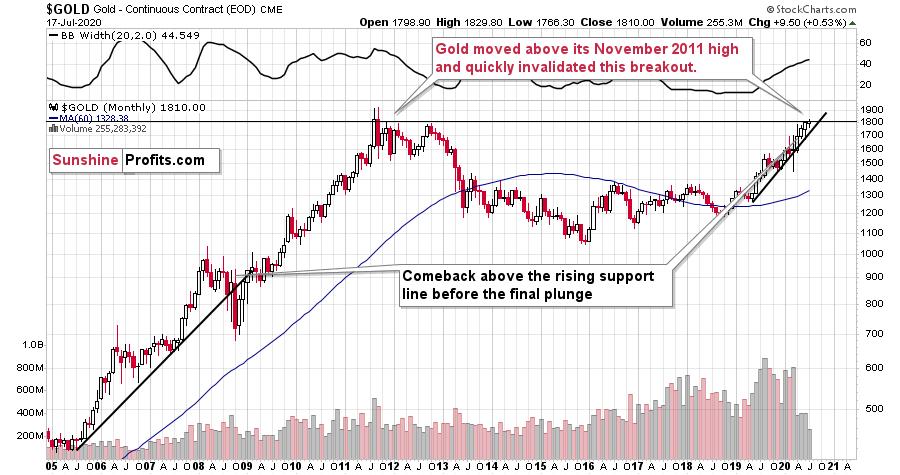

Gold's monthly chart shows that the long-term analogy in terms of prices to what happened in 2008 still seems intact in terms of the monthly price changes.

In 2008, after the initial plunge, and a - failed - intramonth attempt to move below the rising support line, gold came back above it and it closed the month there. The same happened in March 2020.

During the next month in 2008, gold rallied and closed visibly above the rising support line. The same was the case in April, 2020.

In the following month - the one analogous to May 2020 - gold initially moved higher, but then it plunged to new lows and finally closed the month below the rising support line.

We haven't seen the plunge last month, but we did see a move very close to the previous highs, just like what we saw in March. As the volatility is now somewhat smaller, it suggests that instead of seeing the slide in May or June, we might see it in July and August.

Gold had declined and it recovered this month, but the above simply prolongs the analogy; it doesn't invalidate it, especially in light of gold's long-term turning point. The important indication of that is that gold didn't manage to confirm the breakout above its long-term resistance provided by the November 2011 high.

Having said that, let's take a look at what silver is doing.

Silver's Supposedly Strong Performance

In short, silver rallied strongly recently.

Silver just moved above the most recent high while gold is far from it. This very short-term outperformance is exactly what we want to see as a confirmation that the top in gold is in. Silver's stand-alone breakouts very often turn into fake-outs and we expect this to be the case once again.

Last week, we wrote that silver had one more important resistance just ahead - the 2019 high of $19.75, and that we wouldn't be surprised to see silver move several cents above it and slide then. Silver (continuous futures) is trading at $19.85 at the moment of writing these words, so it's very insignificantly above the 2019 high.

Once the white metal declines below the rising support line, and the $18 level, the decline's pace is likely to accelerate.

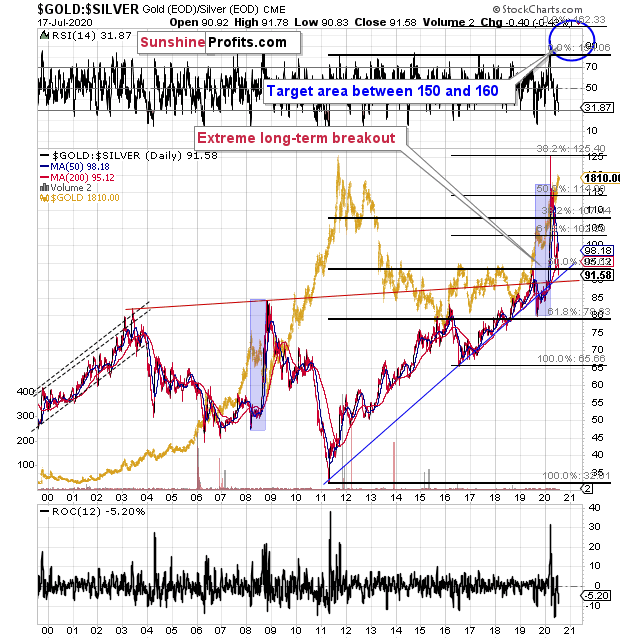

The gold to silver ratio is above 90, which is very close to the high that silver formed in 2019, and the rising blue support line. It seems that silver is verifying the breakout above this high by moving once again to it. The - somewhat ridiculous - target for the gold to silver ratio at or above 150 remains up-to-date.

And what about the mining stocks?

Actually, this is the part of the precious metals sector that we view as most interesting from the analytical point of view.

Gold Miners Likely Short-Lived Strength

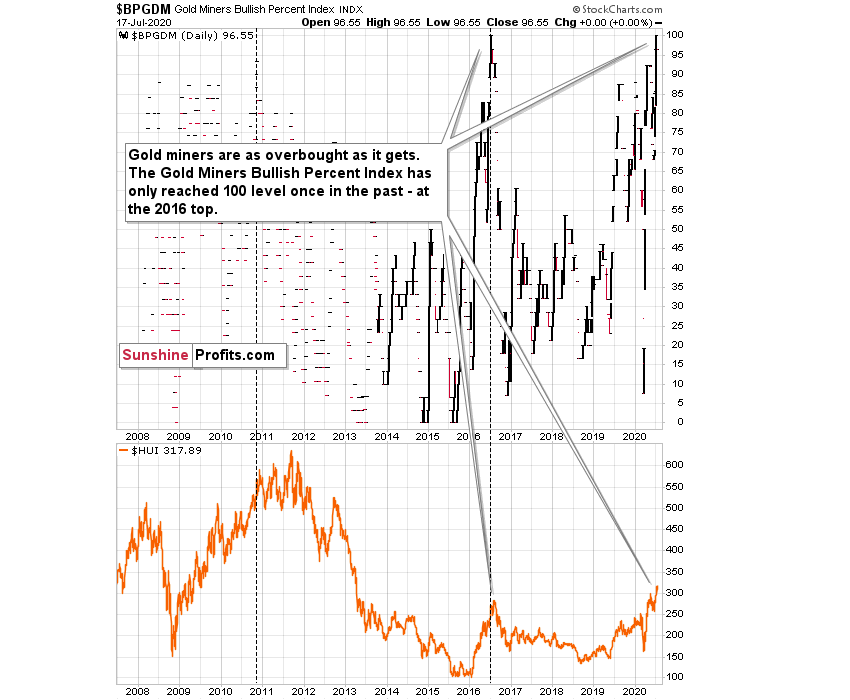

Last week, we wrote that gold miners flashed an "extremely overbought" signal, which they had only flashed once in the past - almost right at the 2016 top. The Gold Miners Bullish Percent Index recently moved to the highest level that it could reach - 100.

The only other case when the index was at 100, was in mid-2016.

We marked this situation with a vertical dashed line. Did miners continue to move higher for a long time, or did they move much higher? No.

Precisely, the index reached 100 on July 1st 2016, and gold mining stocks moved higher for two additional trading days. Then they topped. This was not the final top, but the second top took miners only about 5% above the initial July high.

This year, the index reached the 100 level on July 2nd - almost exactly 4 years later, and once again practically exactly in the middle of the year. Miners seemed to have formed the intraday high on July 9th - four trading days later.

It's not justified to assume that the delay in the exact top would be 100% identical, but it seems justified to view it as similar. Two-day delay then, and four-day delay now seem quite in tune, and this similarity supports a bearish prediction for gold.

There's also one additional point that we would like to emphasize and it's the previous high that the index made on November 9, 2010. That was the intraday top, so there was no additional delay. There was one additional high about a month later, in December, but miners moved only about 1.5% above the initial high then.

One might ask if mining stocks are really overbought right now given the unprecedented quantitative easing, and the answer is yes. Please note that in 2016 the world was also after three rounds of QE, which was also unprecedented, and it didn't prevent the miners to slide after becoming extremely overbought (with the index at the 100 level). The 100 level in the index reflects the excessive optimism, and markets will move from being extremely overbought to extremely oversold and vice versa regardless of how many QEs there are. People tend to go from the extreme fear to extreme greed and then the other way around, and no fundamental piece of news will change that in general. The economic circumstances change, but fear and greed remain embedded in human (and thus markets') behavior. Taking advantage of this cyclicality is the basis for most (if not all) gold trading tips and the same goes for other markets.

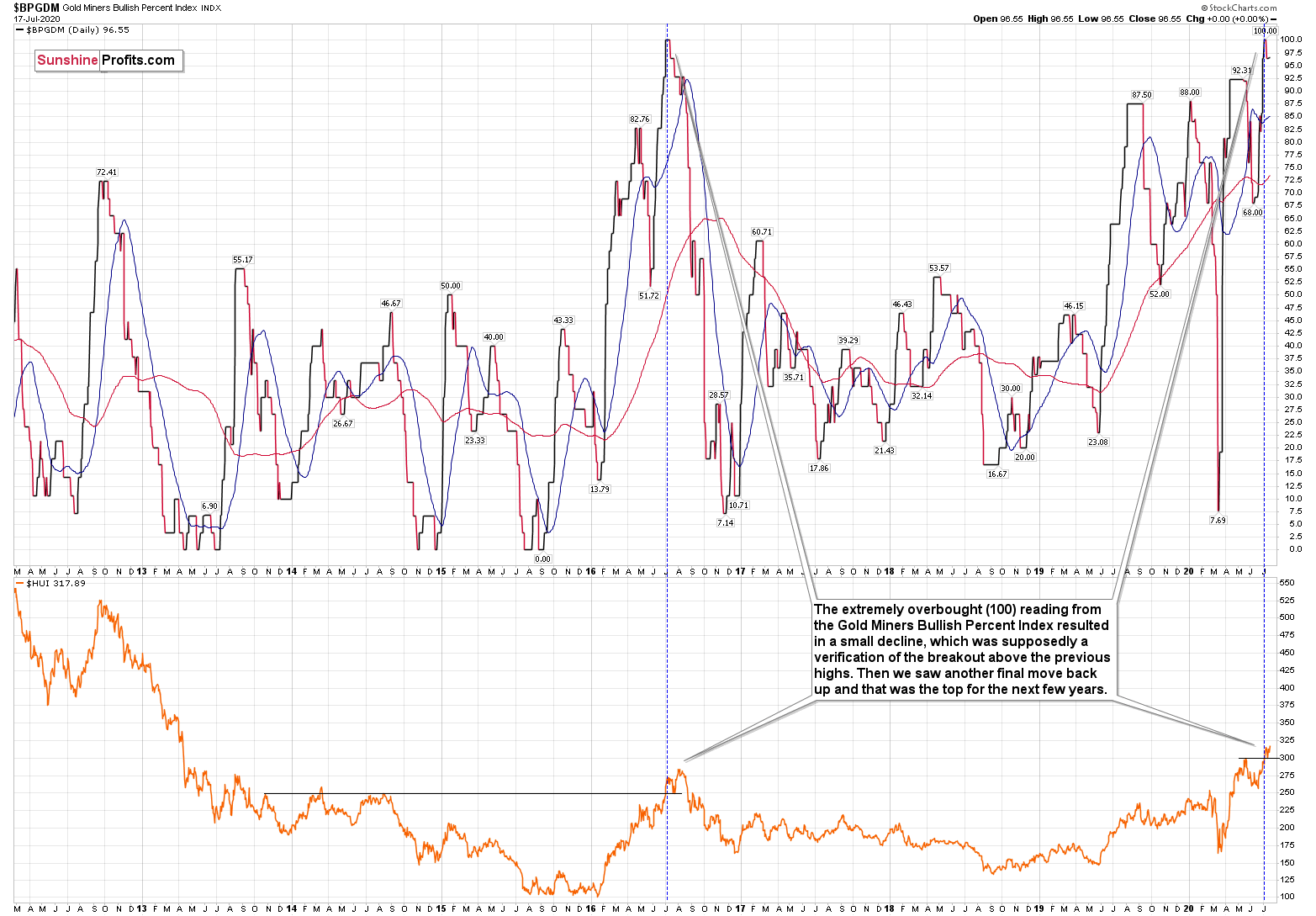

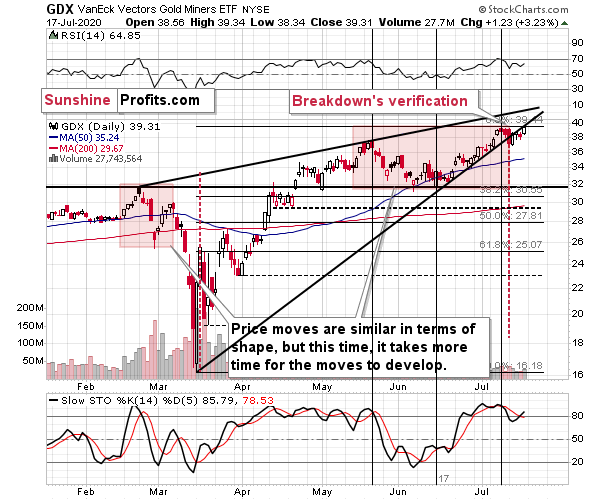

Today, we would like to dig deeper into the analogy to the 2016 top. There are more similarities than just the most-extreme reading from the Gold Miners Bullish Percent Index.

In order to do that, let's zoom in.

Back in 2016, the extremely overbought (100) reading from the Gold Miners Bullish Percent Index resulted in a small decline, which was supposedly a verification of the breakout above the previous (2013 and 2014) highs. Then we saw another final move back up and that was the top for the next few years.

What happened recently? The extremely overbought reading resulted in a decline back to the previous 2020 high and then another move higher. This is very similar to what we saw in 2016.

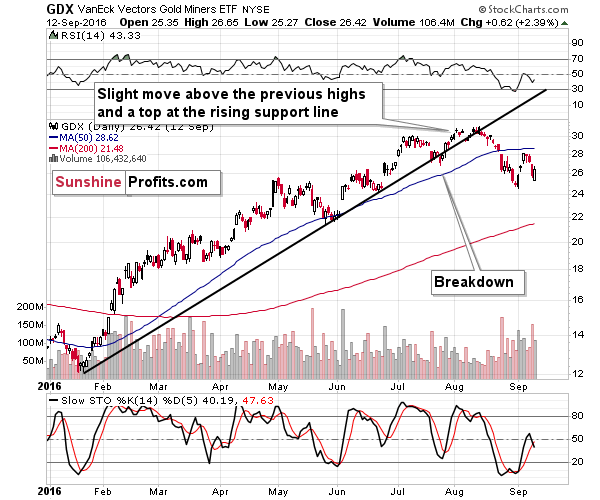

What happened in the GDX ETF with regard to its own technical indications?

Well, shortly after the extremely-overbought reading, the GDX ETF moved lower and broke below the rising medium-term support line. It then moved back up and topped slightly above the previous highs. When the rising support line was more or less at the same price level as the previous high, GDX broke below it and formed a top that was not exceeded for a few years.

And what happened recently in the GDX?

Pretty much the same thing. Shortly after we saw the extreme (100) reading from the Gold Miners Bullish Percent Index, GDX broke below its rising medium-term support line. It then moved back up, and while it didn't move to new intraday highs, Friday's closing price was slightly above the previous 2020 high.

The rising medium-term support line just moved to the previous high as well.

The history has been repeating to a very considerable (quite remarkable) extent, and if it continues to do so - which seems likely - we're likely to see a sizable decline shortly. In fact, Friday's high might have been the high for the next few months. If not, then such a high is very likely to form this week.

Before summarizing, we were asked how did the physical PM demand impact our analysis, and we would like to reply to this question. It does, but not in the way many would expect it to. One could say that we don't take this information at its face value. The increasing physical demand is definitely positive for the market in the long run, as it shows that people are ready to invest, but on the other hand, we realize that it is not that ETF purchases impact the price, but it is actually the other way around. You can find detailed explanation over here.

It's also important to remember that investing in gold is not a value, but pricing "game". Quoting from our methodology page:

Gold is neither a cash generating asset nor a commodity. It means that gold cannot be valued like assets which generate cash flows or even as commodities which value can be at least estimated looking at the balance of demand and supply. It has no intrinsic value, but only a relative one (currencies cannot be valued, but they can be priced against other currencies). Hence, gold investing is more like the pricing game, not the value game. There are no cash flows, while industrial use is minuscule - so, we cannot determine the intrinsic value of gold, but we can try to guess the future price direction, which is affected by the market sentiment.

We are not saying that fundamentals don't matter for the precious metals market. After all, the shifts in the market sentiment are not 'deus ex machina'. People do not formulate their opinions in void, but based on the observation of the changes in objective reality and fundamental drivers. What we are saying is that gold market fundamentals are substantially different than in the generating cash assets or commodity markets. As gold is currency (or anti-fiat currency), the influence of these factors on gold prices occurs via investor's perceptions and moods.

Through our chart analysis we actually analyze both: the fundamental news and the way investors and traders react to them. Consequently, while we base the long-term trends on fundamentals, we think that a mix of fundamentals and technicals is more useful in more short-term periods.

Summary

Summing up, the extremely overbought reading from the Gold Miners Bullish Percent Index and the individual price moves make the current case very similar to the 2016 topping pattern, and other important indications (especially gold's and USD's long-term cycles) point to likely - sizable - decline in the following several weeks.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager