Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday's analysis we commented on the major precious metals ratios and we discussed the most important technical developments in the USD Index and how they are likely to translate into gold prices. We wrote about two specific gold-USD situations similar to the current one and we highlighted which one of them is the key one. Today, we will go into greater detail regarding the most similar case. Taking a closer look reveals that there are many more similarities than apparent at first sight.

In fact, we are surprised that we didn't discover this similarity sooner. Well, we did discover it before practically everyone else, but still, it should have been apparent that such a similarity existed earlier. Why didn't we discover it earlier? Because when one looks at the very long-term charts, the things that catch one's eye are the really extreme values and the values in the middle are usually less interesting and they may even appear boring. The catch here is that what may appear boring right now, was very exciting when it was taking place. Just like most investors are currently focusing on the "gold rallied so much in the last couple of weeks!" narrative and forget that most of the precious metals sector didn't rally visibly, people were focused on the short-term price changes when they took place instead of taking into account the really big picture. This means that when looking at the relatively distant past (like the 90s - time flies and it really is distant future - did you notice that the Shrek movie came out 18 years ago? And that that the year 2035 is closer to today than 2000 is?), it's important to focus on the small details just as much as it is to focus on the really big price extremes. That's exactly what we're going to do today.

But first, we would like to quote what we wrote about the very-long-term situation in the USD Index and how it relates to gold, so that the context of the discussion of details is obvious to everyone (also to those who missed yesterday's analysis).

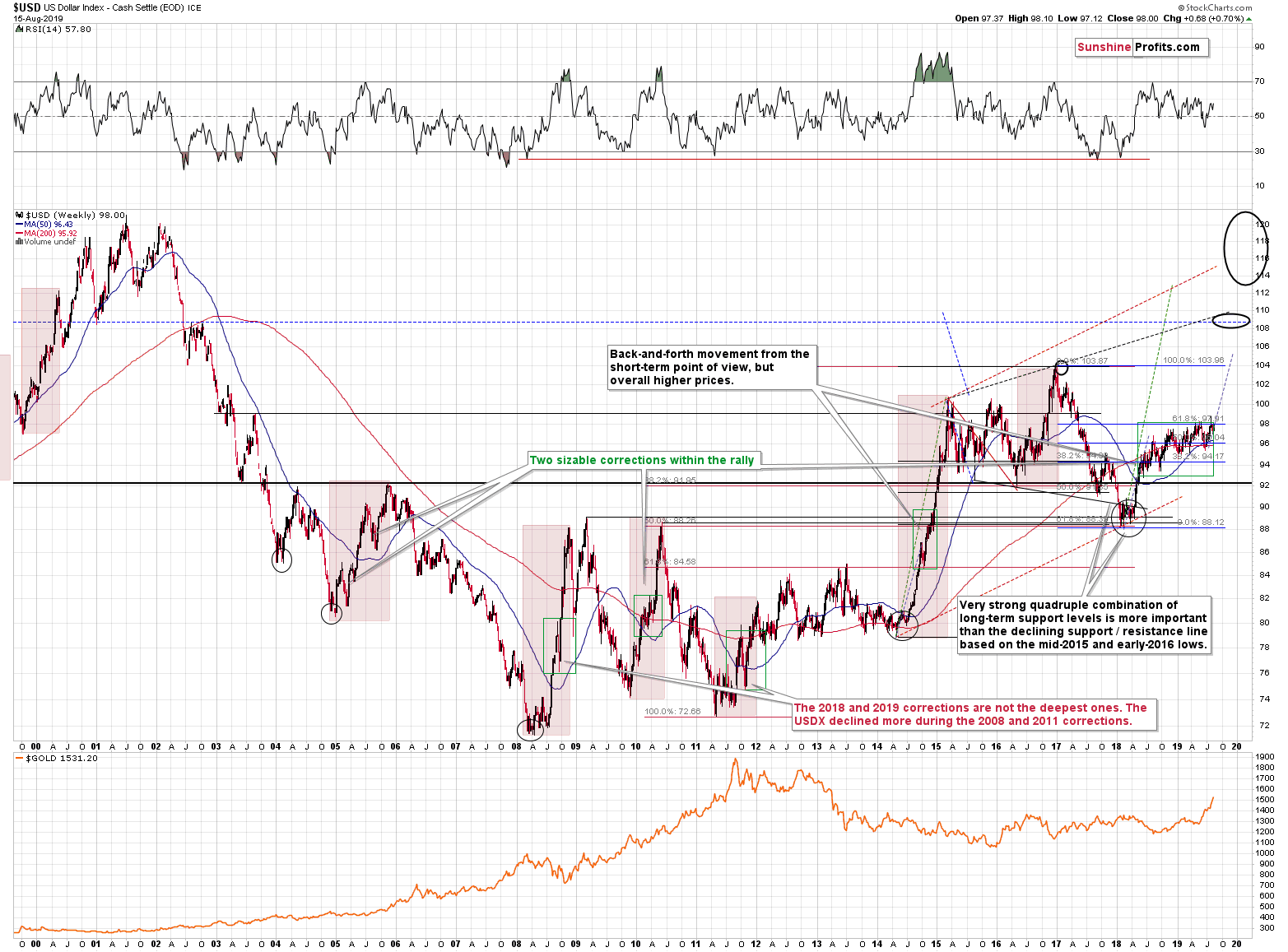

(...) And do you know what the USD Index is doing right now?

It's holding up extremely well despite Trump's calls for lower USD values, the major shift in Fed's policy (moving from rate hike policy to rate cut policy). The only thing that the above combination of strong bearish factors was able to do, was to prolong USD's consolidation. Consolidation, during which the currency moves higher on average anyway. Running corrections like that are typical of the strongest of the bull markets.

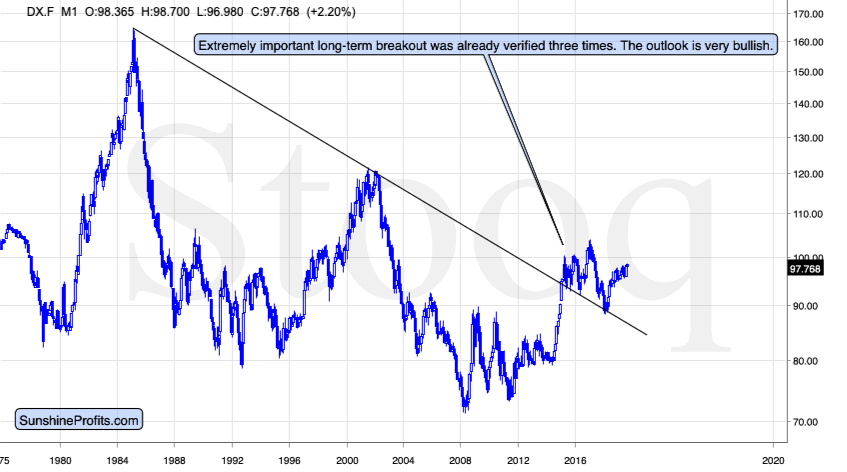

Even though the above chart appears to be very long-term, it's not long-term enough and it misses the most important technical development of the previous years.

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

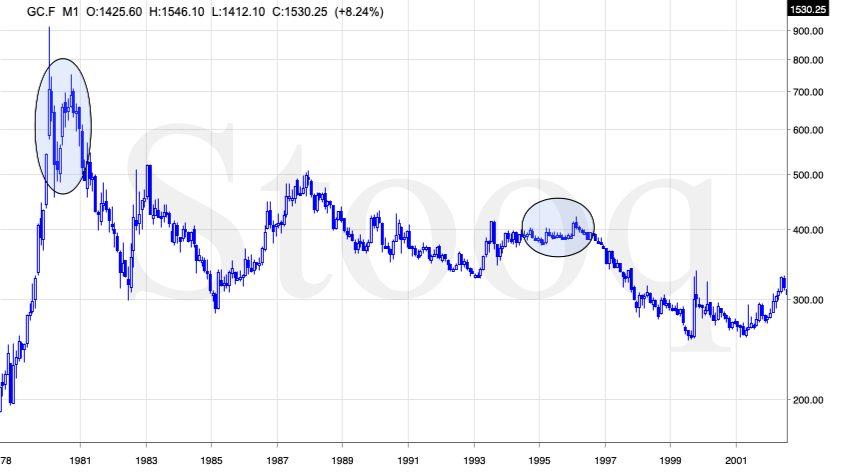

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in 1995. What happened in gold at that time?

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we see right now, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

But gold just rallied so significantly in the last several months!

... And that's most likely what people were saying in early 1995, while they were buying at the top.

It's easy to get carried away by momentum and emotions that it generates. We're here for you to analyze the market as objectively and with as much cold logic as possible. And the key points in gold's supposedly bullish story simply don't add up. Not yet.

Having said that, let's look how gold performed before the final 1996 top.

The Profit Is in the Details

Without getting into details, just have a glance - please ask yourself the following: are these two charts similar?

Of course, they are. They are very similar. Not identical, but definitely very similar. They both start with a top and a sharp decline that is then corrected. Then the decline continues, but the volatility declines in the second half of the decline, where the price of gold moves lower in a relatively narrow trading range.

The bottoms (late-2015 and early-1993) are followed by a sharp rally, which is then followed by just as sharp a correction. Then the price moves higher in a less volatile manner. The 2018 high and the late-1994 high are similar as well - gold topped a bit below the previous important (late-2015 and early-1993) highs and then declined (not as much as after the previous important tops though). The late-2018 and 2015 bottom was U-shaped and it was followed by yet another lower top (early-2019 and early-1995). This is when the analogy gets even more interesting.

The February - May 2019 is the time when gold declined a bit, but not much, while the USD Index was moving higher. That's exactly what happened during most of 1995.

And now, the grand finale of the analogy: in the late 1995 and in May 2019, gold soared, and in both cases, it happened when the USD Index was still moving higher on average, but in a relatively orderly manner. If you look at the very long-term USD Index chart above, you'll see that the shape of the price move in late-1995 and 1996 is very similar to what we're seeing since 2018. And how did gold soar?

In recent months, gold rallied a bit more than it did in the initial part of the rally (late-2018 - early-2019) and it moved above its important previous highs.

What happened in 1996? During the final upswing gold rallied a bit more than it did in the initial part of the rally (early 1995) and it moved above the important previous highs (the 1993 high).

What about the shape? Gold soared sharply recently, and it had soared sharply in early 1996 as well.

The similarity is uncanny.

What about the fundamental situation - surely, it's entirely different right now than it was in early 1996?... Or is it?

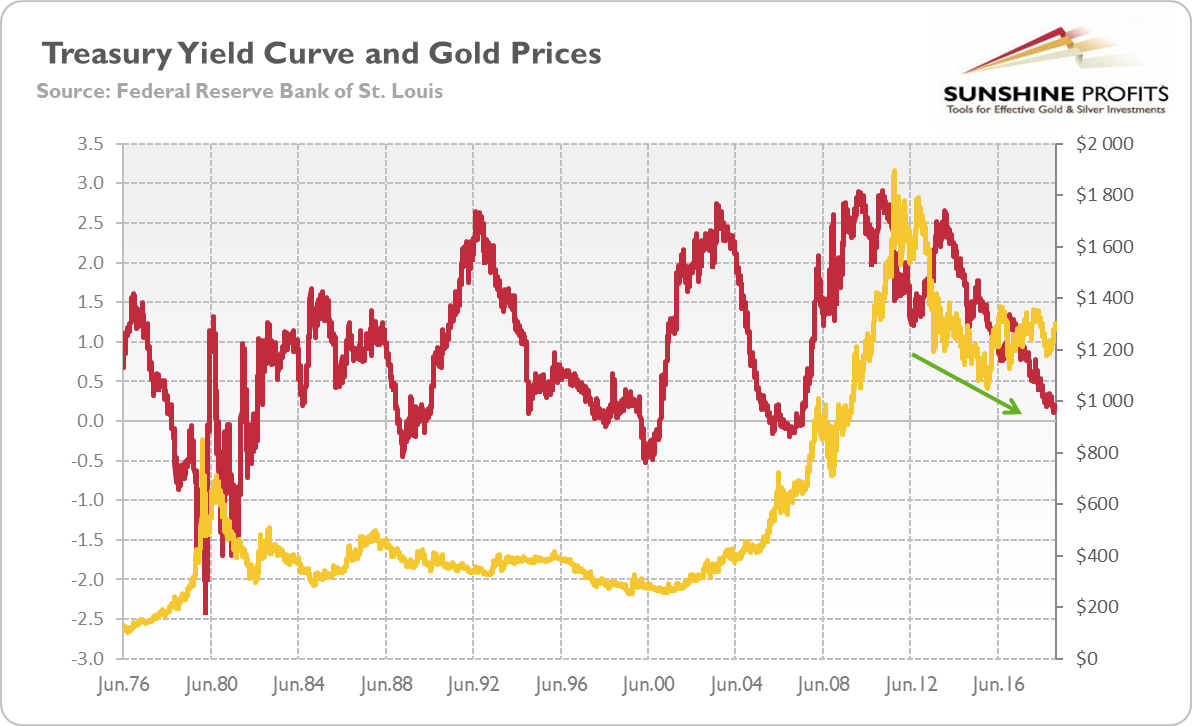

The widening yield curve is a bullish factor for gold from the fundamental point of view - we discussed it yesterday. But, just because it heralds recessions, it doesn't mean that one has to start right away and that gold has to react by rallying right away. The fundamental situation is positive, but... What did the yield curve do in the 90s? It declined.

The slide in the spread between 10-year and 2-year Treasury bonds in the first half of the decade was just as profound as what we saw in the last few years. There were rebounds, but overall the decline in the spread continued until the year 2000. And the same happened with the gold price.

The widening yield curve inversion is a bullish factor for gold - in general and for the long term - but it doesn't prevent a meltdown in the medium term. In fact, the current analogy to what happened in the mid-90s and its bearish consequences for gold are not invalidated by the situation in the bond market. One could even say that they support history's repeat.

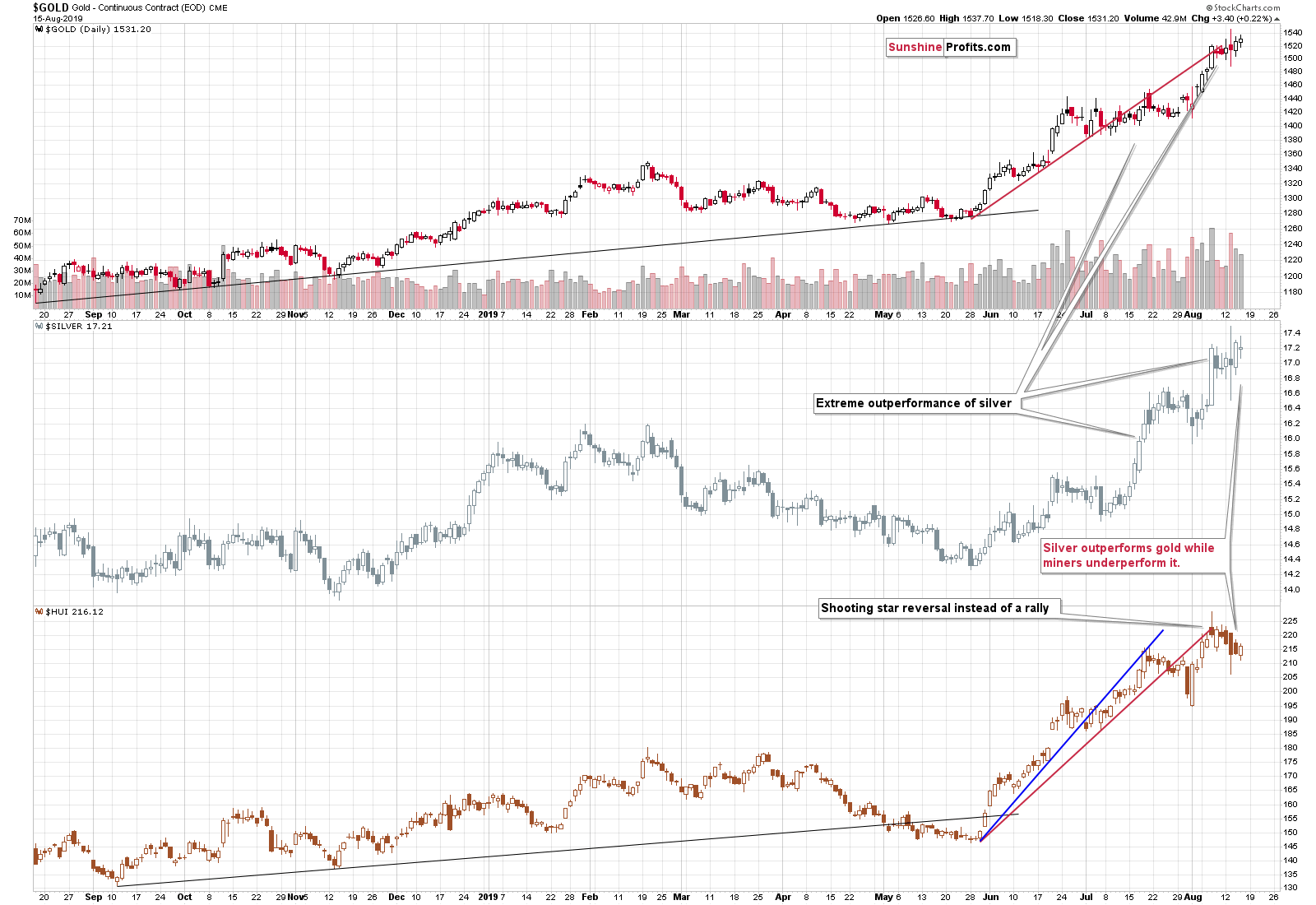

Gold is likely to move much higher in the following years, perhaps based on a recession, but not before declining substantially first as the USD Index soars. The relatively weak performance (from the long-term point of view) of silver and mining stocks confirms it.

Before summarizing, let's take a look at the short-term price moves.

Short-Term PMs Check

Gold moved few dollars higher yesterday, but whatever was gained, is already being lost today. Gold is down more than it was up yesterday and it's about $3 below Wednesday's close. Thus, it doesn't seem that yesterday's move higher is worth paying attention to. The moves in silver and mining stocks were too insignificant to mean anything.

One notable thing is that there was no "comeback" in the gold miners despite gold having closed at new highs (in terms of the closing prices only). This tells us that the situation right now is not as it was in early August, when miners soared after a daily decline.

Summary

Summing up, taking the big investment picture into account, out of the following: gold, silver, gold stocks, silver stocks, the recent upswing was only visible in case of gold. Most of the precious metals portfolio: silver, gold miners, and silver miners suggest that what we saw in the last several months is nothing more than a corrective upswing within a bigger downtrend. The analysis of gold to silver and gold stocks to gold ratios confirms the very bearish outlook for the medium term. The situation in the USD Index is very bullish for the following months and suggests that gold's recent action was likely a fake upswing, similar to the 1995-1996 one. Mining stocks' recent weakness and silver's strong performance in the very short term both suggest that one should be prepared for much lower, not higher precious metals prices.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,552; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $25.37

- Silver: profit-take exit price: $13.81; stop-loss: $17.73; initial target price for the DSLV ETN: $39.08; stop-loss for the DSLV ETN $18.27

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $33.37; initial target price for the DUST ETF: $32.28; stop-loss for the DUST ETF $5.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $23.71; stop-loss: $48.42

- JDST ETF: profit-take exit price: $73.32 stop-loss: $9.67

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

This time is different. This is what the experts say. The inversion of the yield curve did a great job in predicting recessions in the past, but the current inversion is not like the previous. The predictive power of the yield curve has weakened, so it does not signal the recession. This is what the pundits claim. We invite you to read our today's article and find out whether the experts are right and what does it mean for the gold market.

Is This Time Different? Predictive Power of the Yield Curve and Gold

So it happened - oil reversed lower and we were right there. While yesterday's downswing has been partially retraced, and oil is trading close to unchanged today, there're still plenty of valuable clues as to the upcoming price action. Let's dive in to see how they reflect on our yesterday's profitable decision.

Profitable Moves in Oil's Volatile Trading

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager